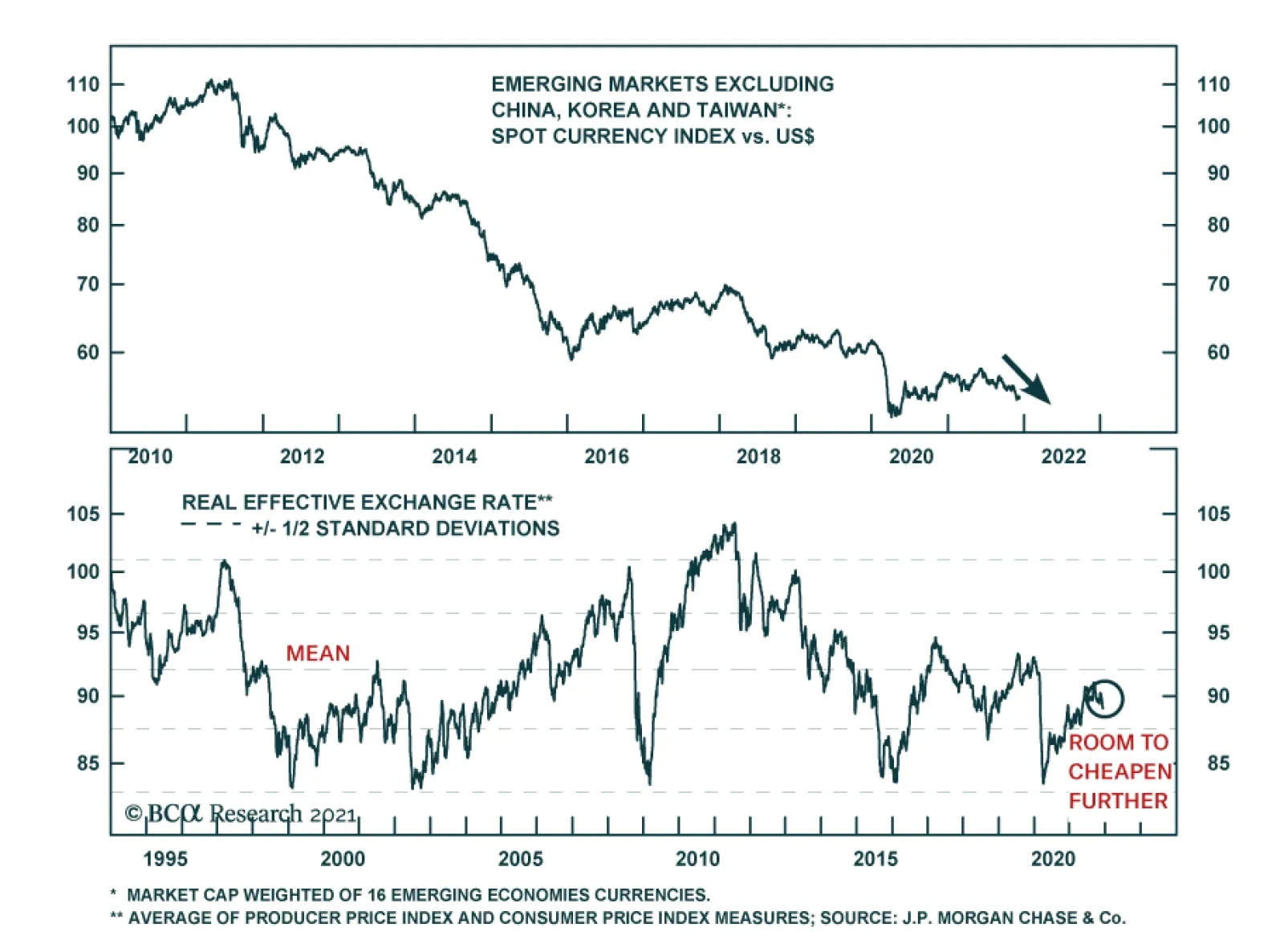

The JP Morgan Emerging Markets Currency Index has fallen sharply over the past month and is now at lows last seen during the initial phase of the COVID-19 crisis in the spring of 2020. The currency index that excludes China,…

