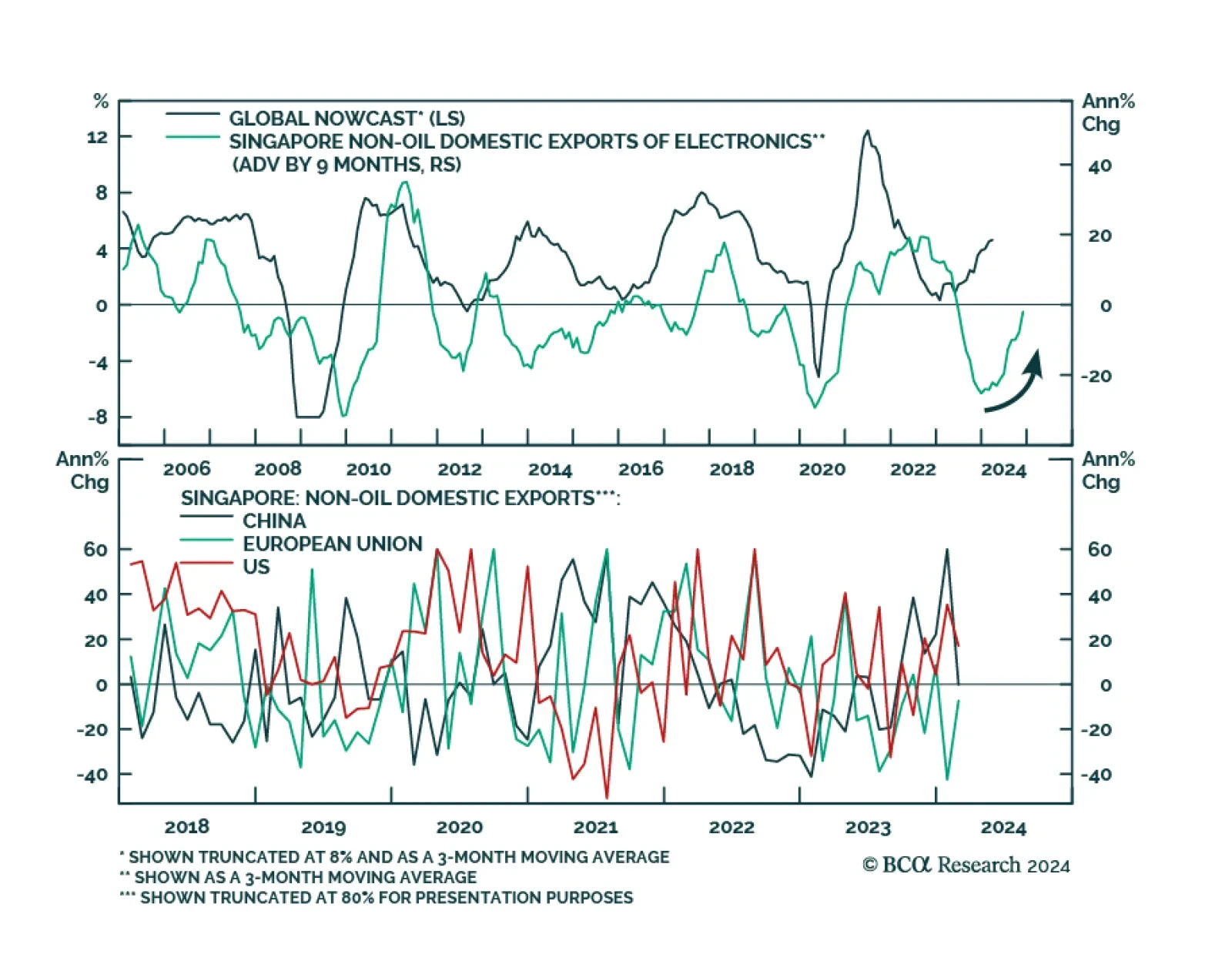

Singapore non-oil exports (NODX) largely disappointed in February, contracting by 4.8% m/m following a 2.3% m/m expansion in January, and falling below expectations of a milder 0.5% m/m decline. In a similar vein, the 0.1% y/y…

