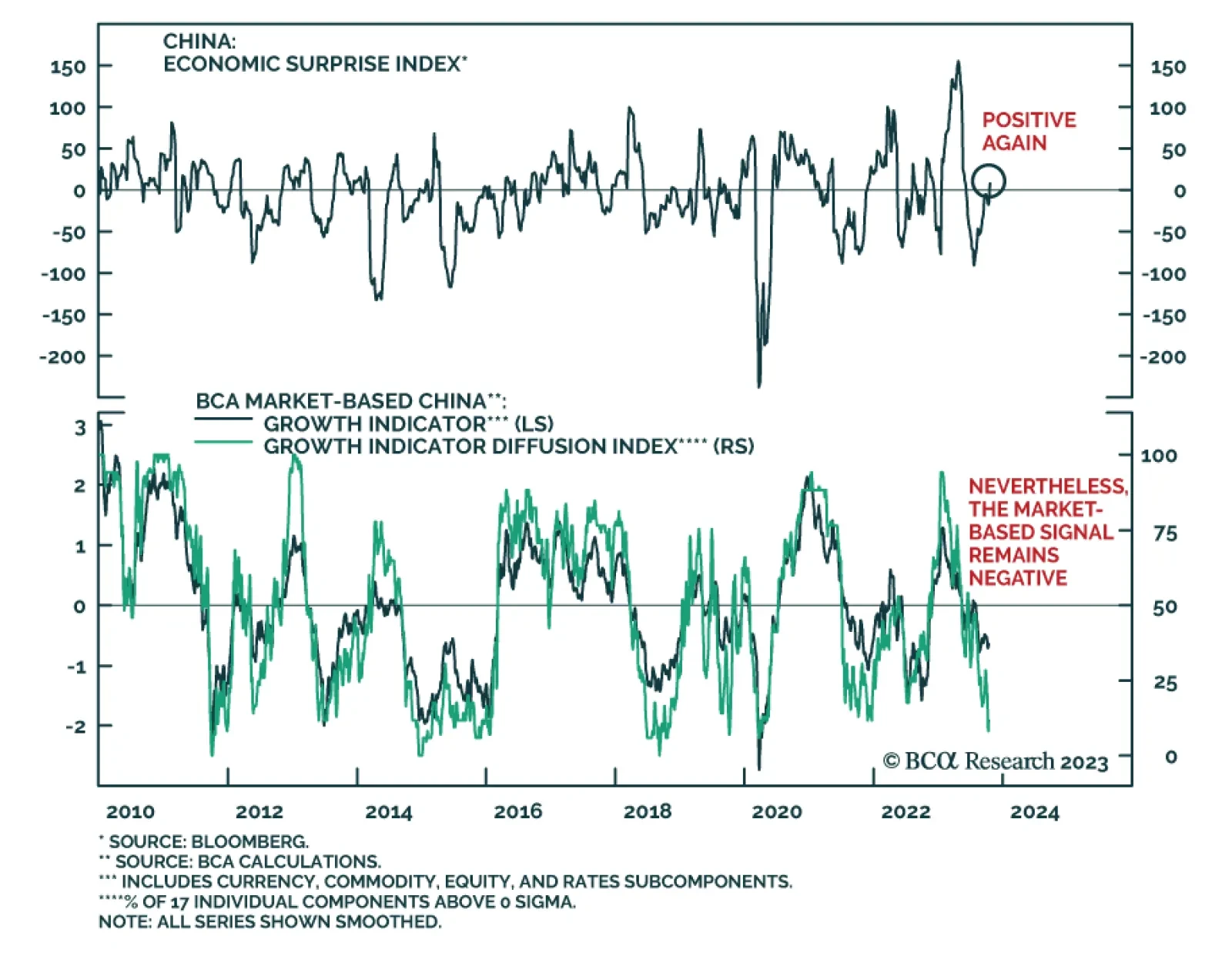

China's CSI 300 equity index fell below its March 2020 pandemic low on Monday, bringing its loss since the February 2021 peak to -40%. Similarly, BCA Research's market-based China growth indicator – a broader…

