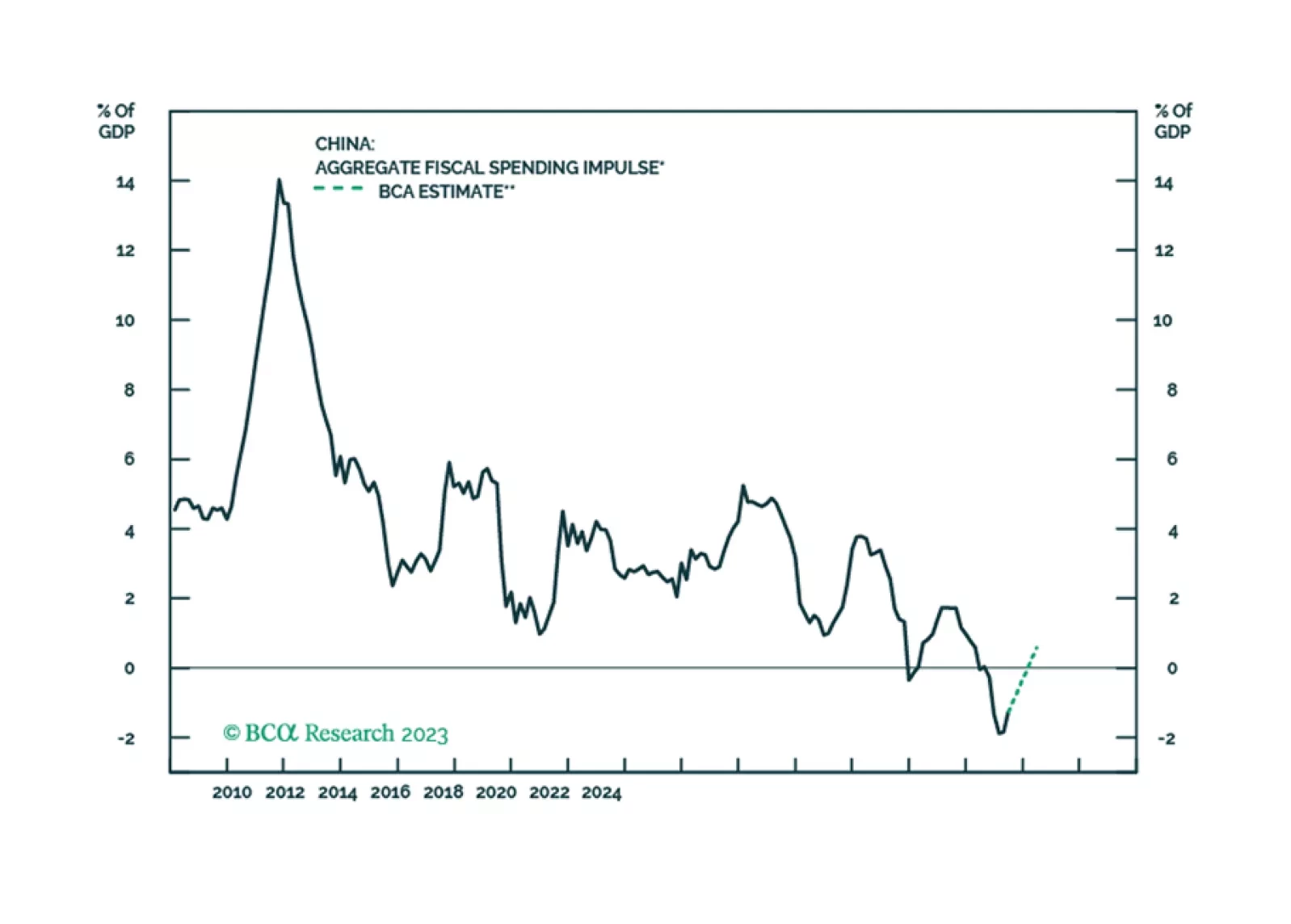

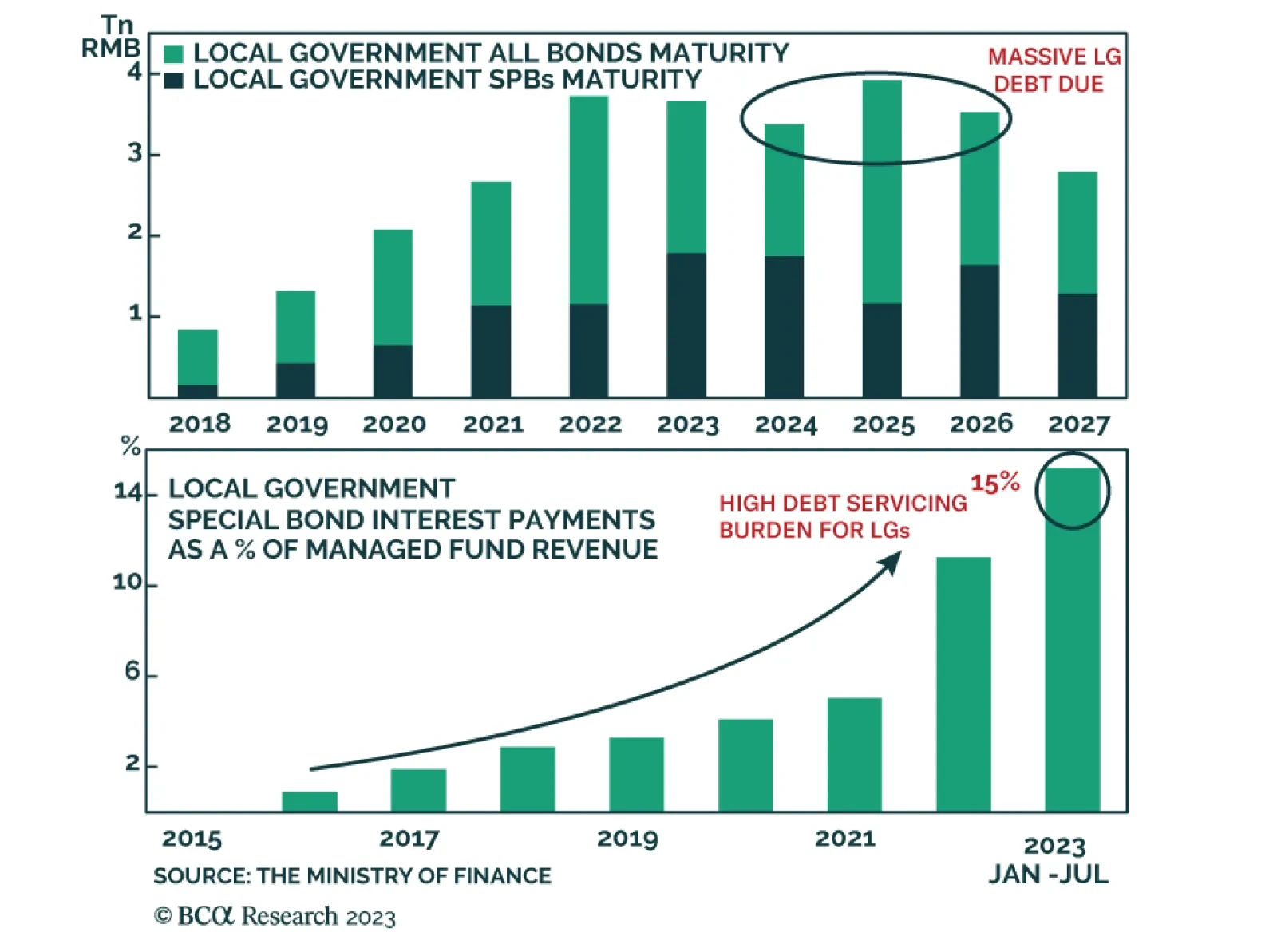

According to BCA Research’s China Investment Strategy service, China's recently introduced debt swap program will help prevent mushrooming defaults, but it will not lead to an acceleration in growth. In August, the…

