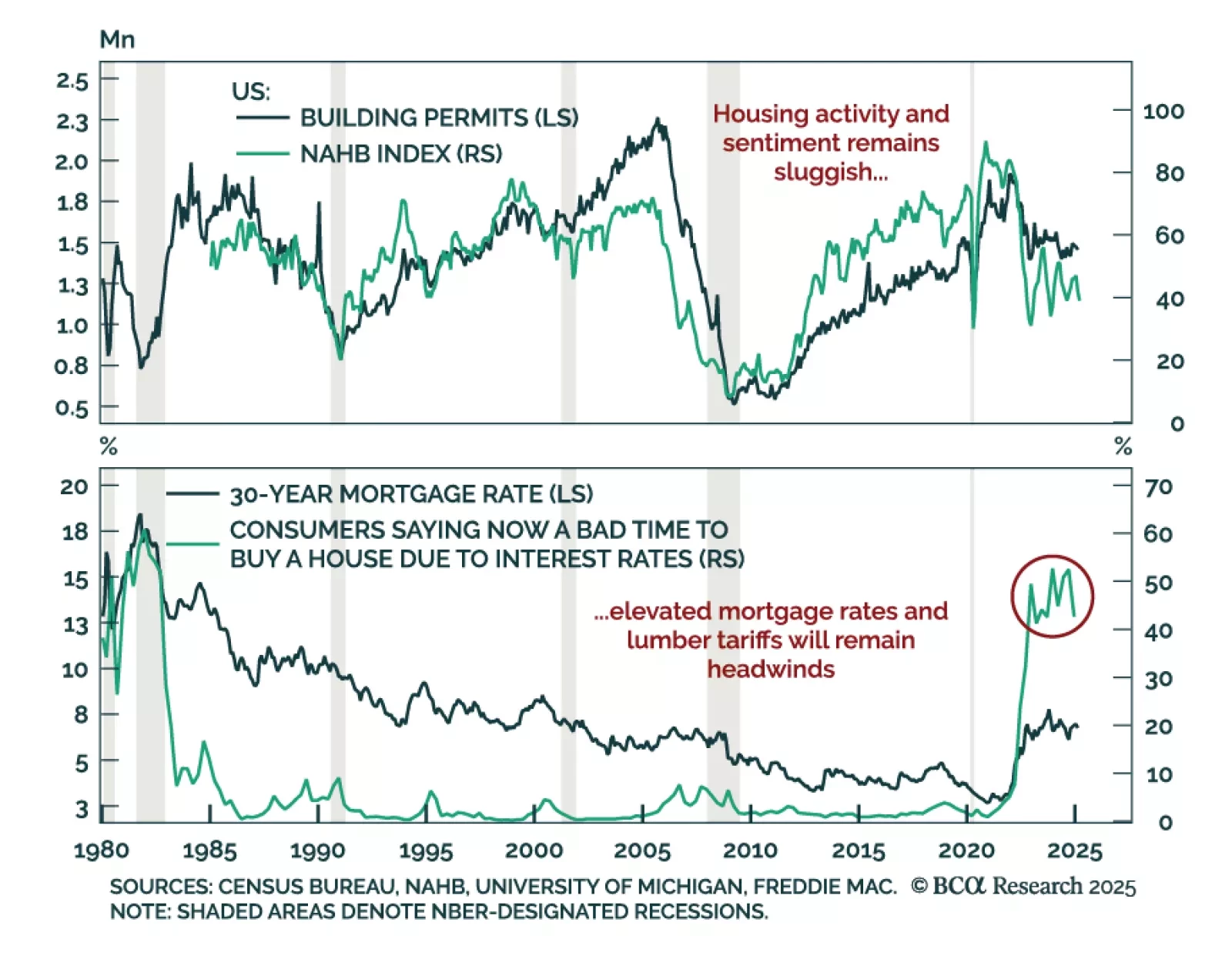

US February housing data was relatively strong, with housing starts rising 11.2% m/m after falling 9.8% in January. While they fell less than expected, building permits still declined at a faster pace than in January. The March NAHB…

