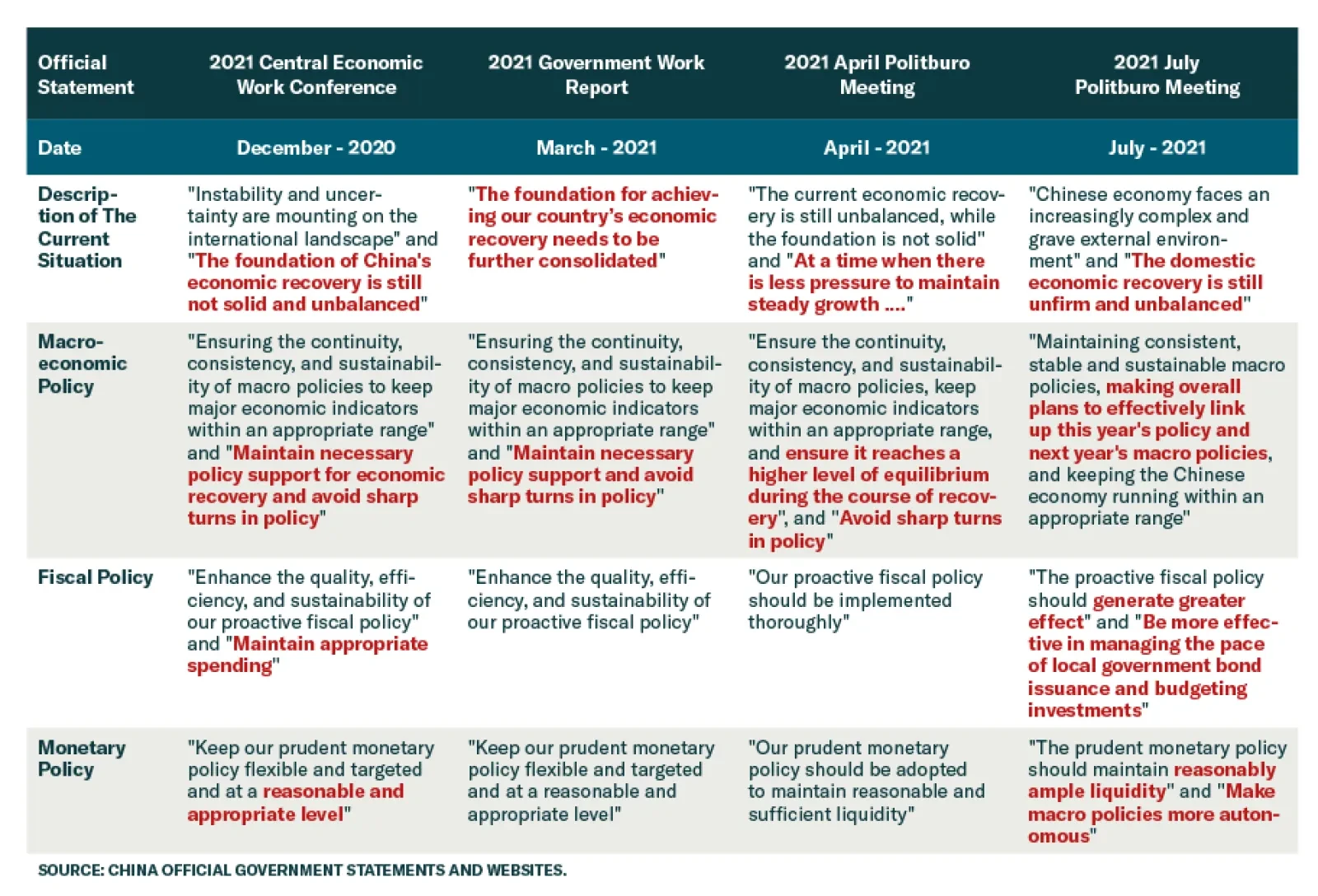

China’s policymakers are responding to their domestic economic and political constraints, which should point to more accommodative policies over the coming 12 months. Our Geopolitical Strategy’s key view for 2021 held that…

