Highlights The number one risk to our upbeat view on European economic activity and assets is a Chinese economic slowdown. The second most important risk to our view is a potential deterioration in the global credit impulse, even…

Highlights Global oil markets will remain balanced this year with OPEC 2.0's production-management strategy geared toward maintaining the level of supply just below demand. This will keep inventories on a downward trajectory,…

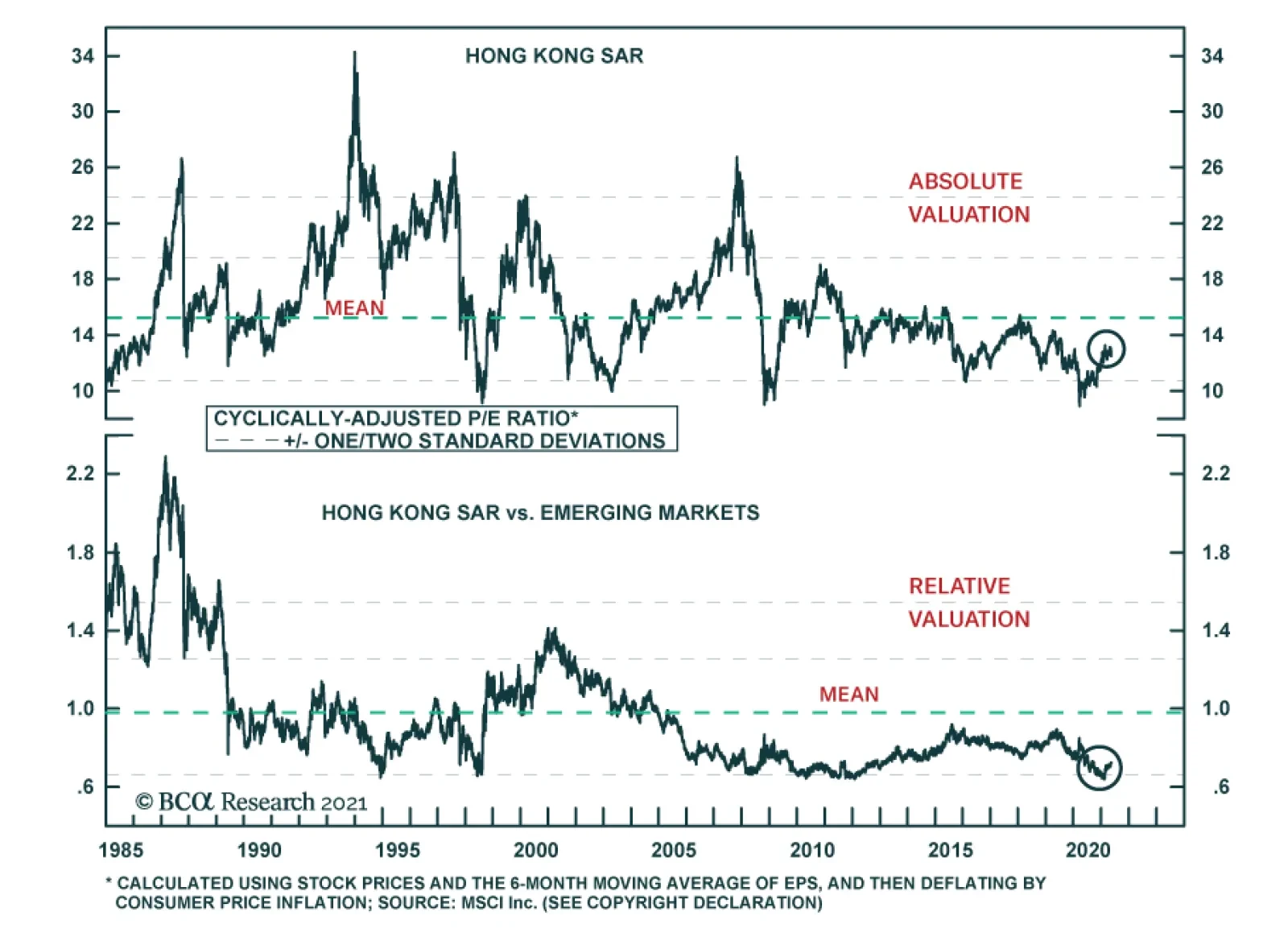

BCA Research’s Emerging Markets Strategy service recommends investors upgrade their allocation to the MSCI Hong Kong (Special Administrative Region) equity index from underweight to neutral within Asian, global and EM…

