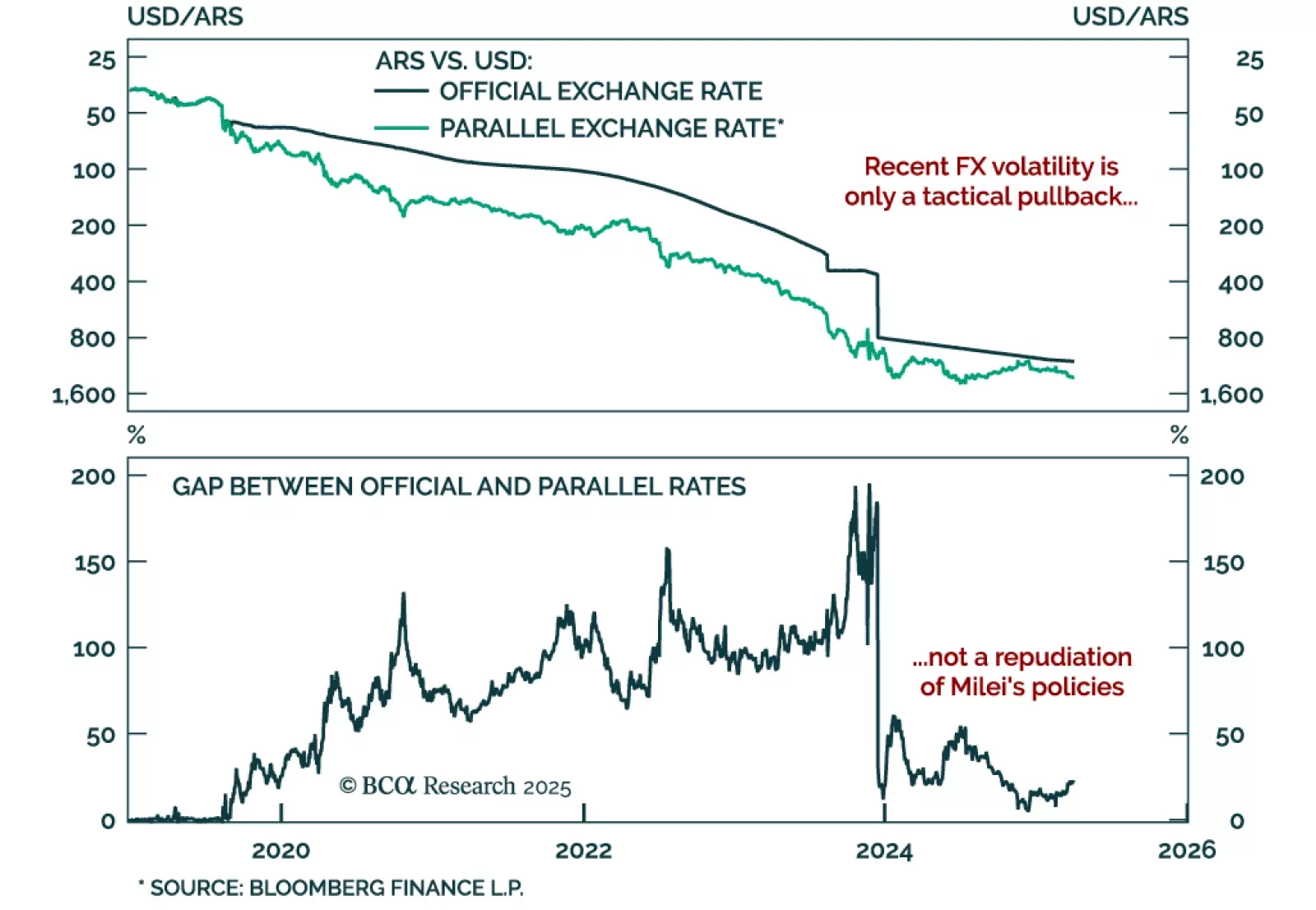

Remain constructive on Argentine assets as recent market moves are a tactical pullback, not a loss of confidence. The gap between official and parallel exchange rates has widened, prompting concerns that markets are questioning…

Low correlations and regional dispersion are shaping market dynamics, creating selective opportunities outside the US even as near-term risks remain. Asset classes tend to become highly correlated during crisis episodes, limiting…

