Negotiations on trade, Iran, and Ukraine will prove critical this month. Markets will remain volatile because positive data surprises enable the White House to press its hawkish tariff hikes, while negative surprises force the White…

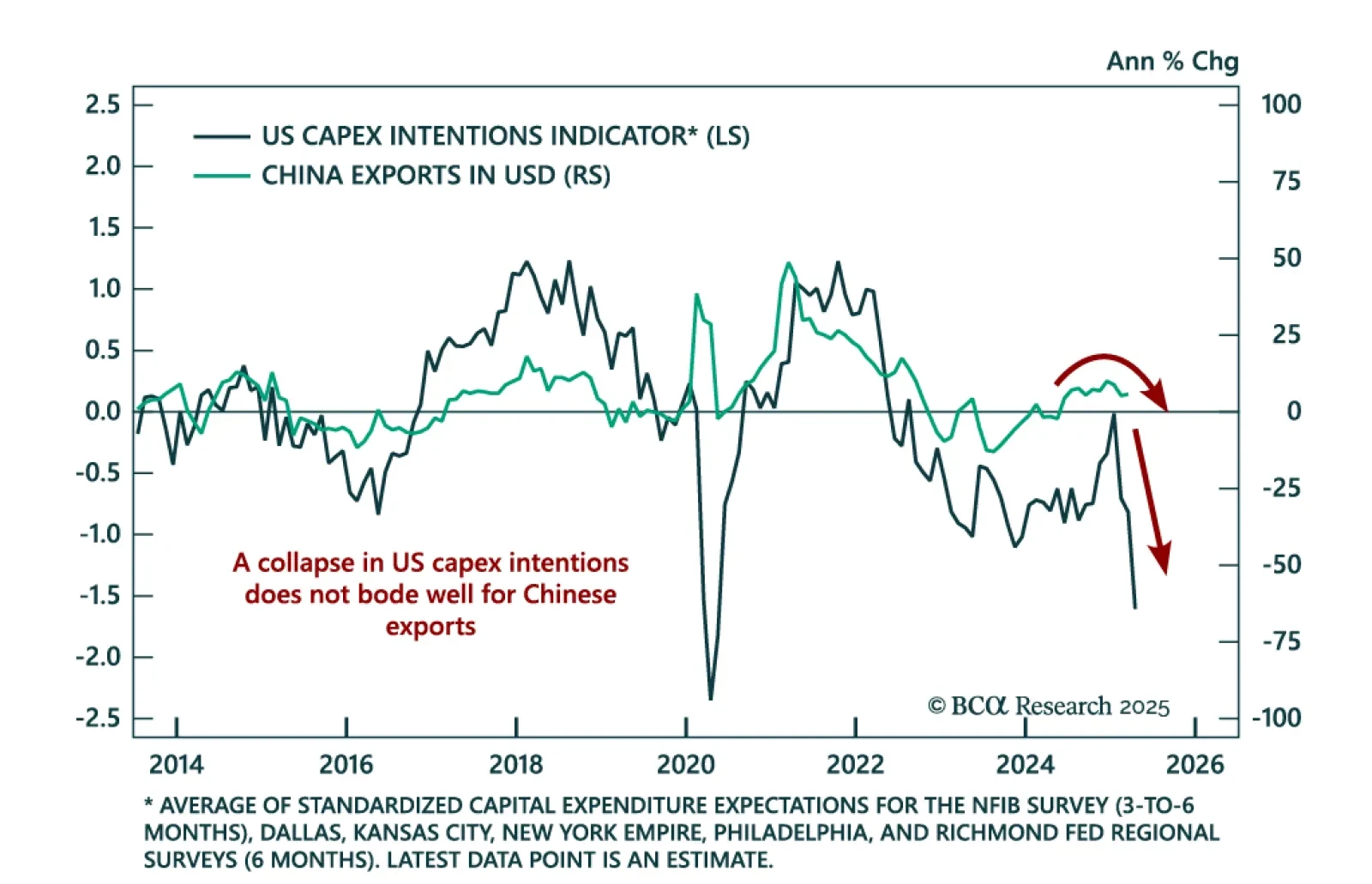

BCA’s China Investment Strategists remain defensive as China’s growth outlook is still weak. Even if some US tariff rates are rolled back, export headwinds and lagging stimulus will continue to weigh on Chinese equities. The…

