Highlights Last week’s market gyrations do not mark the end of China’s structural reforms. The country’s macro policy setting has shifted to allow a higher tolerance for short-term pain in exchange for long-term gain…

Turkey’s inflation rate continued to climb in July, reaching a 2-year high of 18.95% y/y, above consensus estimates of 18.6% and just a hair below the central bank’s policy rate of 19%. Although the core CPI eased slightly to 17.…

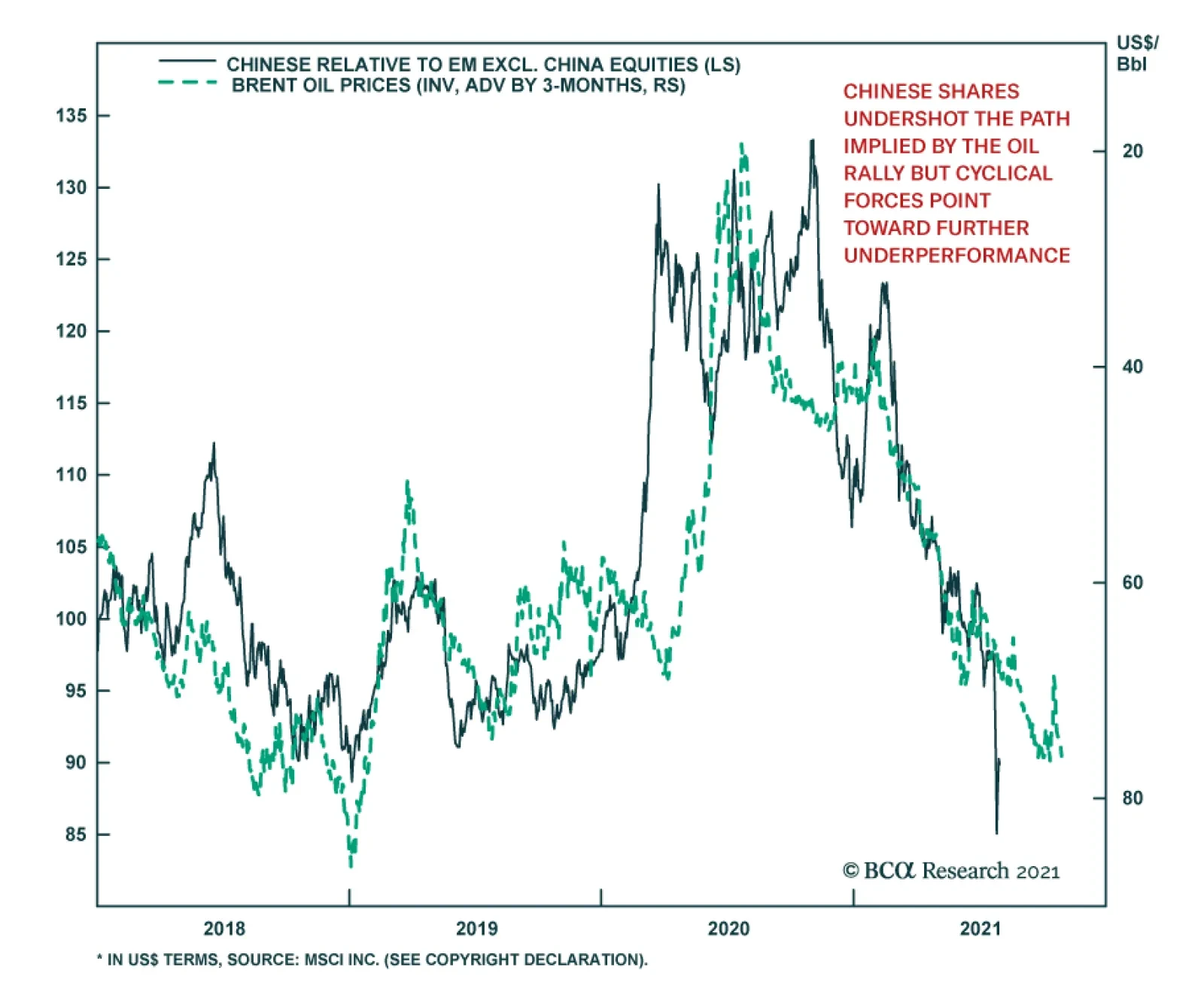

China is a large net importer of oil and rising crude prices act as a significant drag on this economy, at least compared to other emerging markets. Consequently, the relative performance of Chinese equities has tracked with a…