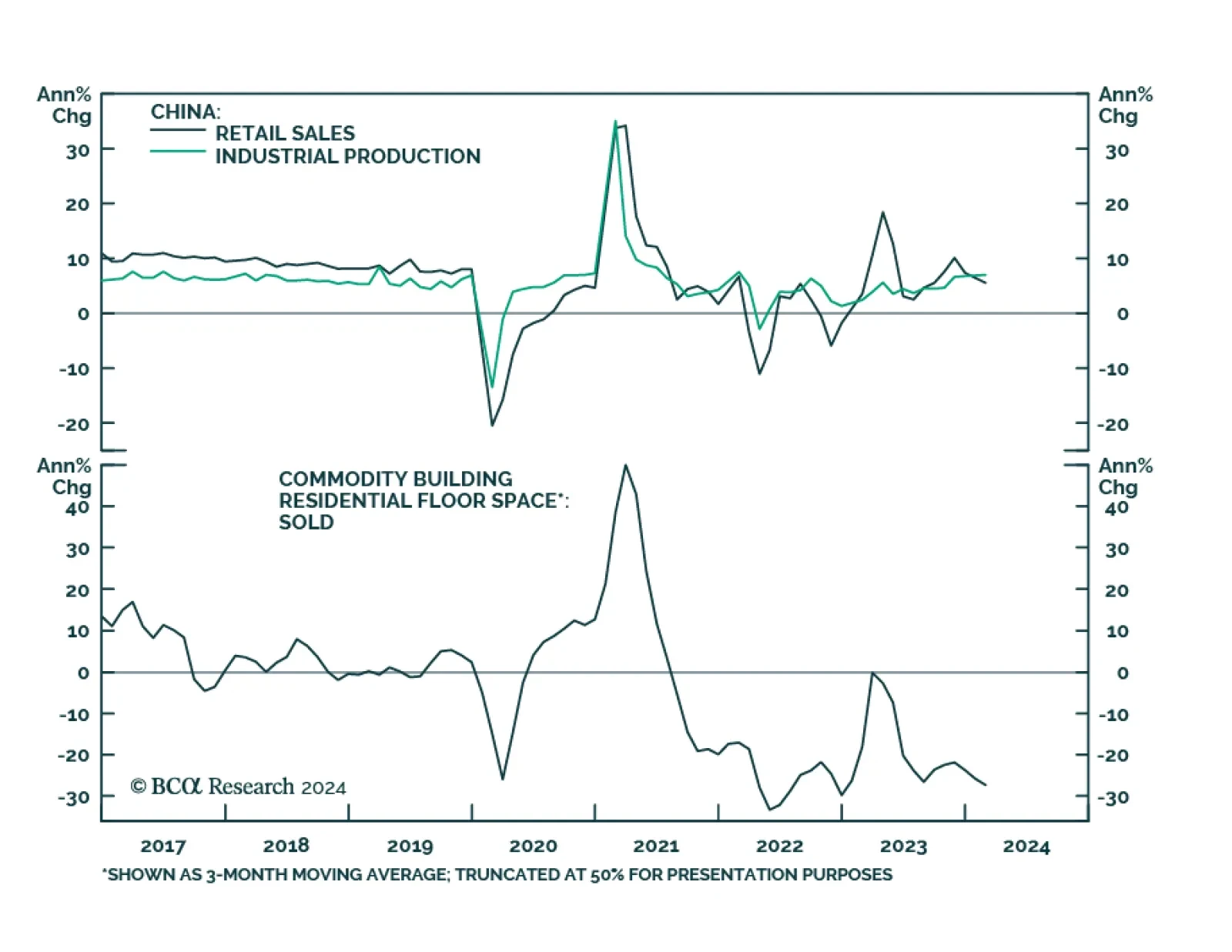

Chinese economic data for the first two months of the year were mixed. On the one hand, industrial production and fixed asset investment growth came in above consensus estimates, accelerating to 7.0% y/y (vs. expectations of 5.2…

