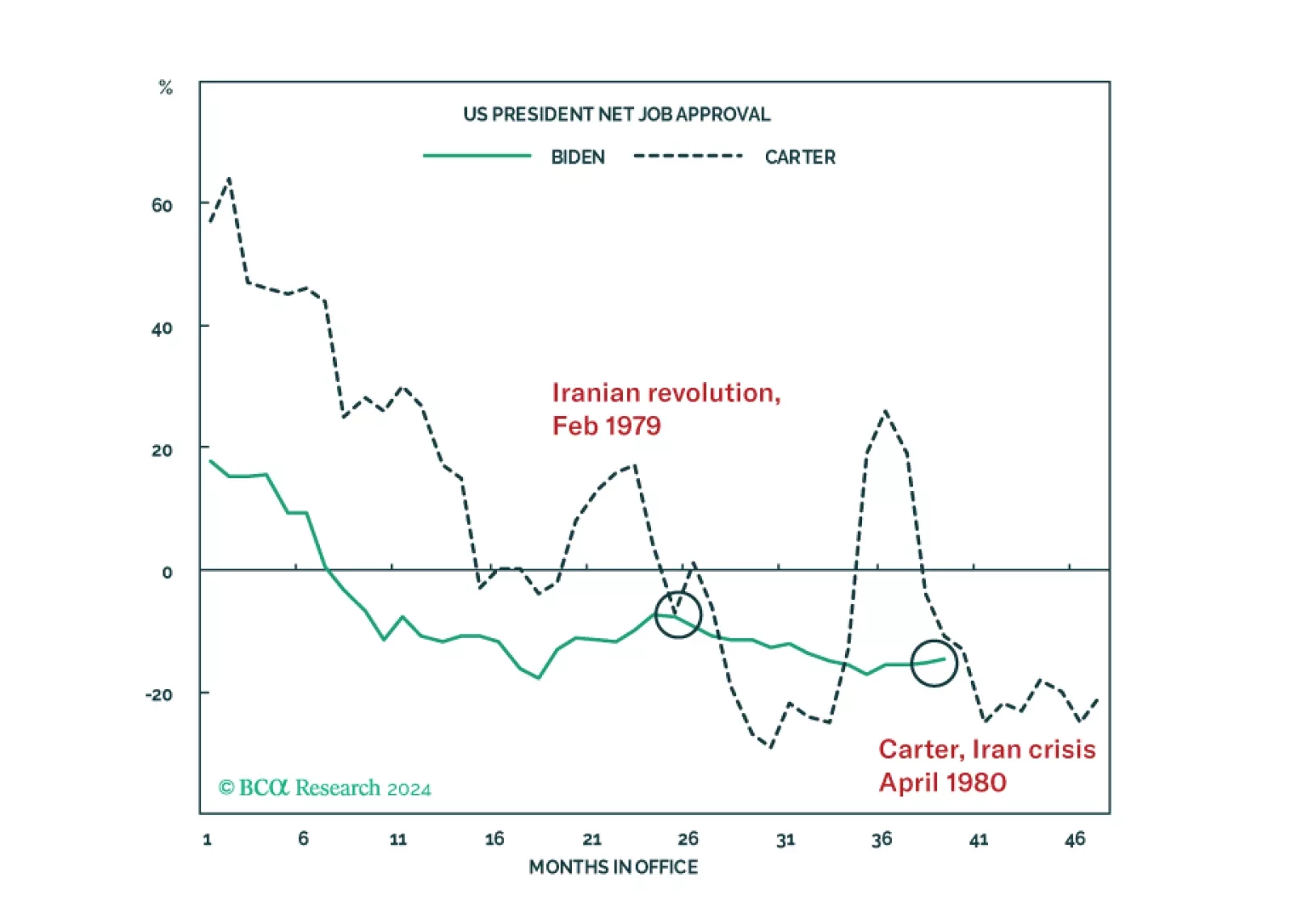

Our quant models suggest Democrats are still slightly favored for the White House. Our Senate model favors Republican control, though Montana and Ohio are the weak links that could deliver Democrats a de facto Senate majority in the…