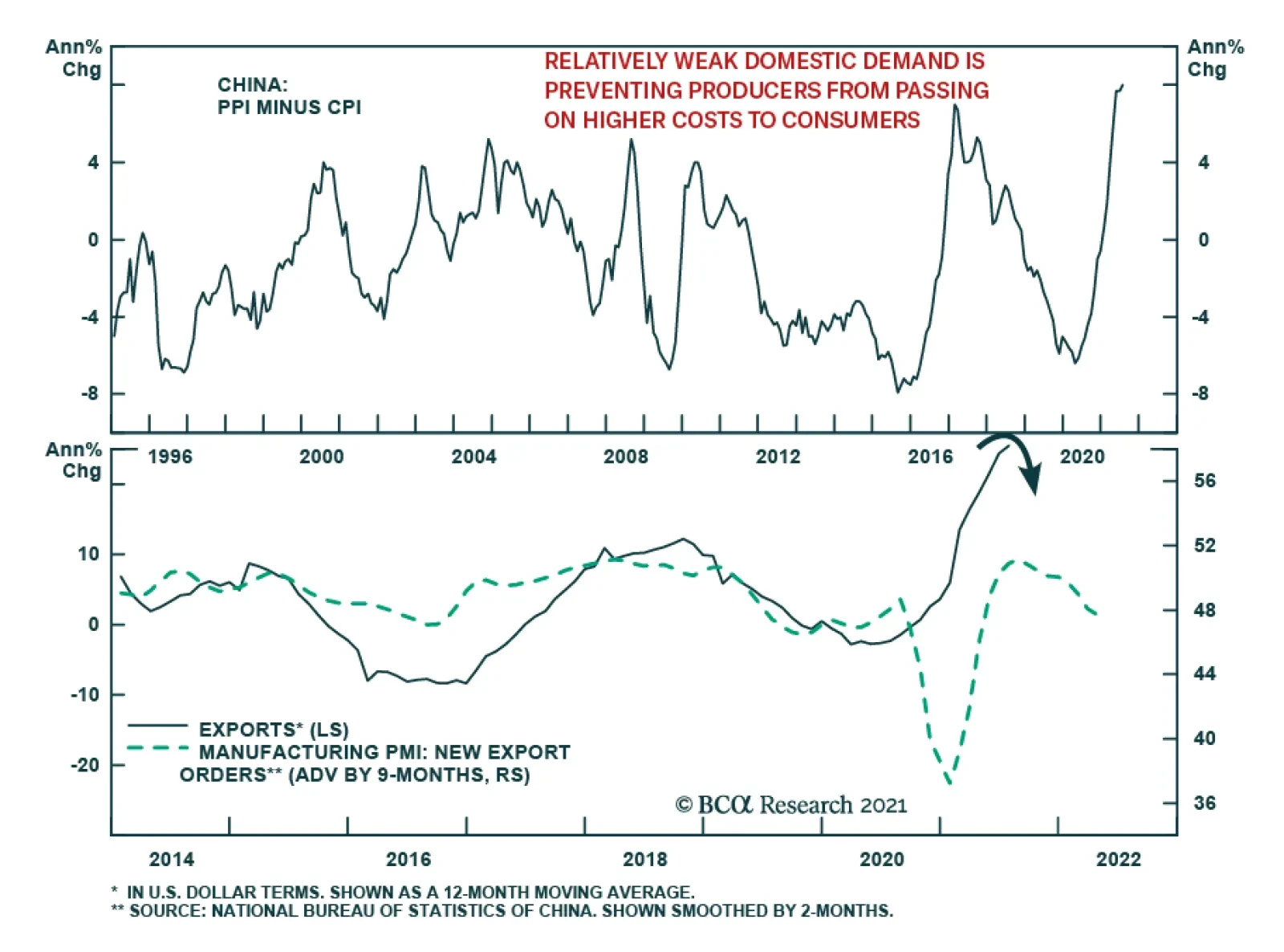

Chinese producer prices accelerated to 9.0% y/y in July, above expectations PPI would remain at 8.8%. Similarly, core CPI rose to a 18-month high of 1.3% y/y from 0.9%. Policymakers are unlikely to respond to signs of price…

