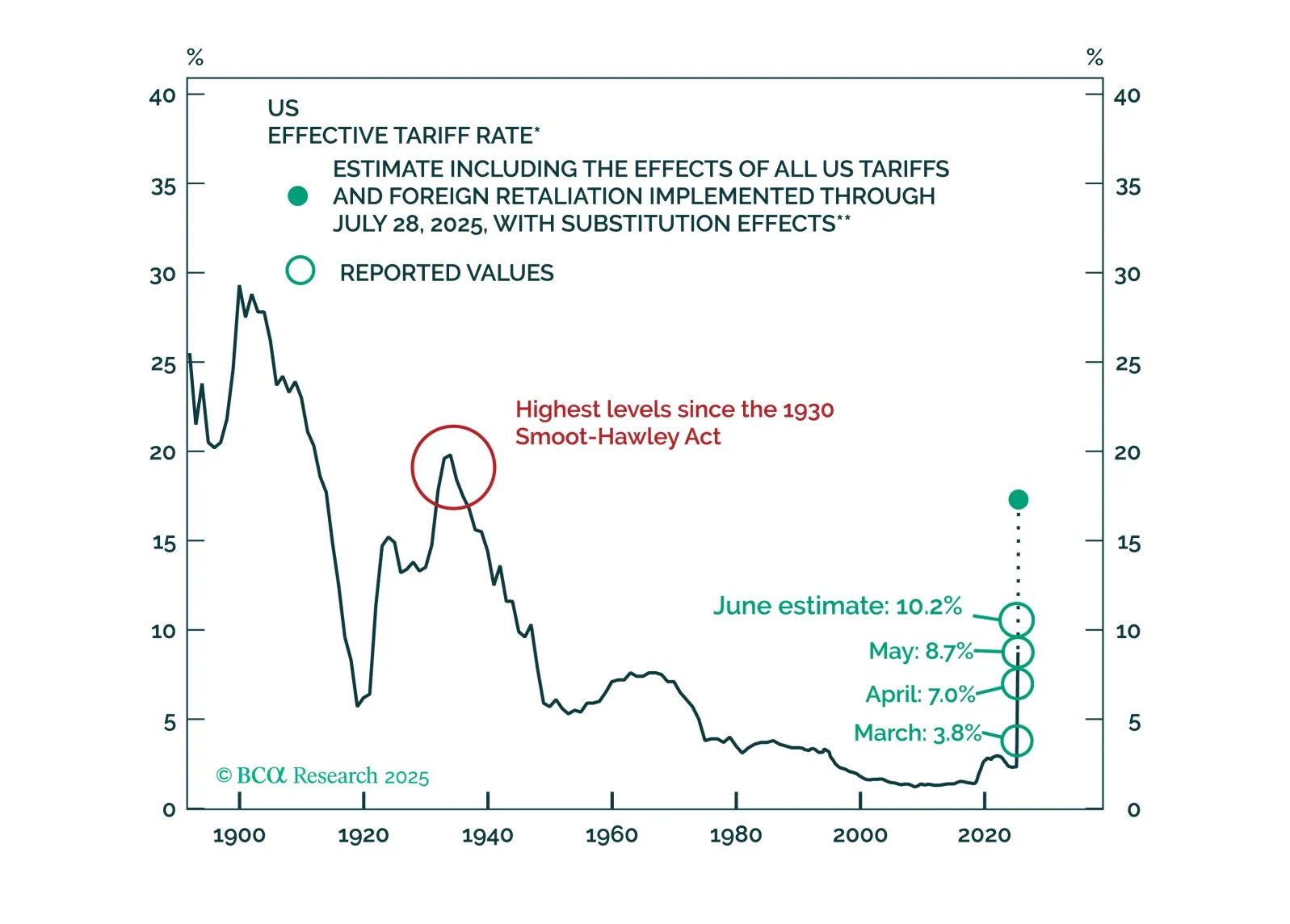

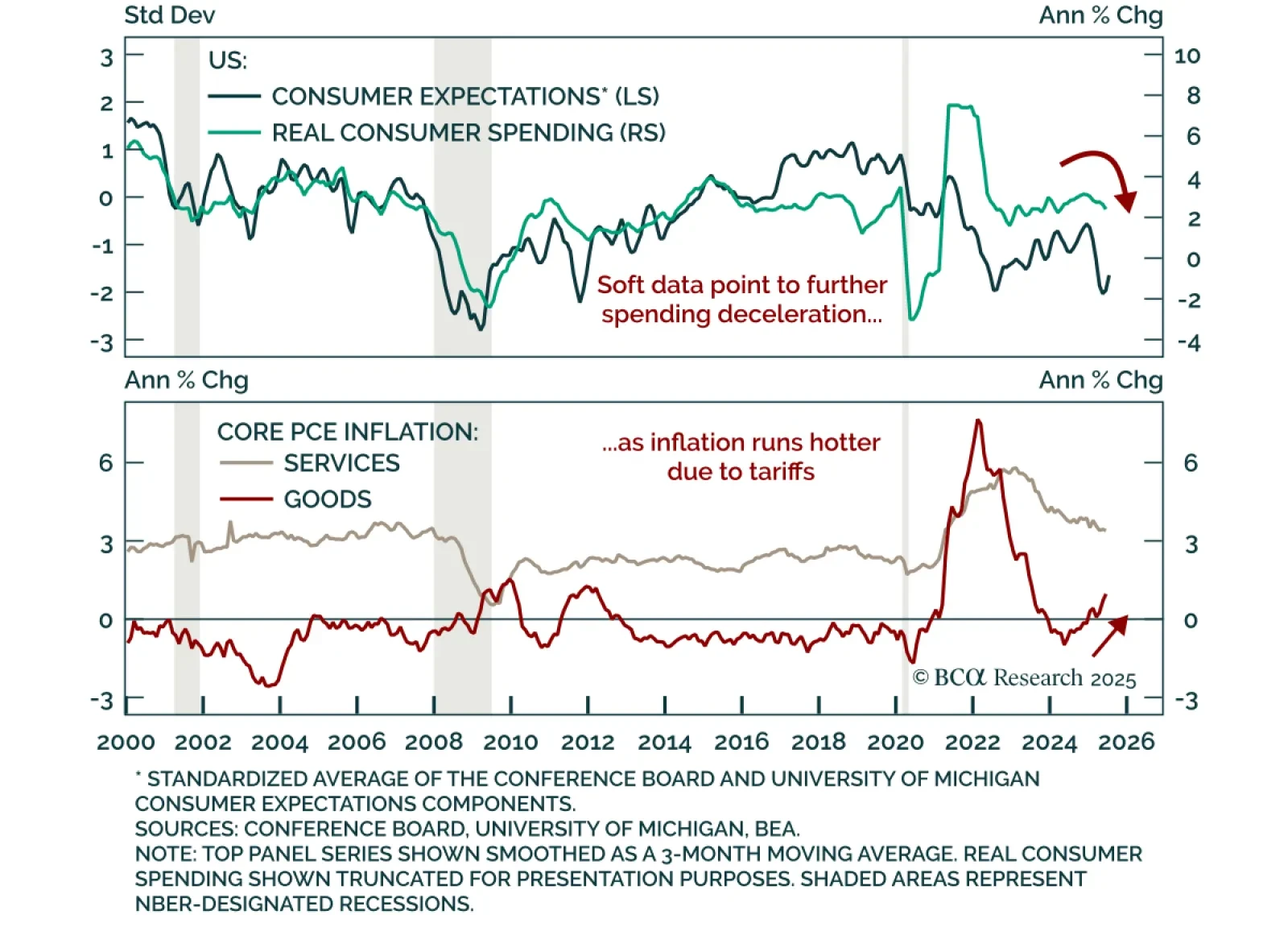

June US income and spending shows softening demand and rising goods inflation pressure, reinforcing our long-duration stance. Real personal spending only rose 0.1% m/m, in line with expectations. Personal income increased 0.3% m…

