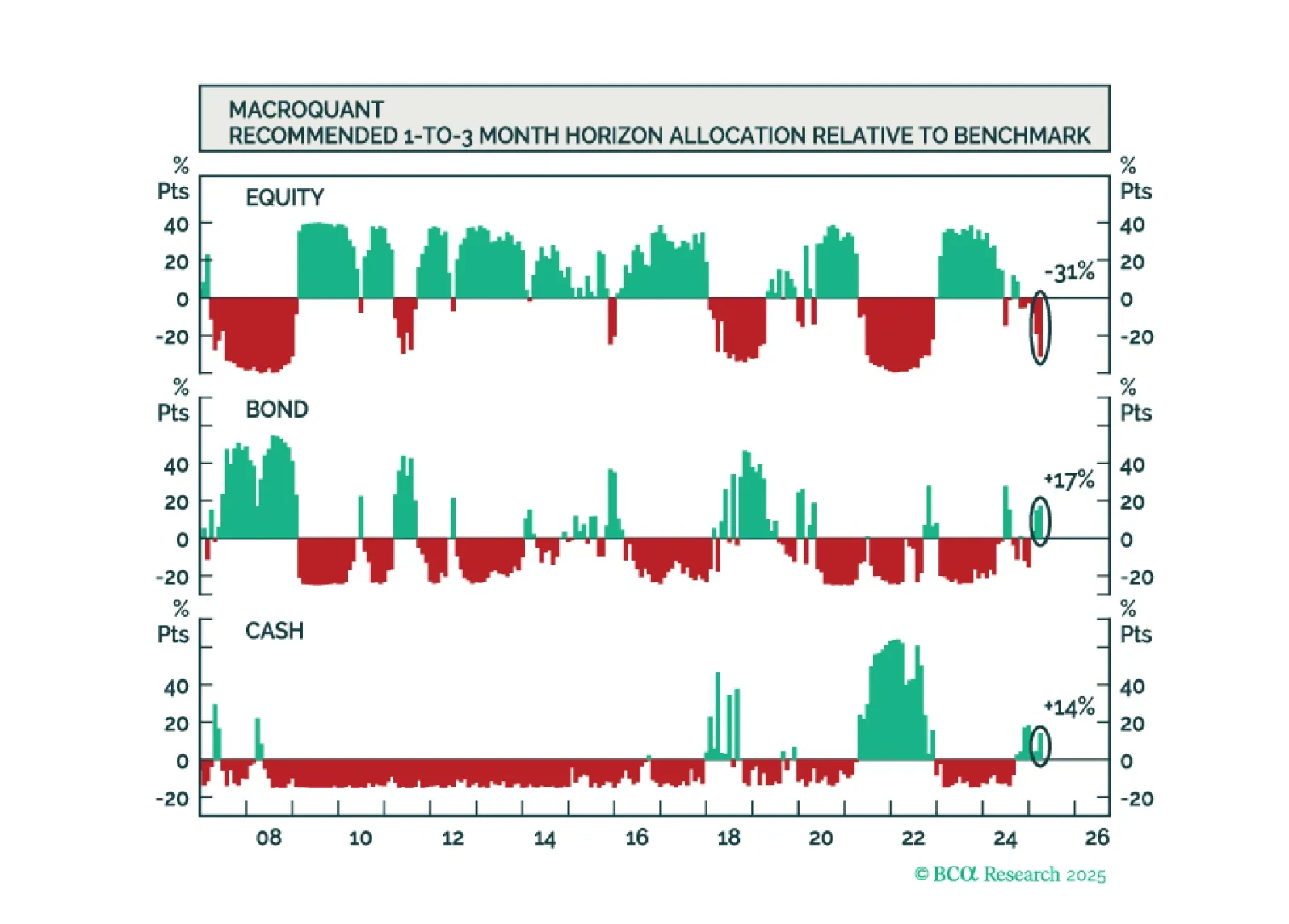

MacroQuant sees the risks to US growth as being to the downside and the risks to inflation as being to the upside. Such a stagflationary brew justifies an underweight on stocks.

MacroQuant sees the risks to US growth as being to the downside and the risks to inflation as being to the upside. Such a stagflationary brew justifies an underweight on stocks.