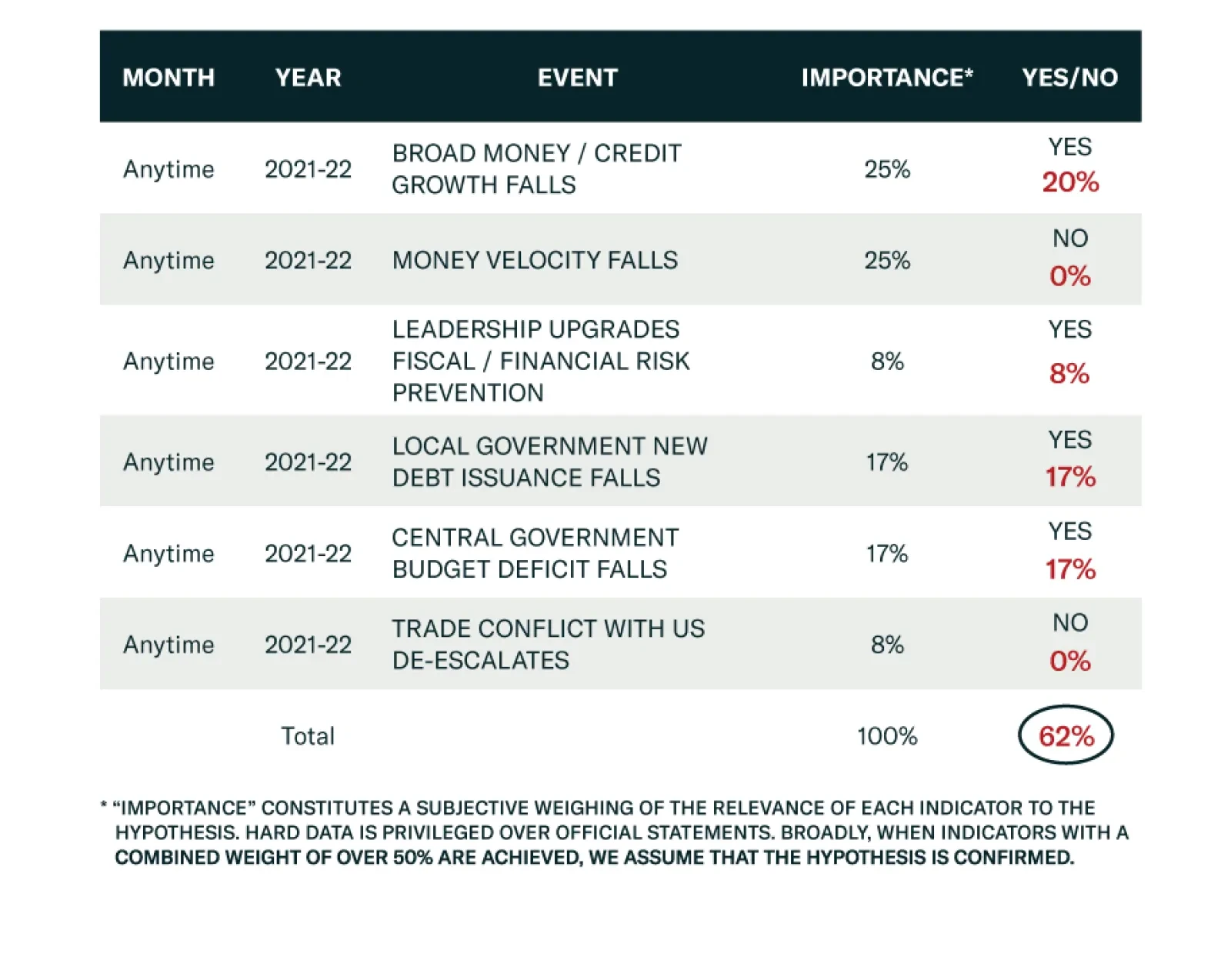

BCA Research’s Geopolitical Strategy service believes that global equities, commodities, and “China plays” are at risk of a substantial correction as a result of China’s policy tightening. China’s…