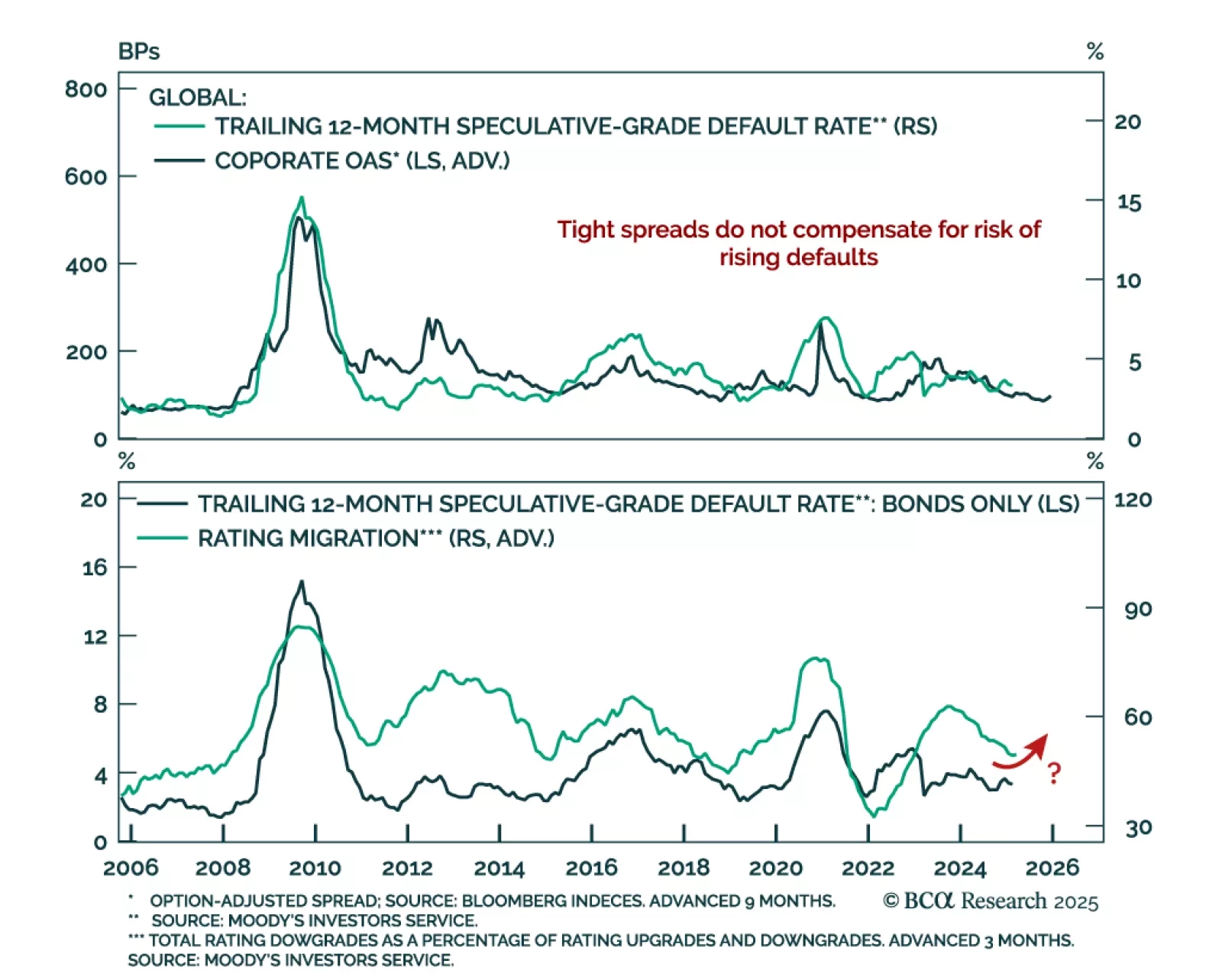

Our Global Fixed Income strategists recommend maintaining an underweight allocation to corporate credit versus government bonds in global fixed income portfolios. Within corporates, they are neutral on the US, UK, Japan, and…