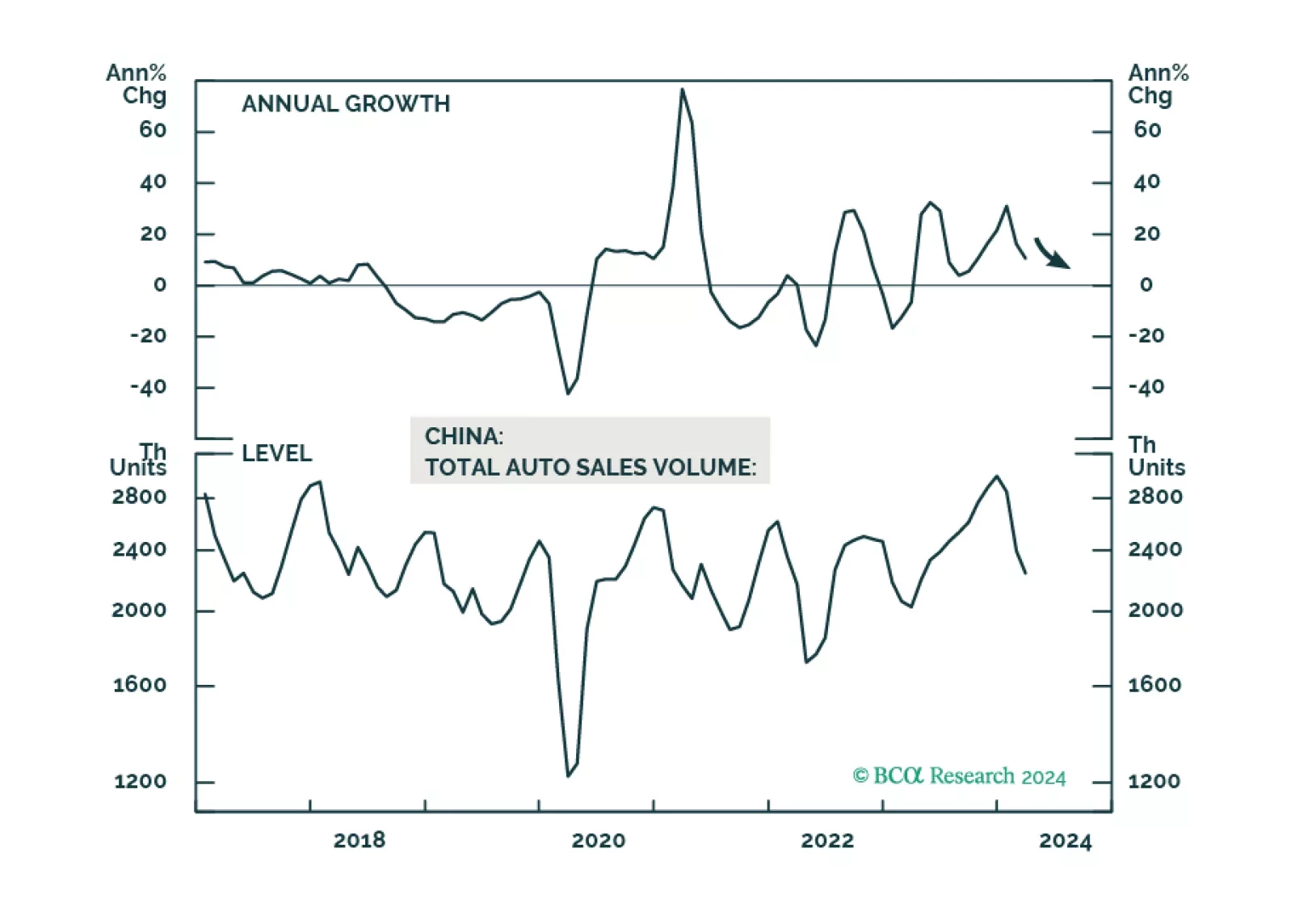

Chinese economic data releases painted a mixed picture of domestic conditions on Tuesday. Chinese real GDP growth accelerated from 5.2% y/y to 5.3% y/y in Q1 2024, beating expectations of 4.8% and suggesting that economic…

