The global political system is destabilizing and the US will turn more hawkish in foreign policy, trade policy, or both, regardless of the election outcome. Tactically go long the dollar.

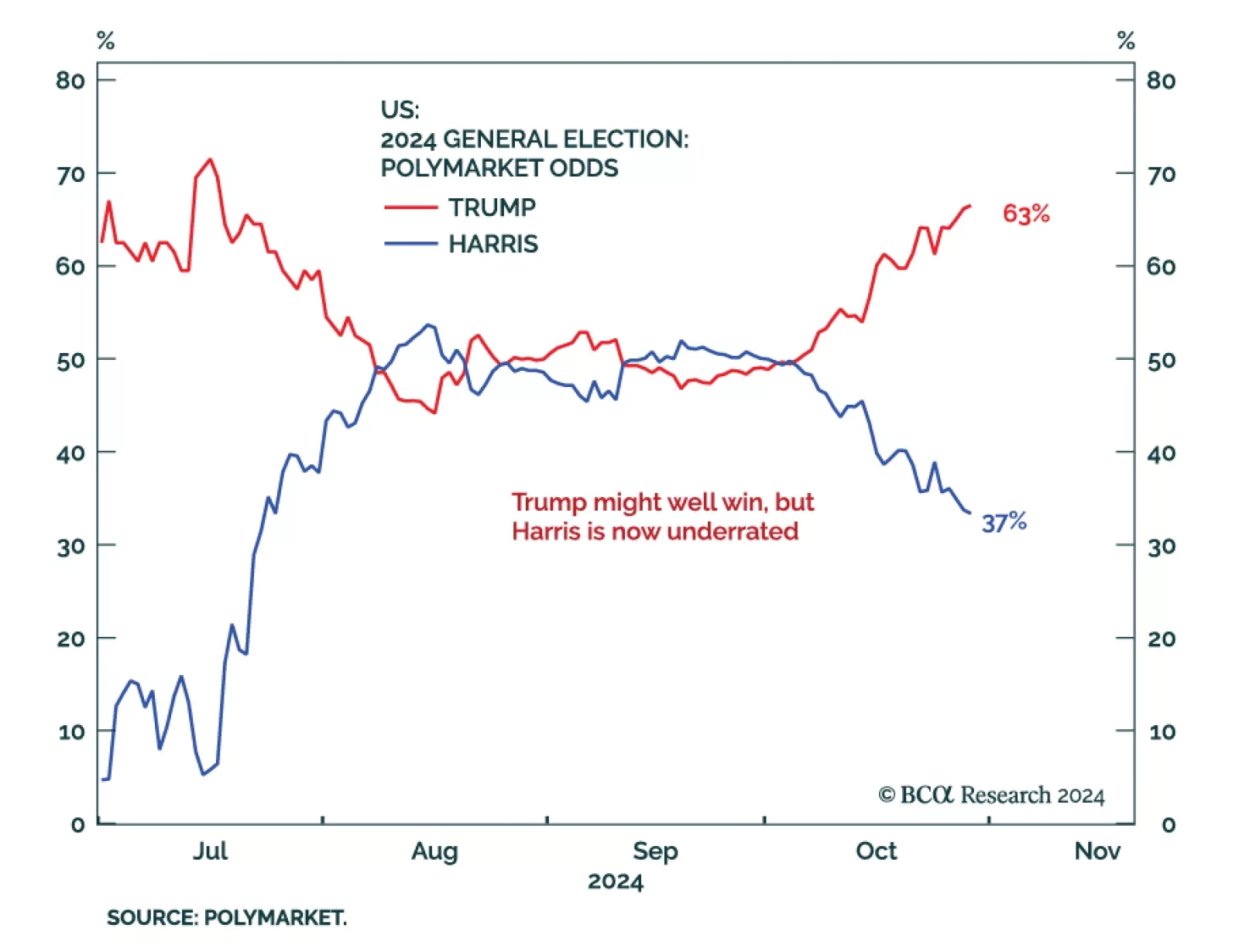

