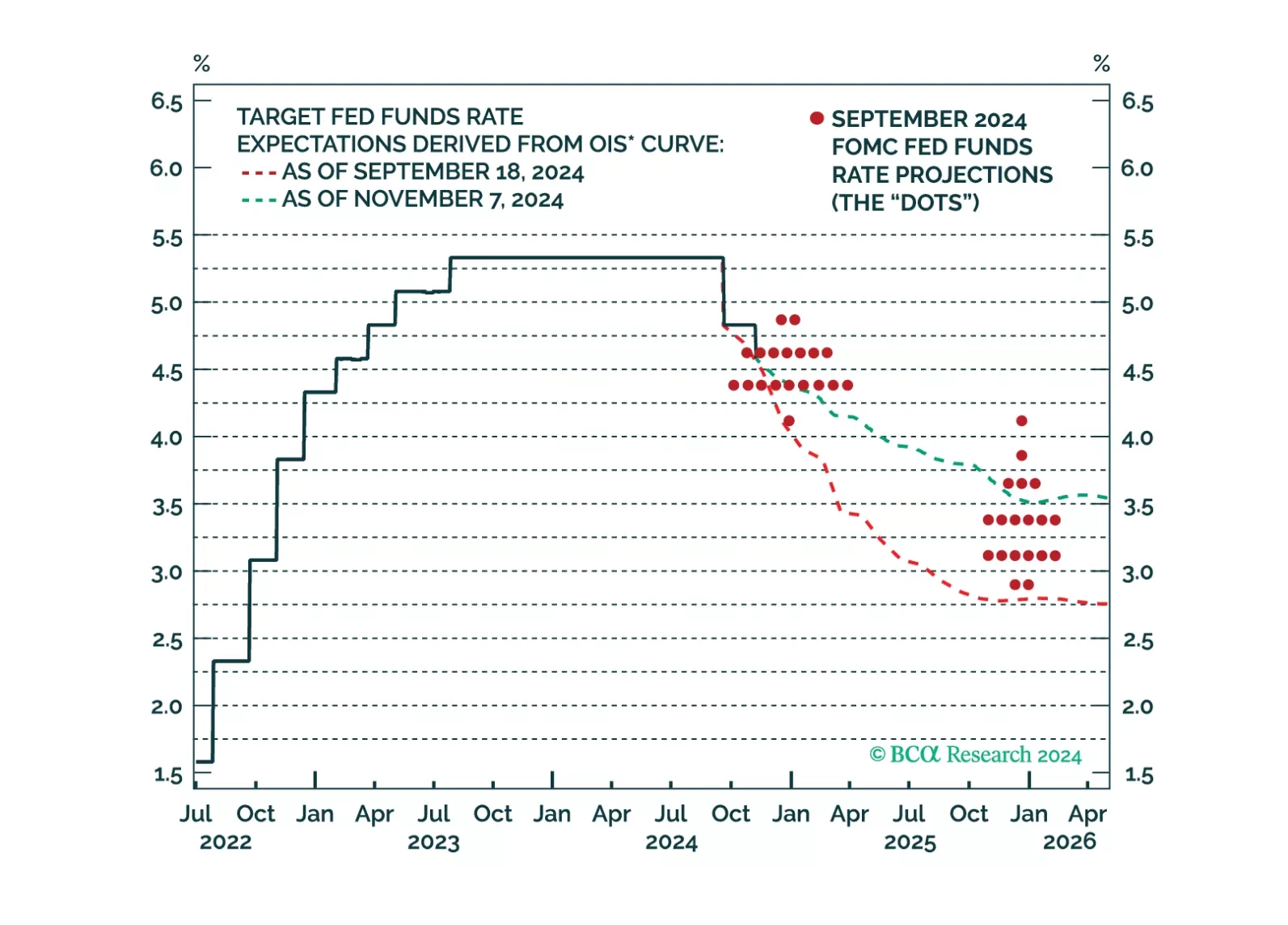

Our thoughts on the bond market’s reaction to the election and this afternoon’s FOMC meeting.