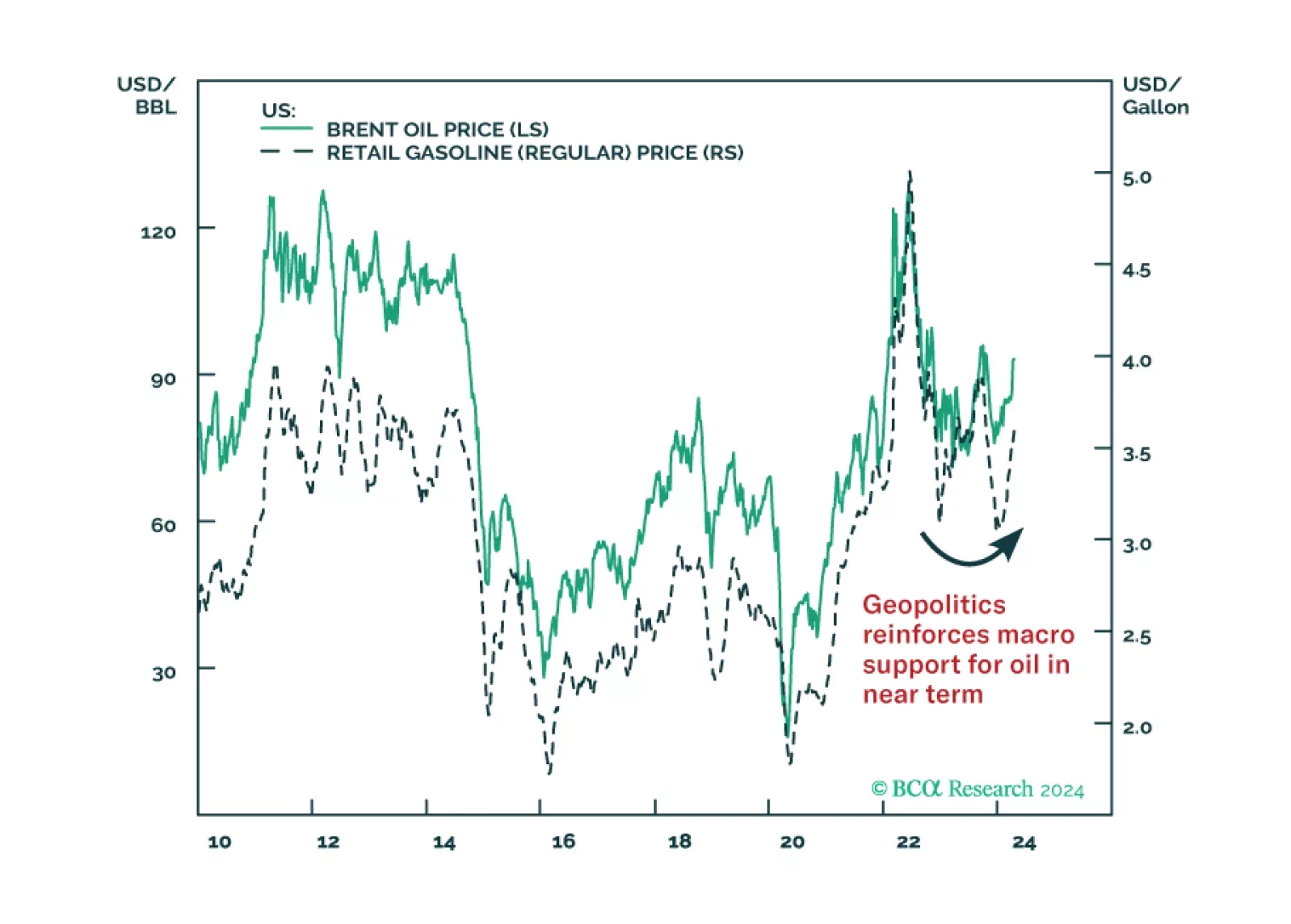

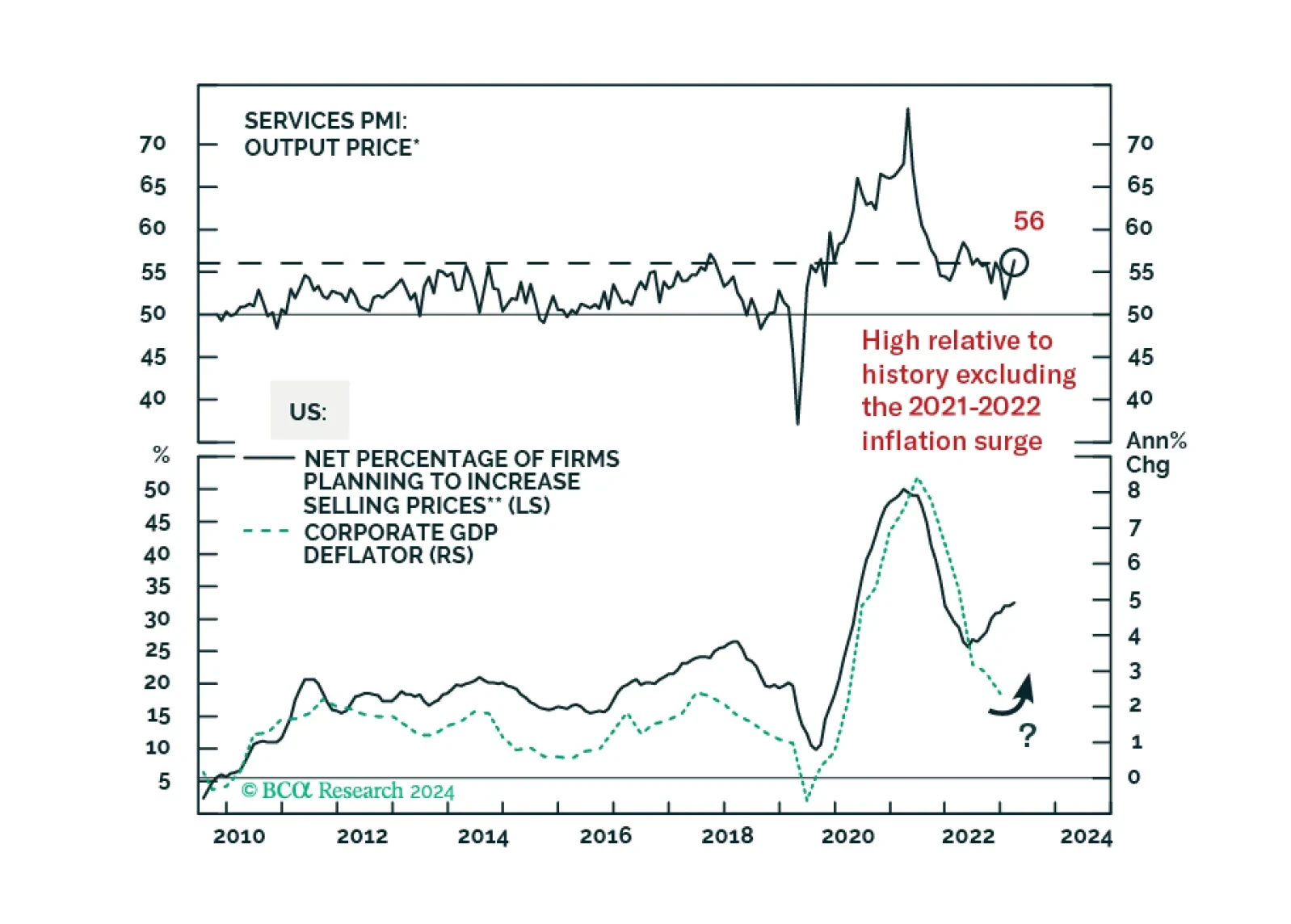

In the near term, favor oil and oil producers outside the Gulf Arab states. Over a 12-month horizon, favor US and North American equities, defensive sectors over cyclicals, and safe-assets. Within cyclicals, stick to energy and…

Stay overweight US equities versus world, long US energy sector versus Middle East stocks, and long Canada and Mexico versus global-ex-US stocks.

In the short run, global risk assets are vulnerable due to rising oil prices and bond yields. Cyclically, a global economic downturn will weigh on global risk assets.

