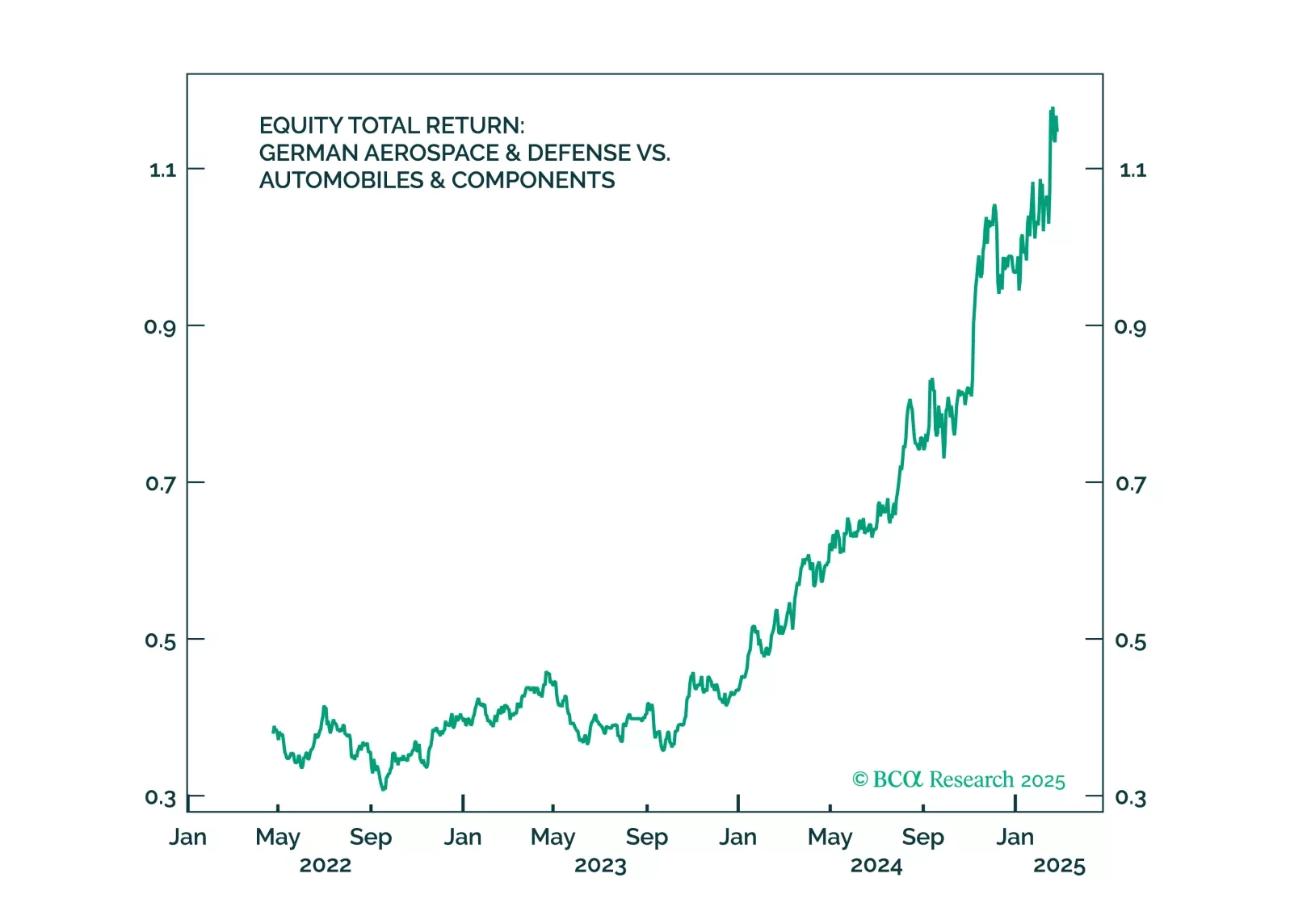

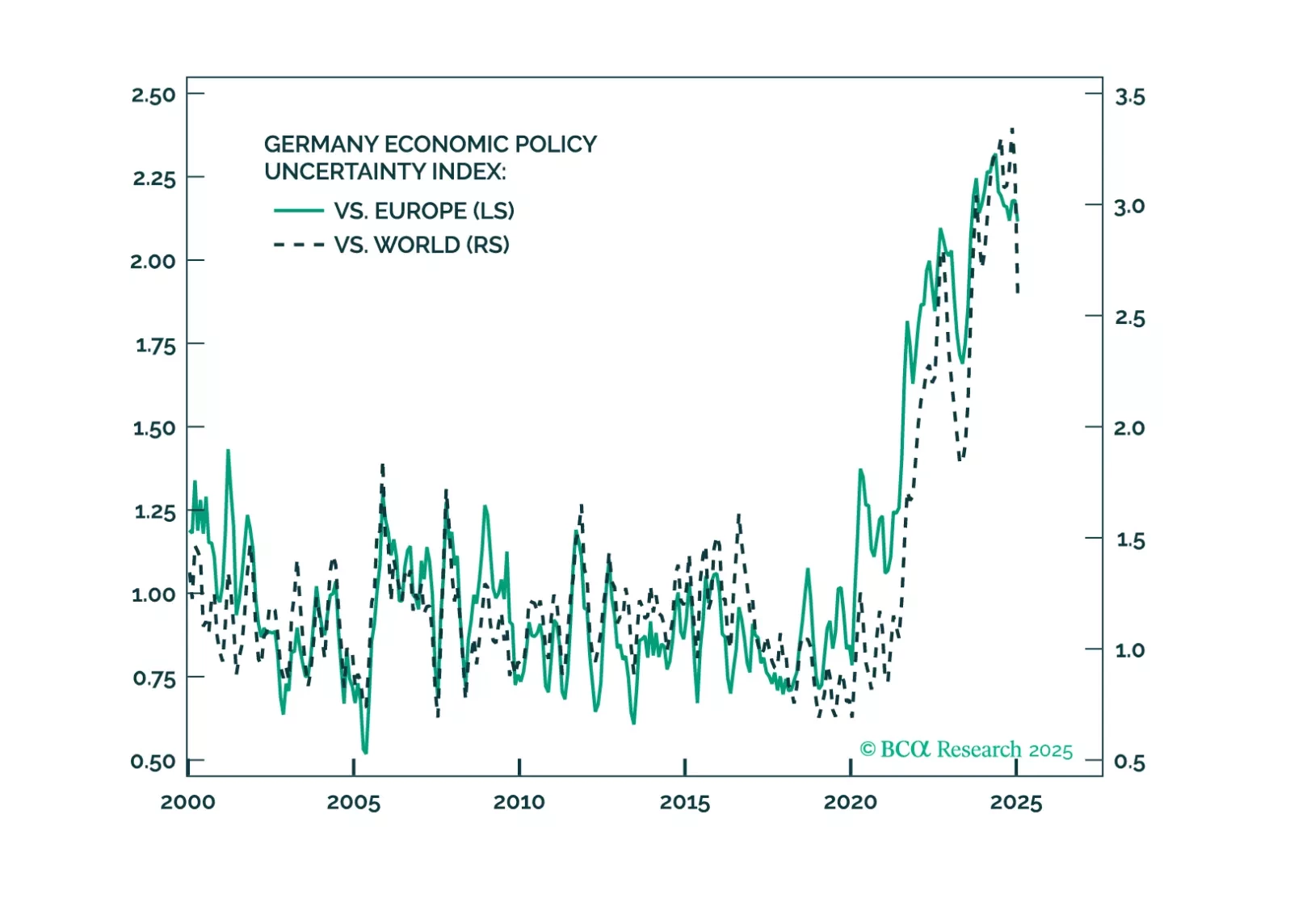

Trump’s ceasefire talks are positive for Germany – and so was the German election result. But Trump’s tariffs will hit Germany soon. Investors should use near-term volatility to increase exposure to Germany.

