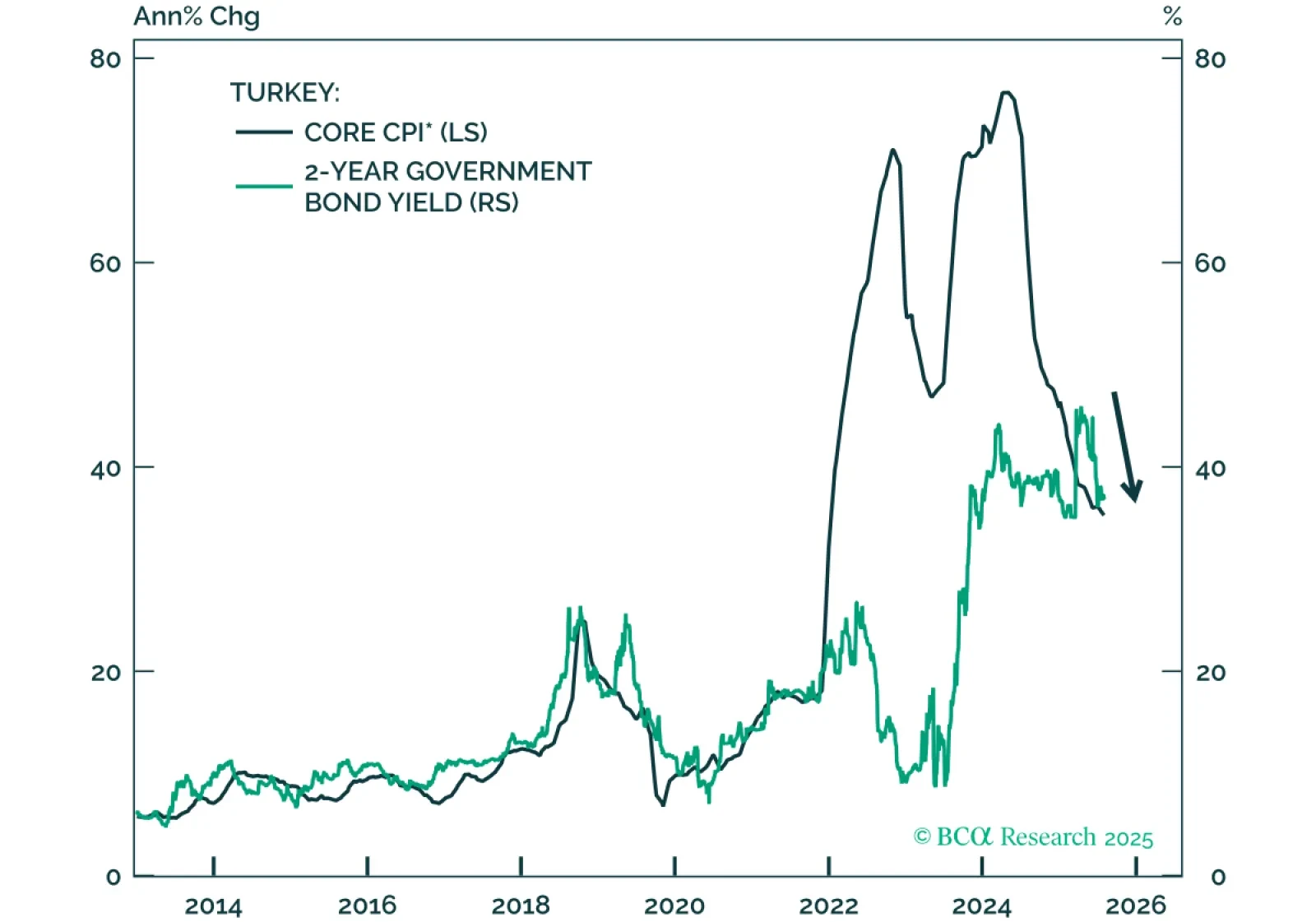

Turkey’s financial policymakers have pursued a disciplined and restrictive policy mix so far, delivering high real interest rates and curbing fiscal expansion even as the economy slows. This commitment to inflation control has paved the…

