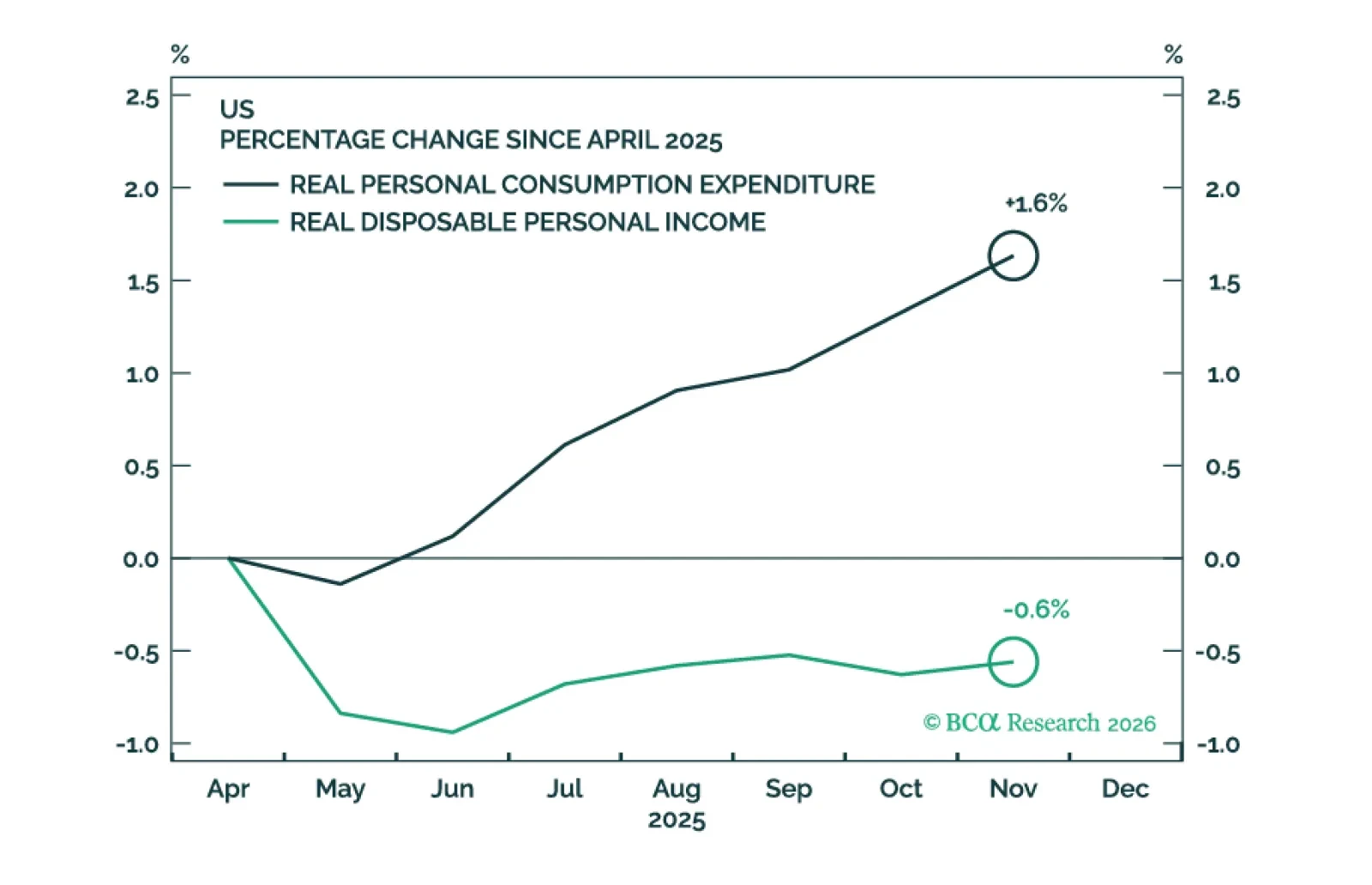

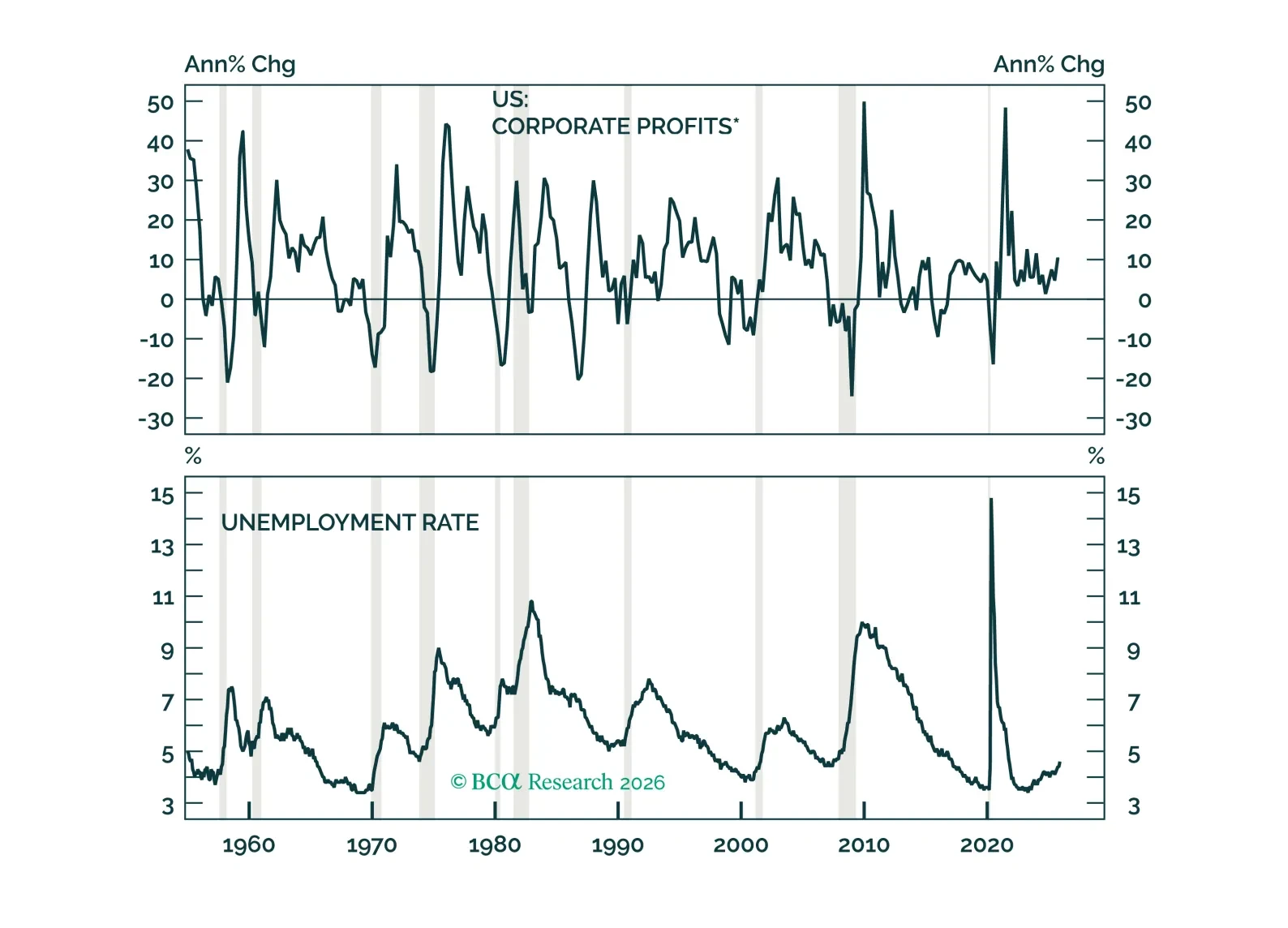

Recent economic data have been reasonably firm. We will cut our 12-month US recession probability to 40% from 50% if the Supreme Court strikes down President Trump’s tariffs. This would take our scenario-weighted year-end 2026…