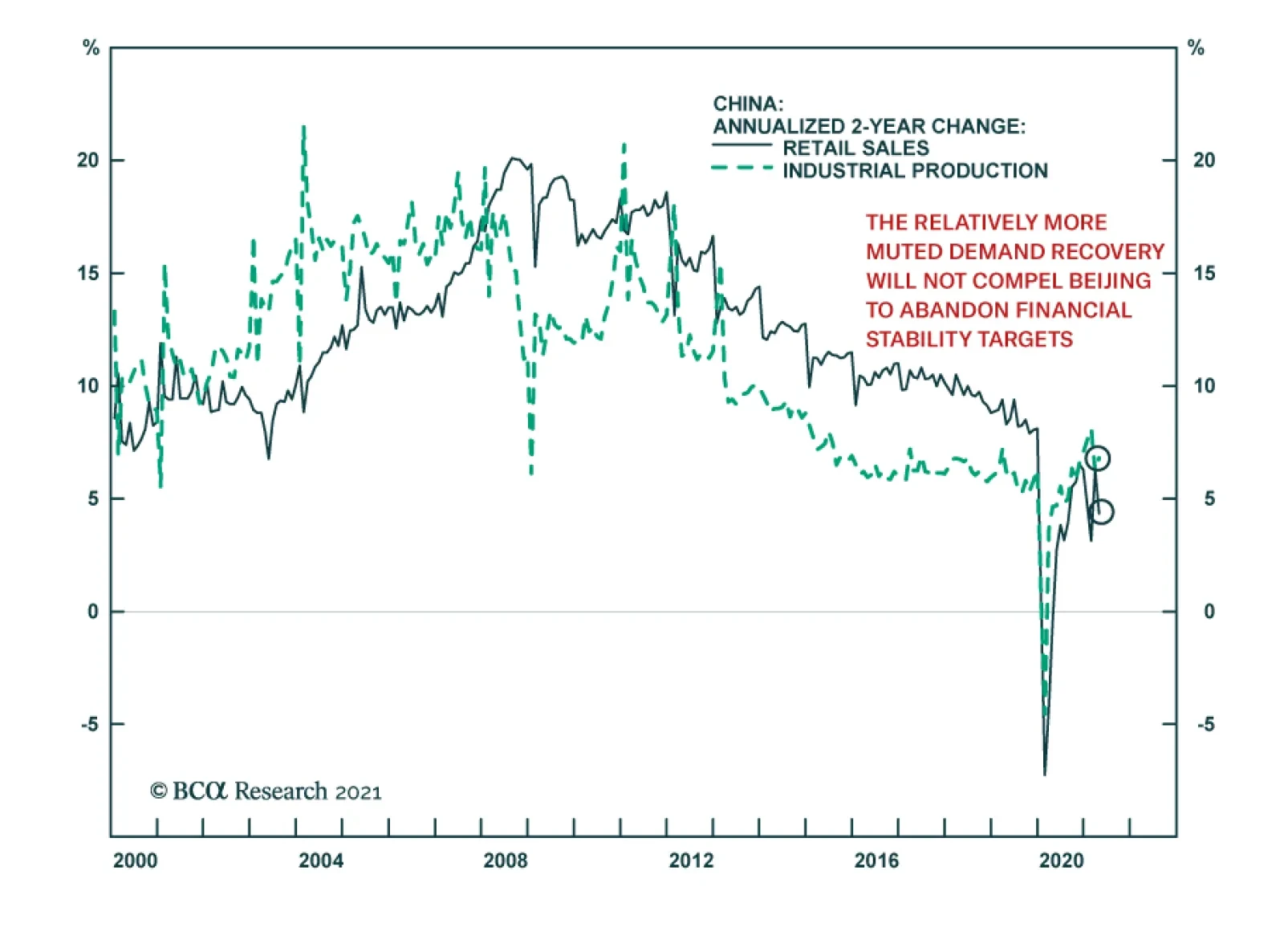

Investment and retail sales data confirm that consumer demand remains the weakest link in China’s economic recovery. While the data generally surprised to the downside, the disappointment was most pronounced in retail sales…

