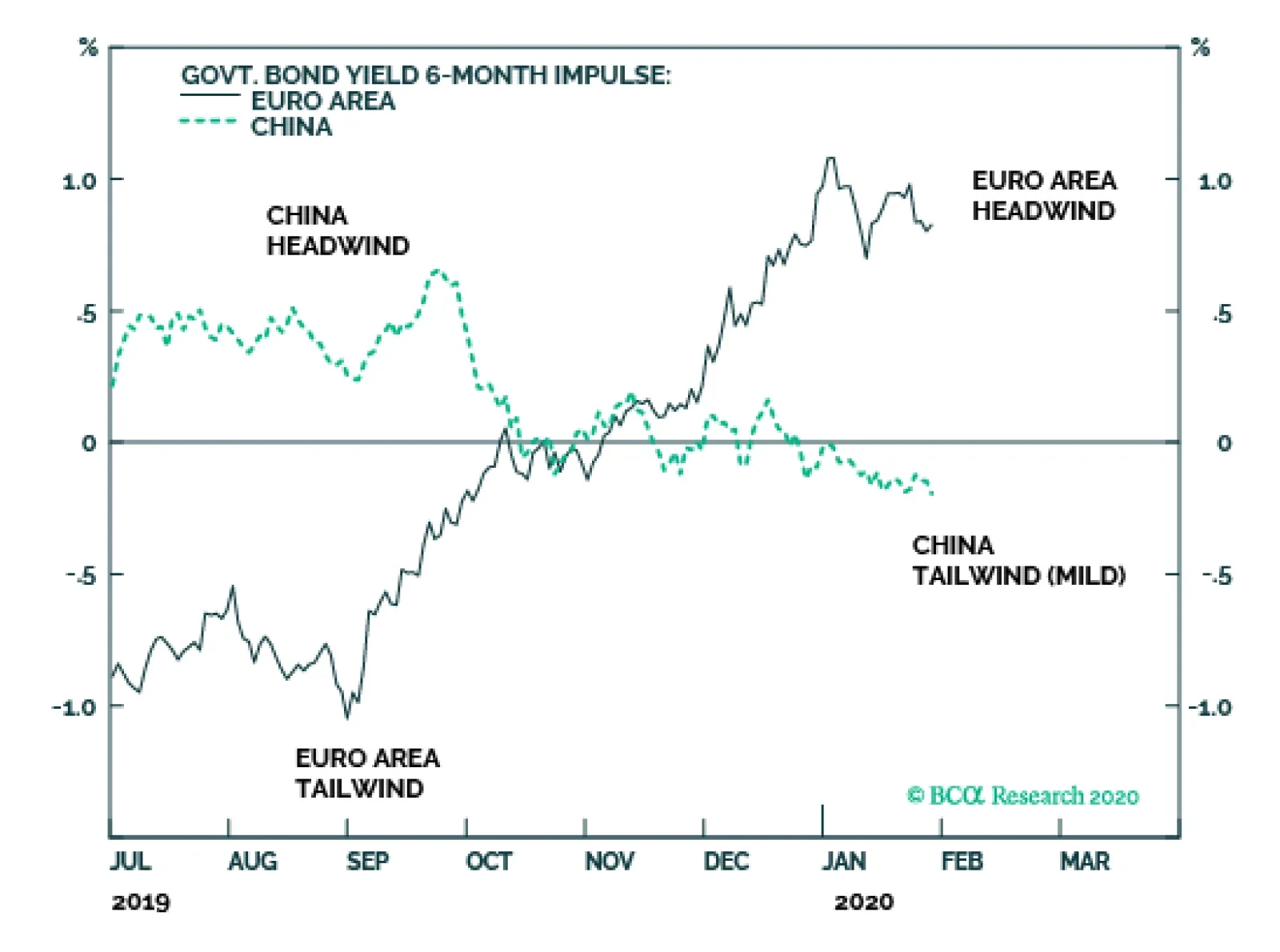

The euro area 6-month bond yield impulse stands near +100 bps, posing the strongest headwind to growth in three years. To make matters worse, the impulse has flipped from a strong -100 bps tailwind last summer into the current…