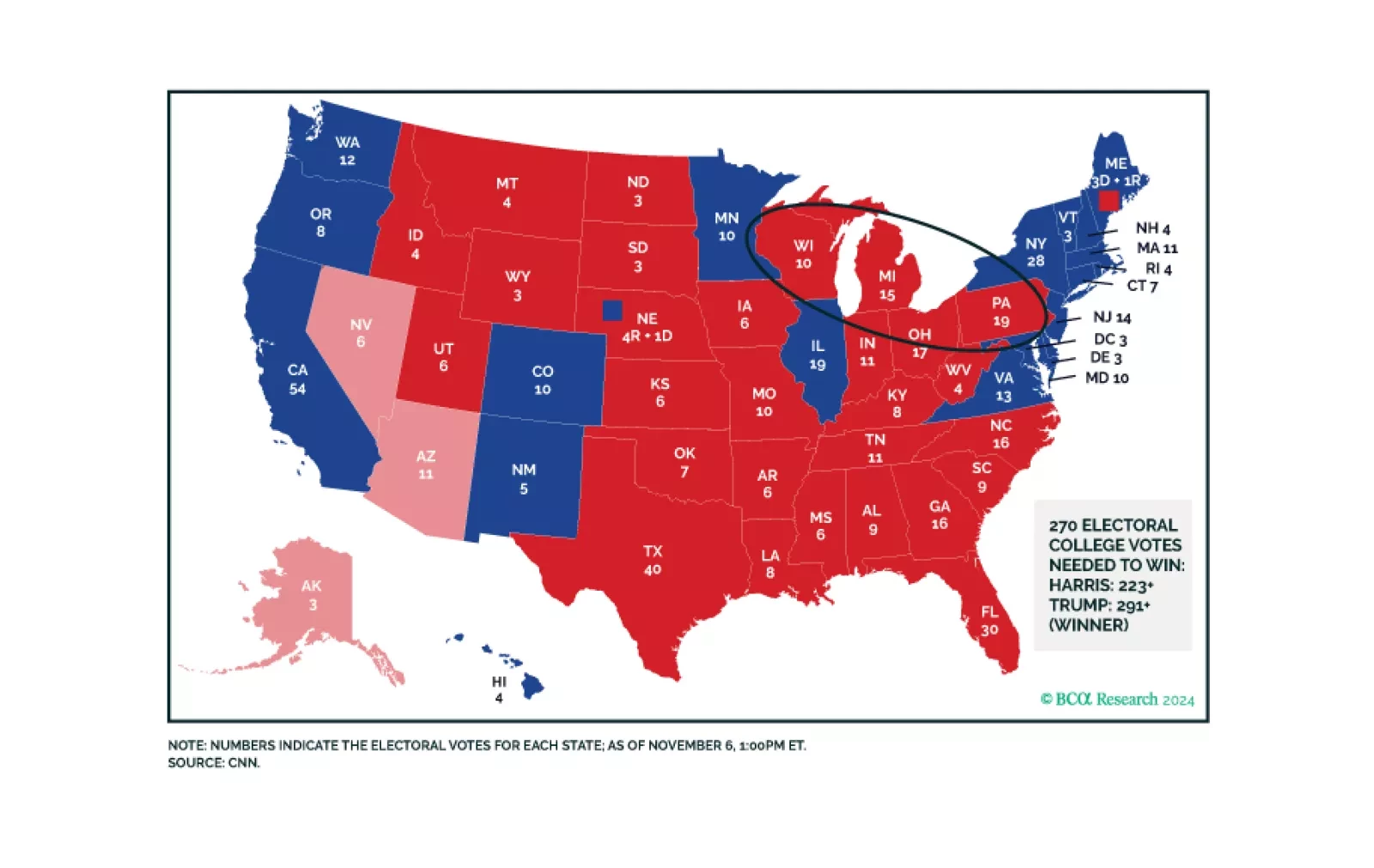

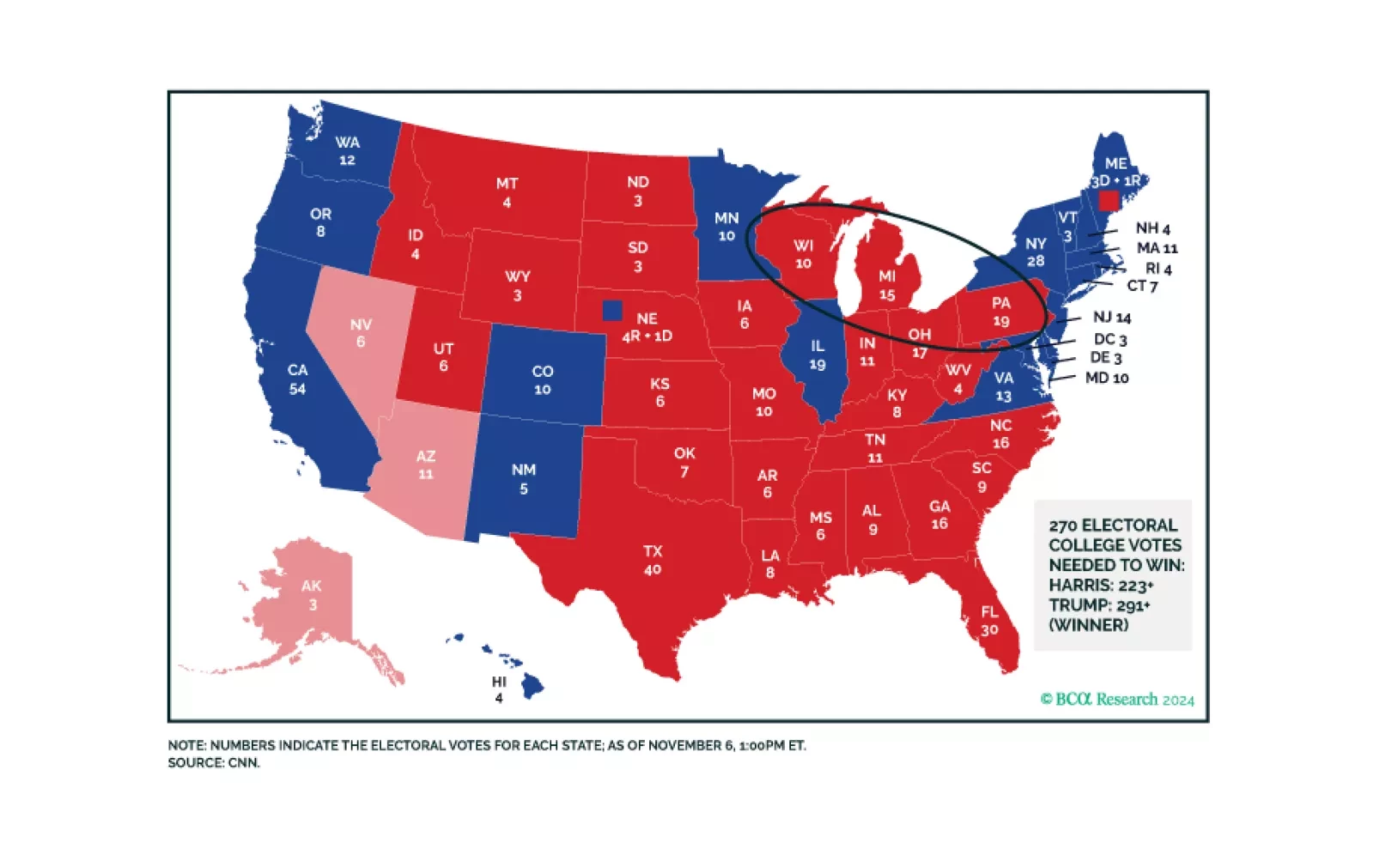

Trump’s resounding victory brings a popular mandate that ensures deregulation and higher trade tariffs. Higher budget deficit and immigration reform are also in the cards as the Republicans look like they may squeak a thin margin in…