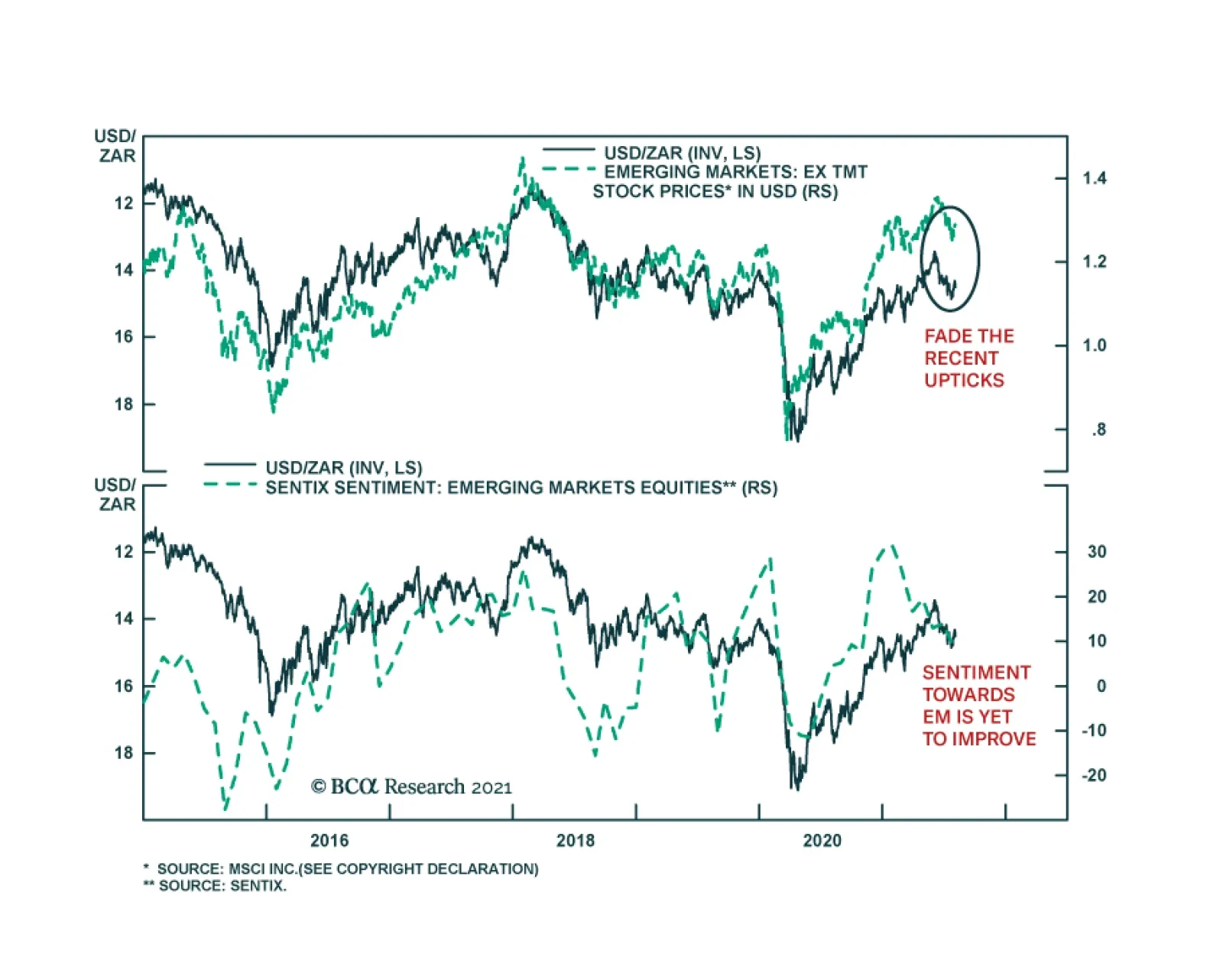

After surging earlier this year, the South African rand has been depreciating against the US dollar since the beginning of June. However, over the past two weeks, the ZAR has been strengthening vis-à-vis the greenback. The ZAR’s…

Highlights China’s July Politburo meeting signaled that policy is unlikely to be overtightened. The Biden administration is likely to pass a bipartisan infrastructure deal – as well as a large spending bill by Christmas.…

