BCA Research’s China Investment Strategy service estimates that China’s oil demand growth will decline from 12% year-on-year in the past eight months to a still robust 4%-6% in the next six-to-nine months. China…

US fiscal, monetary, and foreign policies are unlikely to deliver any dovish surprises for investors in Q4, due to the impending government shutdown, persistent inflation, and instability among OPEC+ and China.

The global downturn will be shallower than it was in 2008 and in 2020 but will last for longer. The primary reason for a more prolonged downturn is that policymakers in the US, Europe, and China will be reluctant to proactively and…

We continue to expect Brent crude to trade just above $101/bbl in 4Q23, and to average $118/bbl in 2024. Higher volatility looms. We expect Russia will cut oil production next year as part of a concerted effort to undermine Biden’s…

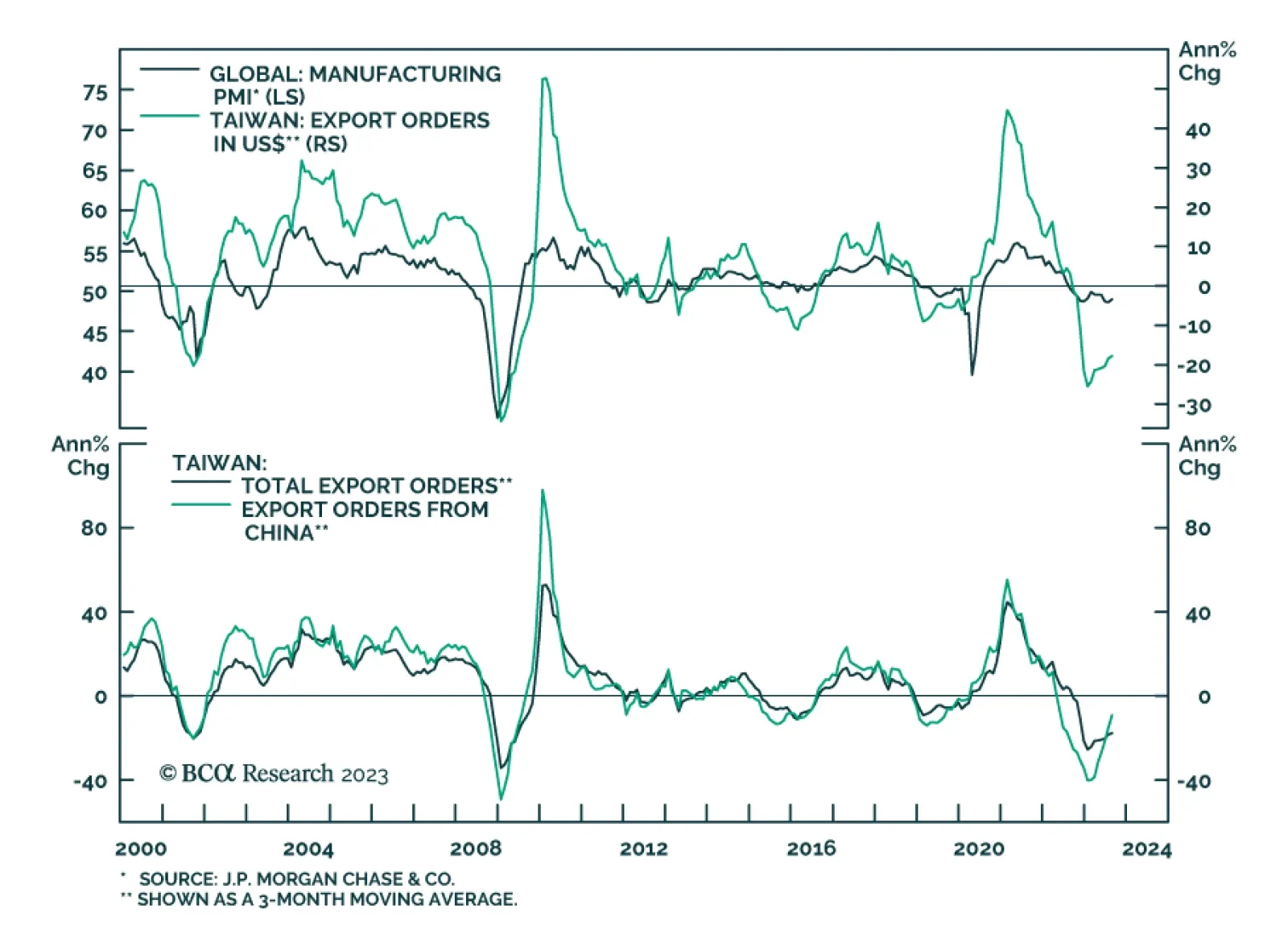

Taiwanese export orders sent a disappointing signal about global manufacturing conditions on Wednesday, corroborating the message from Singapore’s NODX release earlier this week. The pace of decline in export orders…

