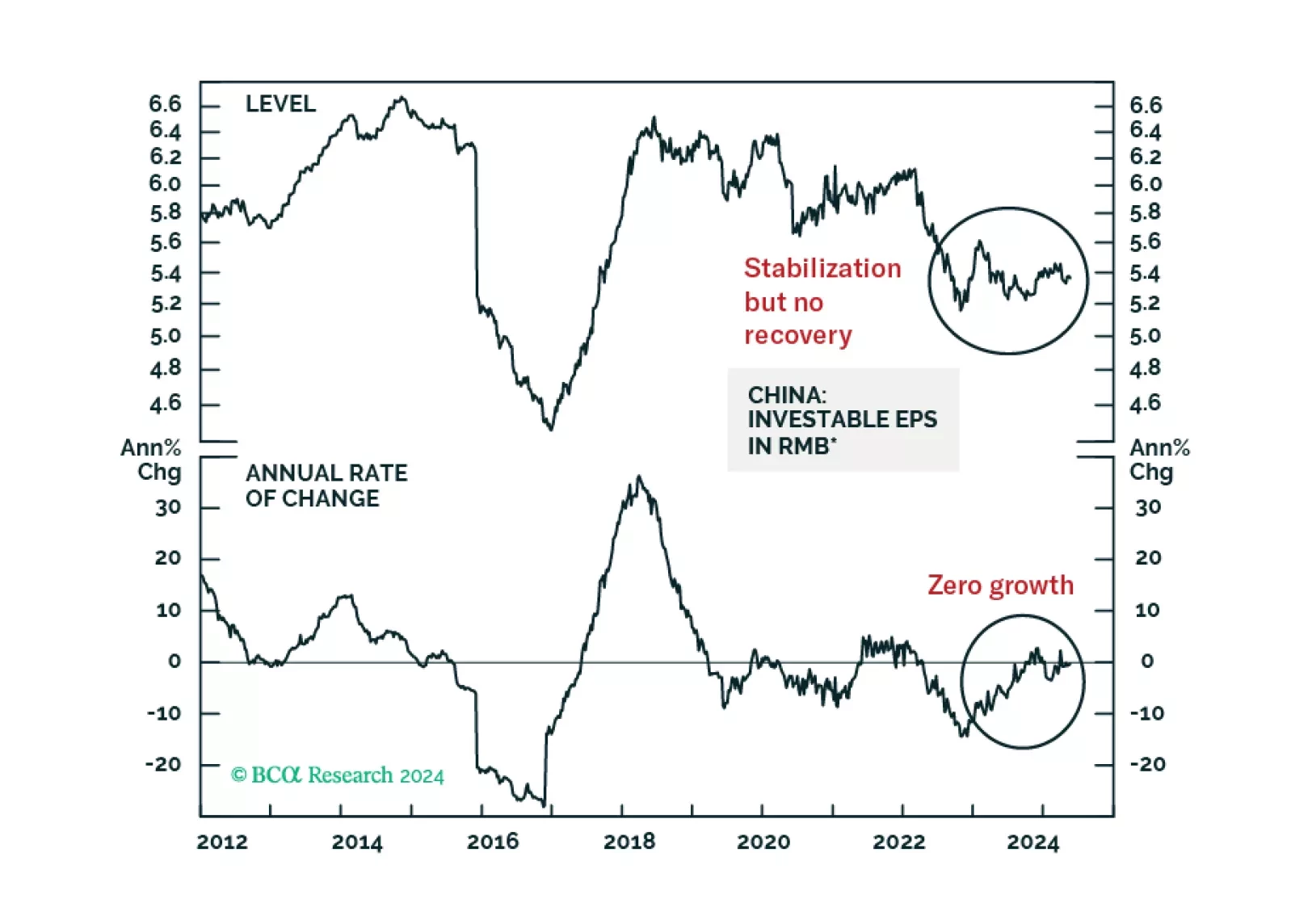

As in many other countries, China’s cyclical consumption growth is primarily driven by labor market conditions, income, and borrowing. BCA Research’s China Investment Strategy service maintains the view that these…

