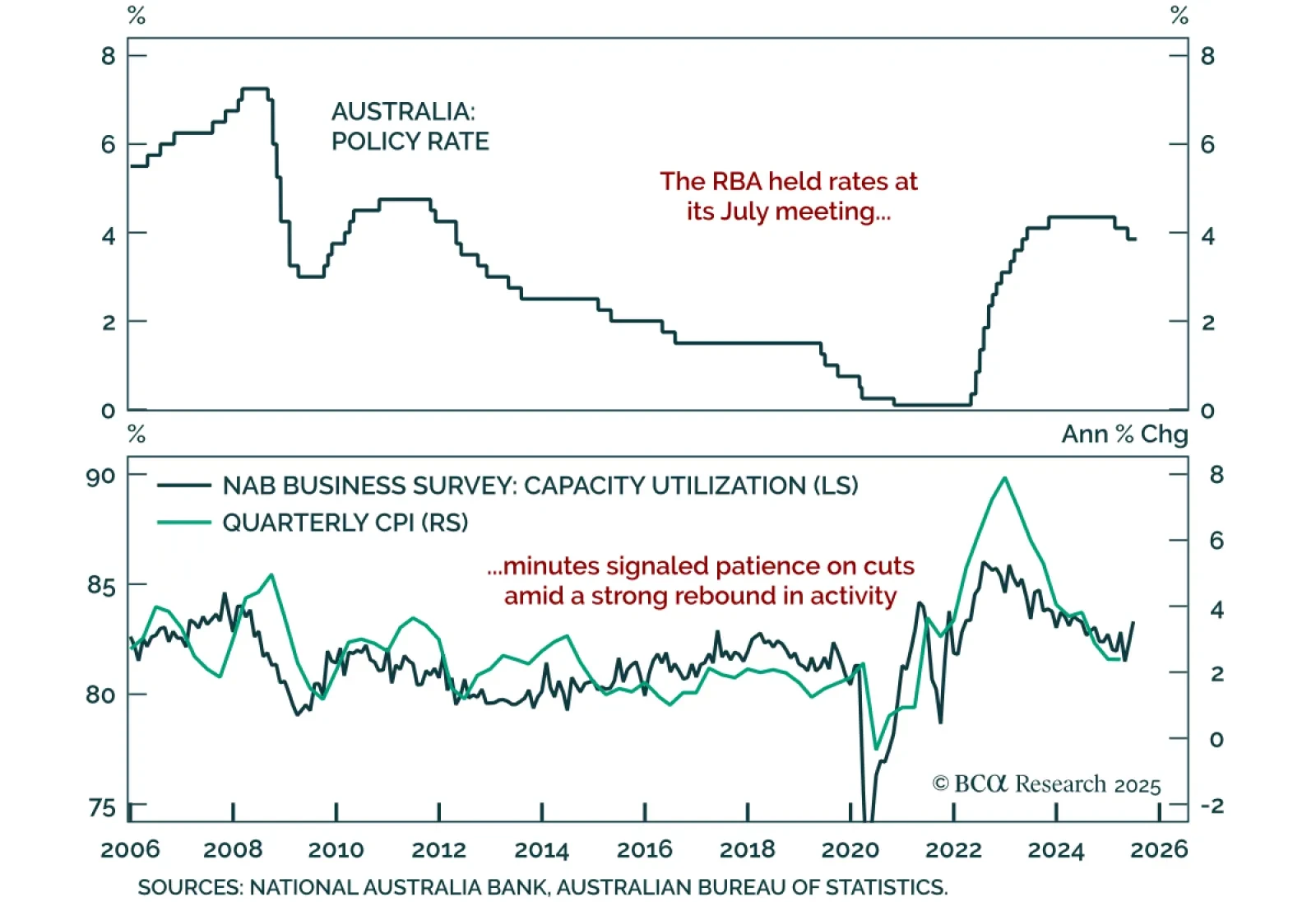

RBA minutes confirmed a cautious approach to easing, reinforcing our underweight in ACGBs and long AUD/NZD stance. The decision to hold at 3.85% surprised markets expecting a 25 bps cut. Governor Bullock had framed the decision…

