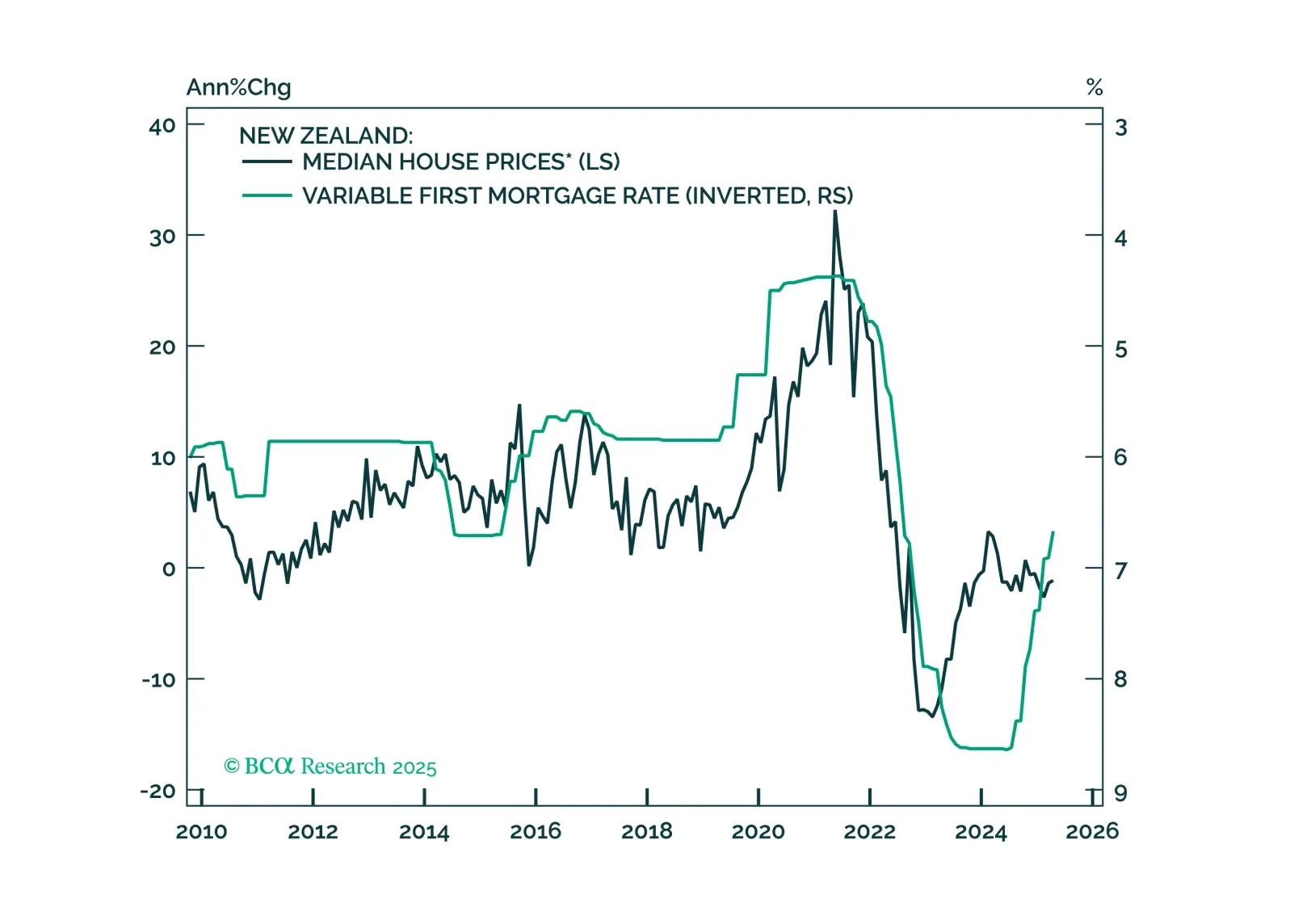

This Insight looks at the implications of the RBNZ’s rate cut on New Zealand assets.

