Highlights The ECB has changed its inflation target, but its credibility remains weak. Inflation will not allow the ECB to tighten policy anytime soon. Instead, the ECB will have to add to its asset purchase program next year and may…

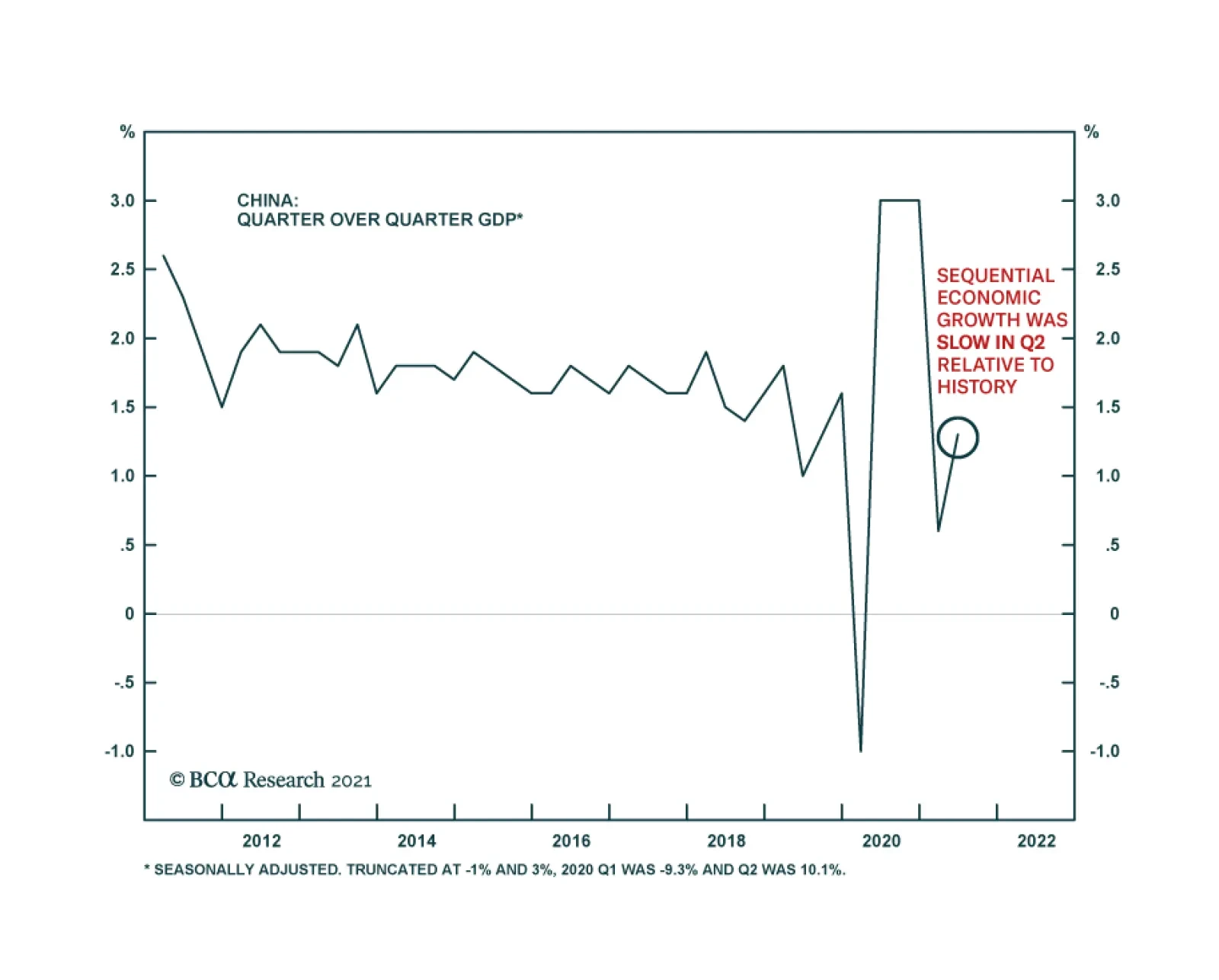

On the surface, the slew of Chinese data released on Thursday was positive. As expected, Q2 GDP slowed down sharply to 7.9% y/y from 18.3% y/y in Q1, reflecting the impact of the easing base effect. However, the…