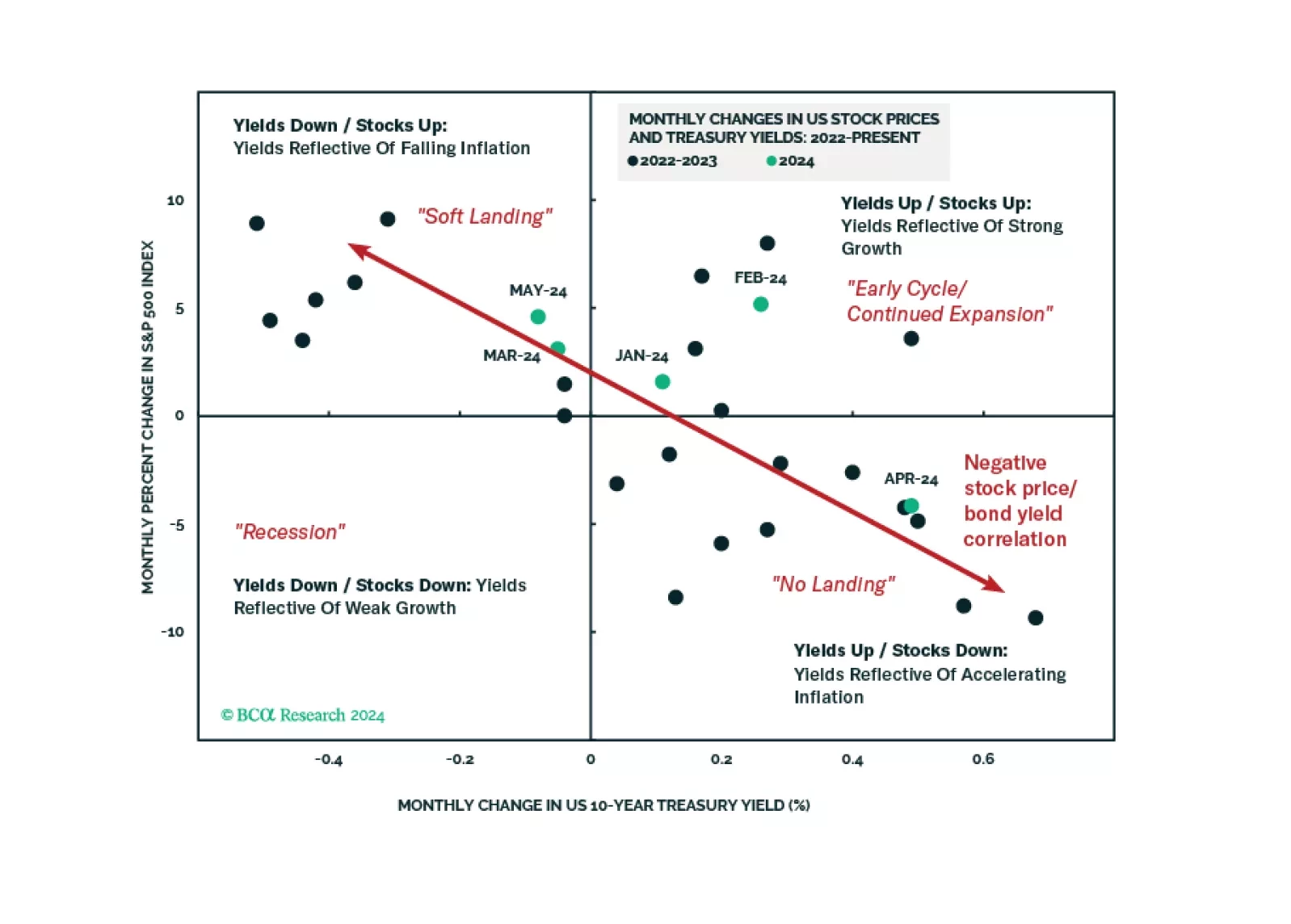

In Section I, we argue that global investors have been lulled into a false sense of security concerning the resiliency of the US economy. Tight monetary policy means that something must change for a recession to be avoided, and…

The large buildup in Chinese households’ savings deposits is unlikely to fuel consumption. Poor outlooks on labor market conditions, income, and households’ unwillingness to borrow will hinder consumption through the rest of 2024.

