The wave of COVID-19 continues to spread across EM economies, but the outlook for EM assets has improved significantly. EM equities and currencies trade at valuation levels consistent with long-term bottoms. While depressed…

Highlights A buildup in industrial inventory may temporarily slow down China’s commodity imports over the next month or two. Last week’s Politburo meeting stated that policy supports will remain in place for 2H20, despite a…

Highlights Global Bond Yields: The growing divide between falling negative real bond yields and rising inflation expectations in the US and other major developed economies may be a sign of investors pricing in slower long-run potential…

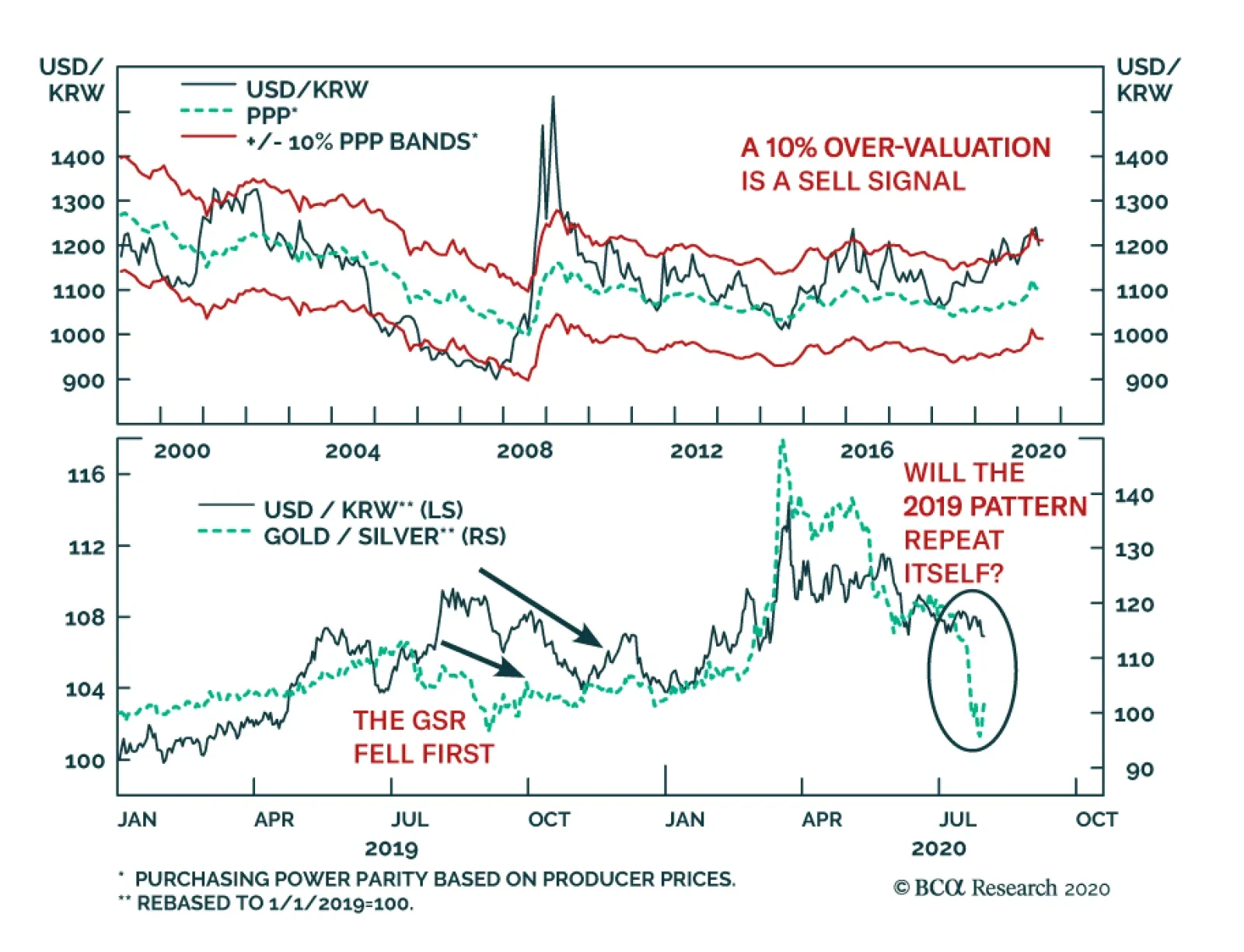

Selling USD/KRW is an attractive trade. The KRW is cheap. USD/KRW trades 10% above it purchasing-power-parity equilibrium. Since the GFC, a 10% premium has created a reliable entry point to sell USD/KRW. This time will not…