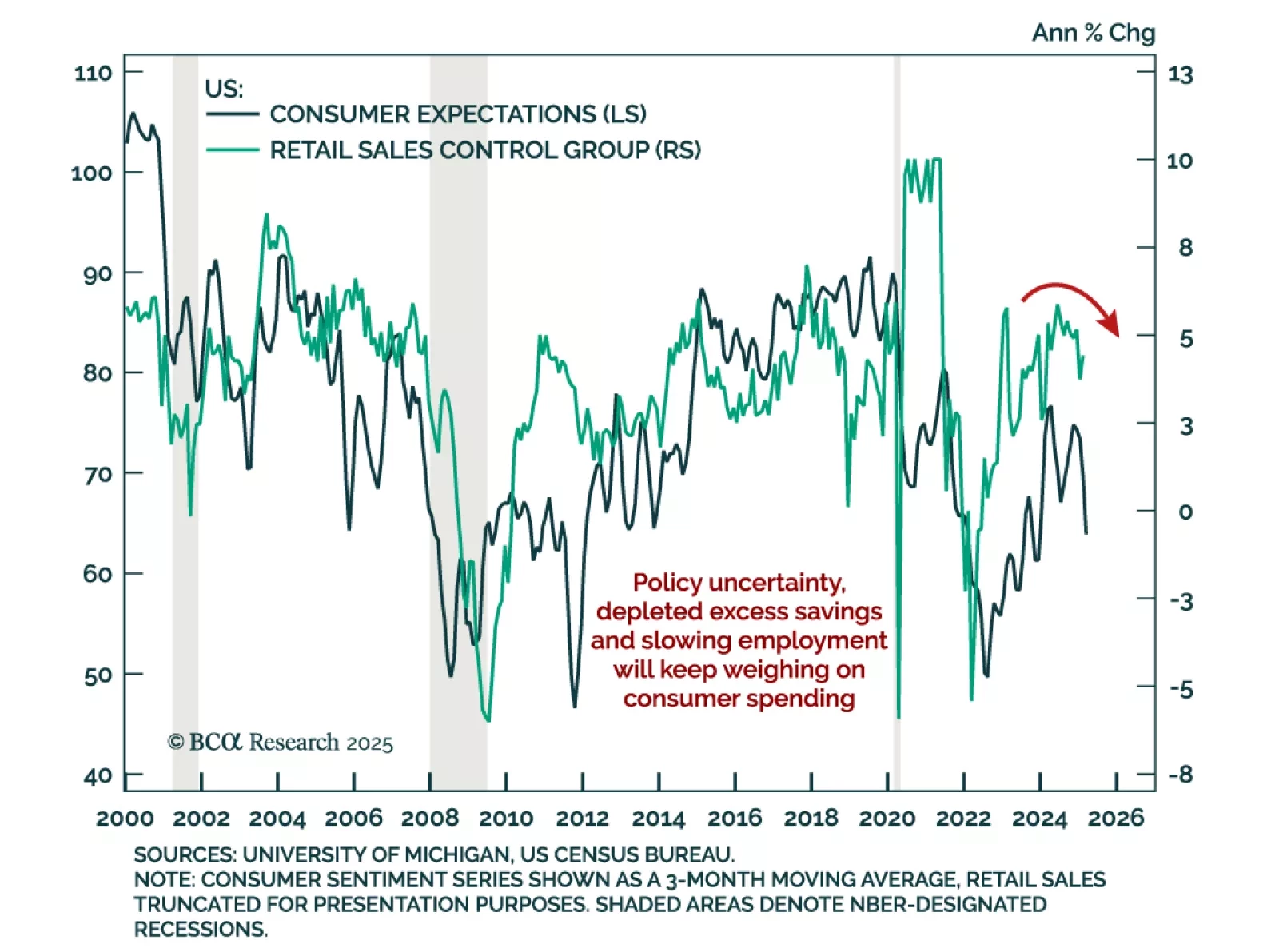

February US retail sales were mixed, with the headline number missing expectations at only 0.2% m/m. January’s reading was revised down to -1.2%. Core measures (excluding gas & autos) were roughly in line with estimates, but the…