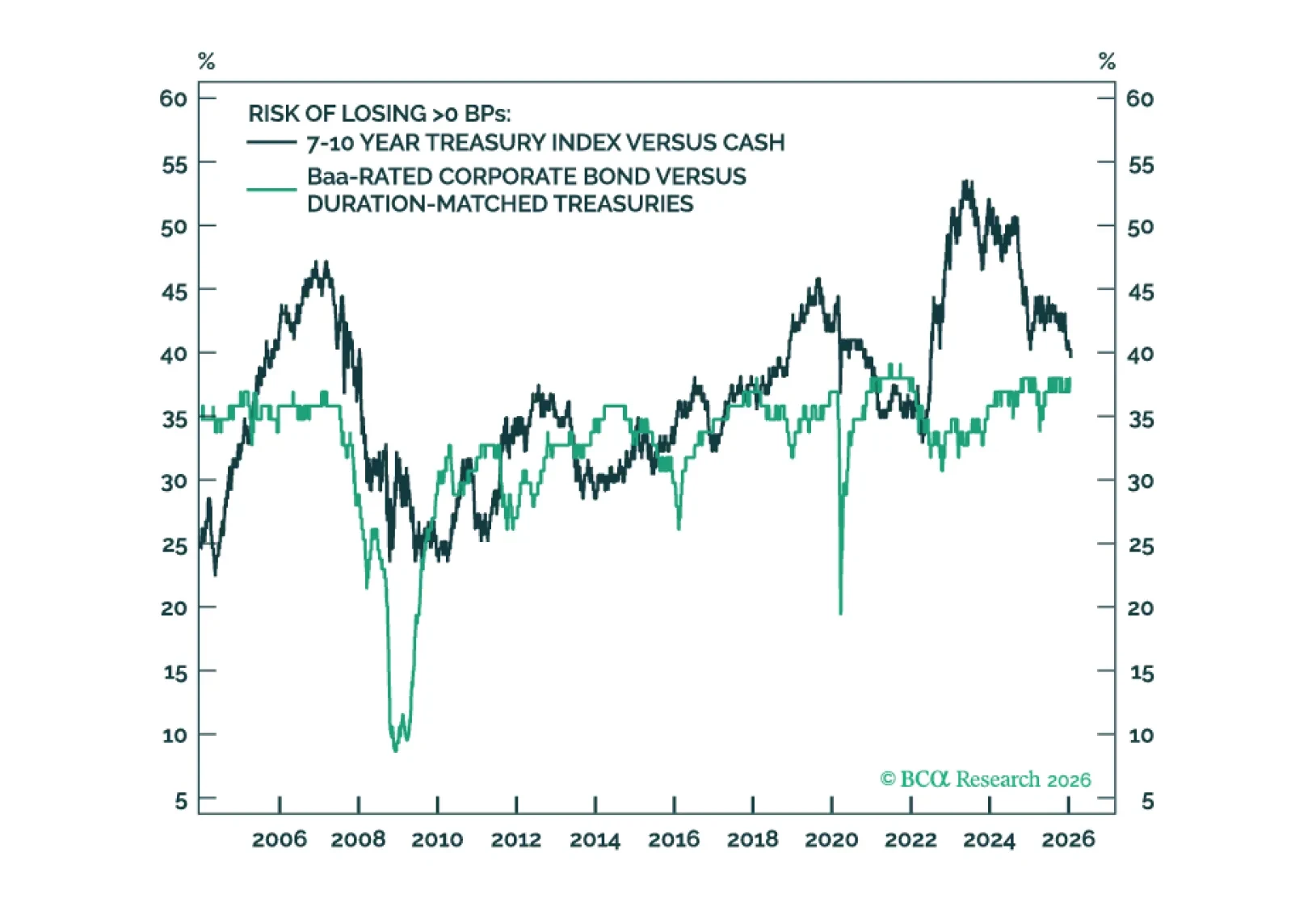

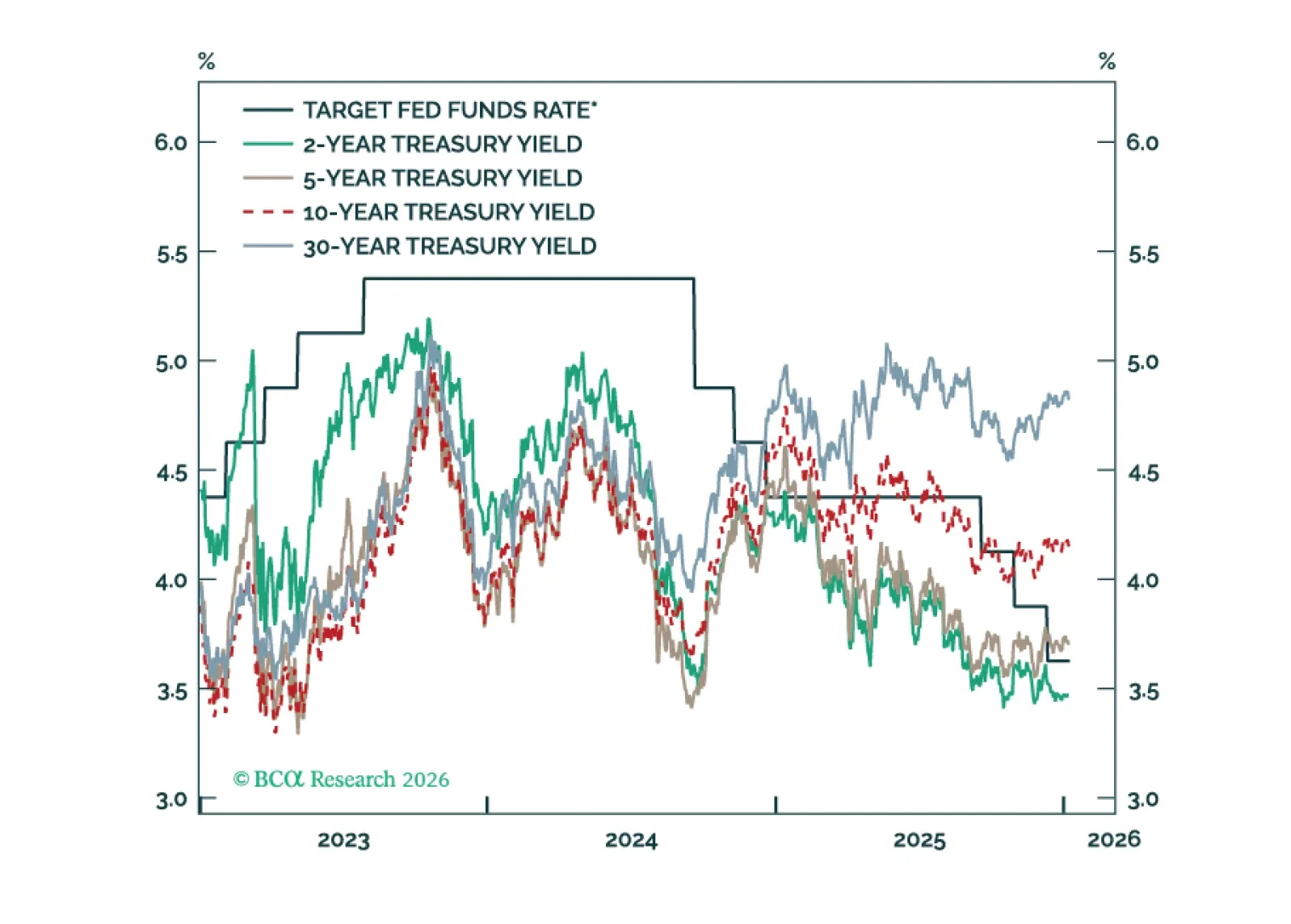

The 10-year Treasury term premium is now competitive with Baa- and Ba-rated credit spreads. Even without term premium compression, duration carry trades could outperform credit carry trades in a low rate vol environment.