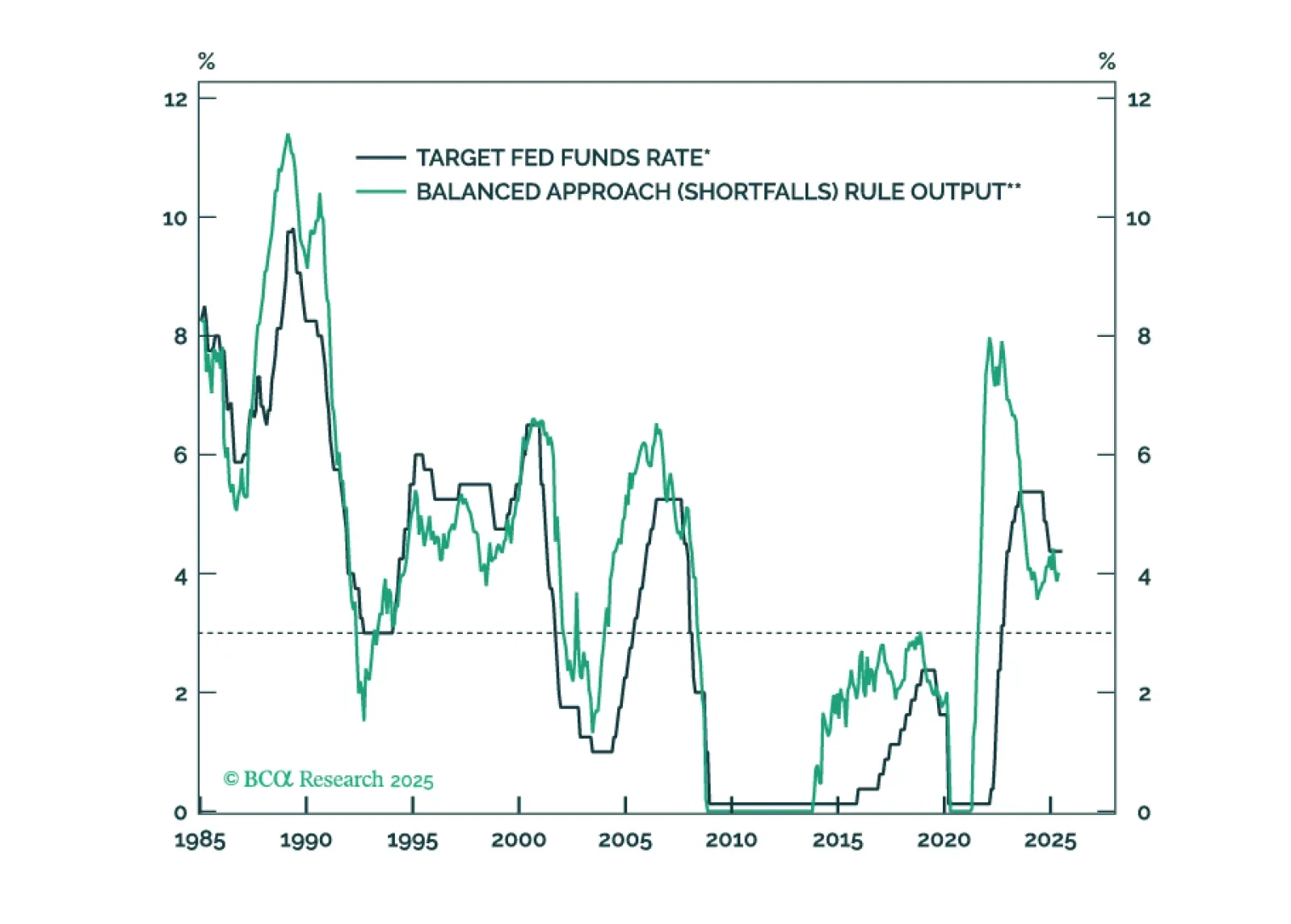

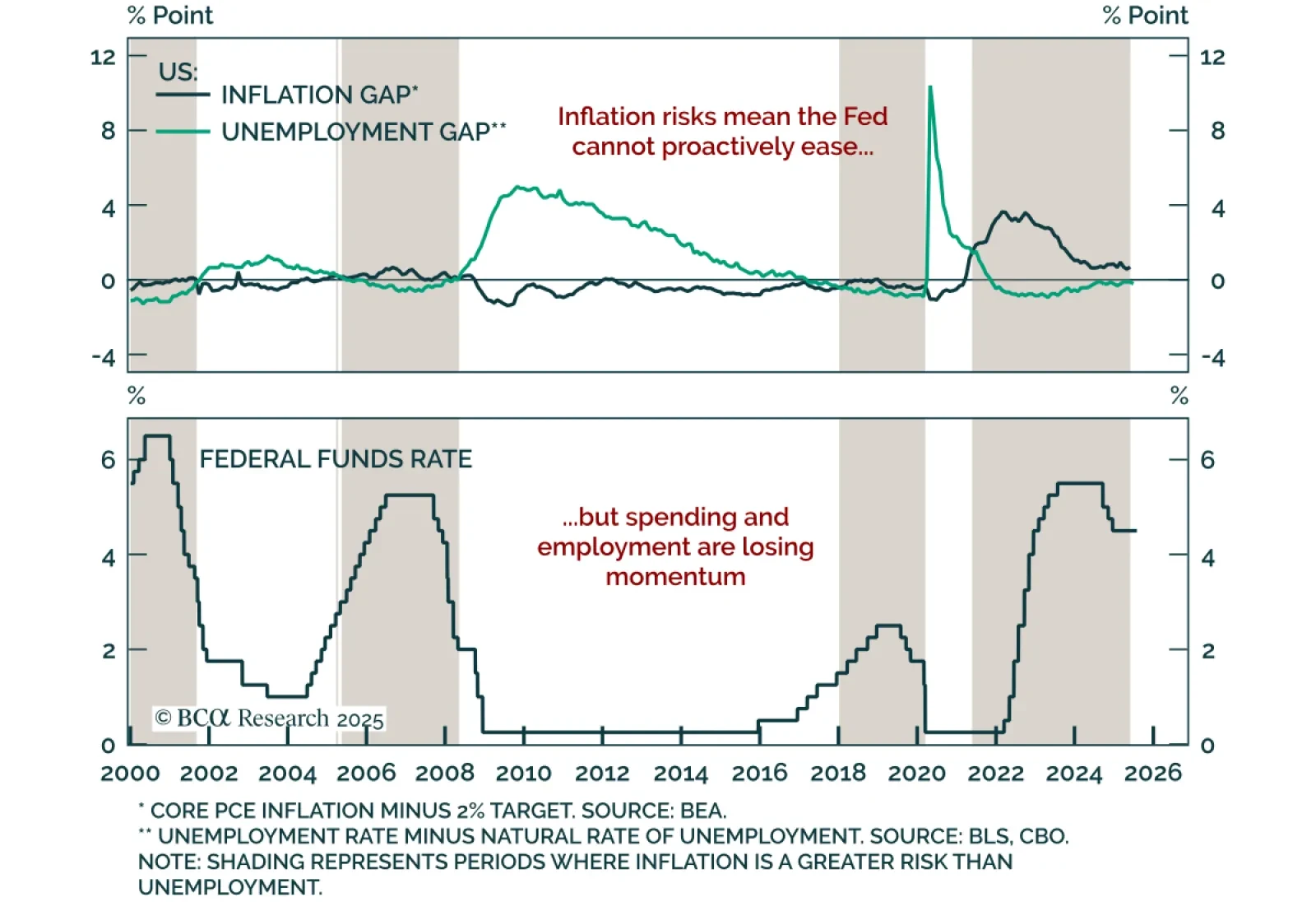

