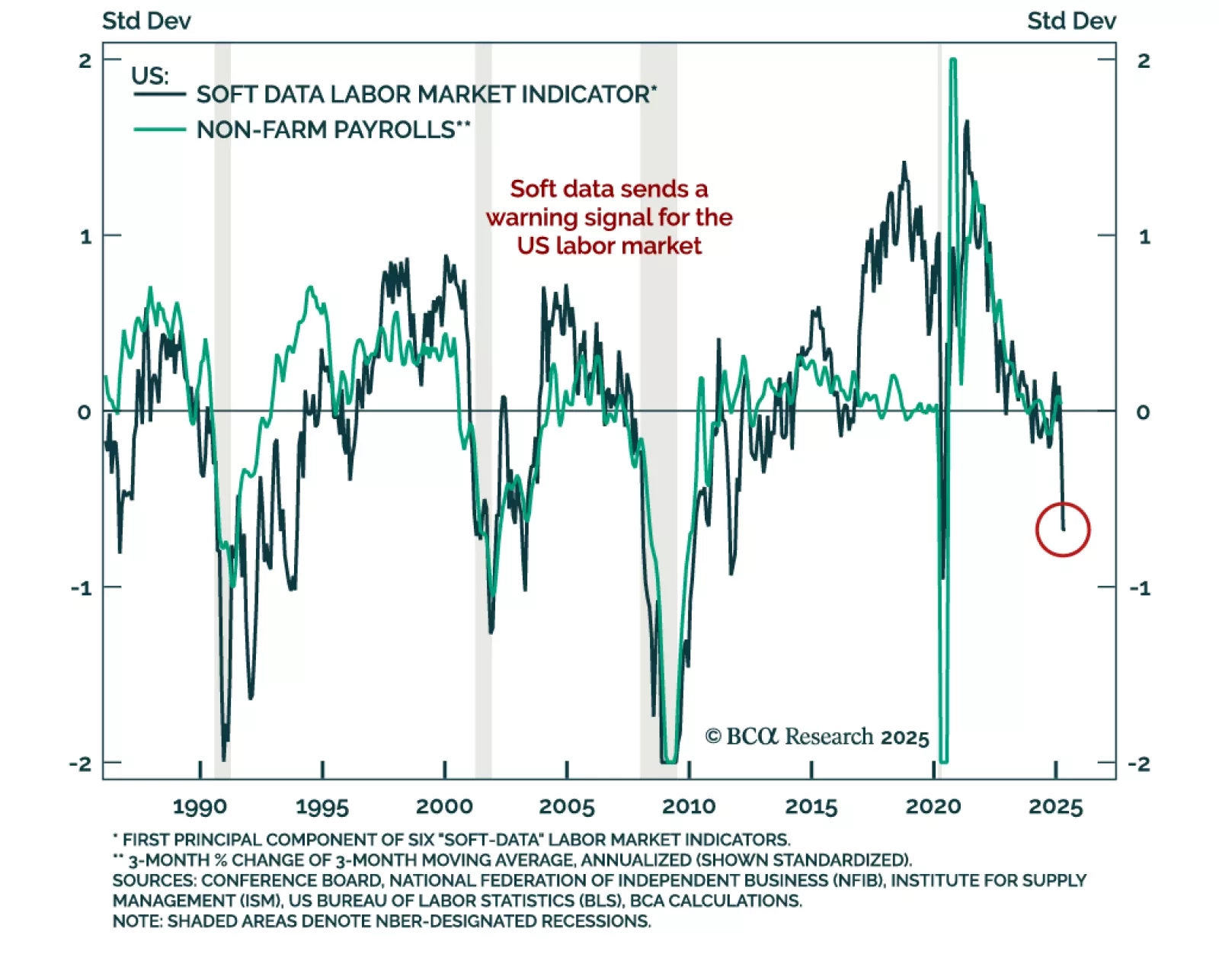

Soft data for the US labor market has turned sharply lower, reinforcing the case for a defensive asset allocation. Our Chart Of The Week comes from Miroslav Aradski from our Global Investment Strategy team. While it may take months…