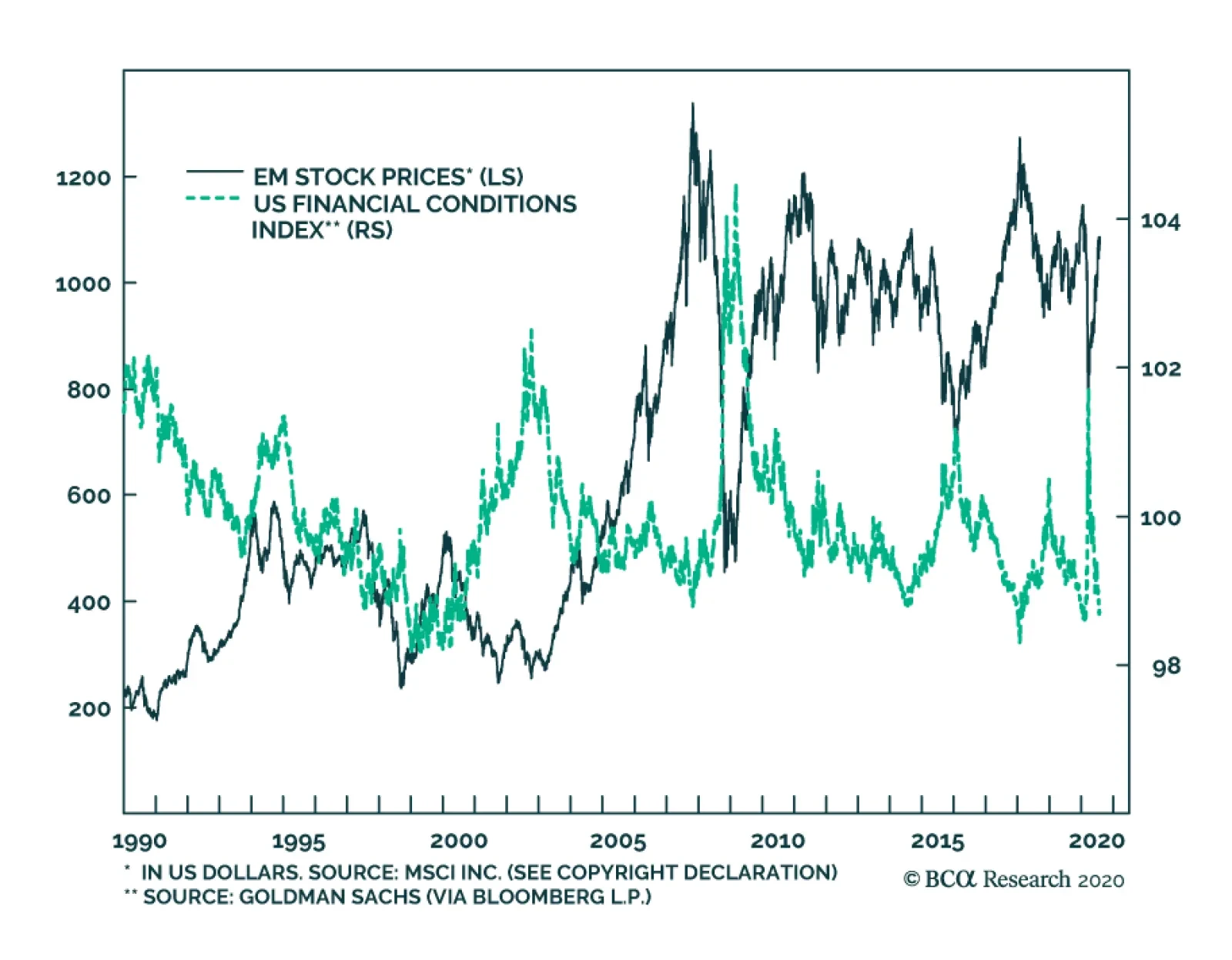

BCA Research's Global Investment Strategy service believes that the US dollar will weaken further over the next 12 months. Global equities in general, and non-US stocks in particular, tend to fare well in a weak dollar…

Dear Client, In lieu of our regular report next week, we will be sending you a Special Report from my colleague Garry Evans, Chief Global Asset Allocation Strategist. Garry will be discussing the social and industrial changes that will…