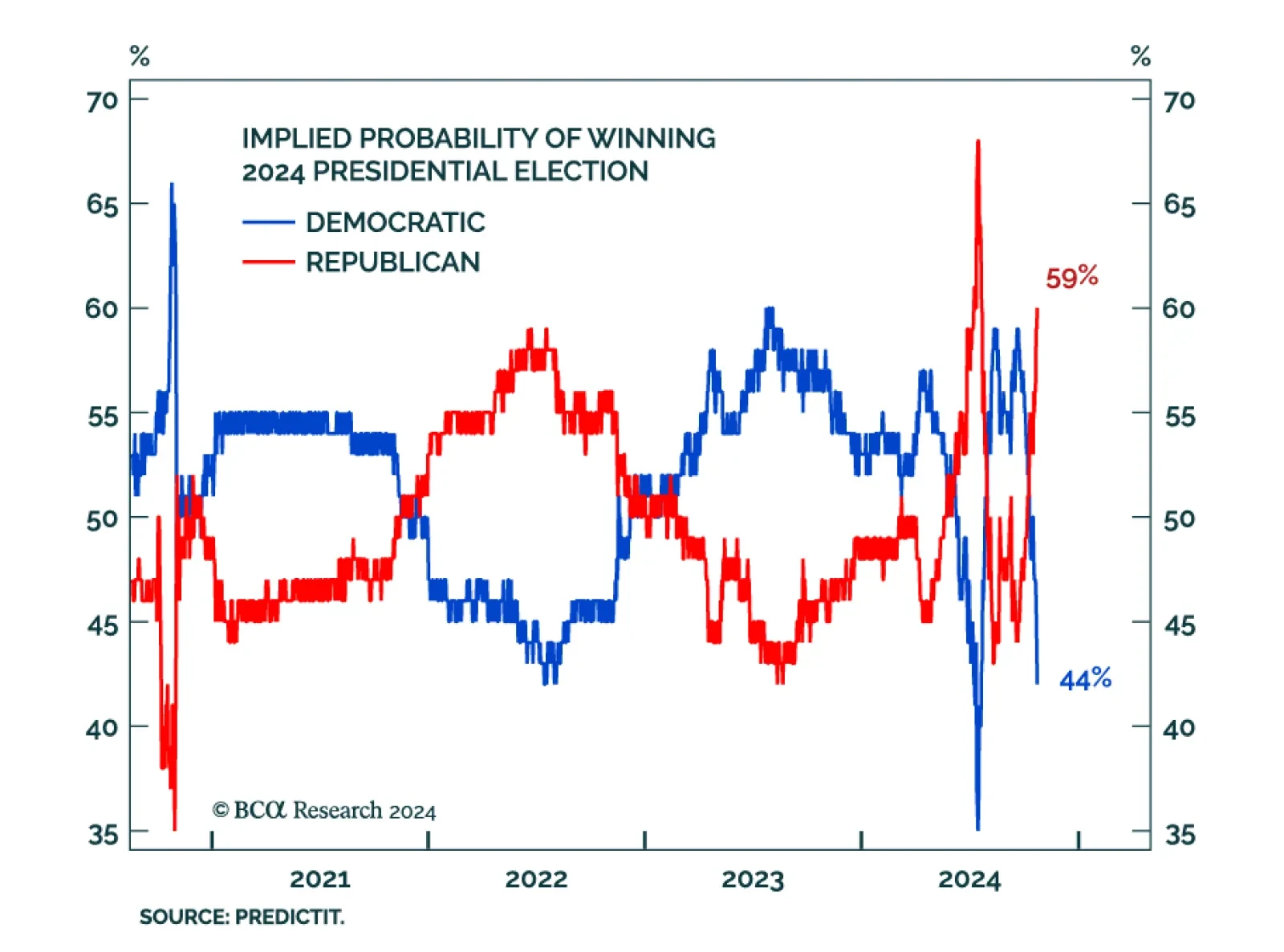

Our US Political Strategy colleagues now see 55% odds of a Trump victory, with odds of a Republican sweep at 47%. As odds of a contested election are rising, they built on their 2020 work to provide answers for next week’s…