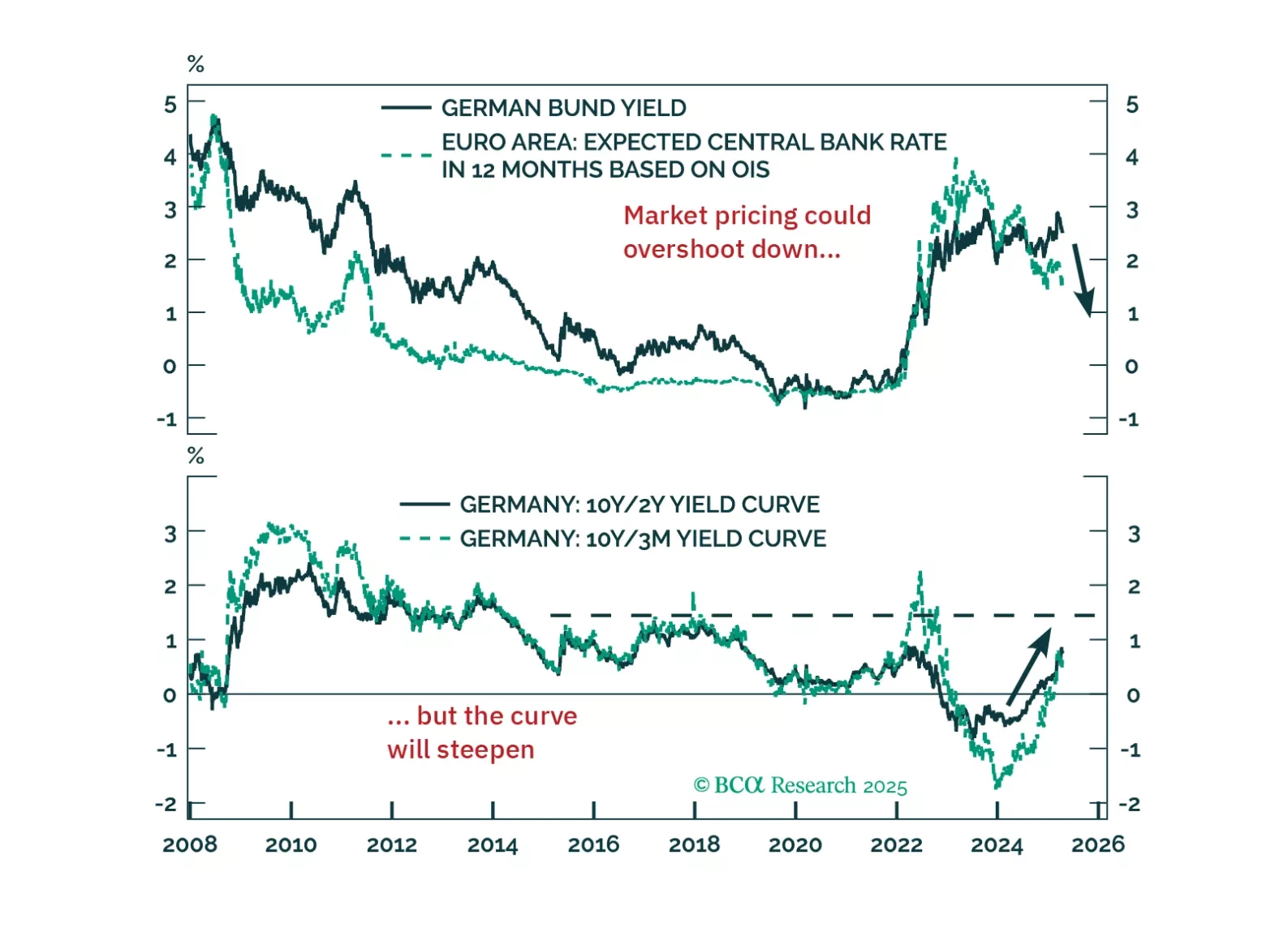

Europe’s deflation problem is getting harder to ignore. This week’s ECB cut is just the beginning — tariffs, the euro’s rally, and softening demand all point to more easing ahead. We explain what it means for yields, equities, and…

Fed Chair Jay Powell’s remarks yesterday were in-line with our base case expectation that the Fed will not cut rates proactively in the face of rising tariff-driven inflation.