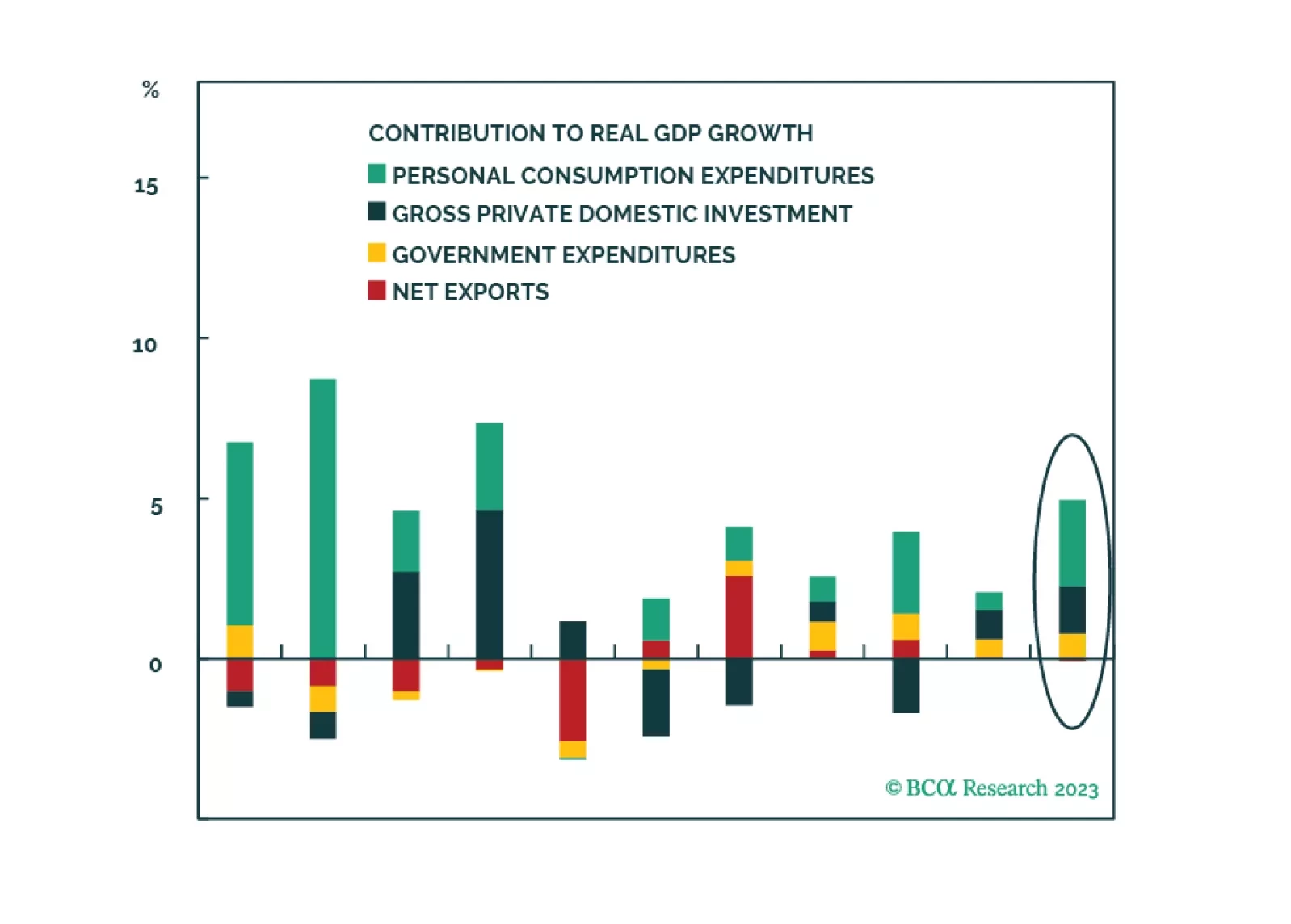

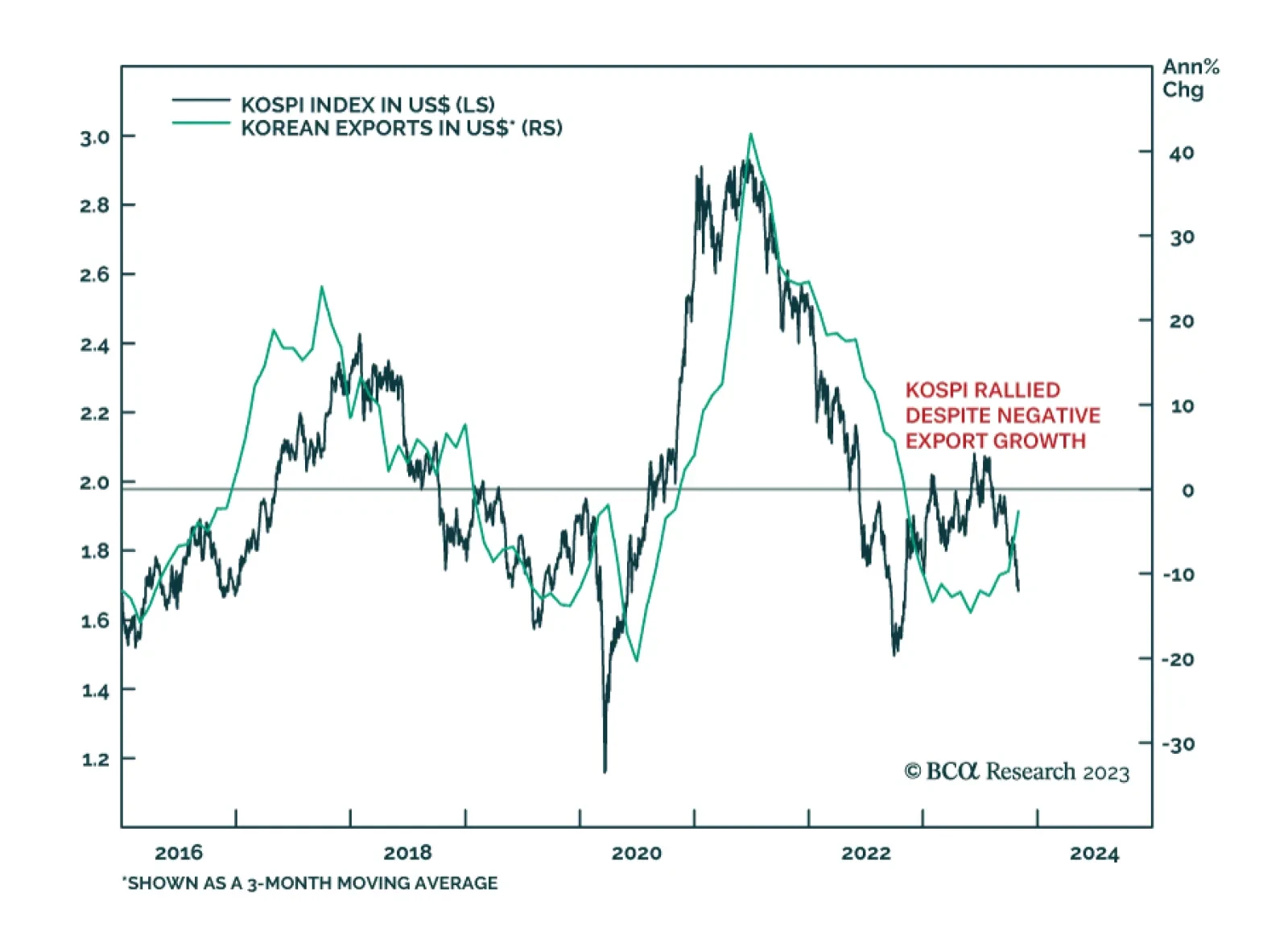

South Korean exports are the latest in a series of Asian trade data suggesting that the global trade cycle is bottoming. The 5.1% y/y increase in October marks the first return to growth since September 2022. Among South Korea…

We maintain our view that China’s economic growth in the coming months will remain lackluster. Beijing's recent measures to provide additional financing may help to bridge the gap in government spending in the rest of 2023 and into…