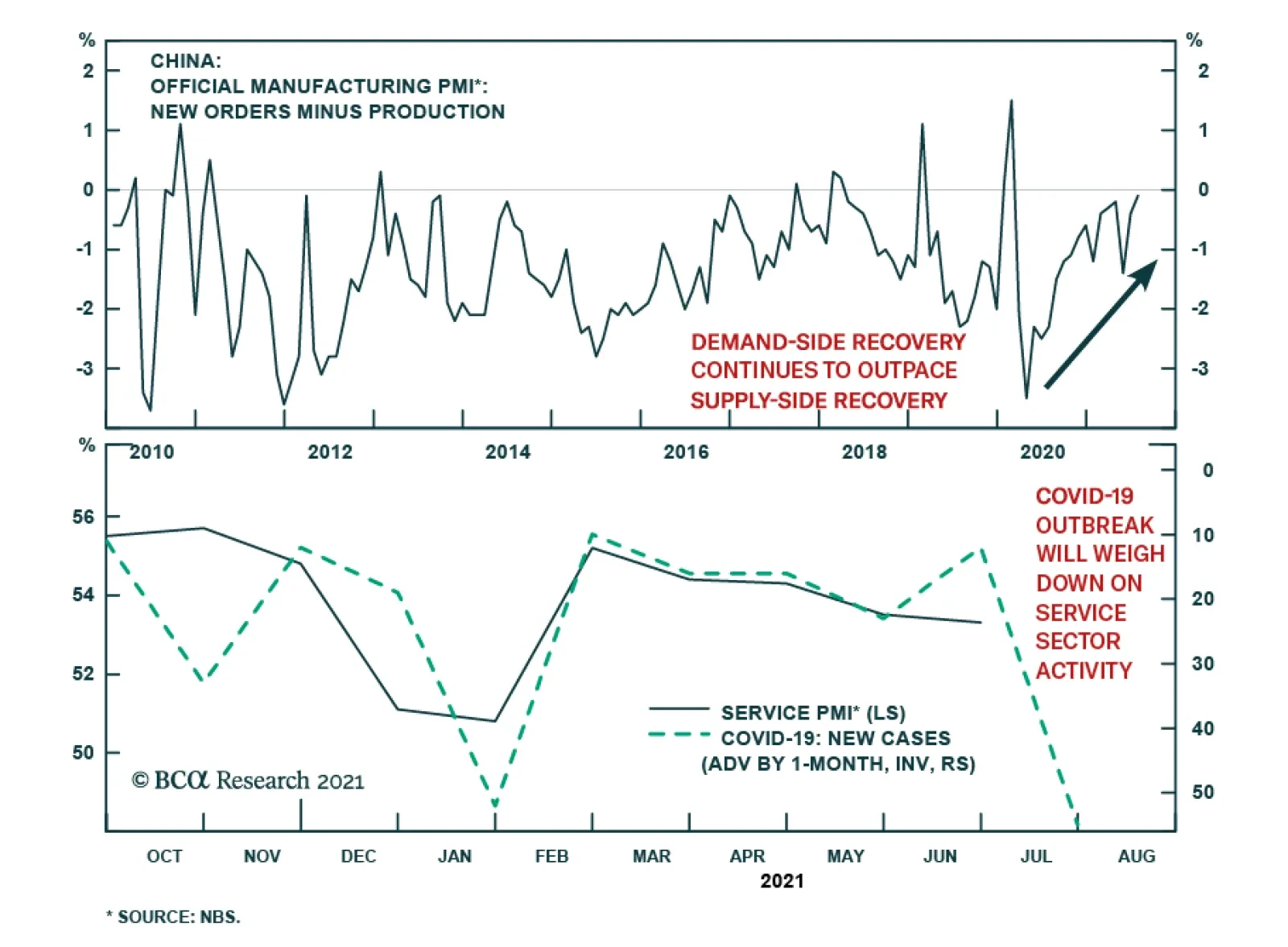

Chinese PMIs indicate that economic activity continues to slow. The Caixin PMI fell 1 point to 50.3 in July, below the anticipated 51.0. Similarly, the NBS manufacturing index eased to 50.4, disappointing expectations of a 0.1…