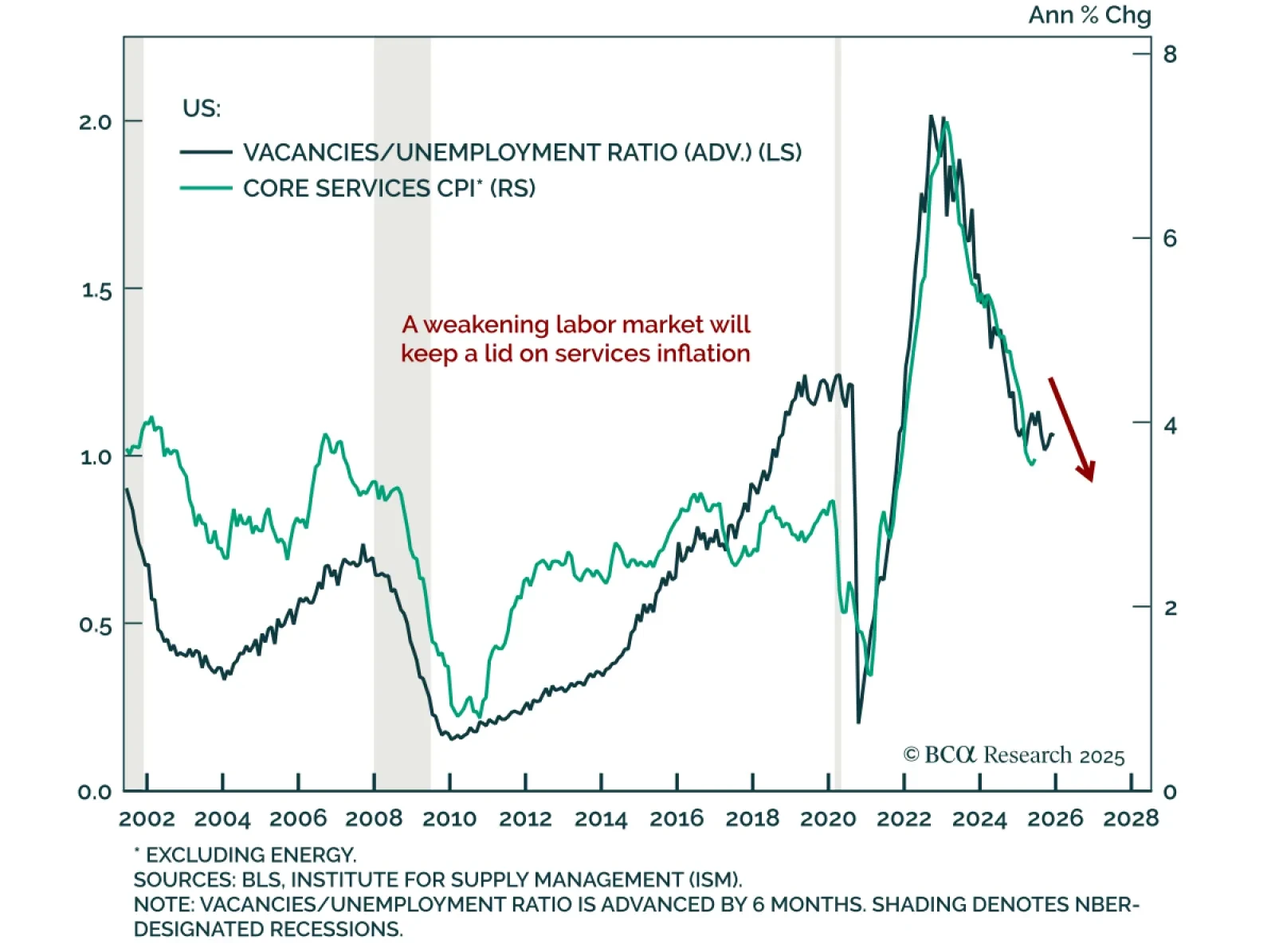

The Fed will keep rates on hold until the unemployment rate forces its hand.