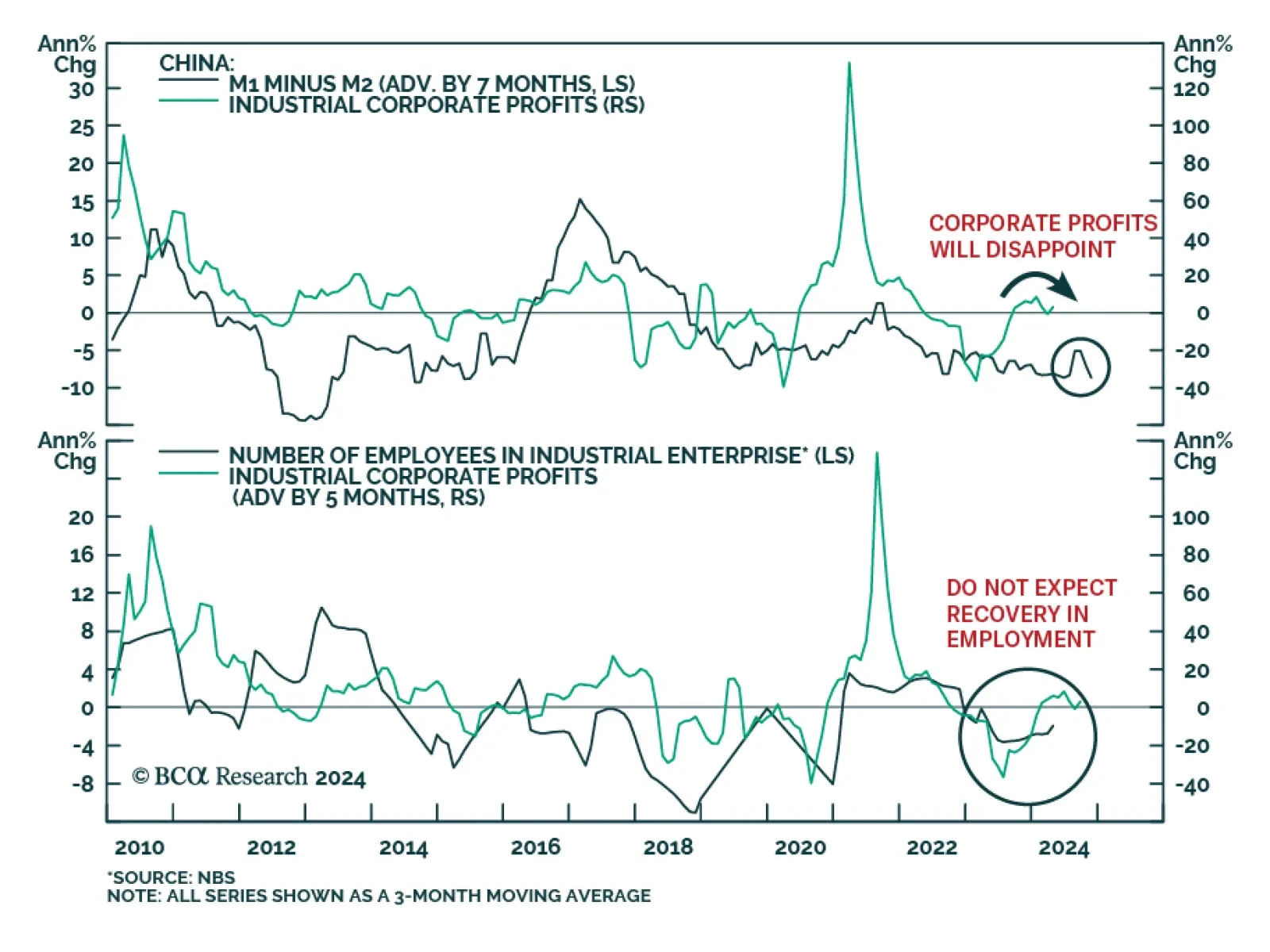

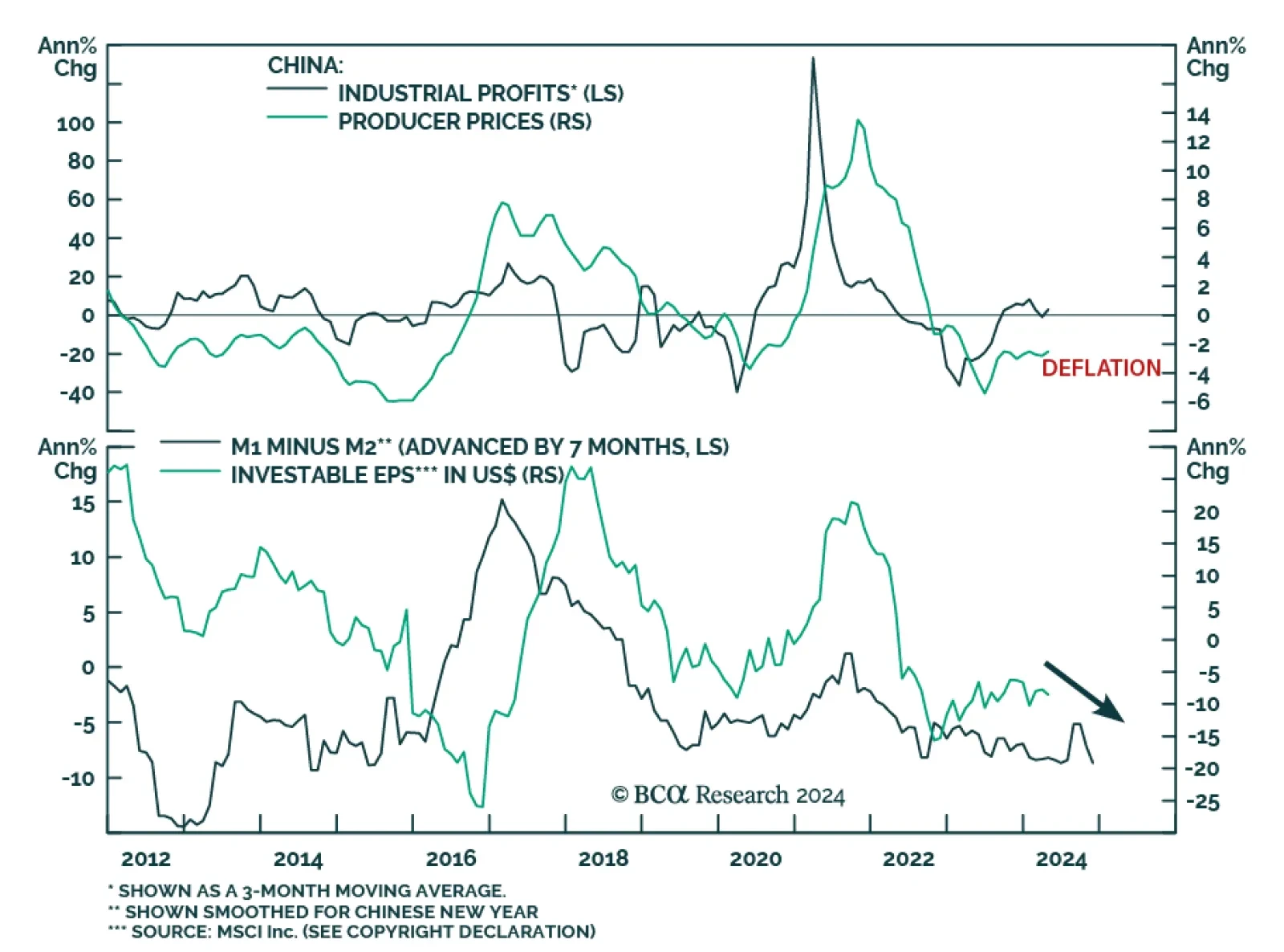

Chinese industrial profits rose by 4.0% y/y in April, from a 3.5% y/y contraction in March. They grew by 4.3% in the first four months of the year, compared to the same period in 2023. In March, the central government pledged…

