Highlights Extremely accommodative fiscal policy and a rapid pace of vaccination puts the US on track to close its output gap by the end of the year. The situation is different in Europe, and the euro area economy will likely continue…

After bottoming in April 2020, the South African rand surged versus the US dollar for the remainder of the year. However, since December, the USD/ZAR has been stuck between 14.5-15.5. The ZAR’s fluctuations coincided…

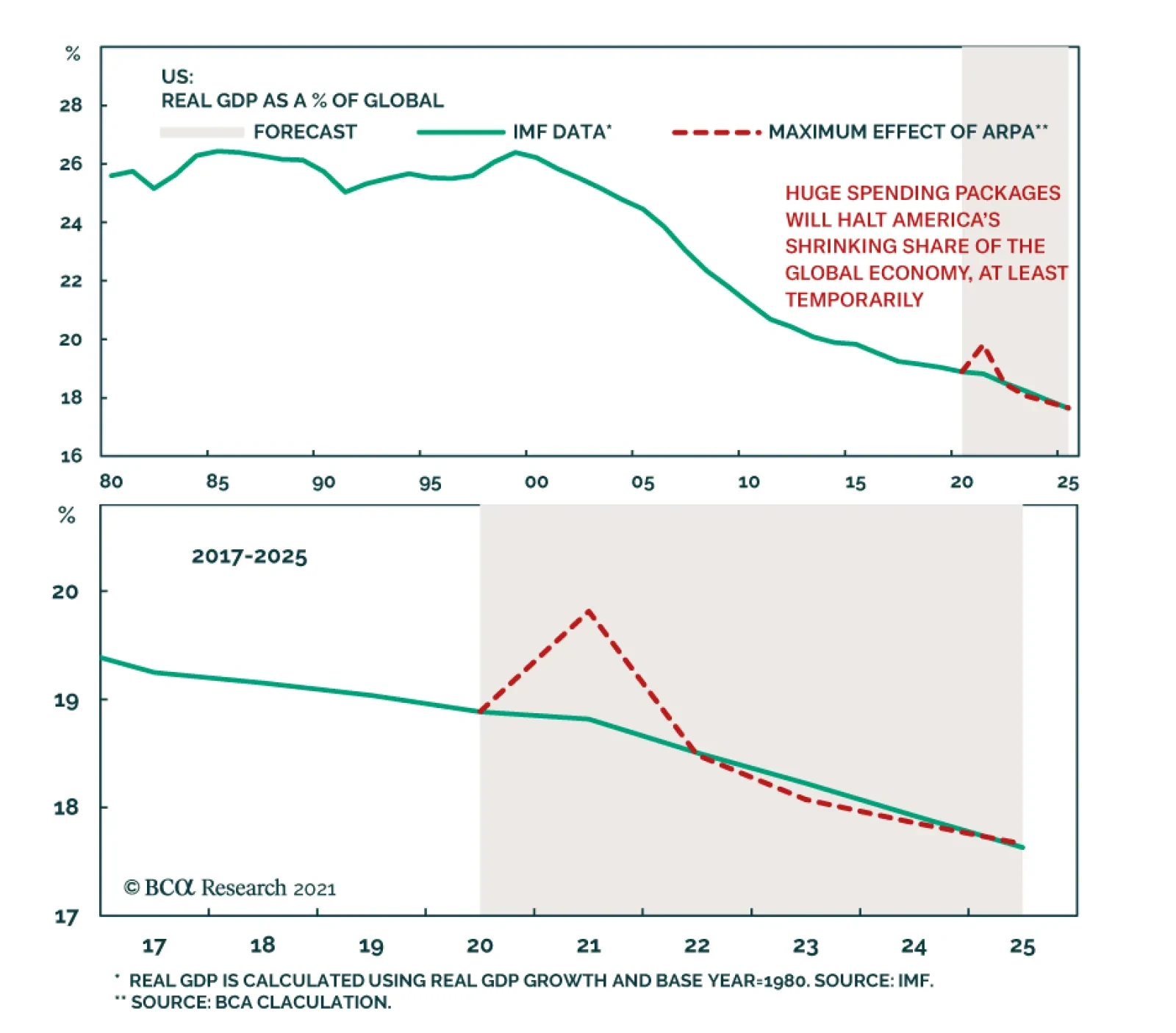

The US saw its share of the global economic decline since the accession of China to the WTO in 2001. This decline coincided with domestic ills like inequality and weak wage growth to elicit a domestic populist response, marked by…