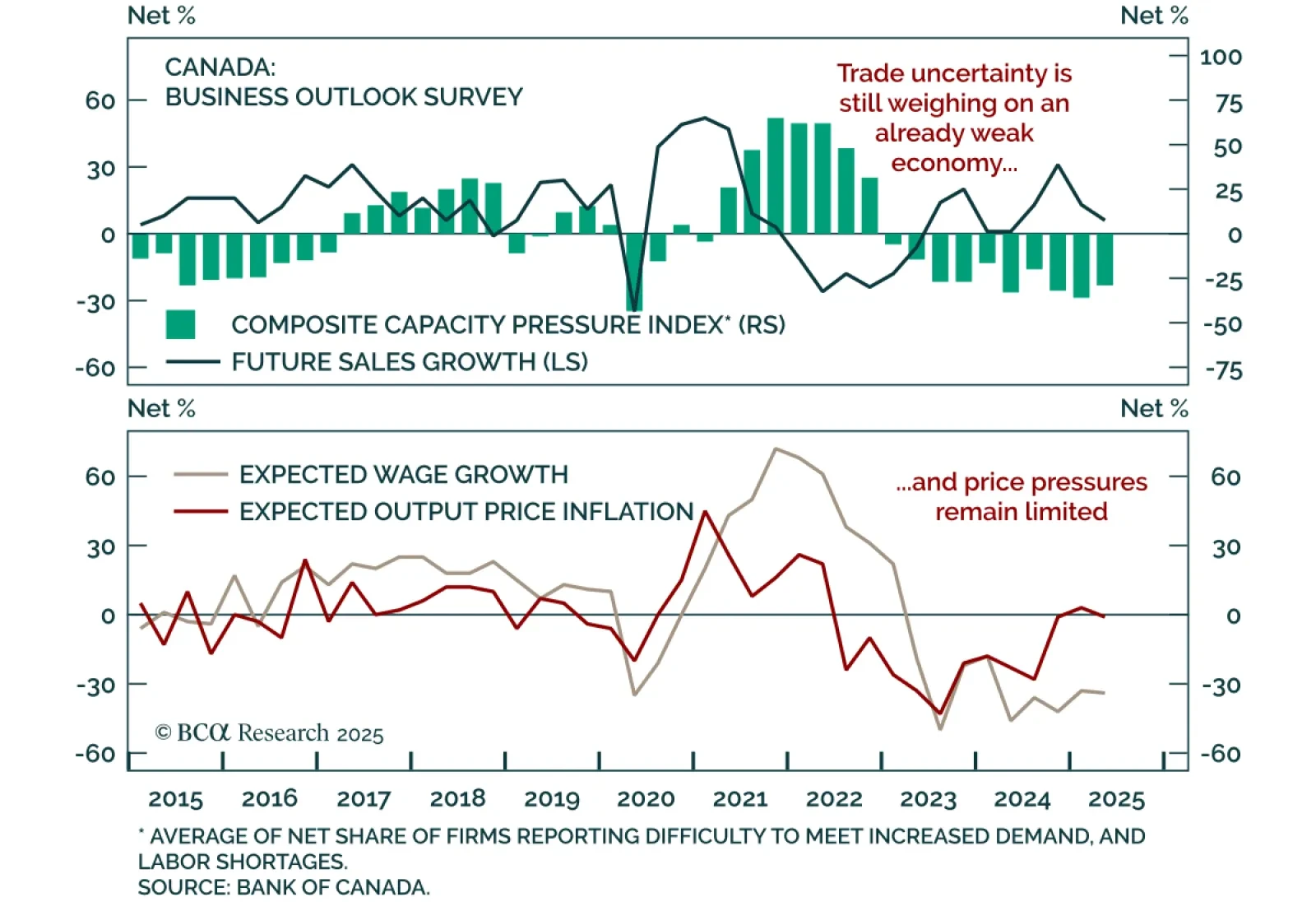

The Q2 Business Outlook Survey showed weaker sentiment and subdued hiring and investment intentions, reinforcing the case for deeper BoC rate cuts and our overweight in Canadian bonds. The BOS indicator ticked down to -2.4 from -2.1…