The Fed held rates steady for a fifth straight meeting, with a divided FOMC and resilient growth keeping policy on hold, supporting our long-duration stance. The target range remains at 4.25%–4.50%, with the statement reflecting only…

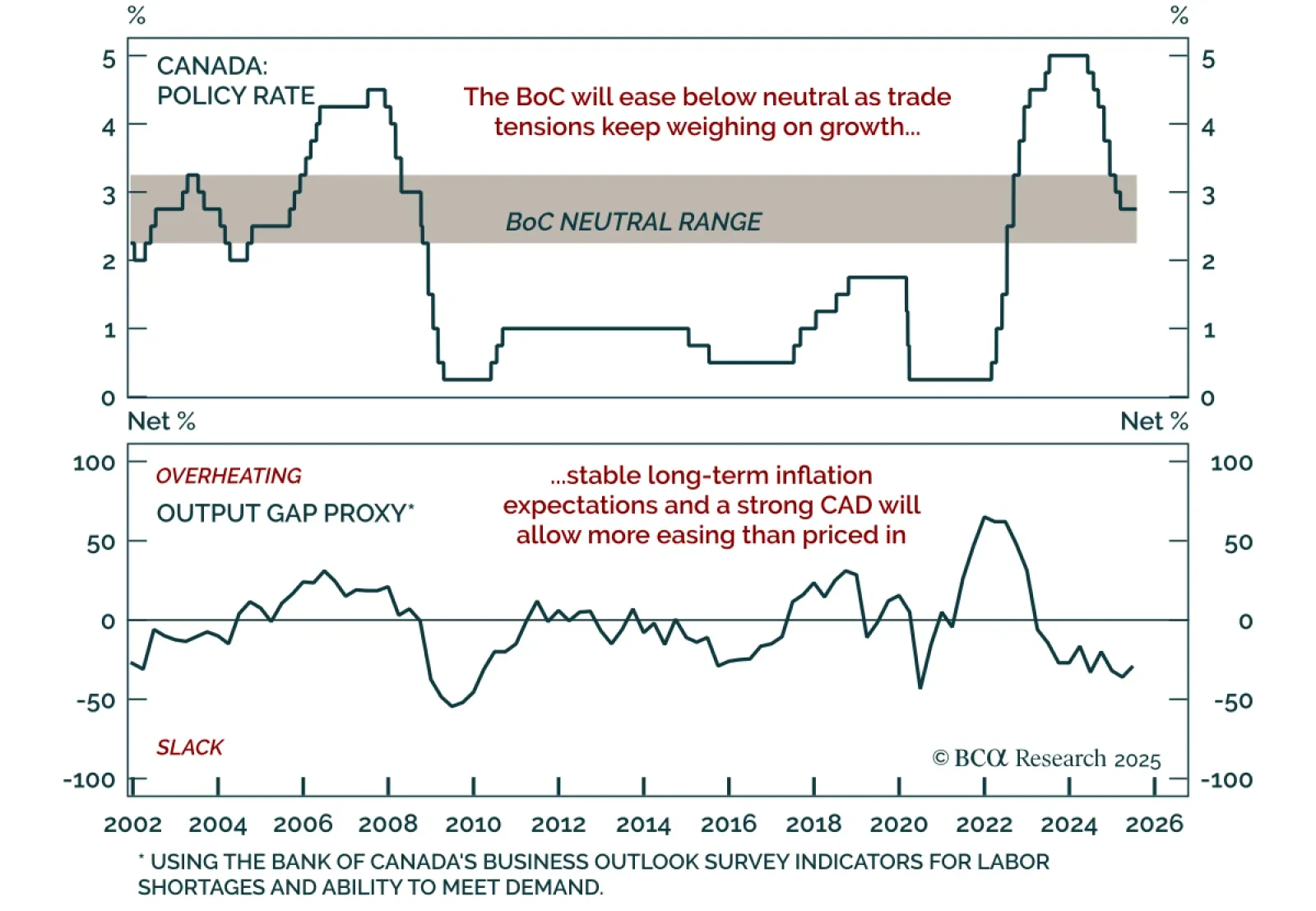

The BoC held rates at 2.75% for a third consecutive meeting, but a weak growth outlook and contained inflation reinforce our overweight in Canadian bonds. With policy within the 2.25%–3.25% neutral range, the BoC remains…