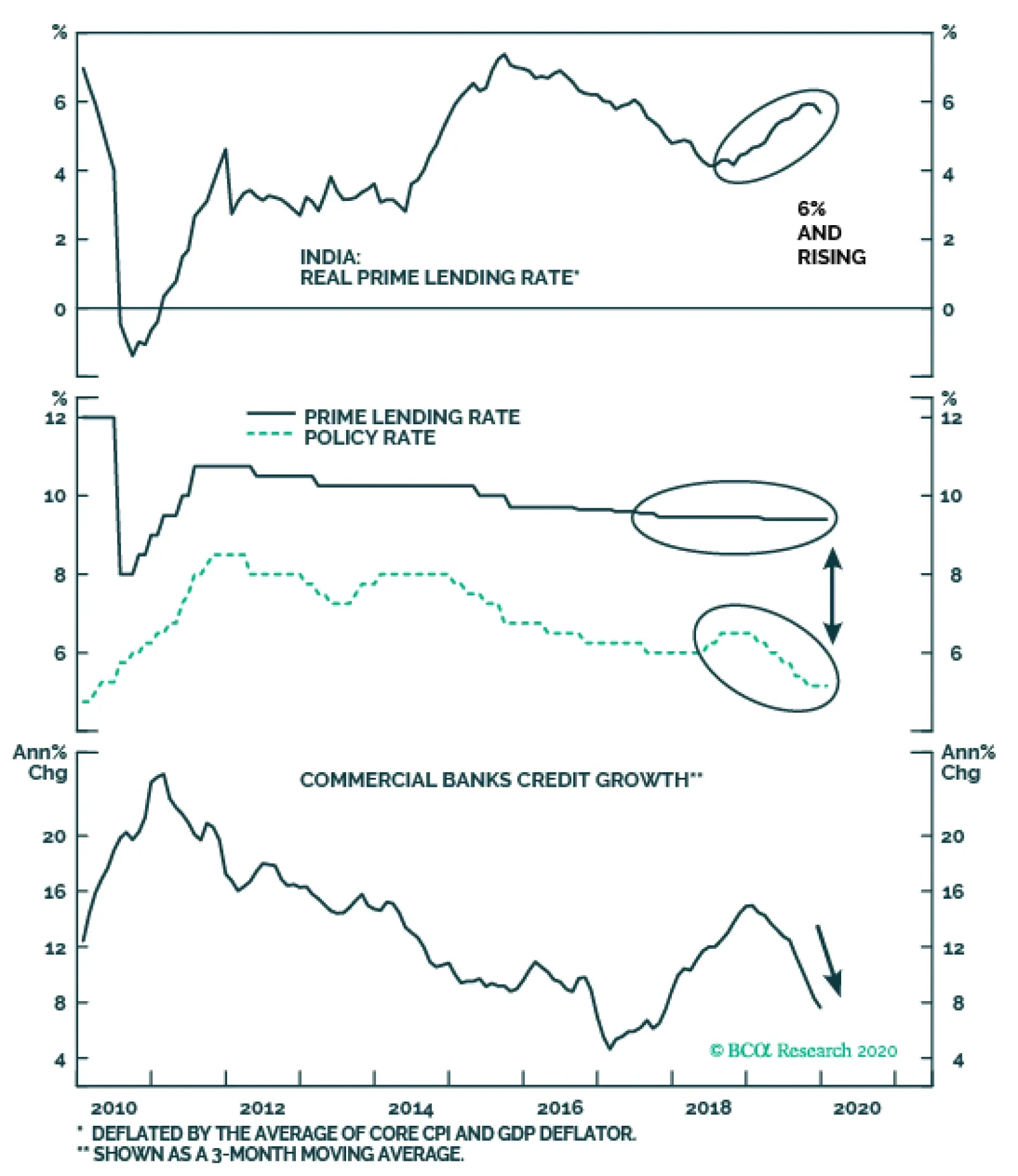

The entire Indian economy is suffering from high real borrowing costs. The monetary policy transmission mechanism has not been working effectively in India. Even though the central bank has cut its policy rate by 135 basis points…

Highlights Portfolio Strategy There are high odds that China’s real GDP deceleration will continue for the next decade, casting a shadow over the profit prospects of the S&P 1500 metals & mining index. A structural below…