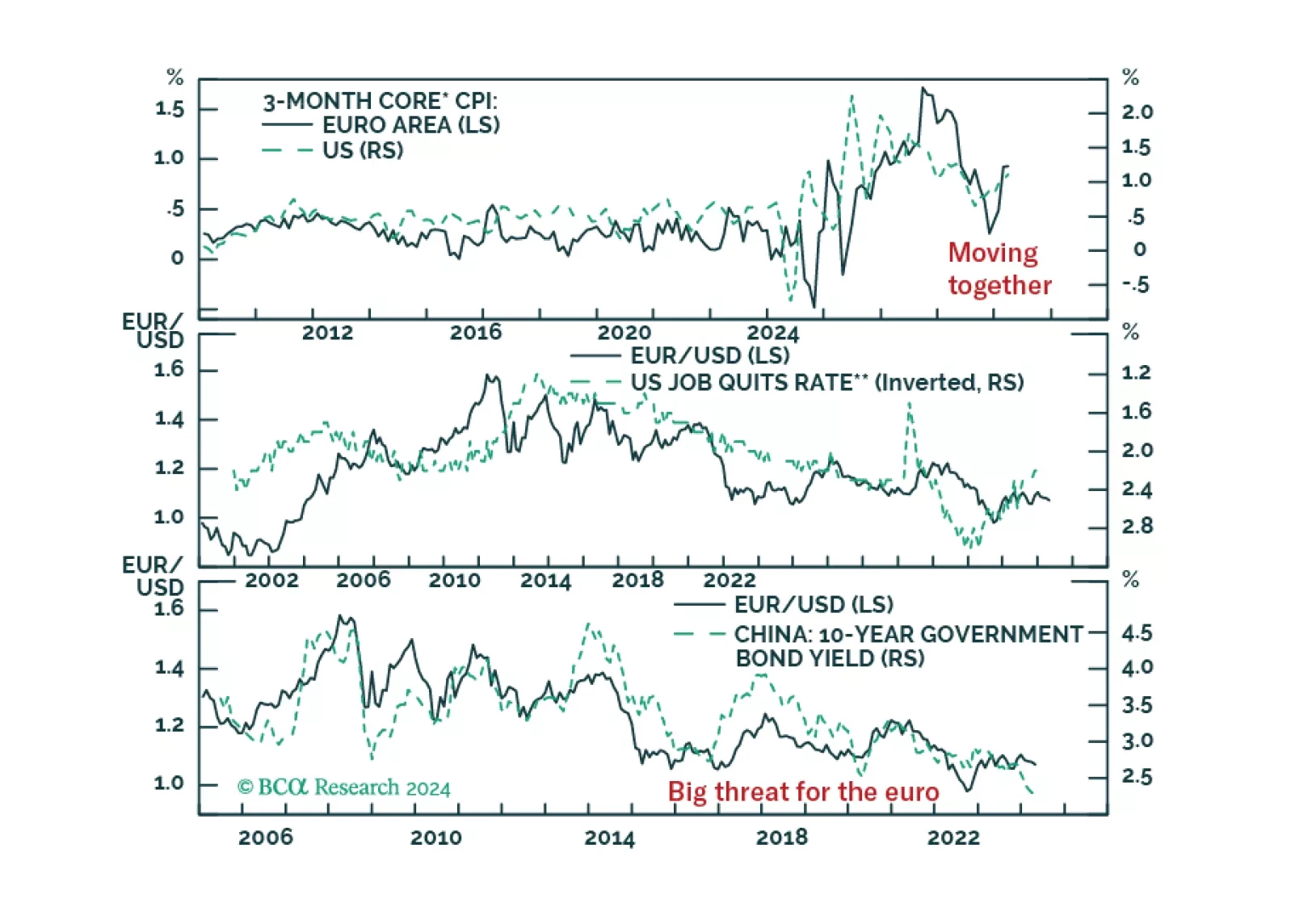

EUR/USD collapsed in the wake of last week’s hotter-than-expected US CPI report. Is this pessimism warranted and will the euro’s trading range that has prevailed since 2023 breakdown?