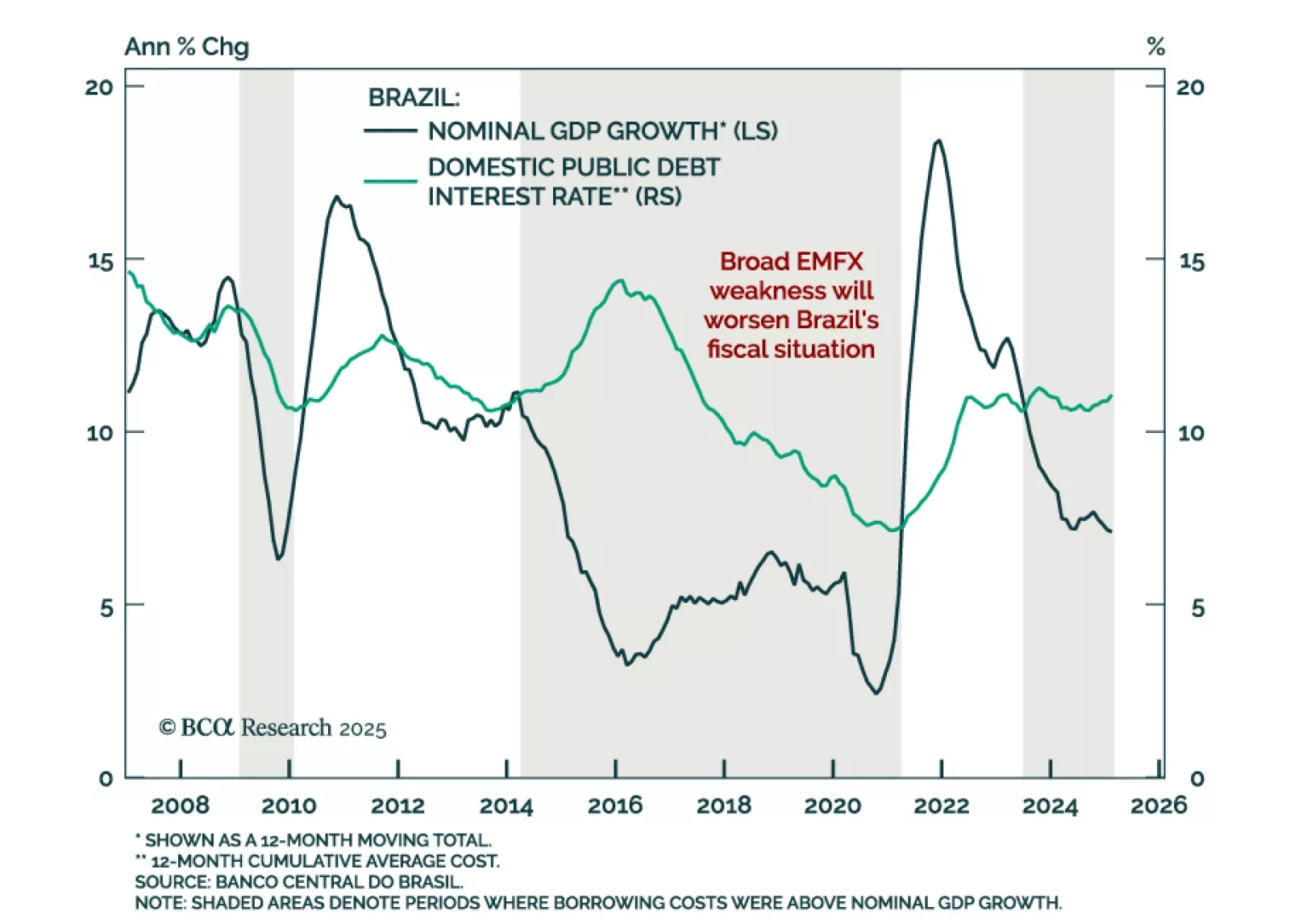

Brazil’s deteriorating fiscal dynamics and rising stagflation risks reinforce our negative stance on Brazilian assets, both outright and relative to EM peers. The latest global financial turmoil, combined with President Trump’s…