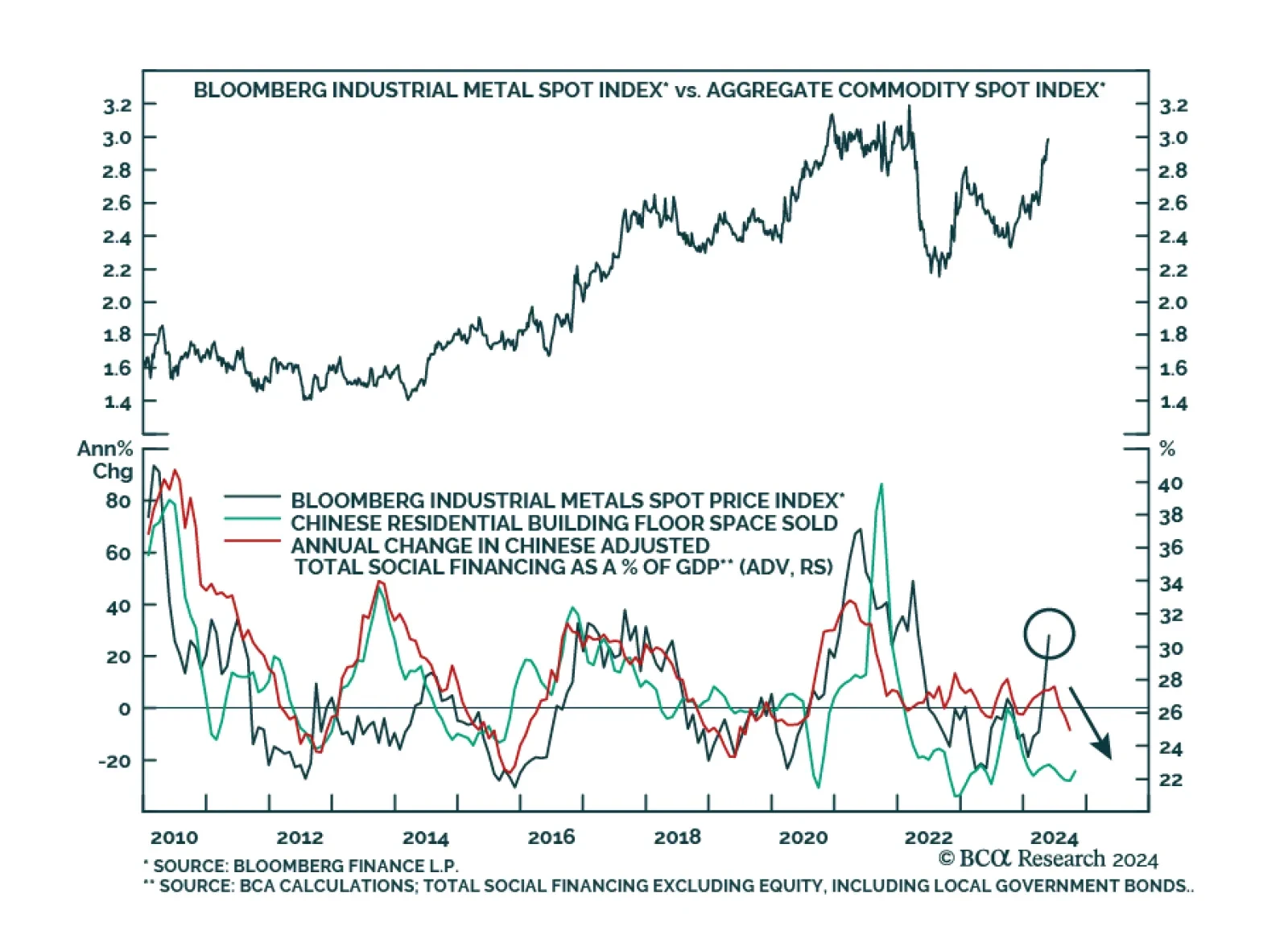

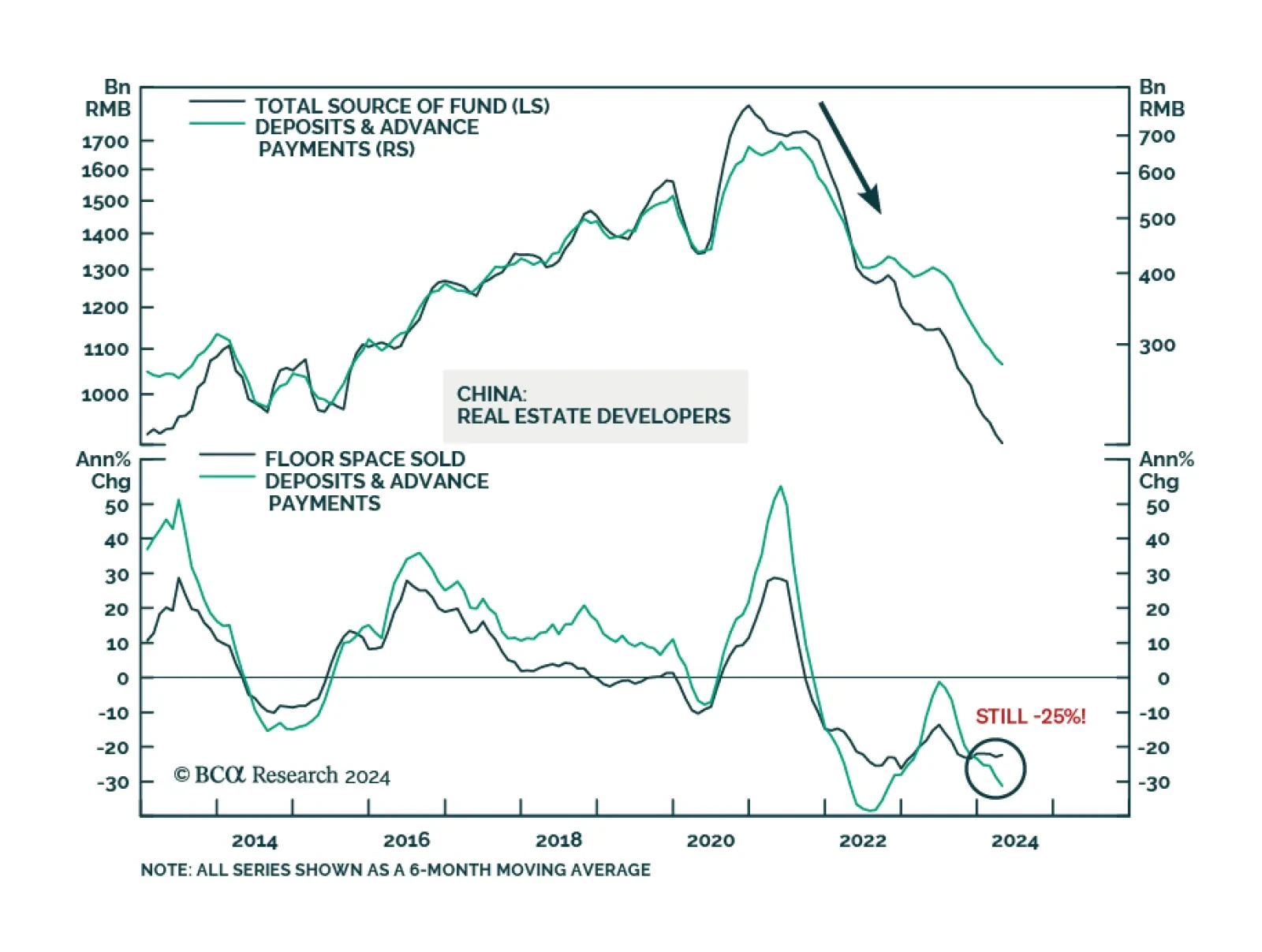

The RMB 500 billion program is small, as it is equivalent to only 4% of property developers' total funding from the past 12 months. This will preclude a recovery in property construction this year. Corporate profits will determine…

