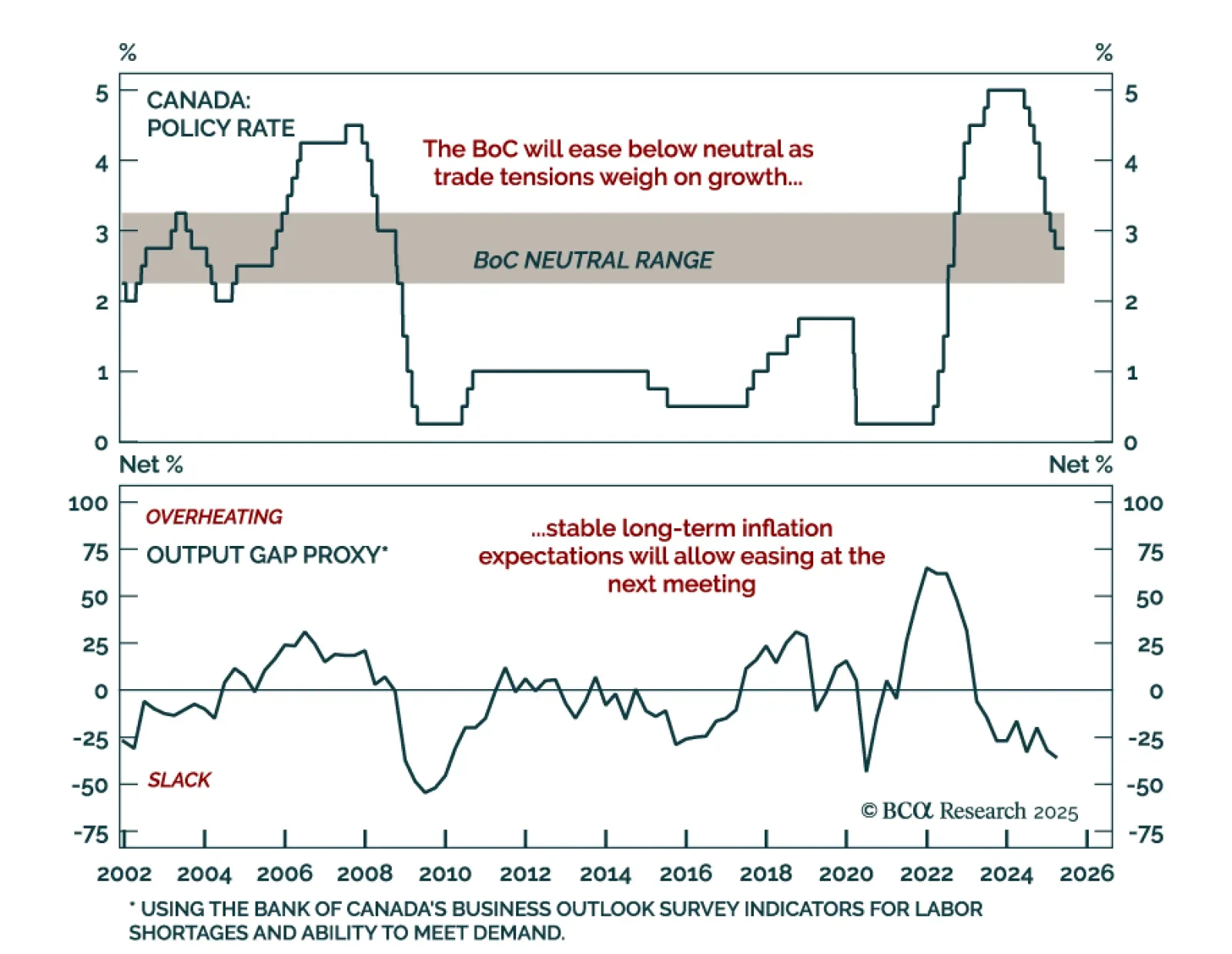

The Bank of Canada held rates at 2.75% but signaled a dovish shift, pushing us to overweight Canadian government bonds and go long CORRA futures. The policy rate remains within the BoC’s neutral range, allowing the Bank to wait for…

Our Portfolio Allocation Summary for June 2025.