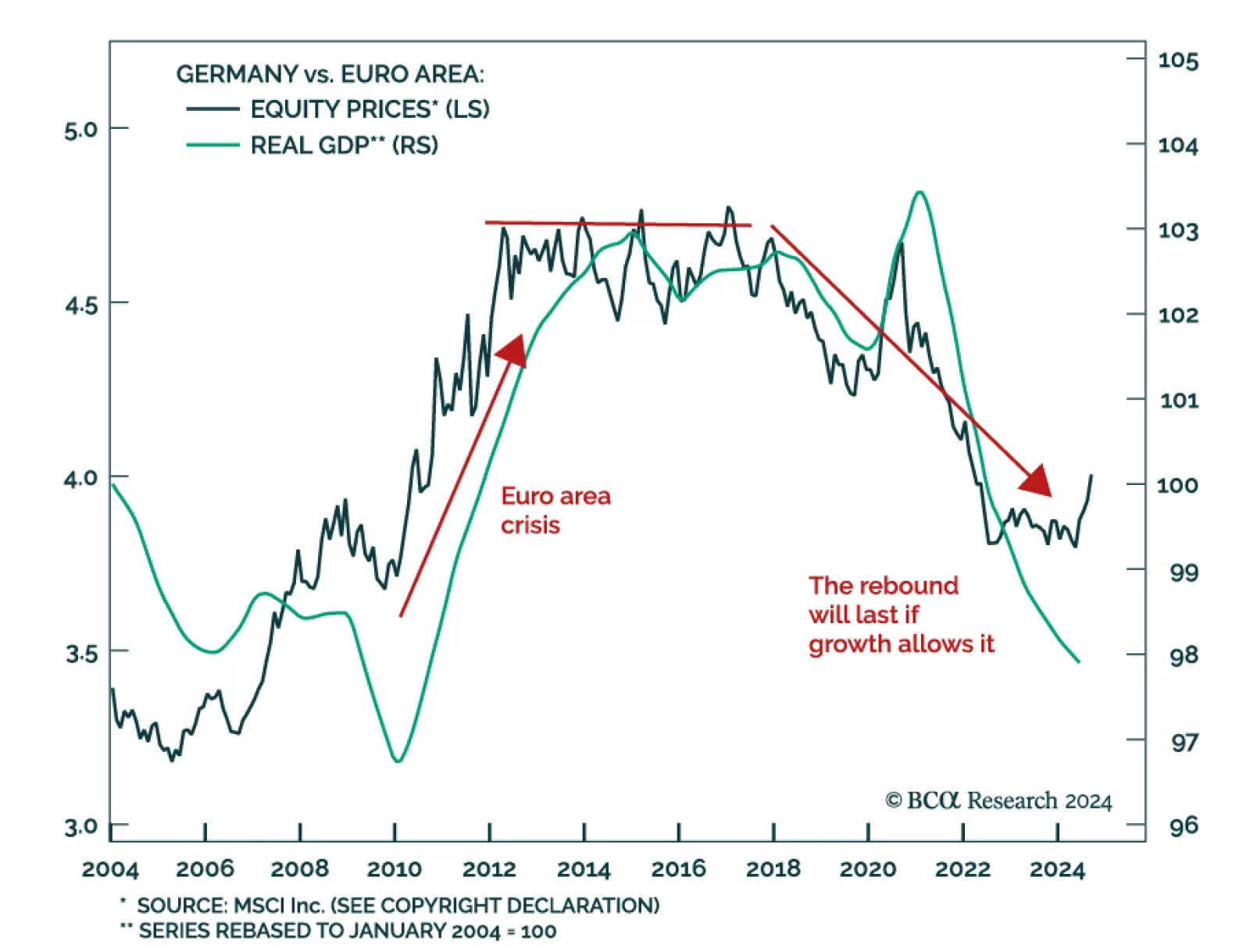

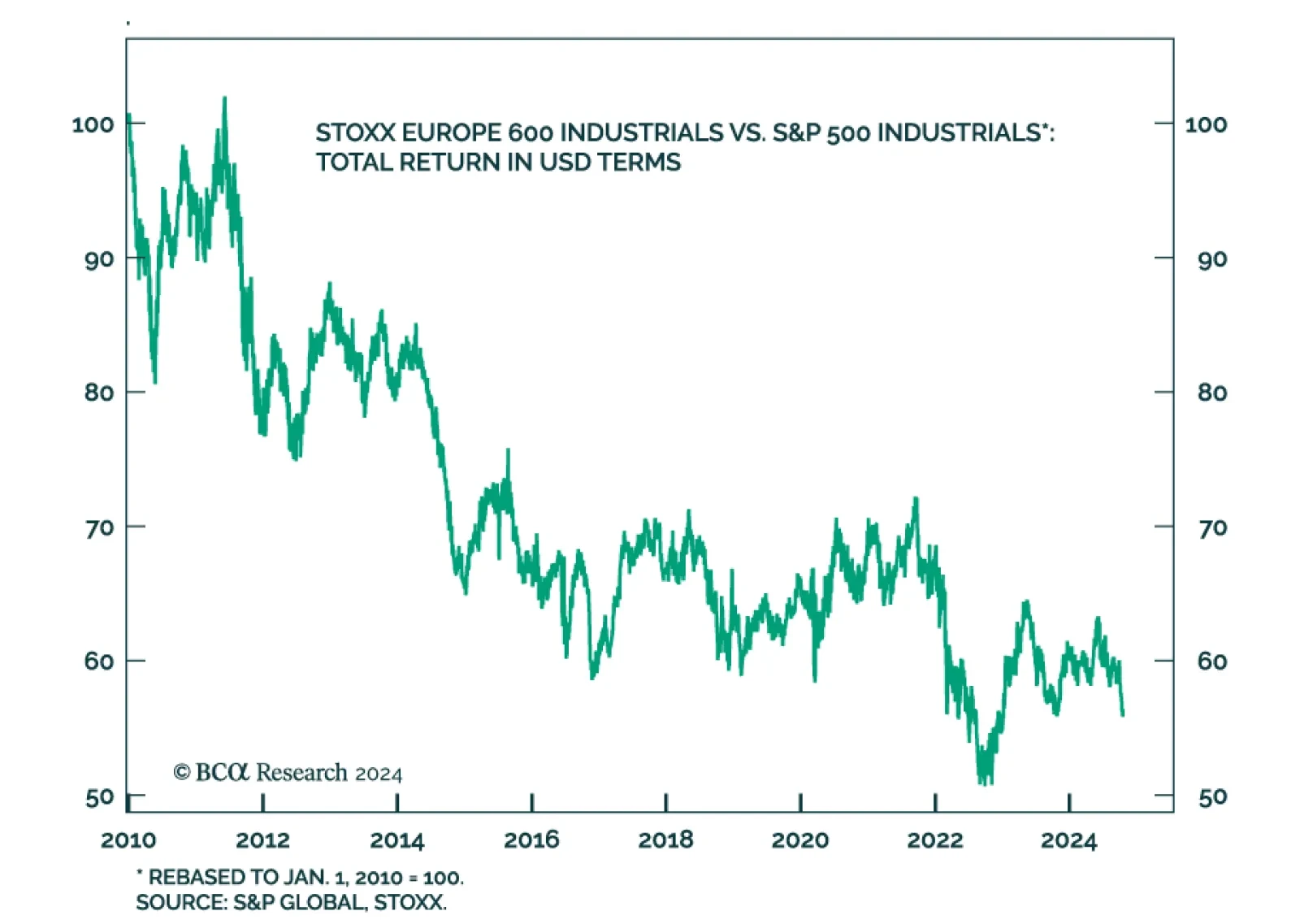

Germany’s problems are well known: Demographics, Chinese competition, underinvestment, energy dependence, and constrained fiscal policy. Our European Investment Strategy colleagues believe this bad news is priced in…

