Investors have given up on European assets, which now suffer exceptional discounts to US ones. However, tighter US fiscal policy, the end of Europe’s austerity and deleveraging, the LNG Tsunami about to hit European shores, and the…

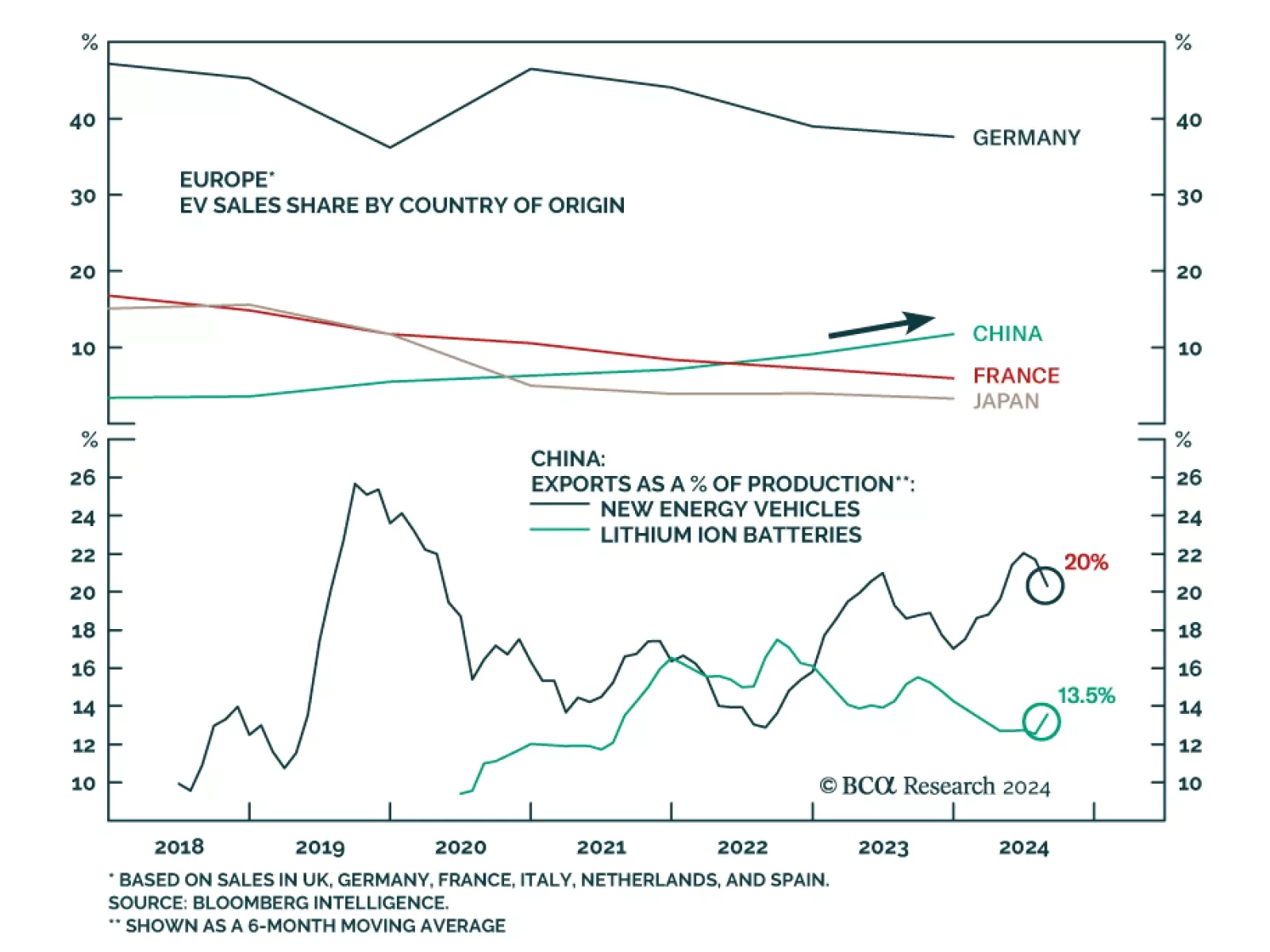

The European Commission voted to impose tariffs of up to 45% on imports of Chinese electric vehicles (EVs). The announcement follows previous tariffs imposed on Chinese EV imports back in June. This new round of economic…

Underweight This week’s Eaton Corporation weak earnings release was good news for our underweight S&P electrical components & equipment (EC&E) position. More specifically, ETN reported contracting revenues…

Underweight BCA U.S. Equity Strategy’s electrical components & equipment (EC&E) three-factor earnings model did an excellent job in anticipating the recent breakdown in the S&P EC&E index (top &…

Highlights Portfolio Strategy The sustained global growth slowdown, widening junk spreads, along with the risk of a U.S. recession becoming a self-fulfilling prophecy suggest that caution is still warranted in the broad equity market…

The previous Insight showed that the industrial sector share price spike was in danger of a reversal. The S&P electrical equipment and components index looks equally vulnerable. Hefty short positions likely played a large role in…

Highlights Portfolio Strategy The strong U.S. dollar is tightening global liquidity conditions, putting the post-election jump in stock prices at risk unless growth imminently accelerates. The spike in large cap industrial stocks…

Fed hawkishness reinforces the need for an imminent profit recovery to justify current valuations. Our Indicators do not signal such an outcome. Stay defensive, and return to an underweight stance in the industrials sector.

The S&P electrical equipment & components (EEC) group has comparatively less resource exposure than many other industrial sub-industries. The EEC index is comprised of mature, diversified manufacturing businesses with exposure…