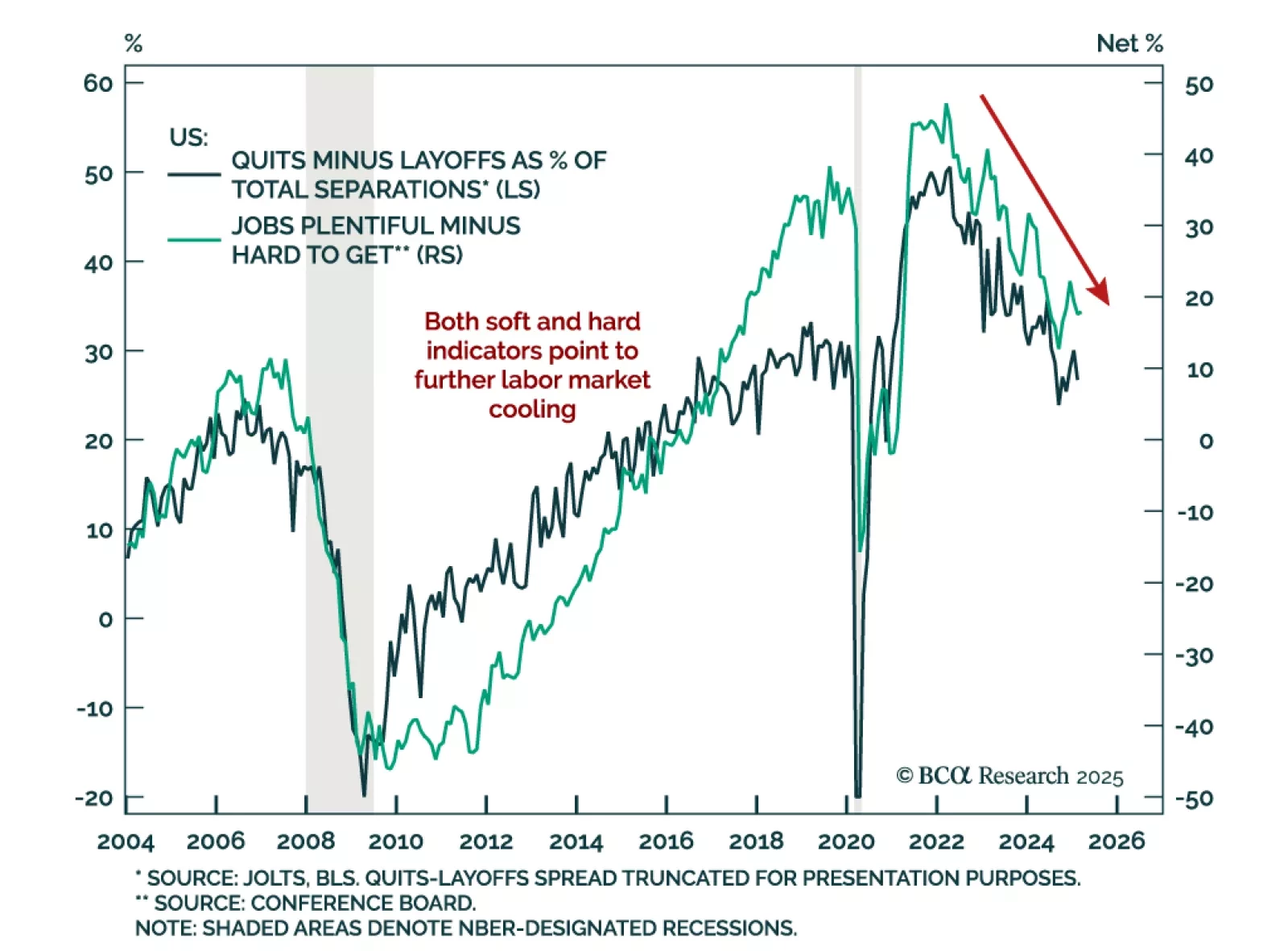

Labor market data continues to cool, reinforcing our overweight in government bonds and above-benchmark duration stance. February job openings fell to 7.6m, below expectations. Declining quits and rising layoffs signal that labor…