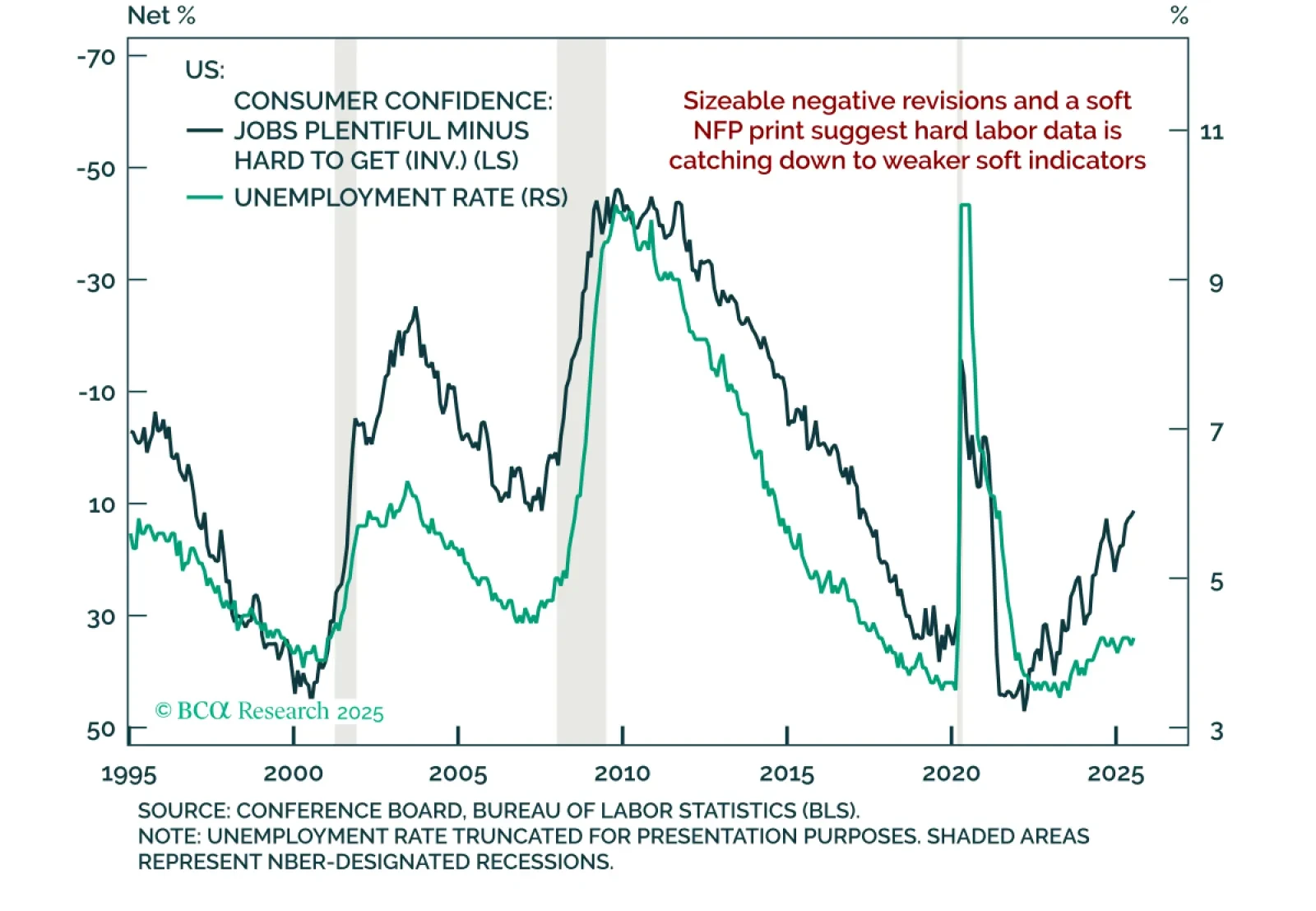

We maintain our 12-month US recession probability at 60%. However, until the “whites of the recession’s eyes” are more clearly visible, we would refrain from moving to a fully defensive stance.