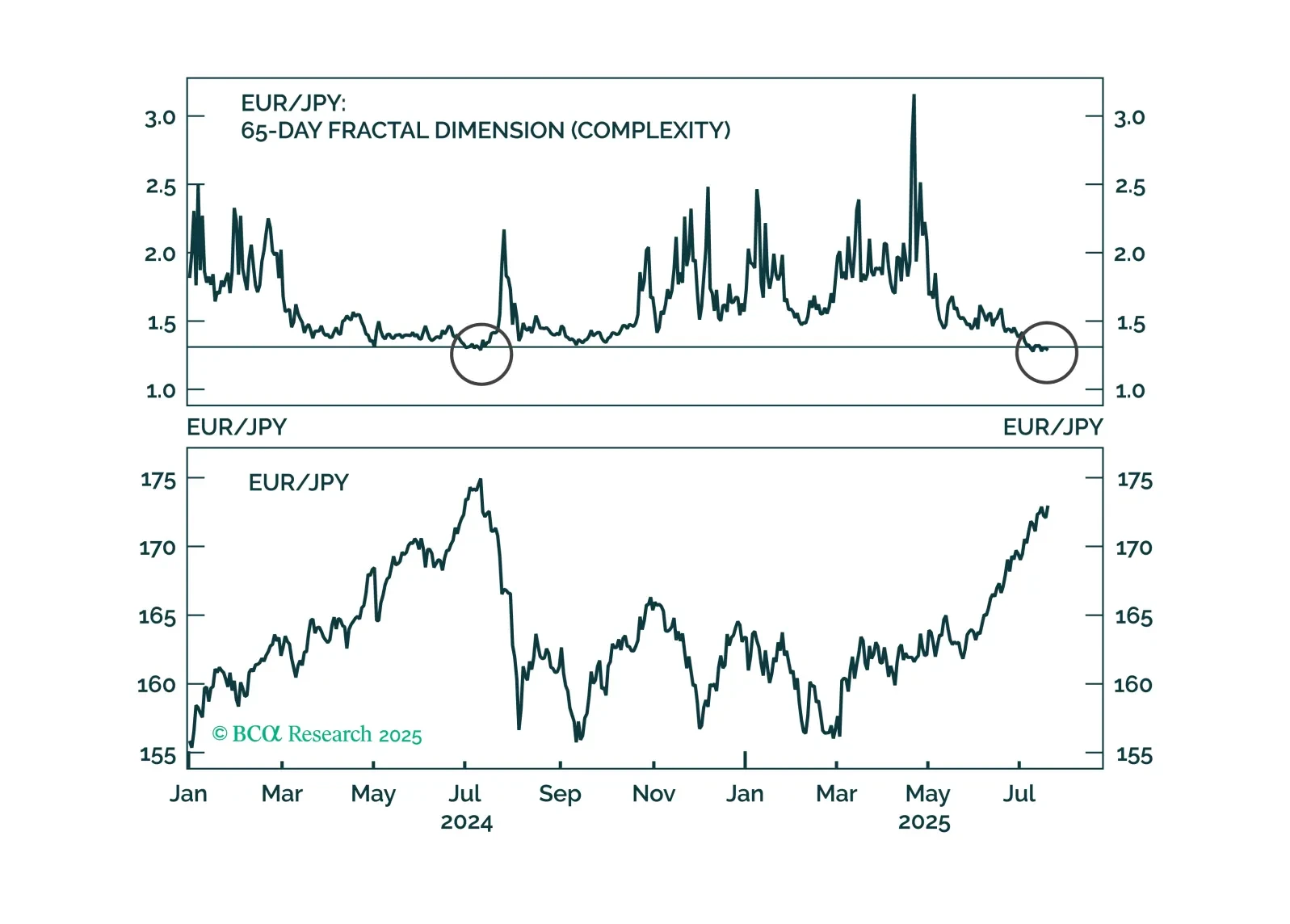

EUR/JPY has reached stretched levels, prompting new short trade recommendations across BCA Strategies. The calls are underpinned by compelling valuation, macro, and technical signals.