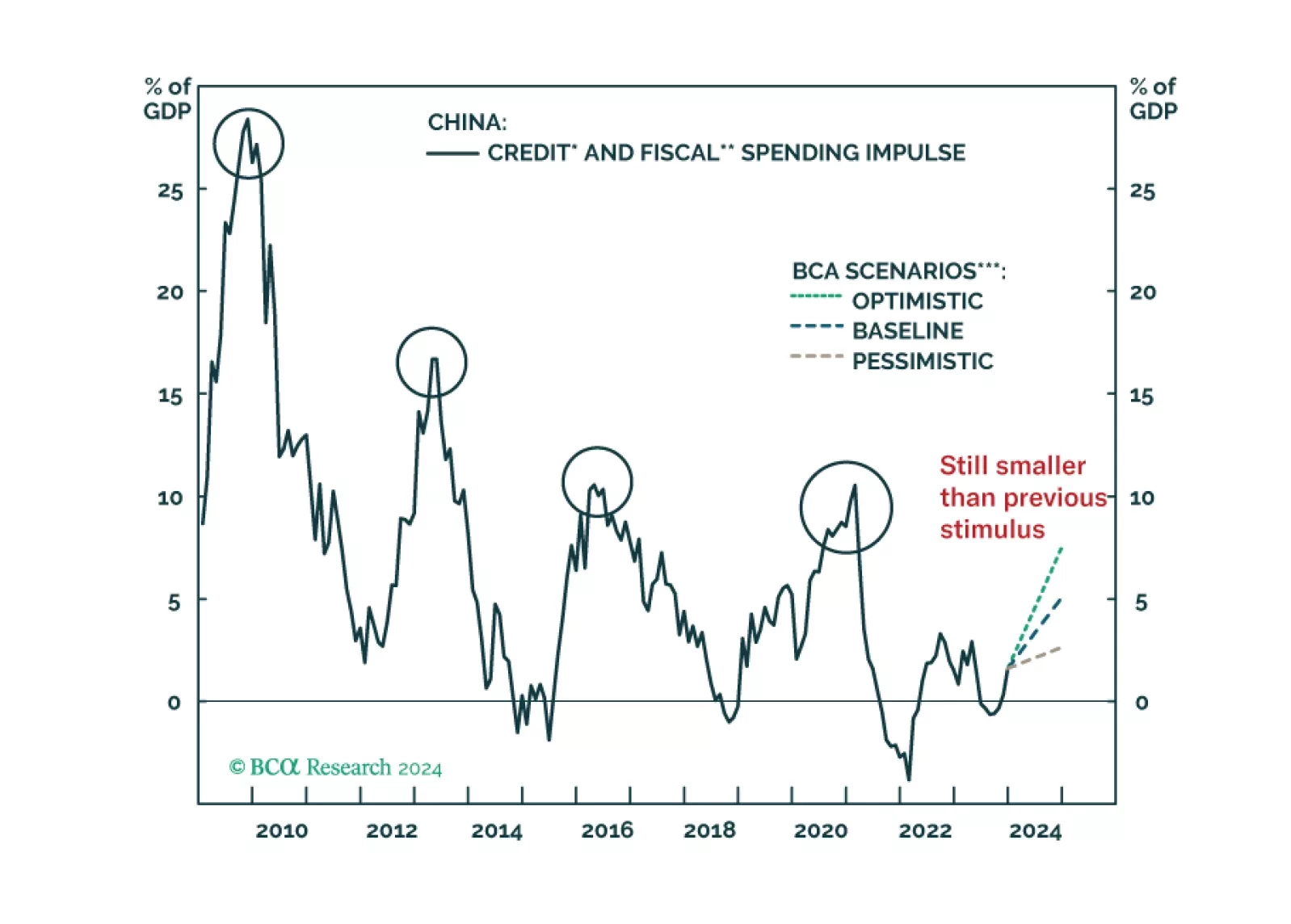

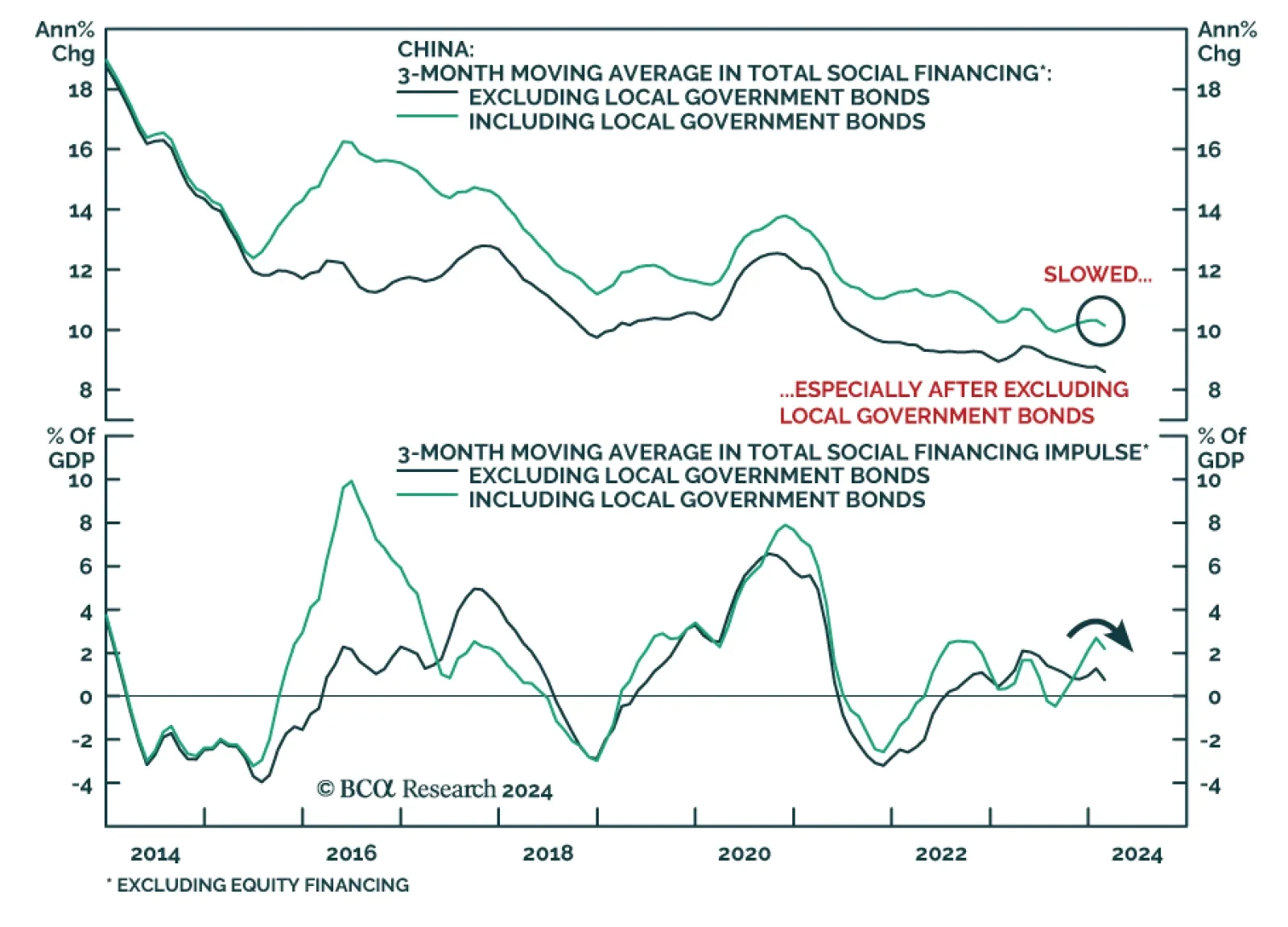

Chinese private sector credit demand remained weak in February, sending a negative signal about domestic economic conditions. Total social financing growth slowed from a record CNY6.5 trillion in January to CNY1.56 trillion,…