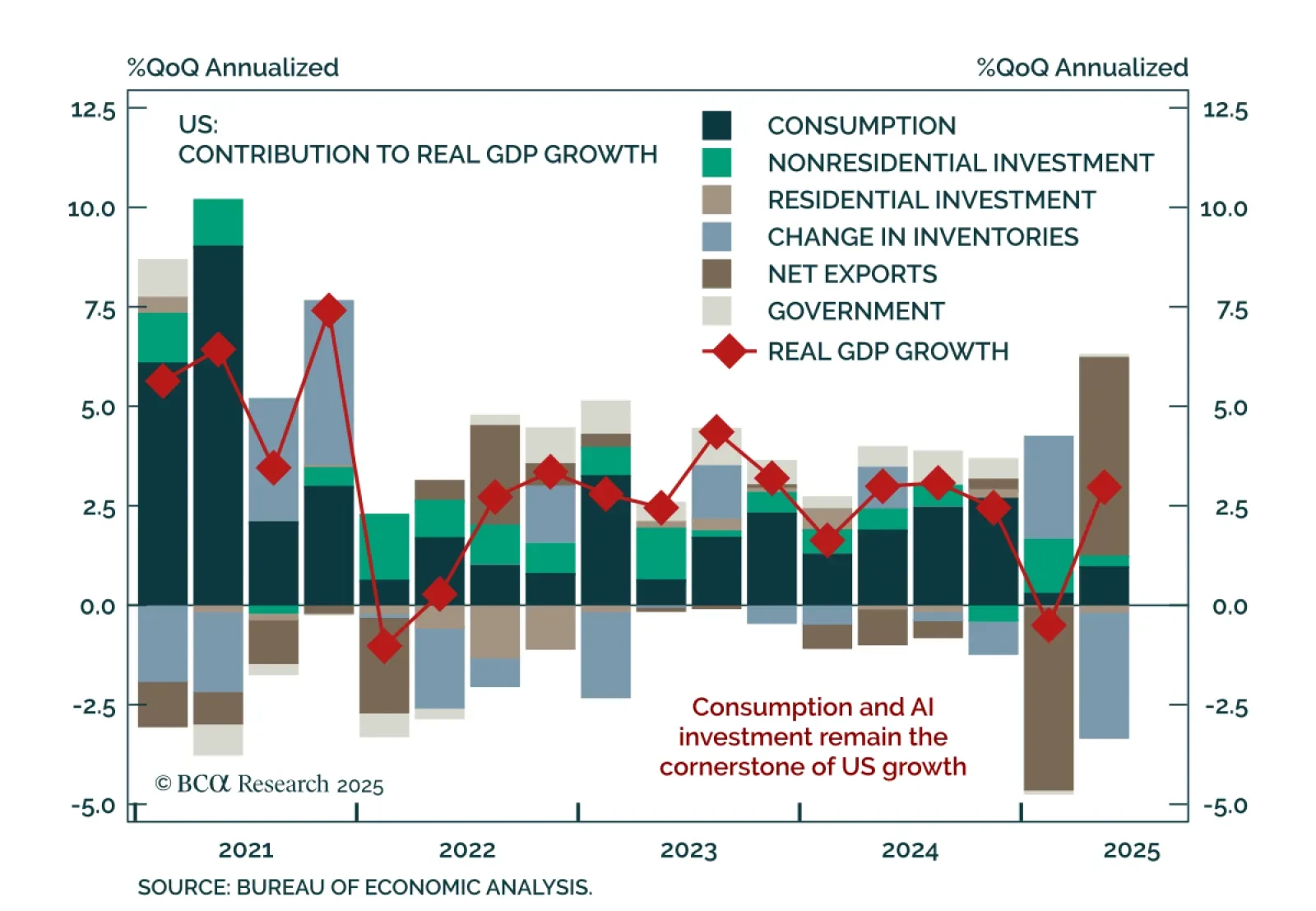

Q2 US GDP beat expectations at 3.0% annualized, but the underlying data confirm that growth momentum is fading, reinforcing our defensive stance. Consumption rebounded, but disappointed at 1.4%. The quarter was heavily distorted by…