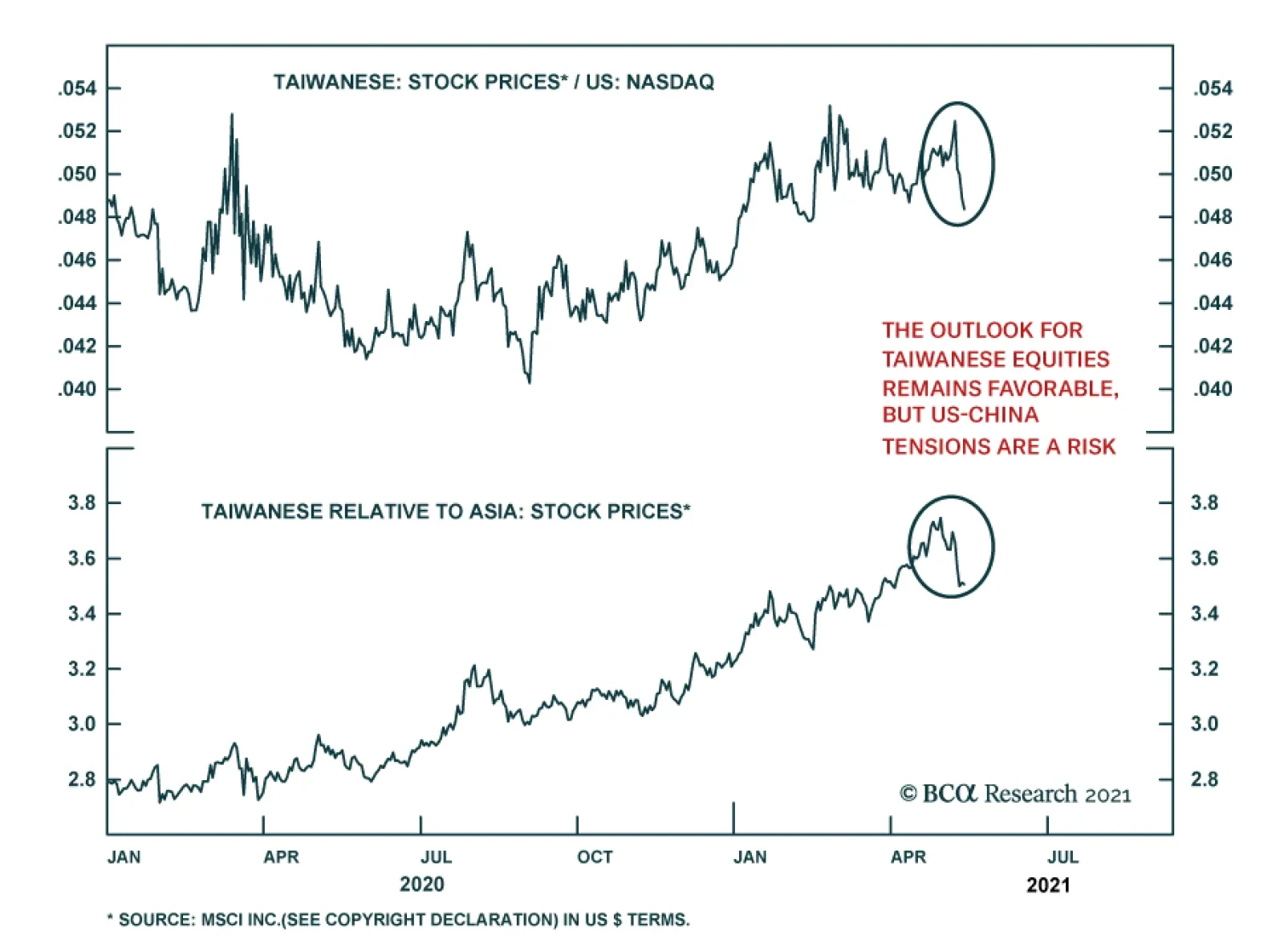

After rallying more than 100% since mid-March 2020, Taiwanese equities peaked at the end of April, and are down 11% since then – bringing the index into correction territory. Last week’s global tech selloff as…

Highlights Global currencies are at a critical level versus the dollar. From a positioning standpoint today, a break below 89-90 on the DXY index will be extremely bearish, while a bounce from current levels should be capped in the 3-…