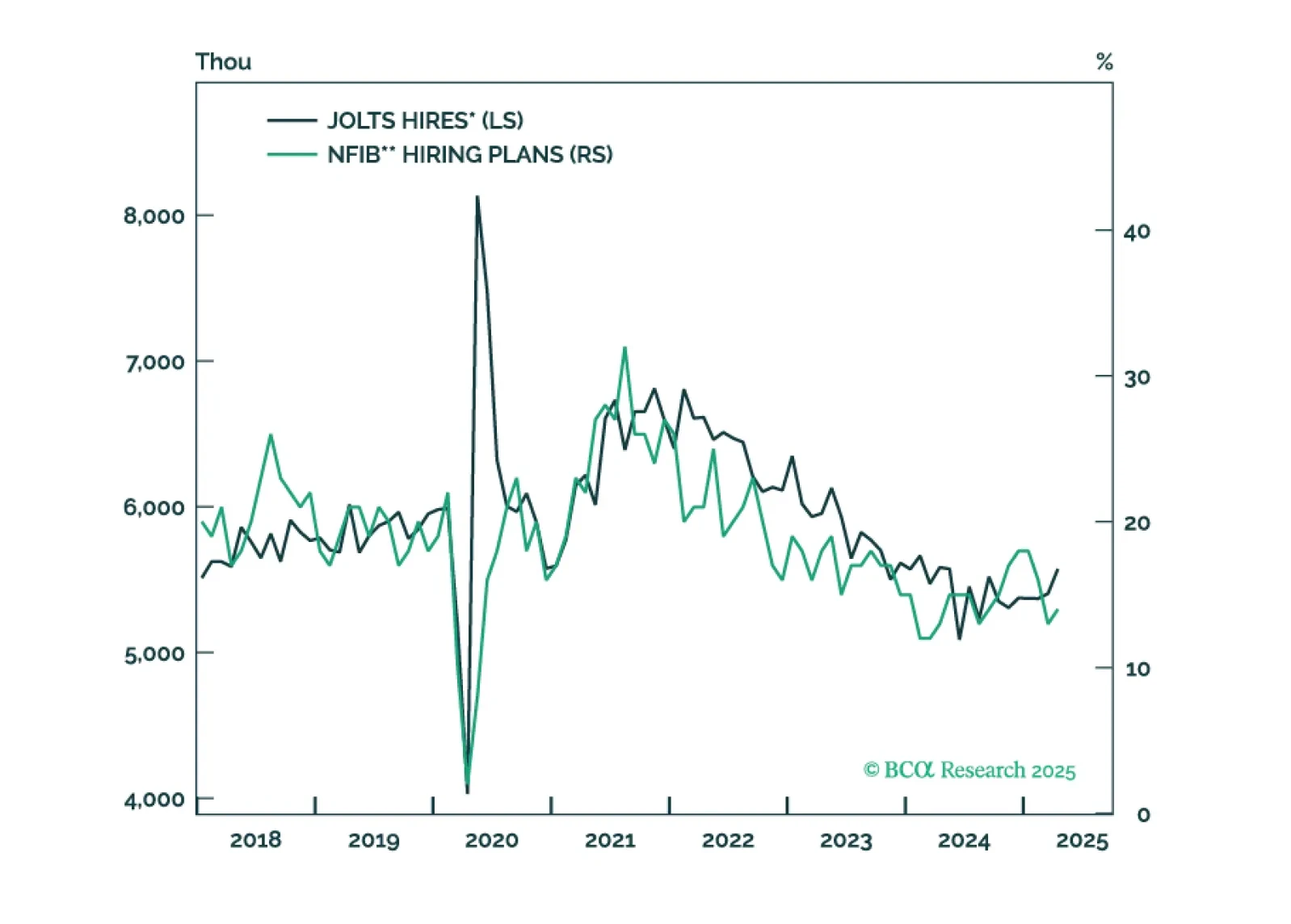

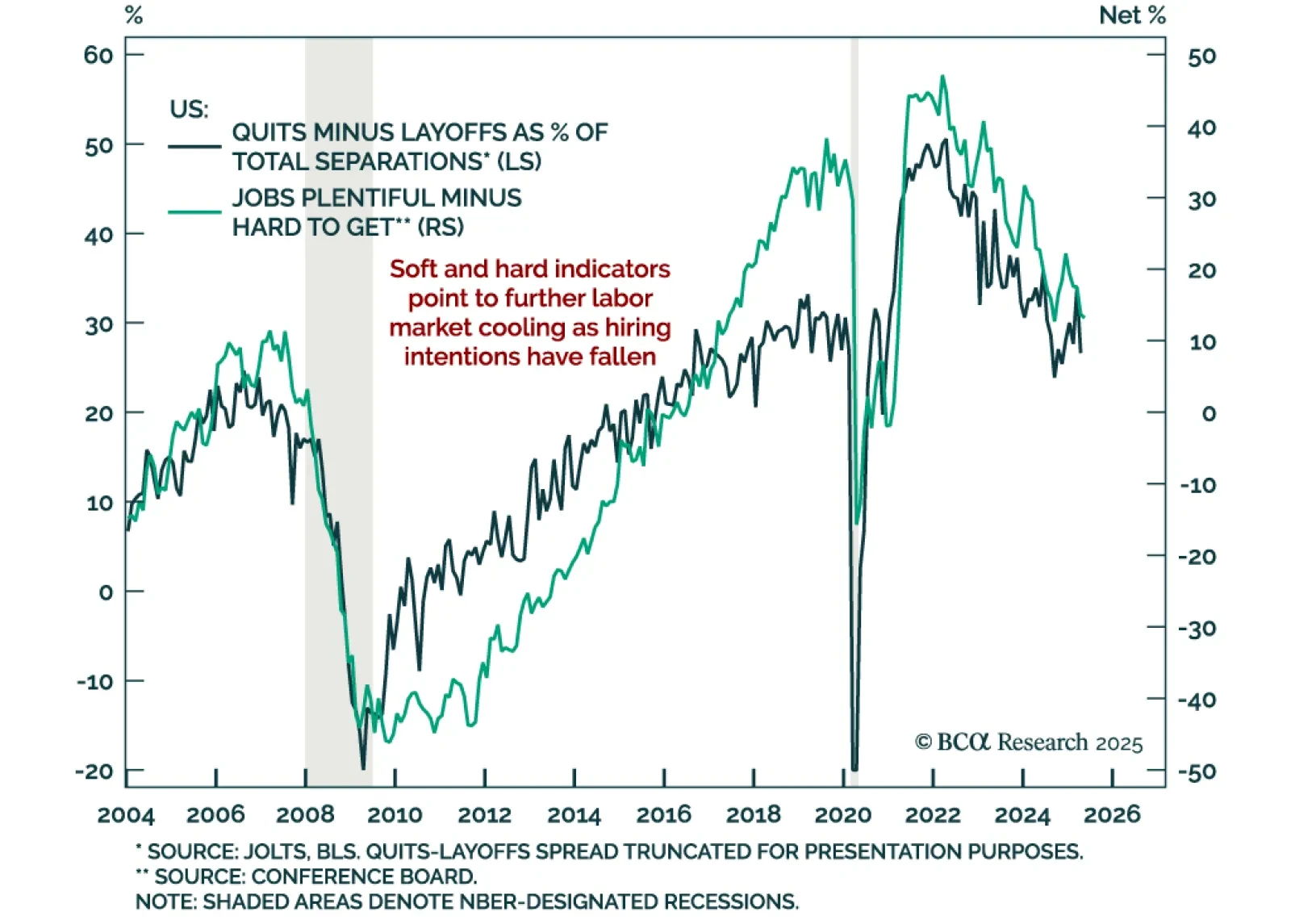

The April JOLTS report was mixed, but the underlying trend still points to a weakening labor market and reinforces our overweight in government bonds. Job openings rose to 7.5m from 7.2m, and hiring picked up, though gains were…