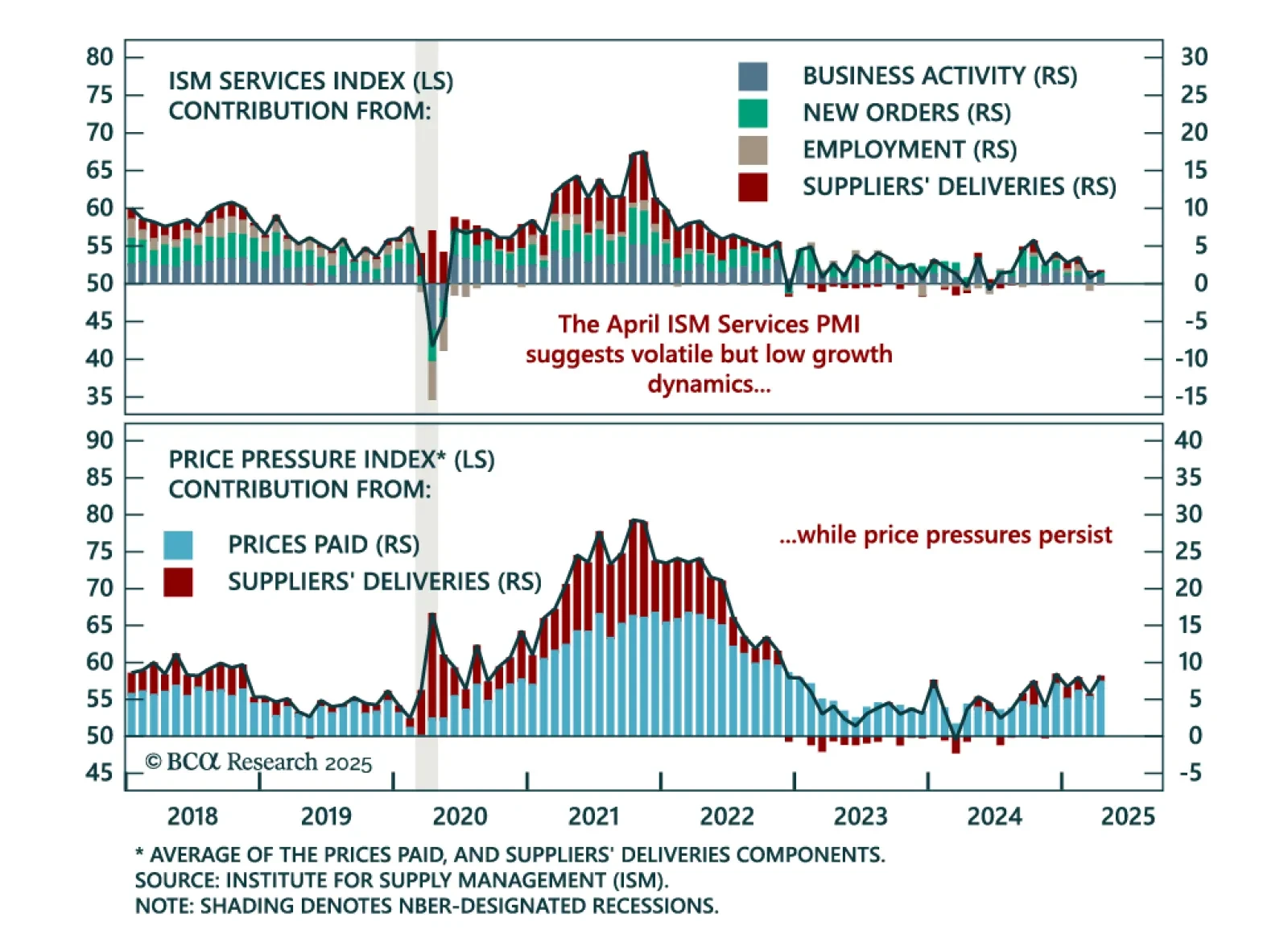

April’s ISM Services upside surprise does not shift our defensive stance, as its components show mixed momentum and rising price pressures. The headline index beat estimates, rising to 51.6 from 50.8. Business activity and new orders…