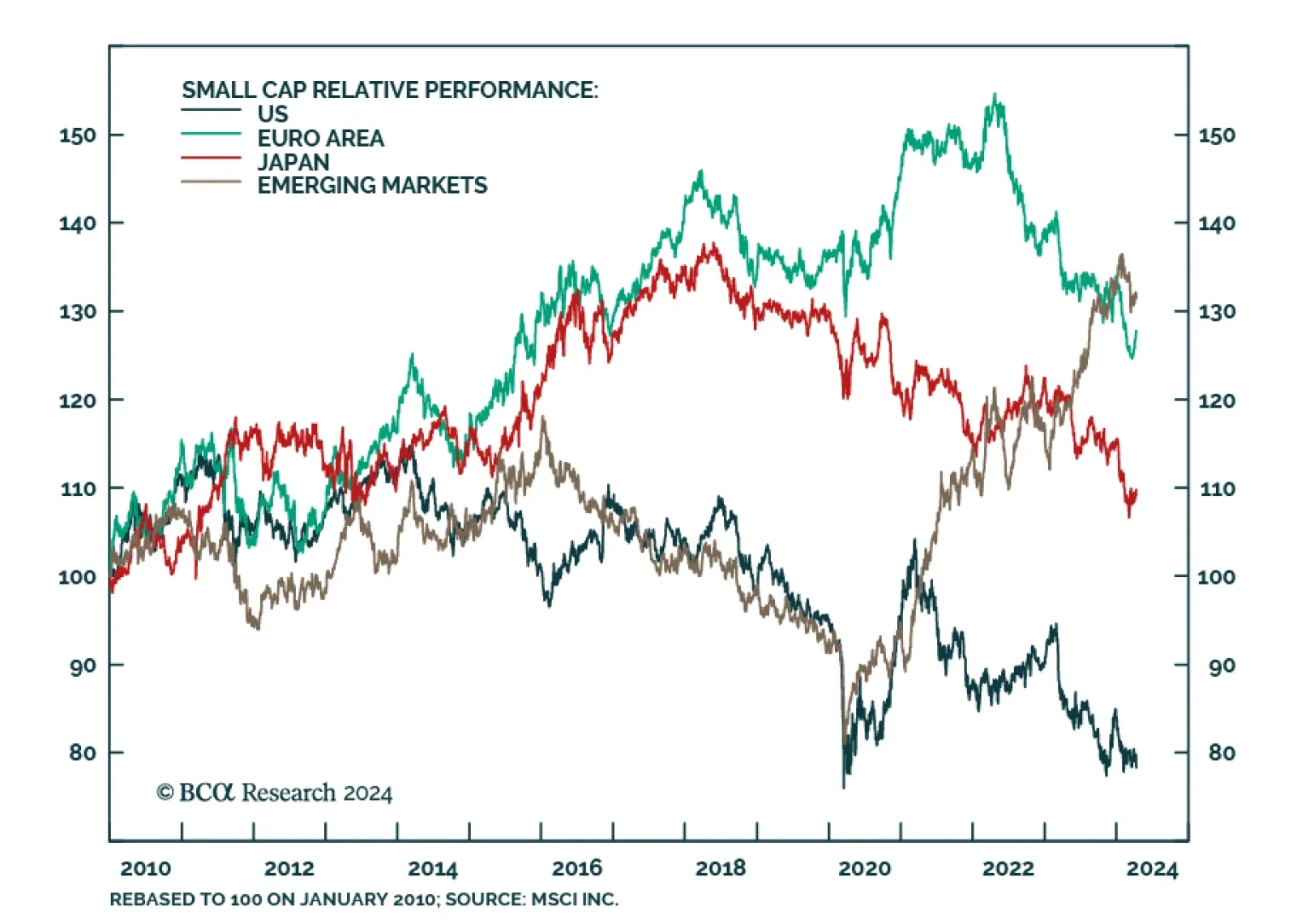

US, European and Japanese small caps have underperformed their large cap counterparts by 22.6%, 15.3% and 10.1% respectively since 2021. They now face conflicting forces. On the one hand, they are extremely beaten down and cheap…