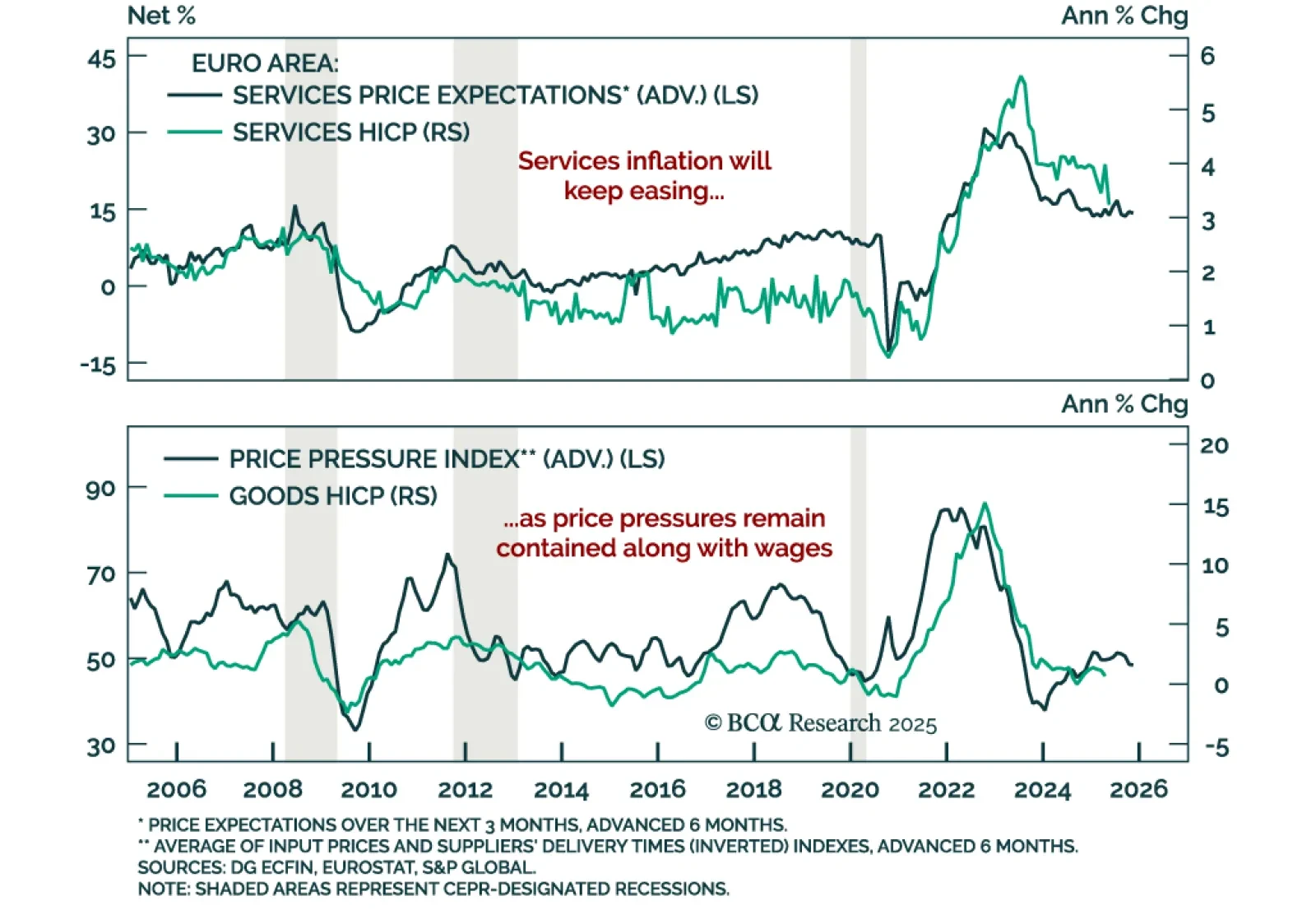

Cooler May inflation in the Eurozone and Switzerland reinforces the case for an ECB rate cut and supports our defensive positioning across European rates and FX. Headline Eurozone HICP fell to 1.9% y/y from 2.2%, with core down to 2.…