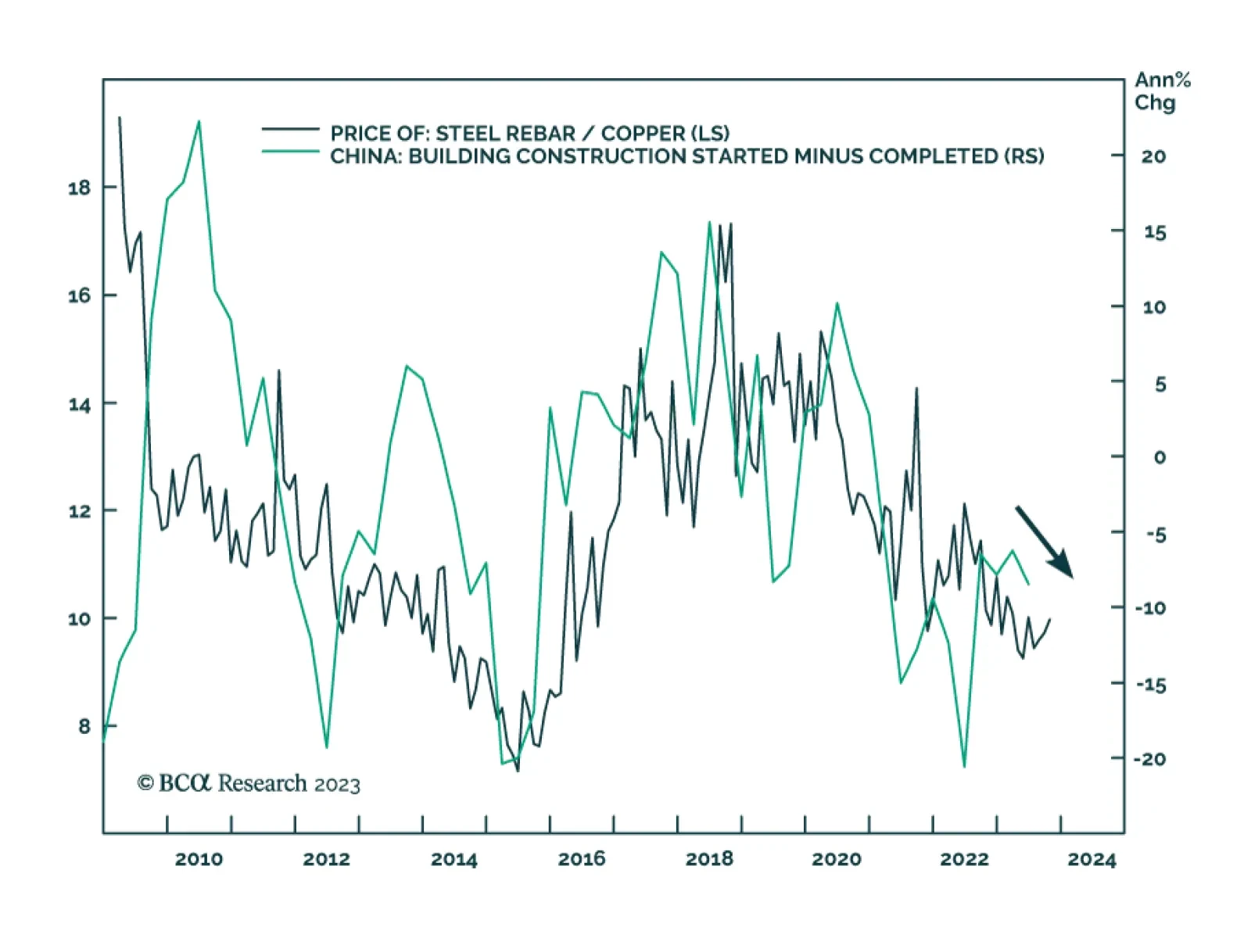

Earlier this year we highlighted that China's property market dynamics pose a greater risk to the price of steel vis-à-vis copper. This view was based on the expectation that Chinese policymakers will direct financing…