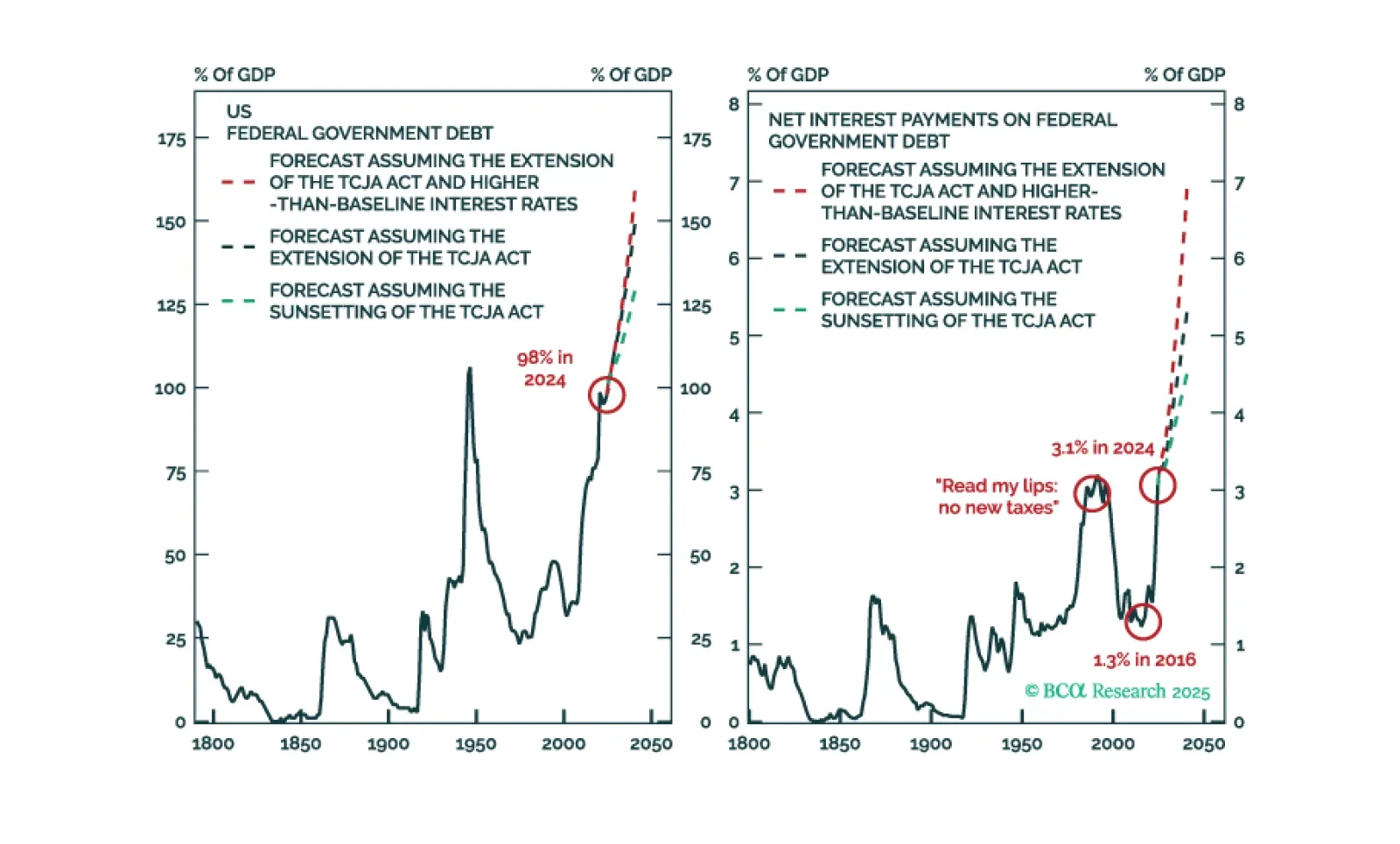

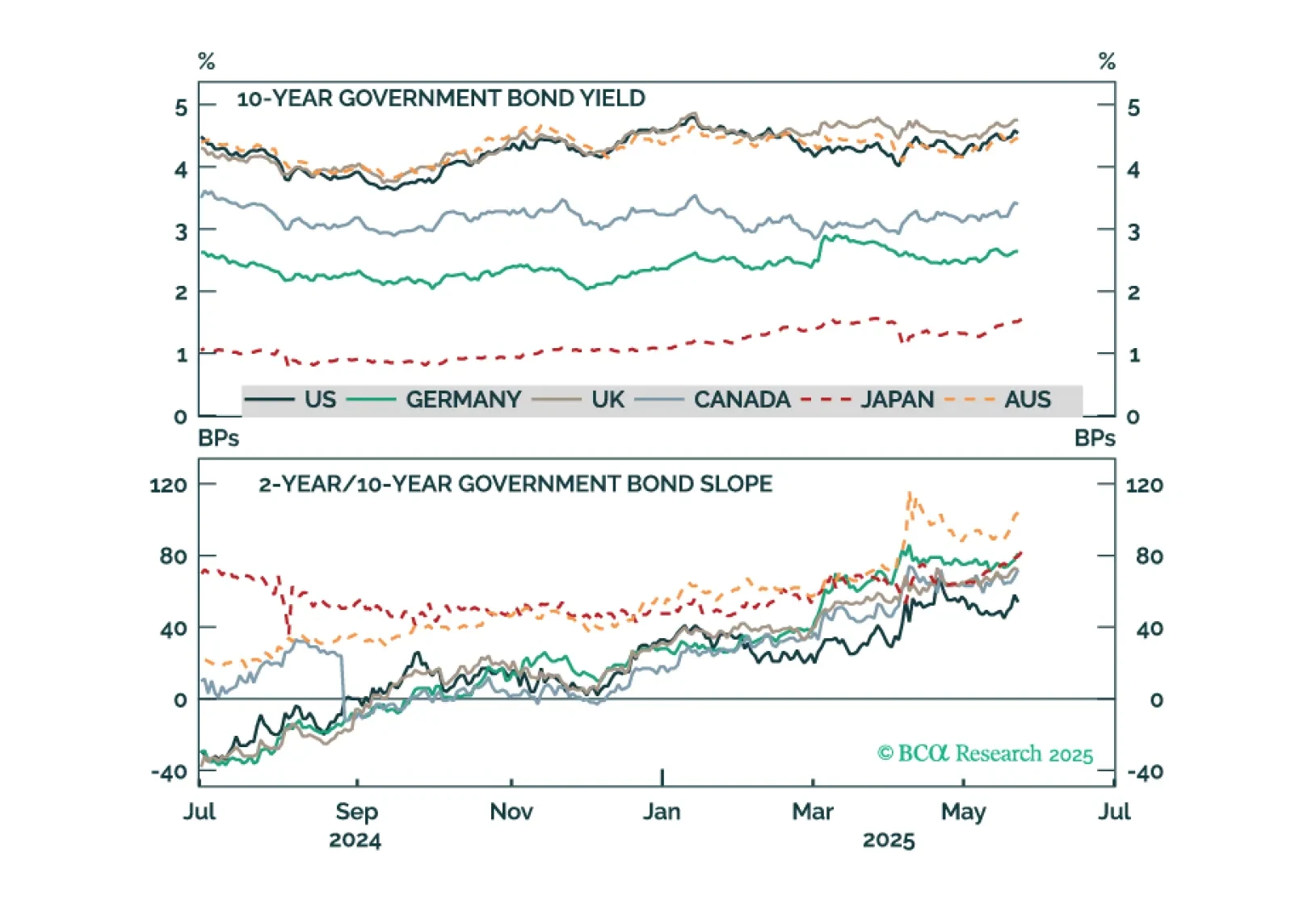

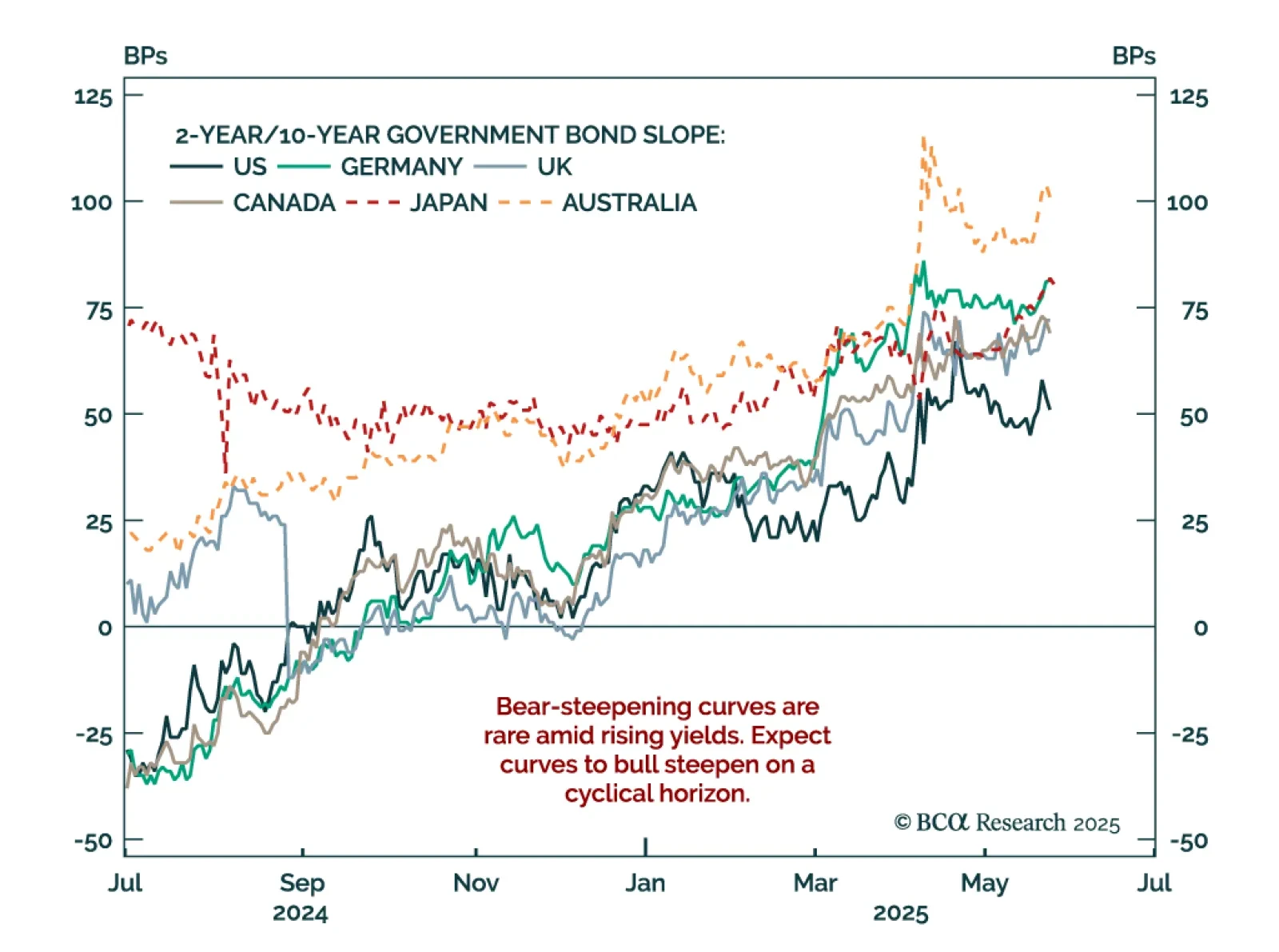

Rising bond yields may present an even greater danger to the global economy than the trade war. With equity valuations no longer discounting much economic risk, investors should position themselves defensively.