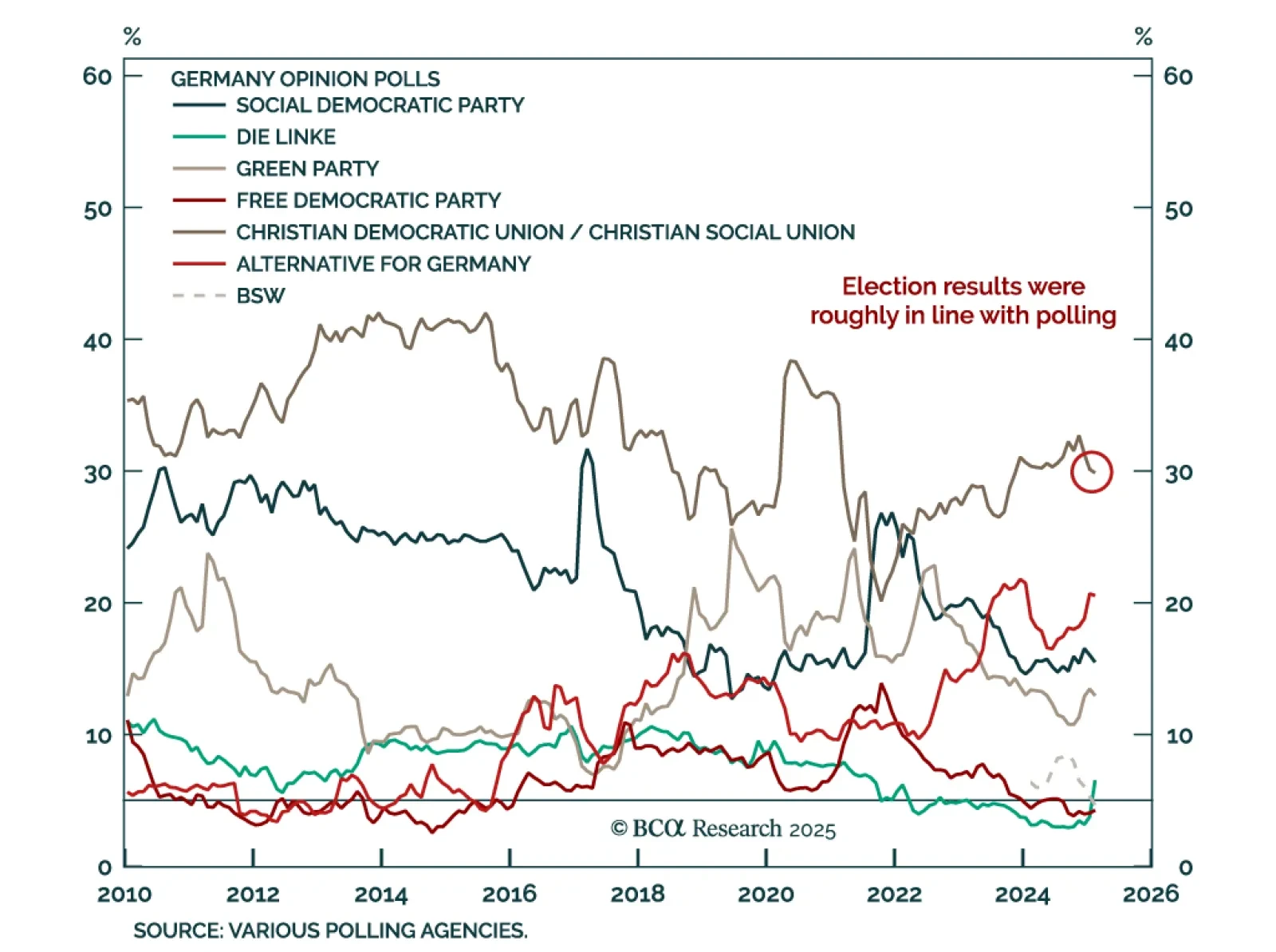

Germany’s election delivered no major surprises but raised questions about whether Chancellor Friedrich Merz’s government will relax the “debt brake,” which caps budget deficits at 0.35% of GDP. The new coalition, comprising the…