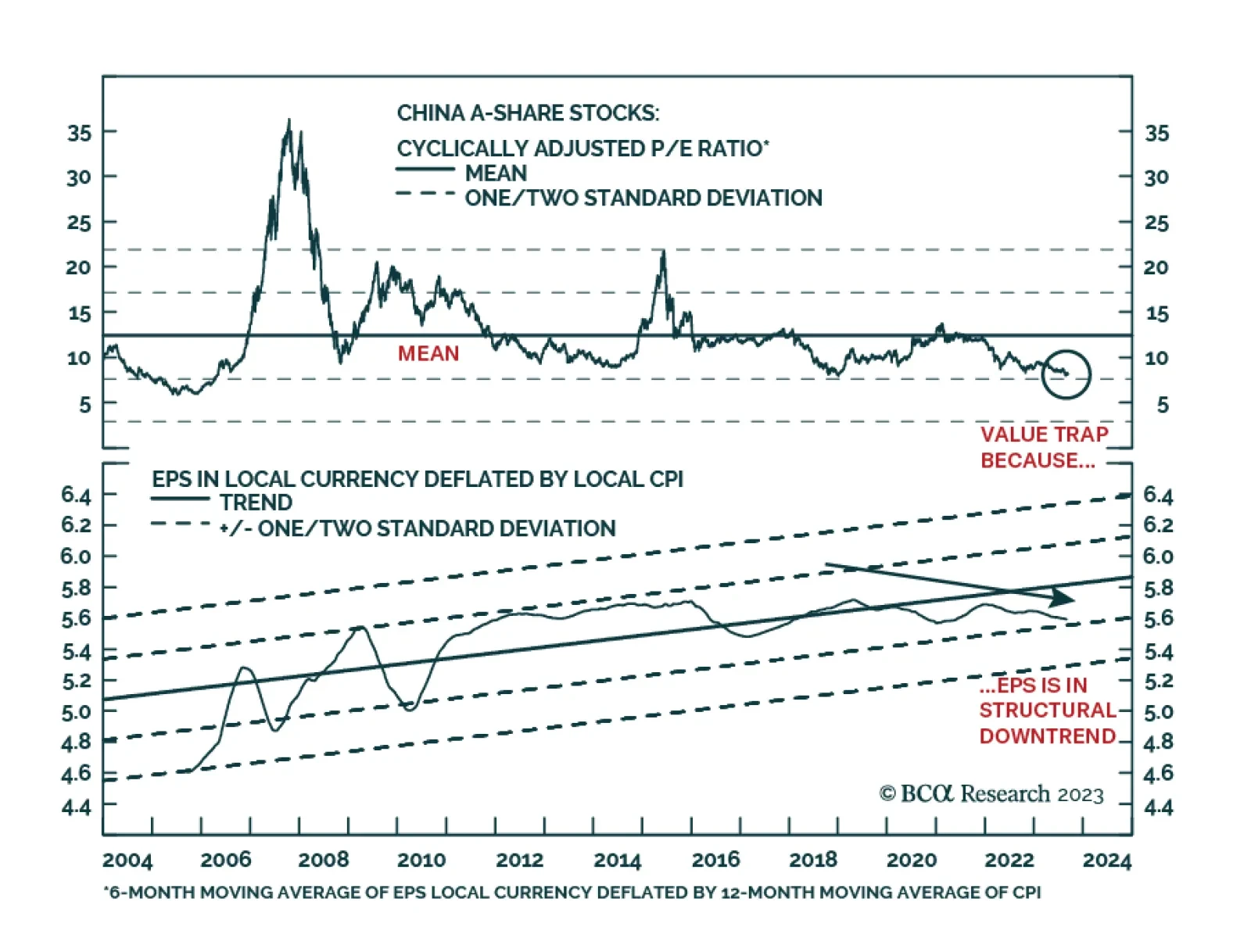

The Chinese economy will not recover without significant “irrigation-style” stimulus. The latter is still unlikely for the time being. Dim economic fundamentals justify lower valuations of Chinese equities. Lingering deflationary…