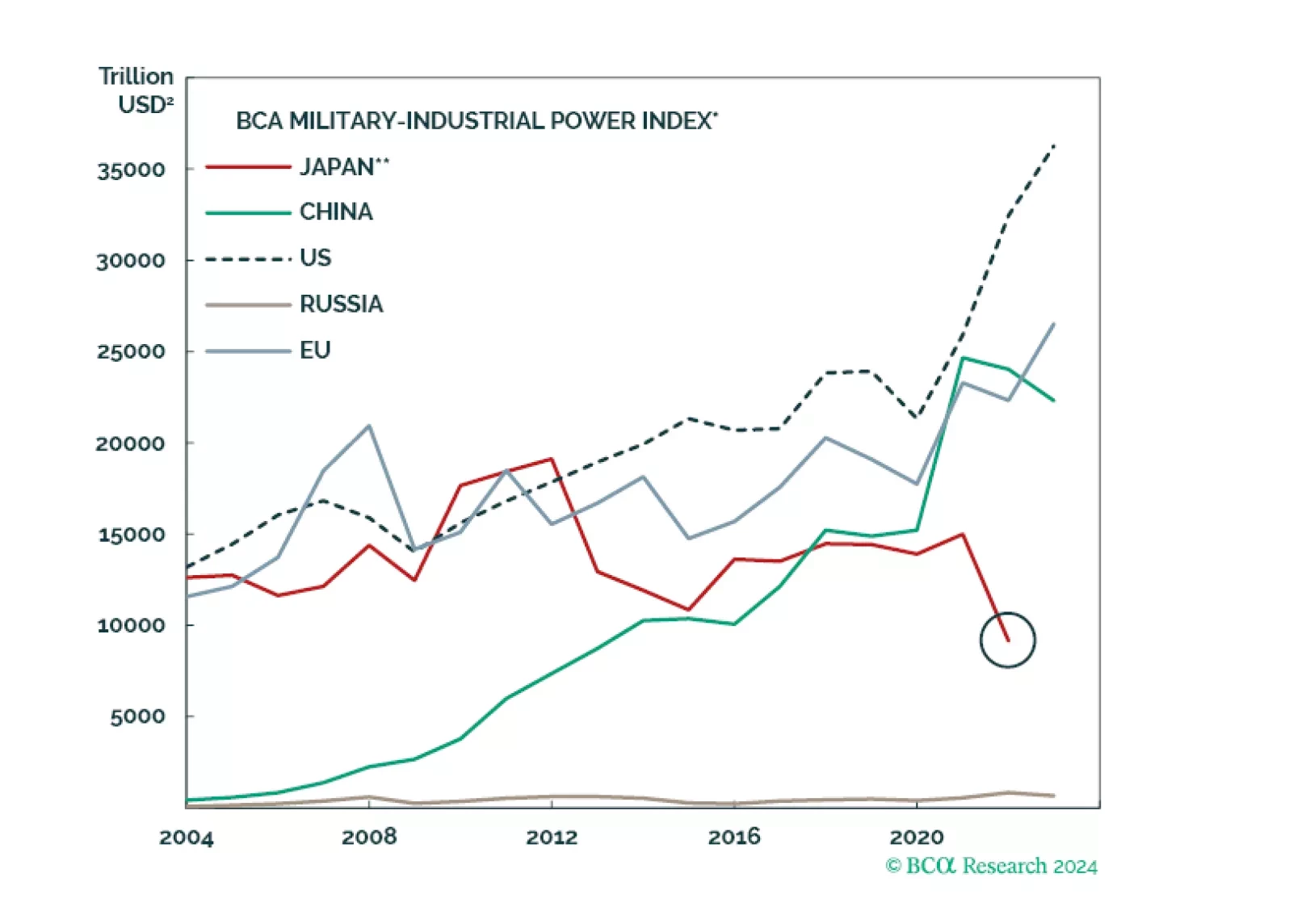

Over the next few months, Japan’s new government will ease fiscal policy, which will improve domestic demand on the margin. Monetary policy may tighten further in the short run but not too much over the long run. The geopolitical…