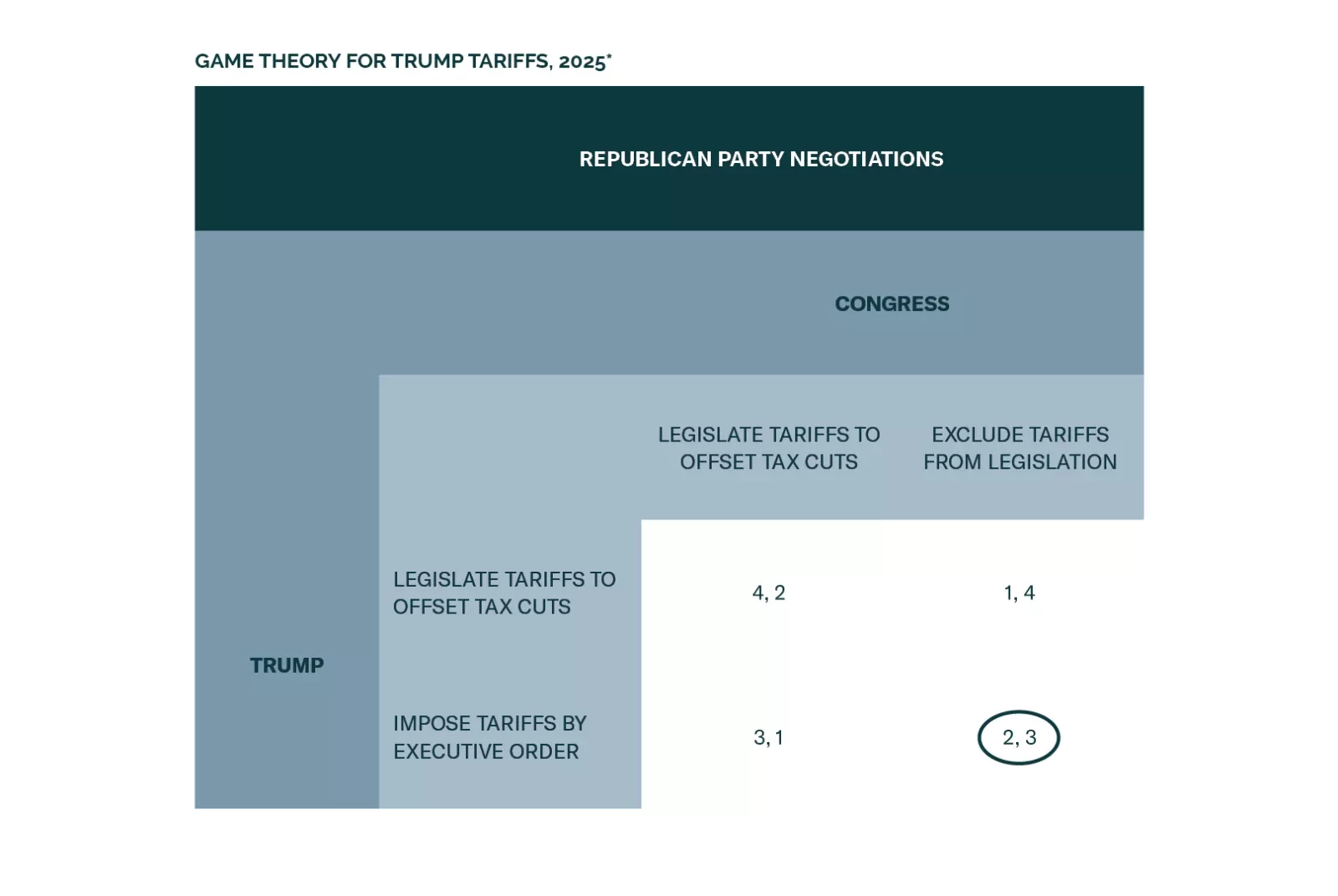

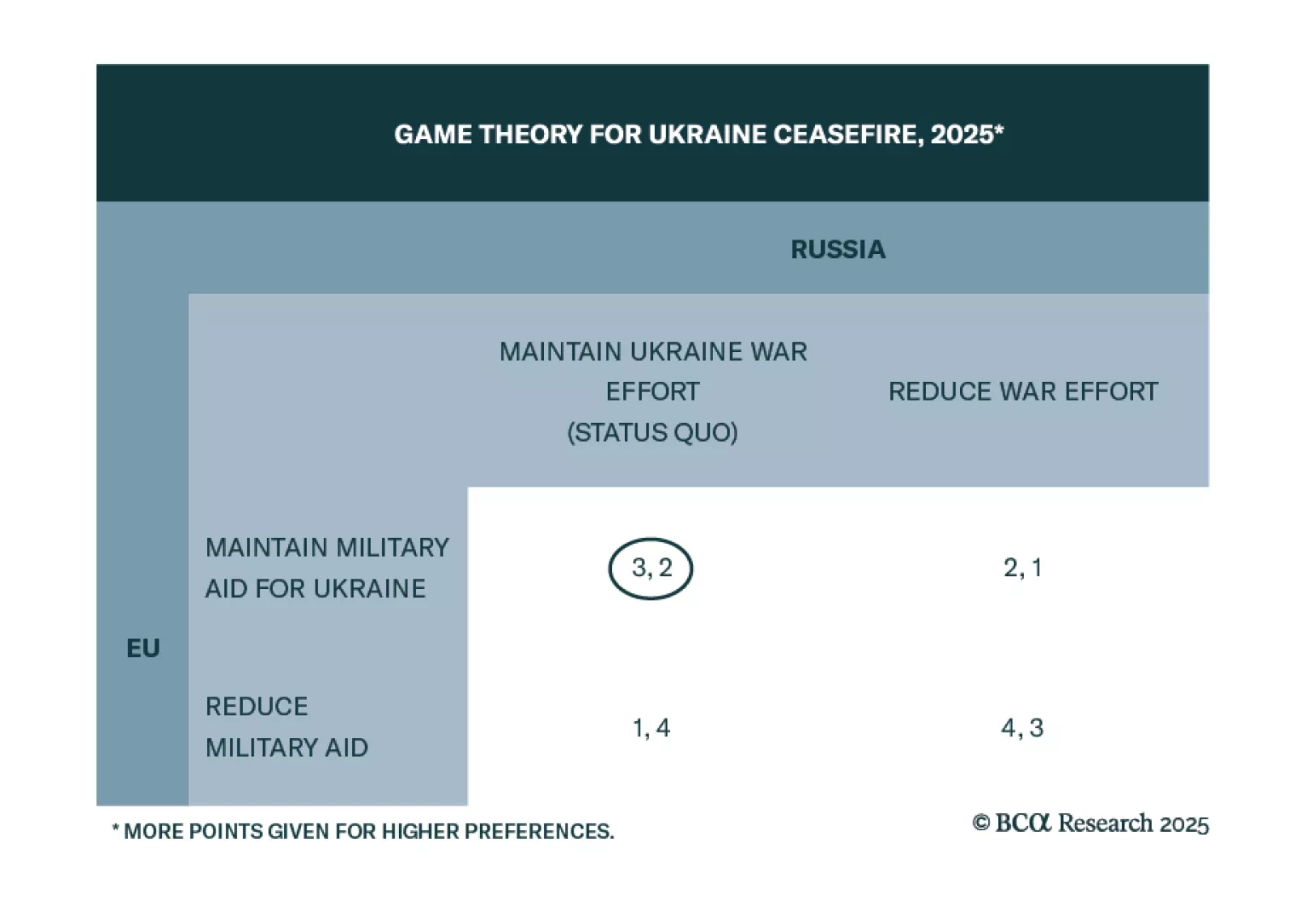

Our Geopolitical Strategy team modeled several of the Trump administration’s most disruptive policies in a simple game theory framework. The Trump administration’s policies have created a complex web of trade and foreign…

Our Emerging Markets strategists put together a hypothetical conversation between President Trump and Treasury Secretary nominee Scott Bessent on what economic policy would look like for the Trump 2.0 administration. …