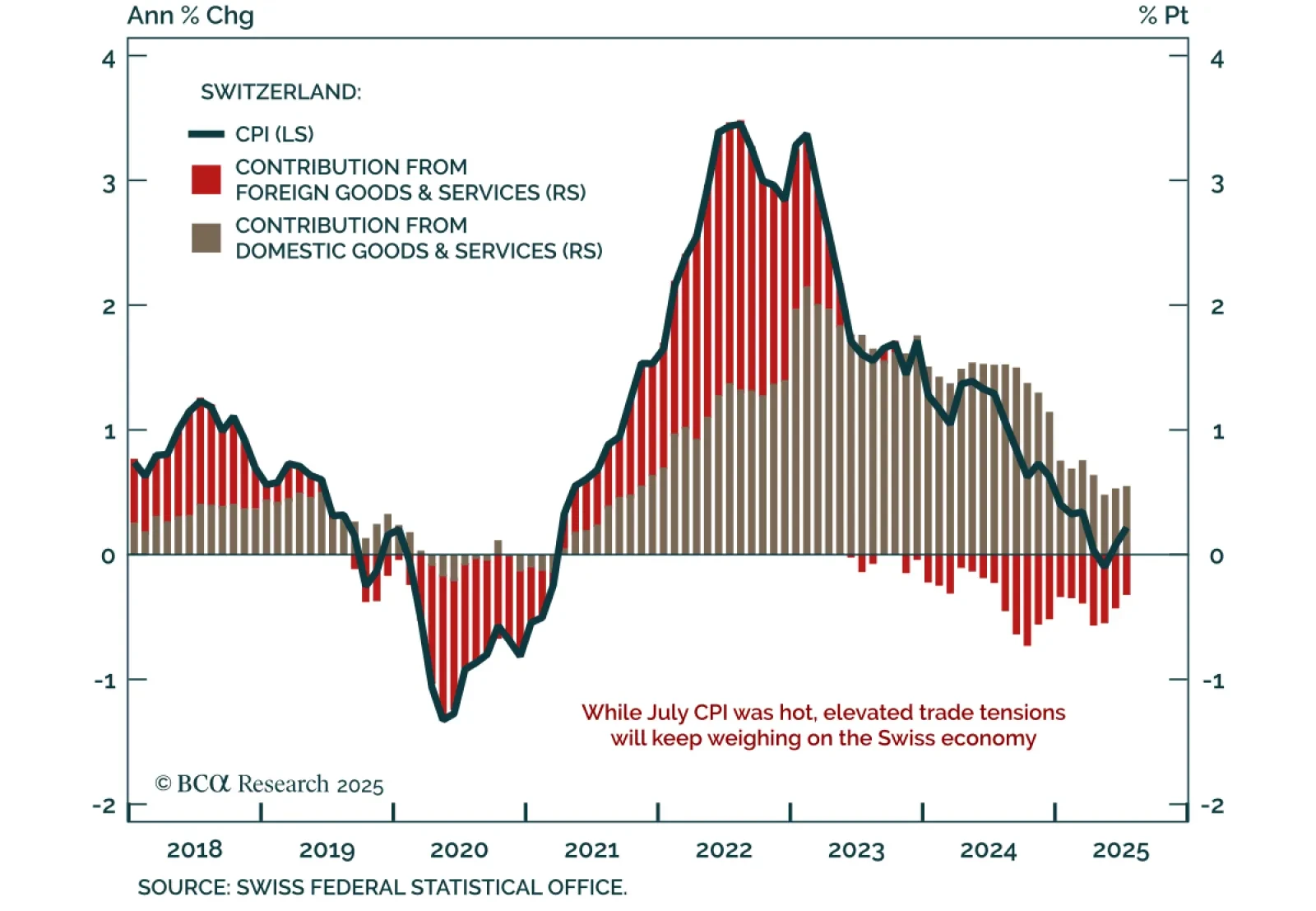

Hot July inflation does little to alter Switzerland’s near-term deflationary outlook, as soft data and trade risks support a defensive stance and preference for bonds over equities. CPI ticked up to 0.2% y/y from 0.1%, with core…