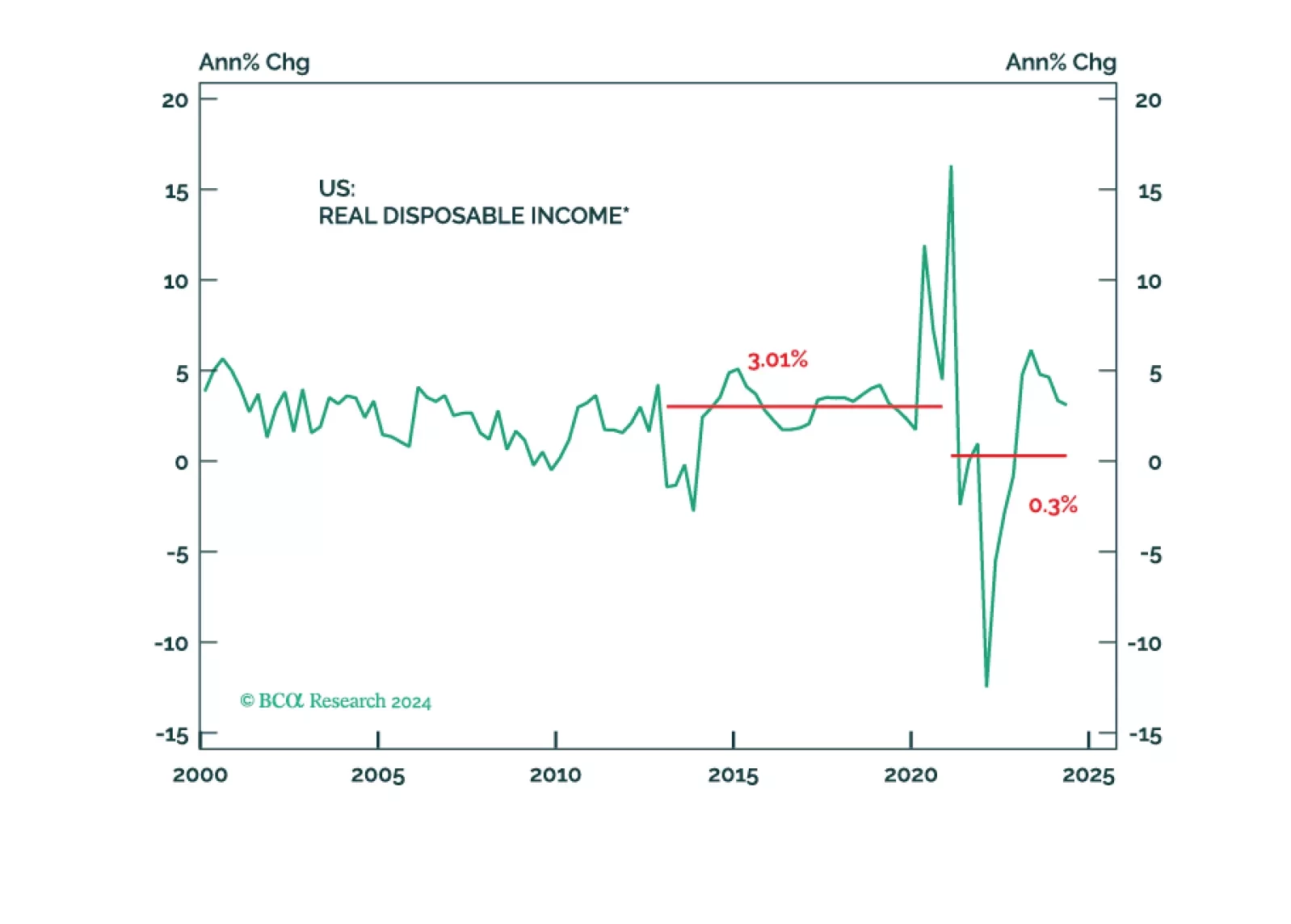

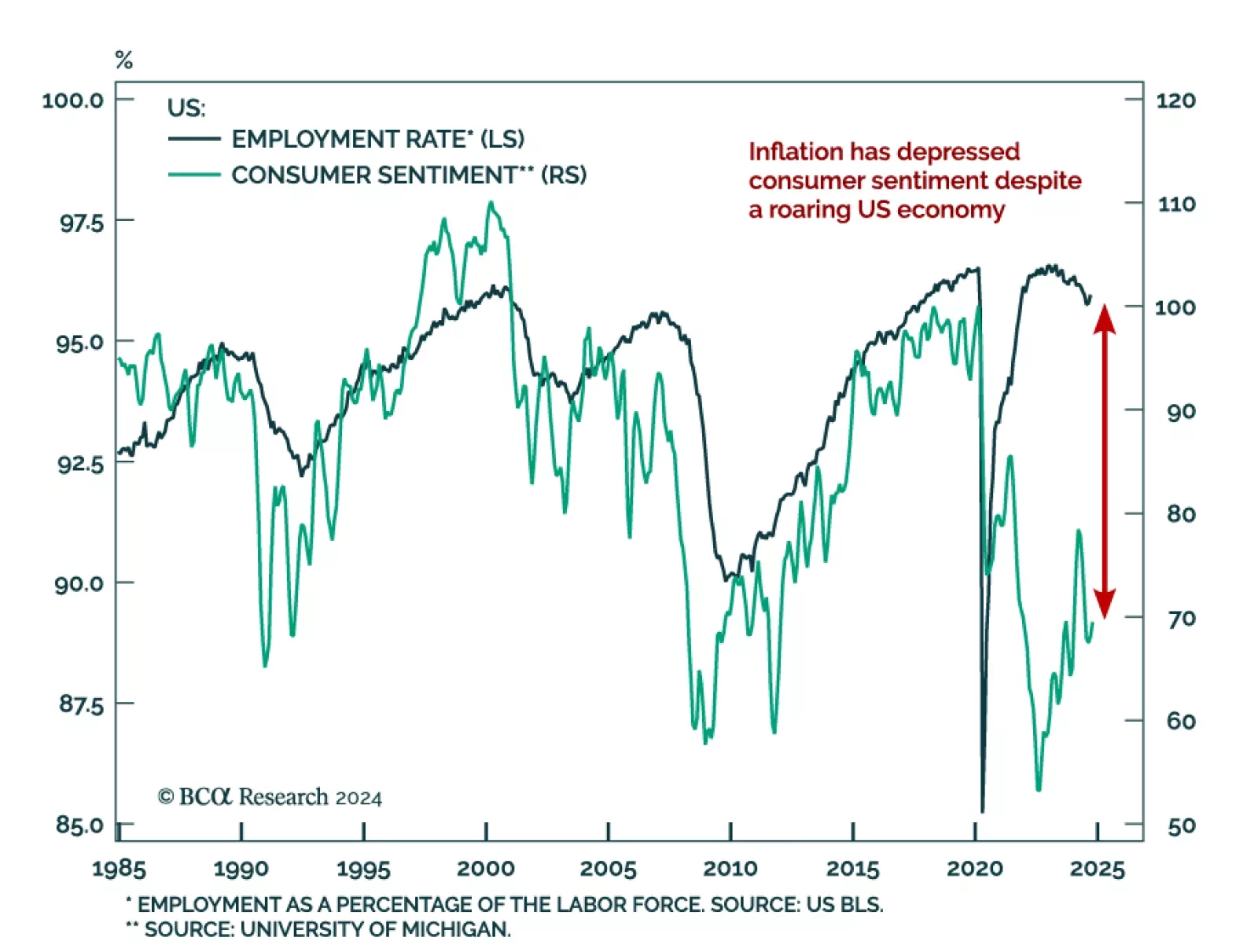

The main driver of global consumer sentiment in the past few years has been high inflation. Nowhere has this been the case more than in the US, where measures of animal spirits were depressed despite a roaring economy. Today,…

The US election is tightening in its final weeks, and the latest polls challenge our Geopolitical Strategy’s base case of a Democratic White House. The original thesis was built on the premise of a Democratic incumbent…