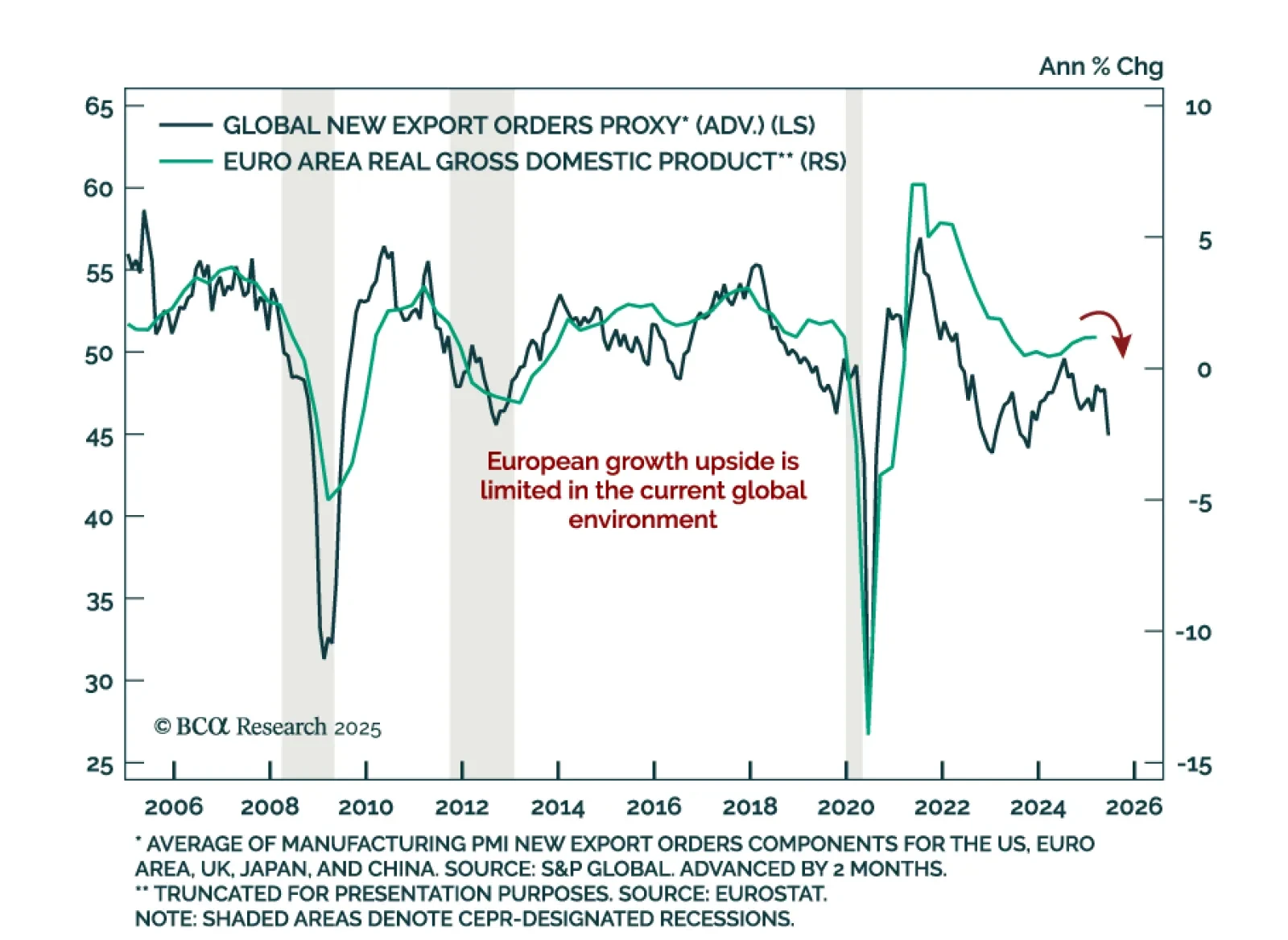

Eurozone GDP beats expectations, but trade distortions and weakening demand momentum support a risk-off Eurozone playbook. Flash Q1 GDP rose 0.4% q/q (1.2% y/y), up from 0.2% in Q4, driven largely by net exports. A key contributor…