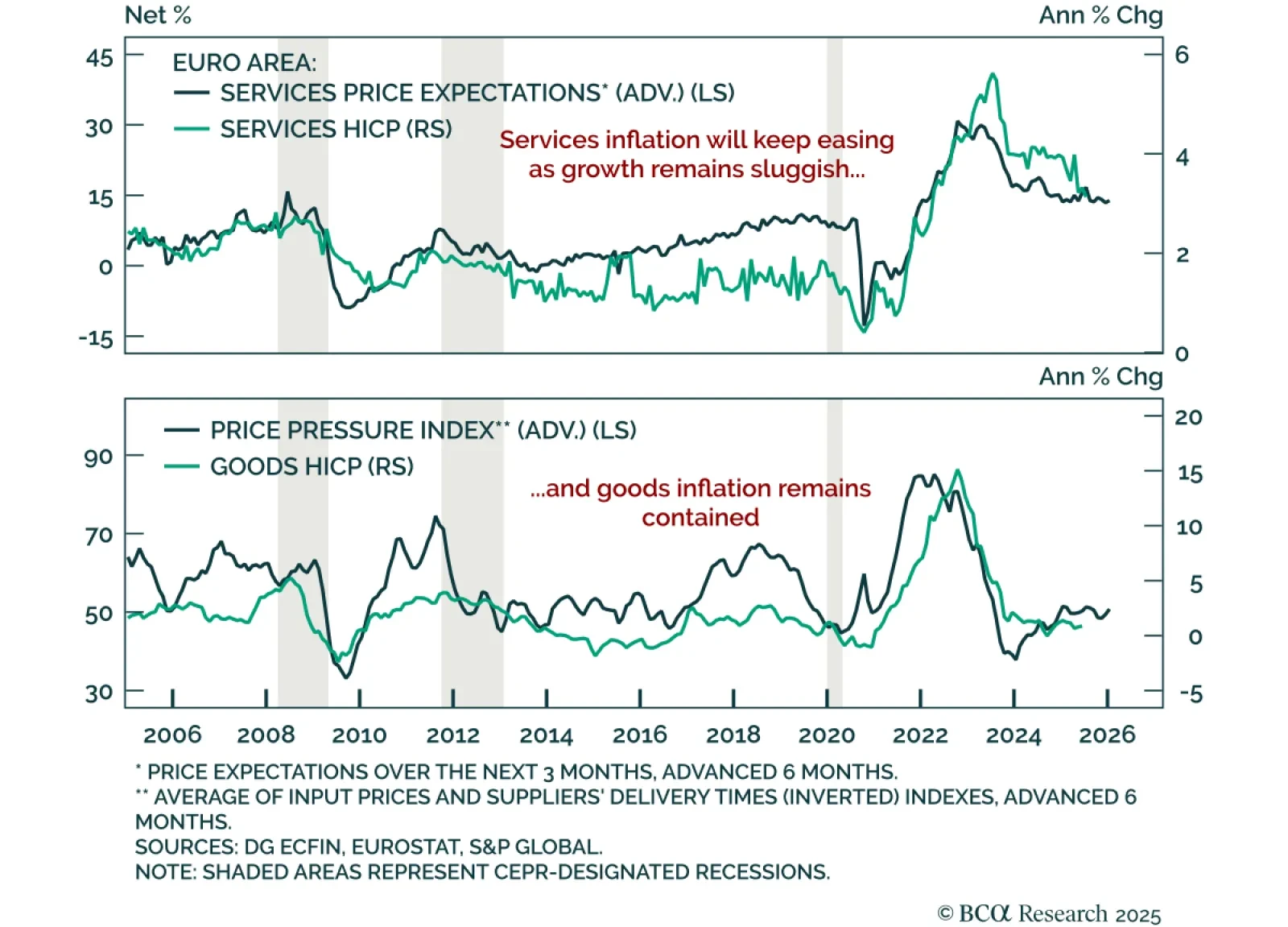

Euro area inflation held steady in July, but near-term risks remain. Long-term investors should buy on dips. Headline and core HICP came in at 2.0% and 2.3% y/y, roughly in line with expectations. The ECB held its deposit rate…

