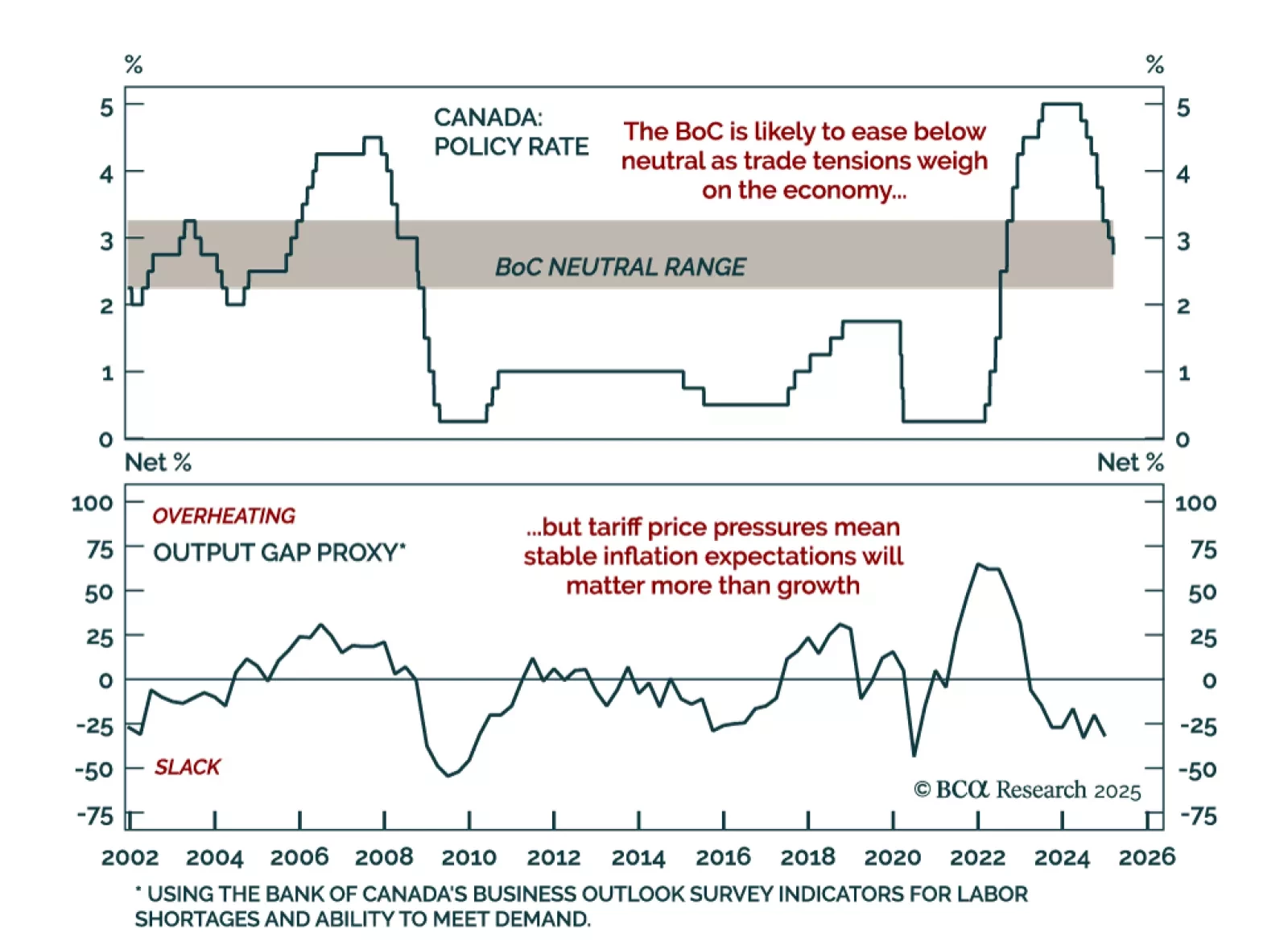

The Bank of Canada cut by 25 bps to 2.75% as expected. This seventh consecutive cut brings the policy rate further into neutral territory, estimated to be in the 2.25%-to-3.25% range. The BoC is in a tough place. The trade war…