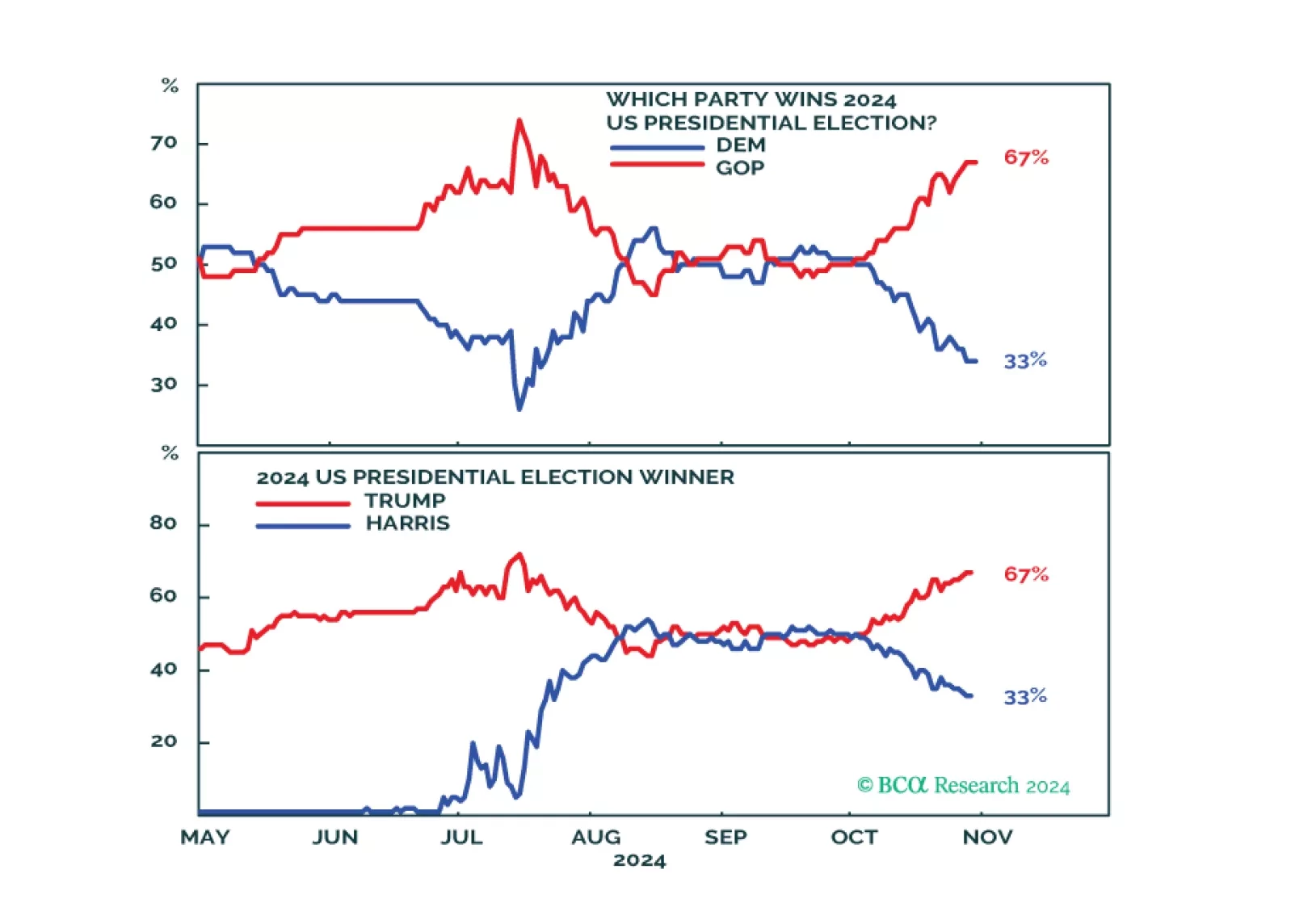

The Election Day is finally upon us. No, there is no final “silver bullet” forecast contained in this email. Just our long-term forecast of how the election will, no matter who wins, impact the markets.