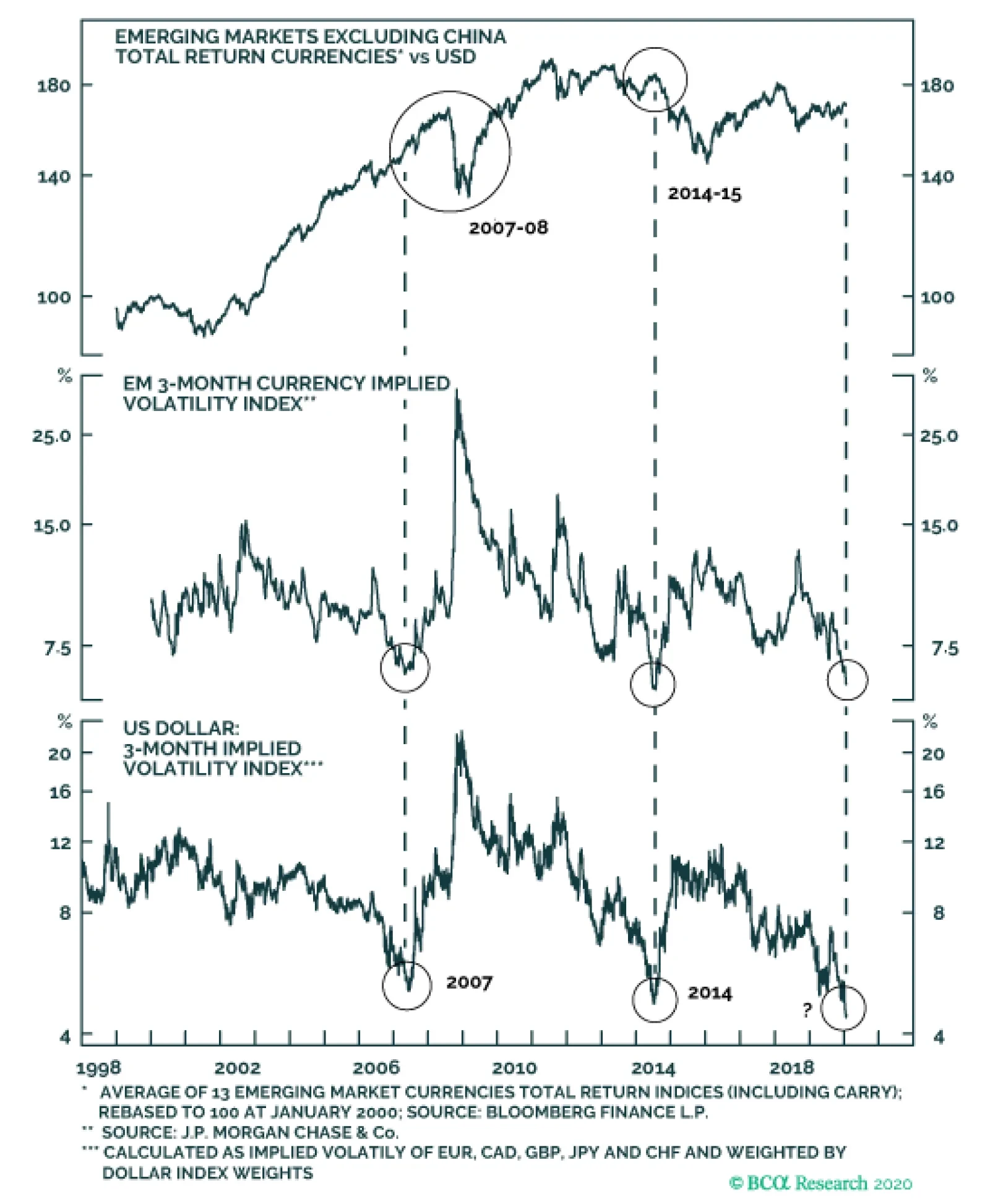

Implied volatility for the US dollar, EM currencies and a wide range of equity markets has plummeted to record lows. Such low levels of implied currency market volatility historically preceded major moves in currency markets and…