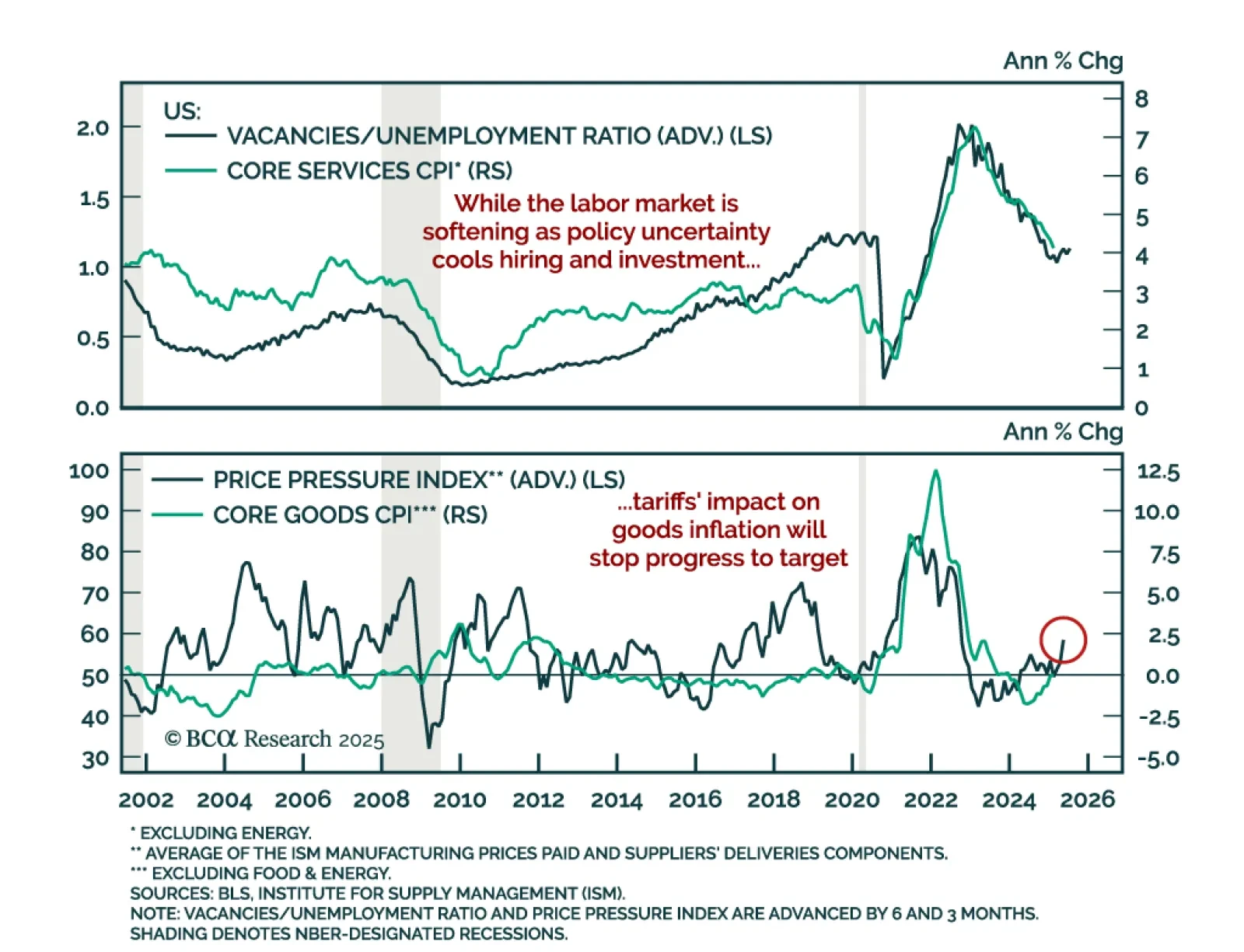

The February US CPI came in cooler than expected. Headline inflation decelerated to 0.2% m/m (2.8% y/y), as did core which now stands at 3.1% y/y. Core services inflation declined while core goods inflation was roughly unchanged.…