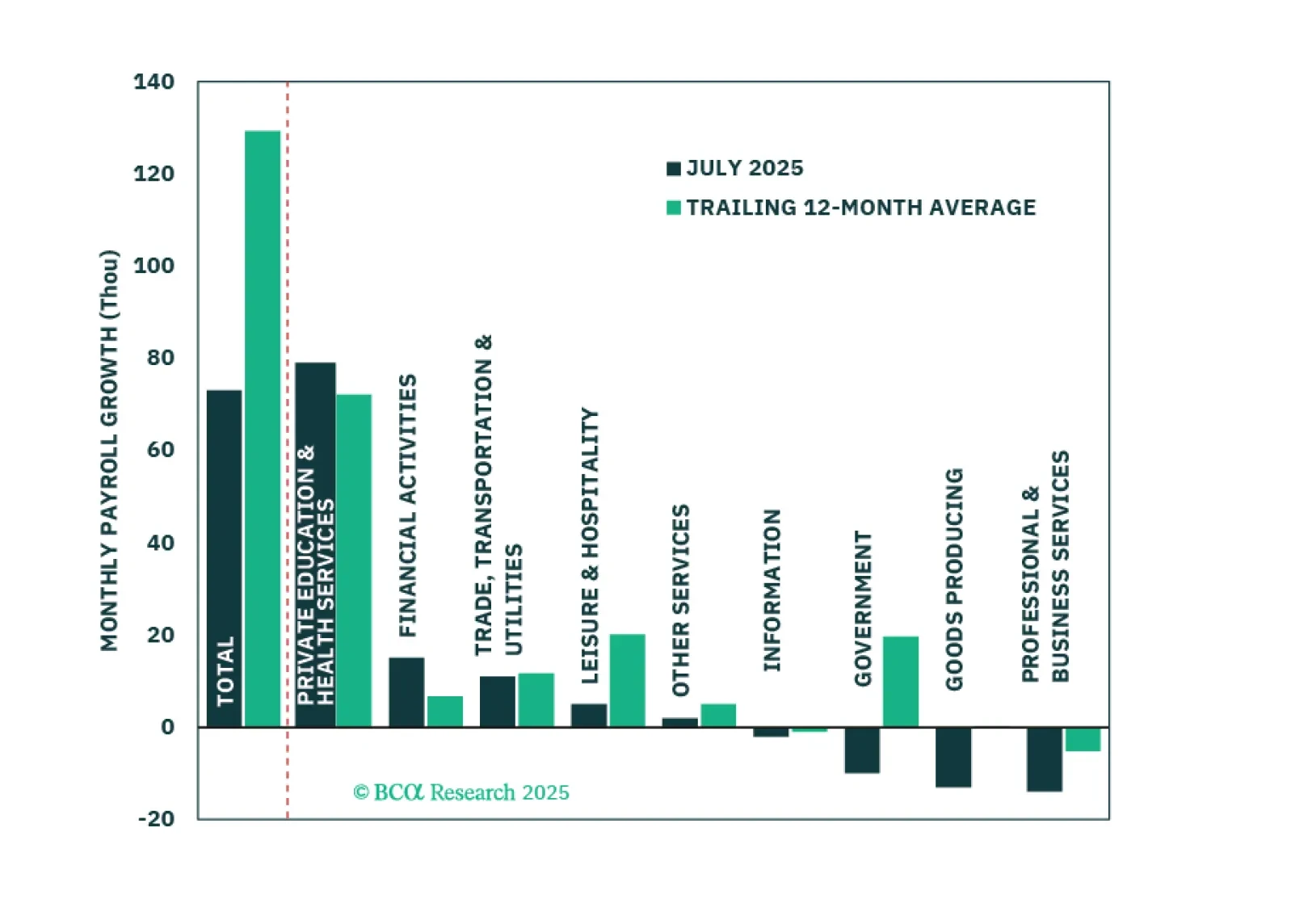

The July employment report revealed large downward revisions and slowing payroll growth, reinforcing our defensive stance. Nonfarm payrolls rose just 73k, and prior months were revised down by 258k, bringing the 3-month average to…