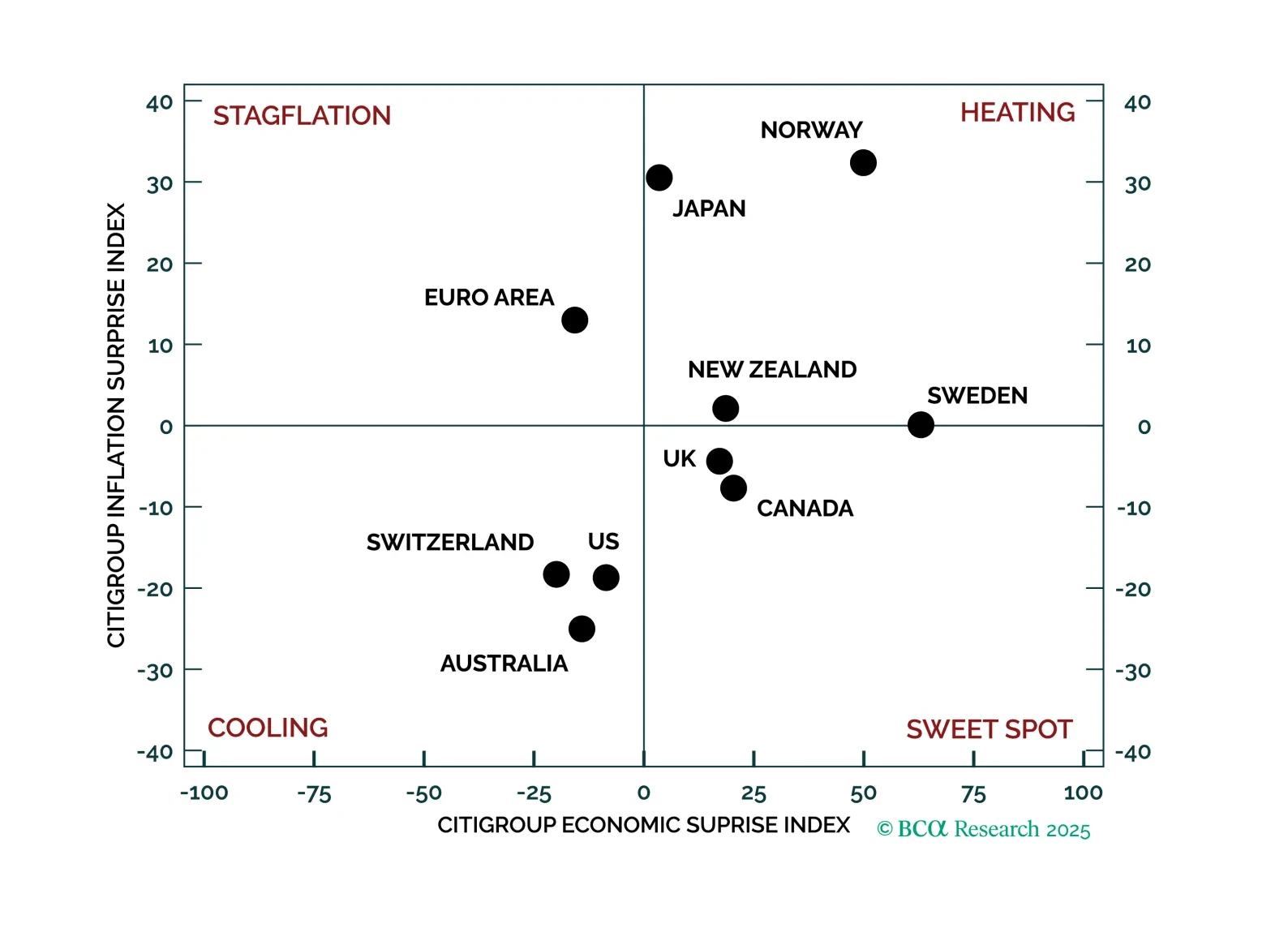

We apply our systematic approach to investing based on economic, inflation, and monetary policy surprises to the major global bond markets. The economic regimes defined by the current macro-surprises setup confirm our existing fixed-…