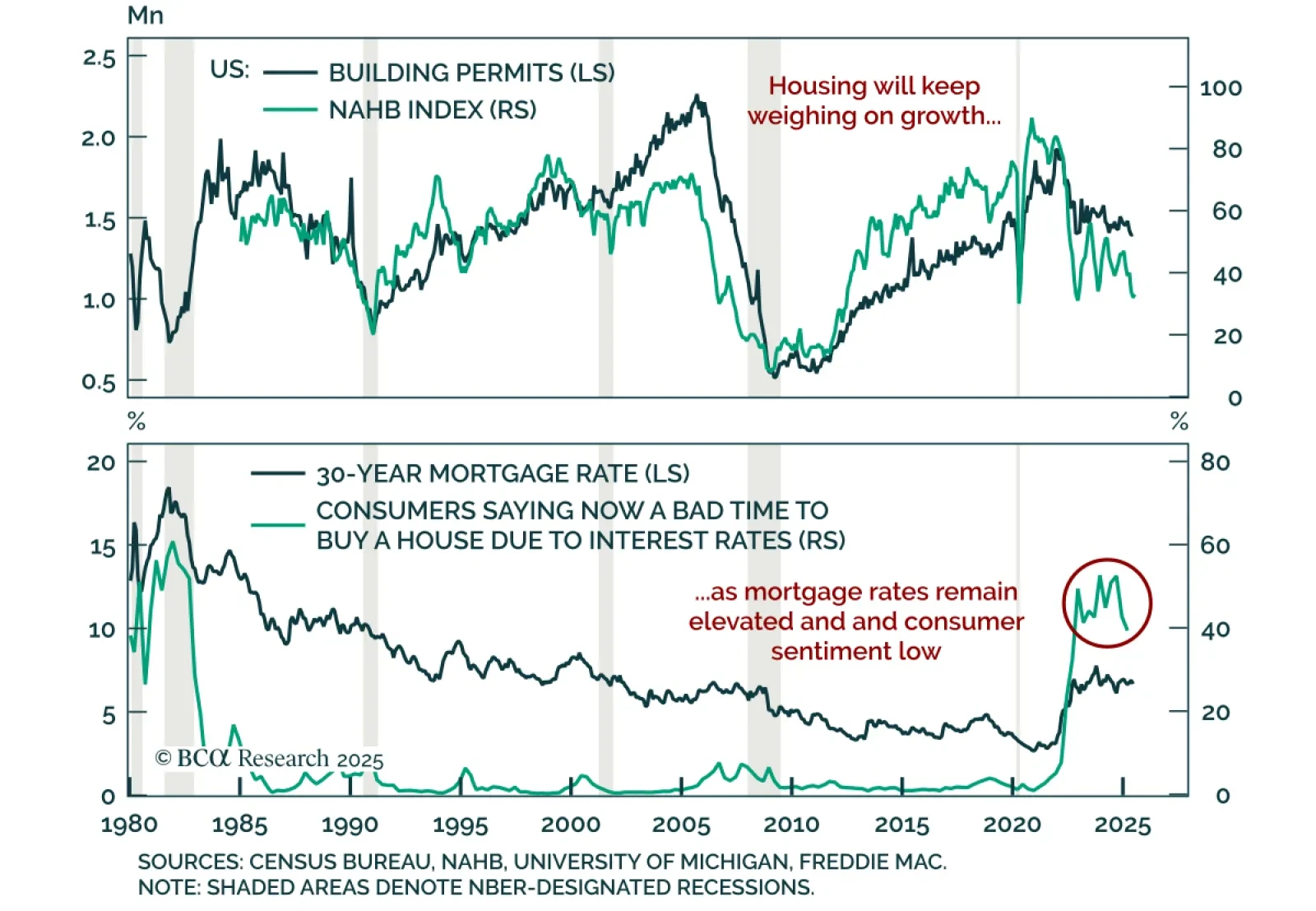

June US housing data surprised to the upside, but the broader sector is still weak, reinforcing our modest underweight on equities. Housing starts rose an annualized 4.6% m/m, and building permits ticked up 0.2% after a 2.0%…