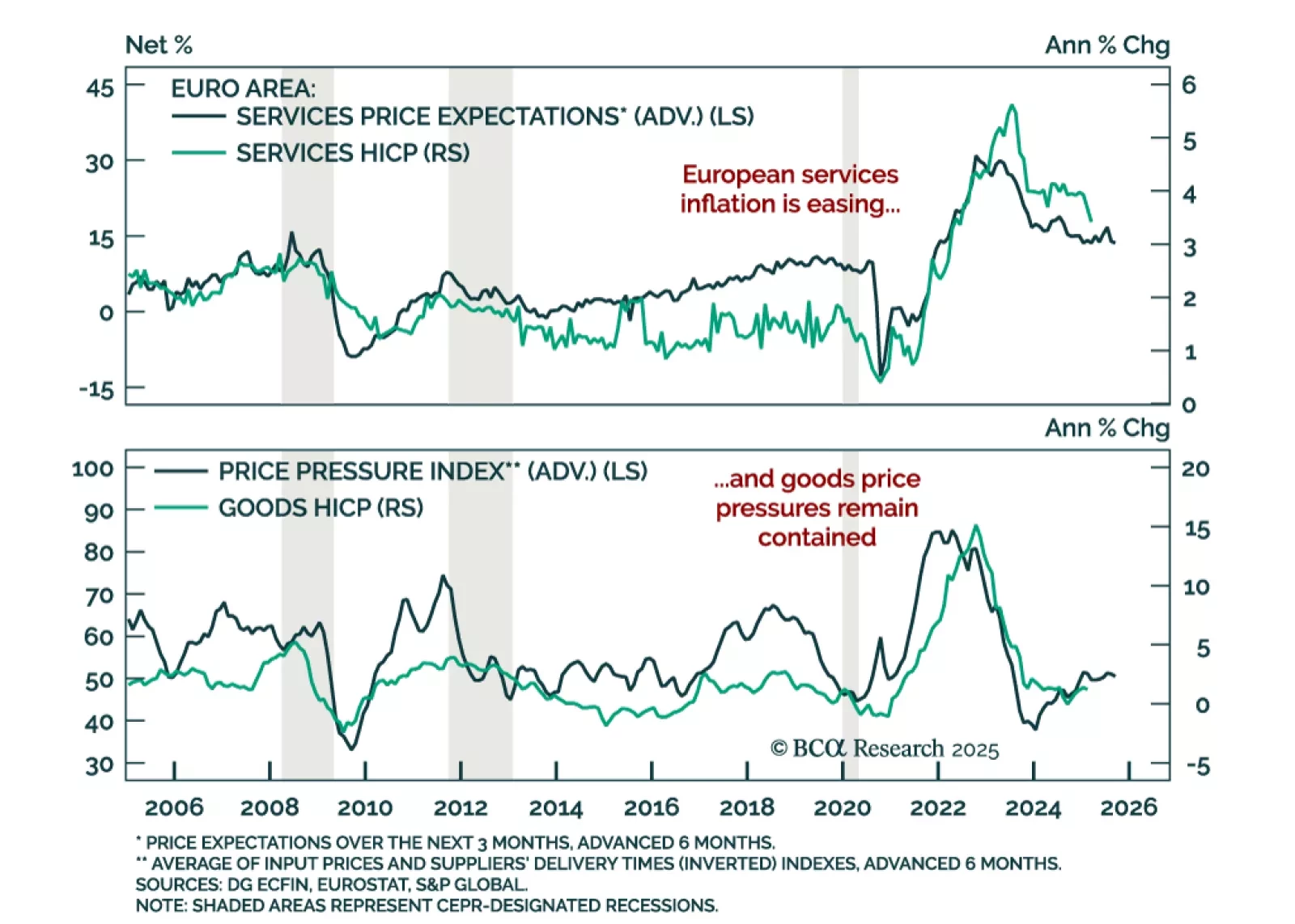

Eurozone inflation is cooling steadily, supporting our tactical overweight in German bunds versus European equities and increasing the odds of an April ECB cut. Headline HICP eased to 2.2% y/y in March from 2.3%, while core came in…