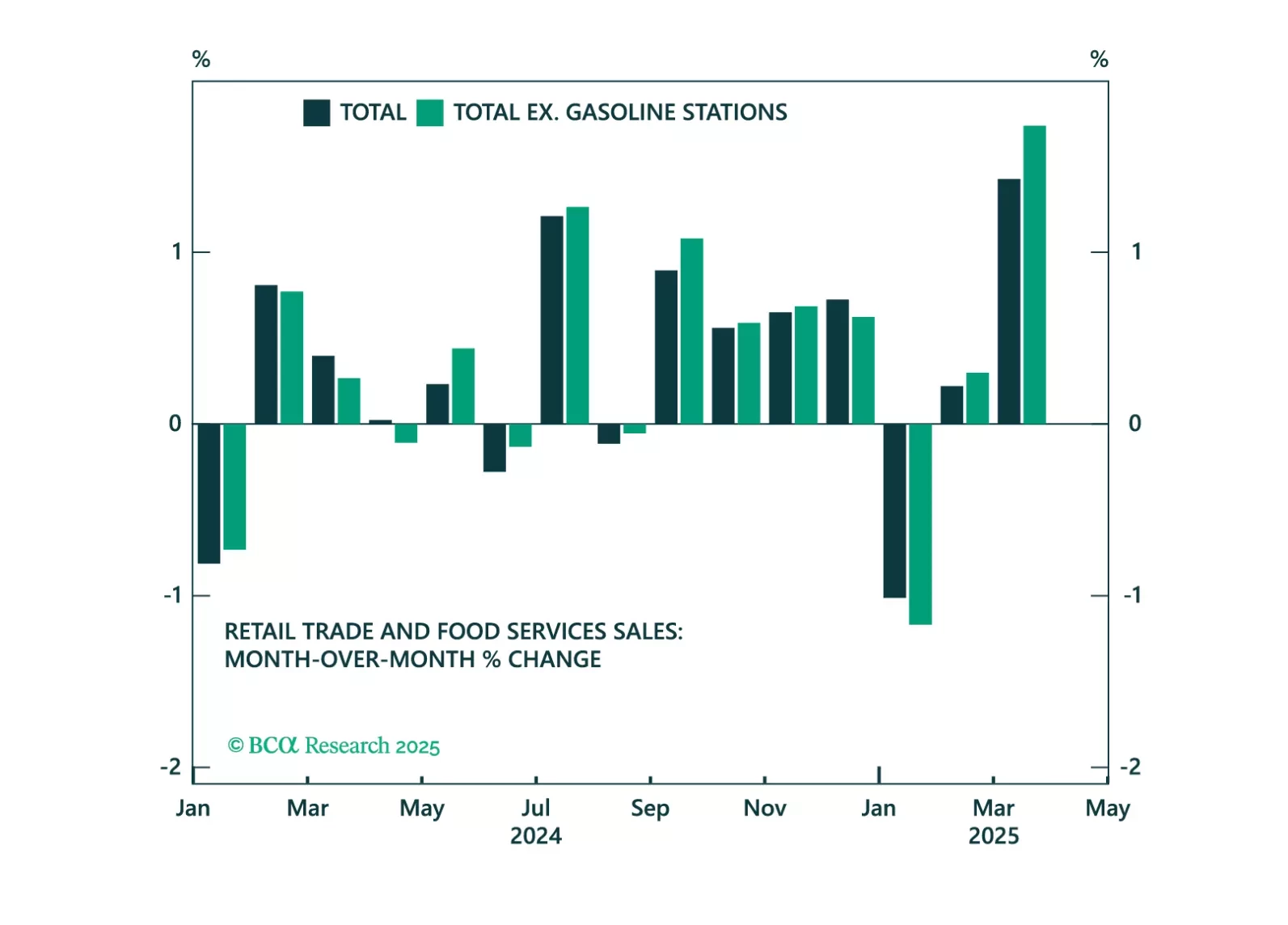

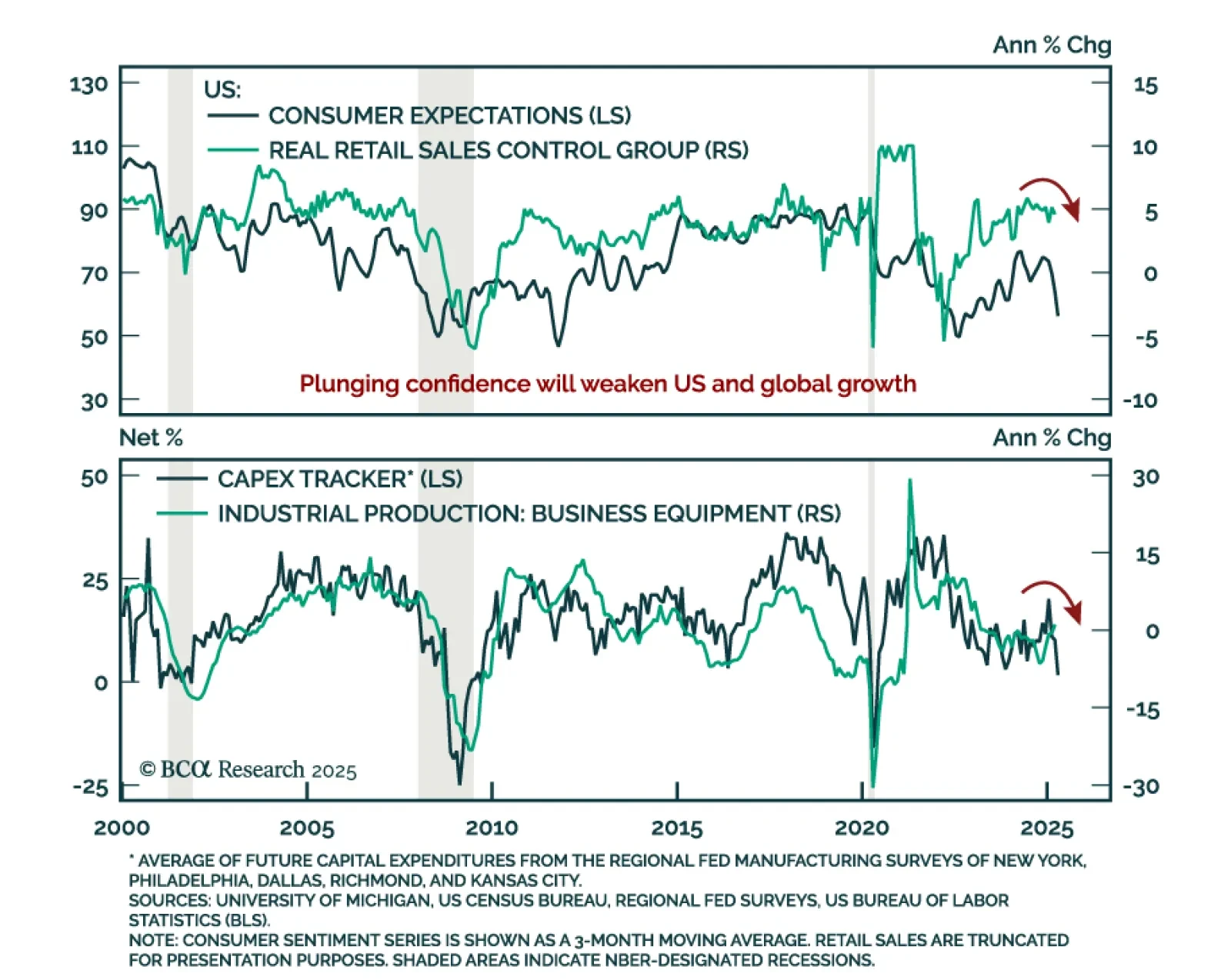

Soft data continues to deteriorate and hard data will soon follow, reinforcing our defensive asset allocation. Consumer and business confidence have plunged as policy uncertainty and inflation expectations rise, with spending, hiring…

Please join BCA Research's Chief US Equity Strategist, Irene Tunkel, for a US Equity Intelligence session on Wednesday, April 16 at 9:00 AM HKT, 11:00 AM AEST.