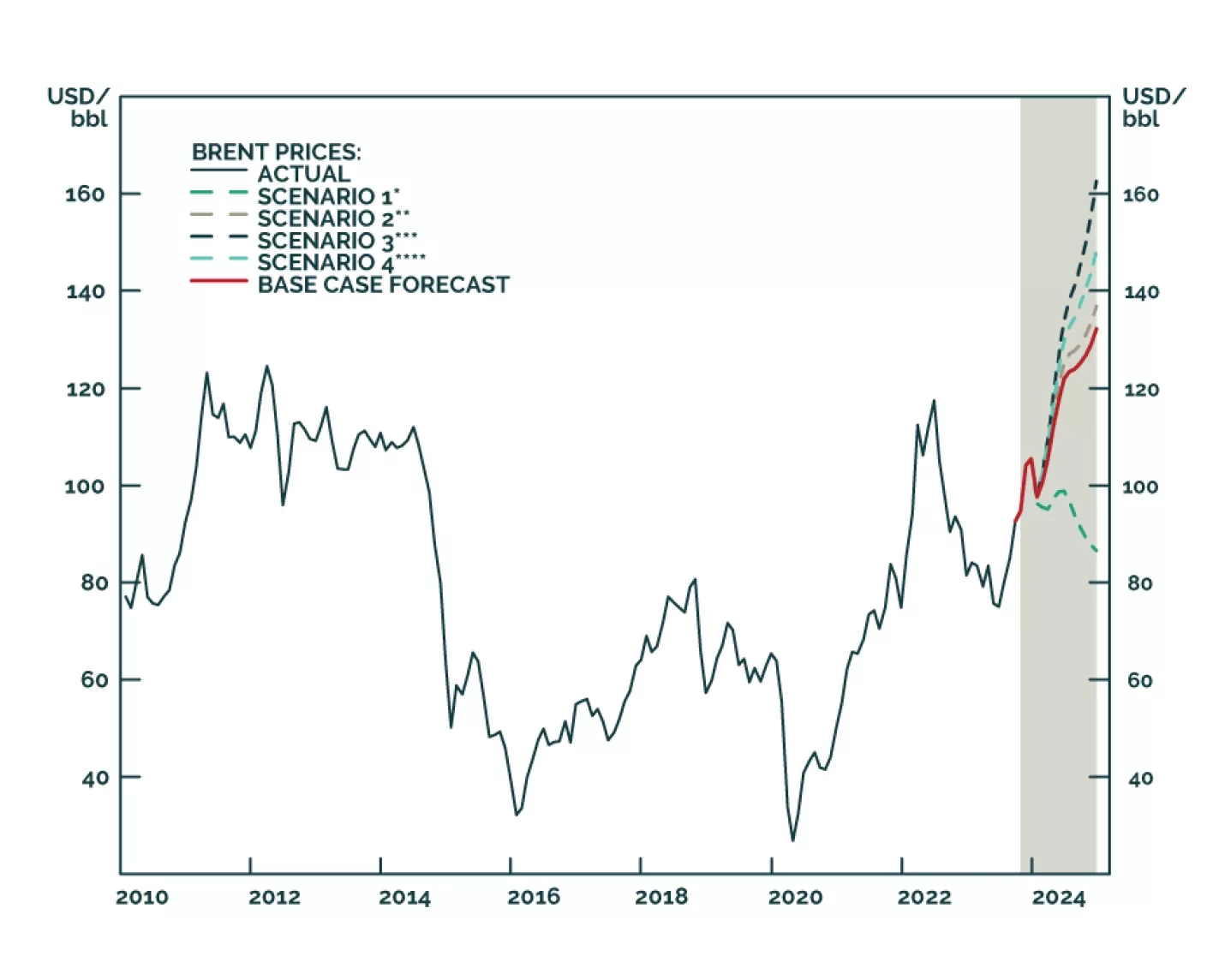

Despite higher uncertainty, our Brent price forecasts remain unchanged at just over $101/bbl for 4Q23 and $118/bbl for next year. We remain long equity exposure to oil and gas producers via the XOP ETF, and commodity exposure via the…