Highlights Global growth is poised to accelerate this year, although the spread of the coronavirus could dampen spending in the very short term. History suggests that the likelihood of a recession rises when unemployment falls to very…

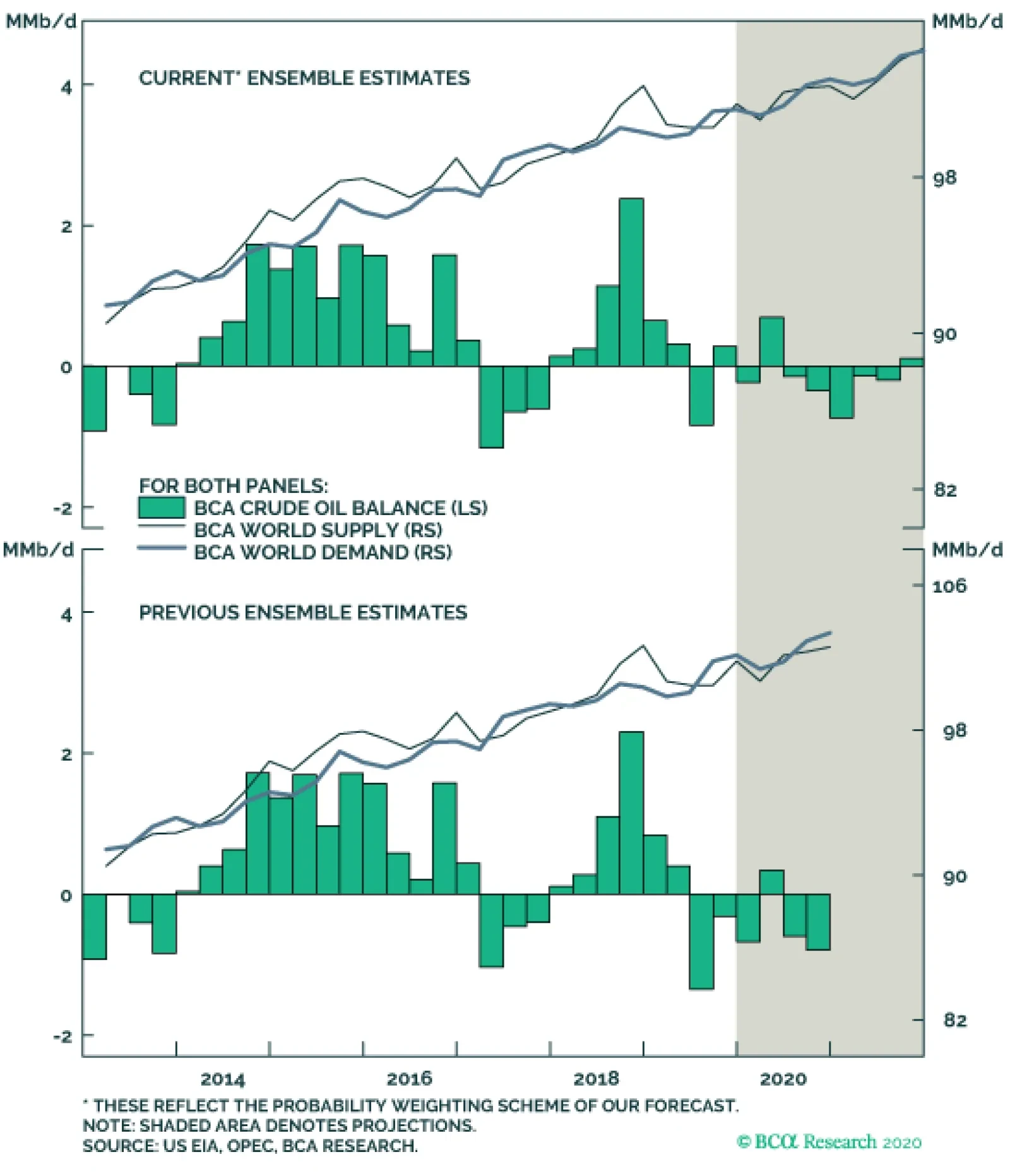

Crude oil fundamentals continue to favor higher prices. We continue to expect demand to grow 1.4mm b/d this year. For 2021, we expect growth of just under 1.5mm b/d, reaching 103.65mm b/d globally. For its part, the EIA is…