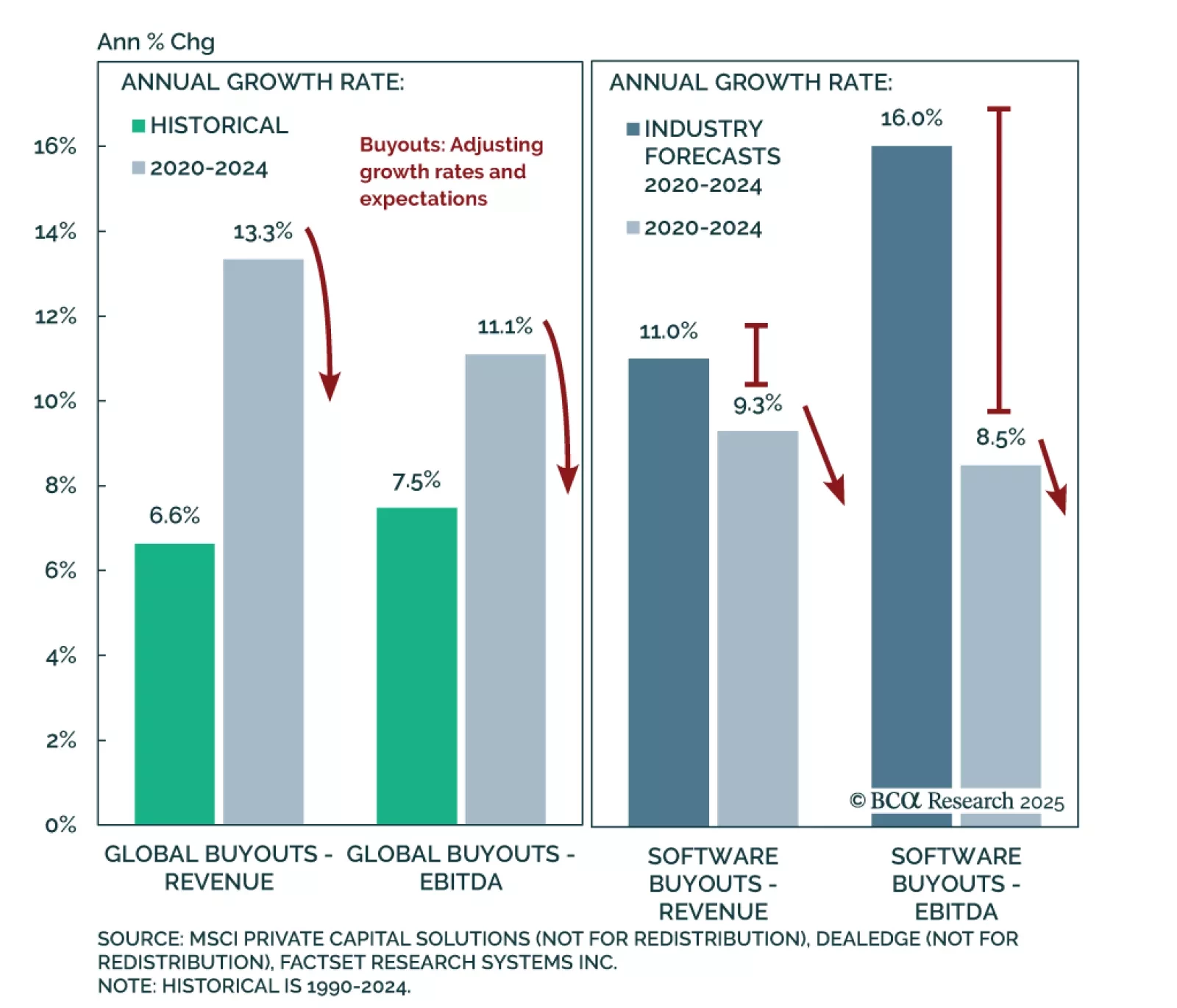

Our Private Markets & Alternatives strategists remain positioned for a downturn. Private Equity is most threatened as tariffs intensify existing recession risks. Buyout strategies face stress from record-low distributions…