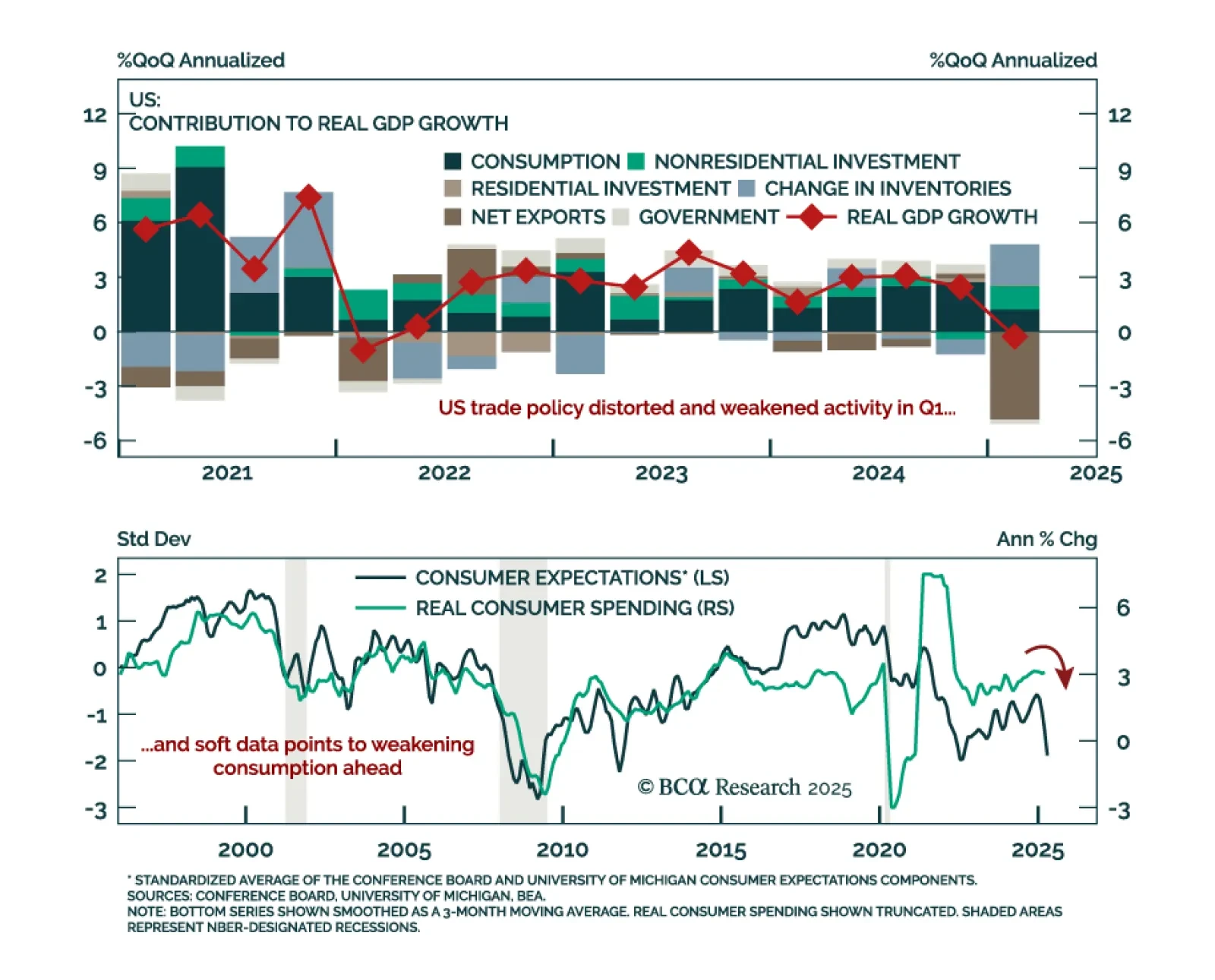

The Q1 US GDP contraction and inflation dynamics reinforce our defensive asset allocation. GDP missed estimates and contracted -0.3% annualized, led by a sharp slowdown in net exports. Consumption slid to 1.8% from 4.0%, reflecting…