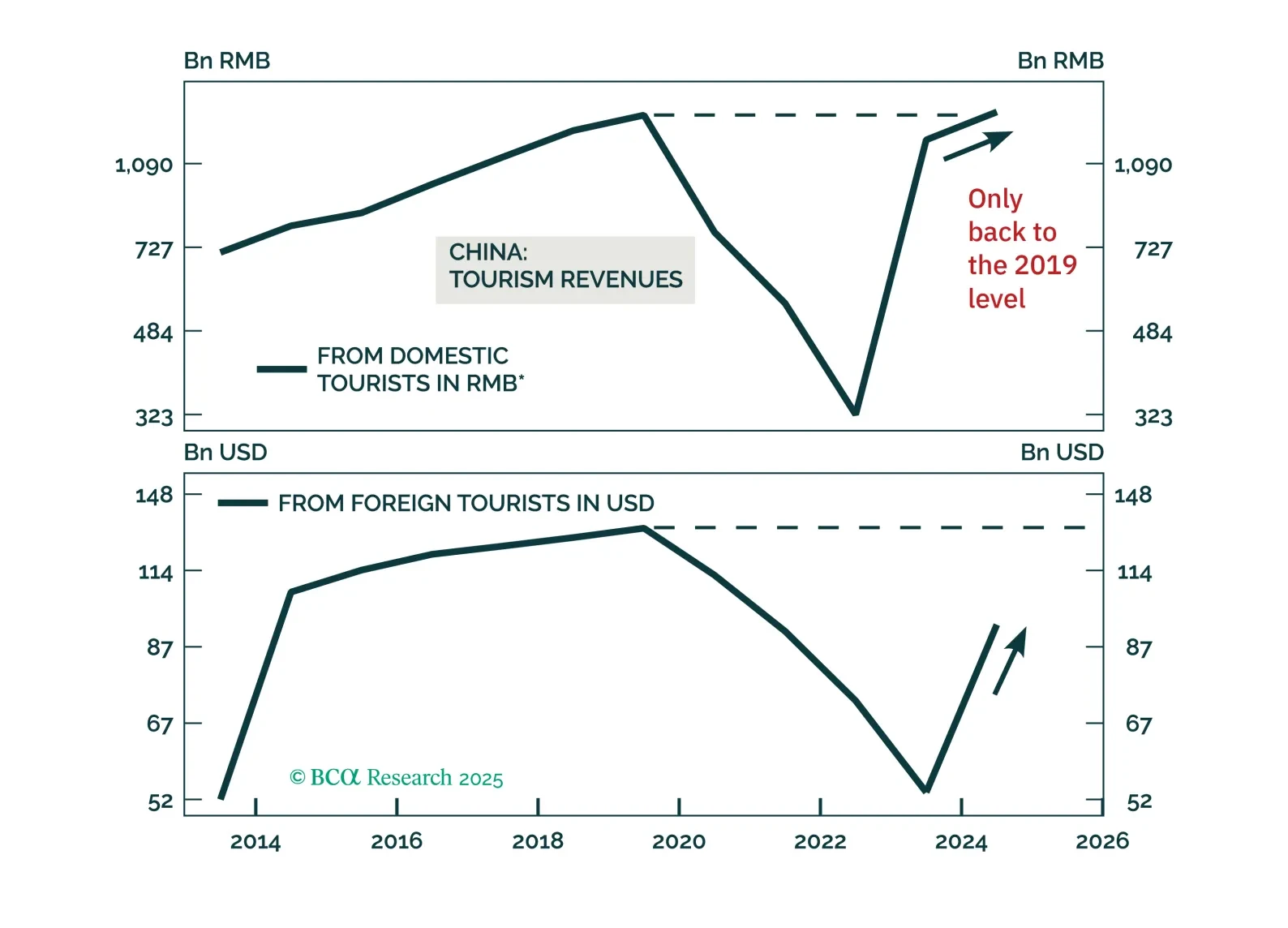

Chinese tourism will continue growing, but investors should be mindful not to overpay for Chinese tourism stocks by extrapolating their past double-digit revenue growth into the future.