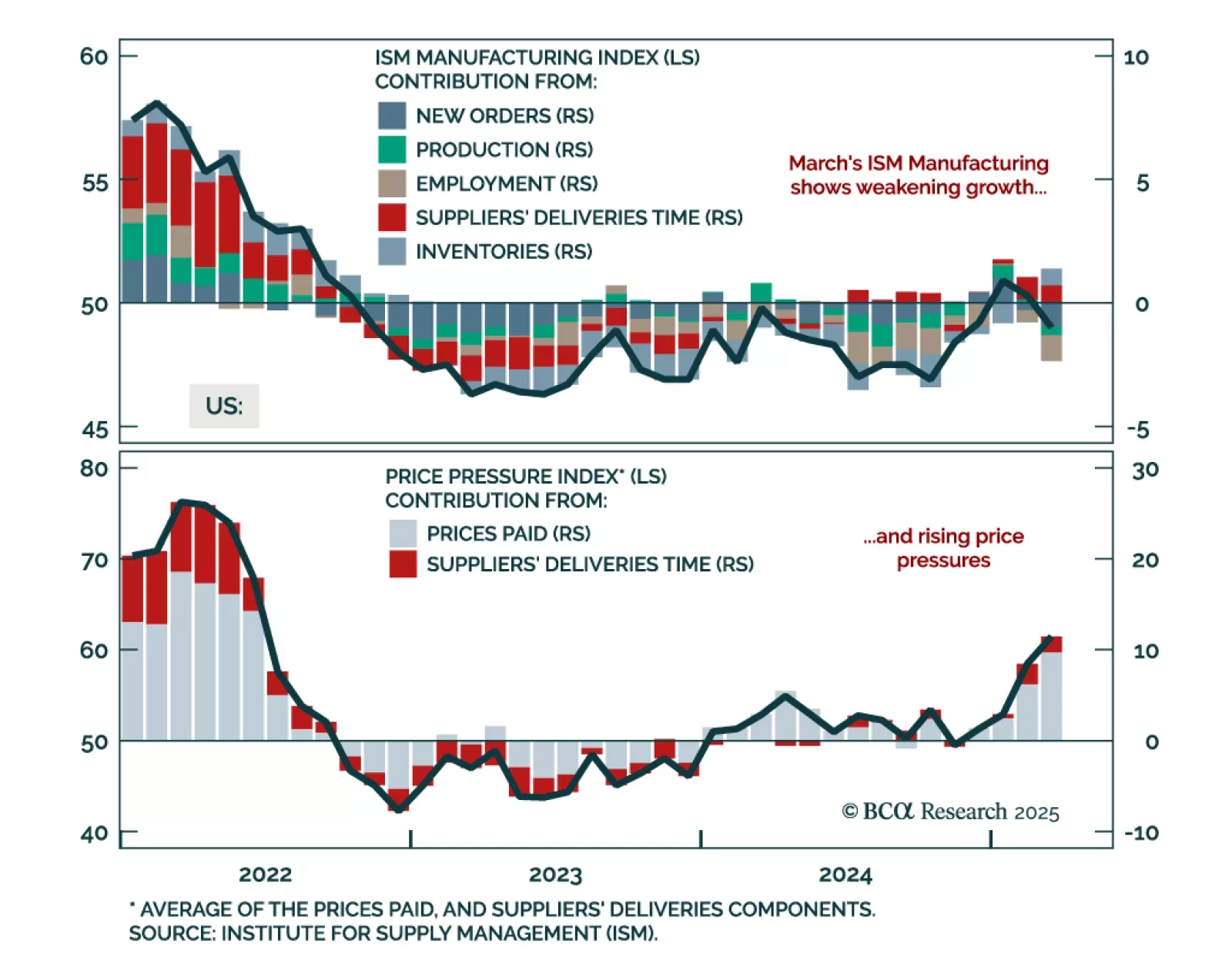

The March ISM Manufacturing adds to the recent stagflationary impulse, but markets remain focused on the growth drag, reinforcing our defensive asset allocation. The headline index fell more than expected to 49.0 from 50.3, with new…