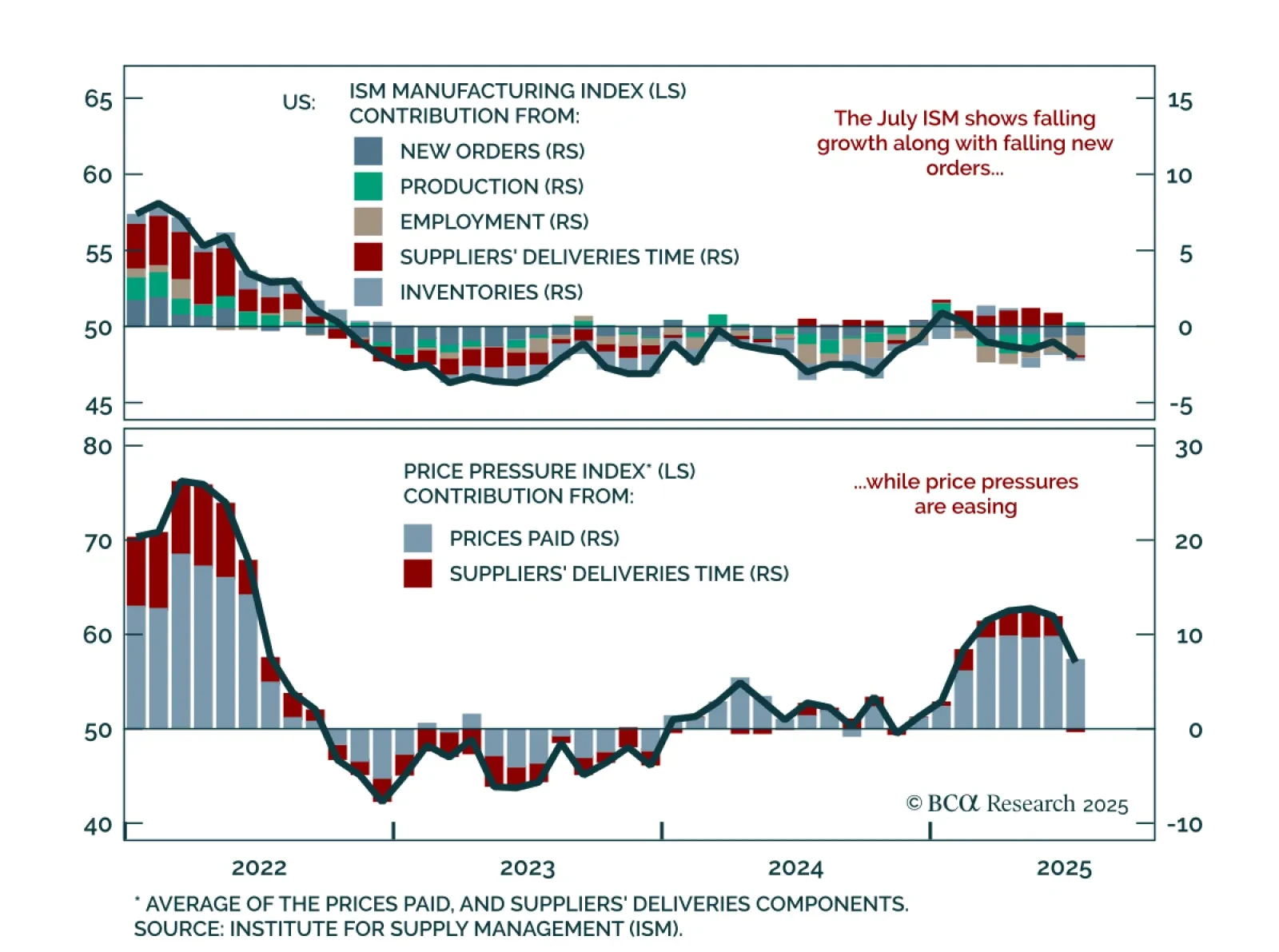

The July ISM Manufacturing miss shows weakening growth and decelerating inflation, reinforcing our long-duration stance. The index fell to 48.0 from 49.0, with only the production component contributing positively. New orders remain…

Economic activity and hiring cooled significantly in the first half of the year. The most important question for investors is whether this signals an imminent increase in labor market slack.