China’s reopening faltered and now it is applying moderate stimulus. OPEC 2.0’s production discipline is getting results, with oil prices climbing. The Fed will not be able to deliver dovish surprises in Q4 2023. Investors should…

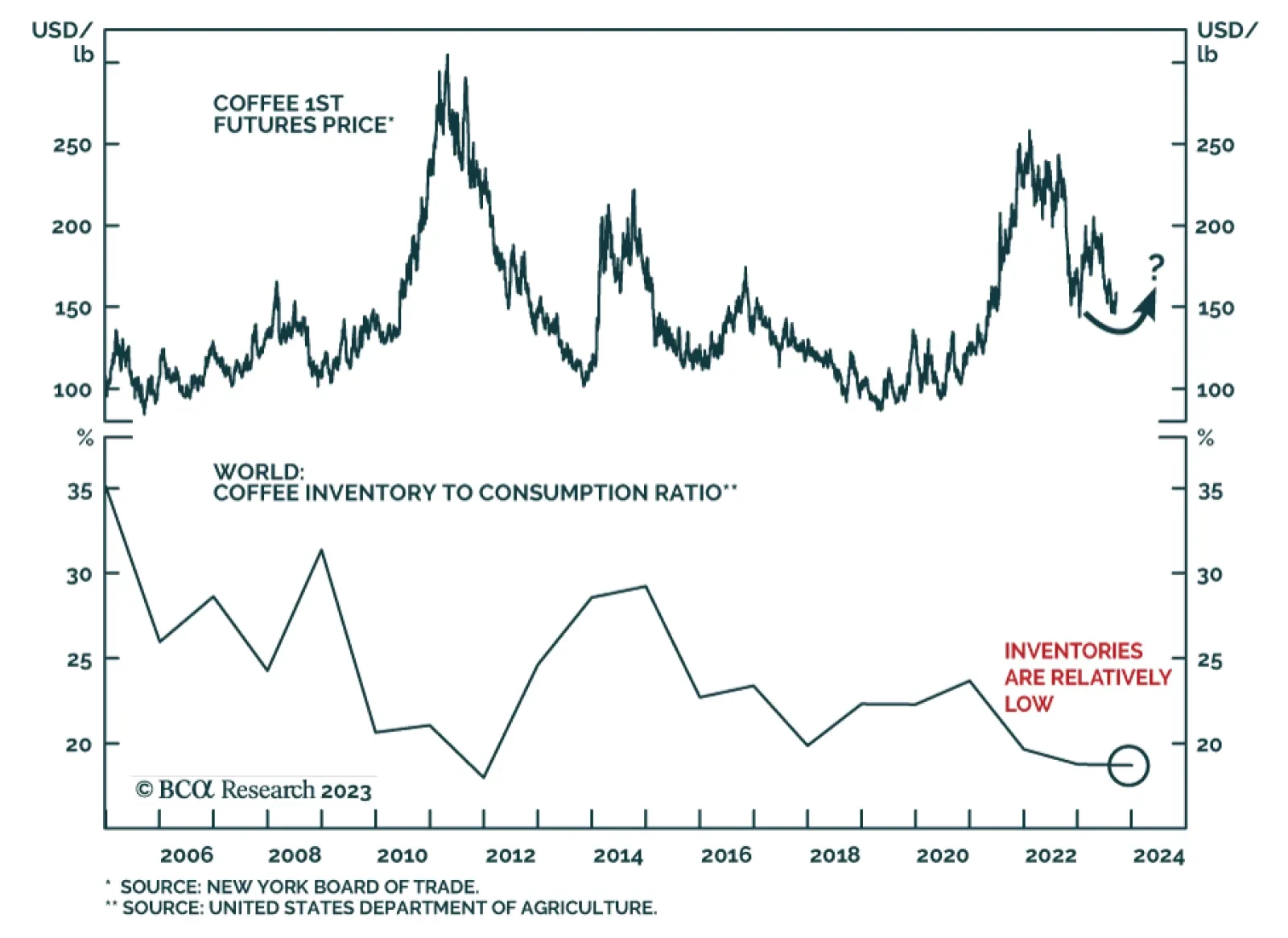

Coffee prices have surged in recent days and have now gained 8.5% over the past week. Two main forces are behind this rally. First, the recent pause in the US dollar strength is a tailwind for coffee prices. In particular, the…

According to BCA Research’s China Investment Strategy service, lower valuation readings in Chinese equities are justified by fundamentals. In absolute terms, valuations of both A-shares and investable stocks are…