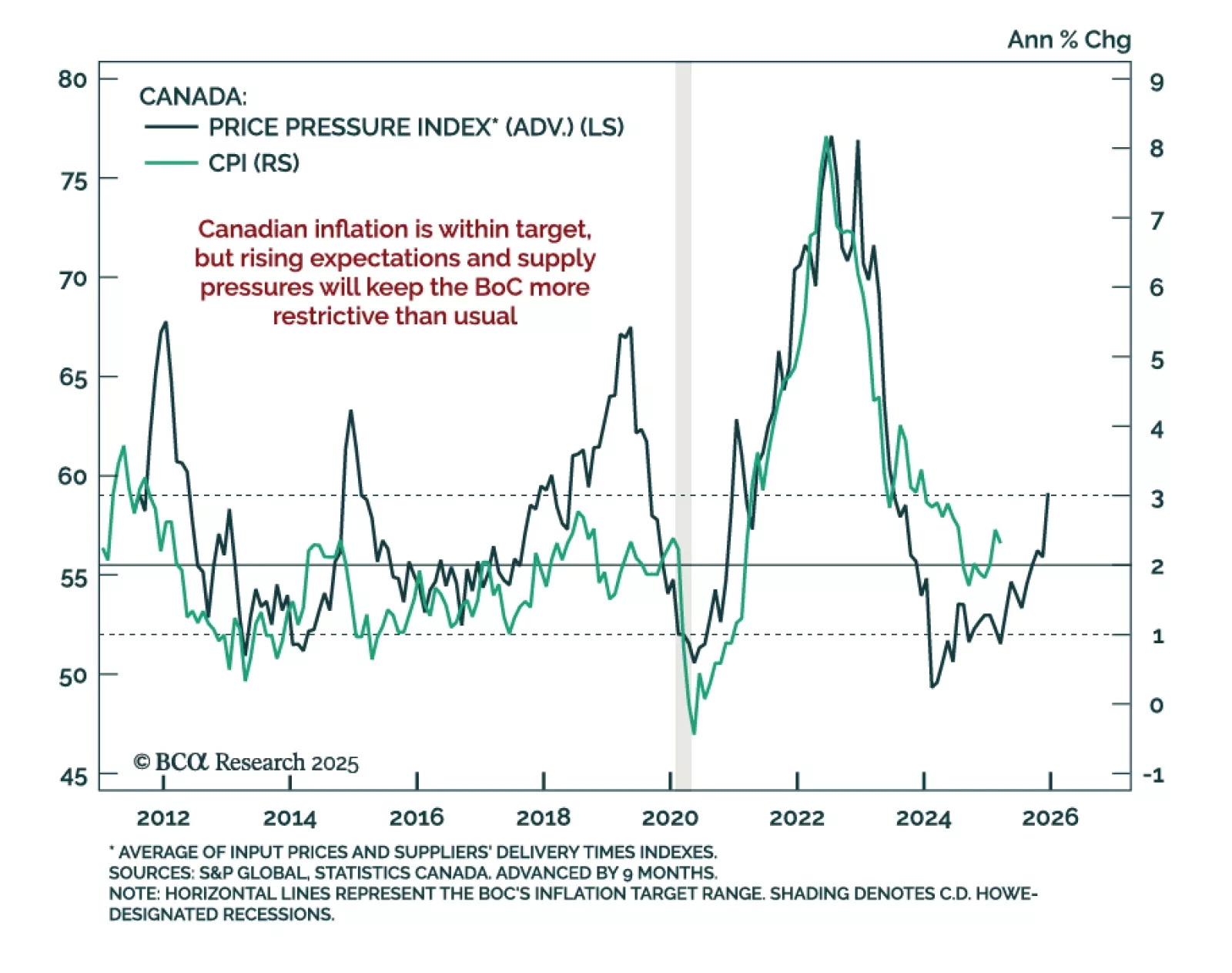

Cooler inflation will not shift the BoC’s stance, as stagflation limits potential easing, keeping us neutral on Canadian bonds. In March, headline CPI slowed more than expected to 2.3% y/y from 2.6%. However, lower energy prices…