Highlights Global oil demand will remain betwixt and between recovery and relapse through 3Q21, as stronger DM consumer spending and increasing mobility wrestles with persistent concerns over COVID-19-induced lockdowns in Latin America…

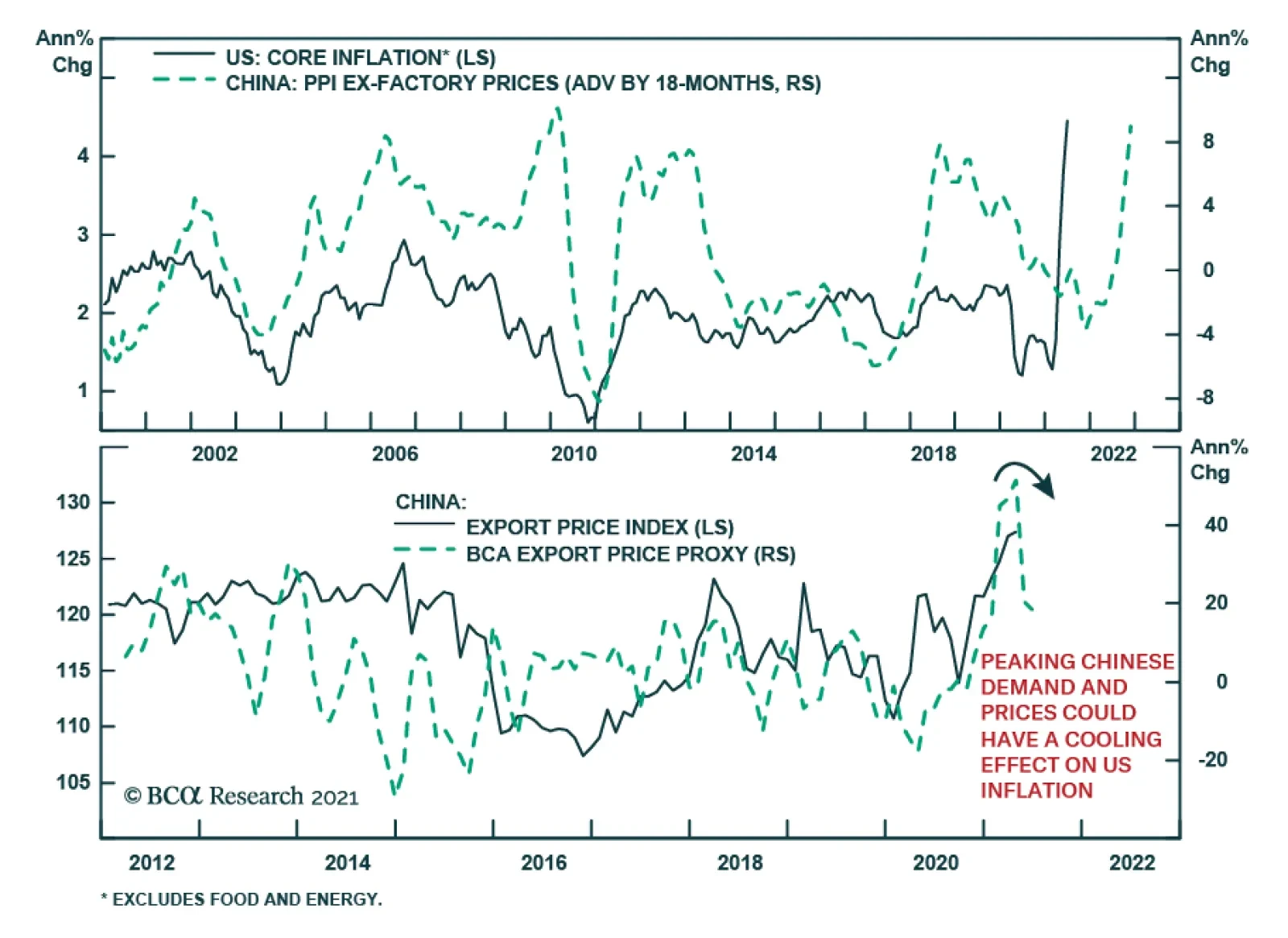

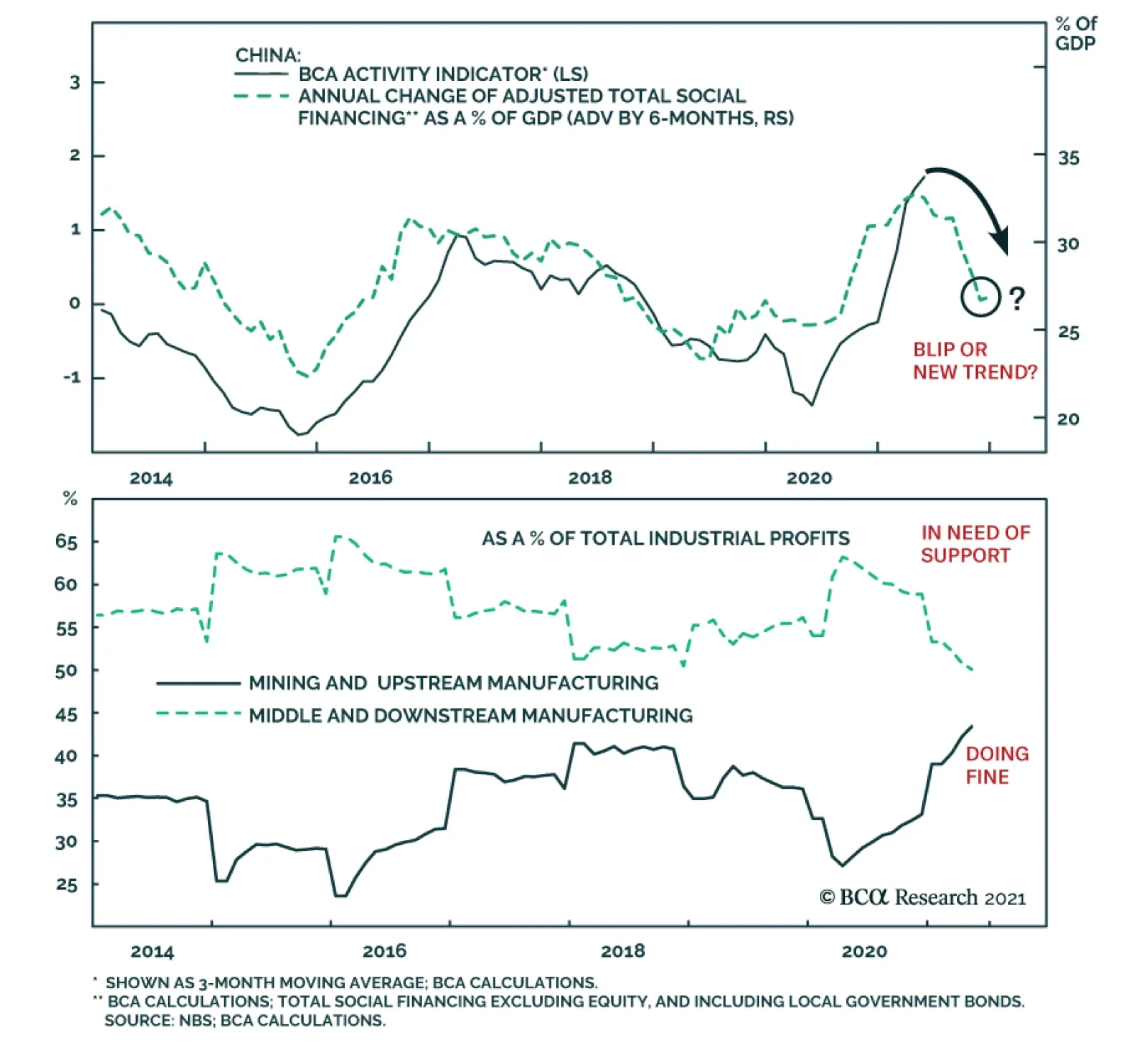

June’s US consumer price index, which was released on Tuesday, surprised on the upside. However, there is one cooling effect on the horizon that the sizzling hot US inflation should take note of: a slowing China. Chinese…

Highlights It is too early to conclude that the PBoC’s surprise rate cut last Friday to its reserve requirement ratio (RRR) marks the beginning of another policy easing cycle. Historically it took more than a single RRR…