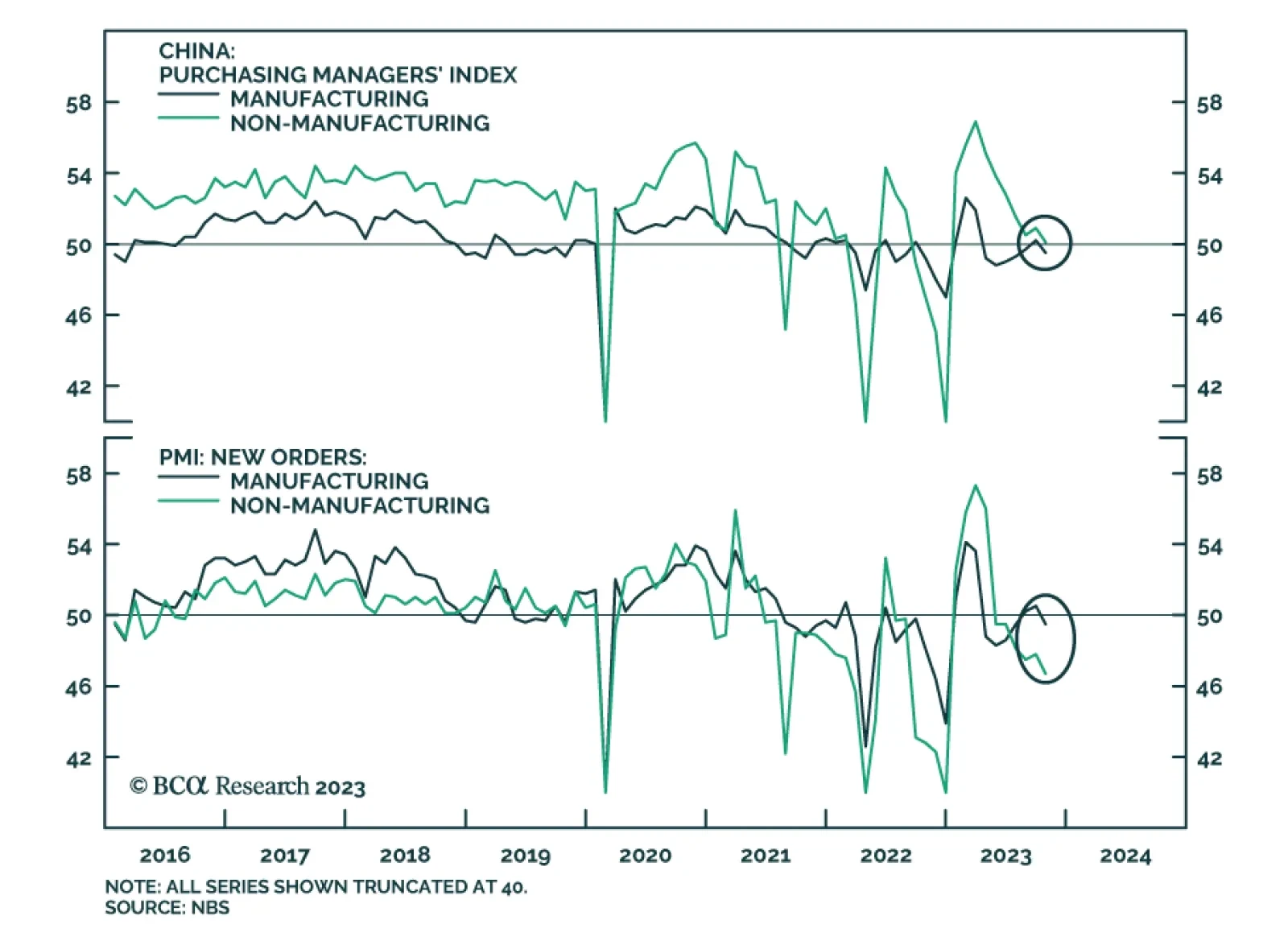

Tuesday’s China PMI release delivered a negative update on economic activity in October. The NBS’ Manufacturing PMI fell from 50.2 to 49.5 while the Non-manufacturing PMI declined from 51.7 to 50.6. Both measures fell…