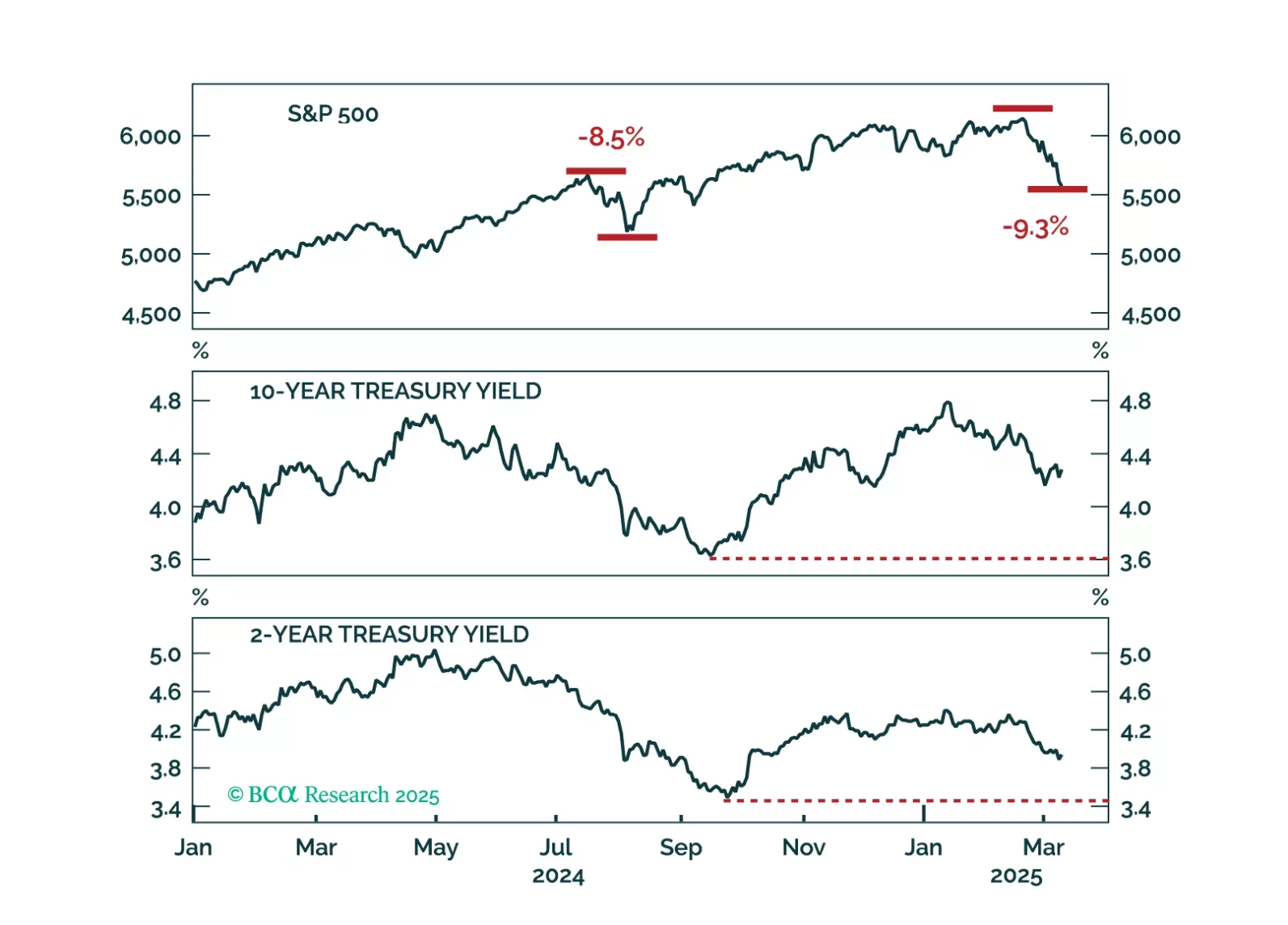

A falling stock market and sticky bond yields represent the worst of both worlds for investors. We interrogate why bond yields haven’t dropped more given the large selloff seen in equities.