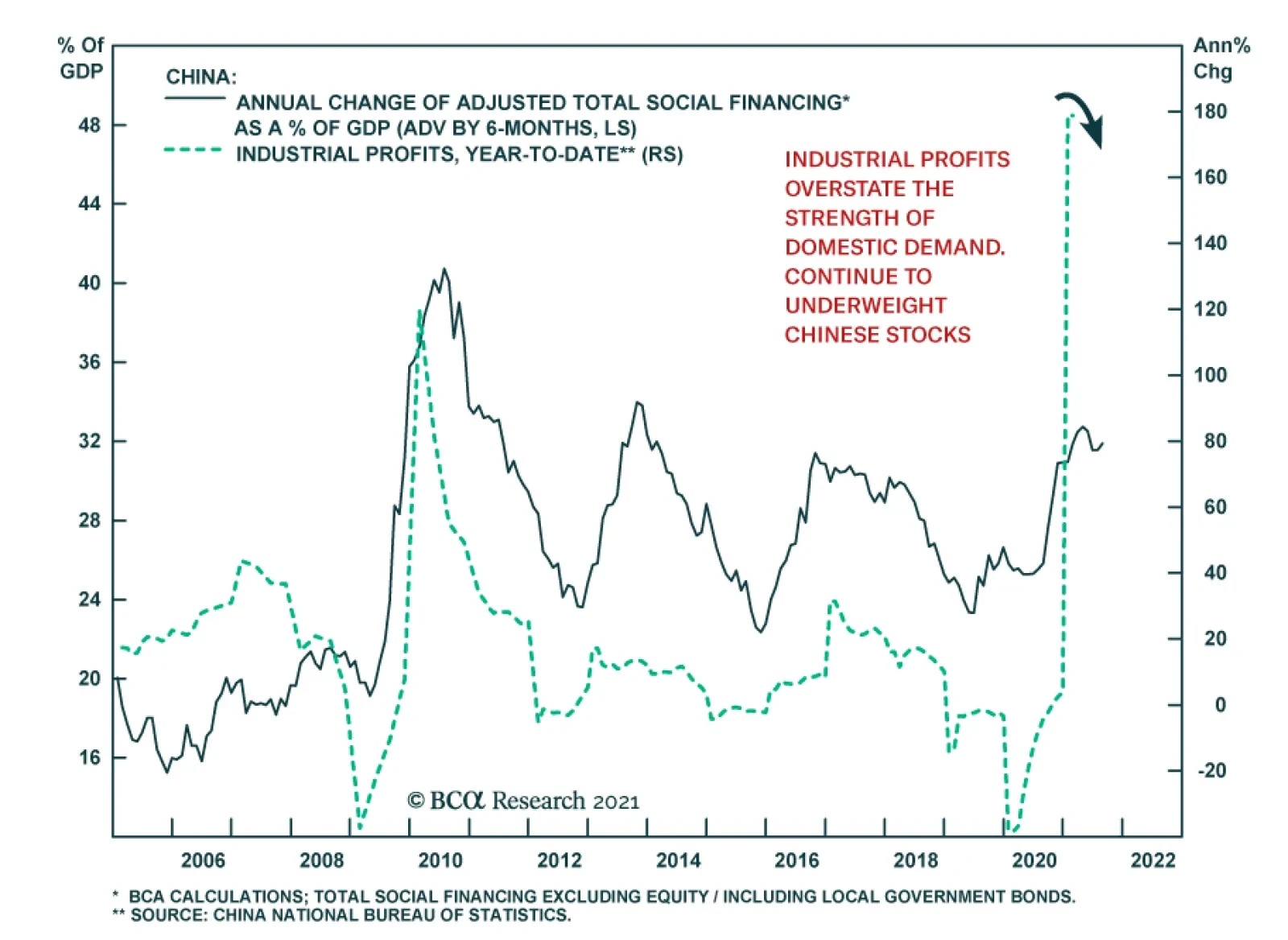

Chinese industrial profits surged 178.9% y/y in the first two months of the year, marking a significant acceleration from December’s 20.1% y/y pace. However, investors should be careful not to interpret this as a sign of…