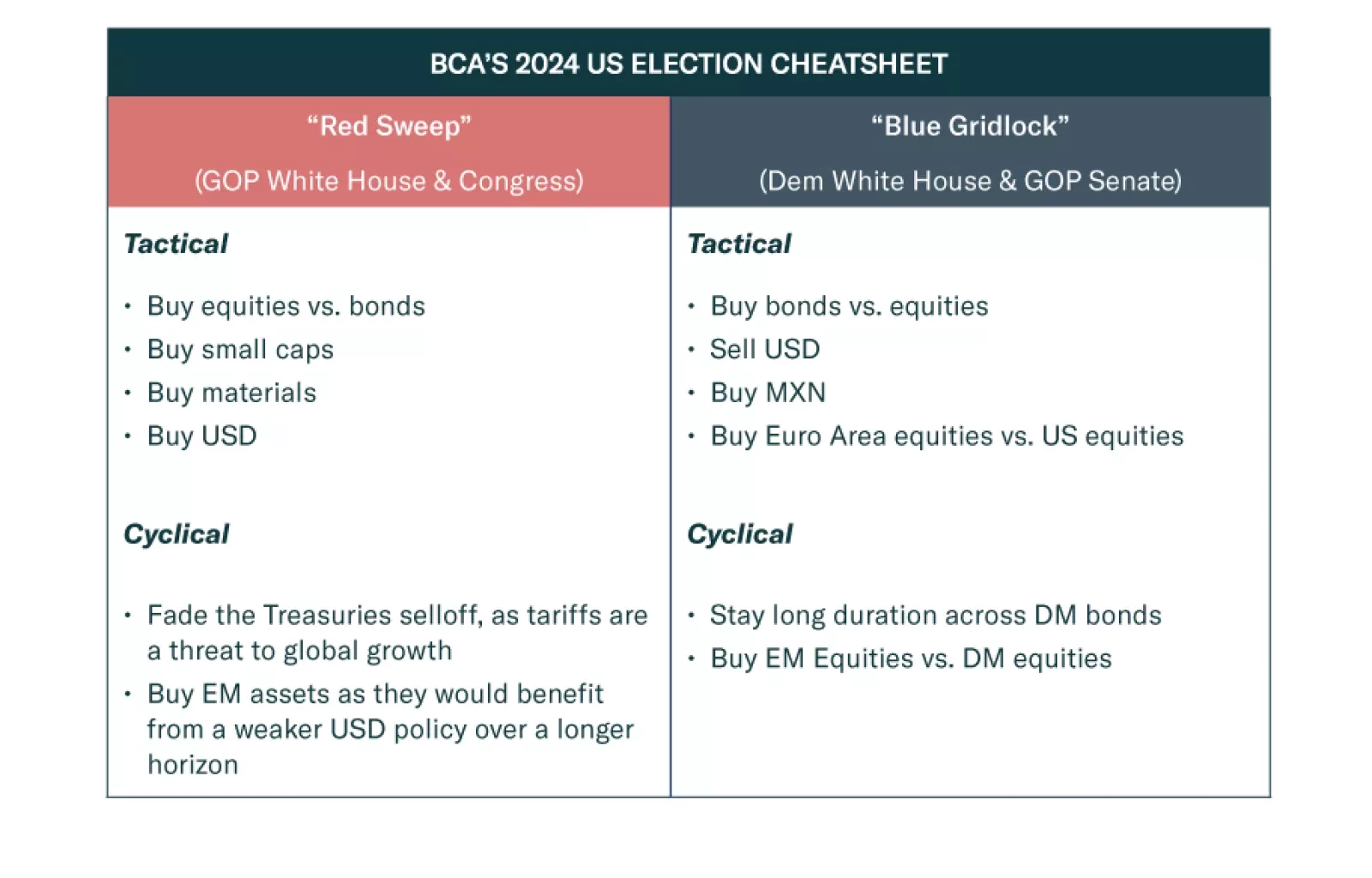

As markets settle into waiting mode for the US election, we provide a concise but not exhaustive cheatsheet for what to expect as the results come out. Our US & Geopolitical strategists’ two most likely outcomes are a…