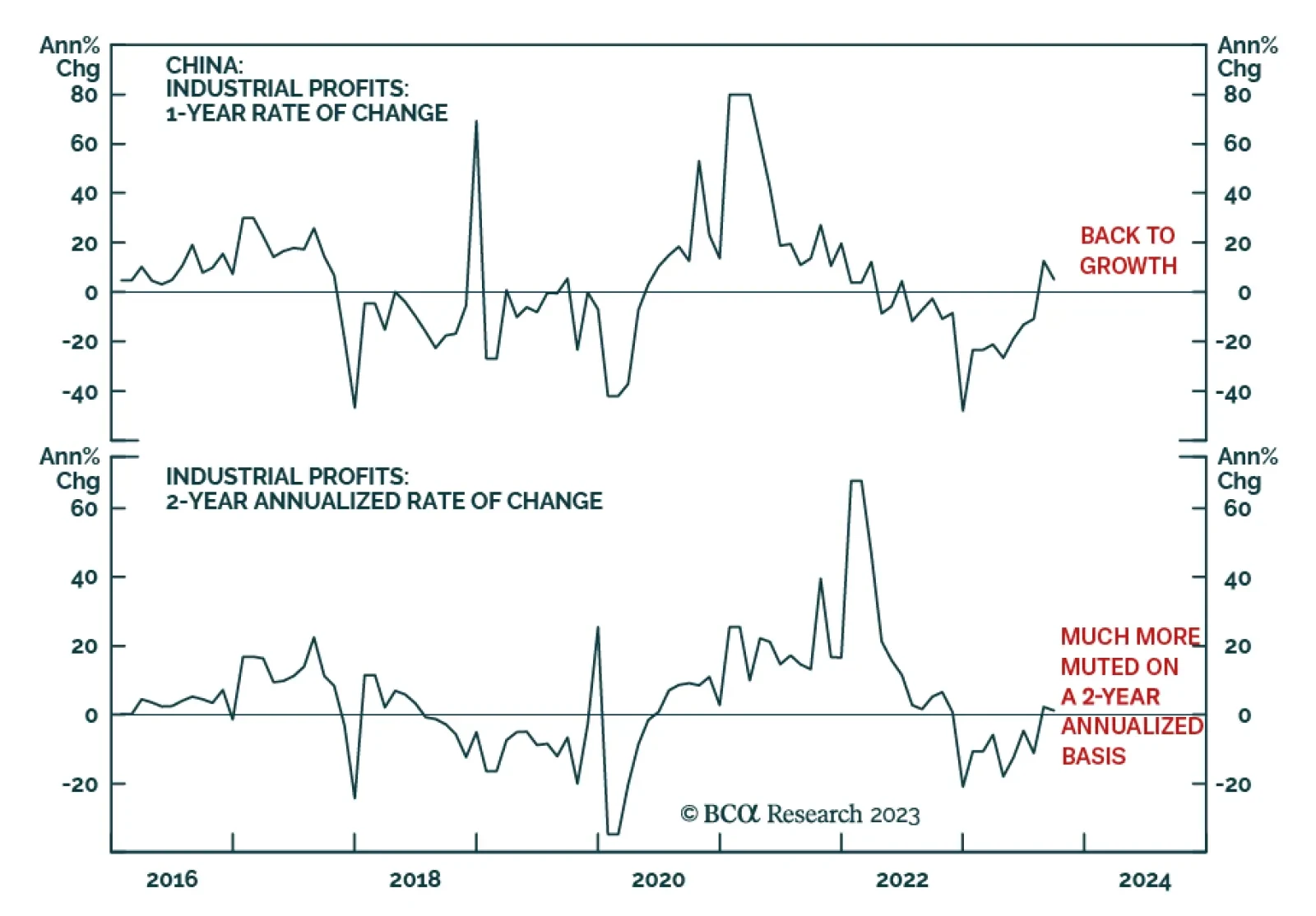

China's industrial profits delivered a positive signal over the past couple months. Total profits expanded on a year-on-year basis in both August (+17.2% y/y) and September (+11.9% y/y). Rebounding industrial profits is…

Stronger US growth elicits a response from the House Republicans. But a government shutdown is not devastating to the economy. What is more devastating would be a crisis in the Middle East, Europe, and Asia. Stay long US defense,…