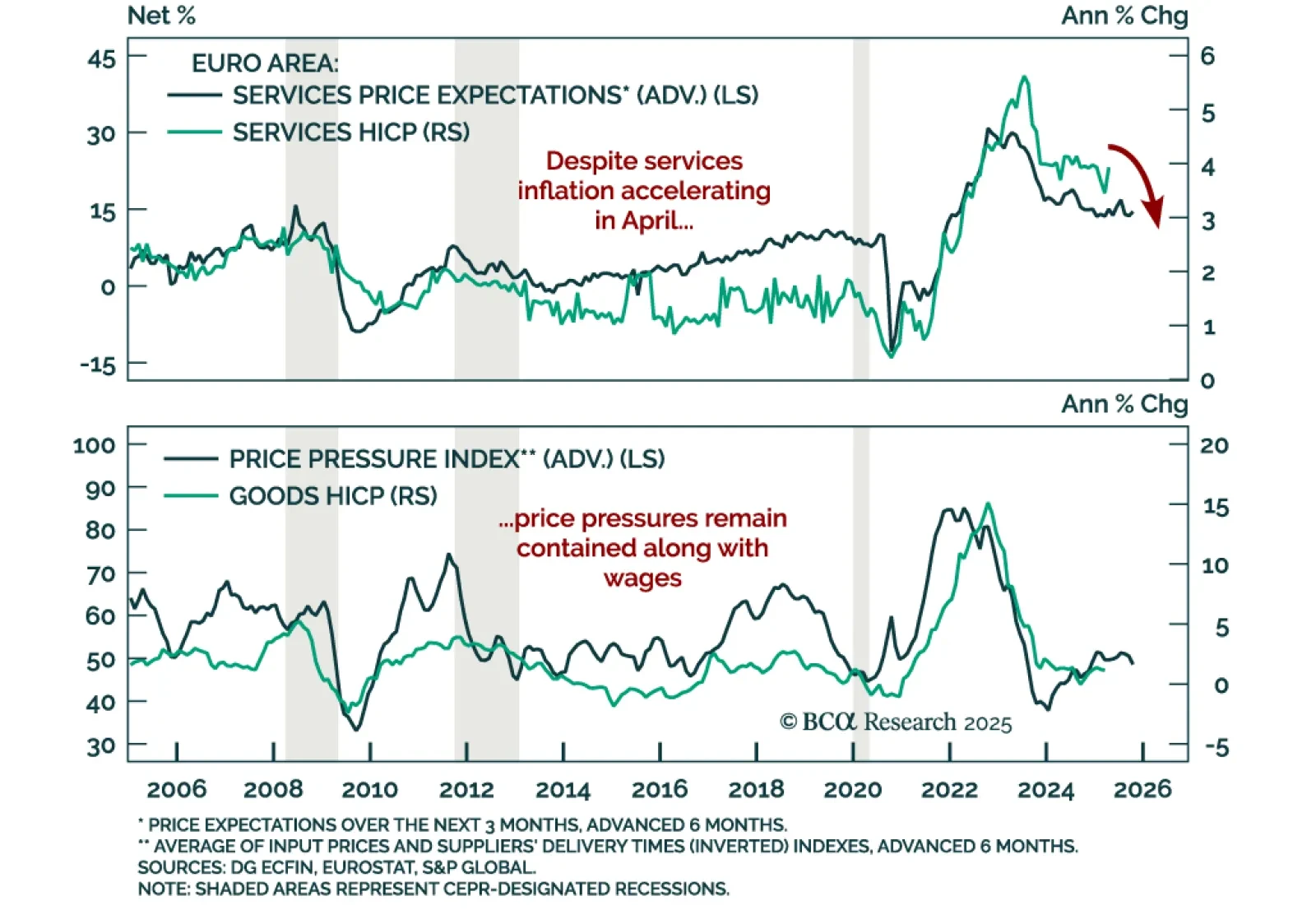

April’s Eurozone inflation data supports BCA’s bullish Bund stance and cautious view on EUR/USD. Headline HICP inflation held steady at 2.2% y/y while core ticked up to 2.7% from 2.4%. Services inflation rebounded to 3.9%,…

