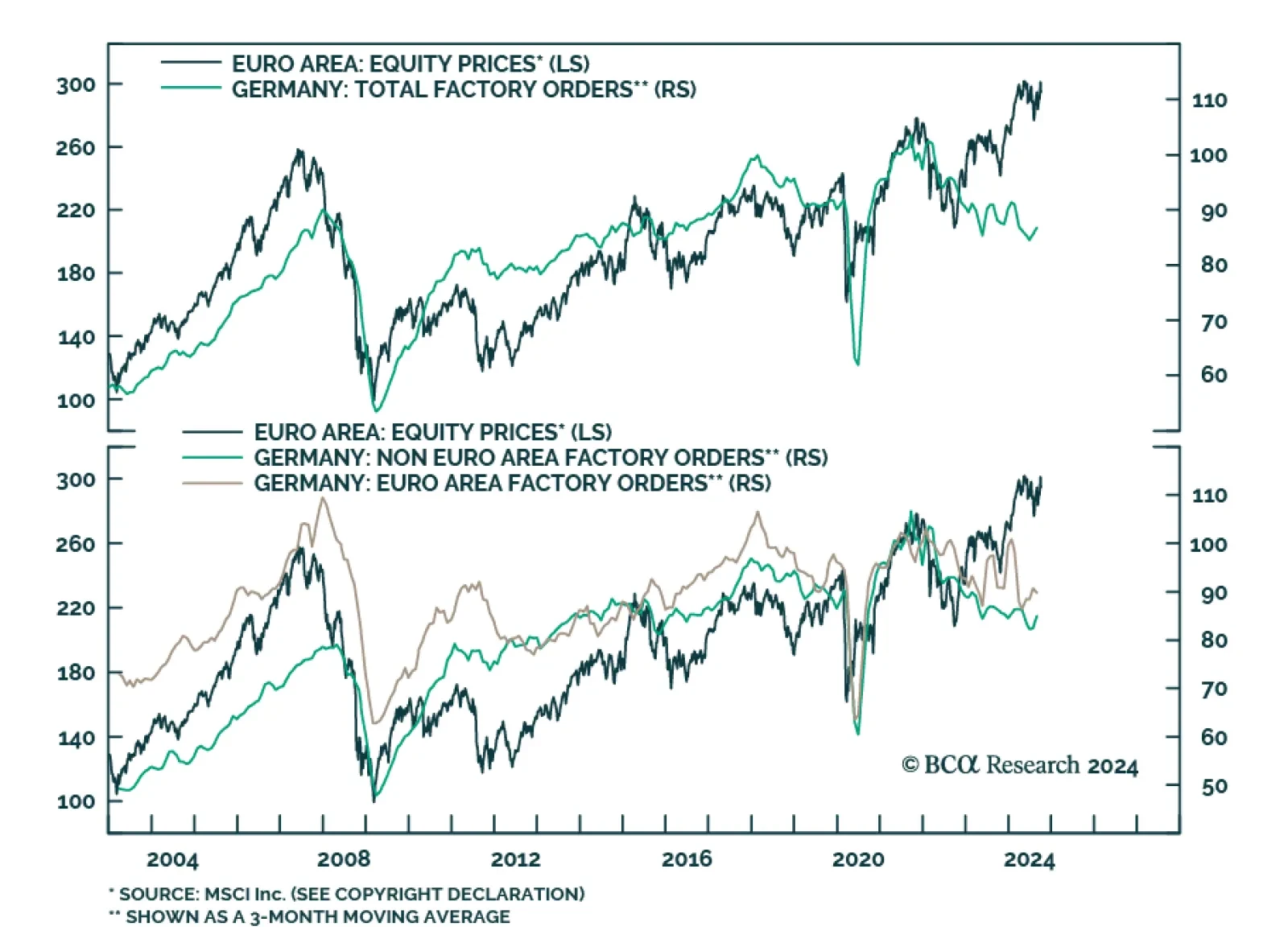

German factory orders contracted by a larger-than-anticipated 5.8% m/m (3.9% y/y) in August, from a 3.9% expansion (4.6% y/y). Domestically, Germany is constitutionally bound to maintain a balanced budget. The emergency…