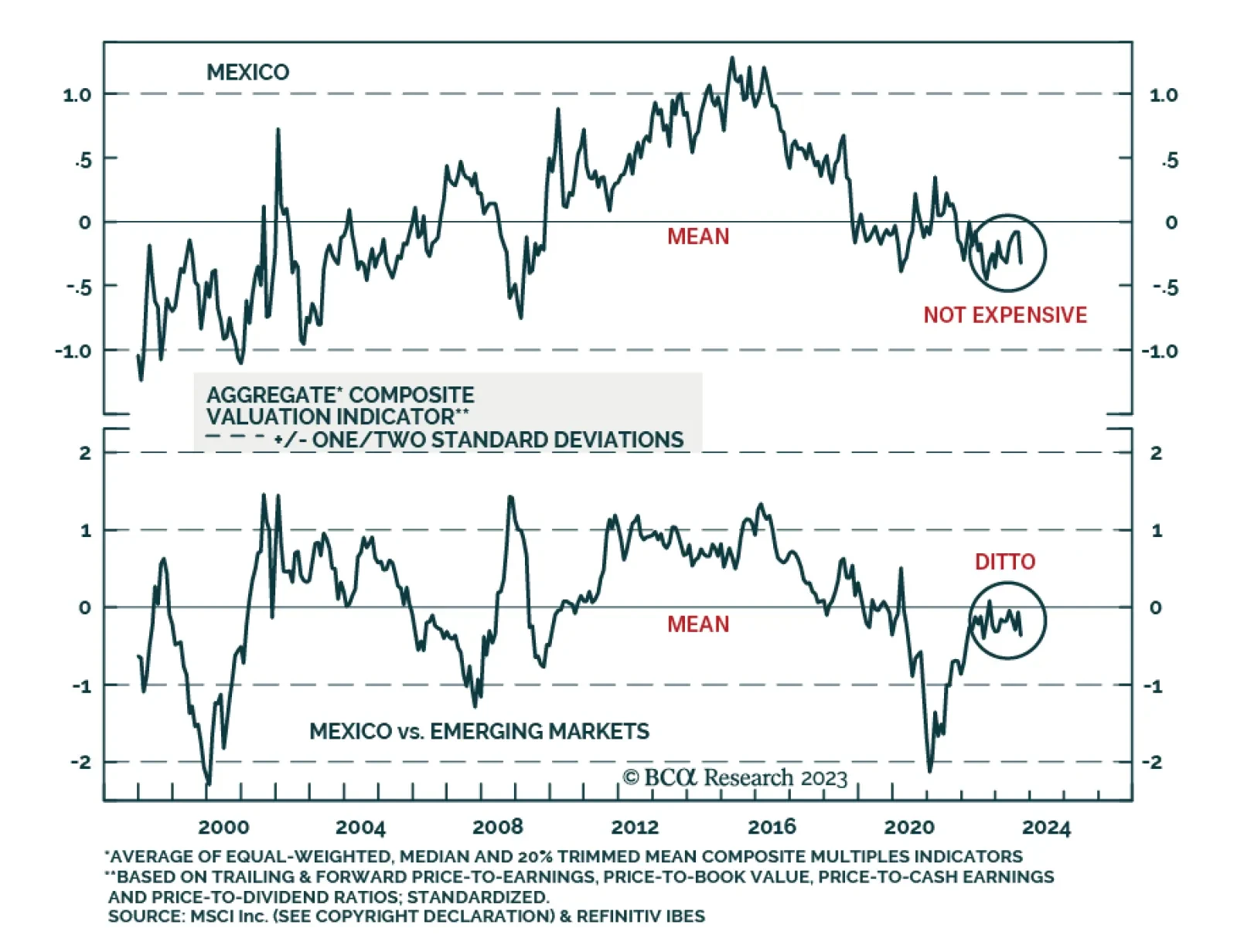

BCA Research’s Emerging Markets Strategy service remains overweight Mexican financial markets relative to their EM counterparts on a cyclical and structural basis. While Mexican markets will suffer in absolute terms with…