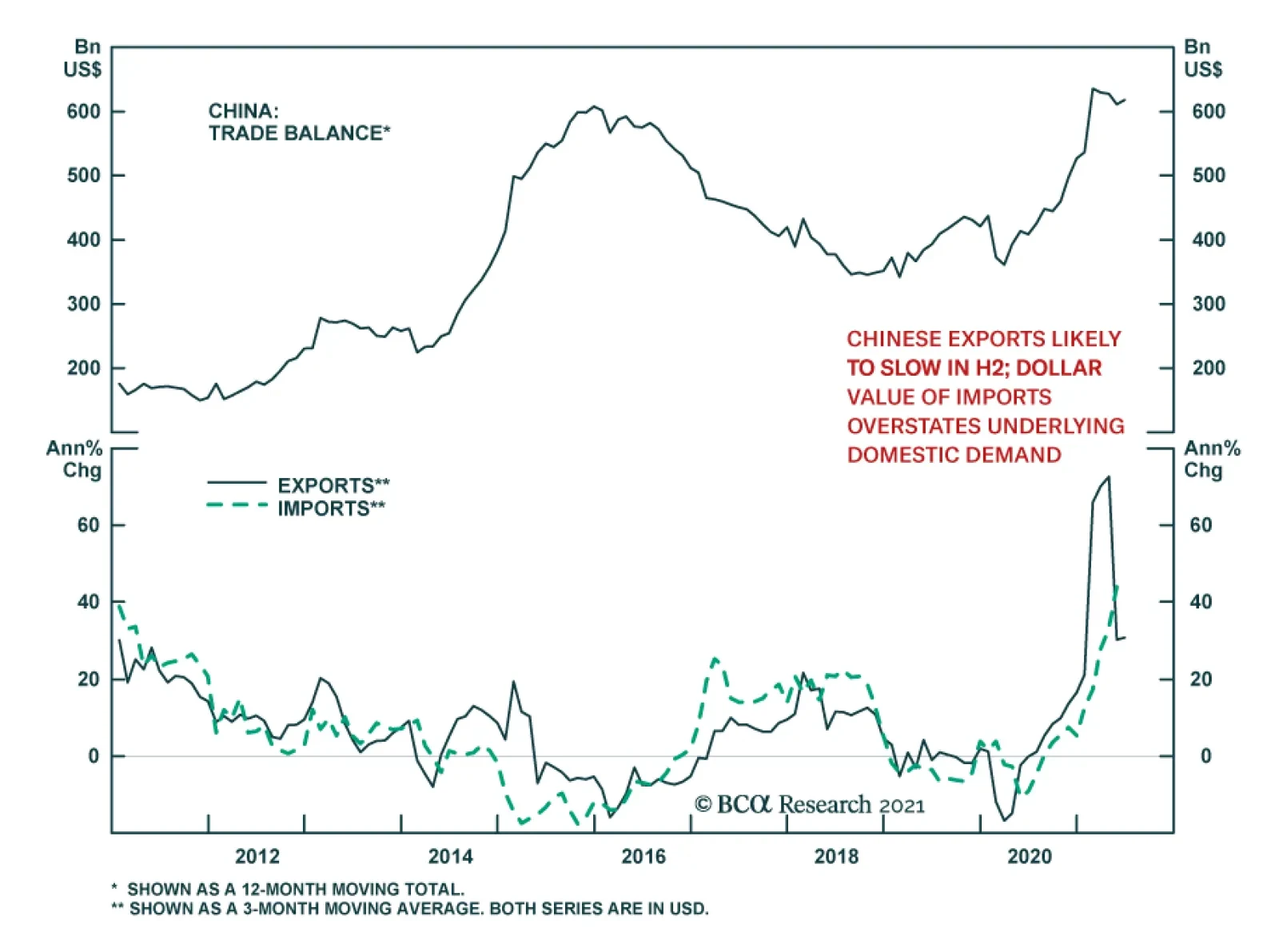

China’s trade surplus expanded unexpectedly in June, rising to $51.5 billion from $45.5 billion. The wider surplus reflects an acceleration in exports to 32.2% y/y from 27.9% y/y. Meanwhile, imports slowed to 36.7% y/y from…

Feature Since the end of the first quarter, the decline in Treasury yields has been the most important trend in global financial markets. It has contributed to the return of the outperformance of growth stocks relative to value stocks,…