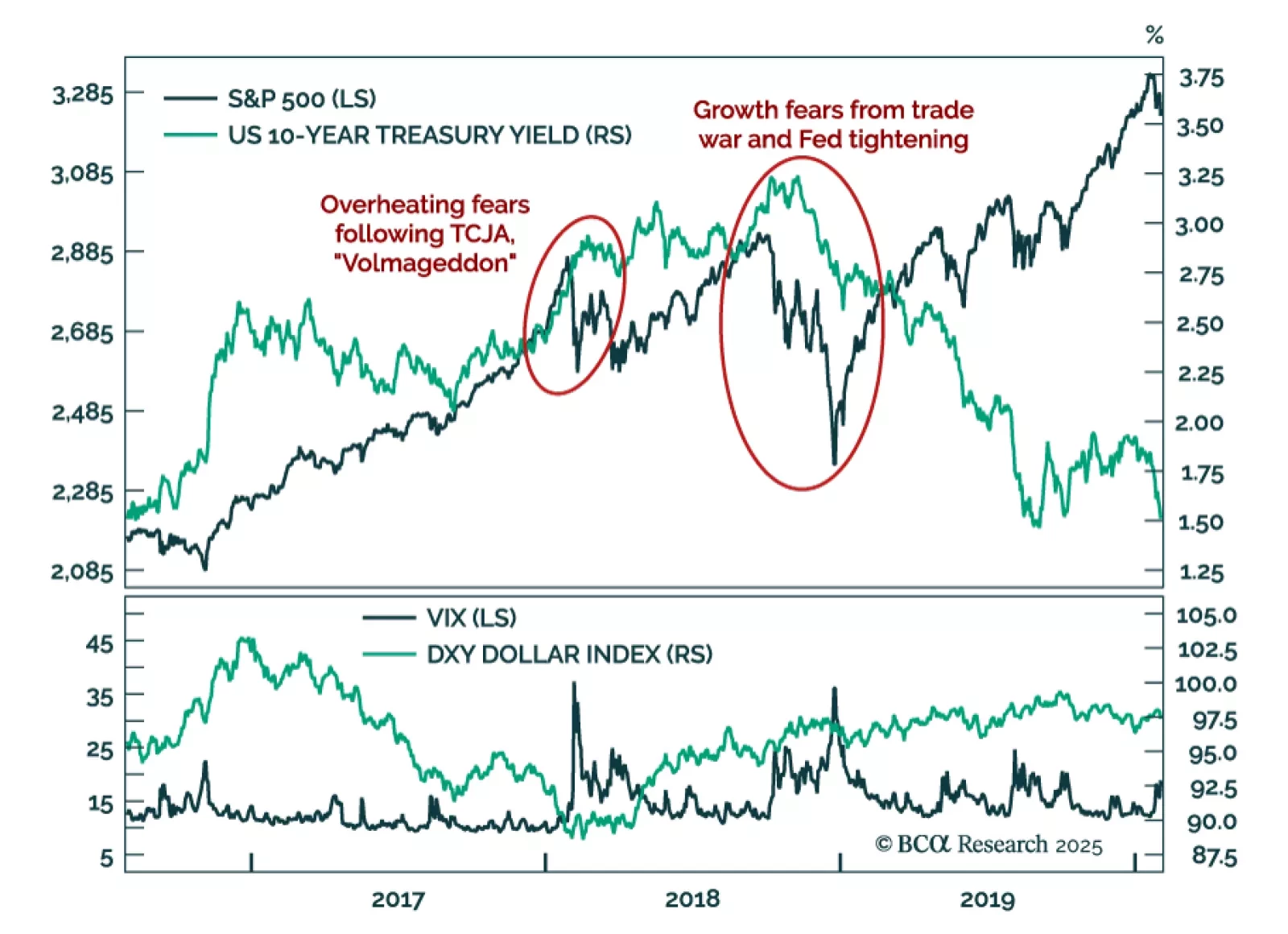

We look at President Trump’s first mandate for lessons on how markets would likely react to different policies. On the fiscal front, the 2017 Tax Cuts and Jobs Act (TCJA) was the first pro-cyclical stimulus in decades. Markets pushed…