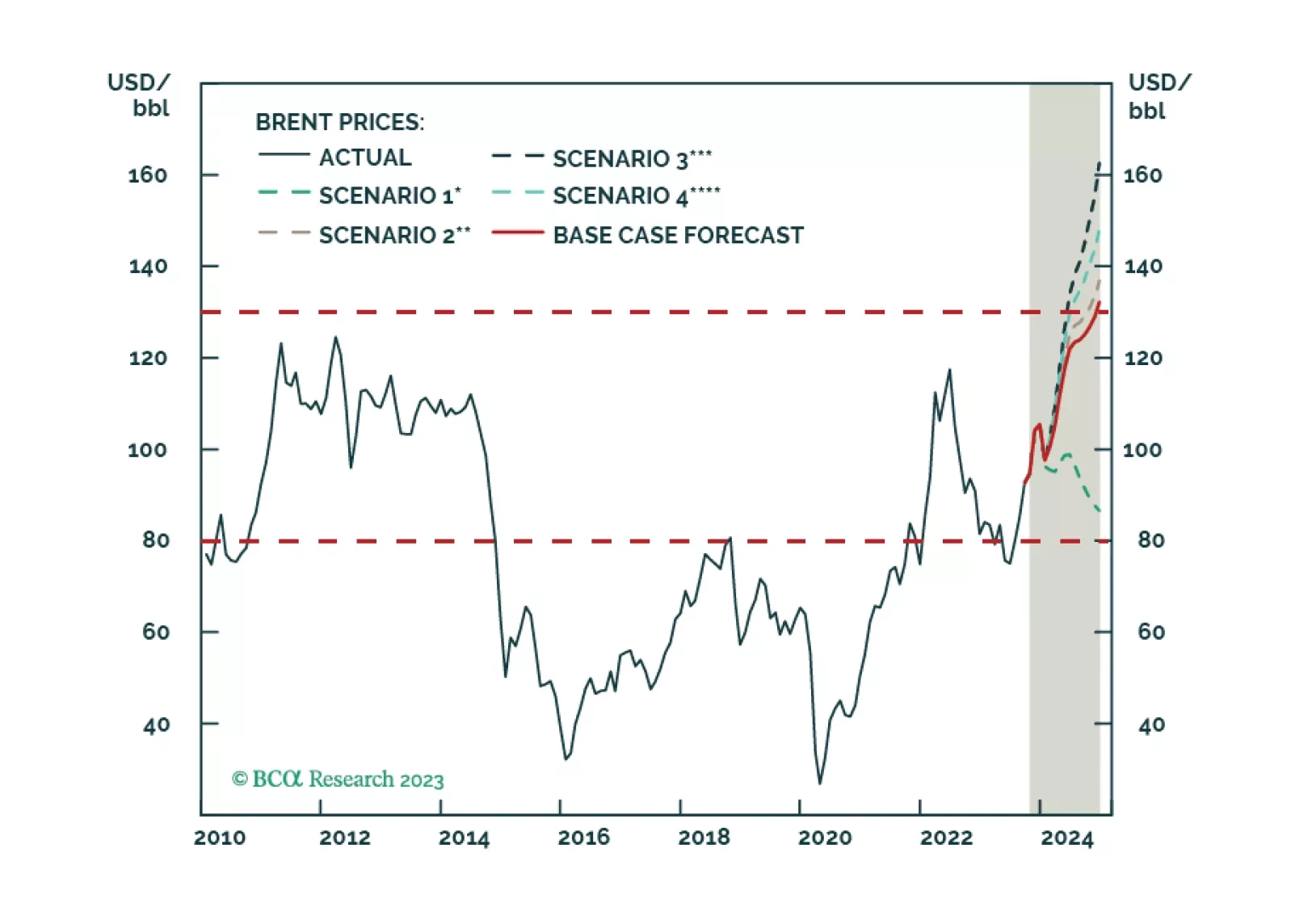

The US and core OPEC 2.0 are – wittingly or not – laying the groundwork for a price band with a floor and cap on oil prices – at $79/bbl and $130/bbl, respectively – “at least” to May 2024. This accommodates multiple goals for both…