Highlights The dollar is fighting a tug of war between two diverging forces: an economic slowdown around the world but plunging real interest rates in the US. The litmus test for determining which force will gain the upper hand is if…

Highlights Globalization is recovering to its pre-pandemic trajectory. But it will fail to live up to potential, as the “hyper-globalization” trends of the 1990s are long gone. China was the biggest winner of hyper-…

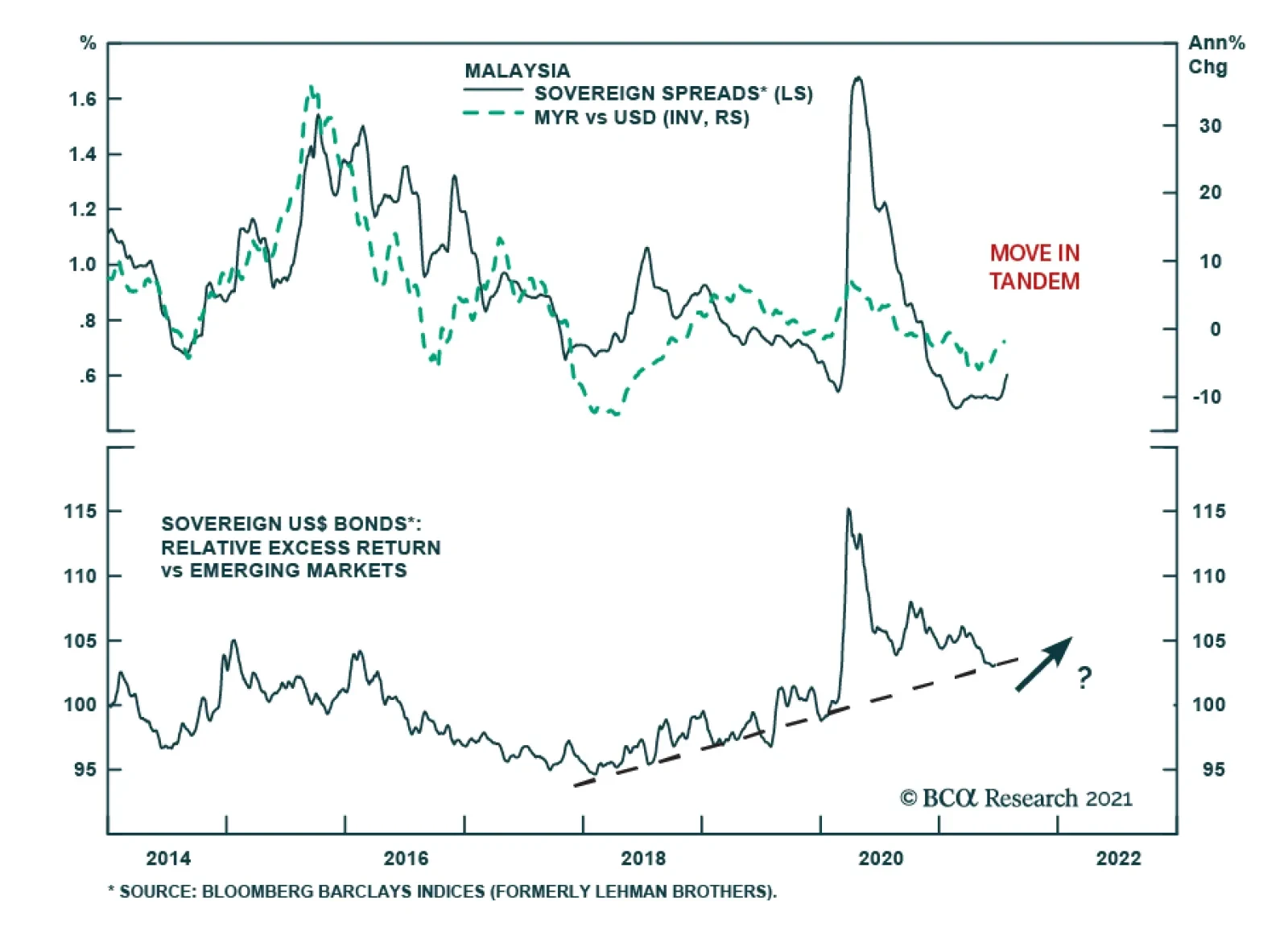

BCA Research’s Emerging Markets Strategy service concludes that dedicated Asian/EM fixed-income investors should continue to overweight Malaysia in both EM local currency and sovereign bond portfolios. First, statutory…