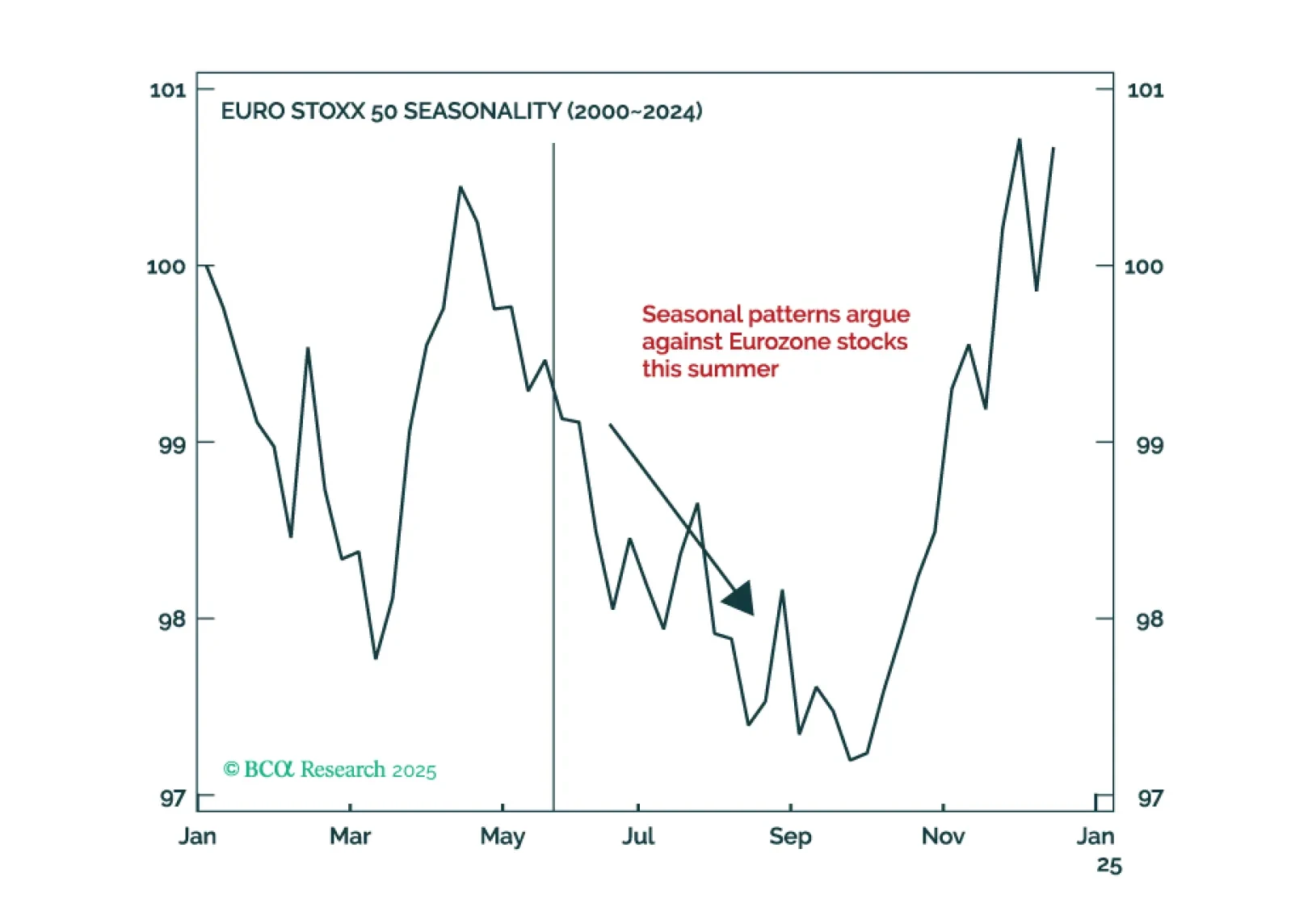

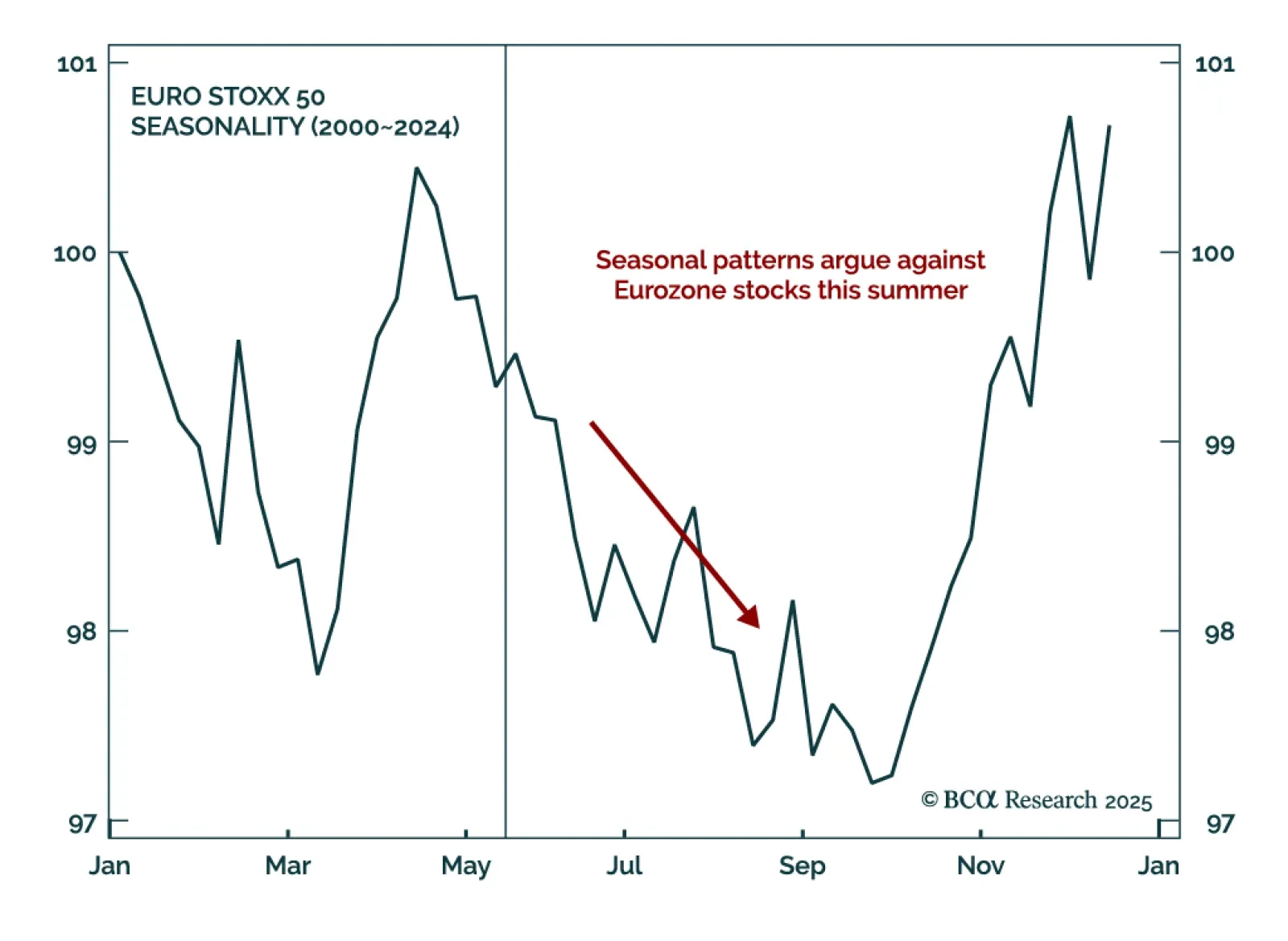

Our European strategists expect the EURO STOXX 50 to remain rangebound between 4750 and 5500 this summer, creating a punishing environment for buy-and-hold investors. With the index near the top of its range, they recommend trimming…