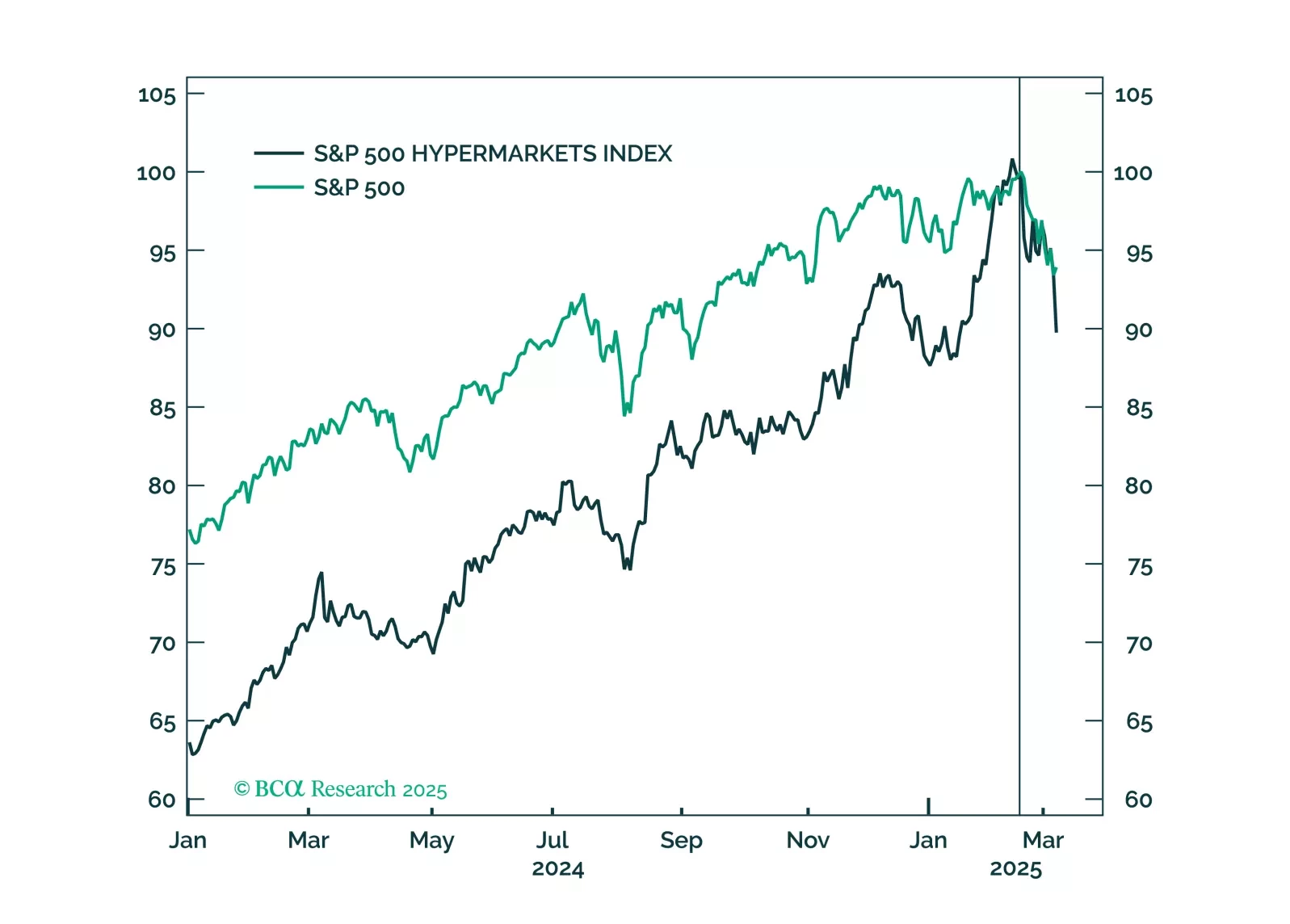

Our US investment strategists believe the Trump administration’s resolve to cut spending as well as tariff uncertainty have increased the probability of a recession.The Department of Government Efficiency’s sweeping cuts may…