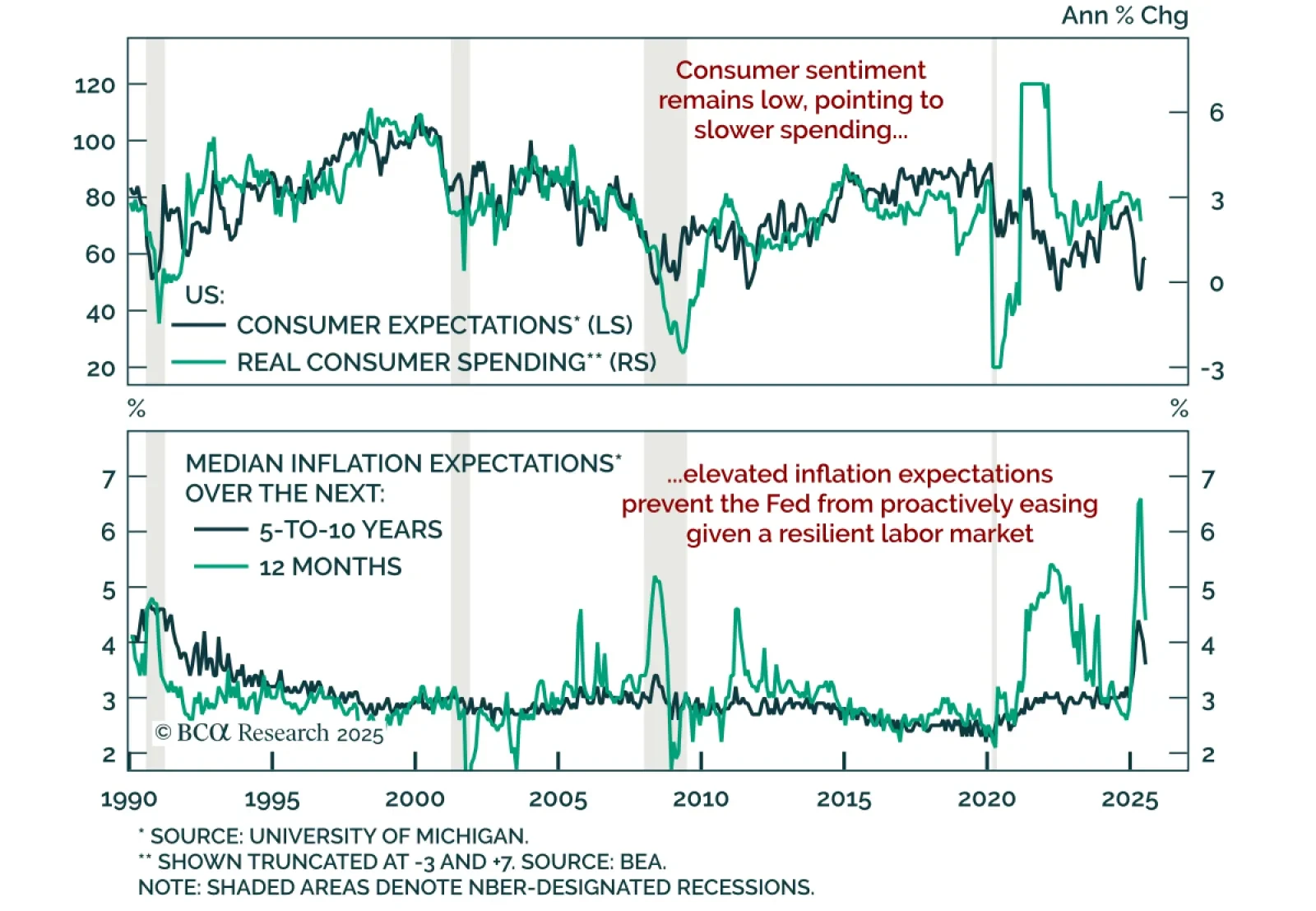

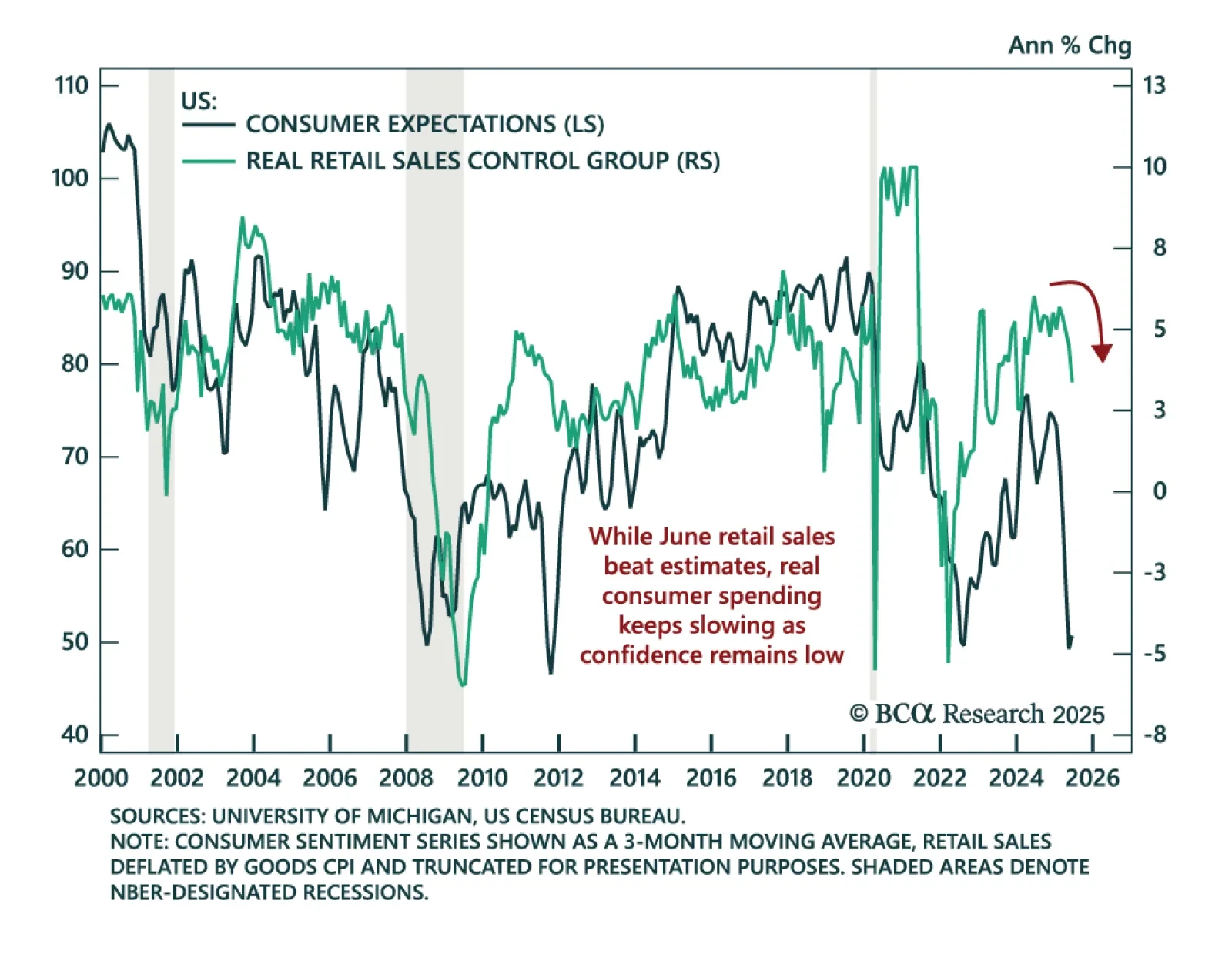

Consumer sentiment improved modestly in July, but remains at levels that still point to subdued spending, reinforcing our defensive stance. The preliminary University of Michigan index rose to 61.8 from 60.7 in June. Expectations…