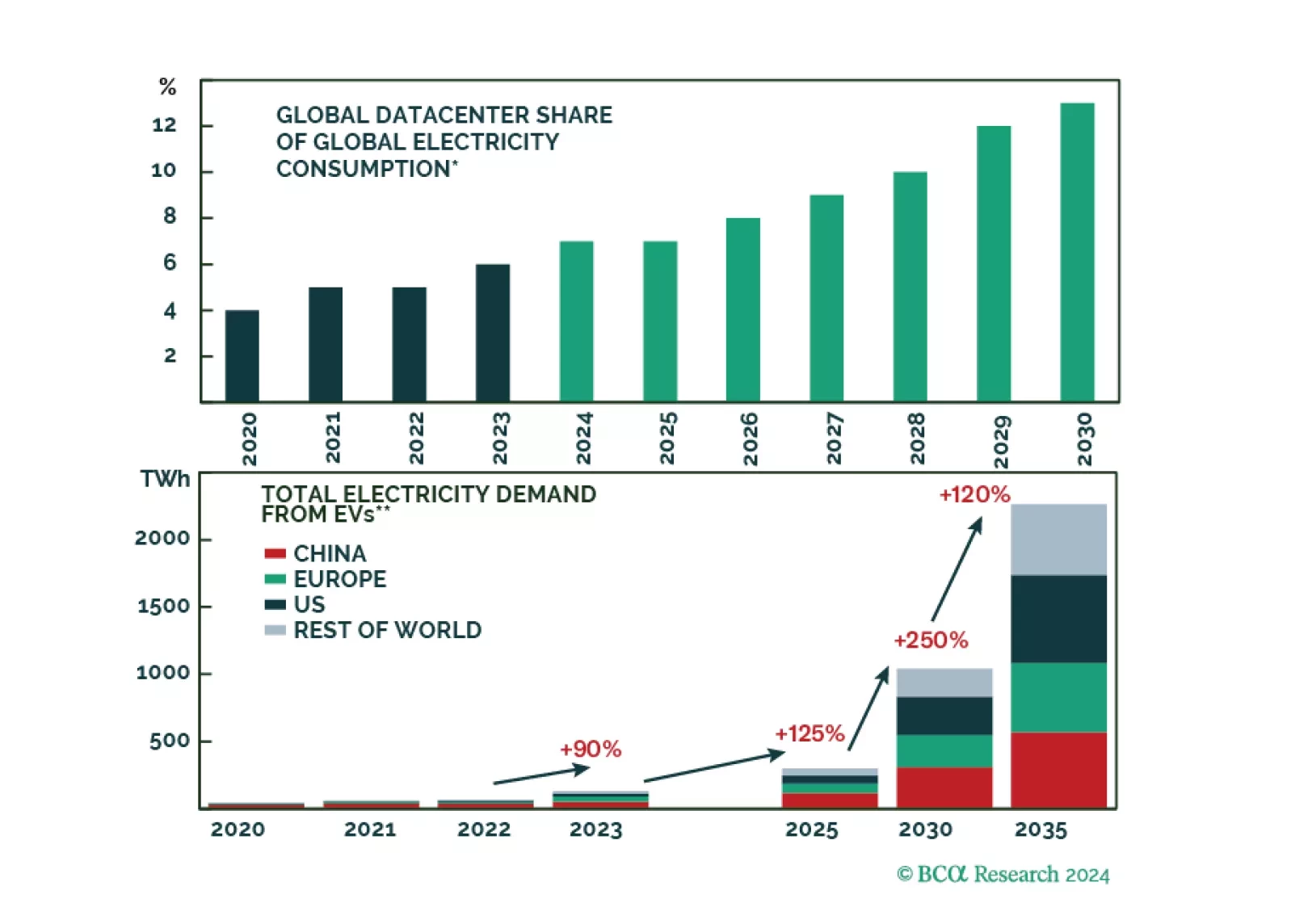

Western policymakers are pursuing three capital “T” Truths: China is evil, climate change is a major risk, and Russia is… also evil. Pursuing all three priorities at the same time presents a version of the classic “impossible trinity…