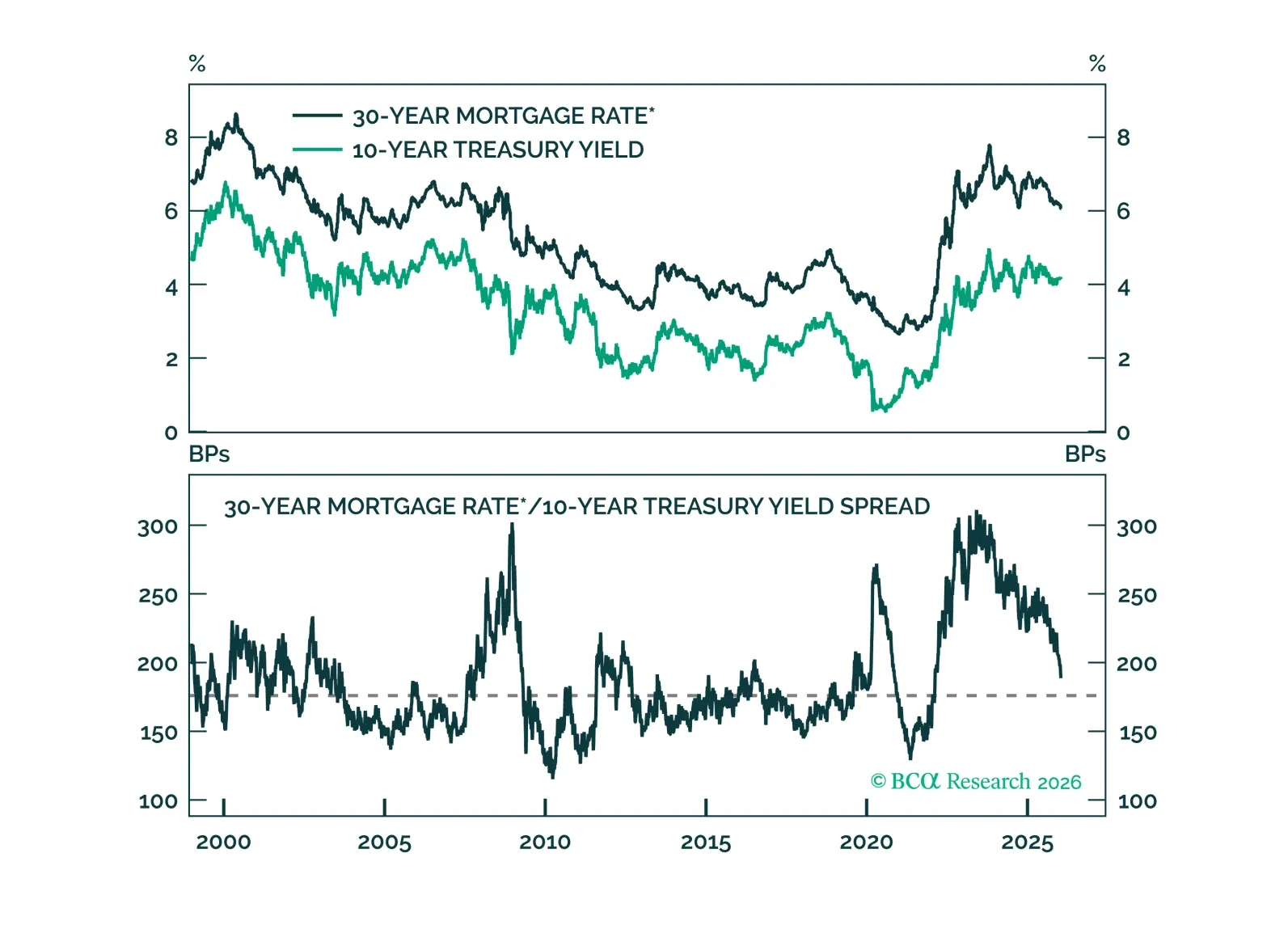

Mortgage spread tightening has run its course. Any further drop in mortgage rates will necessitate lower Treasury yields.