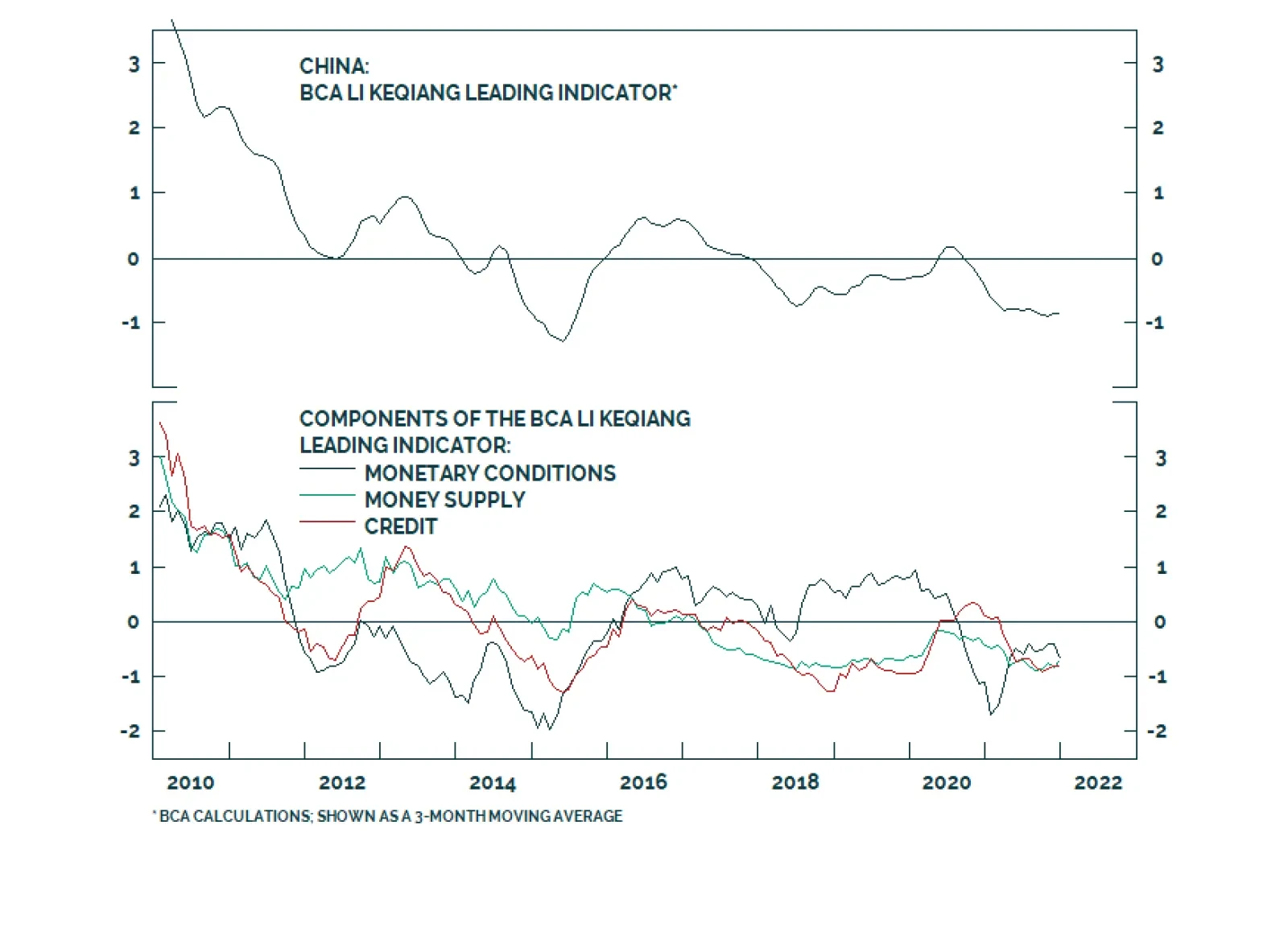

Communication out of China’s annual Central Economic Work Conference prioritizes macroeconomic stability in 2022. This is in line with the Chinese Communist Party’s desire to ensure robust economic conditions ahead of…

Highlights A partial reinvasion of Ukraine cannot be ruled out. The constraints on Russia are not prohibitive, especially amid global energy shortages. On this issue, it is better to be alarmist than complacent. We would put the risk…