Highlights The tech sector faces mounting domestic political and geopolitical risks. We fully expected stimulus hiccups but believe they will give way to large new fiscal support, given that COVID-19 is weighing on consumer confidence…

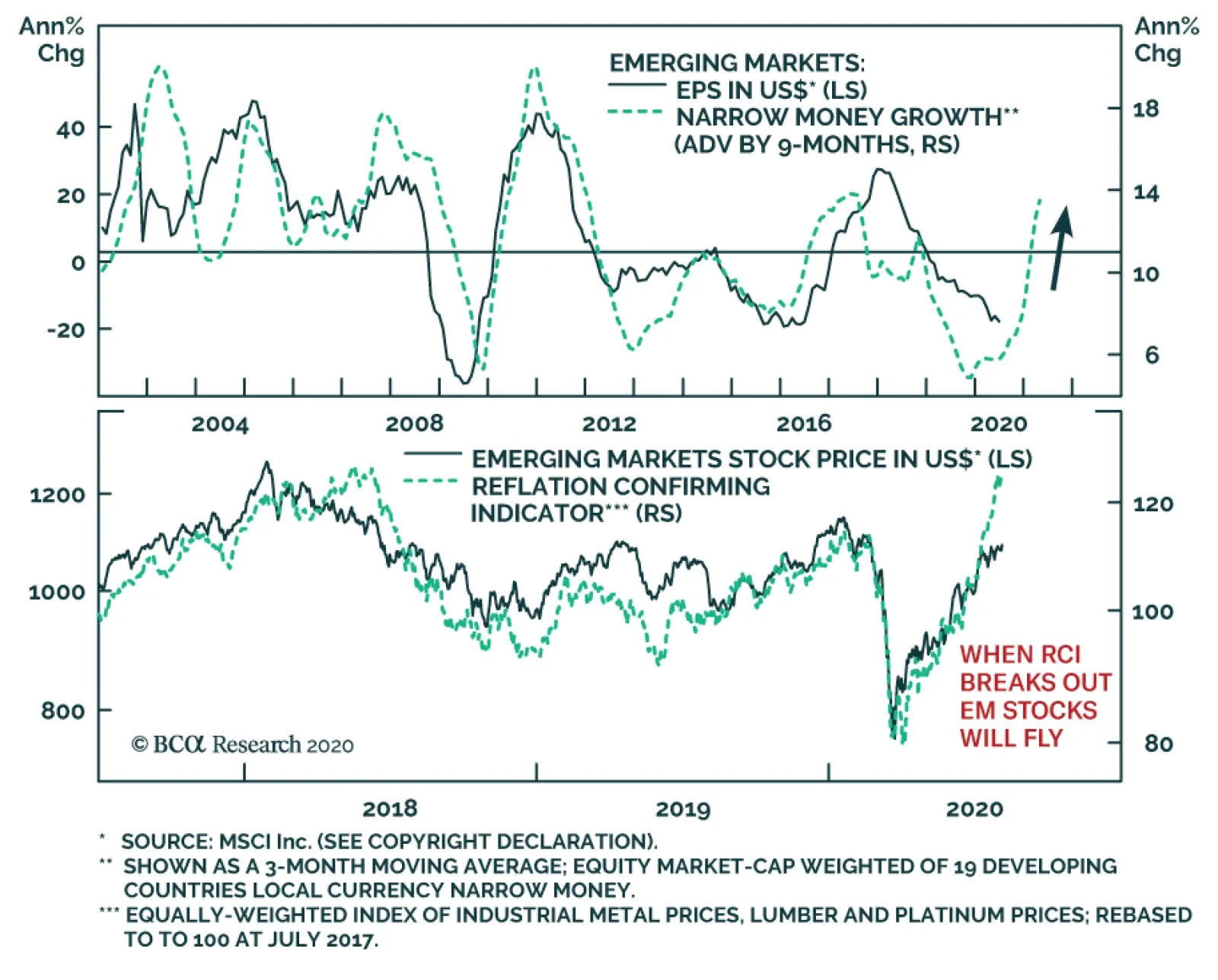

BCA Research's Emerging Markets Strategy service concludes that EM currencies have bottomed versus the US Dollar. We had been bullish on the US dollar and bearish on EM currencies since early 2011, but on July 9 made a…

Highlights The implementation of an oil-price hedging strategy by Russia’s government – consisting of put buying a la Mexico’s strategy for putting a floor under government revenues – would force us to re-…