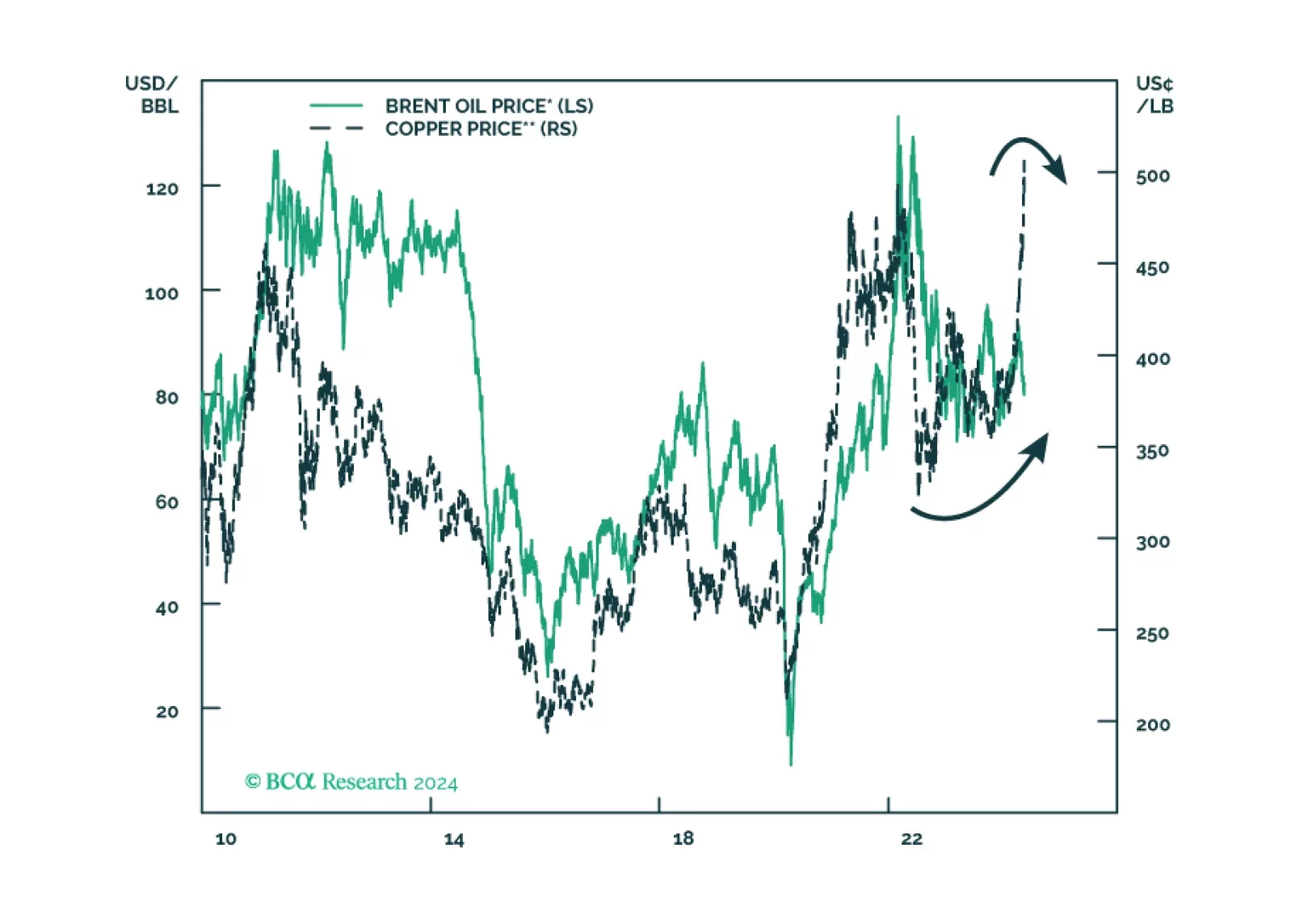

Industrial metals have outperformed the broad commodity complex this year and raced above the broad commodity complex even more meaningfully since the beginning of April. Our Commodity and Energy strategists have highlighted…