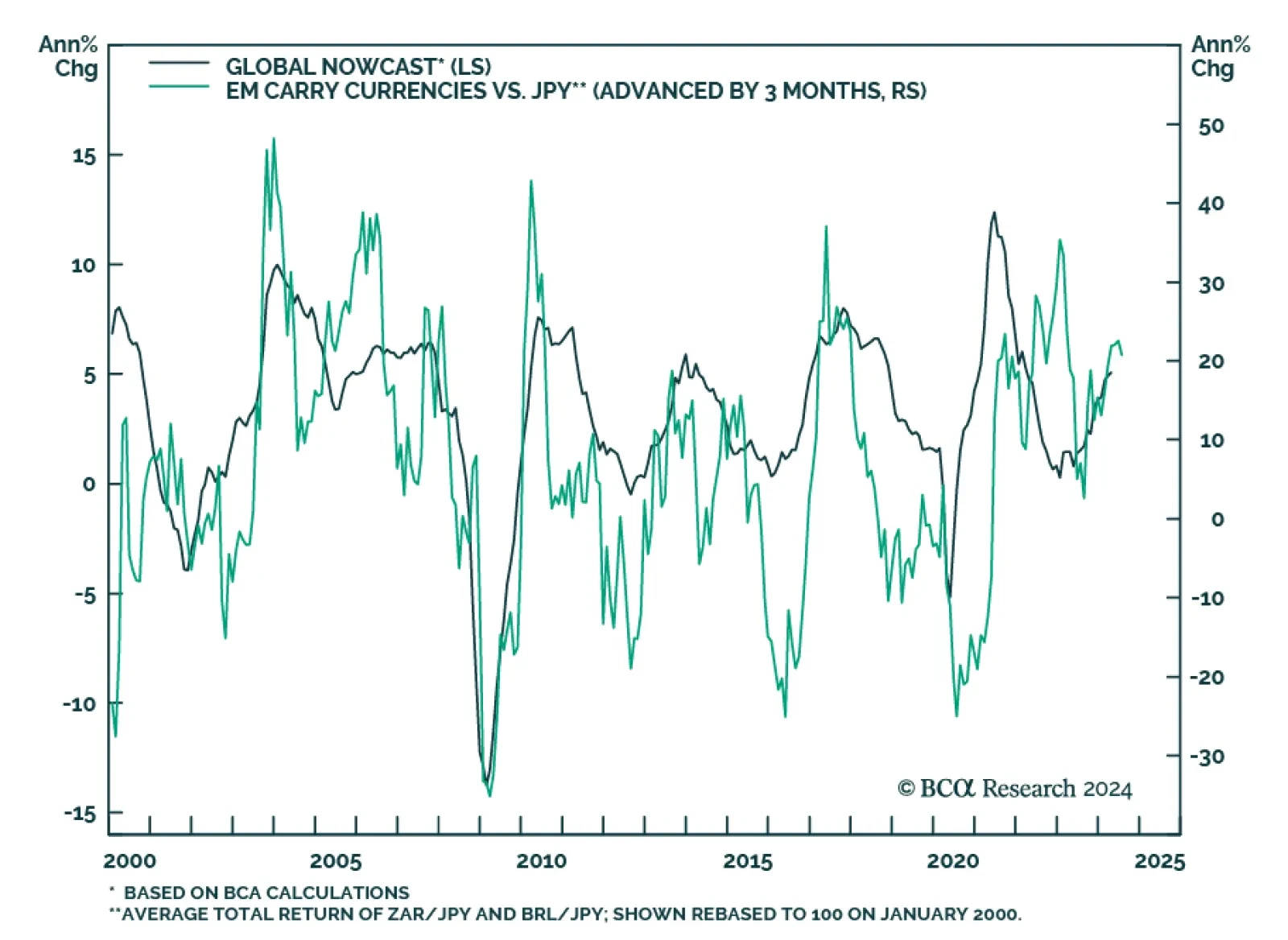

The total return of a carry strategy that is long high-yielding currencies like the Brazilian real and the South African rand and short a funding currency like the Japanese yen is pointing to a recovery in global growth. Carry…