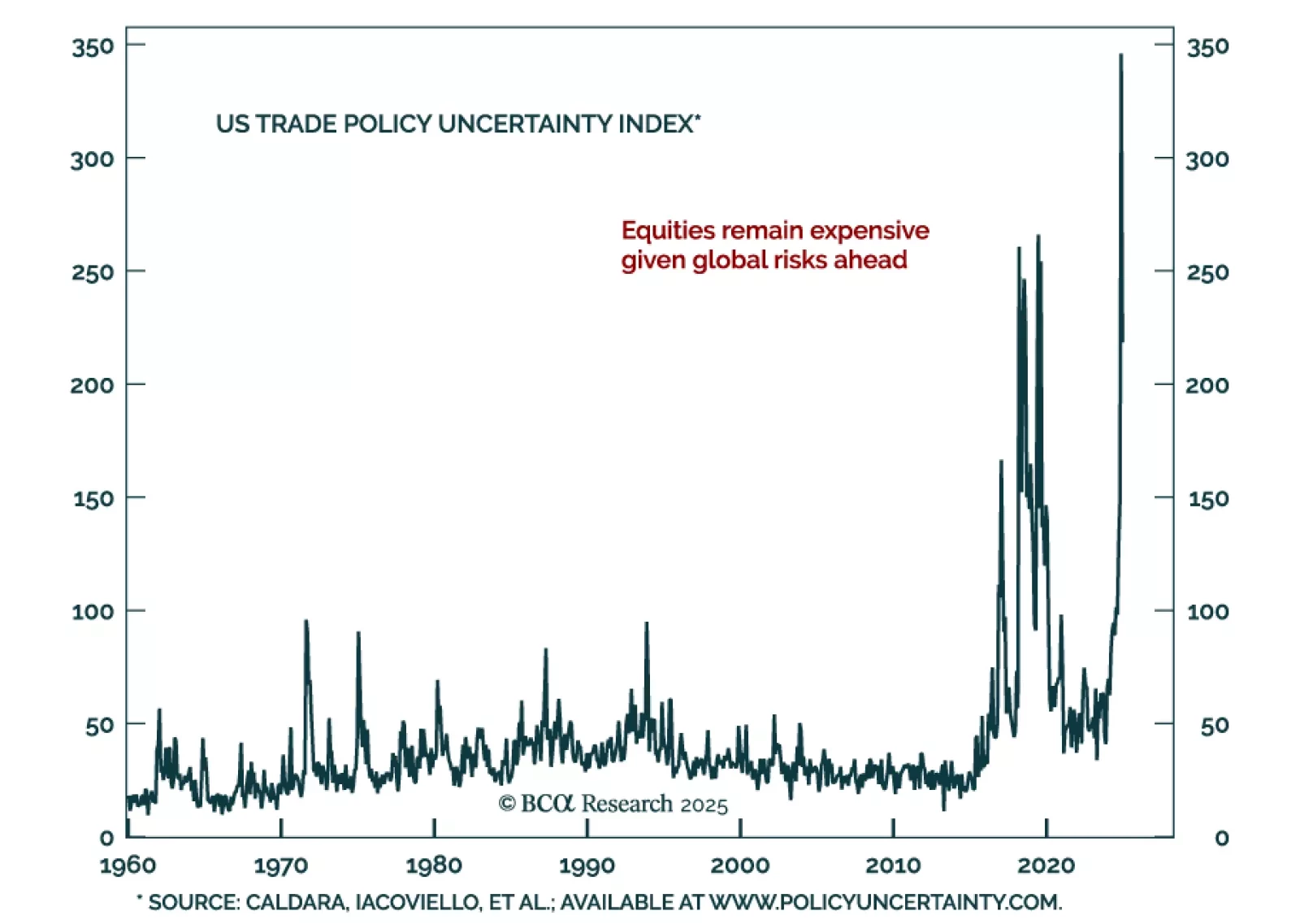

President Trump’s inaugural speech outlined his second term agenda. The theme was that the US will become “far more exceptional” than it already is. Trump pledged to reverse America’s decline, rebalance the justice system, streamline…