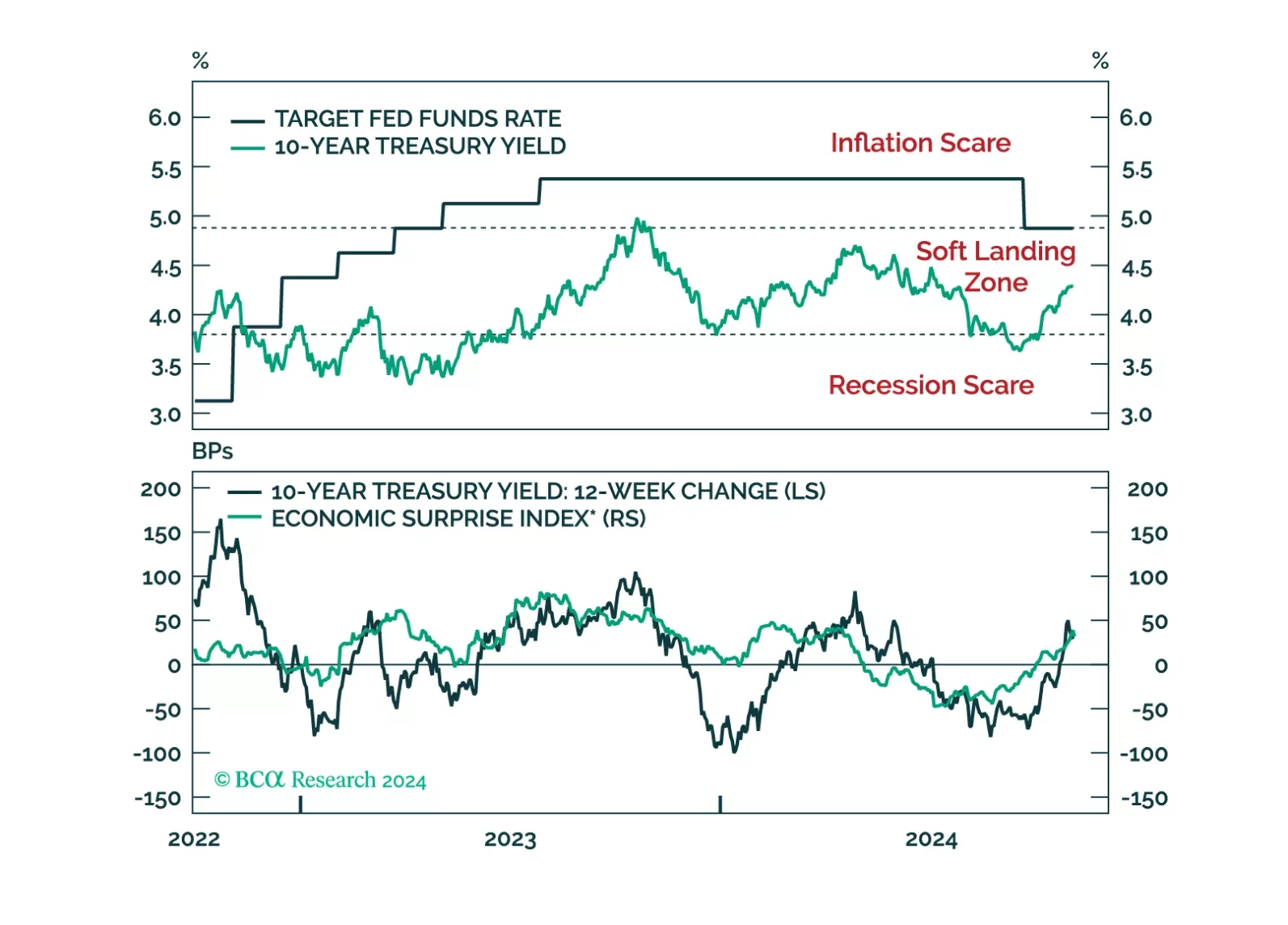

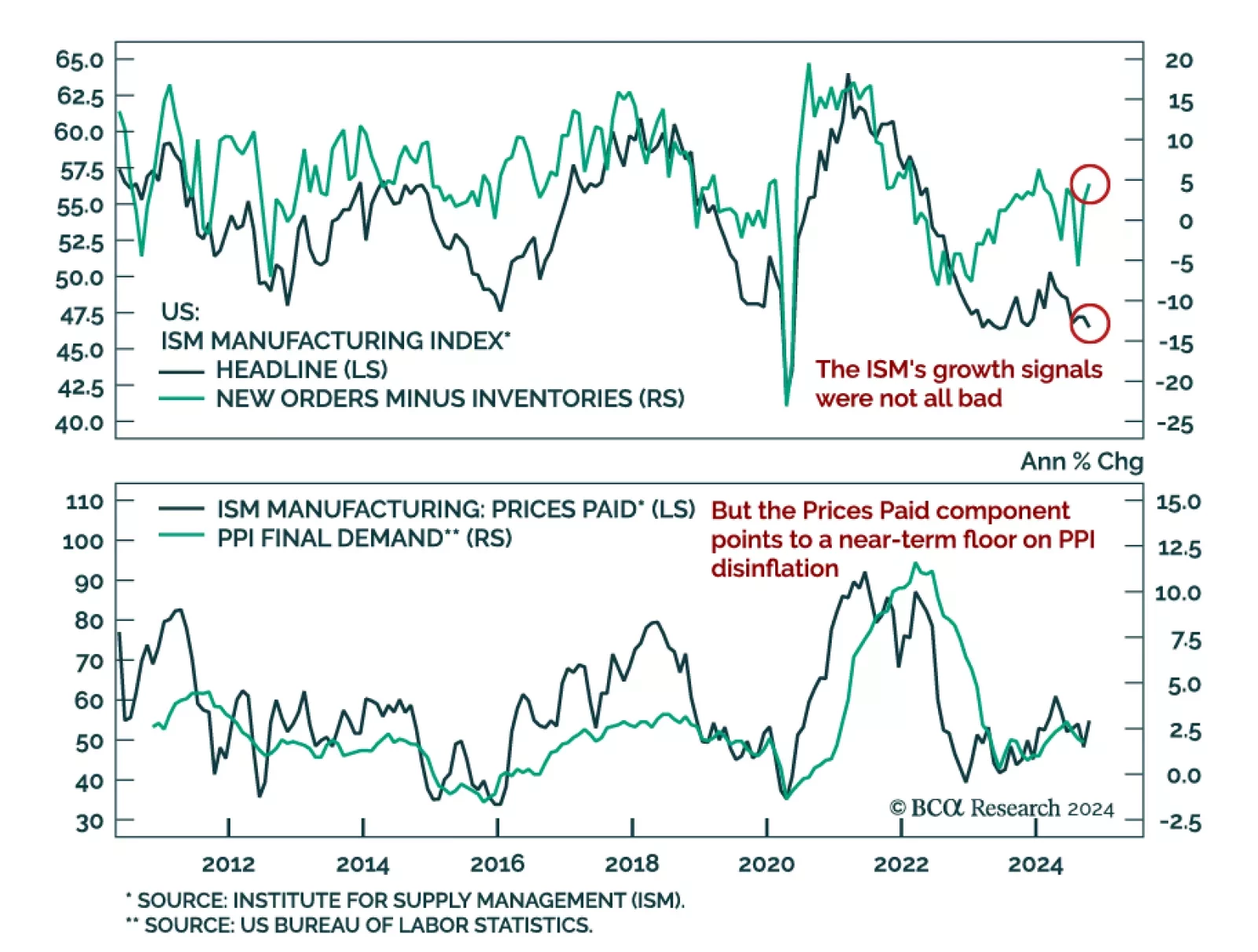

The October ISM Manufacturing missed expectations, decreasing to 46.5 from 47.2 in September. The Prices Paid component jumped, rising to 54.8 from 48.3 the month prior. New Orders showed a small upside surprise at 47.1, up 1…

A reaction to this morning’s employment report and a preview of the potential bond market implications of next week’s US election and FOMC meeting.