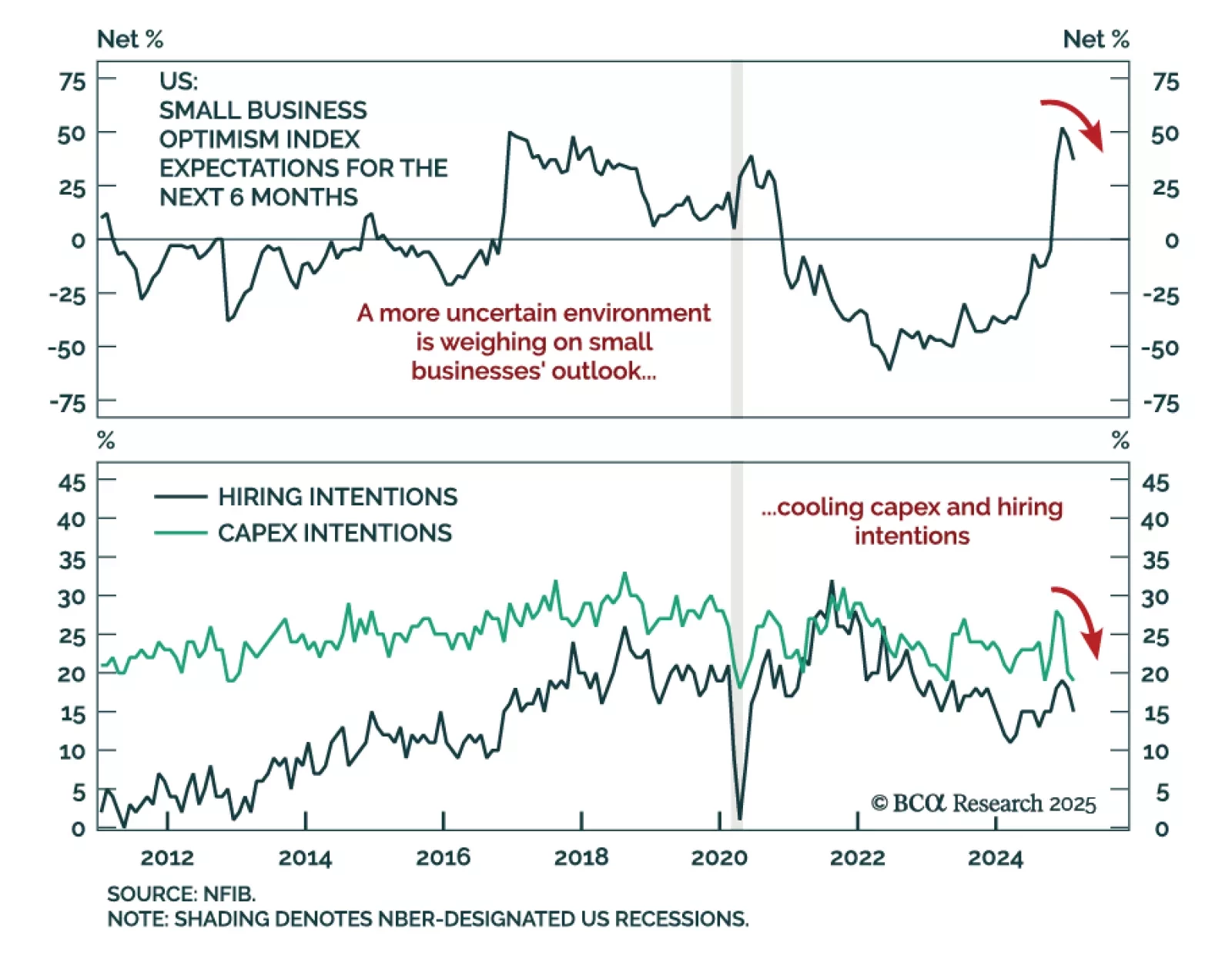

The February NFIB Small Business Optimism index decreased more than expected to 100.7 from 102.8. The decline extends the reversal seen since the November US election as policy optimism yields to uncertainty. The signal from the…