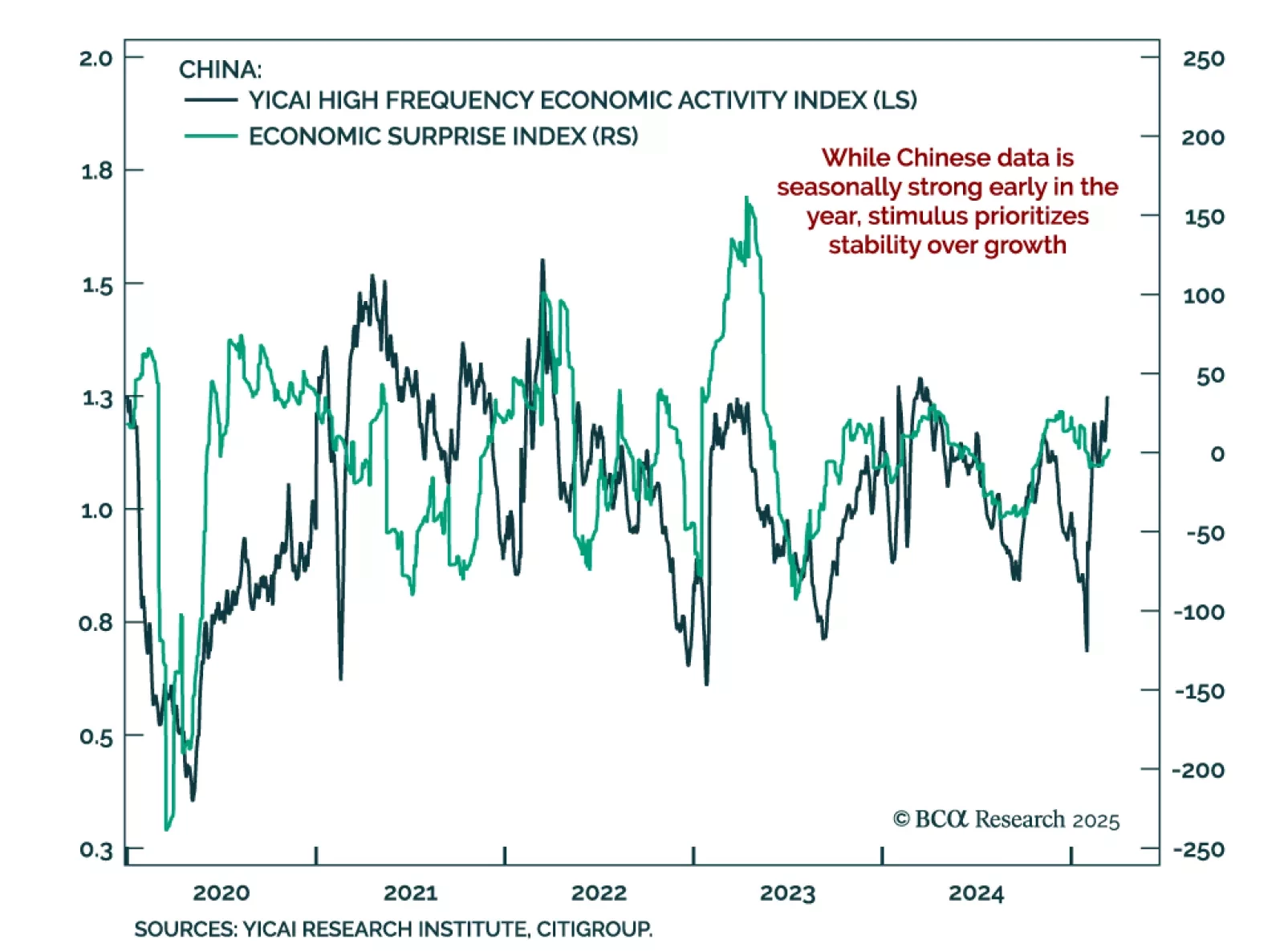

Outside of the real estate sector, Chinese activity was decent in January and February. Both industrial production and retail sales were slightly stronger than expected. The jobless rate ticked up to 5.4% while property investment…