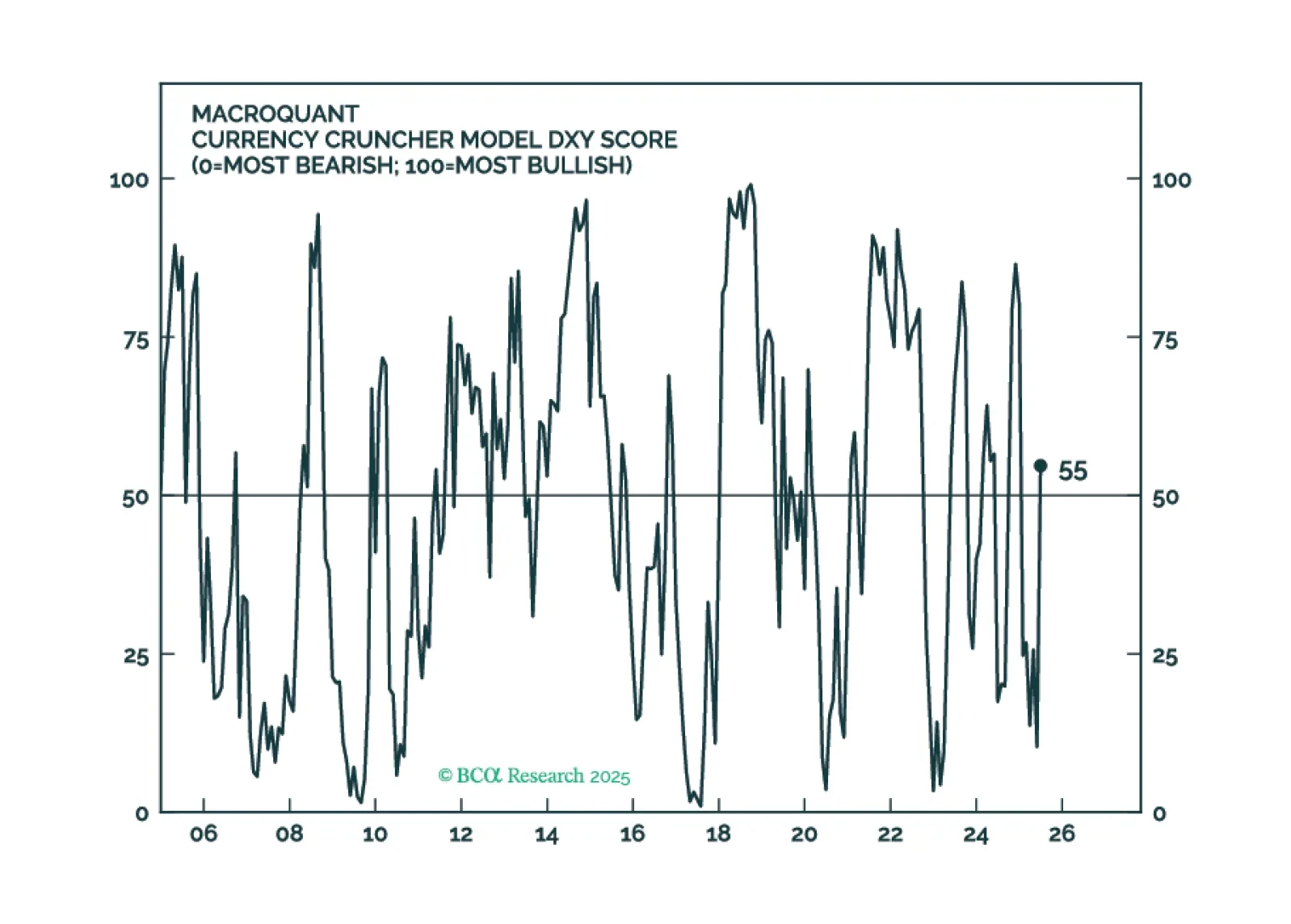

MacroQuant is recommending that equity investors keep their finger near the eject button but avoid pressing it for now. The model is warming up to the dollar again and sees scope for oil prices to rise.

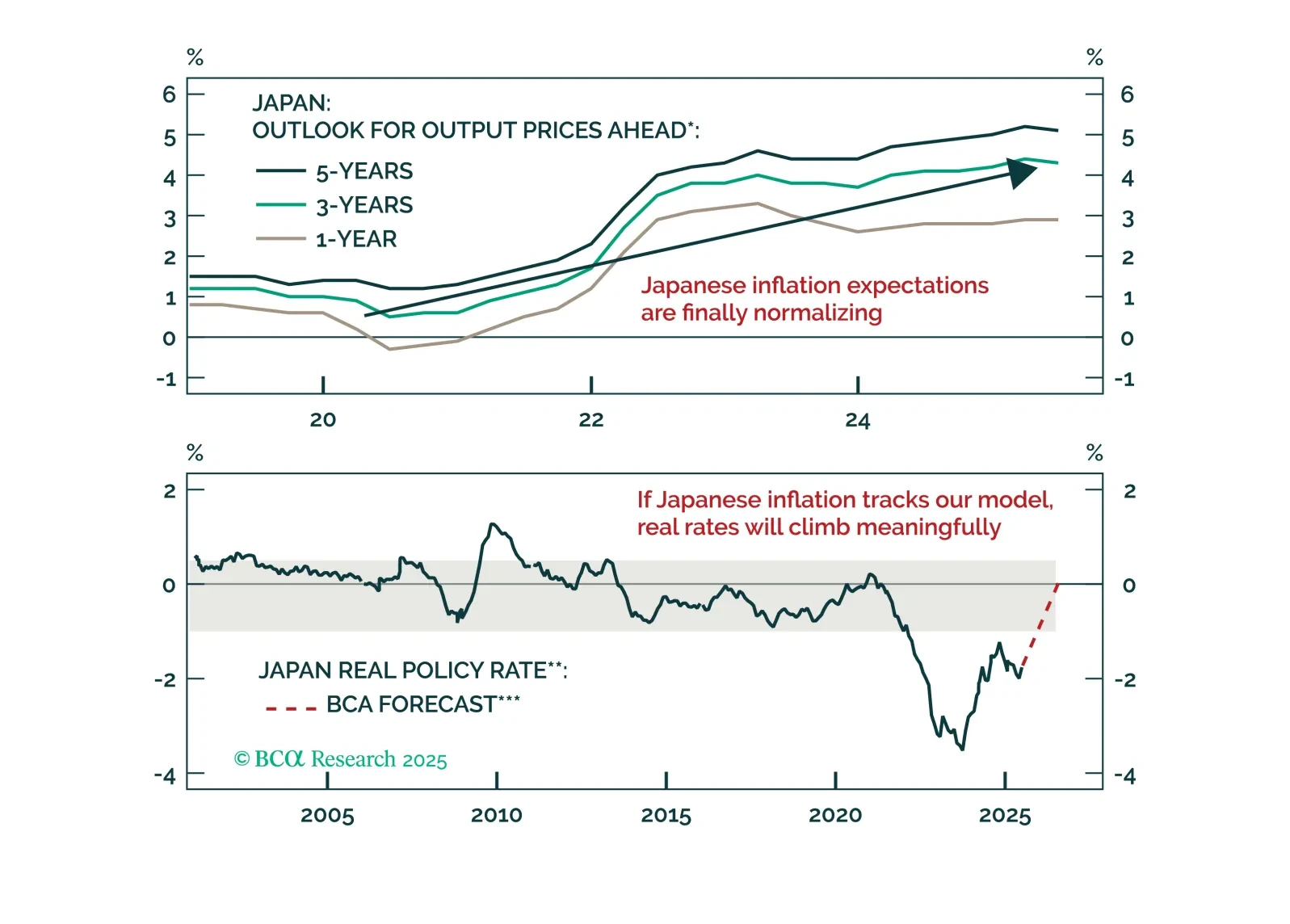

The yen’s discount, surplus, and rising real rates line up for a multi-quarter surge. Find out why EUR/JPY is the first short and when USD/JPY follows.