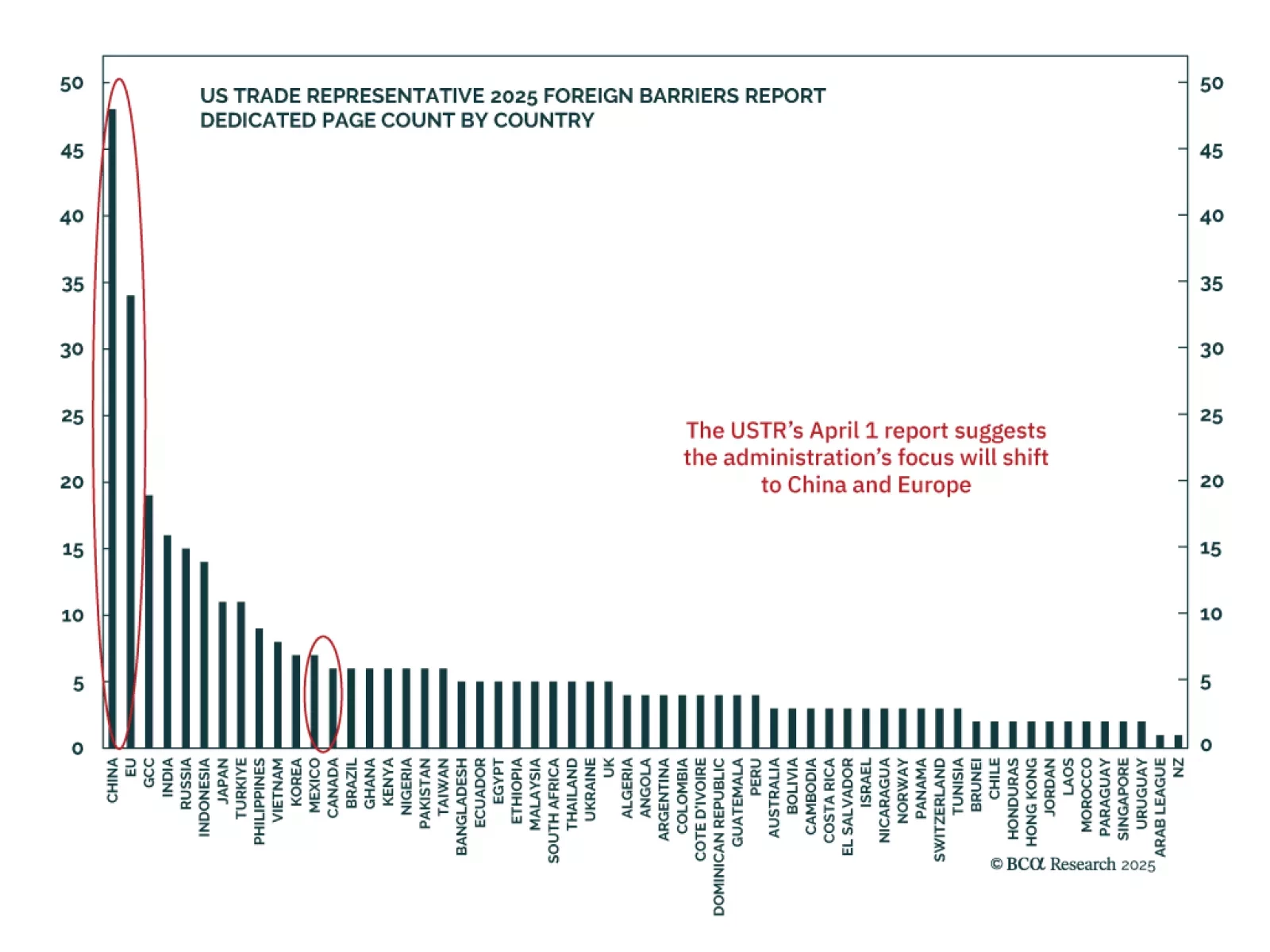

April 2 may mark peak trade tensions, but the path forward remains highly uncertain, supporting our underweight on risk assets and industrial commodities. The USTR’s long-awaited report on trade barriers will guide the next phase of…