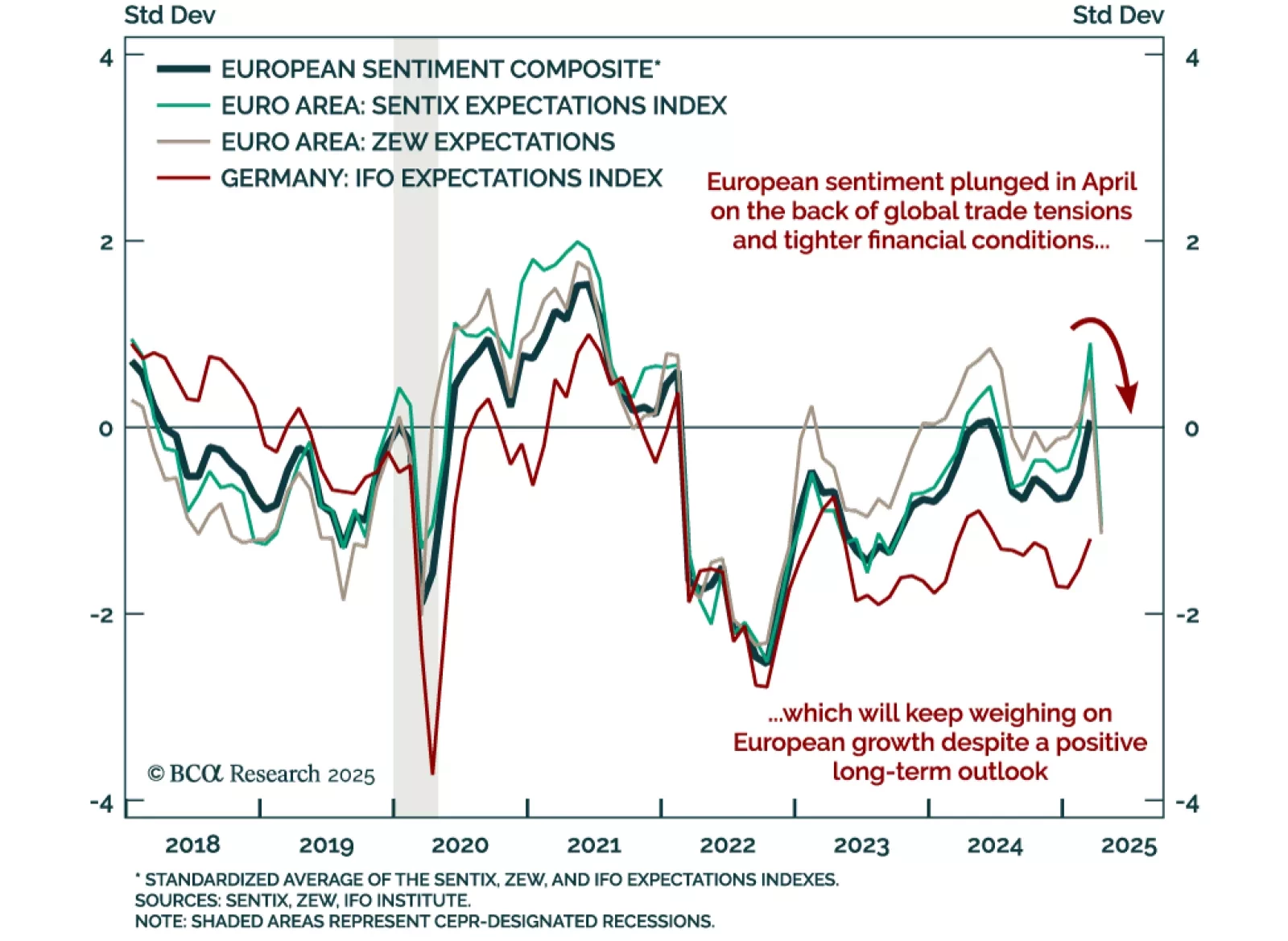

Eurozone sentiment has sharply deteriorated, reinforcing a cautious stance on European assets over the next 6 to 12 months. The April ZEW expectations index for the eurozone collapsed to -18.5 from 39.8, while Germany’s gauge also…