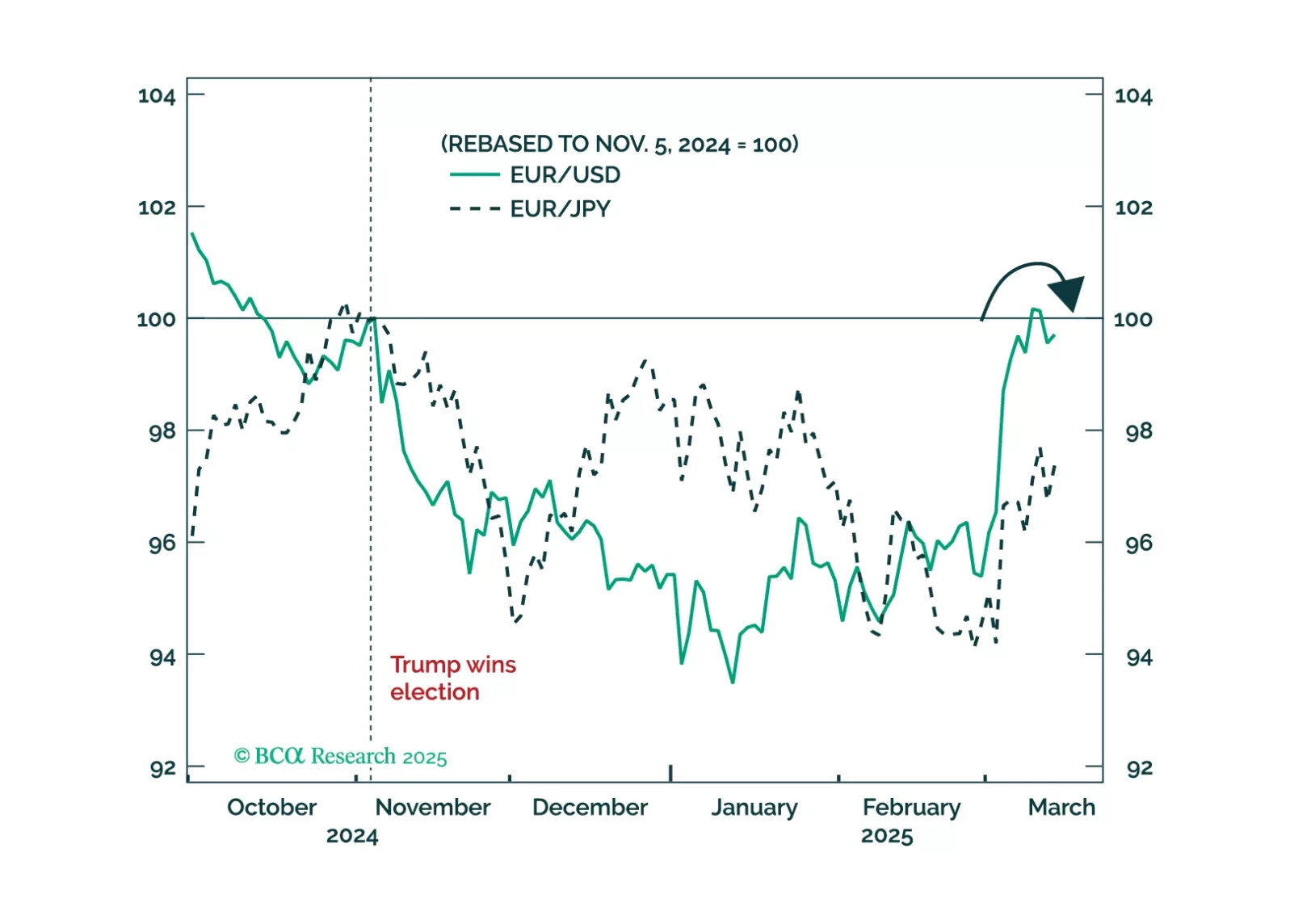

Trump’s foreign policy can be explained by rational US interests, but it requires settling the trade war with allies sooner rather than later. Book gains on EUR-USD for now.

Despite our Global Investment strategists’ bearish stance, their latest report reviews scenarios that could be bullish for equities. Our colleagues remain bearish on equities, expecting a US recession this year. However, several…