Highlights Global manufacturing activity will soon peak due to growing costs and China’s policy tightening. This process will allow the dollar’s rebound to continue. EUR/USD’s correction will run further. This…

Highlights Biden’s policy on China is hawkish so far, as expected, but temporary improvement is possible. We are cyclically bearish on the dollar but are taking a neutral tactical stance as the greenback’s bounce could go…

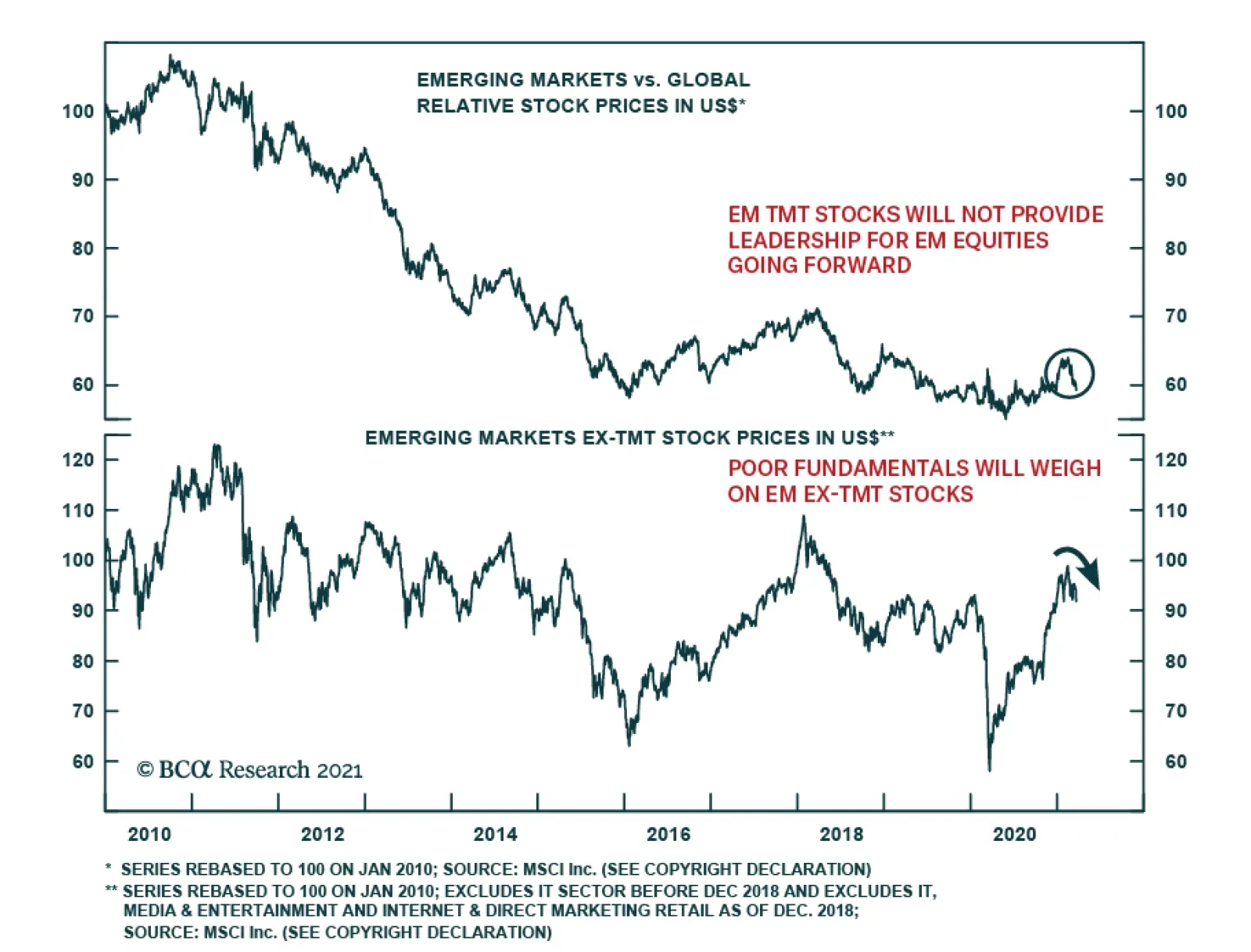

Our Emerging Markets Strategists recently argued that the outlook for EM shares prices remains unfavorable over the coming months. The breadth of EM equity outperformance versus DM in H2 last year was narrow. This…