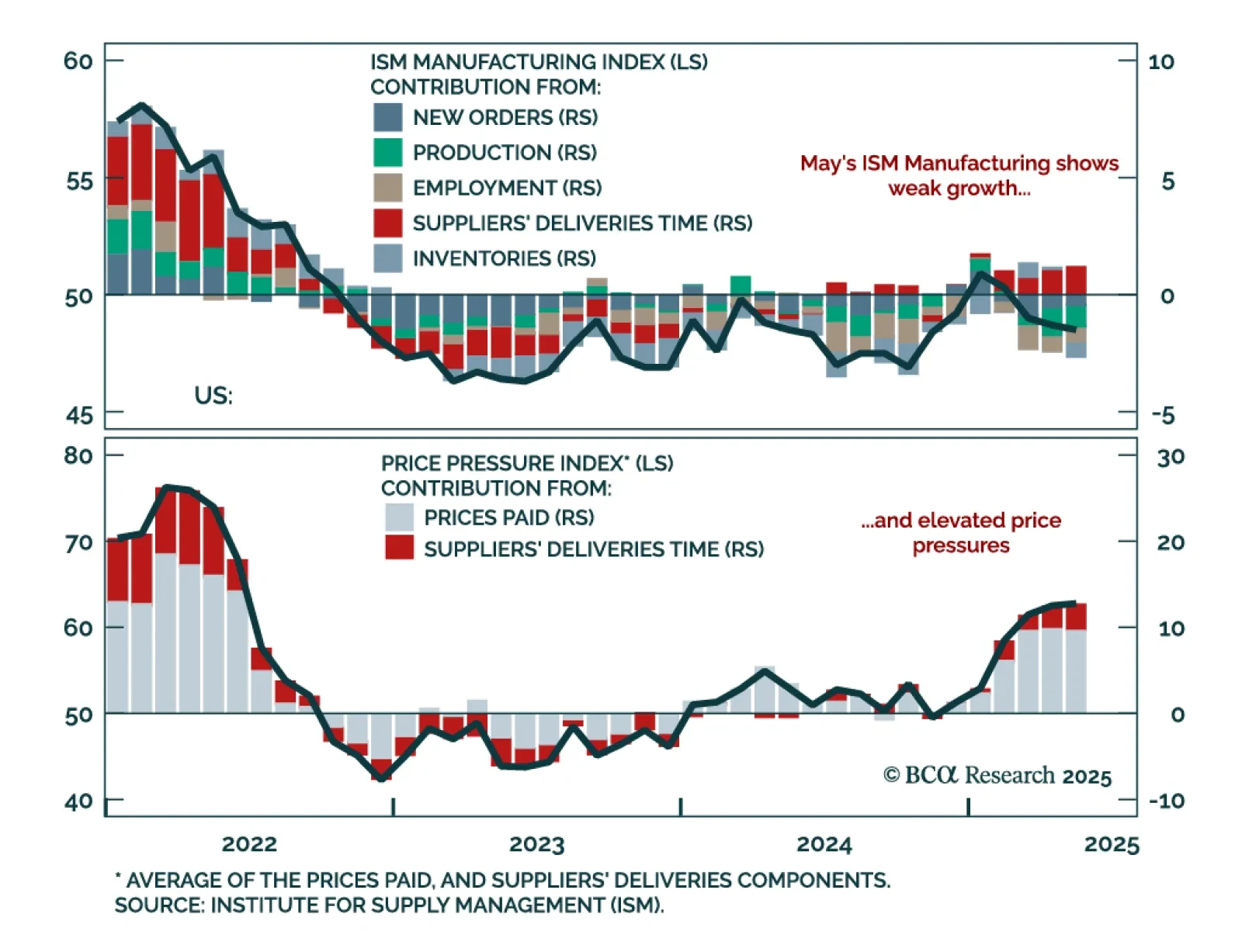

The May ISM Manufacturing Index missed expectations, reinforcing our view that recession risks remain underpriced. The headline fell to 48.5 from 48.7, while new orders and employment both rebounded slightly but remained below the 50…