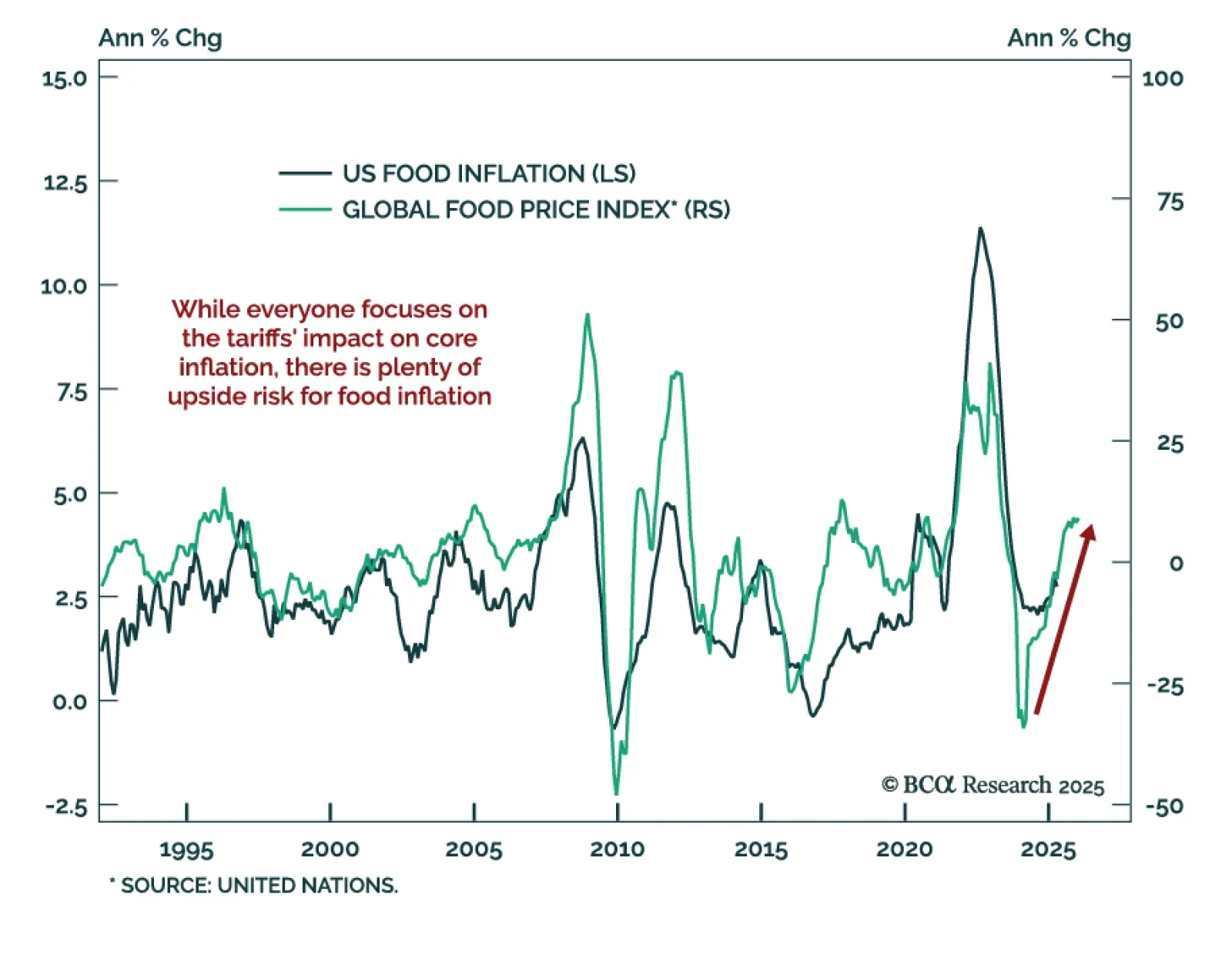

The upward trend in global food prices suggests that food inflation risks re-accelerating in the US. Historically, US food inflation lags the United Nations’ global food price index by about nine months. The annual growth in…