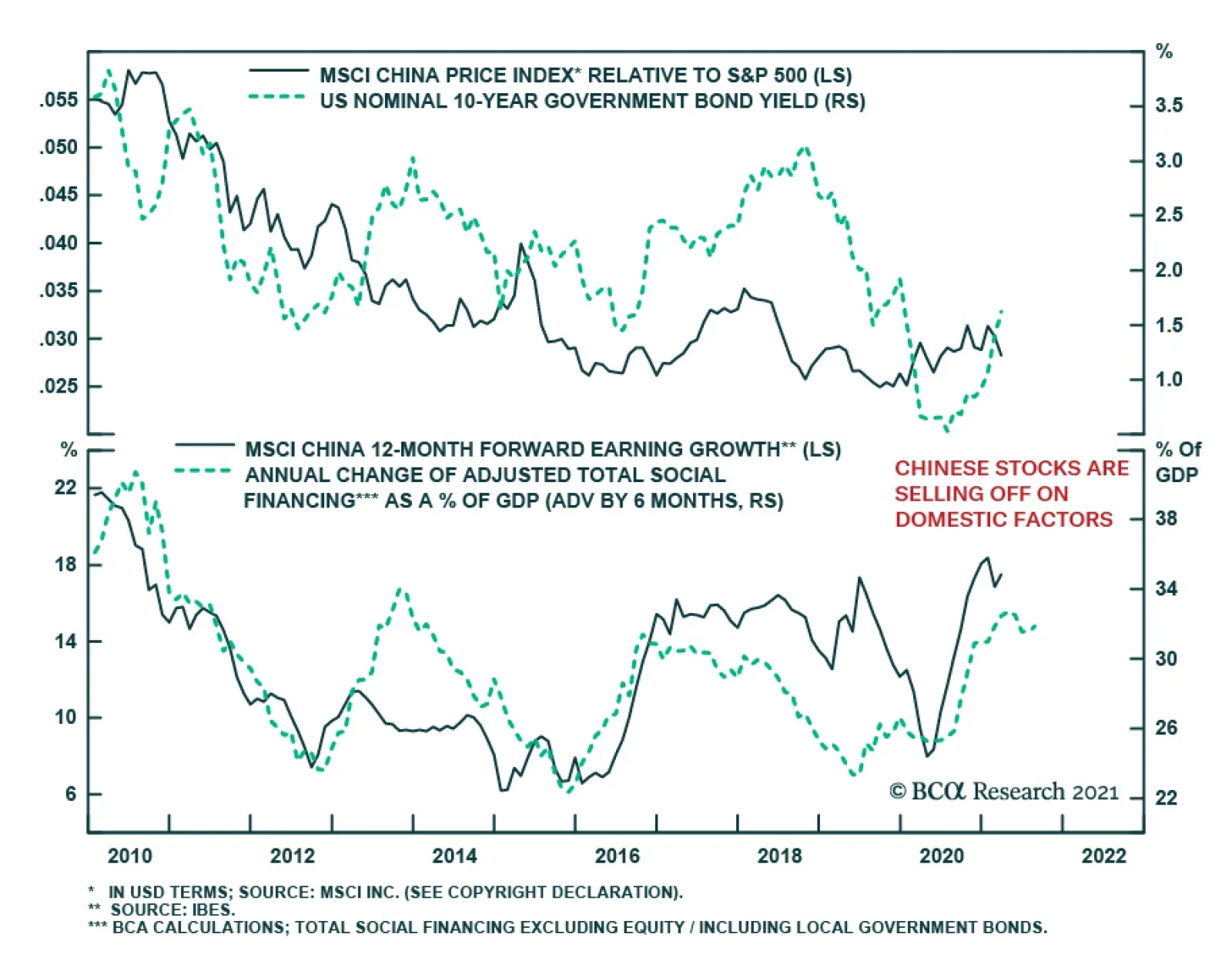

Chinese stocks peaked in mid-February, with the selloff extending well through March. Market participants fear that escalating US Treasury yields will have a sustained negative impact on Chinese risk assets. And while BCA…