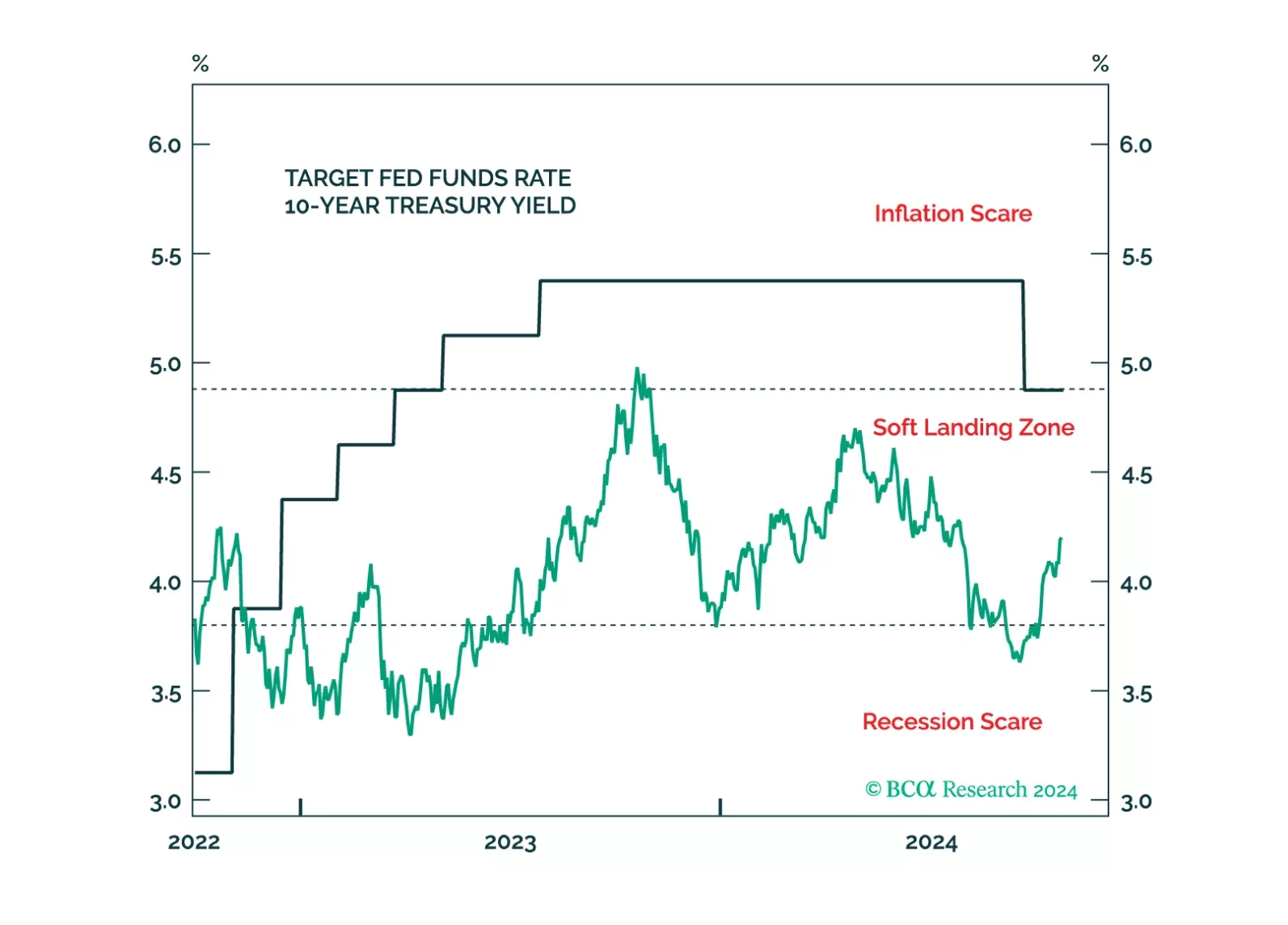

A Donald Trump victory would send bond yields higher during the next few weeks, but yields will fall in 2025 no matter the election outcome.