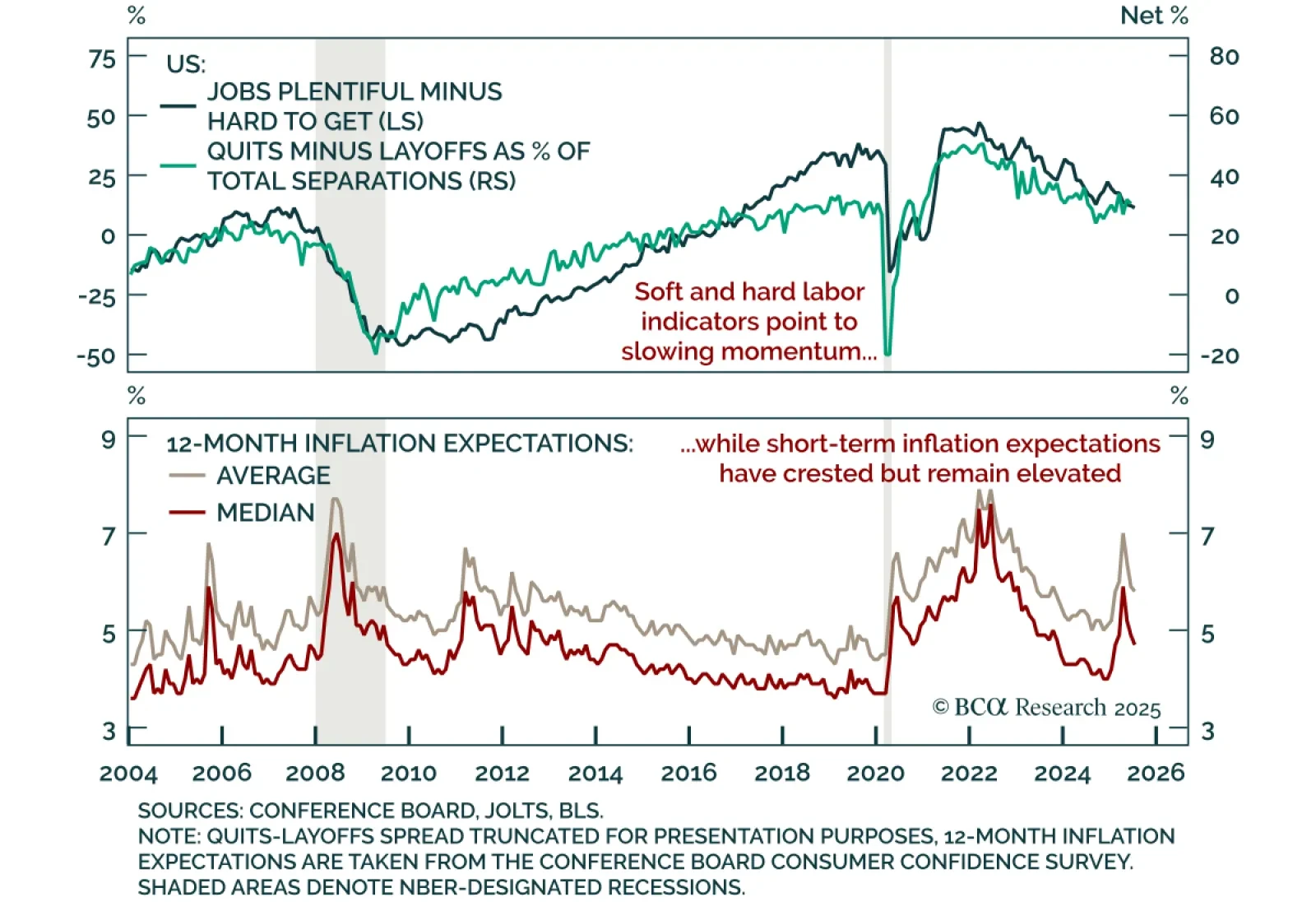

The July Conference Board Consumer Confidence report showed improved expectations but weaker current conditions, reinforcing our defensive stance and preference for downside protection. The headline index rose to 97.2 from a revised…

The June JOLTS report showed further weakening in US labor market momentum, reinforcing our overweight duration stance and preference for steepeners. Job openings fell more than expected to 7.4m from a downwardly revised 7.7m, while…

We will only move to a fully defensive stance if the “whites of the recession’s eyes” appear. So far, they have not. We will be increasingly looking to our MacroQuant model for guidance on when the next turning point in markets may…