On this week's Week In Review, we are sending you a webcast that was recorded recently titled EM/China: An Unfinished Adjustment featuring Arthur Budaghyan, Chief Emerging Markets Strategist and Roukaya Ibrahim, Vice-President,…

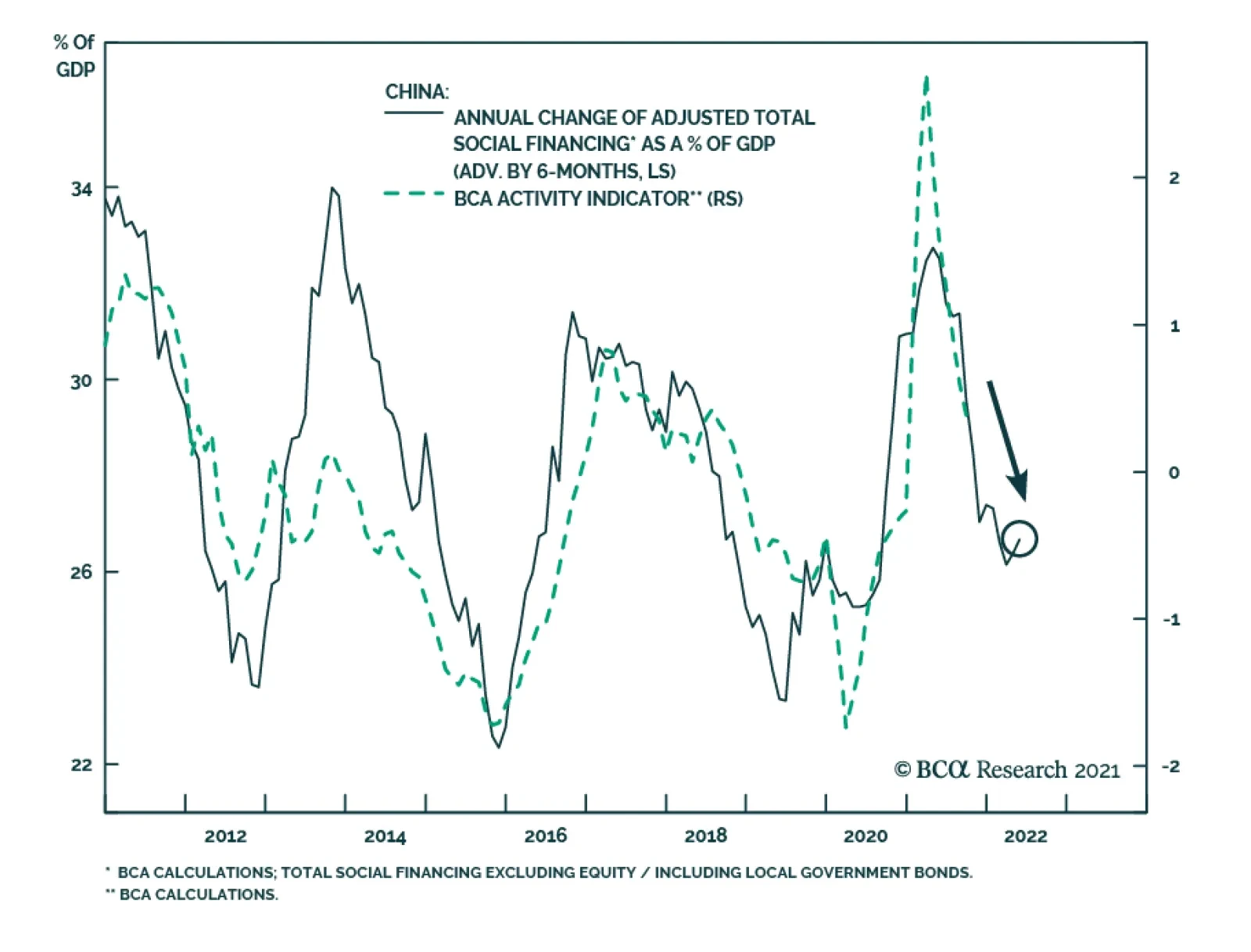

Although China’s credit data improved in November, it fell below expectations. Aggregate financing increased from CNY 1.6 trillion to CNY 2.6 trillion, slightly below the anticipated CNY 2.7 trillion. Although new yuan…