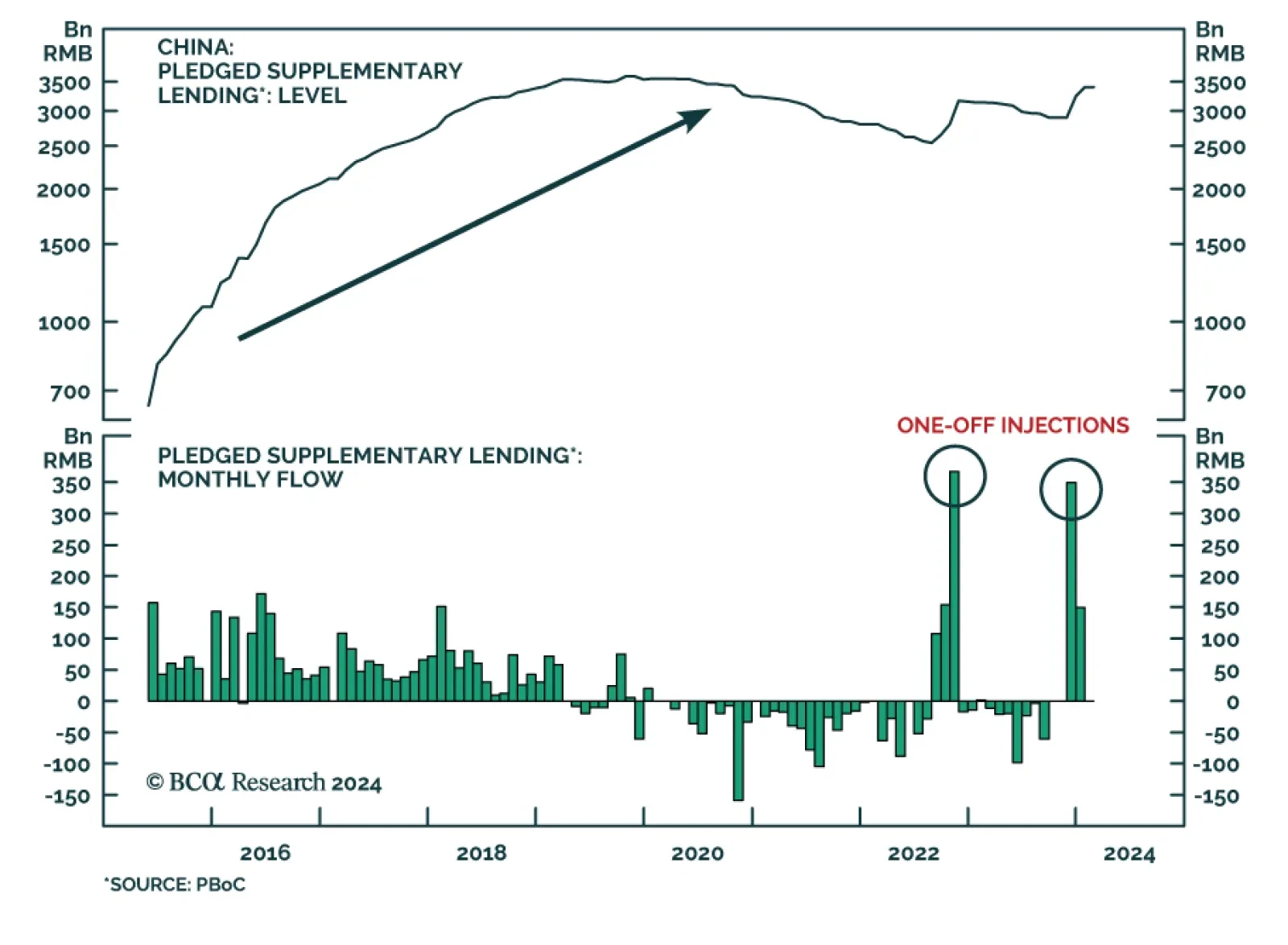

According to BCA Research’s China Investment Strategy service, a very substantial PSL financing scheme for housing, a large LG and LGFV debt swap, and considerable fiscal transfers to households—or a combination…