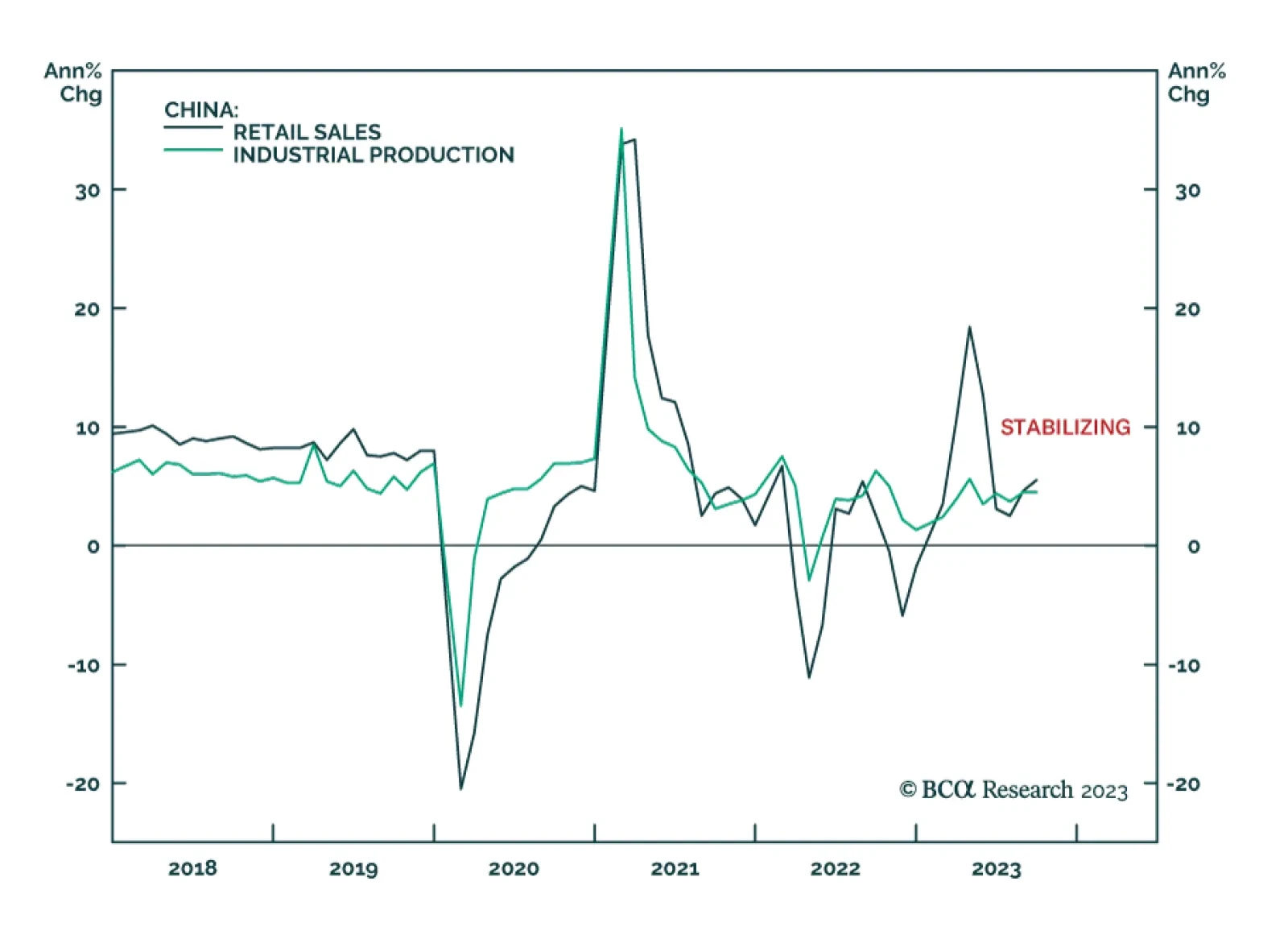

Chinese economic data surprised to the upside on Wednesday. GDP expanded by 4.9% y/y in Q3 – beating expectations of a 4.5% y/y rise. On a quarterly basis, economic activity accelerated from 0.5% q/q to 1.3% q/q –…