Highlights The rapid spread of the COVID-19 delta variant in Asia will re-focus precious metals markets anew on the possibility of another round of lockdowns and the implications for demand, particularly in Greater China and India,…

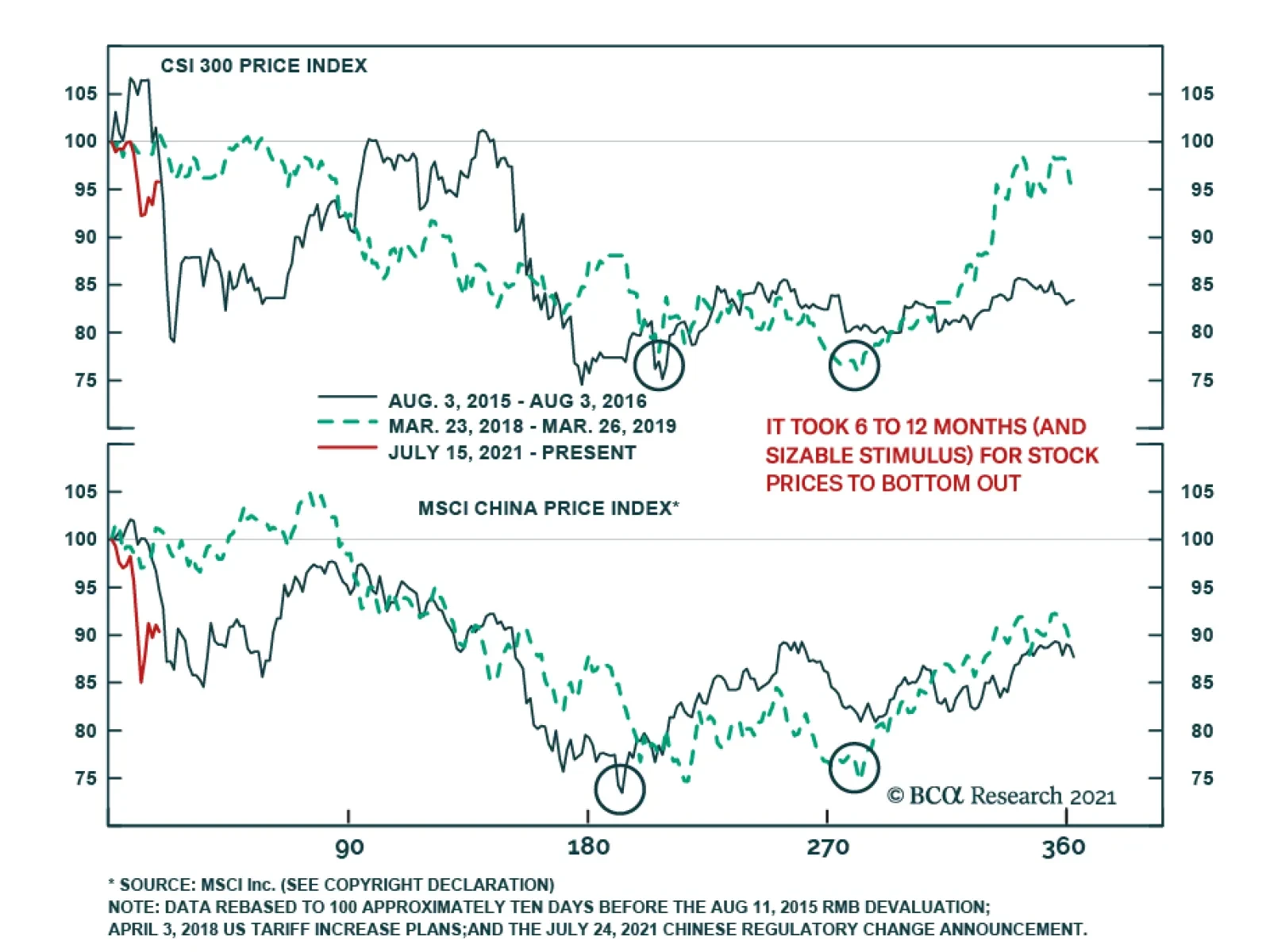

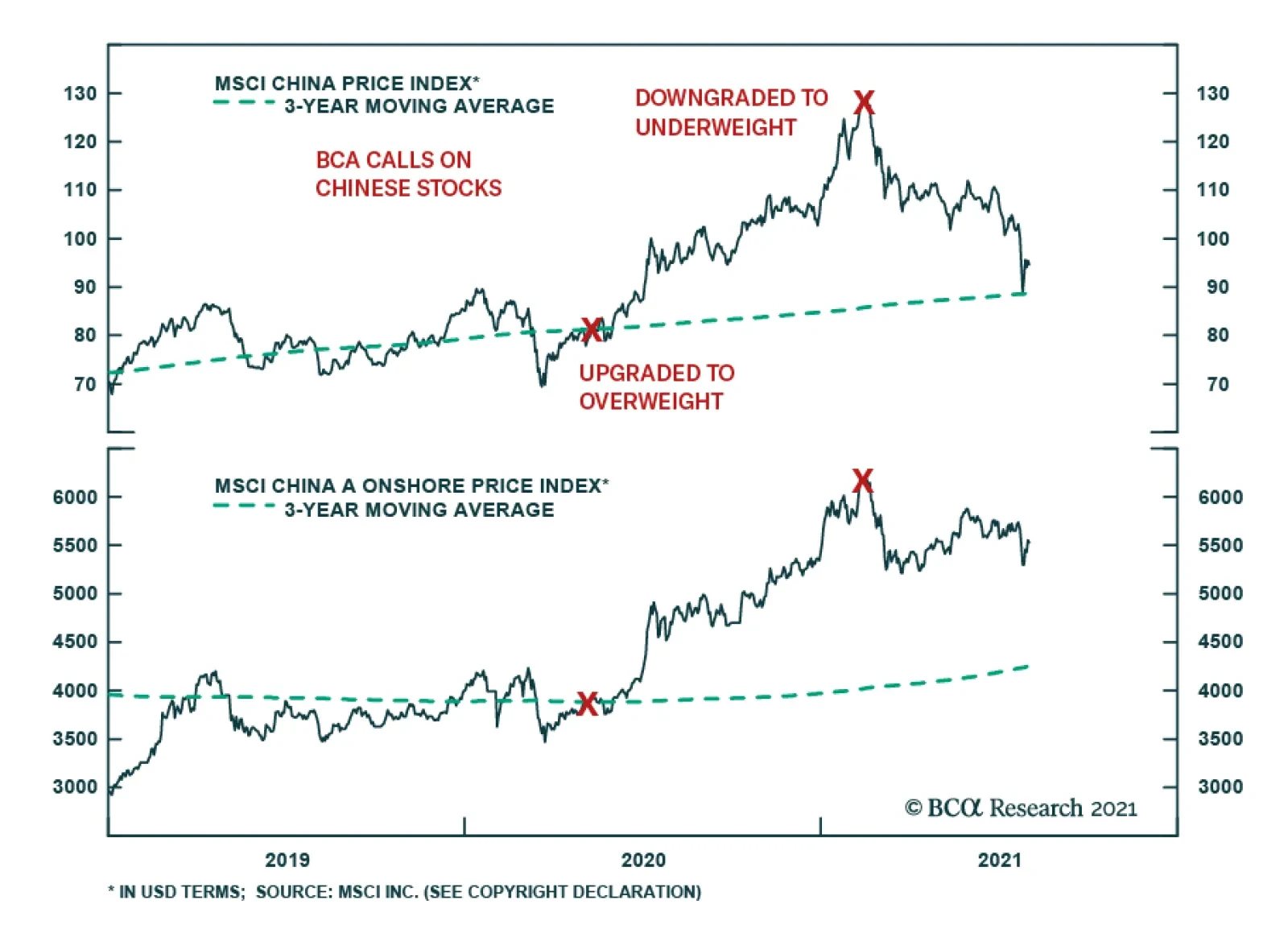

BCA Research’s China Investment Strategy service presents three scenarios of how China’s equity market and policies will likely evolve. In the first scenario (their baseline case) the economy would weaken, but would not cross…

The performance of Chinese stocks last month was almost a mirror image from a year ago. Chinese stocks went from being the best performers among global asset classes in July 2020 to the worst in the same month this year. This…