Highlights Recent progress on the path to a post-pandemic state and the return to pre-COVID economic conditions has been mixed. The share of vaccinated individuals continues to rise globally, and the number of confirmed UK cases has…

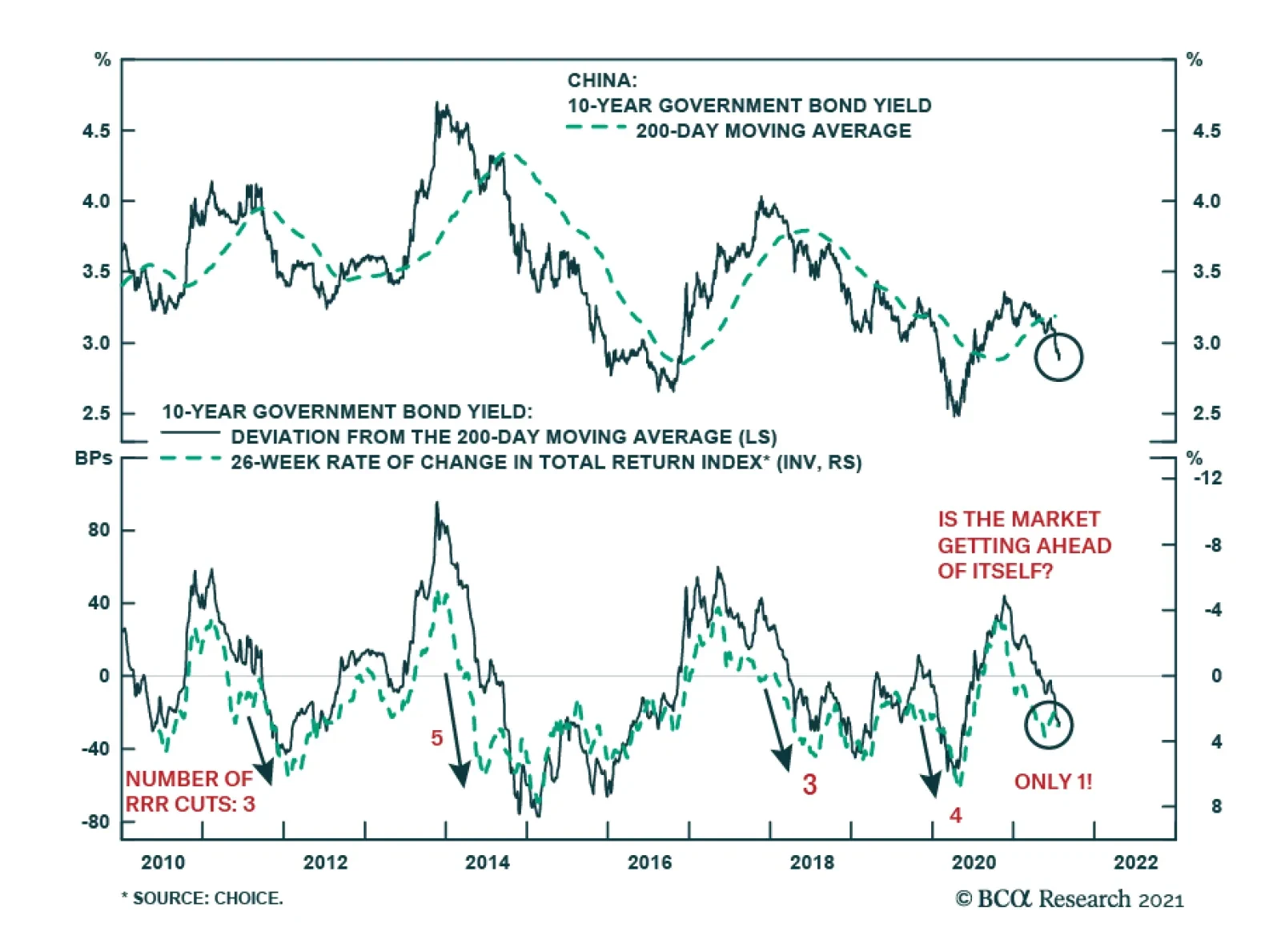

BCA Research’s China Investment Strategy service argues that the Chinese bond market is vulnerable to a near-term reassessment of policy and growth. The RRR cut exacerbated China’s nascent bond market rally as…