European equities will face a clash of powerful forces this summer. Expect sharp swings and false breaks, creating an ideal terrain for nimble traders but a minefield for buy-and-hold investors seeking steady gains.Within this backdrop,…

Bursting Japanese inflation warrants a cautious stance on the country’s bonds relative to other DM markets. Tokyo's annual core CPI reached 3.6% in May, the highest print in 44 years (excluding the post-pandemic inflation flare…

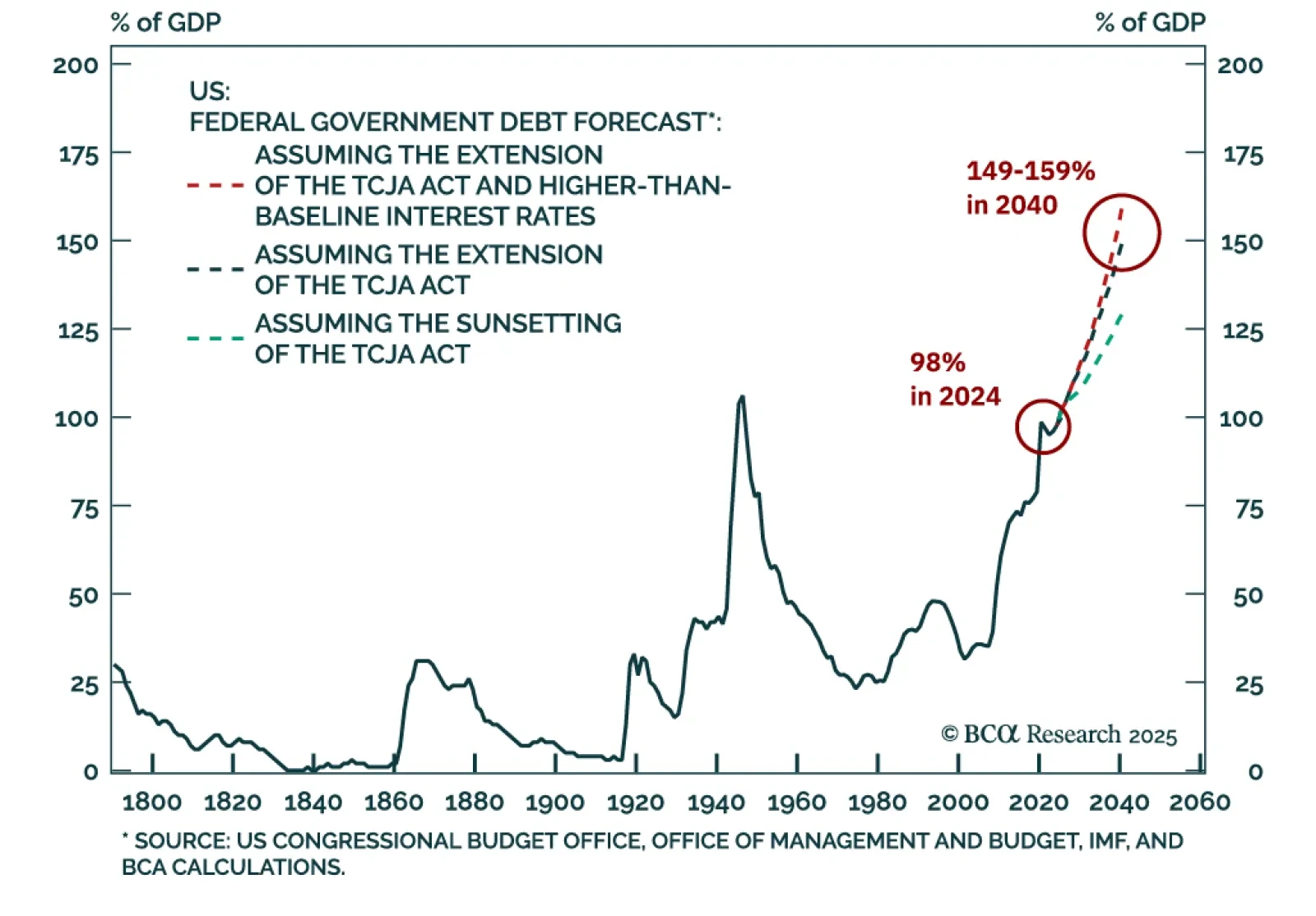

President Trump’s trade truces gave a respite to global markets, but a bigger risk lurks around the corner. Unsustainable public debt dynamics in the US demand higher bond yields, which can push the economy into trouble. The…