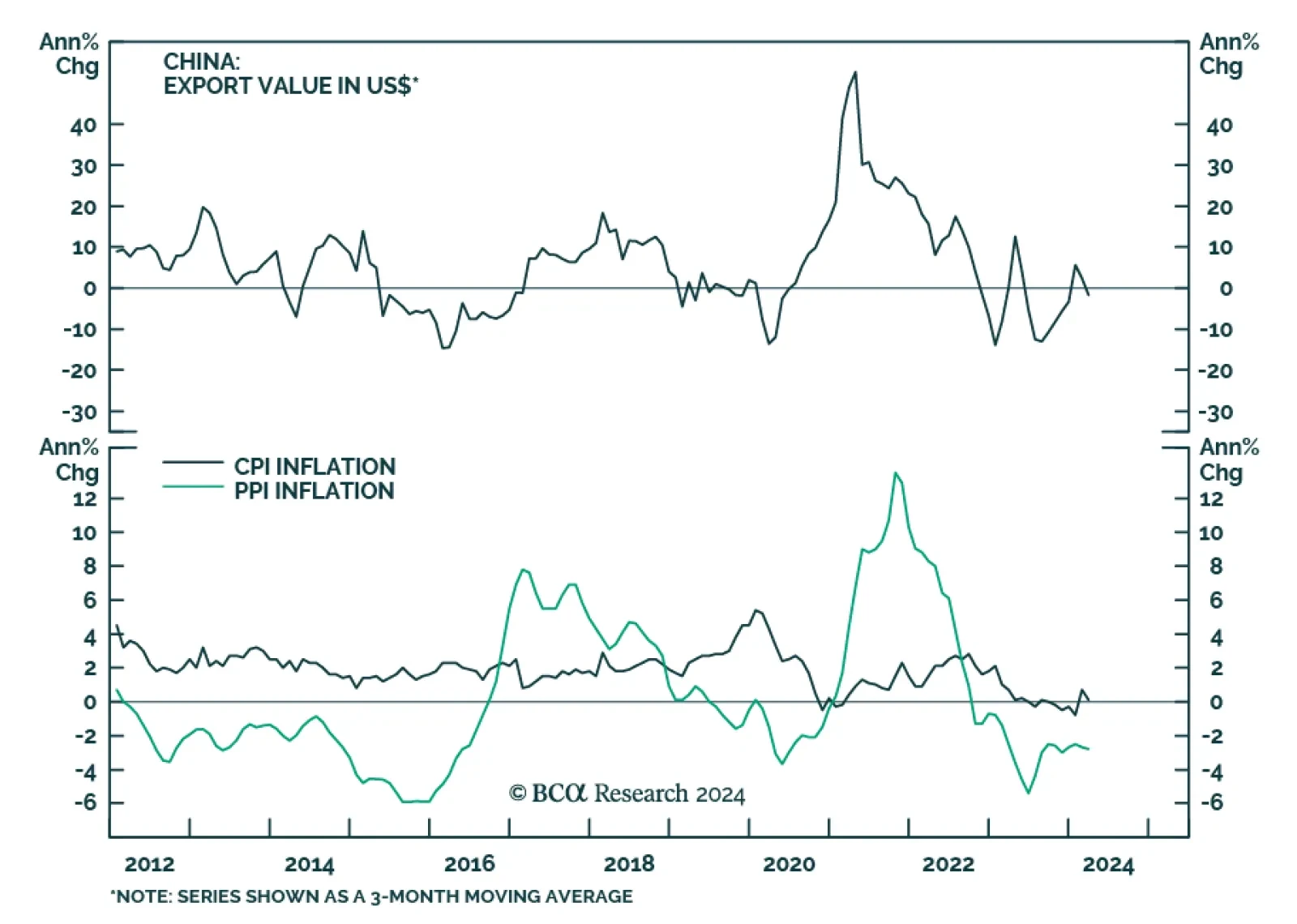

Chinese trade and credit data delivered a negative surprise for March. On the trade front, the 7.5% y/y drop in exports came in below expectations of a 1.9% y/y decline following four consecutive months of growth. While the jump…