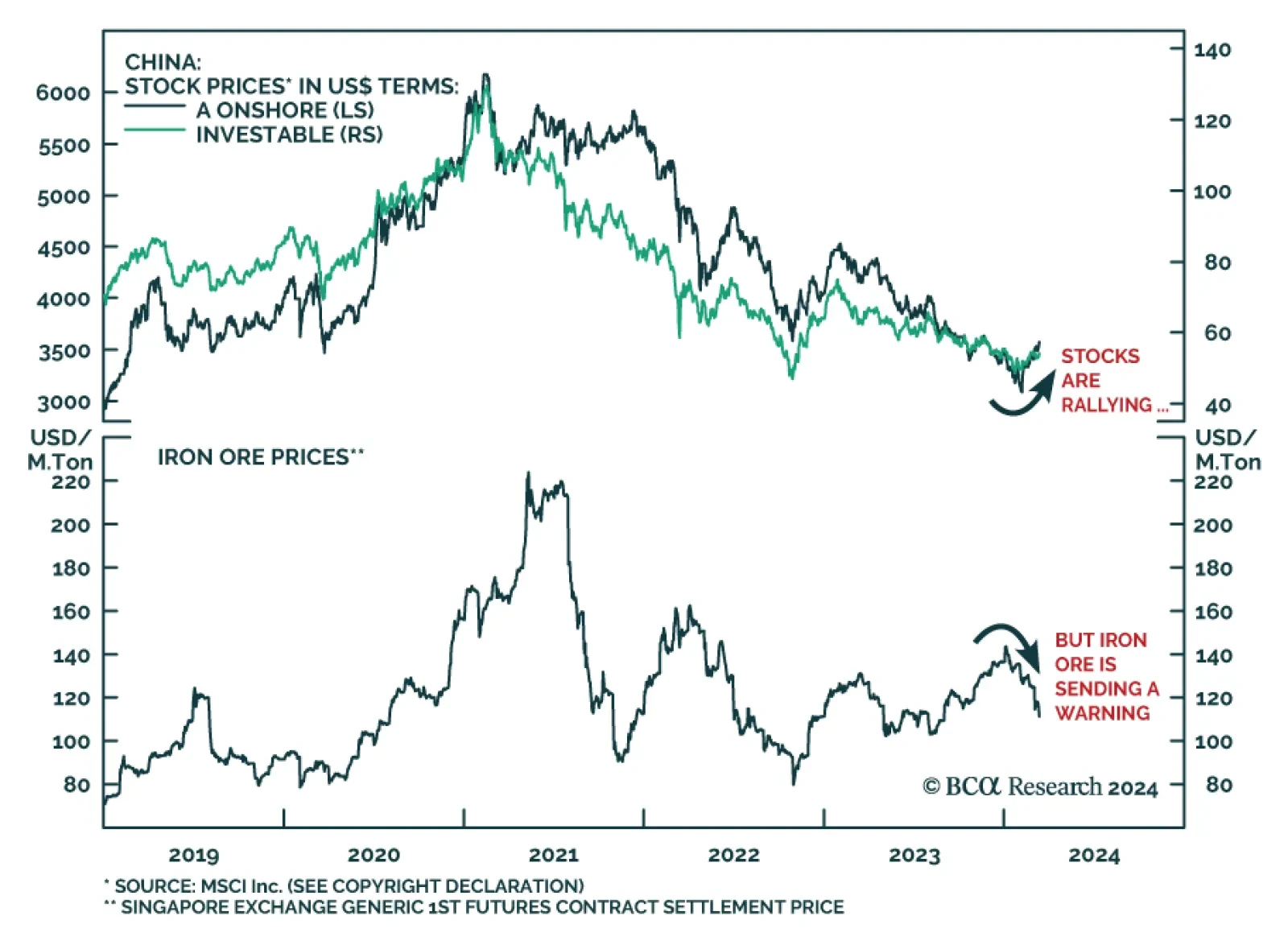

Chinese stocks are experiencing their longest rally since the country’s exit from Covid restrictions over a year ago. The MSCI Onshore and Investable indices (in USD terms) have gained 15.8% and 9.1% respectively since…

Our Portfolio Allocation Summary for March 2024.

The stimulus measures announced at last week's NPC were not a game changer. As in 2023, we expect aggregate government spending will fall short of the budgeted amount again this year.