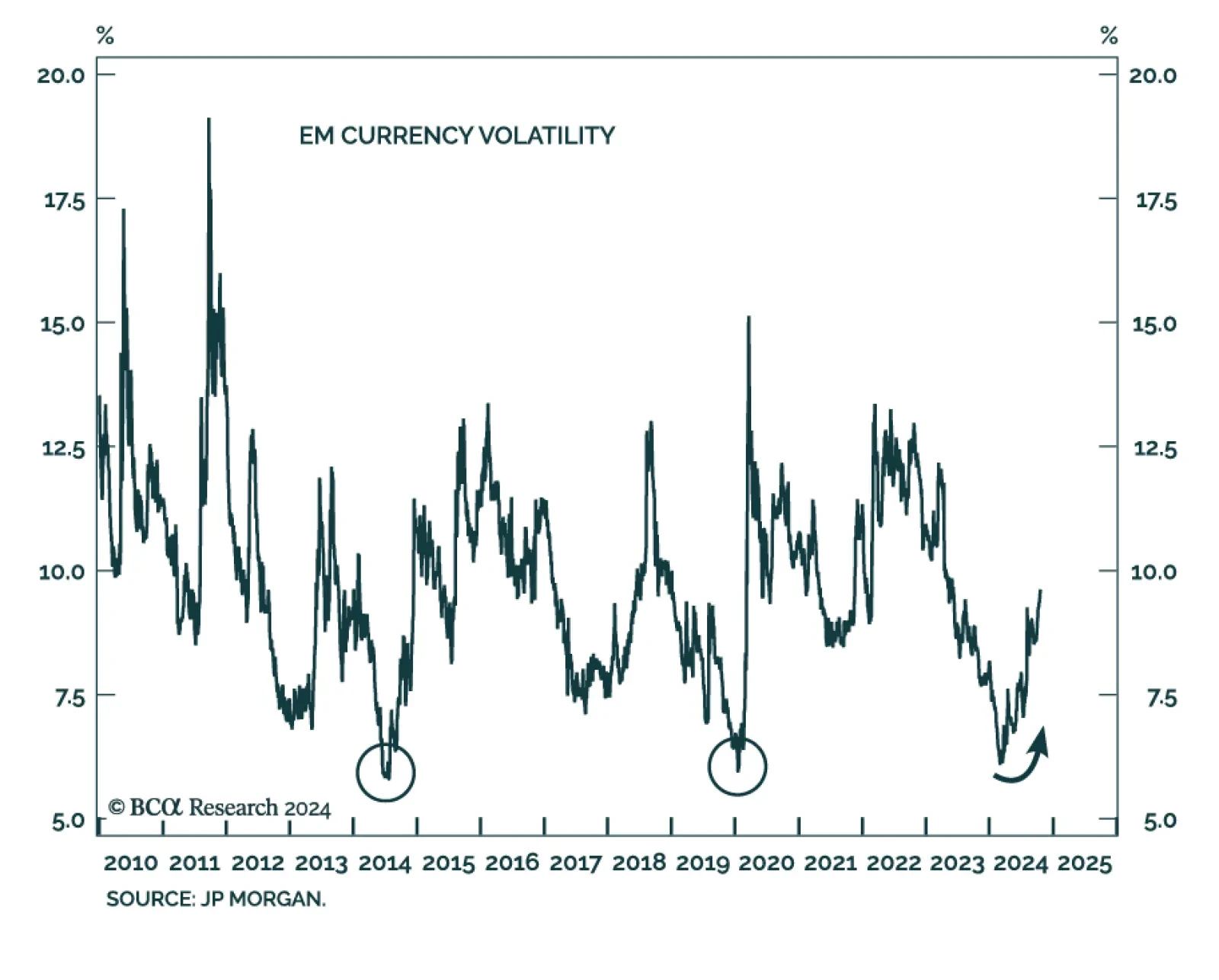

Our Emerging Markets Strategy team sees evidence of a “Trump trade” across markets, as the dollar strengthens, Treasury yields jump, and US small caps try to break out. However, the tactical and cyclical outcomes…

The war in Ukraine has ended in late 2022… for markets at least. This is the conclusion from our GeoMacro team’s latest report, which aims to dispel five crucial myths surrounding the conflict. The myths are the…