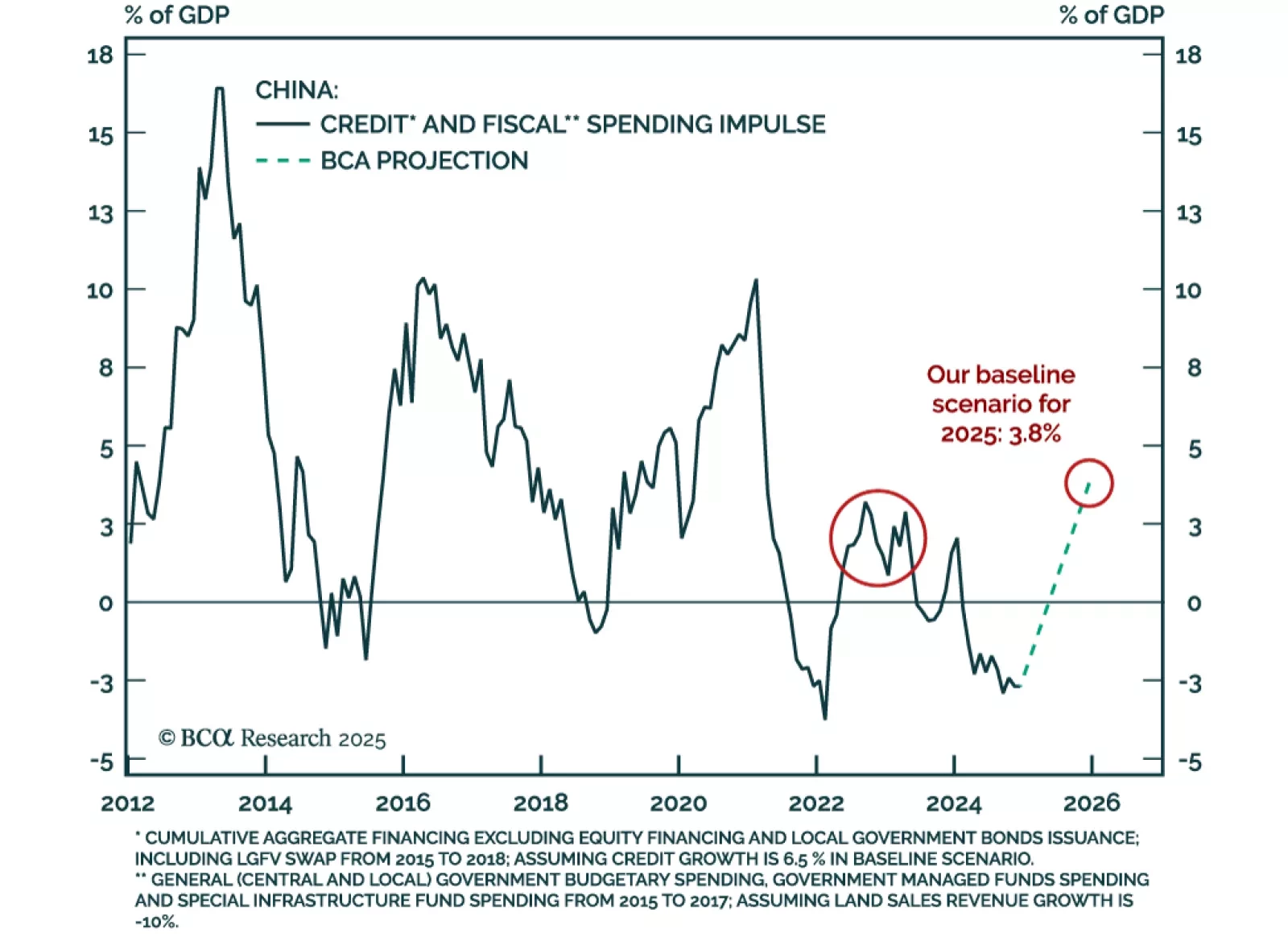

Our China and Emerging Markets strategists assessed China’s outlook after the National People’s Congress concluded last week. China’s latest fiscal stimulus is only marginally larger than last year’s, with a combined credit and…