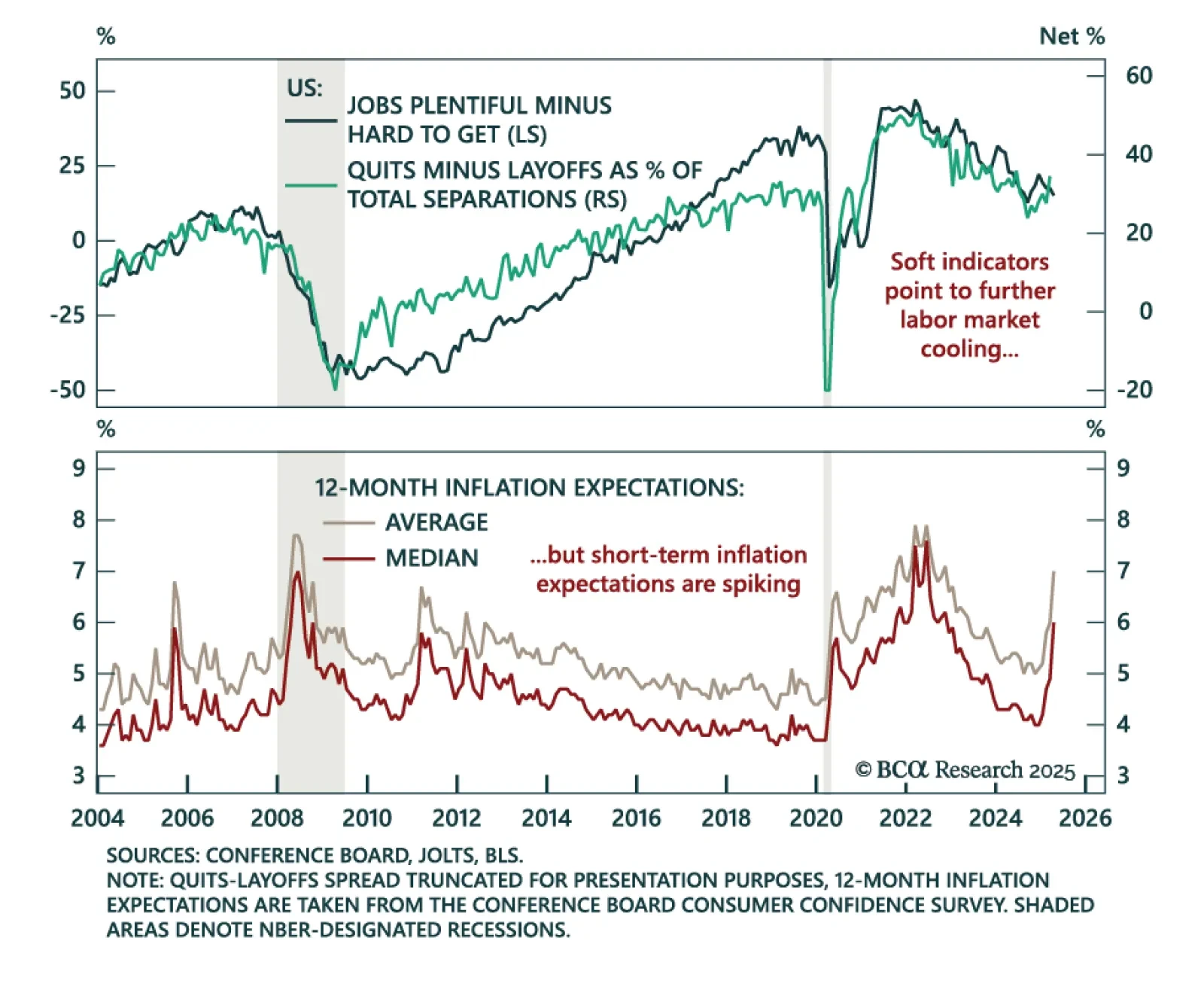

The April Conference Board survey adds to signs of labor market softening, reinforcing our defensive asset allocation. The Consumer Confidence index fell for the fifth consecutive month to 86.0 from 92.9. Expectations plunged to…