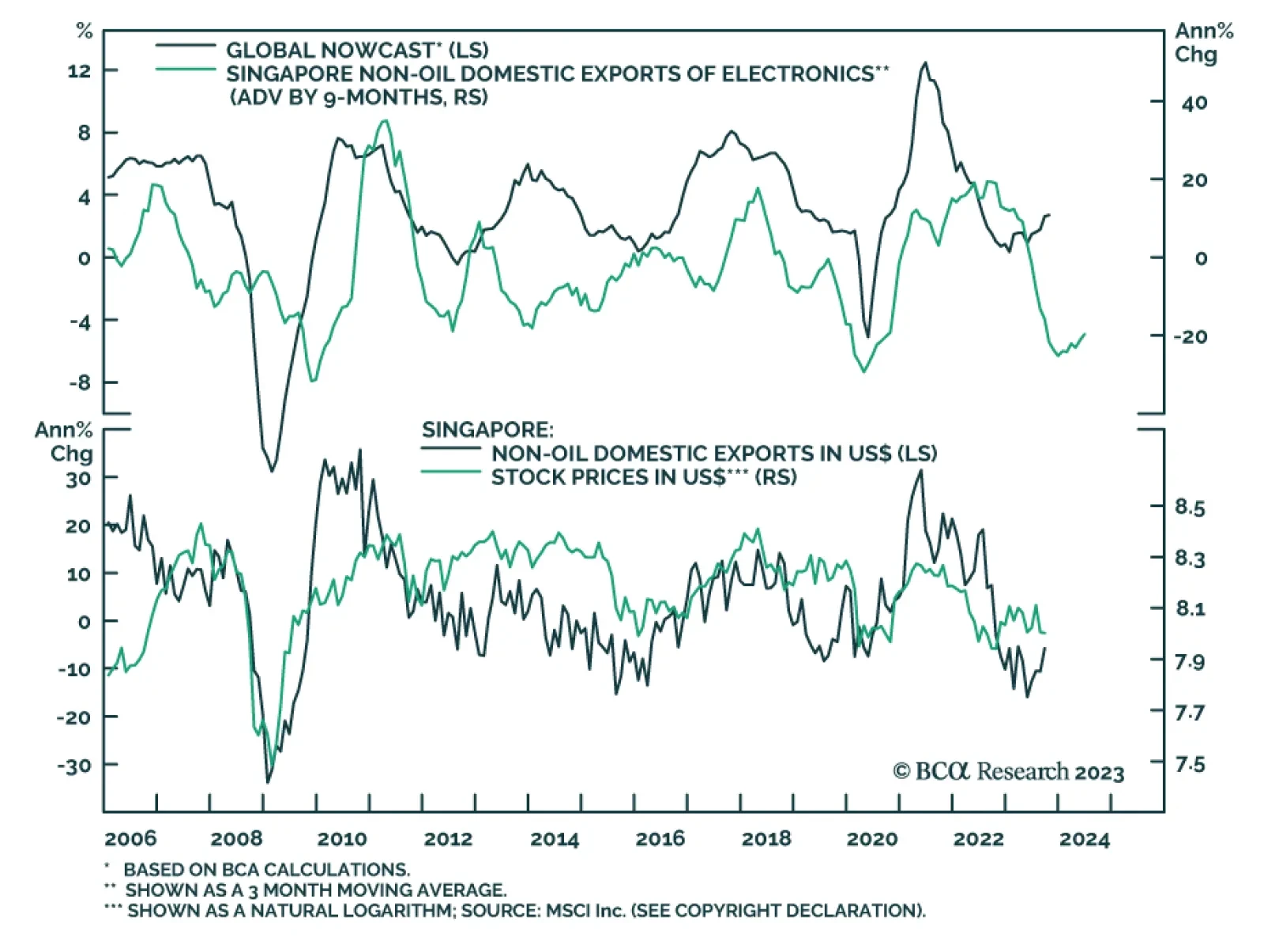

Singapore is a small open economy that is highly sensitive to fluctuations in global and Asian economic activity. This characteristic makes its exports a good bellwether for global growth. On this front, the upside surprise in…