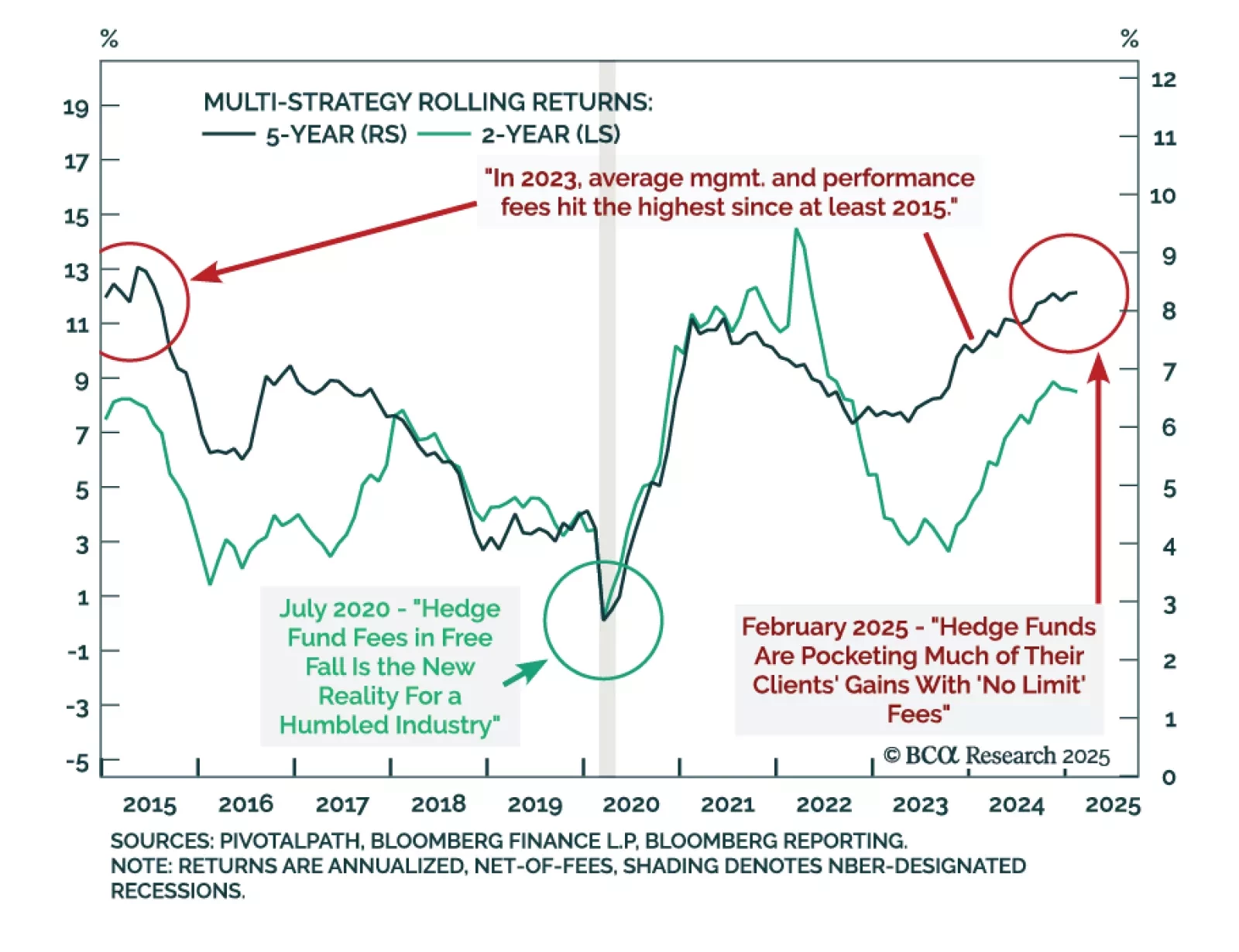

Our Private Markets & Alternatives strategists remain structurally positive but cyclically underweight on Multi-Strategy Hedge Funds. While these funds have delivered consistent alpha and valuable diversification, current market…

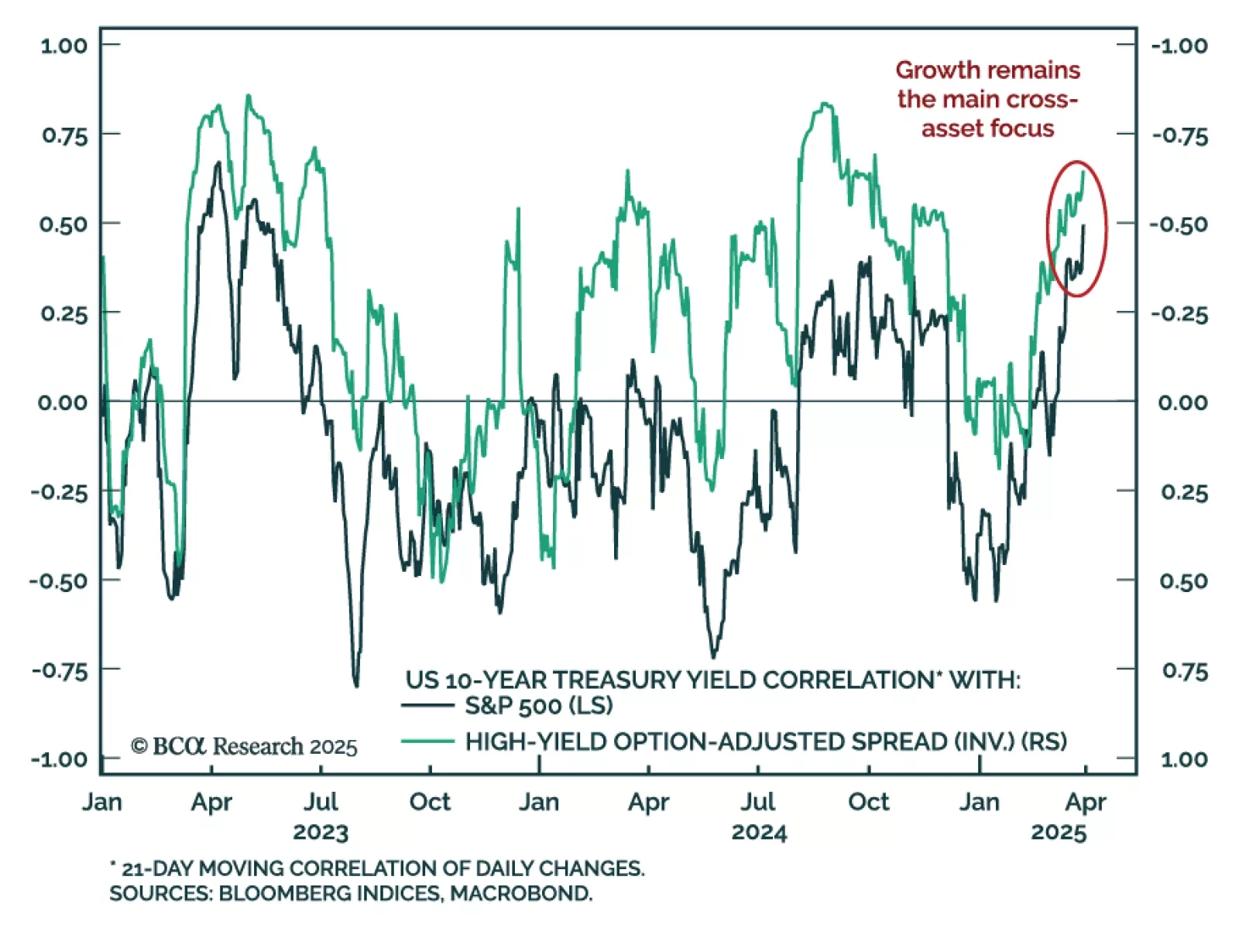

Markets are responding to the growth drag of stagflation, not the inflation impulse, reinforcing our defensive stance. Despite rising short-term inflation pressures in the US, risk assets and bond yields continue to move together,…