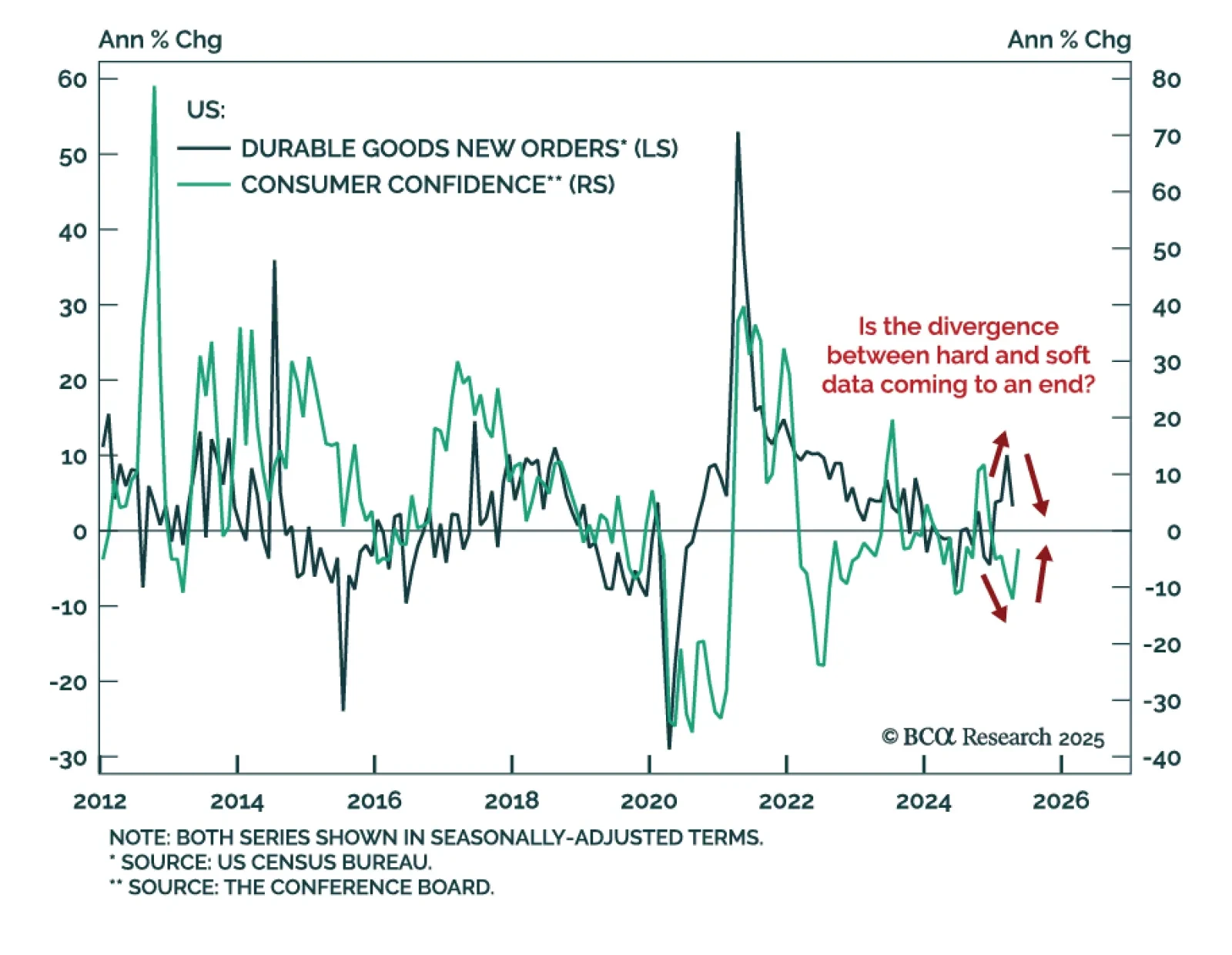

The latest US durable goods orders and consumer confidence figures suggest that hard and soft data are converging, but stocks remain at risk. After months of rising prints, new orders for manufactured goods sank by 6.3% in April…