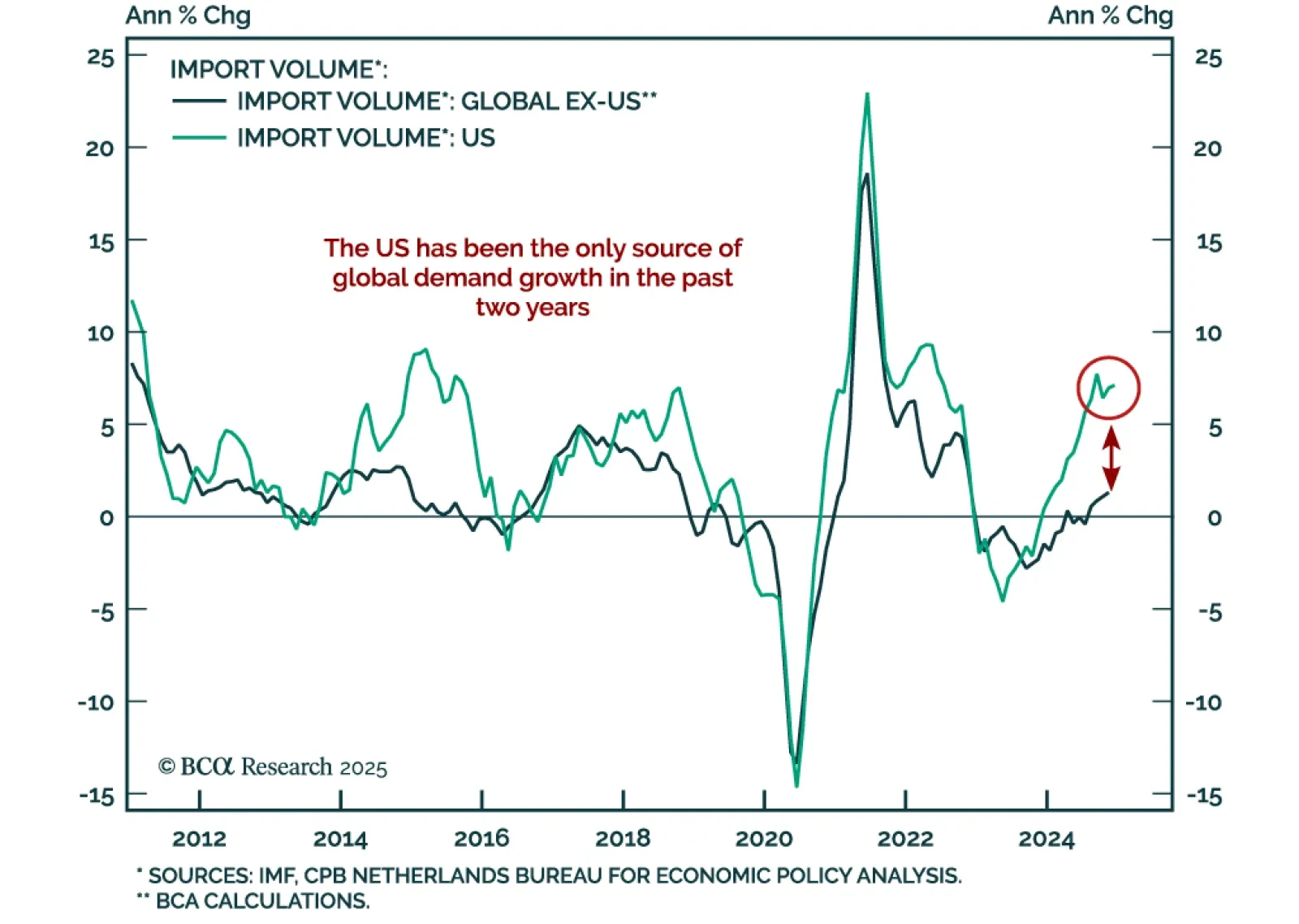

Our Chart Of The Week comes from Arthur Budaghyan, Chief Emerging Markets/China strategist. Arthur highlights a key risk for the global economy, and its implication for the US dollar. By and large, the US economy has been…