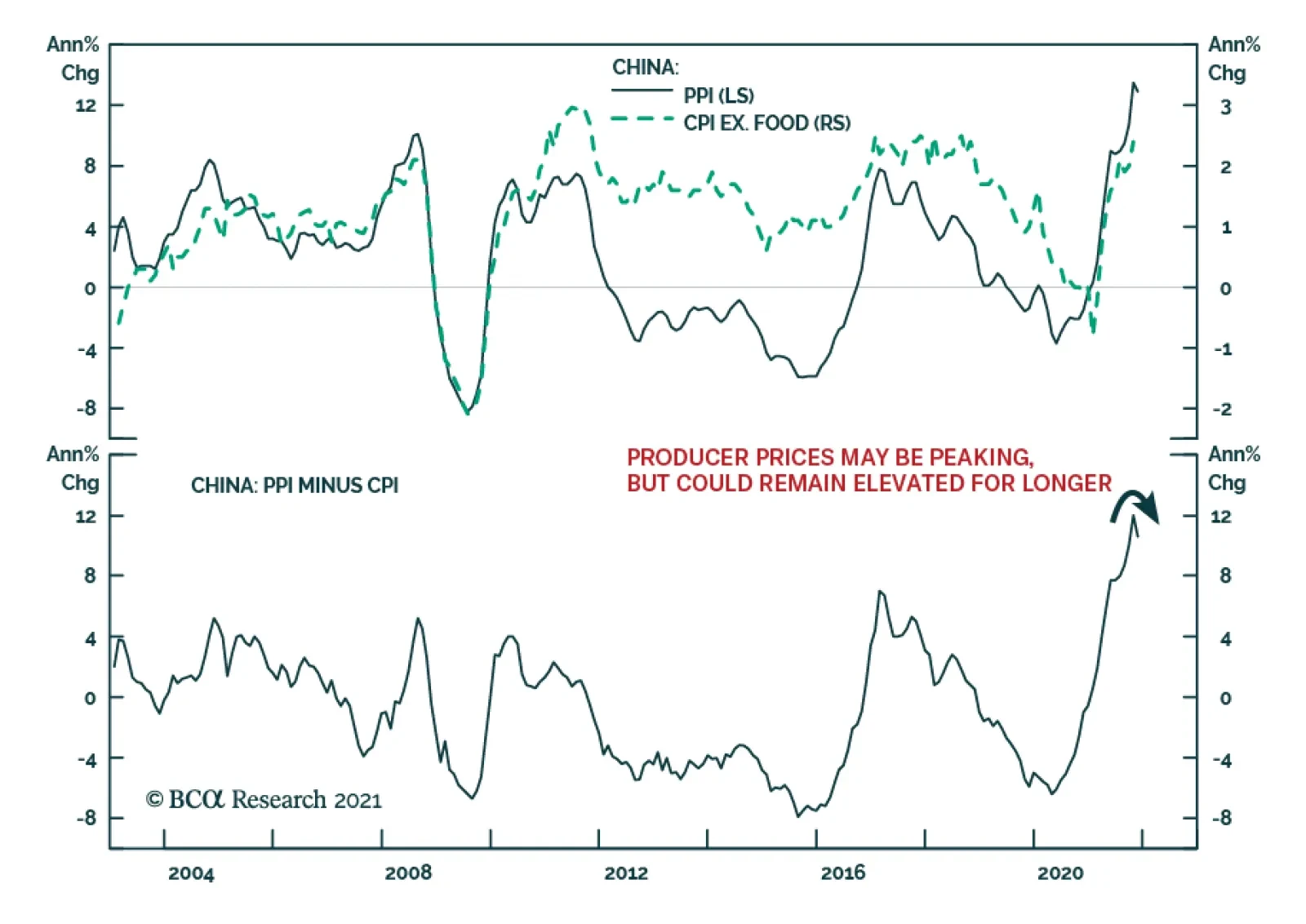

The gap between Chinese producer and consumer price inflation narrowed in November. PPI growth slowed from 13.5% to 12.9% while consumer price inflation accelerated to 2.3% from 1.5%. The moderation in producer prices reflects…