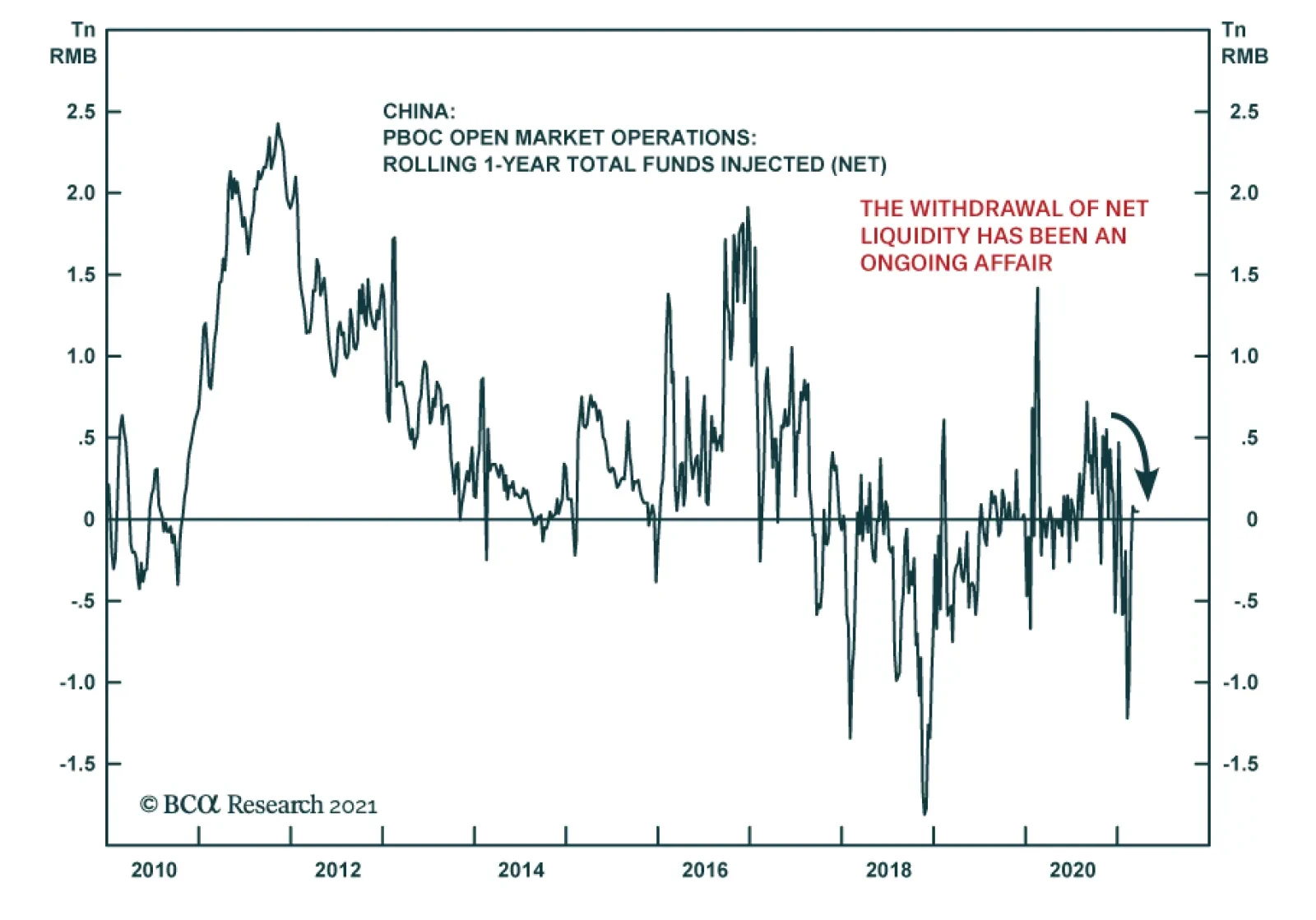

PBoC liquidity injections have been extremely weak recently, with the latest injection among the weakest in the past year. While we expect Beijing to continue tightening policy, this does not signal a further nudge up in…