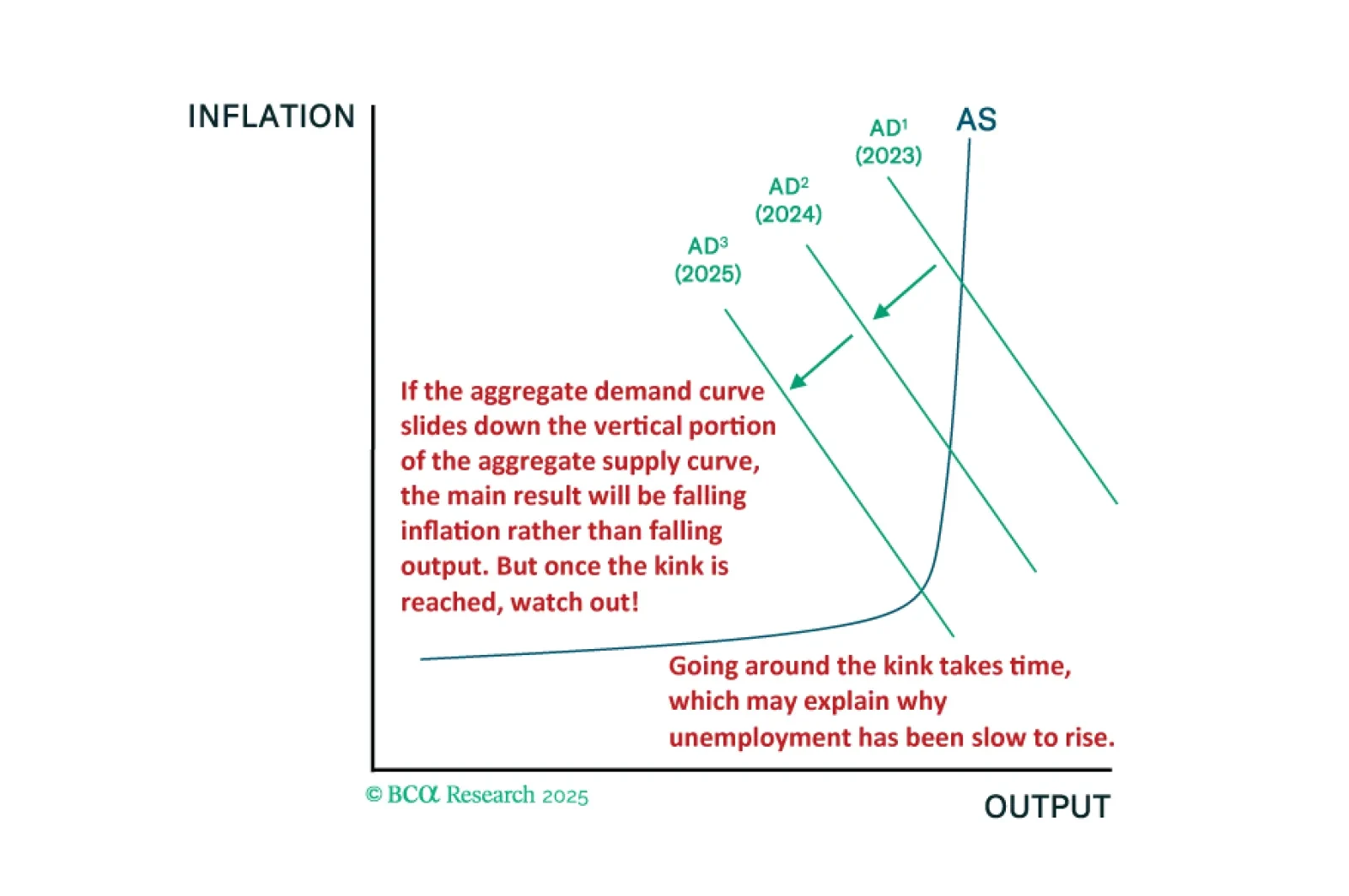

The fact that the US economy has been slower to deteriorate than in past cycles is entirely consistent with our kinked Phillips curve framework. We will be looking to our MacroQuant model for guidance on when to turn fully defensive…