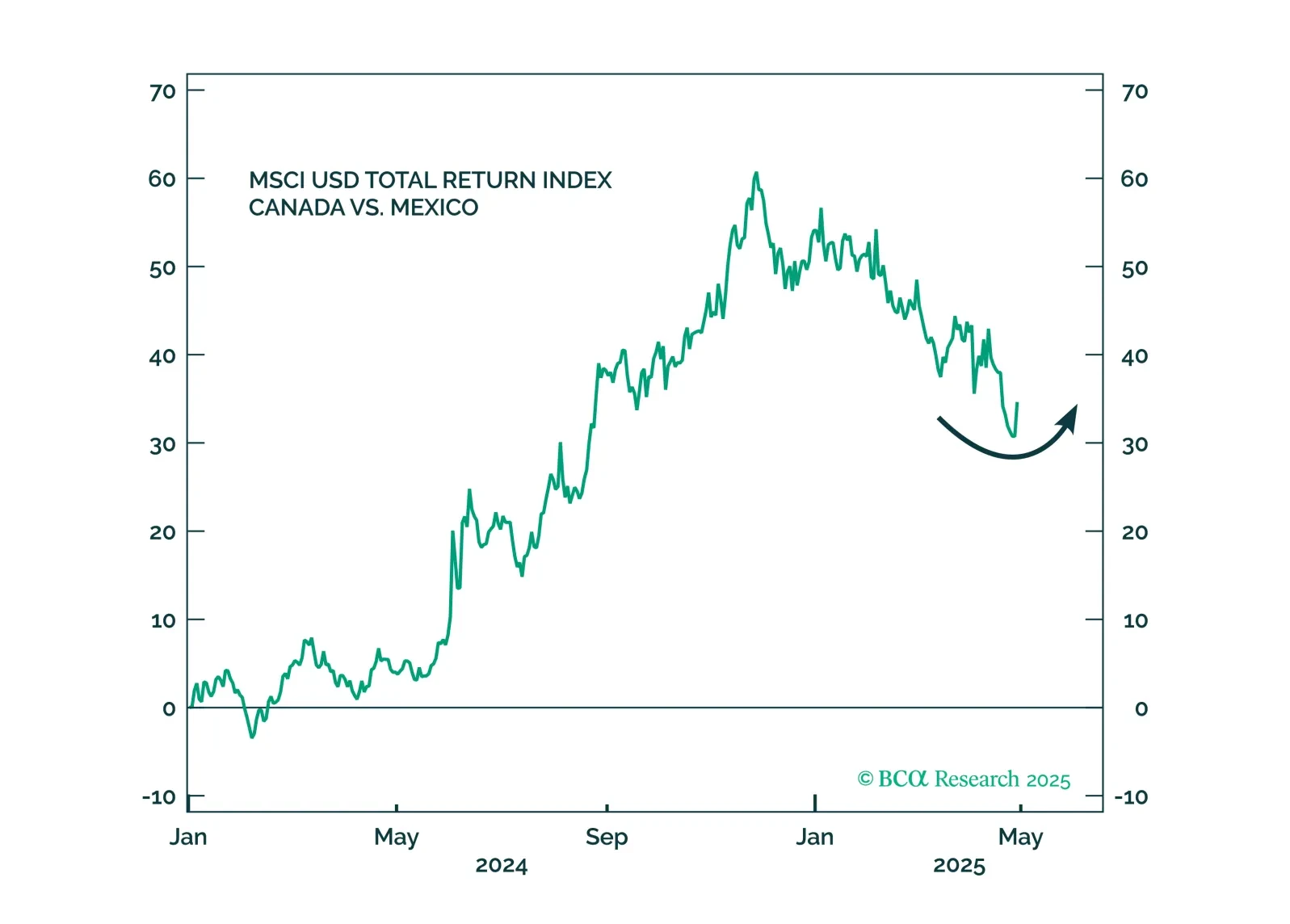

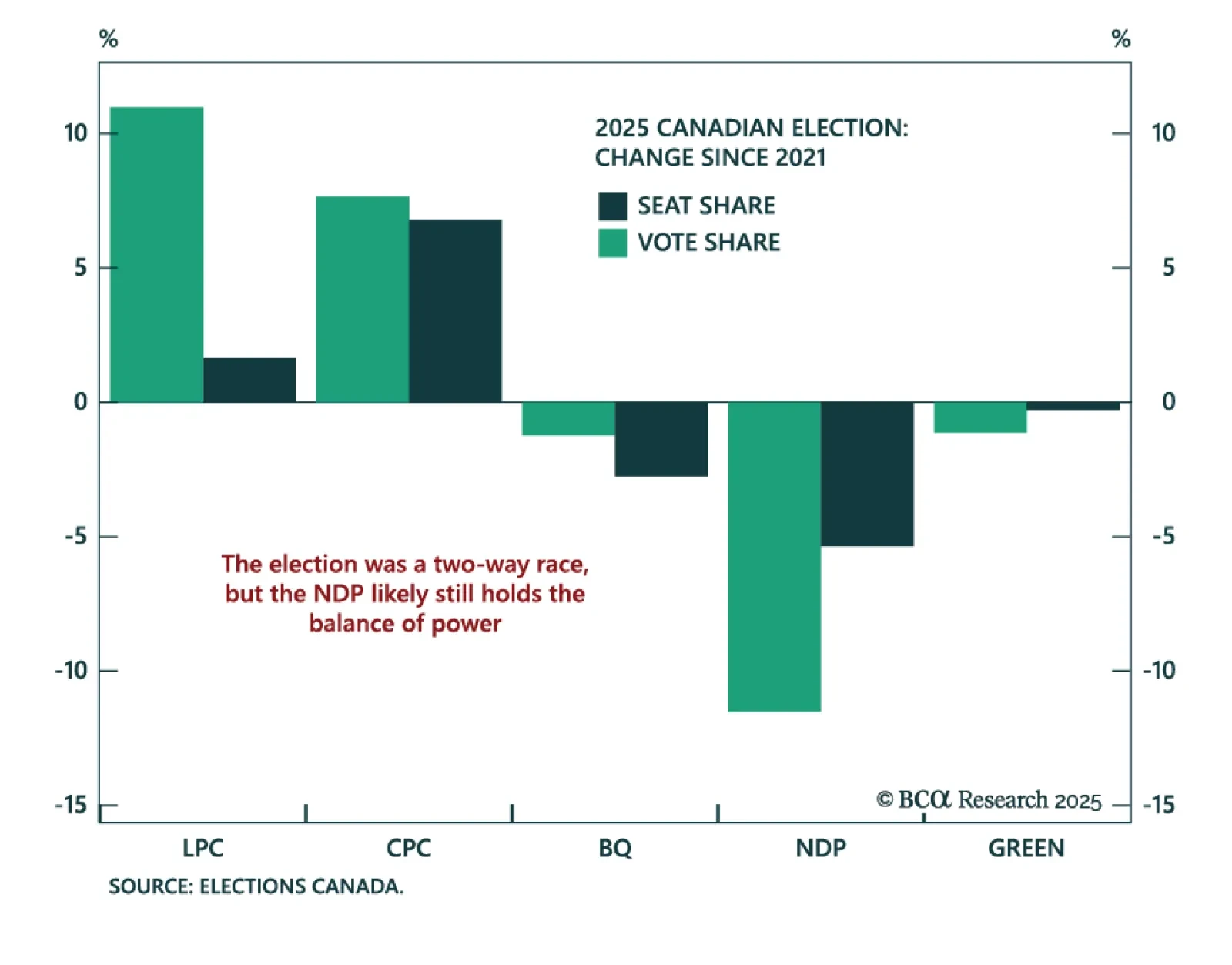

Canada’s election outcome and macro backdrop support our neutral stance on CGBs and long CAD/USD structural positioning. Mark Carney’s Liberals retained power in Monday’s federal election and are likely to form a minority government…