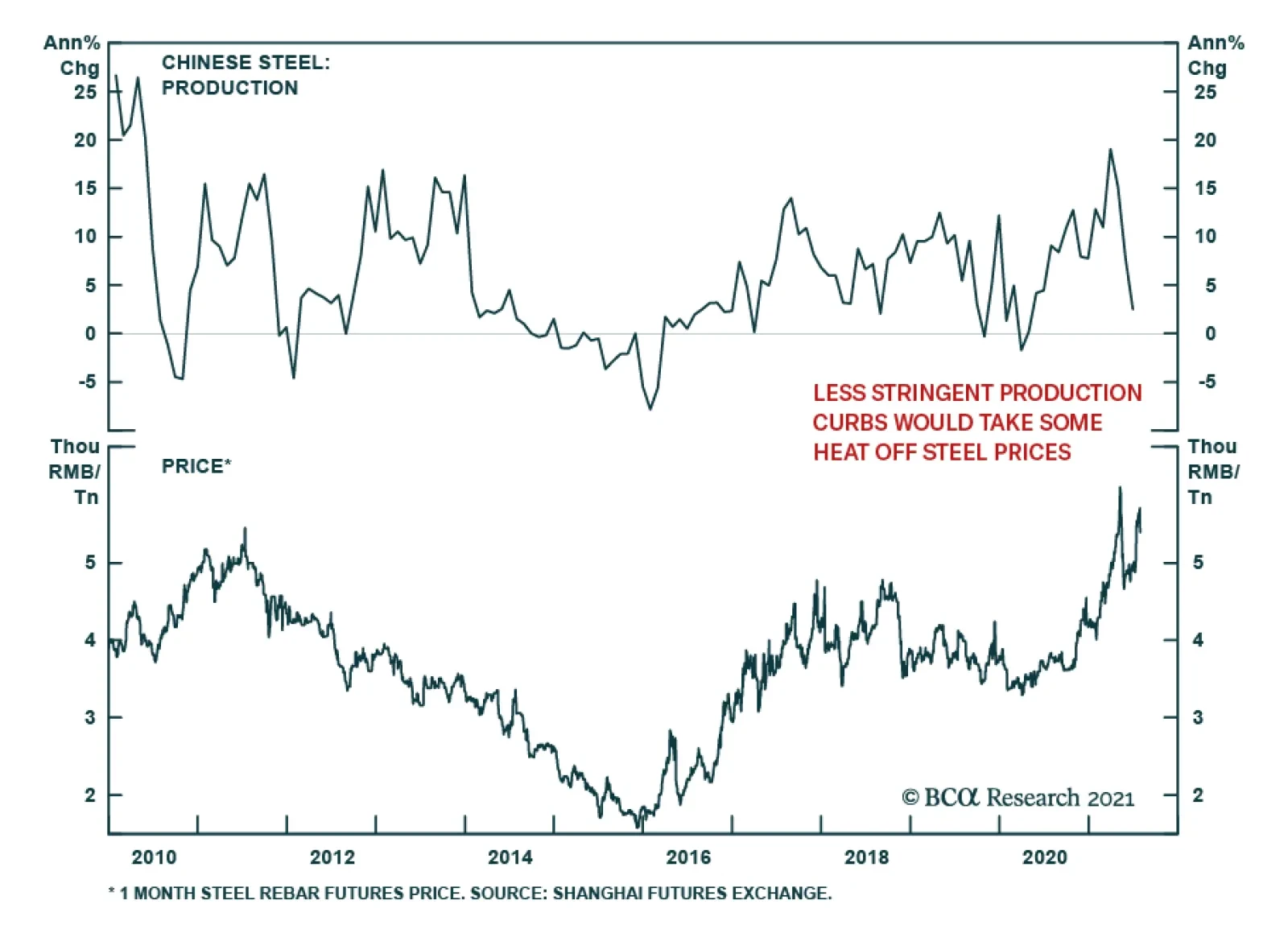

Chinese President Xi Jinping’s de-carbonization drive is well telegraphed. Last year, he announced that carbon emissions will peak by 2030 and that carbon neutrality will be achieved by 2060. Unsurprisingly, the steel industry,…

