Executive Summary Wars Don’t Usually Affect Markets For Long We expect the war in Ukraine to stay within its borders, and therefore to have little impact on global growth. Markets will be volatile, but we recommend…

Executive Summary Hopes of an imminent peace deal between Russia and Ukraine will be dashed. The conflict will worsen over the coming days. As was the case during the original Cold War, both sides will eventually forge an…

On Friday the PBoC boosted liquidity support in the financial system by injecting $45.8 billion through seven-day reverse repo agreements. This is the greatest liquidity injection since September 2020. There are two main…

Executive Summary Stronger Capex Than Last Decade The fog of war continues, but the worst potential outcome for the market—a freeze of Russian energy exports to Europe—has been avoided. Energy inflation is…

Highlights The Russian invasion of Ukraine is a geopolitical incident that is likely to be limited in scope. A wholesale energy cutoff to Europe is the chief risk to global economic activity, but the sanction response from the US and EU…

Executive Summary Risk Premium Abates, But Does Not Disappear The risk premium in crude oil and natural gas prices is abating, and we expect that to continue. In the immediate aftermath of Russia's invasion, Brent…

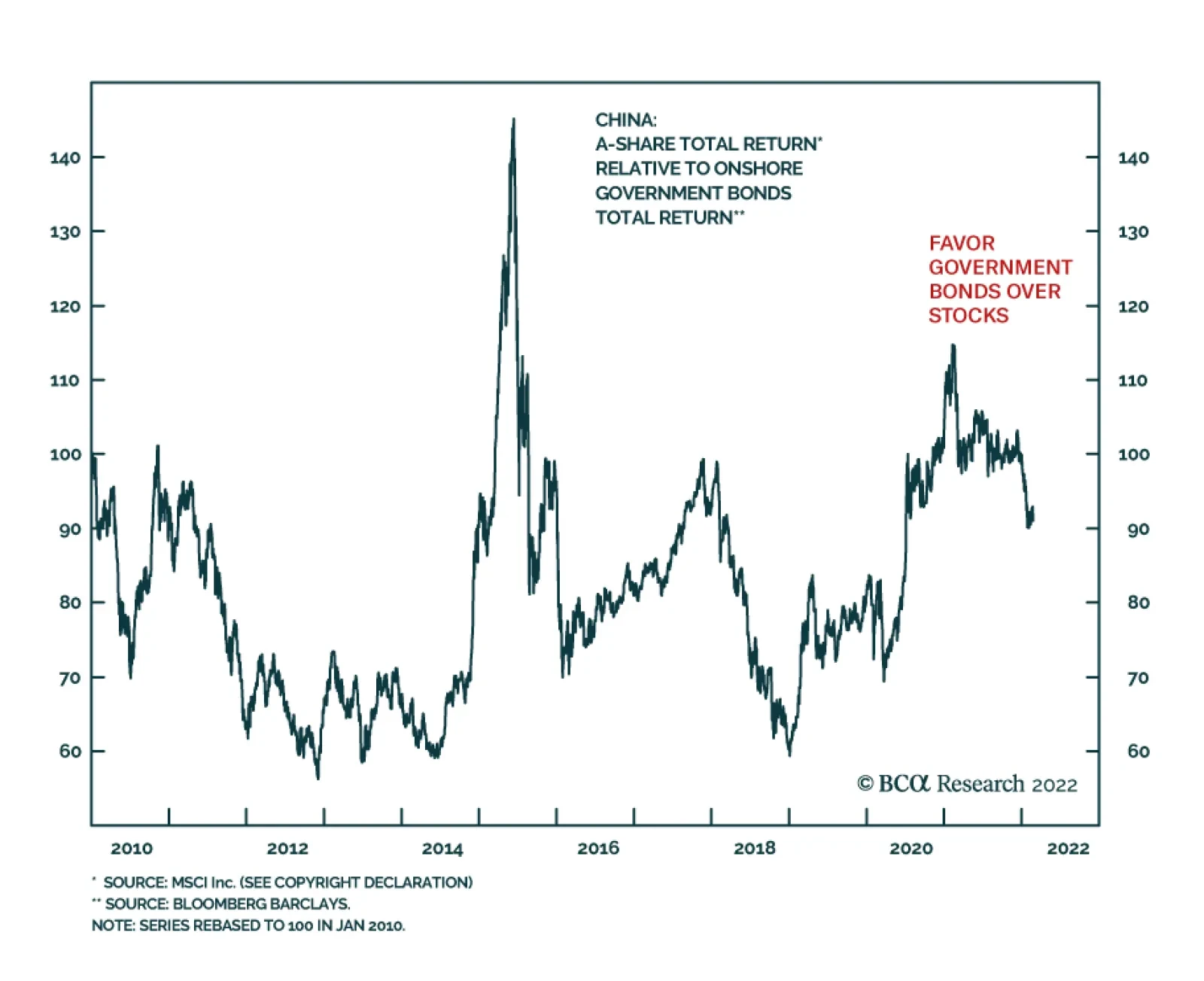

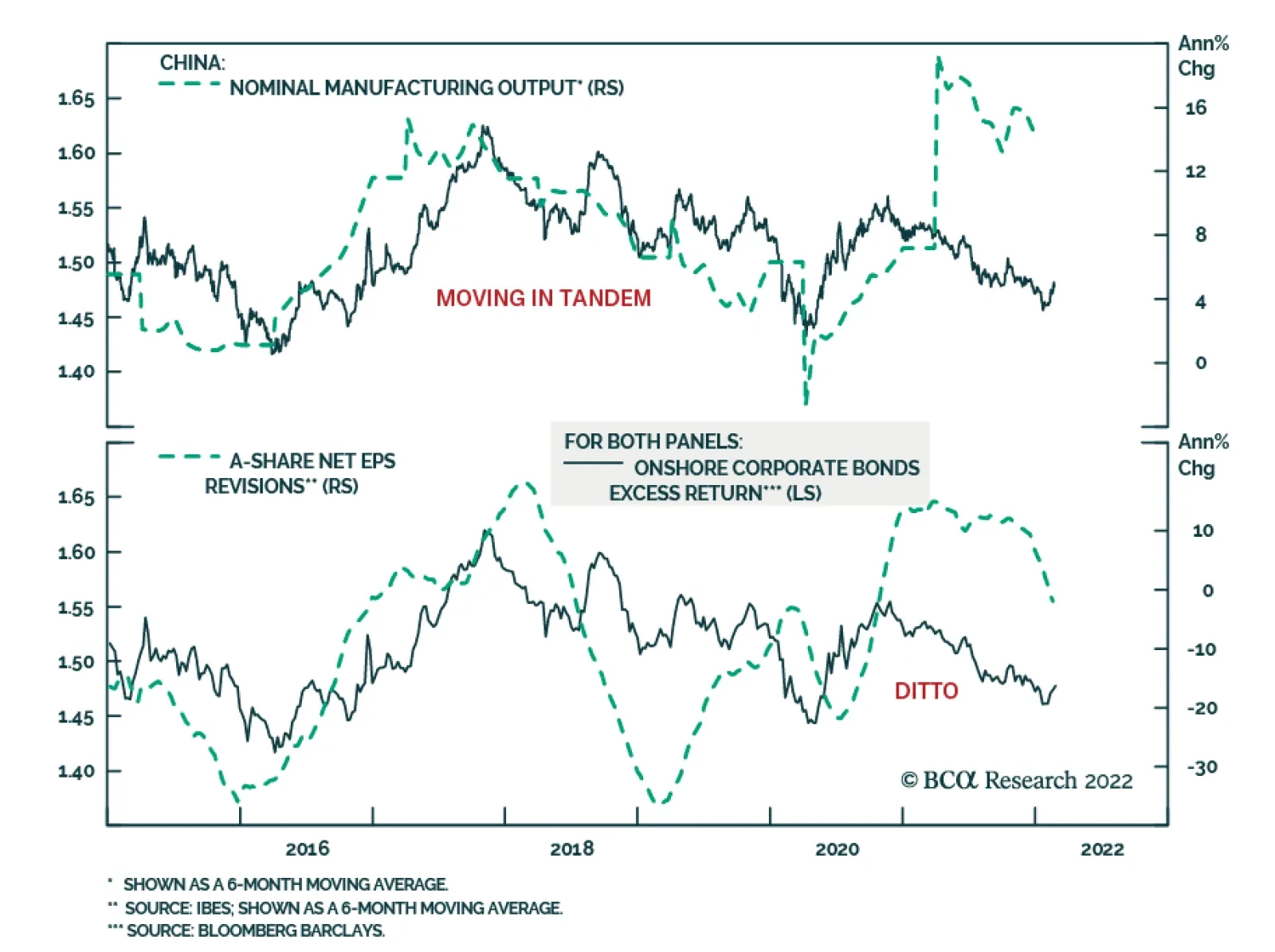

BCA Research’s Emerging Markets Strategy service concludes that fixed-income investors should continue to favor Chinese government bonds over corporate bonds. The proper measure of corporate bond performance is excess…

Executive Summary Copper Demand Follows GDP European copper demand will increase on the back of still-accommodative monetary policy, coupled with a loosening of COVID-19-related gathering and mobility restrictions as the…