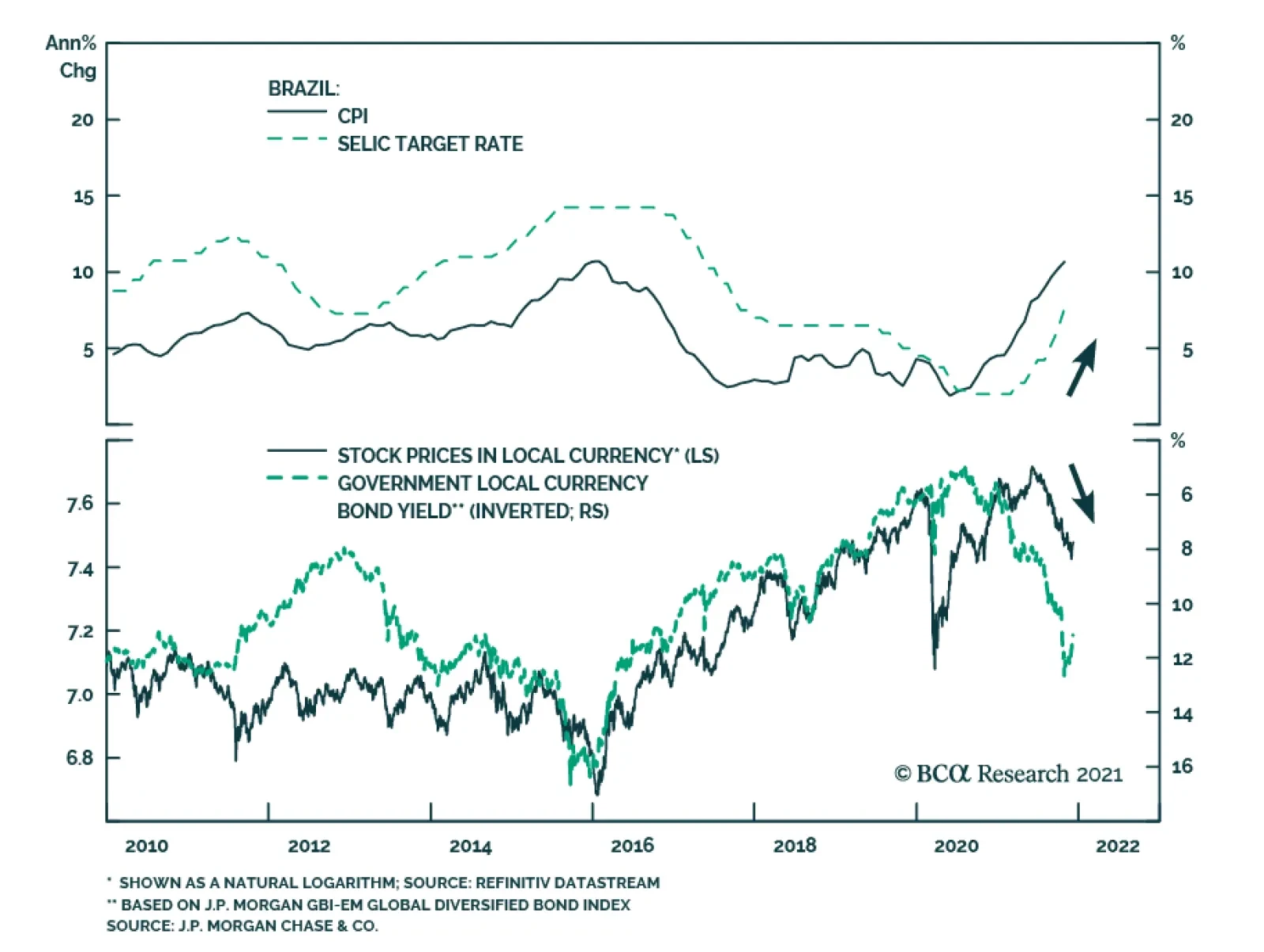

As expected, Brazil’s Central Bank lifted the benchmark Selic rate by 150 bps to 9.25% on Wednesday. This move brings the total increase since the beginning of the year to 725 bps. Policymakers also signaled that another…