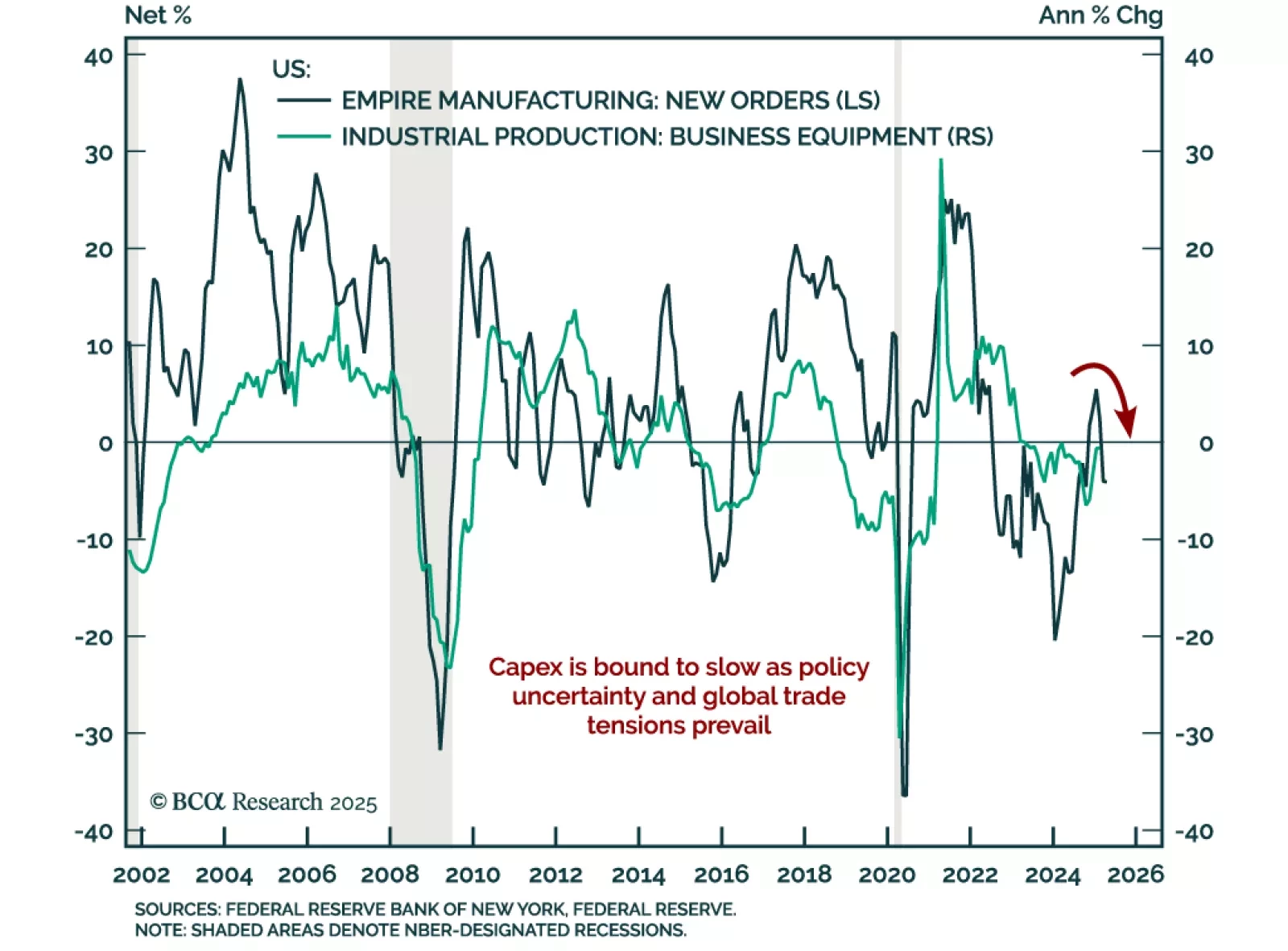

The NY Fed Empire Manufacturing survey adds to recent stagflationary worries, reinforcing our underweight in risk assets and overweight in government bonds. The general business conditions index rose slightly to -8.1 but remains in…