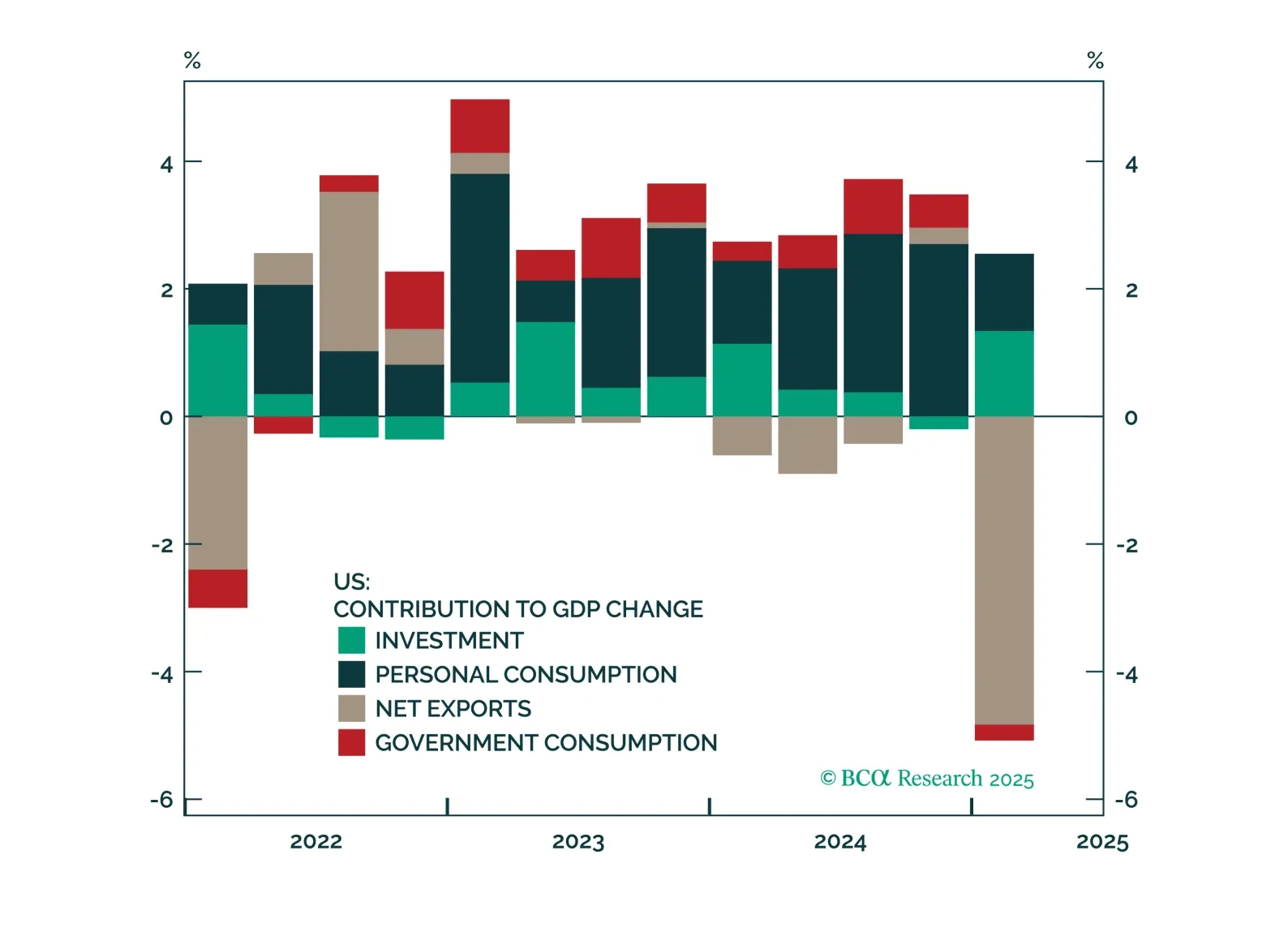

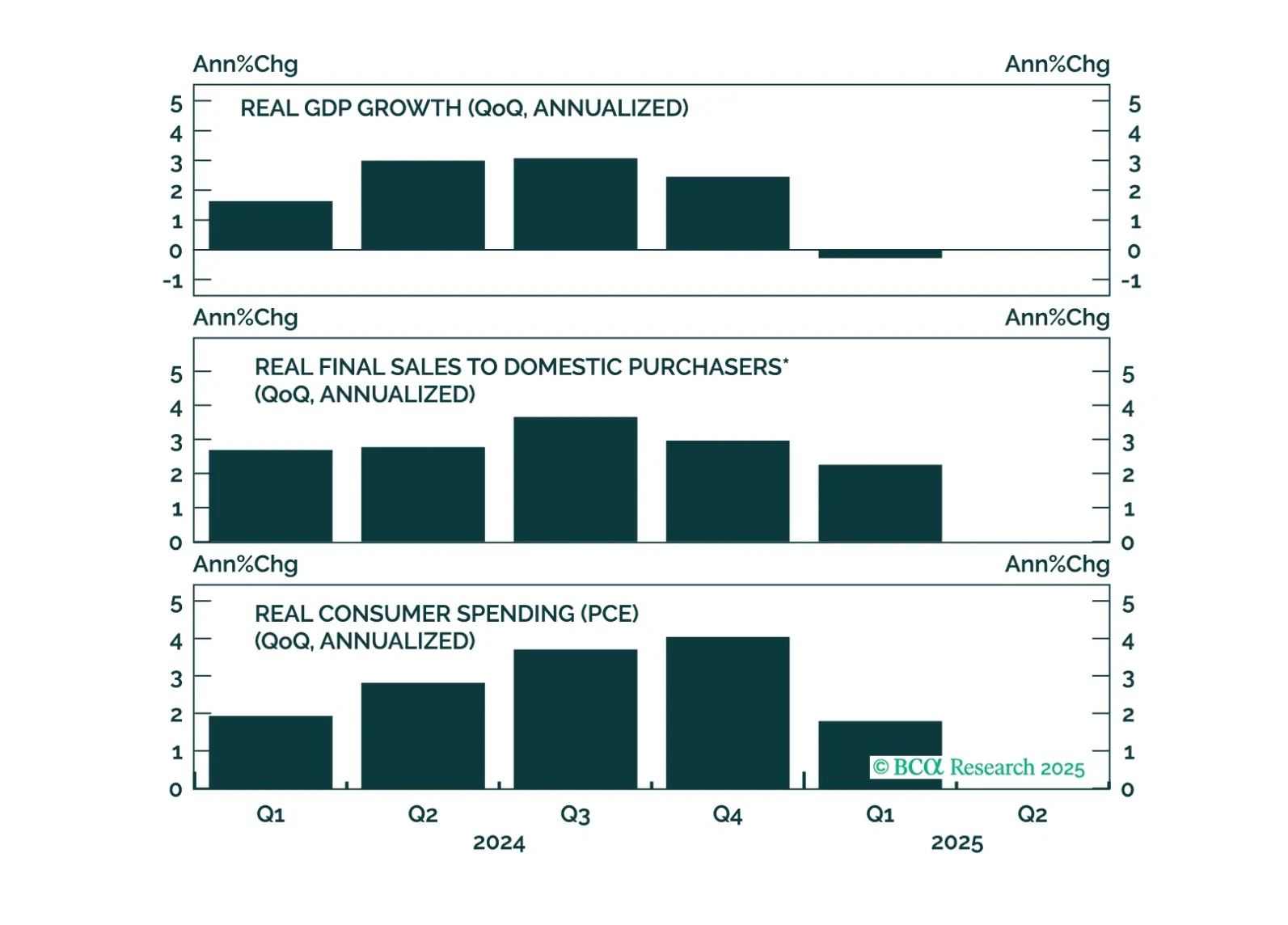

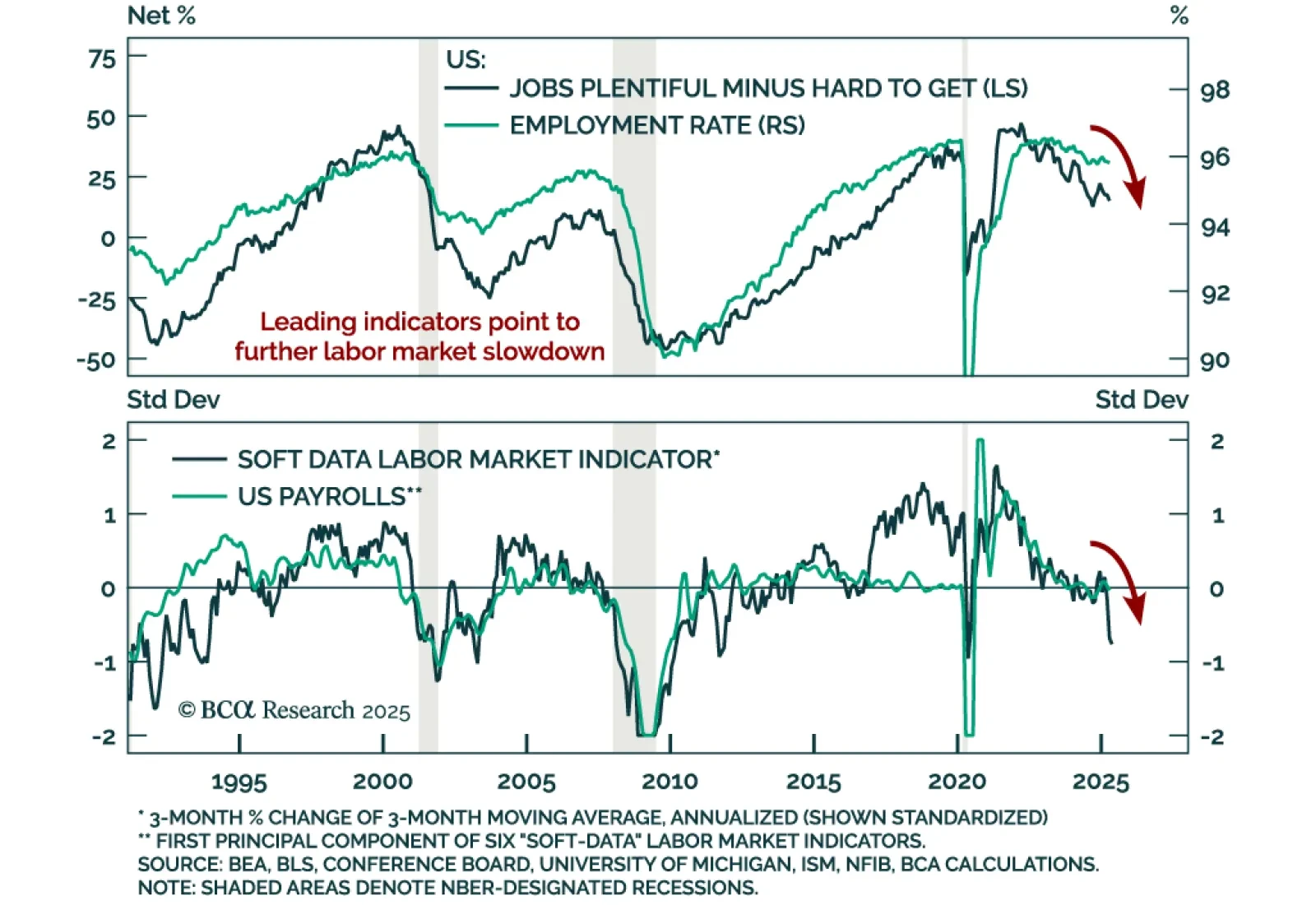

April’s stronger-than-expected US jobs report eased recession concerns, but underlying trends support our defensive positioning. Nonfarm payrolls rose 177k, but downward revisions to prior months totaled 58k, leaving the three-…