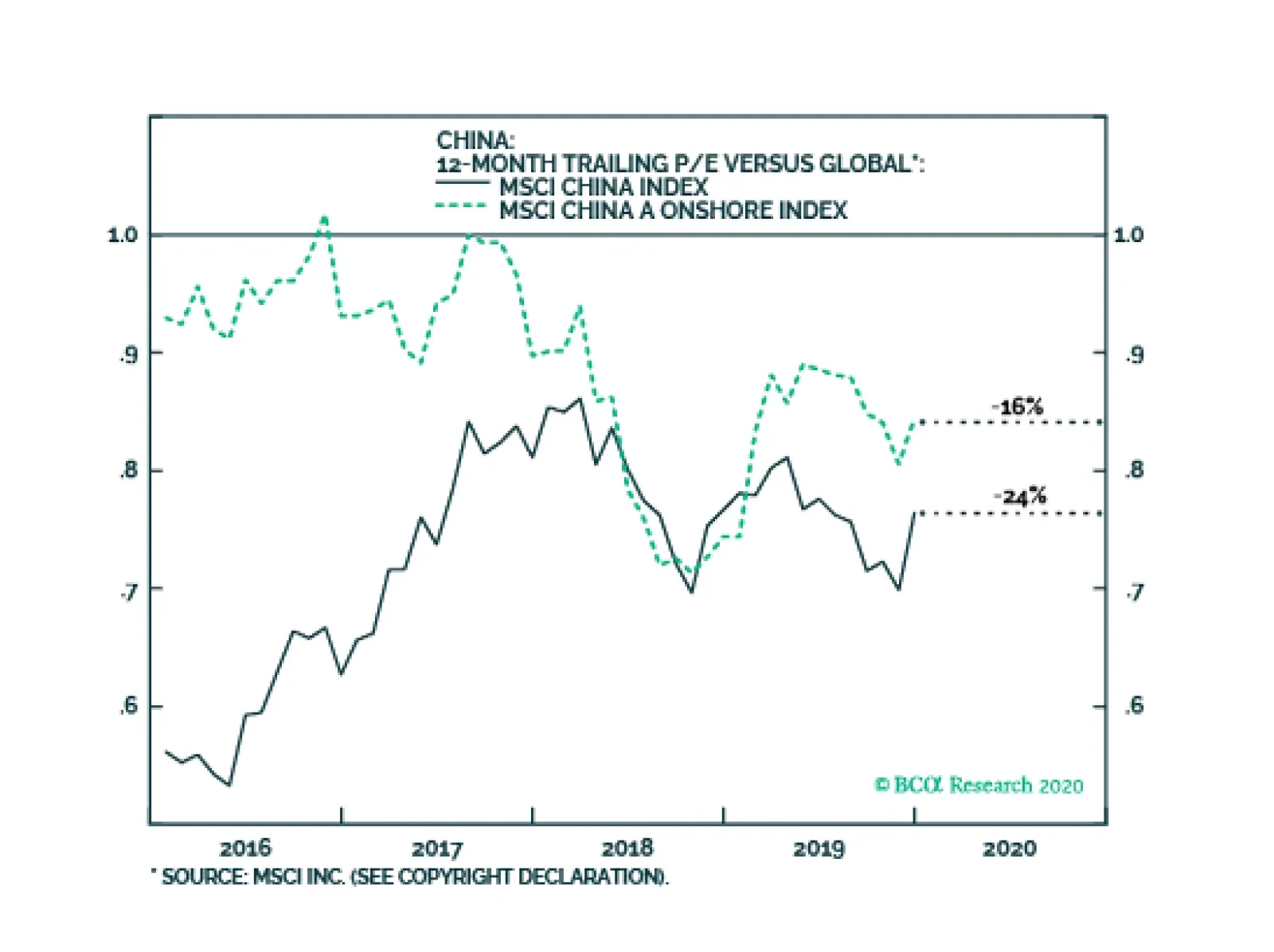

We have been cyclically overweight Chinese stocks, because we expected the economy to bottom in the first quarter of 2020 and a trade deal to materialize eventually. In the past two weeks, these two possibilities became realities…