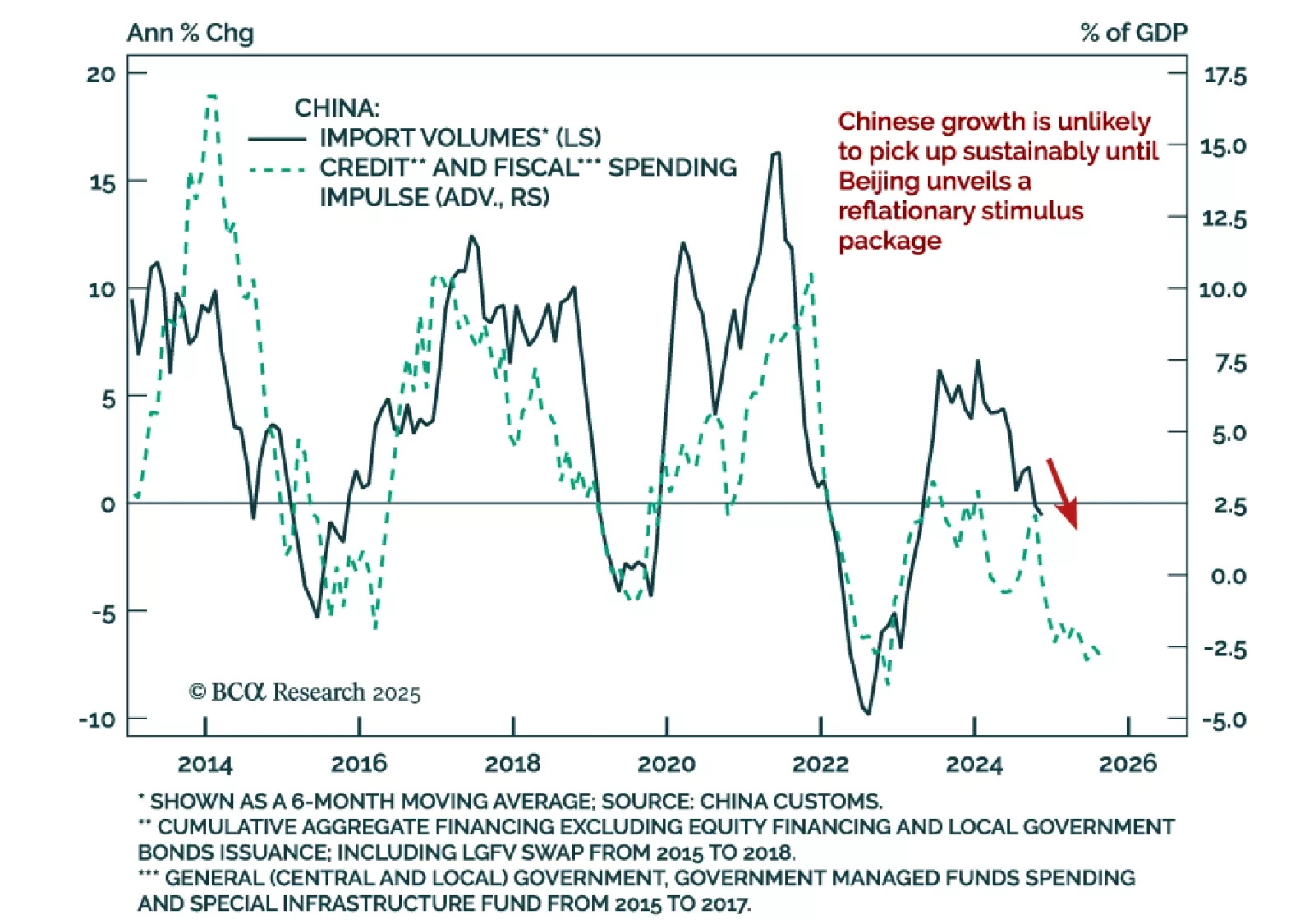

China’s December trade data was positive, with exports in USD terms rebounding to 10.7% y/y from 6.7% in November, and imports rebounding to 1.0% from -3.9%. Taken at face value, the numbers are positive for both the Chinese and…