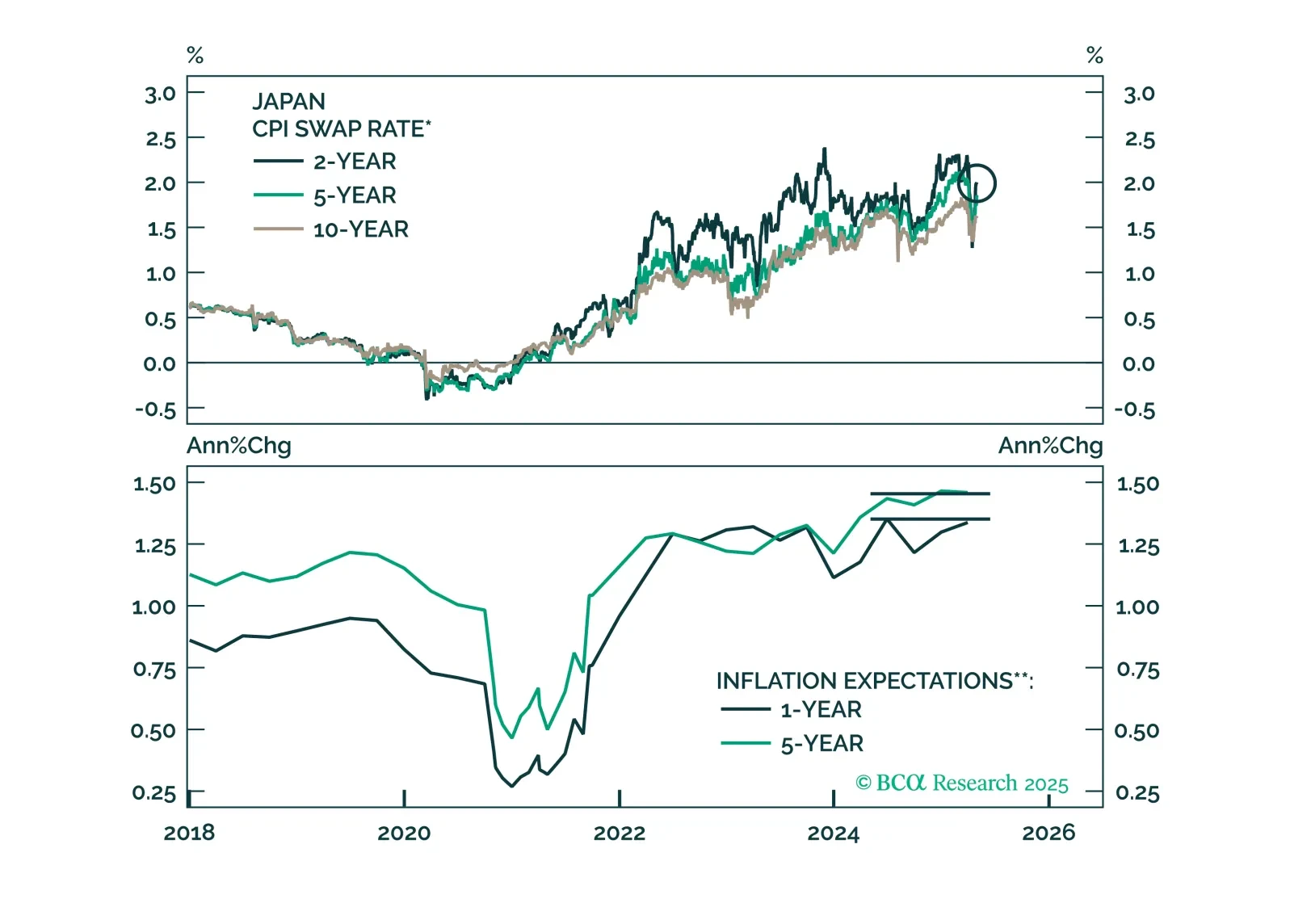

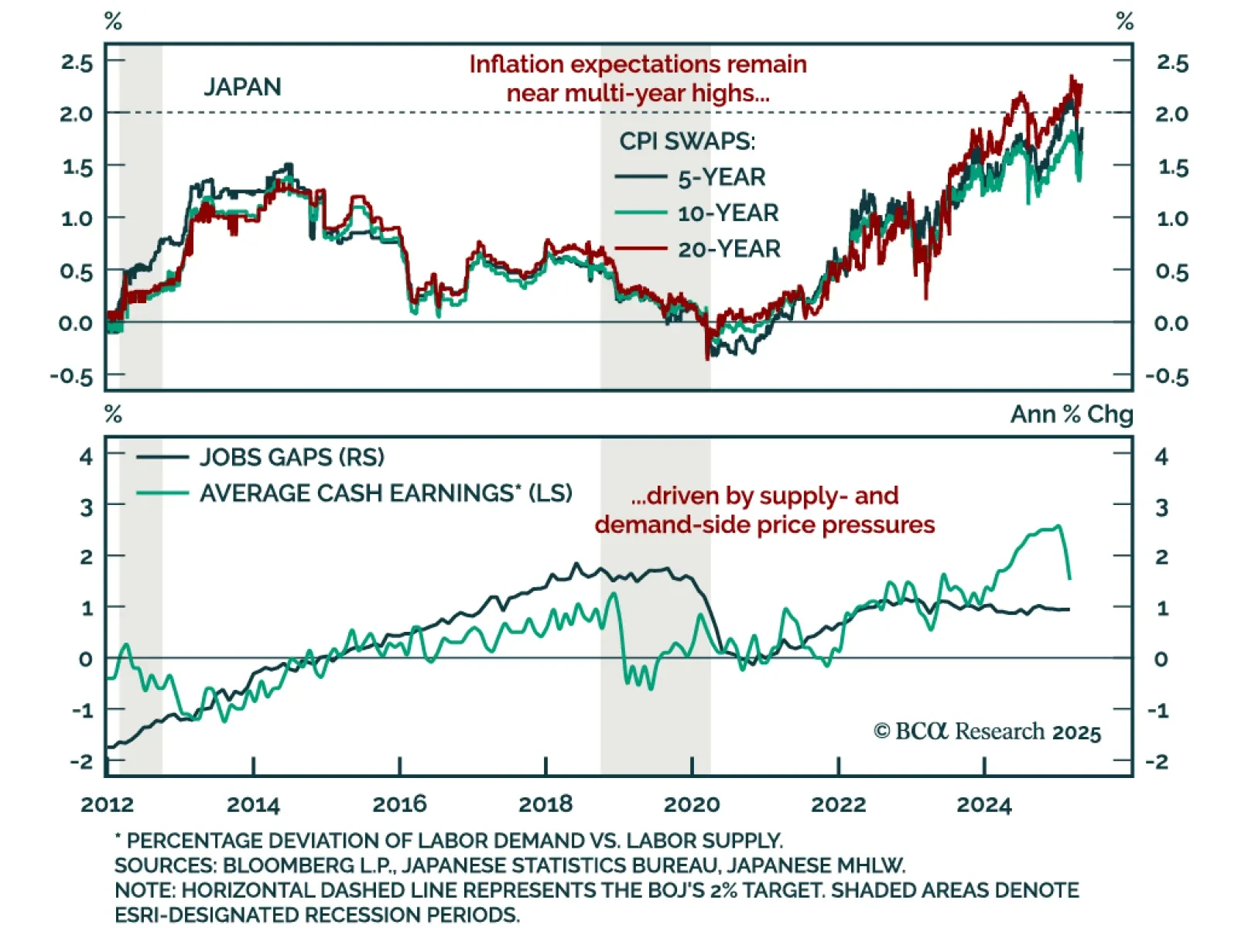

The Bank of Japan’s dovish hold does not contradict BCA’s underweight JGBs and long JPY recommendations. The BoJ left its policy rate unchanged at 0.5% for a second meeting, but slashed its GDP and inflation forecasts for 2025 and…