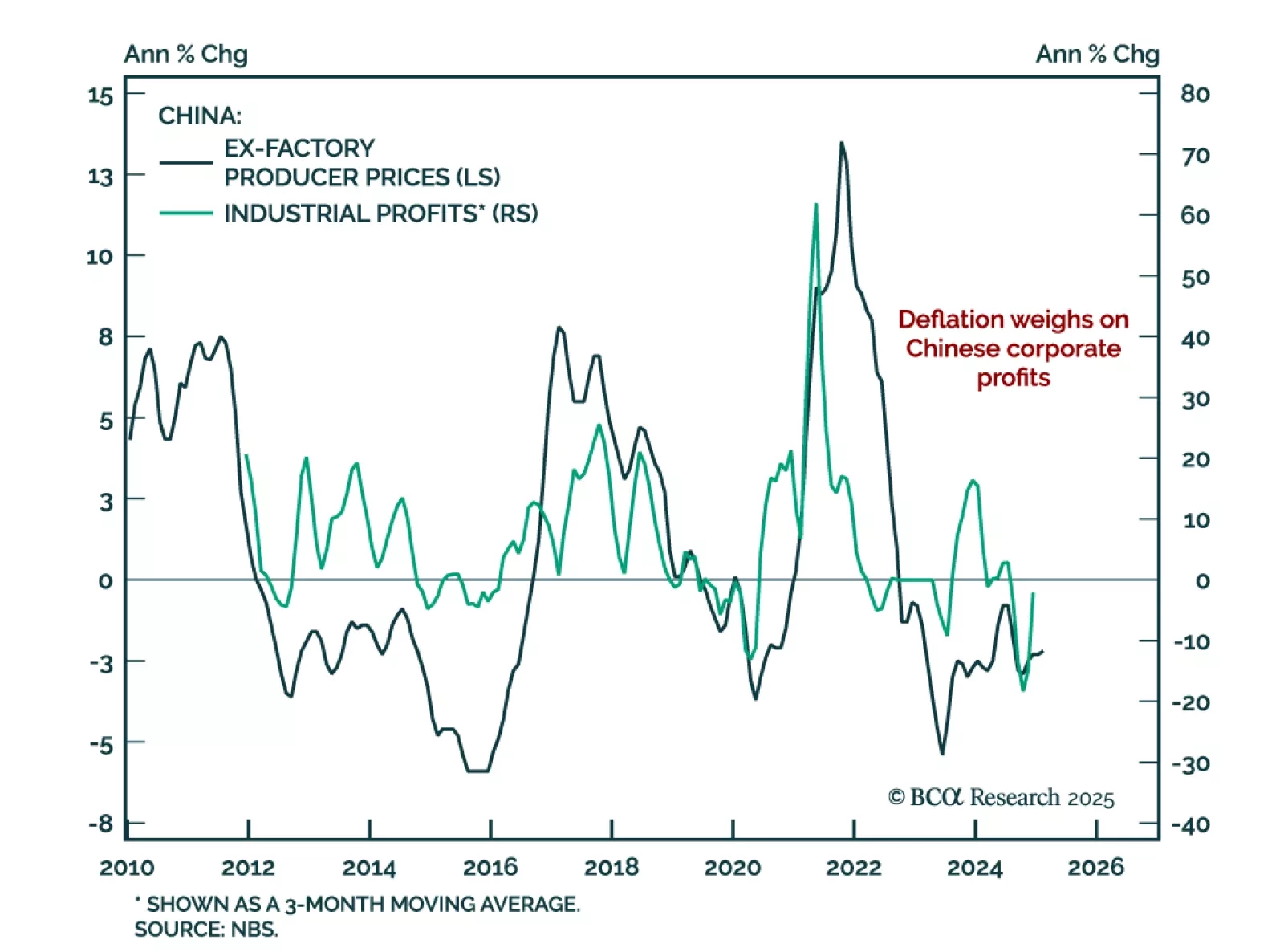

China’s February consumer prices fell 0.7% y/y after expanding on an annual basis in January. Producer price deflation stood at -2.2% y/y, roughly unchanged from a month prior. China’s first quarter data is heavily influenced by…

Although there may be a method to DOGE’s 100-mile-an-hour madness, we think the worries and uncertainty stoked by it and on-again, off-again tariff measures have increased the probability of a recession while bringing forward its…

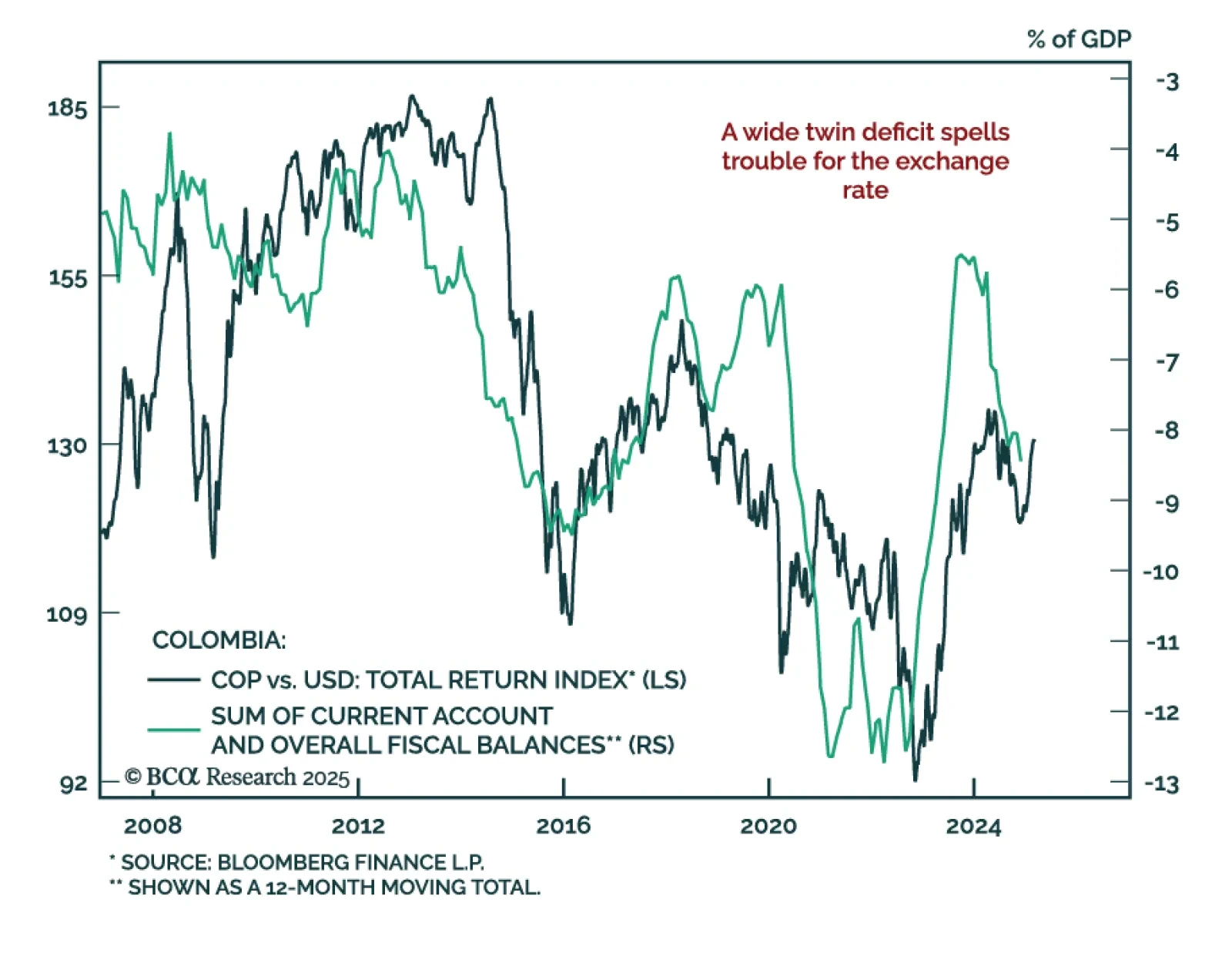

Our Emerging Markets strategists assessed Colombian assets after a significant rally. Colombia faces deep-rooted macroeconomic challenges that will not be easily reversed by a right-wing government in 2026. Public debt is on an…