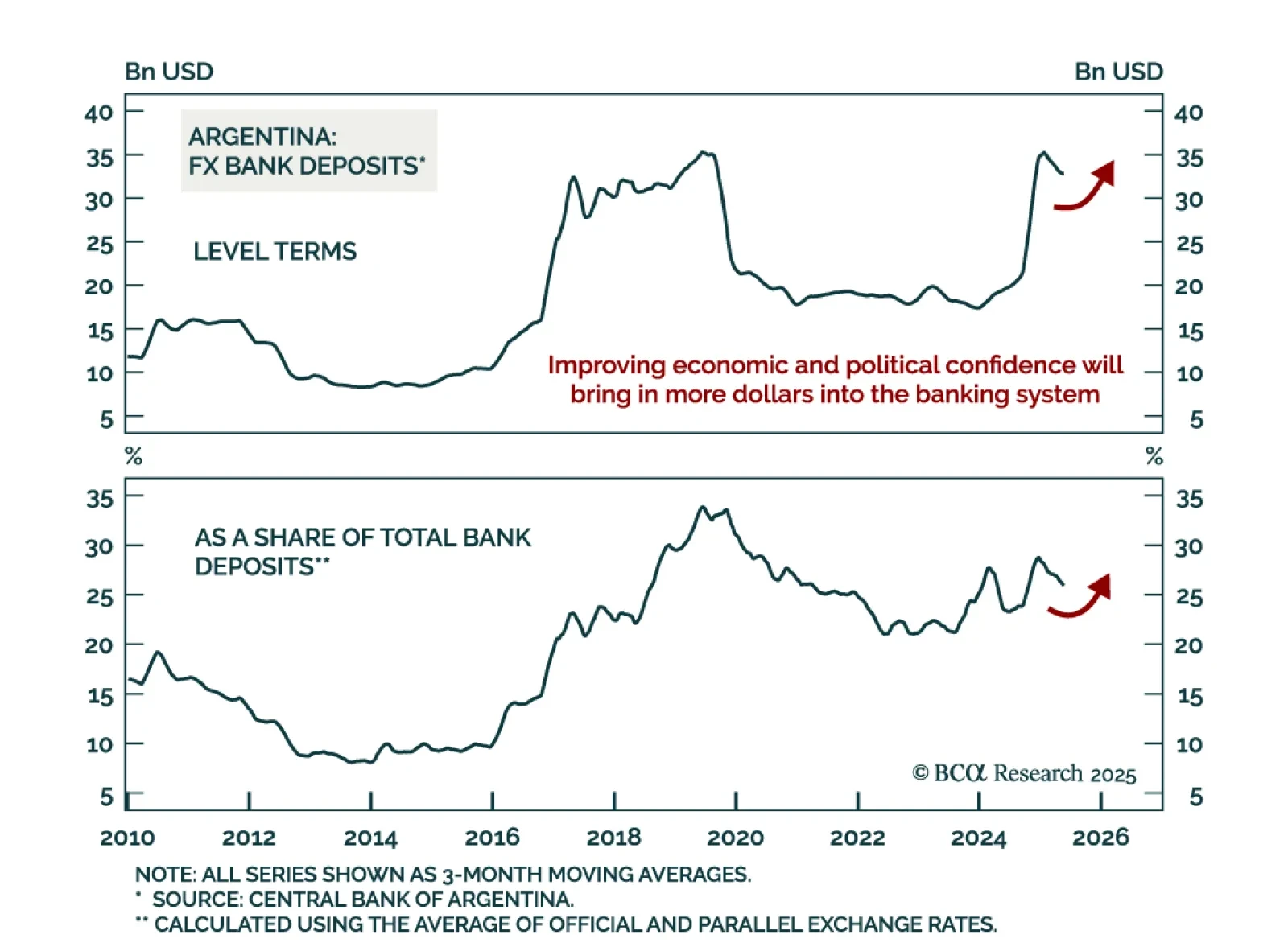

The latest political developments in Argentina increase the odds of further liberalizing reforms and solidify the economy’s structural upside. First, the libertarian governing party came out on top in Buenos Aires’ legislative…