The consensus soft-landing narrative is wrong. The US will fall into a recession in late 2024 or early 2025. We were tactically bullish on stocks most of last year, turned neutral earlier this year, and are going underweight today.…

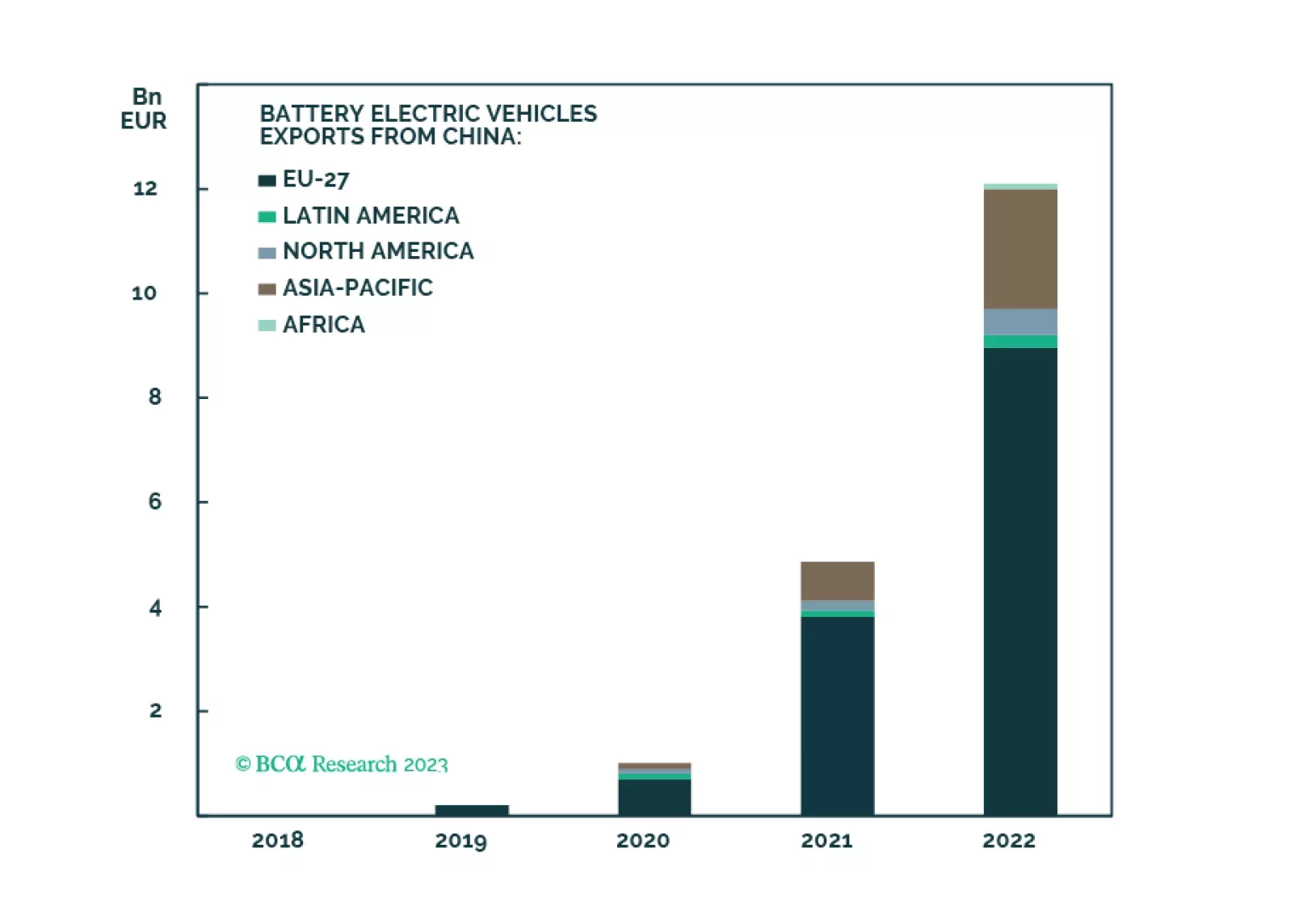

The EU's import tariff increases on Chinese EVs are expected to have a minimal impact on China's overall exports. We anticipate that most Western-brand EV shipments from China will be less affected by the EU import tax hike. Beijing…