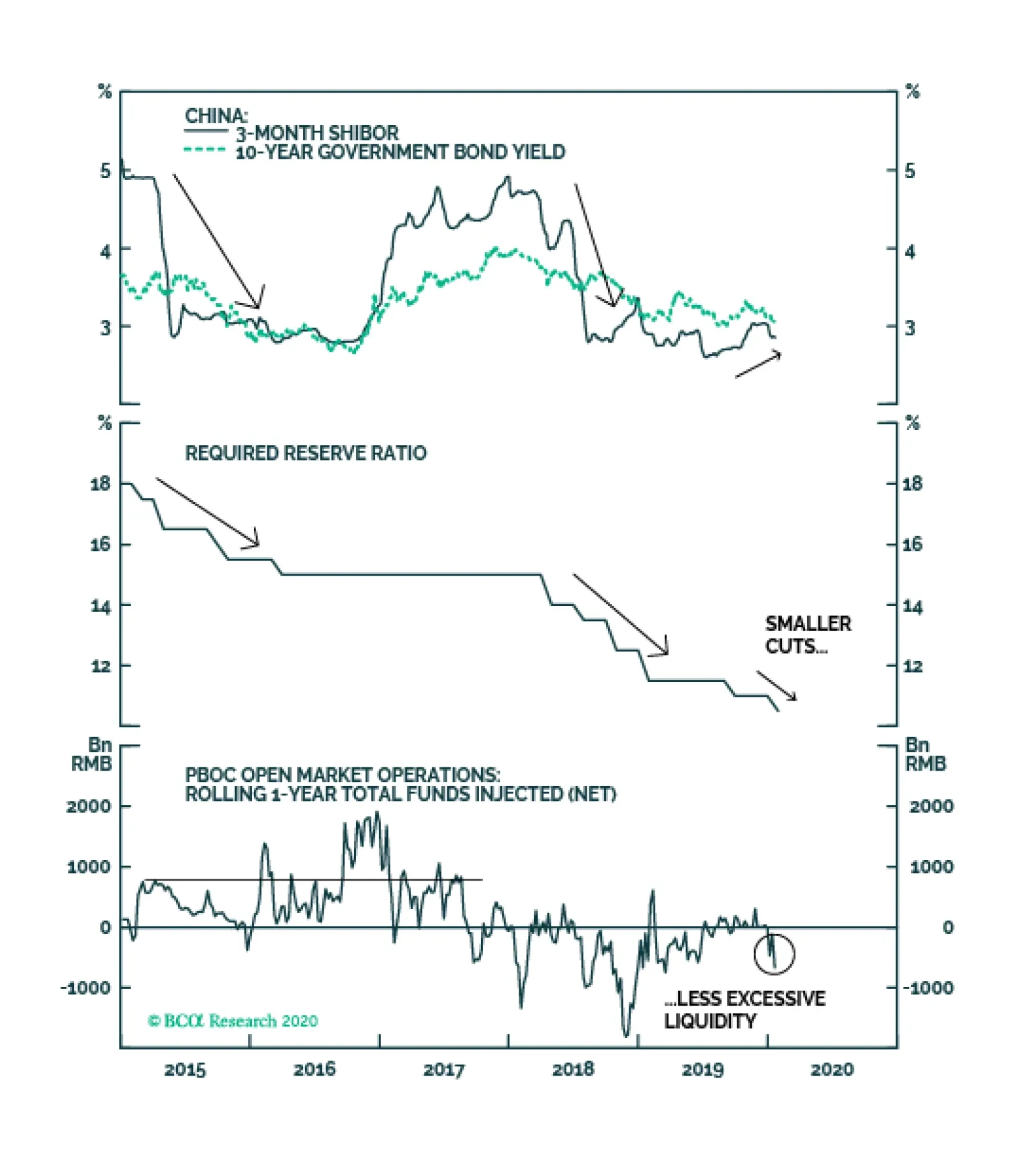

As tensions from the US-China trade war abate, investors are starting to refocus on economic fundamentals. This year, Chinese policymakers will maintain their tight grip on local government spending and bank lending, and will…