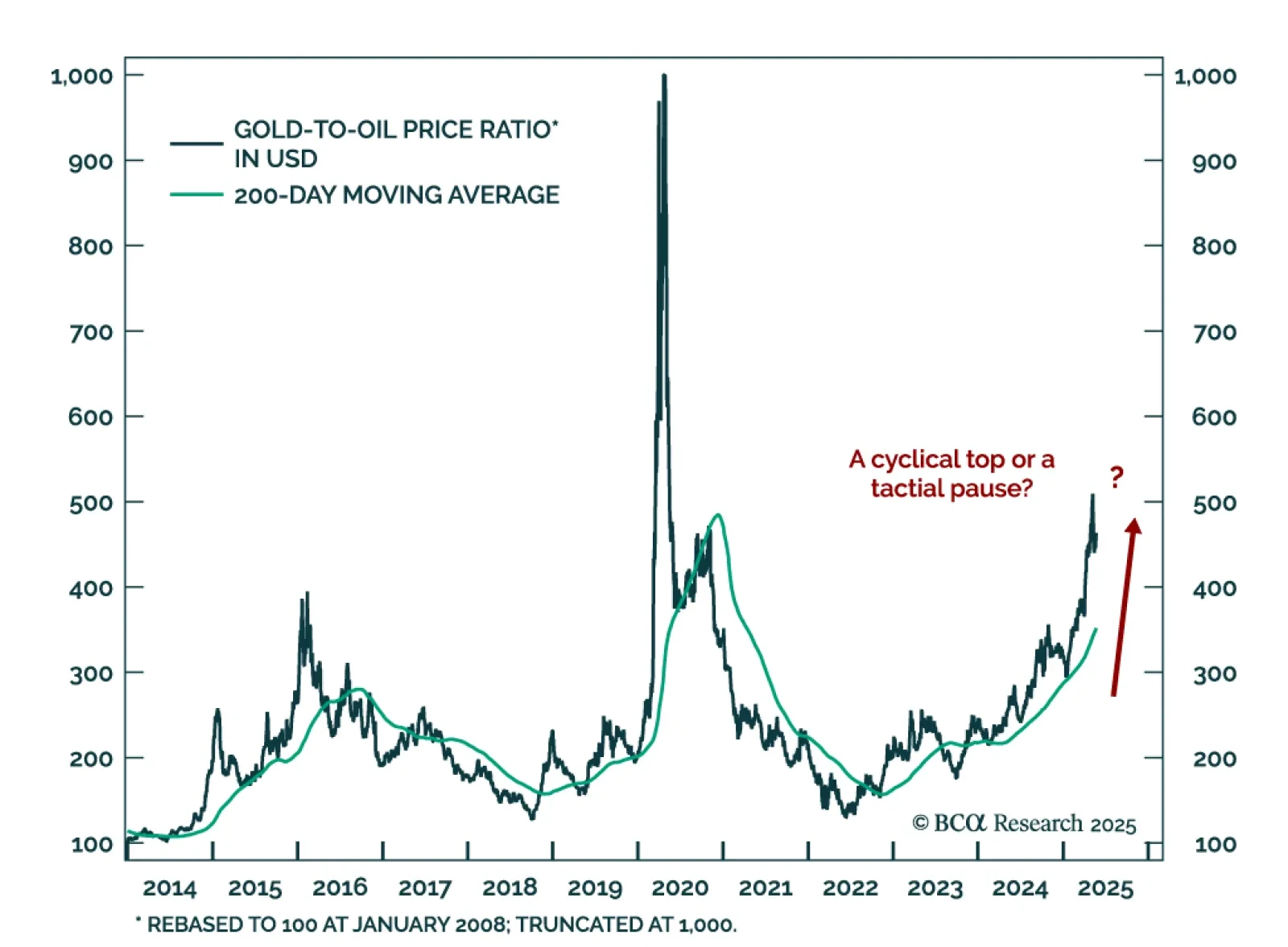

The gold-to-oil price ratio seems tactically overextended, but global macro drivers suggest it will rise further. The gold bull run is still relatively young and not yet stretched compared to rallies from the past 50…

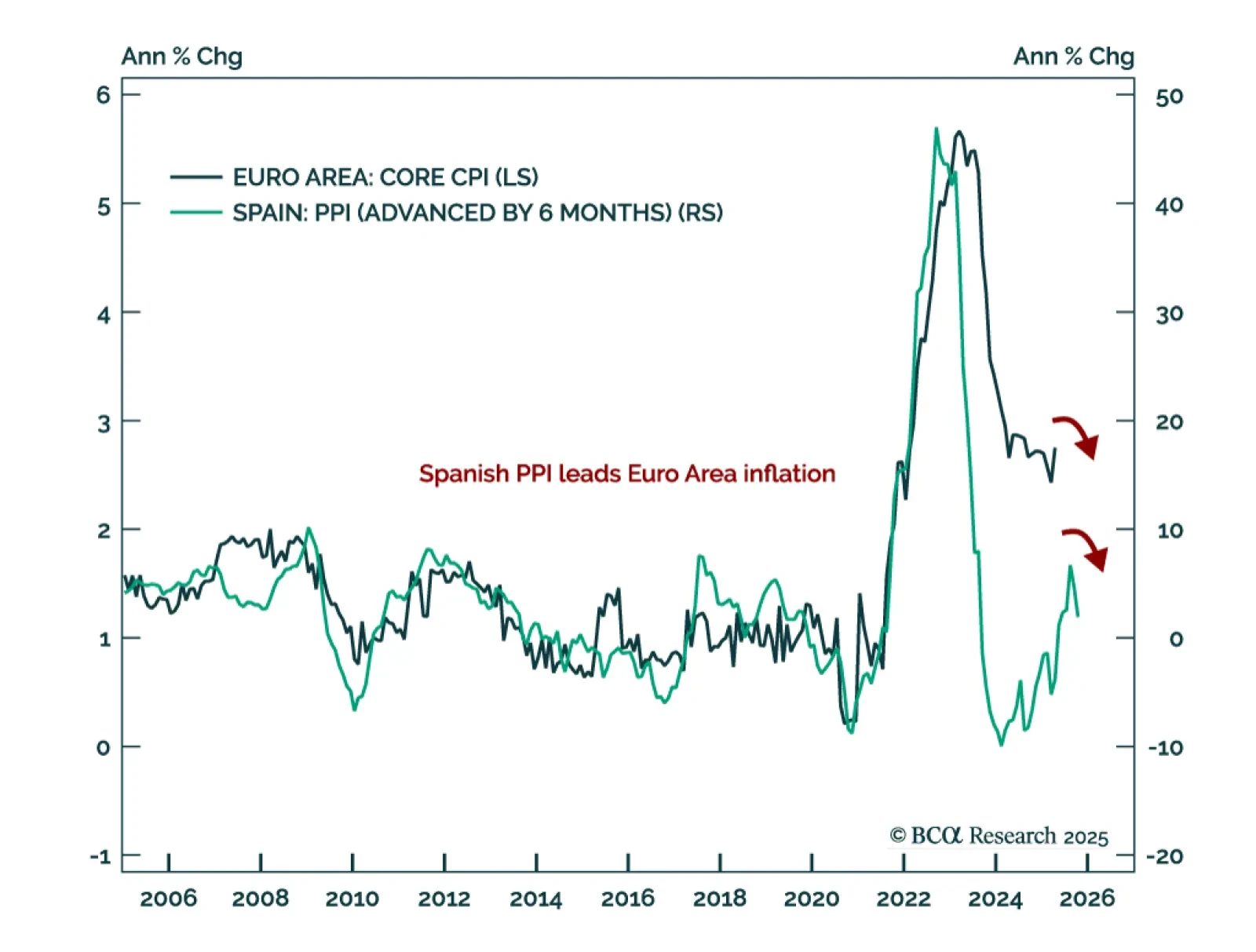

Producer prices in Spain surprised to the downside, foreshadowing a relapse in Euro Area inflation and cementing the ECB’s dovish stance. The Spanish PPI index fell to 1.9% in April, continuing the disinflation trend from the last…

According to our fixed income strategists, the main drivers of rising global yields have been widening bond/OIS spreads and term premiums. Wider government bond/OIS spreads reflect increasing government bond supply (net of…