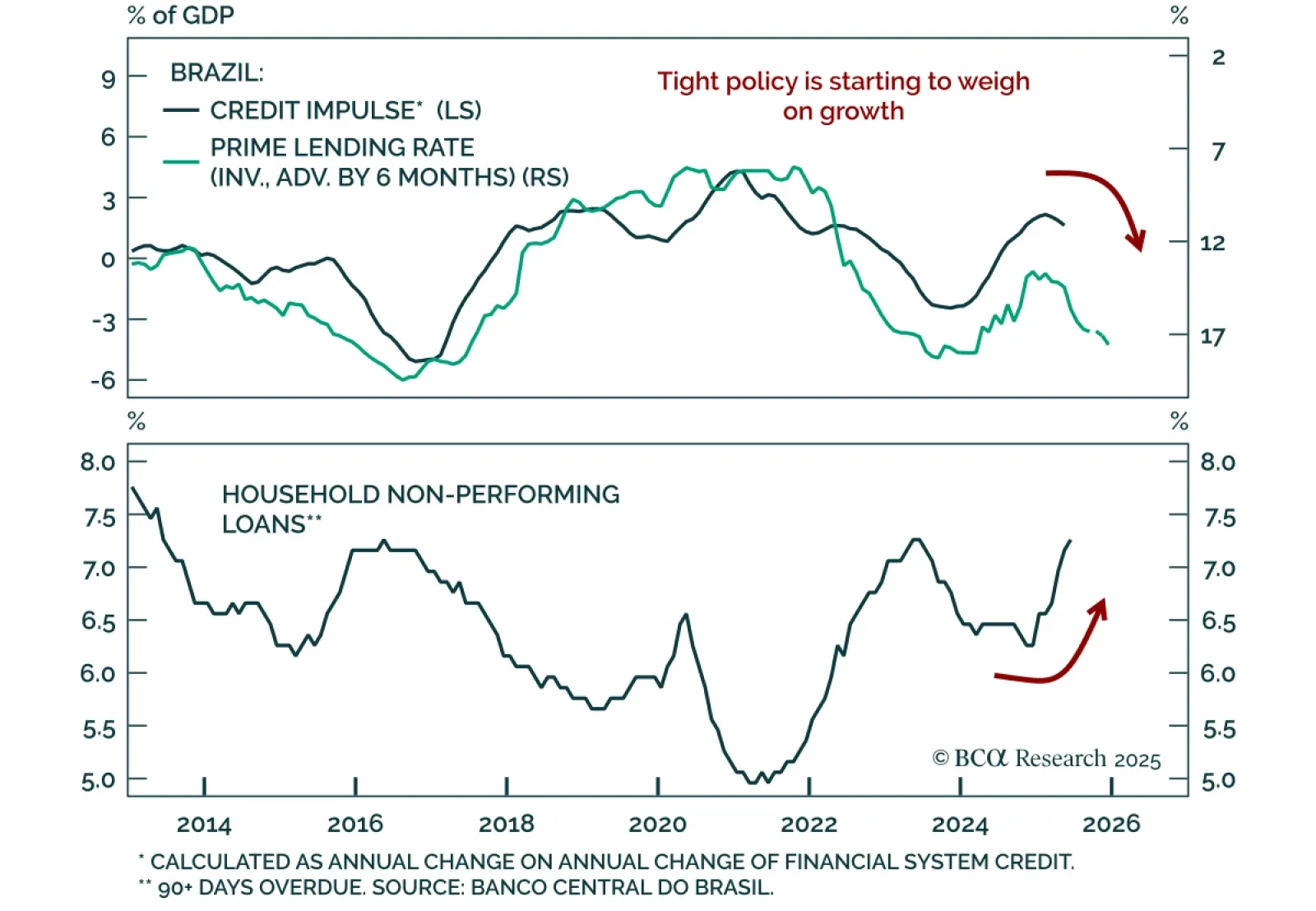

The Central Bank of Brazil (BCB) held rates at 15%, guaranteeing a sharp growth slowdown and reinforcing our underweight stance on Brazilian equities versus EM. All Copom board members voted to maintain an ultra-hawkish policy…