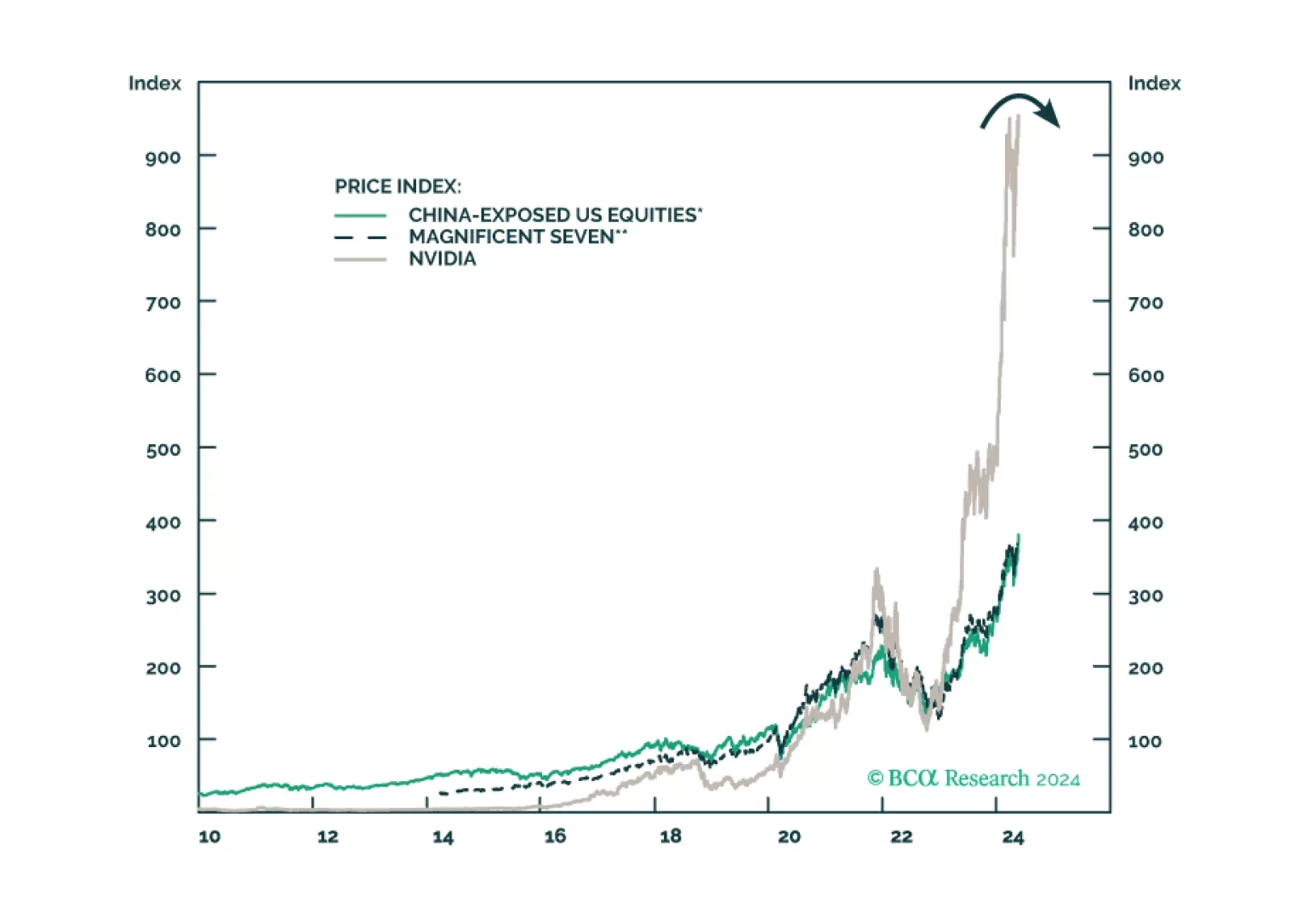

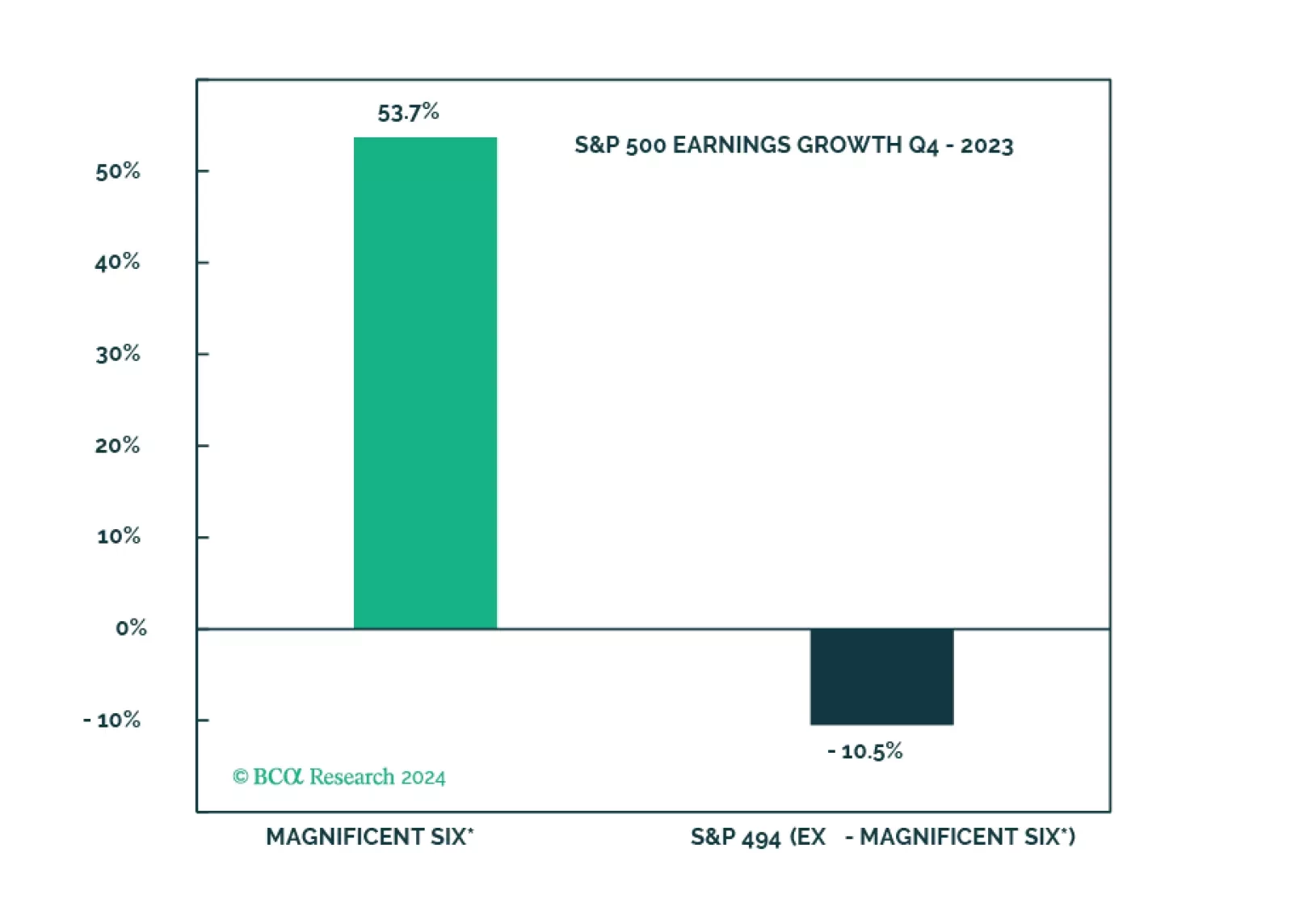

The soft landing and rate cuts narrative is being priced out, and the S&P 500 is overvalued and getting overbought. The Magnificent Seven are about to get a new moniker on the back of performance dispersion. However, without the…

China’s push to dramatically expand its copper-refining capacity will be complemented by further vertical integration of mining assets. However, surplus refining capacity will push treatment and refining charges lower in the short…