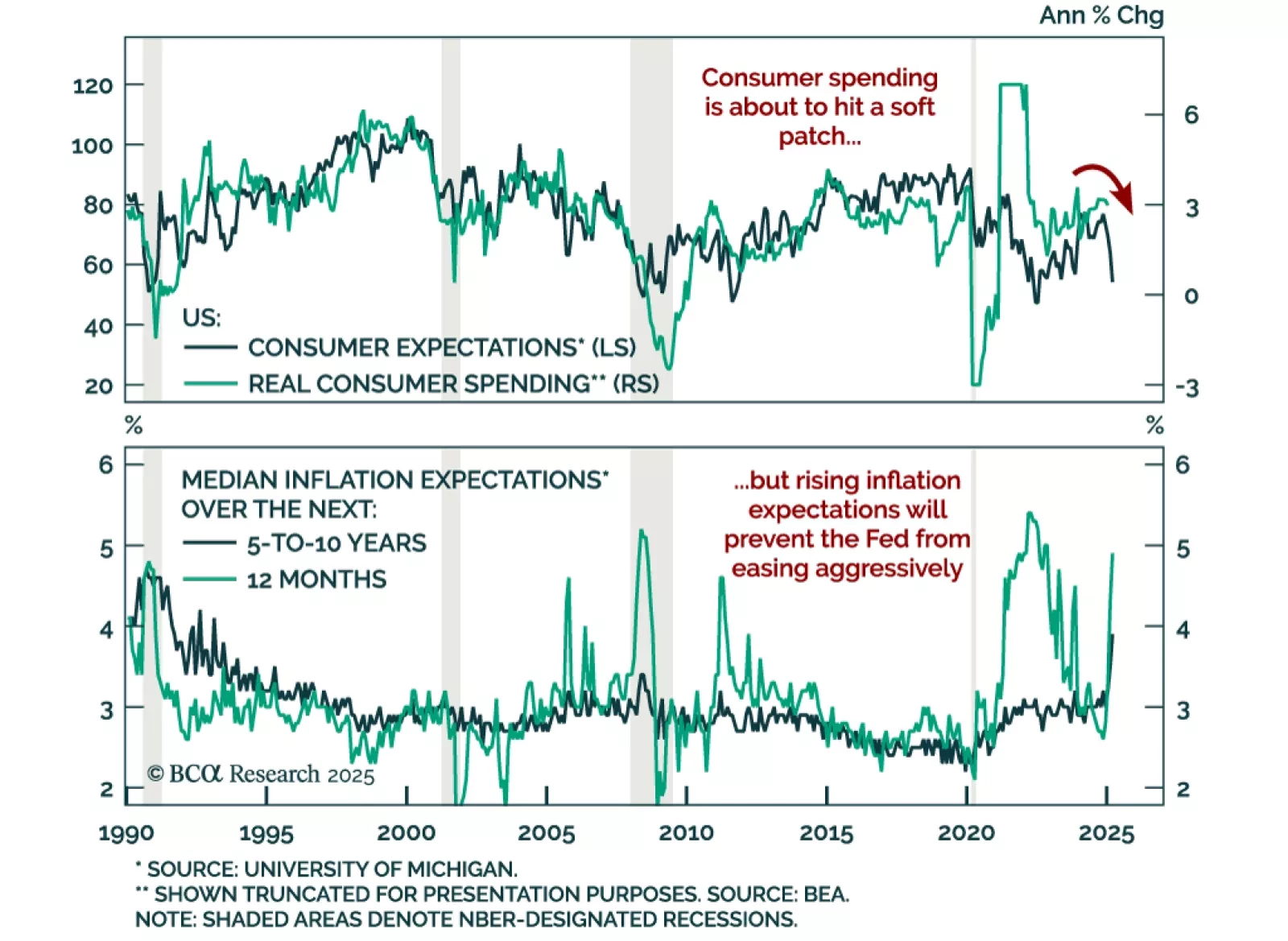

The preliminary March University of Michigan Consumer Sentiment Index missed estimates, falling to 57.9 from 64.7. The decrease came from both the assessment of current conditions and expectations, with the latter falling almost 10…