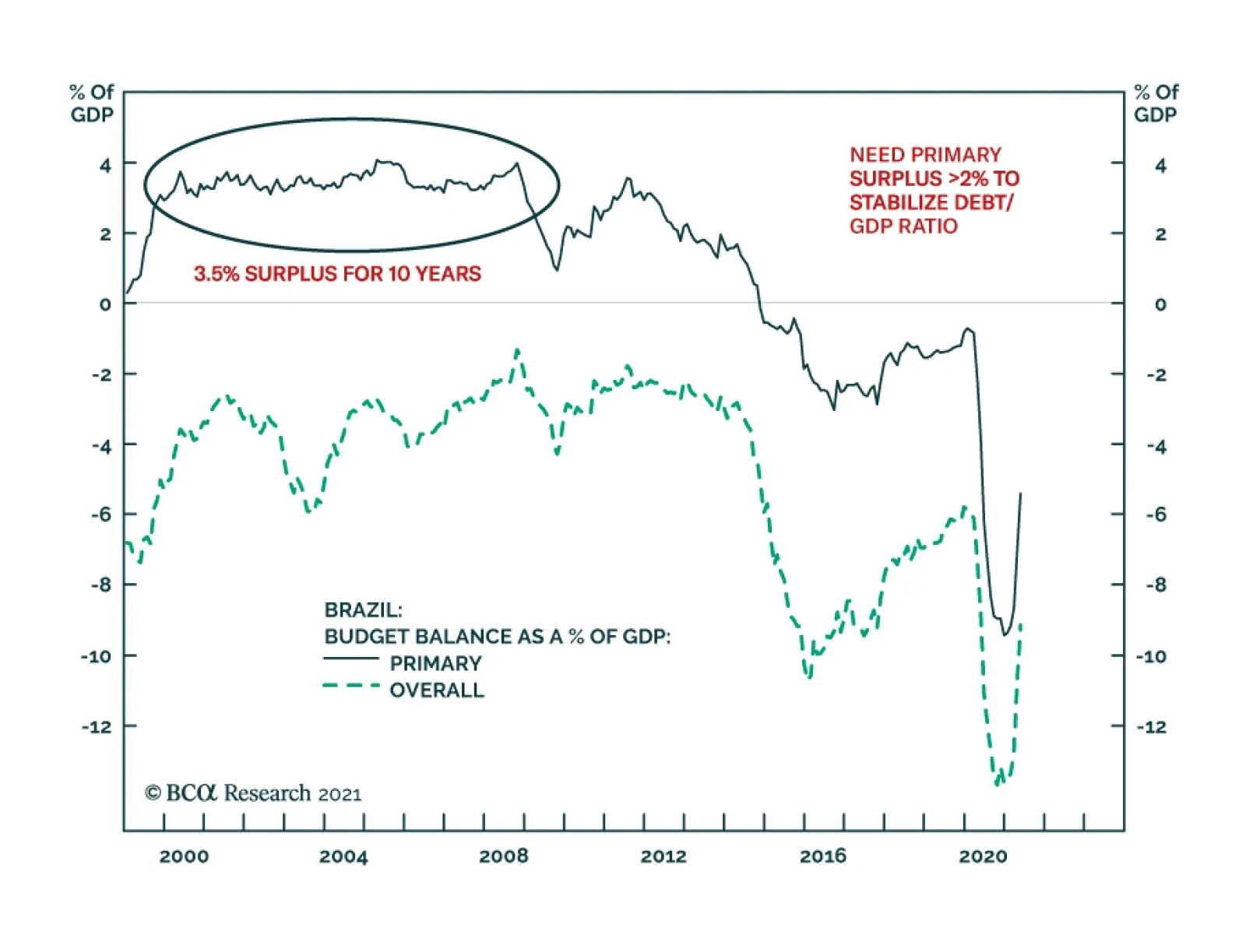

One of the structural challenges Brazil faces is its public debt overhang. The authorities have responded by periodically embarking on fiscal and monetary austerity. Yet, such austerity depresses nominal growth and has in fact…

Chinese credit numbers came in rather higher than expected. Total Social Finance (TSF) grew by RMB3.7 trillion in June, compared to RMB1.9 trillion in May and expectations of RMB2.9 trillion. At the same time, outstanding loan…