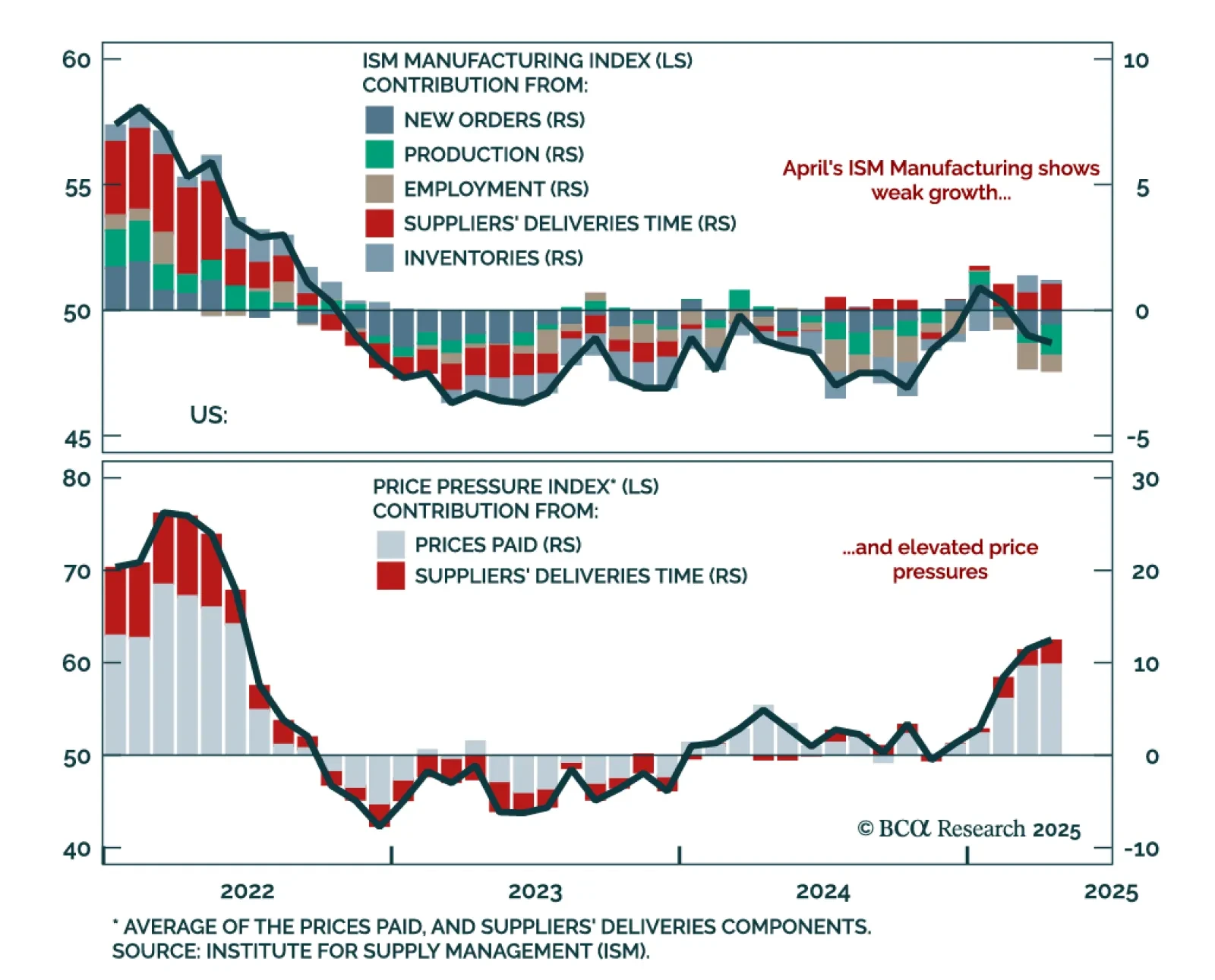

The April ISM Manufacturing adds to recession risks: Collapsing export orders and weak domestic momentum reinforce our defensive positioning. The index slipped to 48.7 from 49.0, with new orders still contracting and new export…

This week’s report looks at Japan, with the recent BoJ meeting. While a trade war has injected uncertainty into the Japanese economy, our conviction remains high that JGBs will underperform other government bond markets, and the yen…

This year’s corporate bond sell off has hit high-yield more than investment grade, and high-yield spreads have turned relatively more attractive as a result.