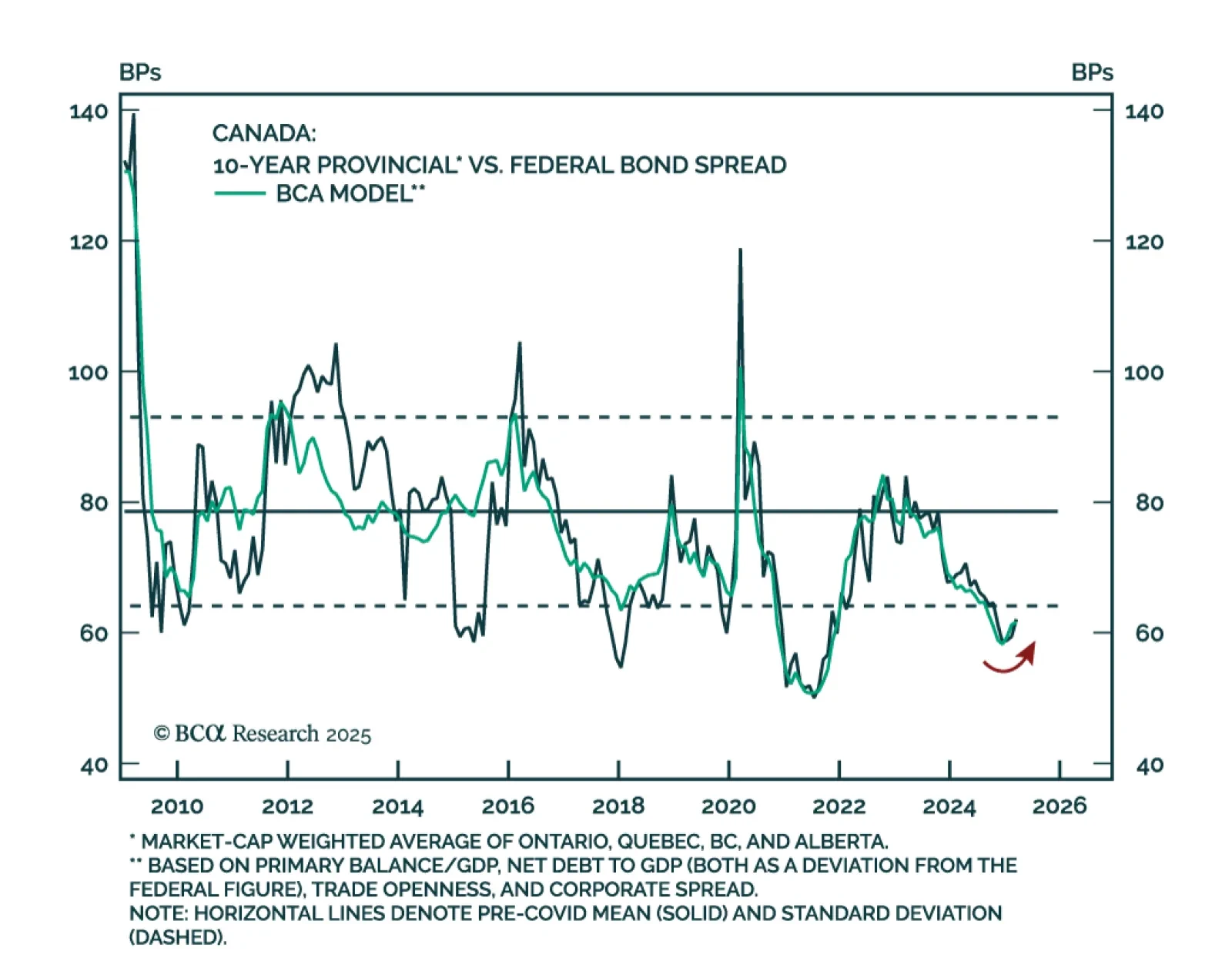

Our Global Fixed Income team wrote a primer on the Canadian provincial bond market, an overlooked yet substantial market. Canadian provincial bonds are a major segment of the country's fixed income market, with spreads primarily…

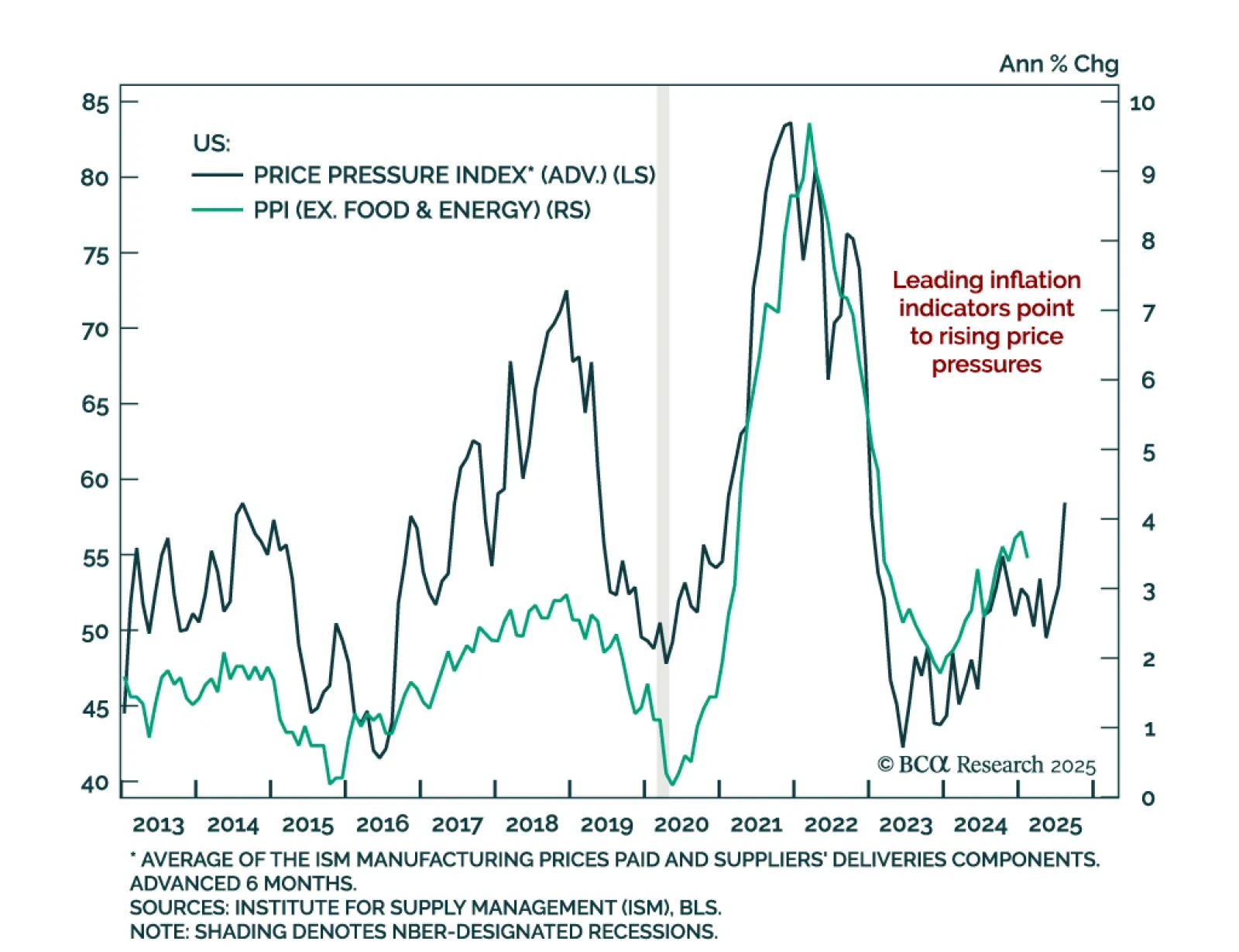

The February US Producer Price Index came in below estimates, with the headline measure showing no monthly change and standing at 3.2% y/y. Core PPI (excluding food, energy, and trade services) was also cooler than expected, coming…