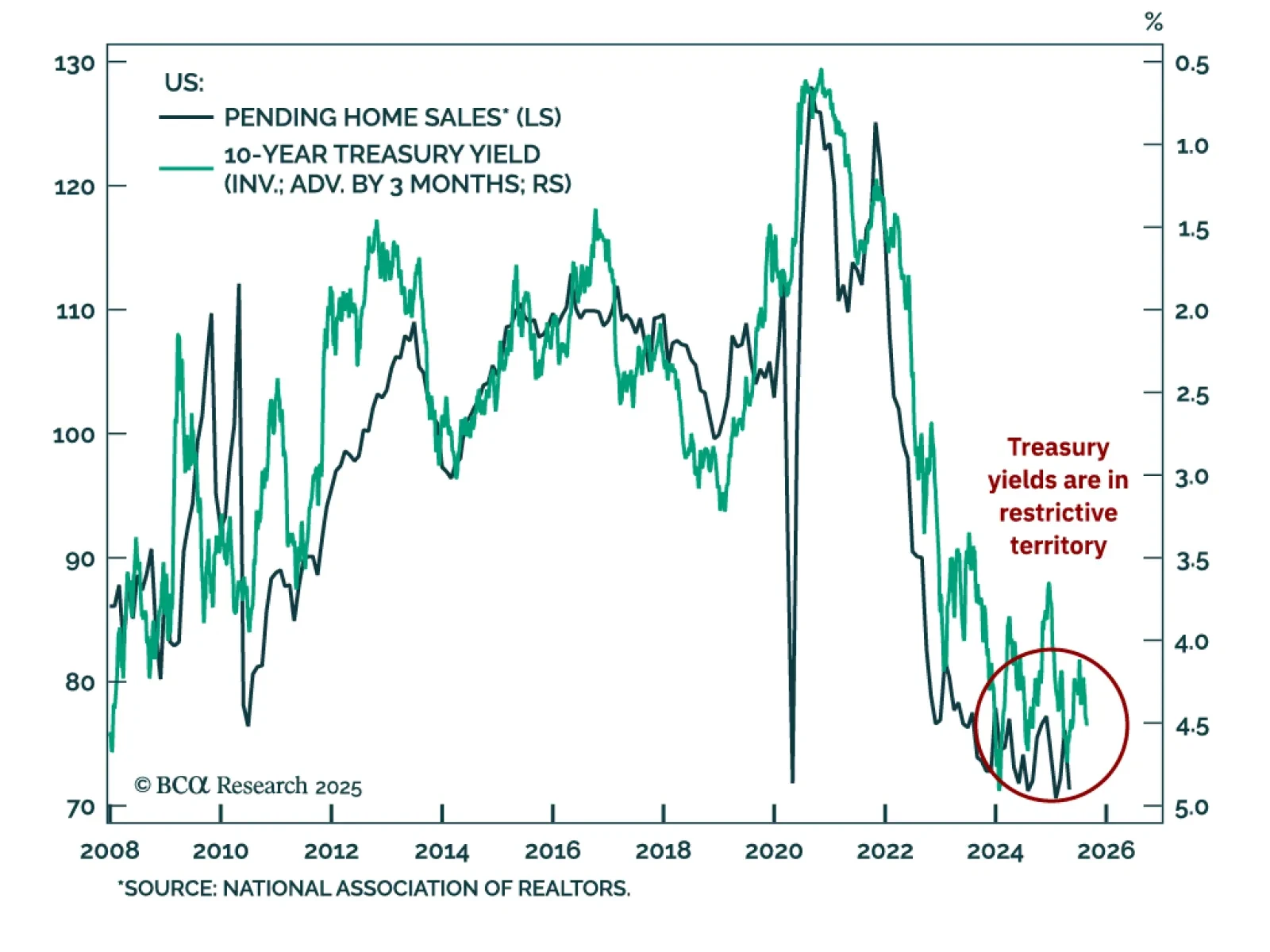

The latest hard data out of the US signals trouble for the economy, prompting caution on US equities. While Q1 growth was revised up slightly from -0.3% to -0.2% quarter-on-quarter, consumer spending slowed and was revised…