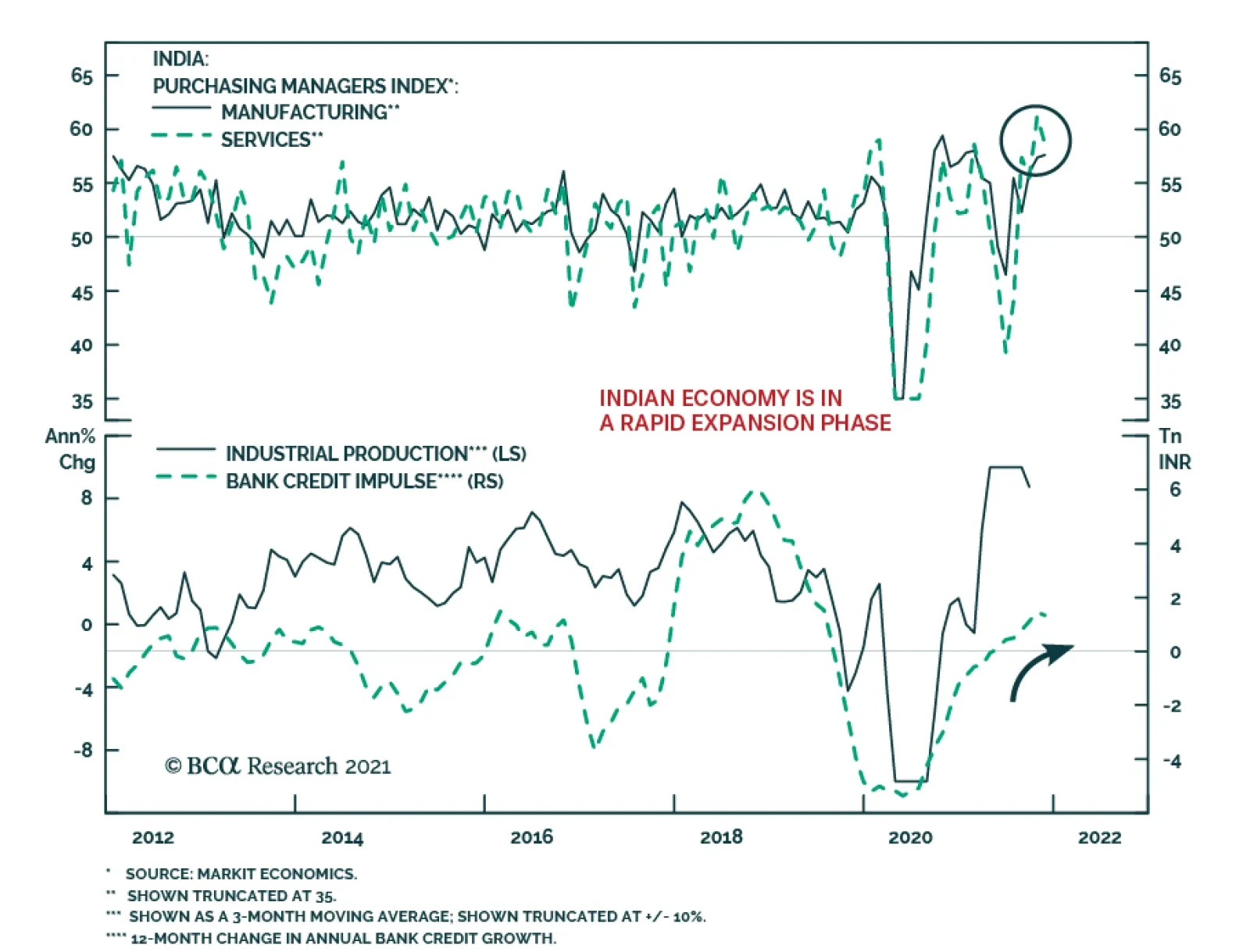

BCA Research’s Emerging Markets Strategy service expects profits to be the main driver of Indian stocks next year. Indian stocks need more time to digest and consolidate the significant gains from earlier this…

Dear Clients, Next week, in addition to sending you the China Macro And Market Review, we will be presenting our 2022 outlook on China at our last webcasts of the year “China 2021 Key Views: A Challenging Balancing Act”.…