Highlights Global stocks are very vulnerable to a correction. But cyclically the Fed is committed to an inflation overshoot and the global economy is recovering. China’s fiscal-and-credit impulse fell sharply, which leaves global…

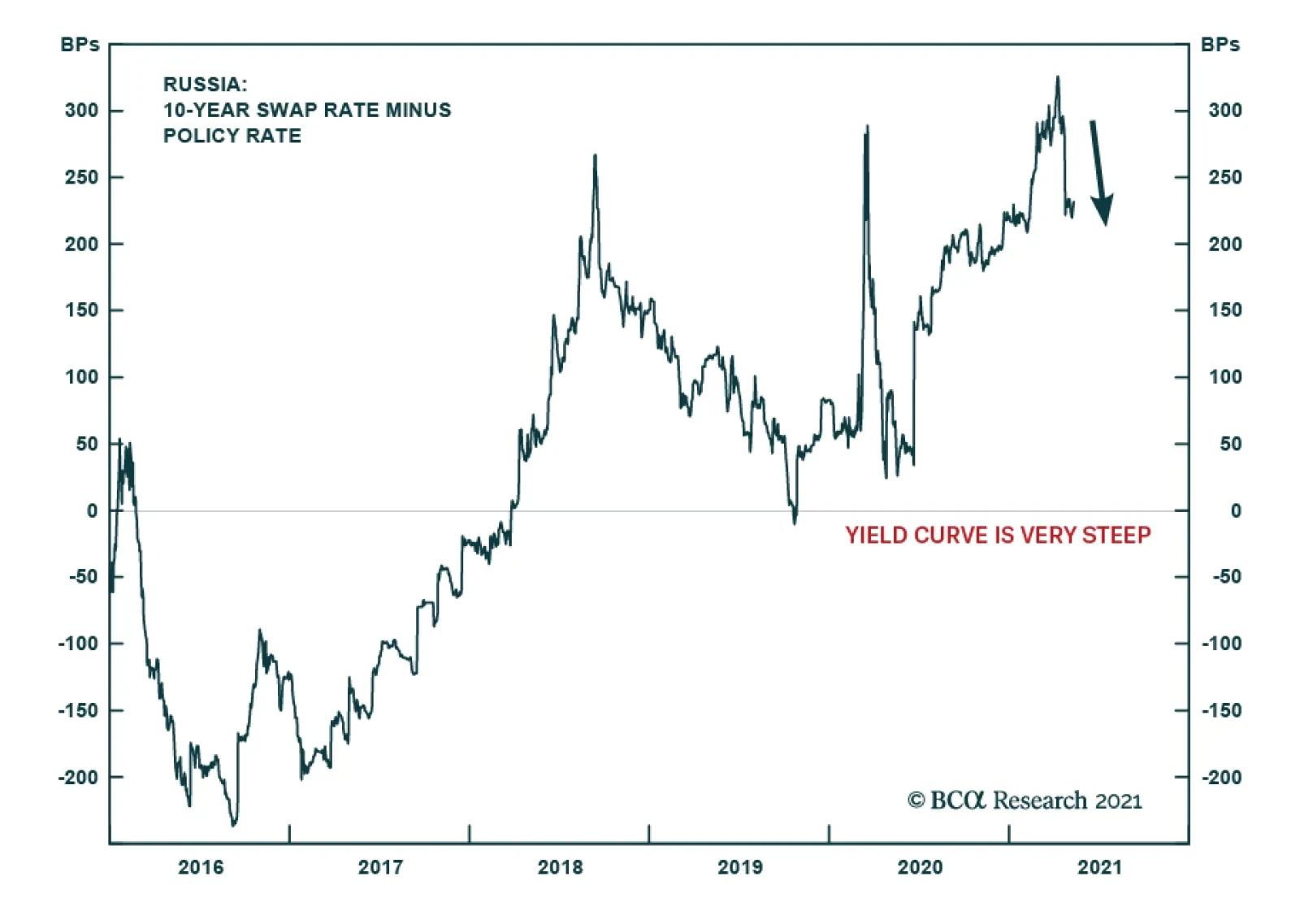

Rising consumer price inflation and inflation expectations have led the Central Bank of Russia (CBR) to hike interest rates from 4.25% to 5% over the past two months. This is a level of hawkishness that stands out globally, as…