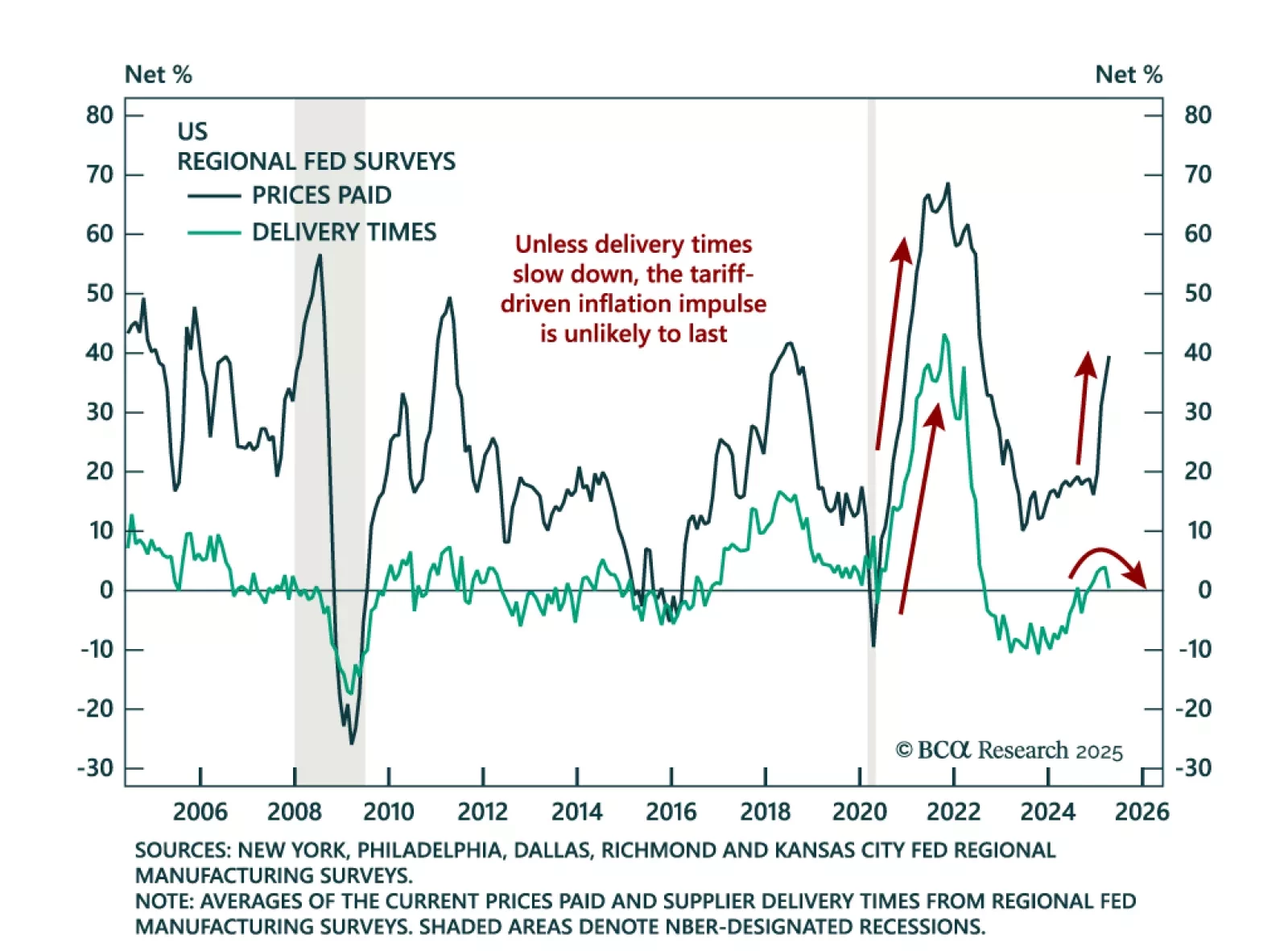

The April Dallas Fed Manufacturing survey adds to recent stagflationary signals, reinforcing our preference for gold over industrial commodities. The index plunged to -35.8 from -16.3 in March, with activity measures deteriorating…

The collapse in soft data points to rising recession risks, but markets are still only priced for a mild slowdown, reinforcing our defensive positioning. As policy uncertainty and market volatility surged, consumers and businesses…