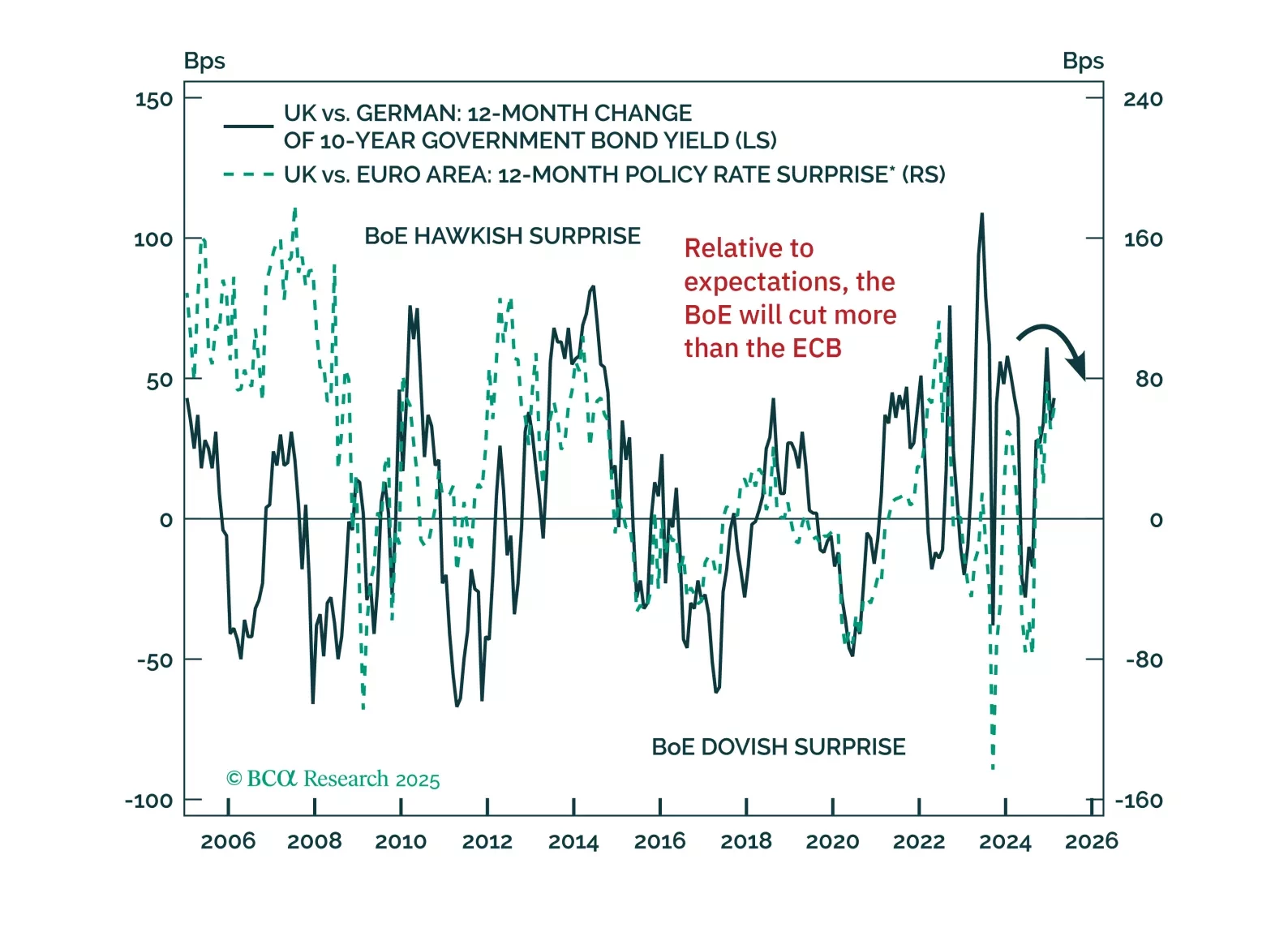

With economic headwinds building and fiscal dynamics shifting, bond markets are at a turning point. Our latest note outlines why German bund yields are set to decline and why UK gilts are poised to outperform — and how to position…