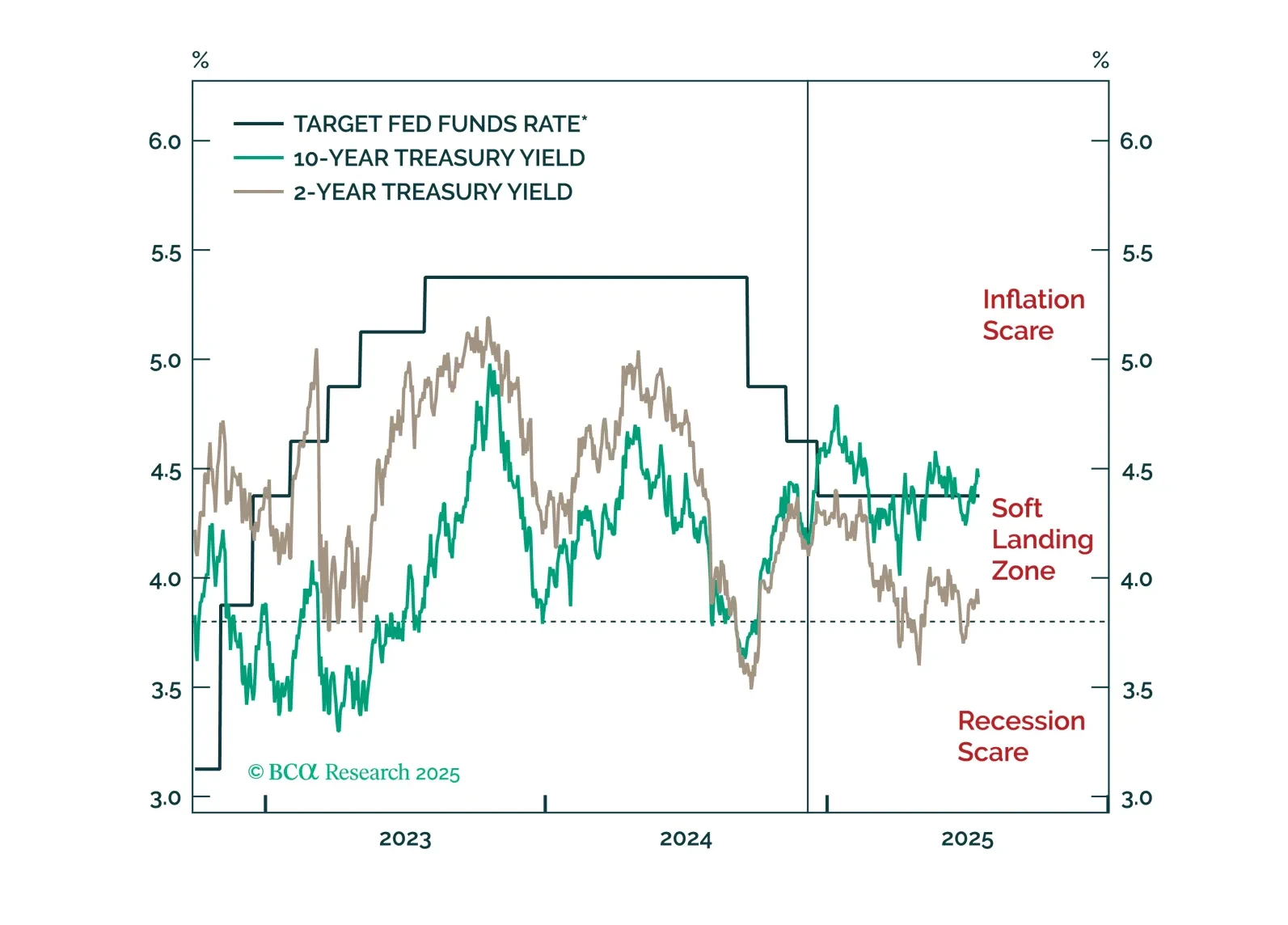

Jay Powell won’t be removed as Fed Chair before the expiry of his term next May, but we will learn the identity of his replacement this year, setting up a potentially awkward “shadow Fed Chair” situation.