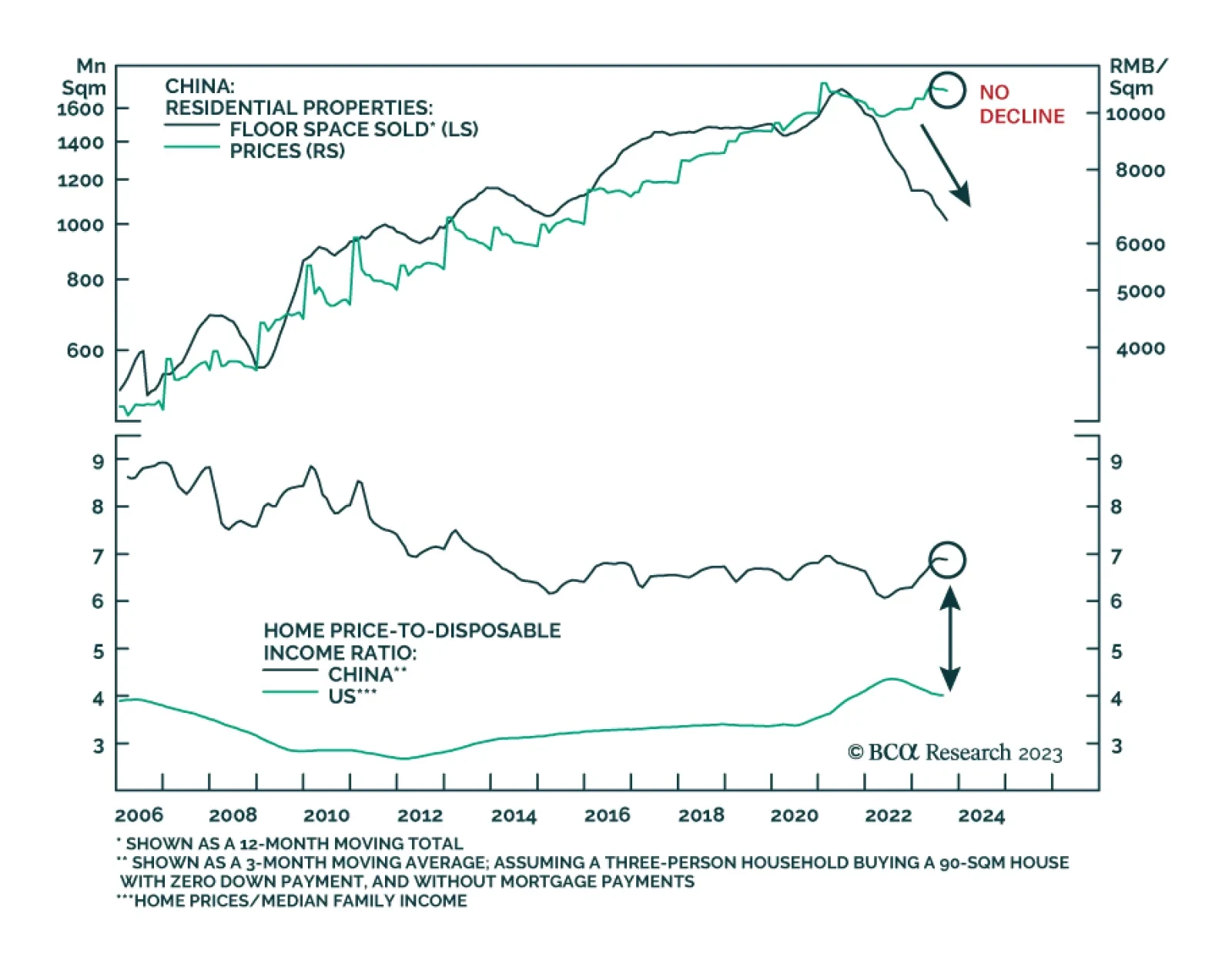

According to BCA Research's China Investment Strategy service, the property market has not cleared. Property market indicators suggest that China's real estate sector is still struggling to stabilize. Home sales and…

China’s economic growth will stagnate, at best, rather than revive. Lower valuations of Chinese equities are justified, and share prices have more downside. The RMB will continue to depreciate versus the US dollar.