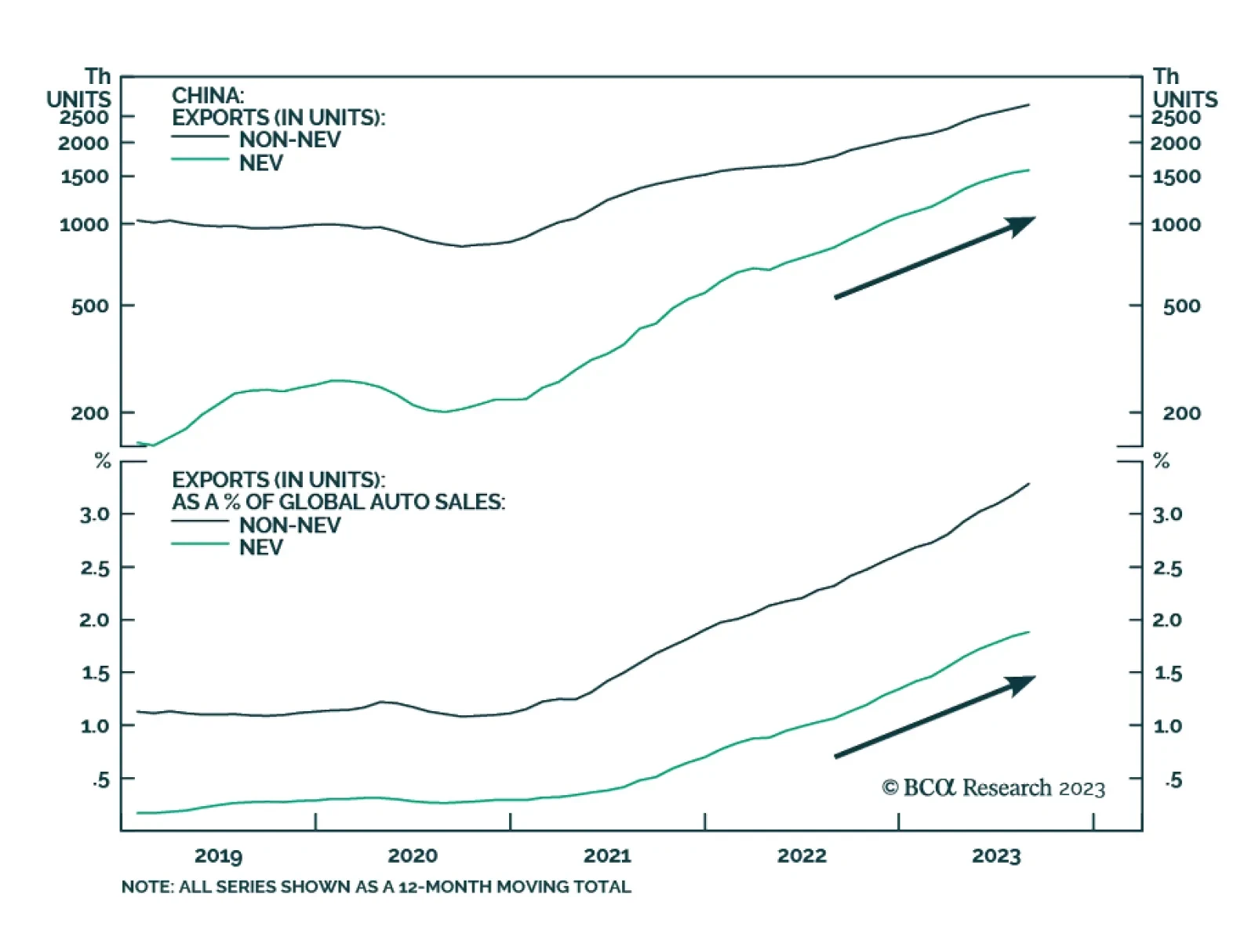

On the surface, the slower pace of contraction in Chinese exports in September is a positive signal for global trade. The 6.2% y/y drop in the dollar value of Chinese exports was not as bad as the 8% y/y decline anticipated or…