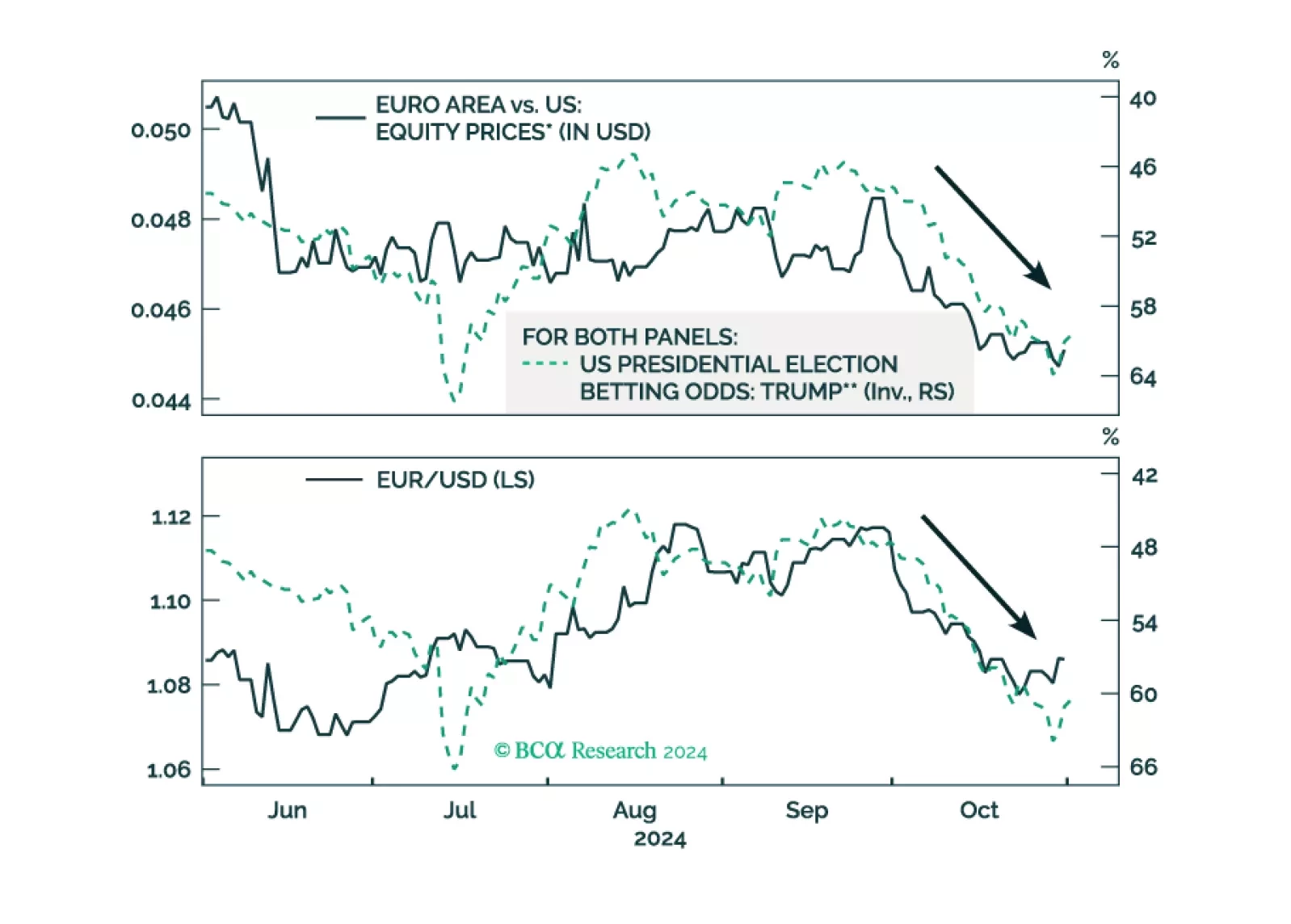

As the odds of a Trump victory rise, European assets underperform US ones. What would be the immediate impact of a Trump victory on European stocks?

Trump may be favored, but Harris is now underrated. The Senate is highly likely to go Republican – Harris would be gridlocked if she pulled off a victory. If Trump wins it will be a full sweep. Expect volatility in the short term.