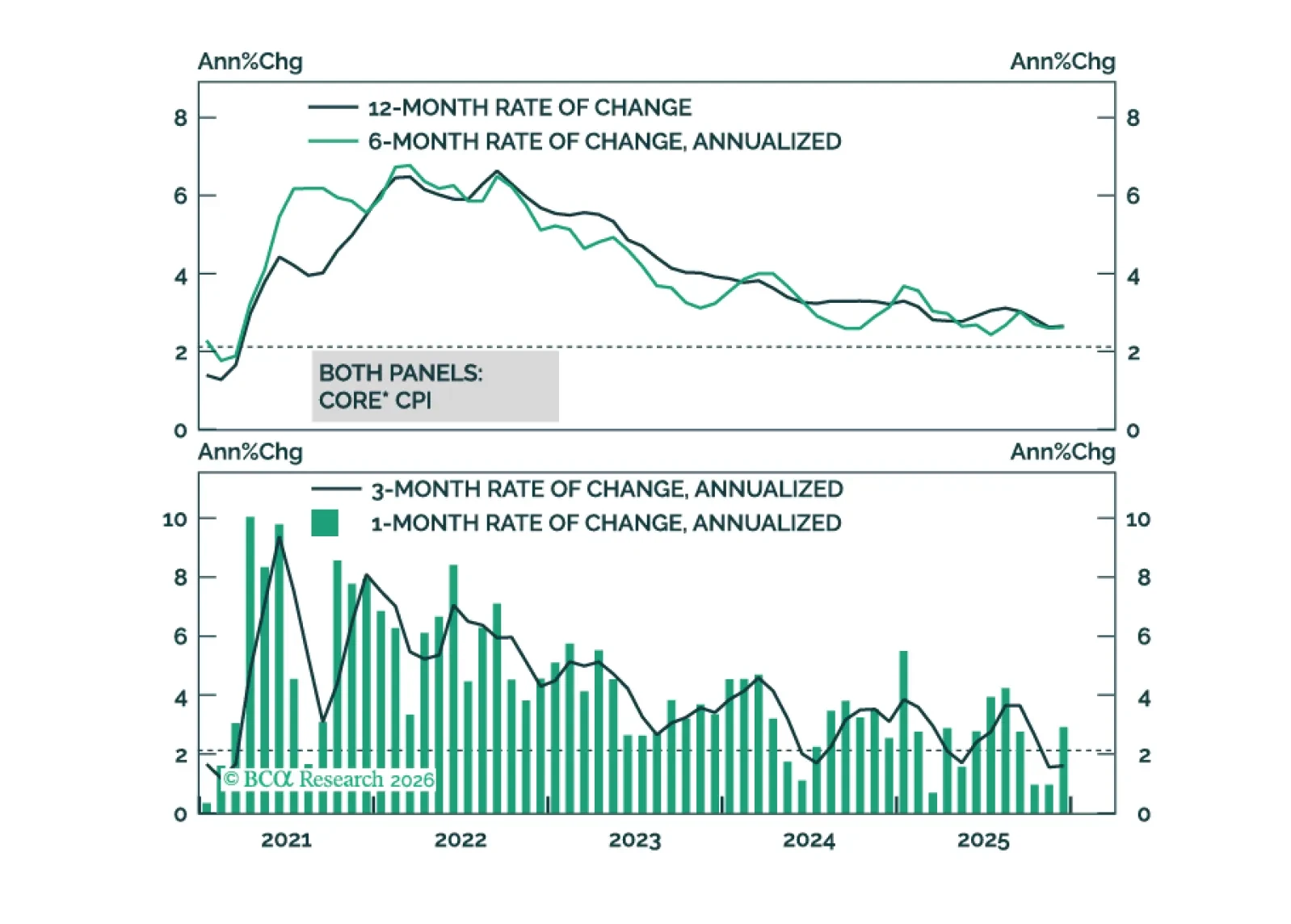

This morning’s CPI report signals that the worst of the tariff impact on inflation may already be in the rearview mirror.