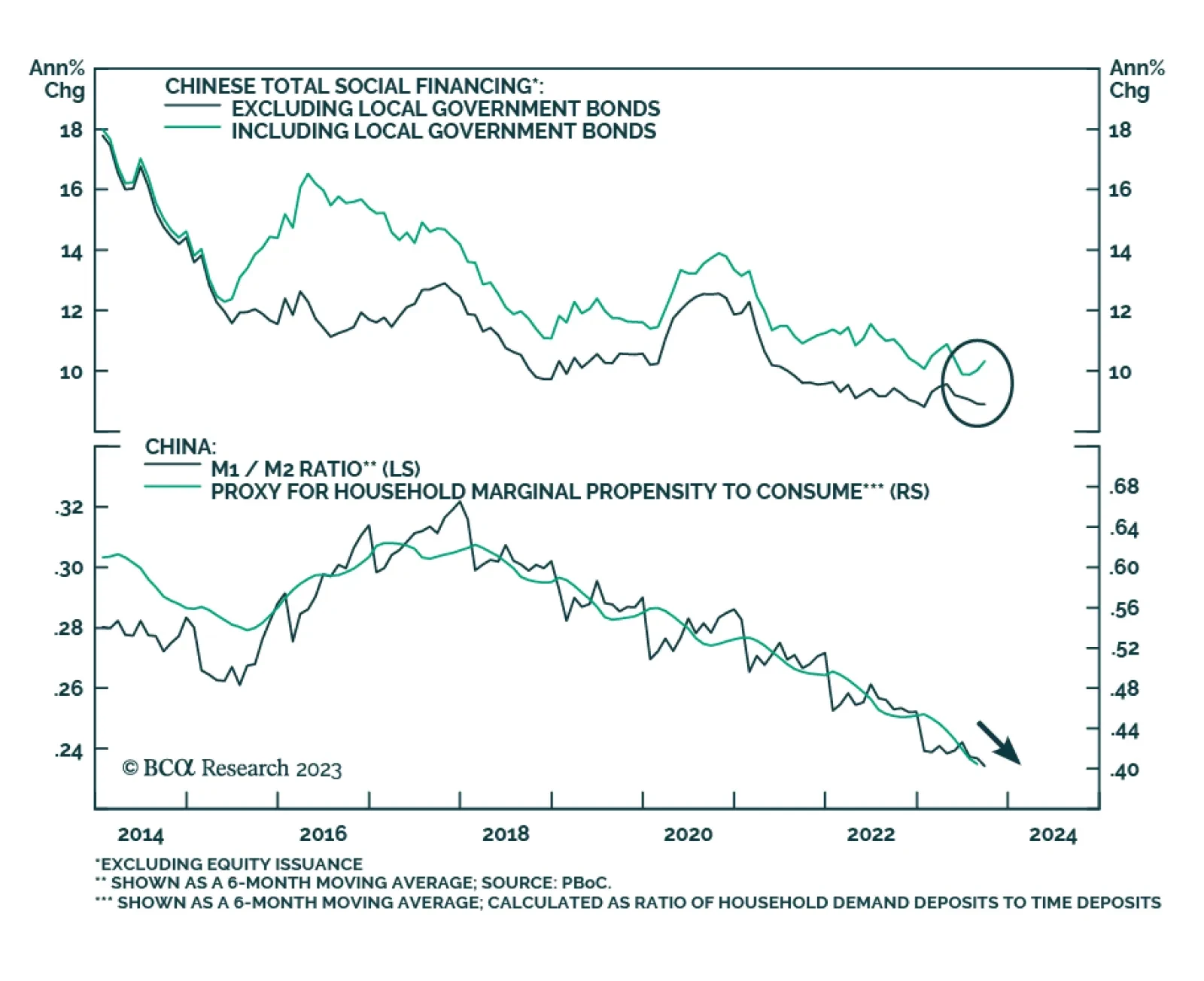

On the surface, Chinese credit data sent a positive signal about the domestic economy. Chinese aggregate social financing totaled CNY 4.1 trillion in September – exceeding both August’s CNY 3.1 trillion and…

As global financial institutions like the IMF draw attention to the real-estate crisis in China, the CCP will be forced to step up regulatory and restructuring efforts to contain its spread and limit further contagion domestically…