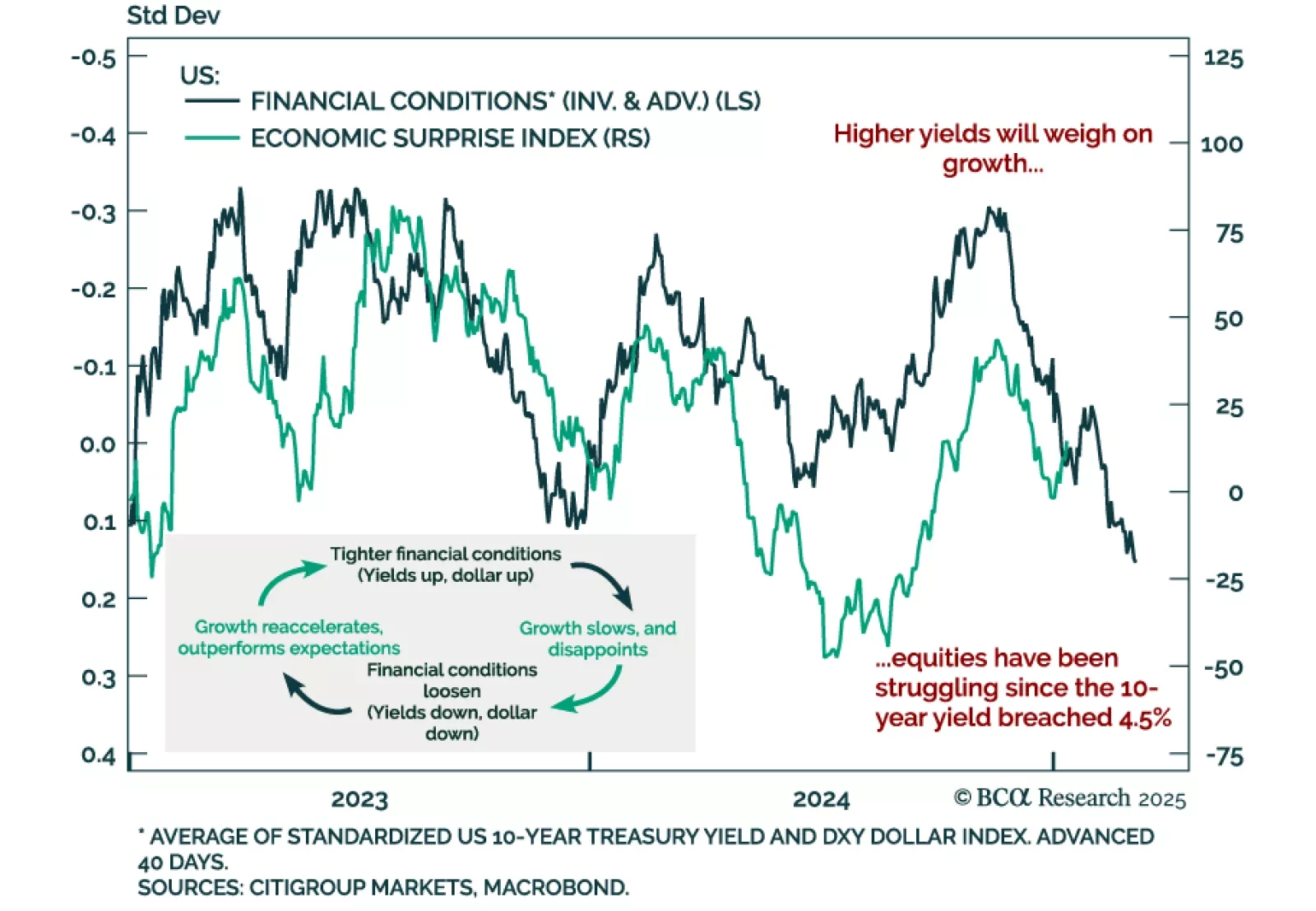

The global economy is subject to numerous cycles displaying reflexivity and feedback loops. One of these is the relationship between financial conditions and growth. Given this relationship, economic strength can plant the seeds of…