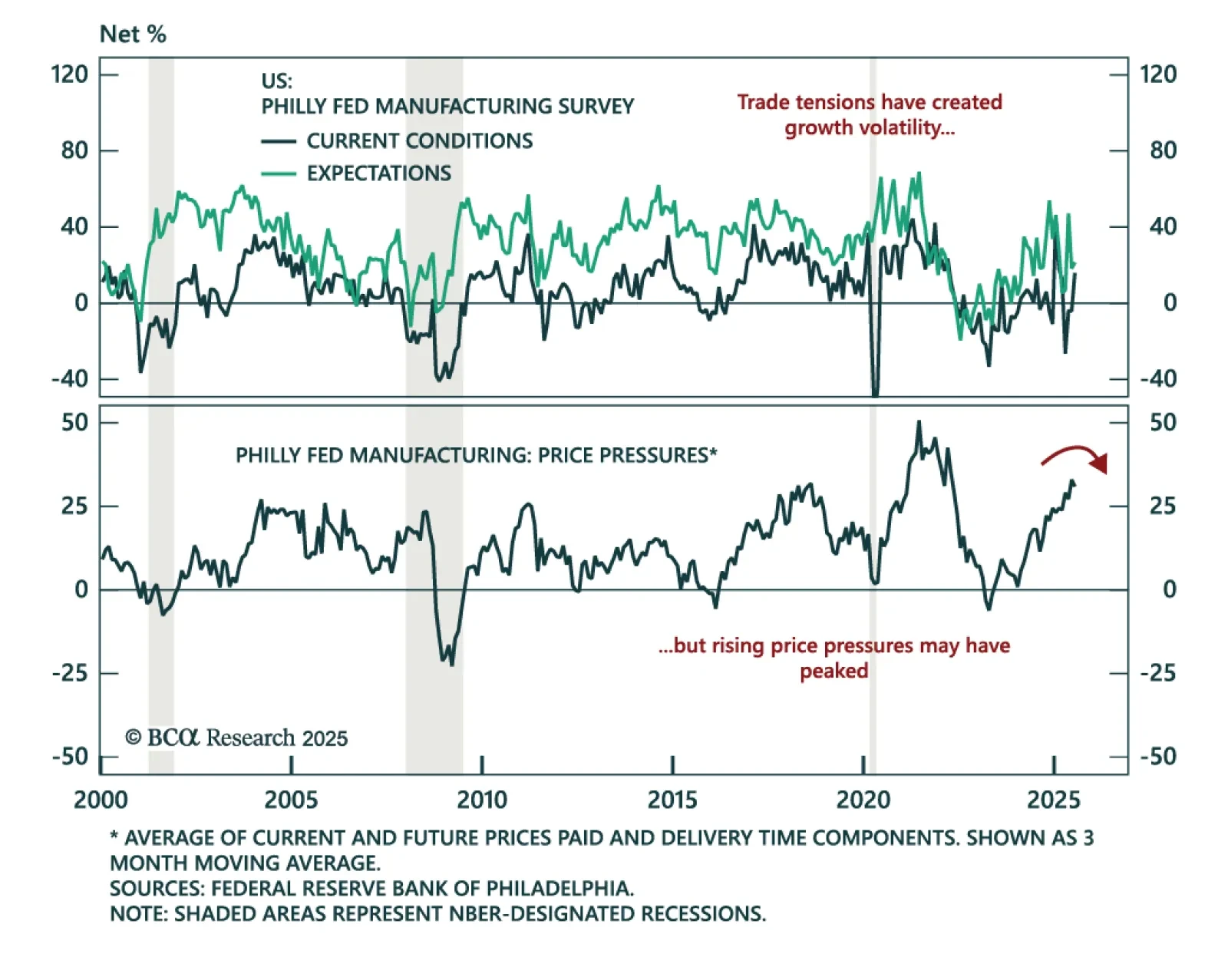

The July Philly Fed beat expectations with broad improvement in activity, but low growth, inventory buildup and margin pressure remains a risk for equities. The headline index rose to 15.9 from -4.0 in June. New orders, shipments,…

June retail sales beat across the board, but inflation and a slowing trend reinforce our defensive stance. Headline and core retail sales rose 0.6% m/m, while the control group climbed 0.5%. Spending on food services and drinking…

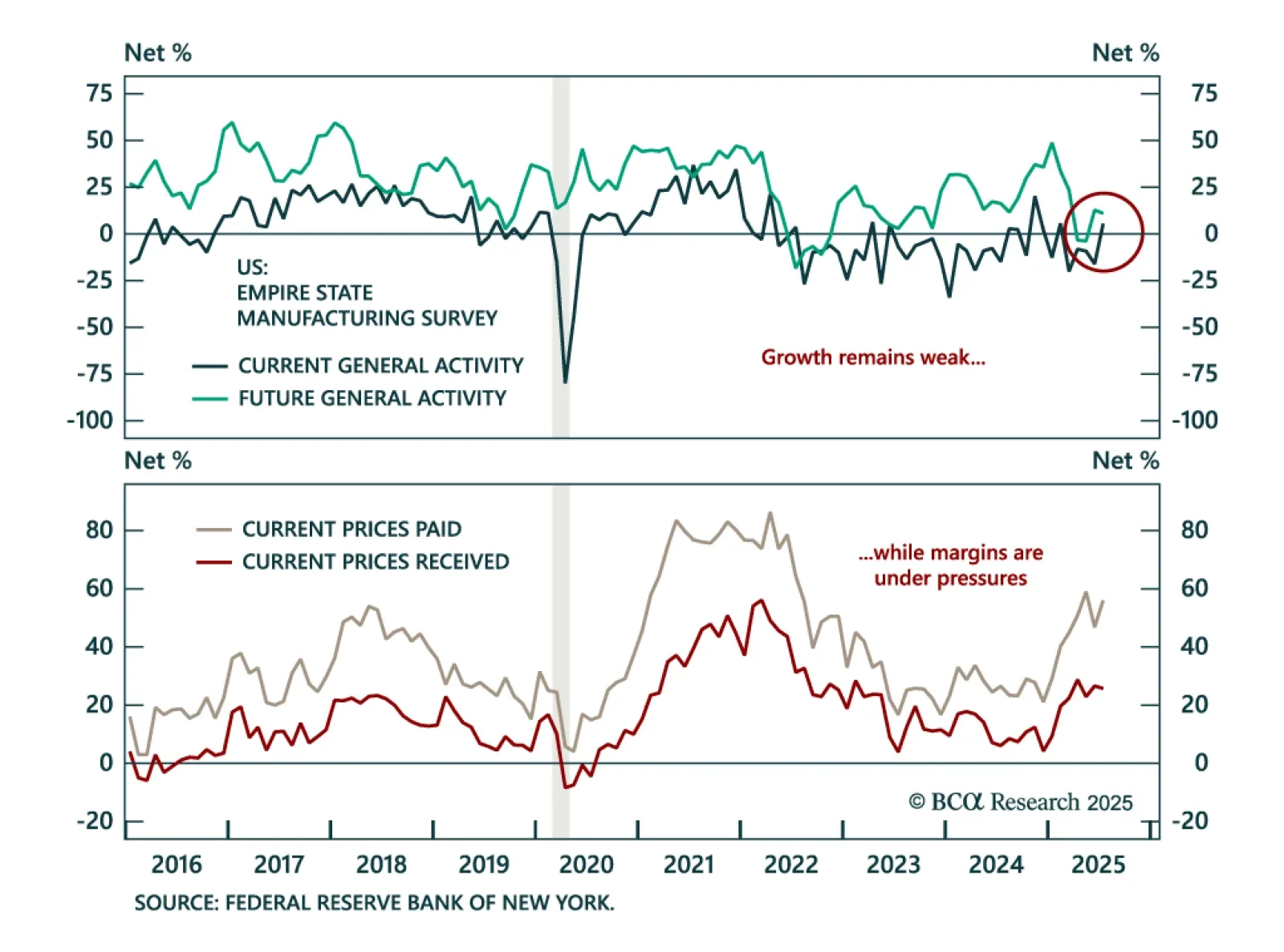

The July Empire Fed beat estimates, but survey volatility, inventory distortions, and shallow strength dampen this signal. The headline index surged to 5.5 from -16.0, supported by gains in shipments, employment, and capex…