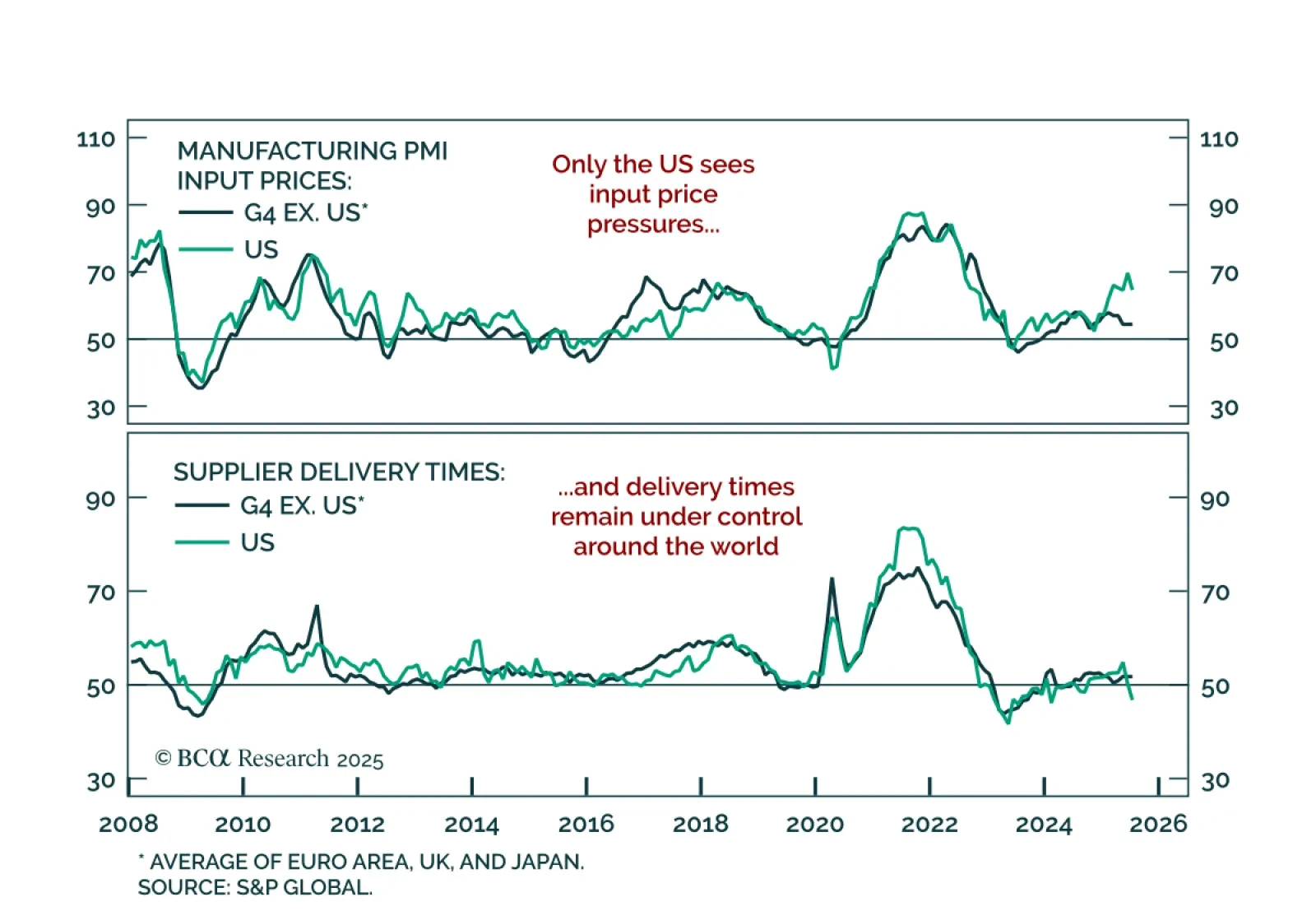

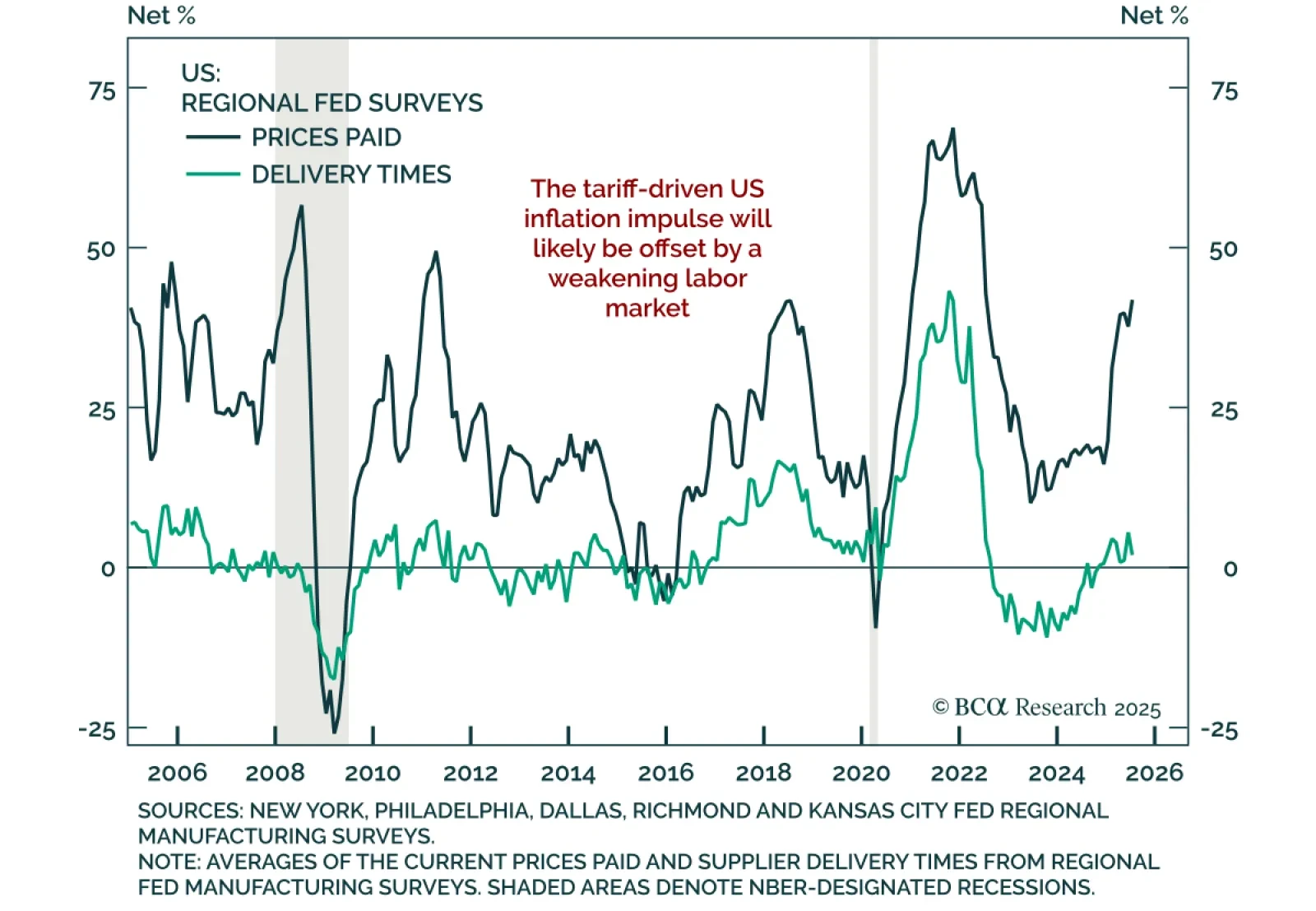

Cresting price pressures and weak global growth reinforce our long duration stance, with labor market slack limiting inflation upside across most major economies. Our price pressure indexes show moderate input inflation outside…

The July Dallas Fed survey beat expectations, pointing to a rebound in current activity, but the outlook remains subdued, supporting our modestly defensive asset allocation. The headline index rose to 0.9 from -12.7 in June, with…