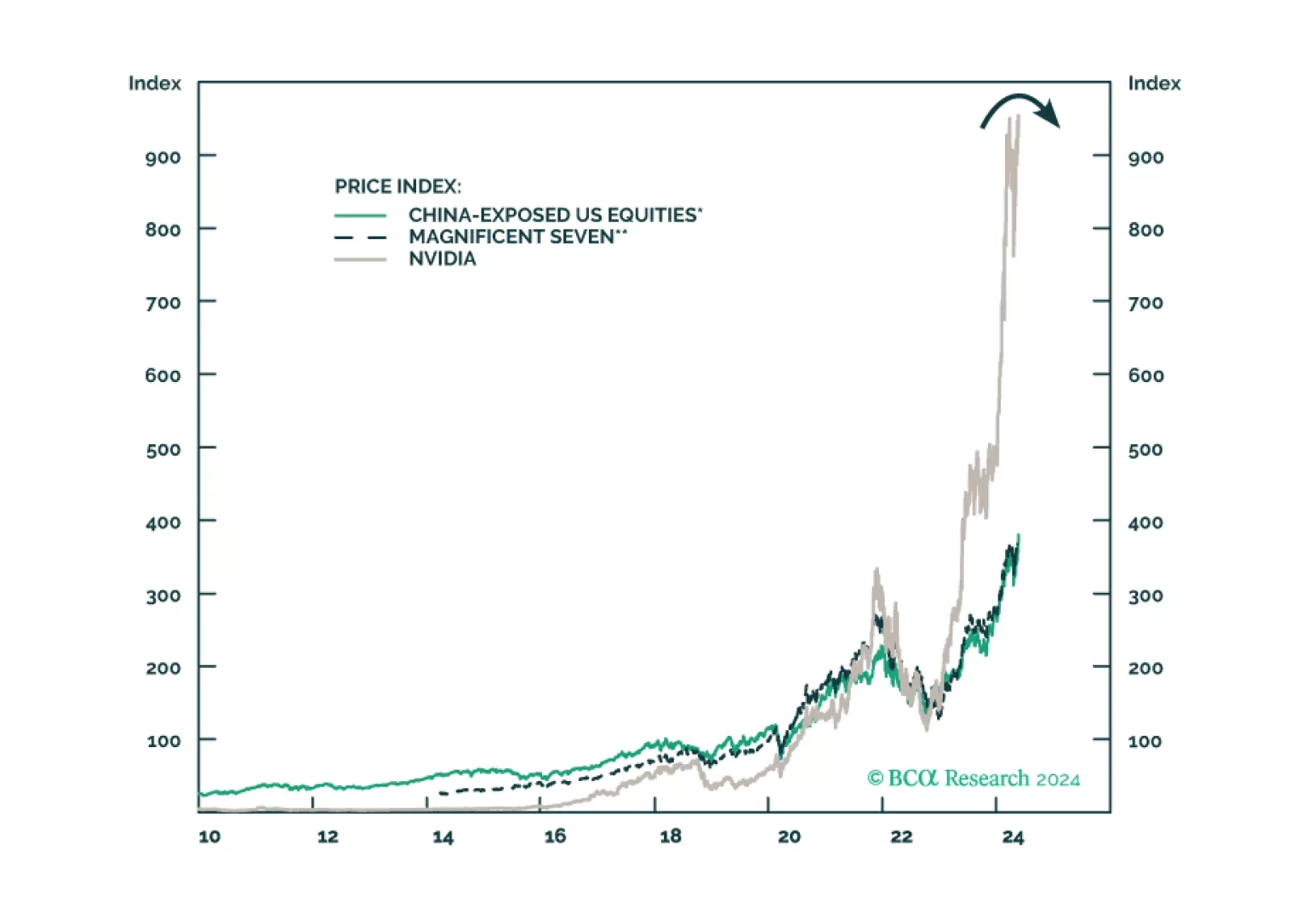

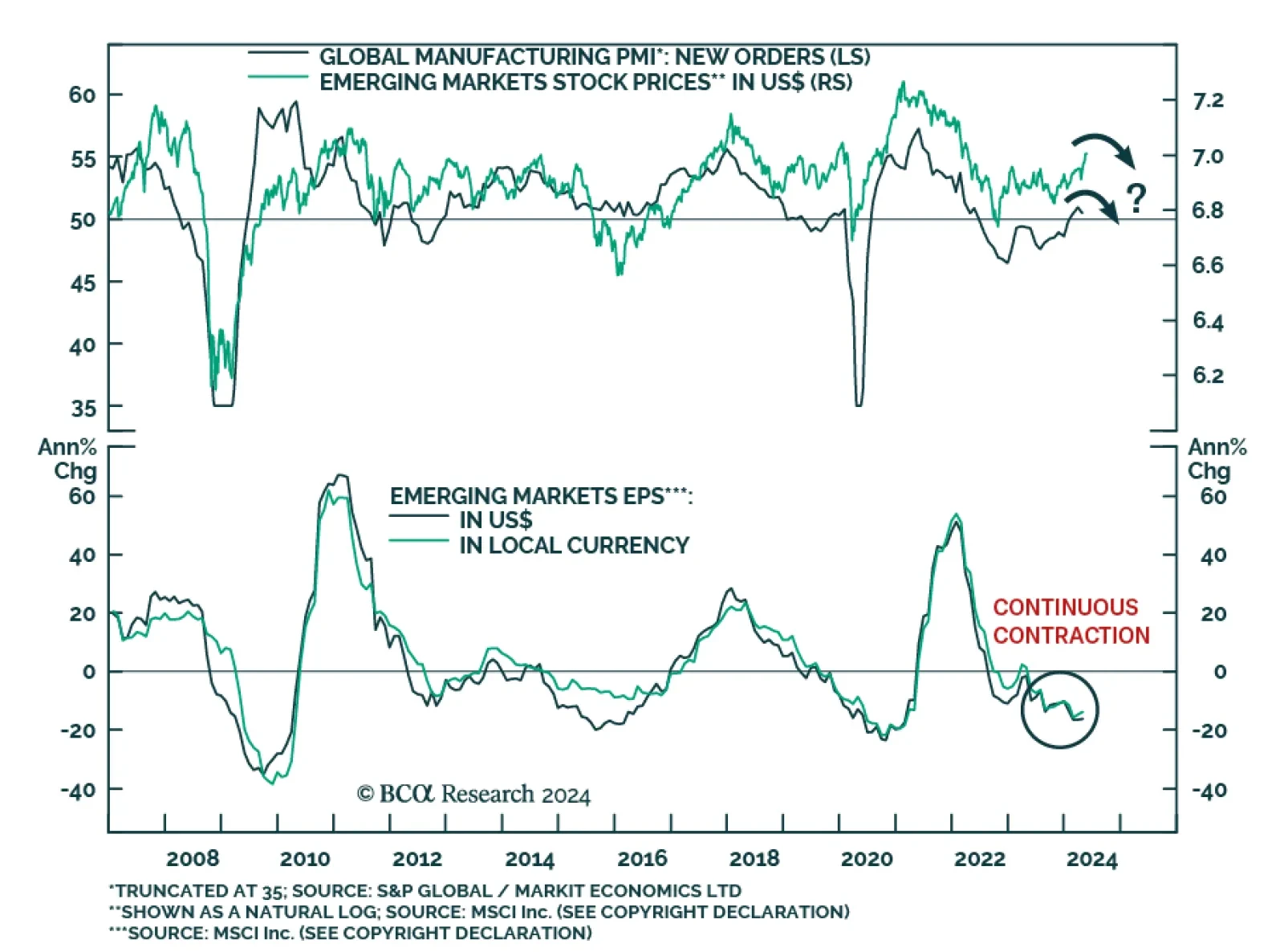

Emerging market stocks have outperformed their global counterparts by 4 percentage points in USD terms since February according to MSCI indices. They have gotten a boost from the bounce in the global manufacturing cycle. The MSCI…

The death of the Iranian president reinforces our base case view of Middle Eastern instability and at least minor oil supply shocks. Rapid geopolitical developments in recent weeks are pointing to a new bout of global instability.…

Several economic releases out of China disappointed in April. Retail sales decelerated from 3.1% y/y to 2.3% y/y and fixed asset investment growth slowed from 4.5% YTD y/y to 4.2% YTD y/y. Both were expected to accelerate.…