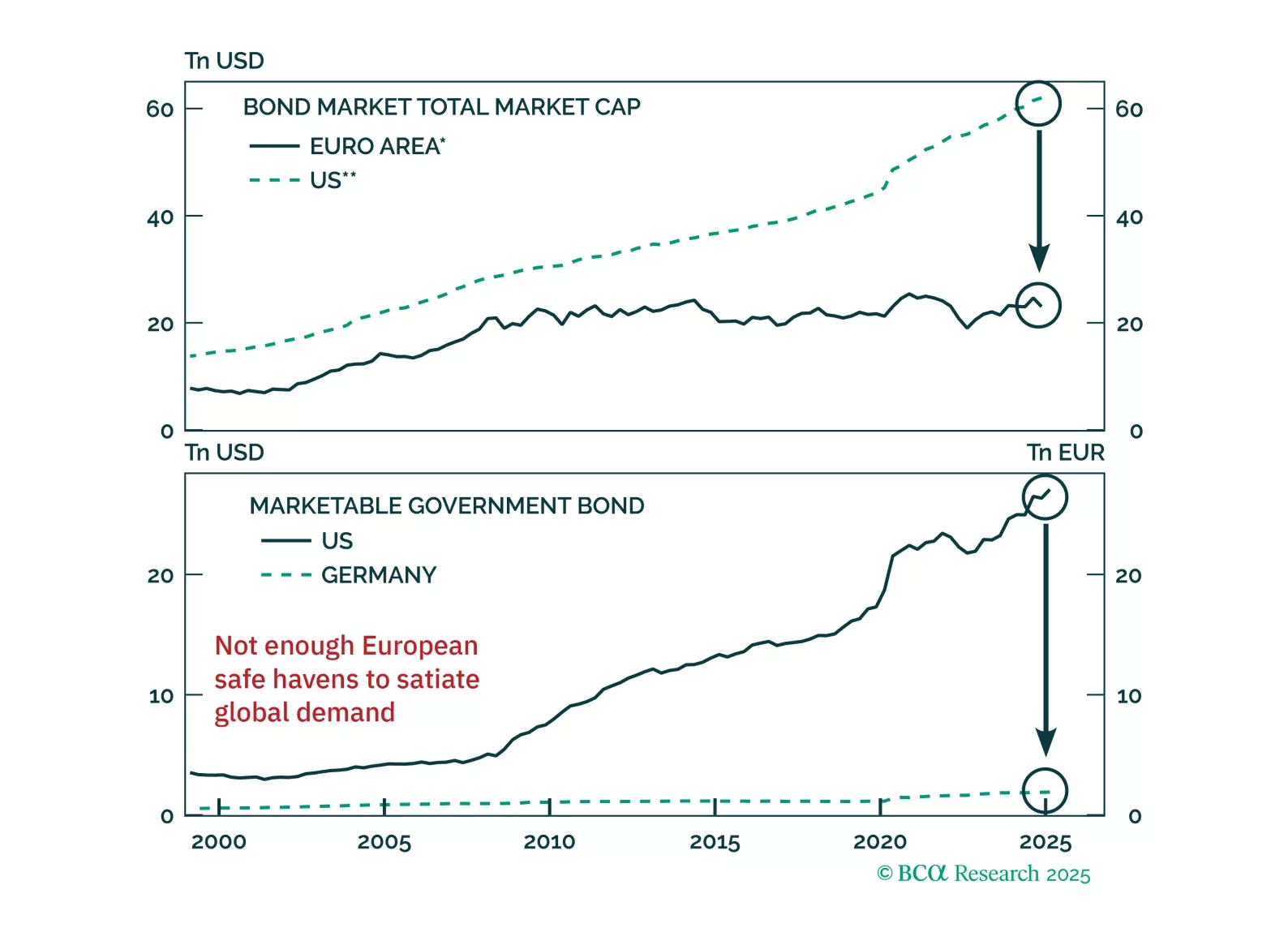

Are bunds the new Treasurys? The euro and German debt are gaining favor as safe havens, but markets may be overplaying the shift. Our latest report dissects what's durable, what's not, and how to trade the dislocation.