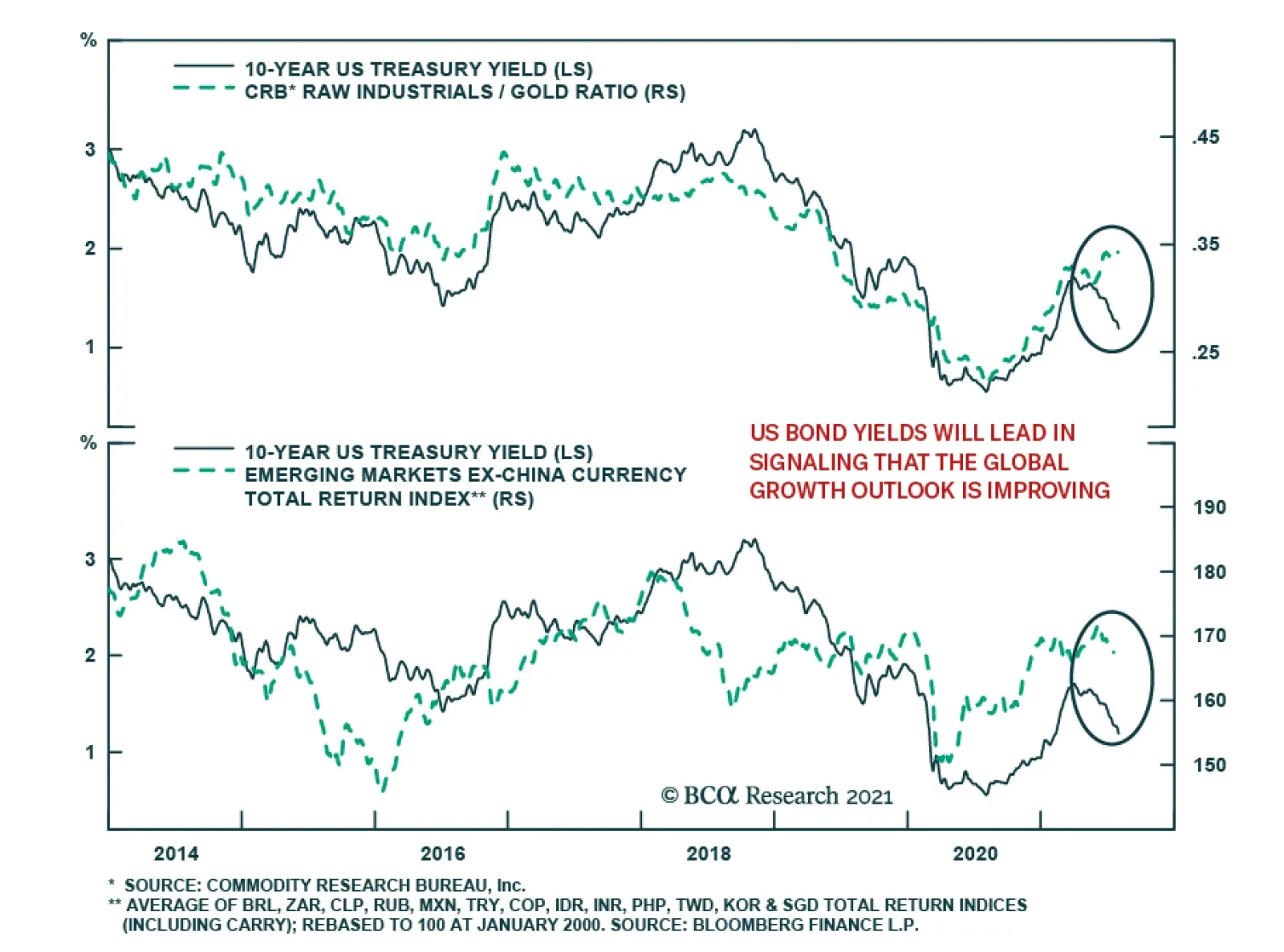

As expected, the US bond rally has coincided with the outperformance of both defensive equity sectors relative to cyclical ones, and growth stocks versus value. However, among growth-sensitive assets, two relationships stand…