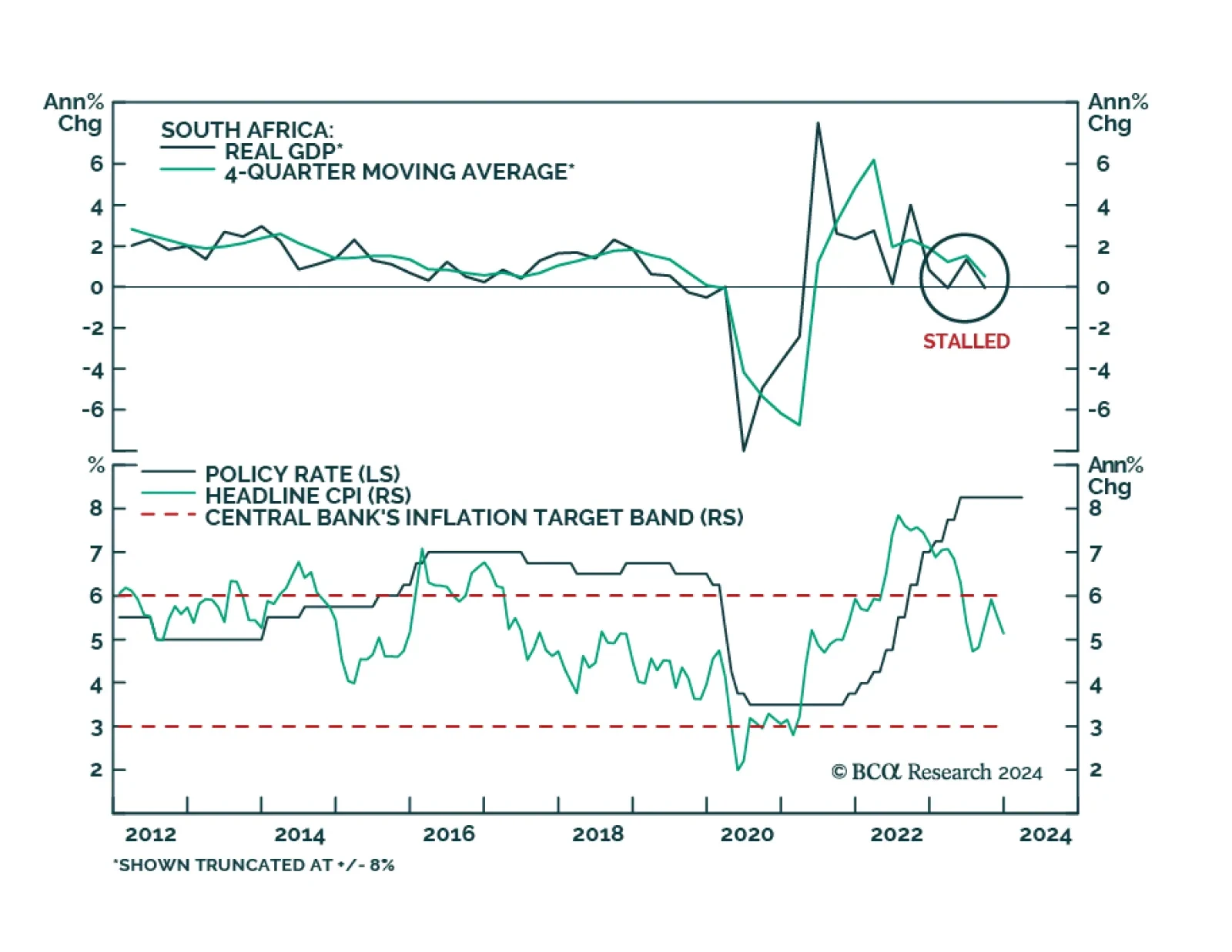

Our Emerging Markets Strategy team posits that the South African economy is heading into a recession later this year. The South African government refrained from announcing any stimulus measures in its recent budget proposals.…

Presently, our four high-conviction themes are: (1) the US dollar will rally as US growth continues to outpace the rest of the world; (2) US equities will continue to outperform EM and European stocks until a major sell-off occurs; (…