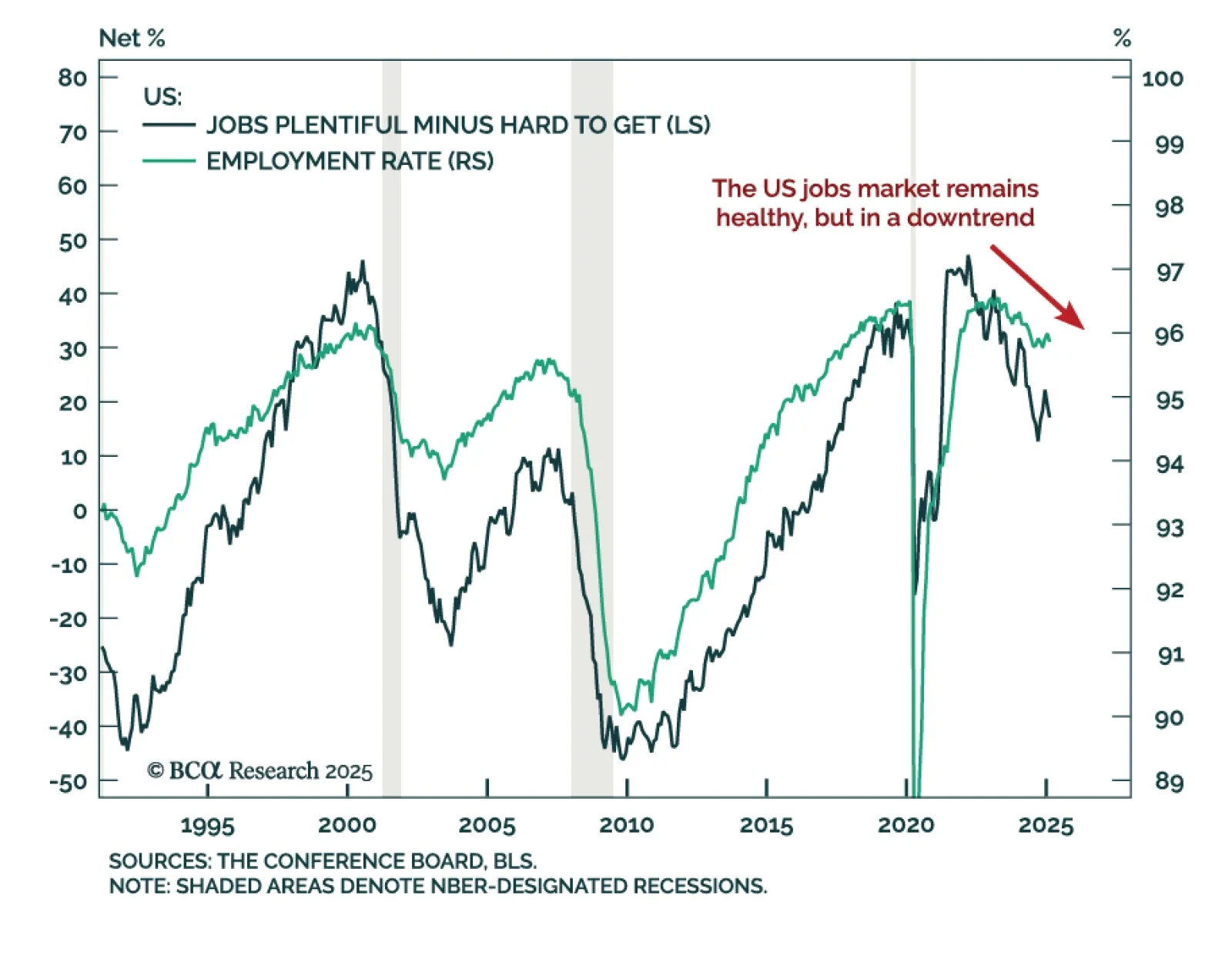

The February US jobs report was slightly weaker than expected, reflecting a slowing but still healthy labor market. At 151k, payrolls missed estimates. January’s number was revised down from 143k to 125k, bringing the 3-month moving…