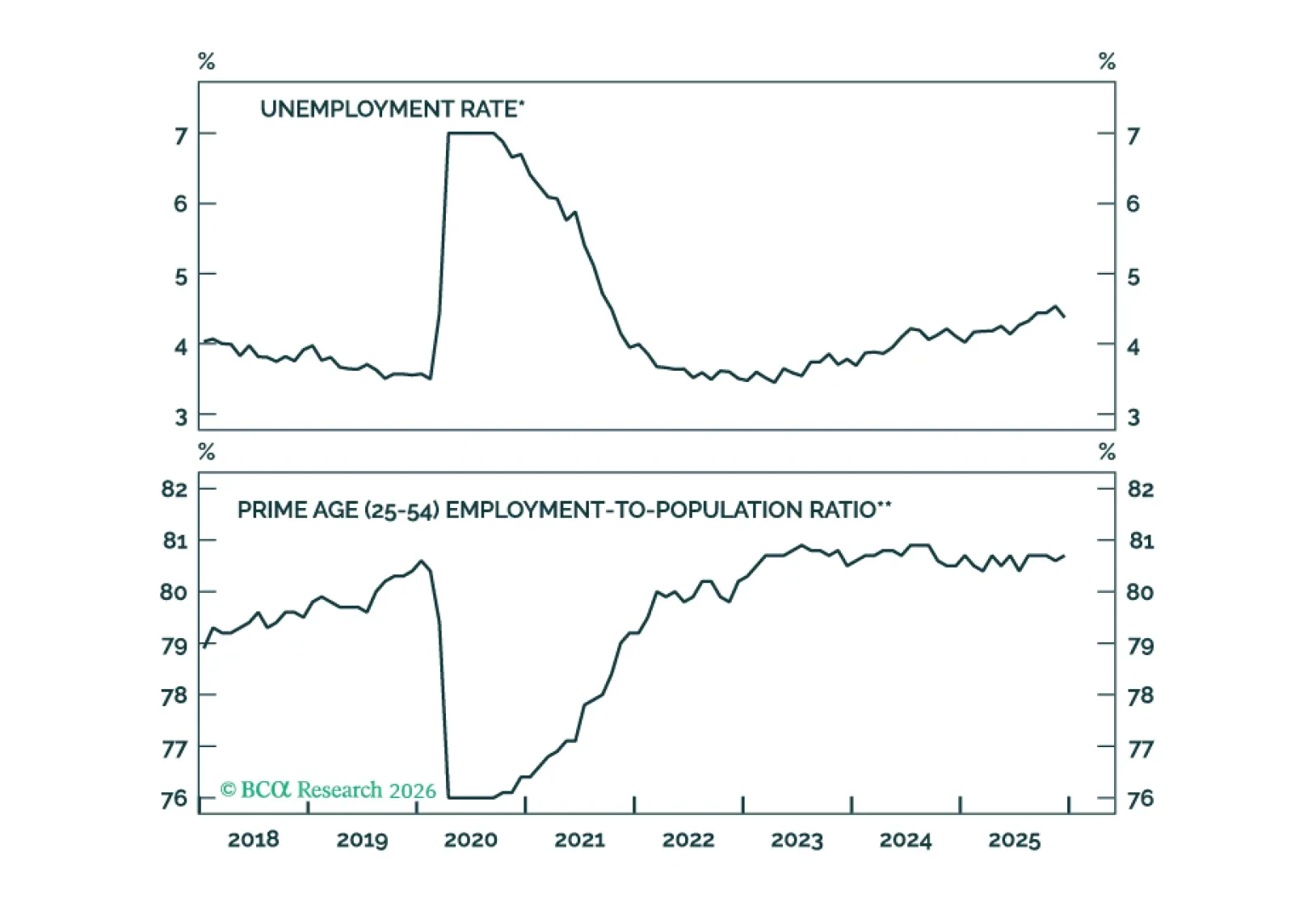

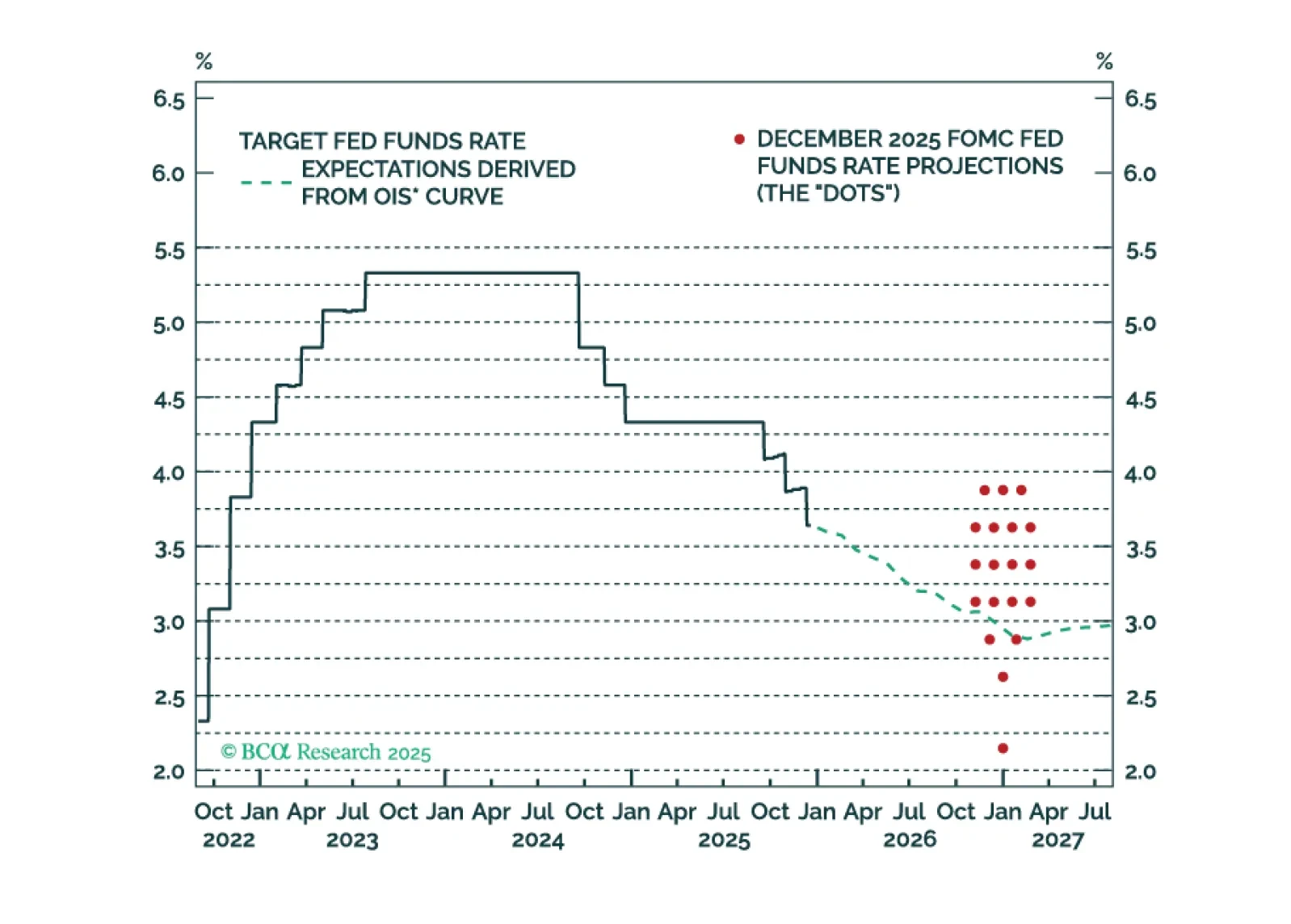

Measures of labor market utilization improved in December, ruling out a January cut and significantly reducing the odds of a March cut.

To start 2026, we answer what we believe are the most important questions facing investors surrounding the labor market, monetary and fiscal policy, and AI stocks. Overall, we reiterate our overweight views on risk assets and…

Our Portfolio Allocation Summary for January 2026.

MacroQuant has downgraded equities to underweight, favors a below-benchmark duration stance in fixed-income portfolios, remains bearish on the US dollar, and is still bullish on gold.