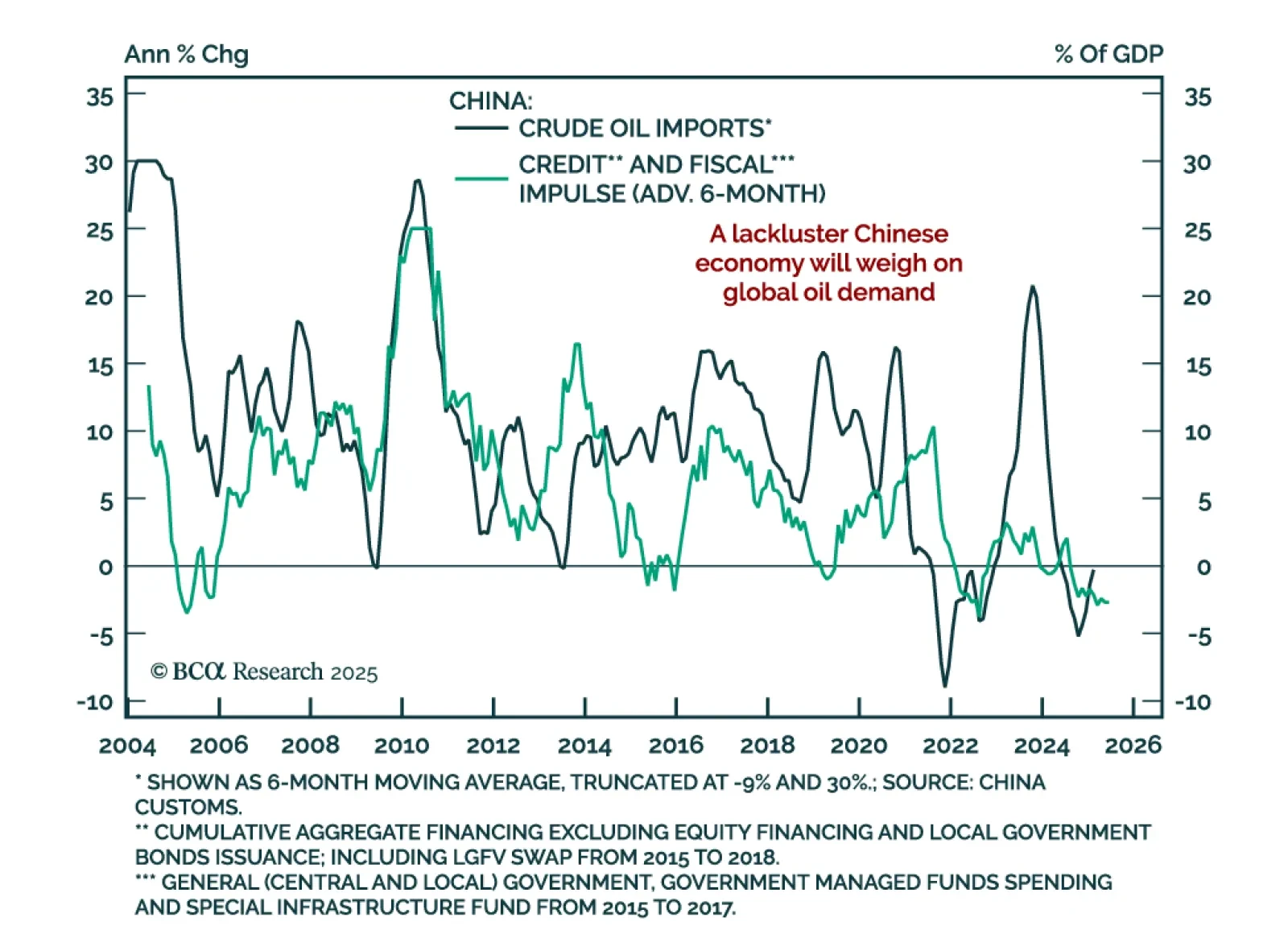

Our Commodities strategists assessed the outlook for oil as crude remains pulled between geopolitical and fundamentals forces. OPEC+’s decision to raise oil supply is driven more by geopolitics than economics. A sustained…