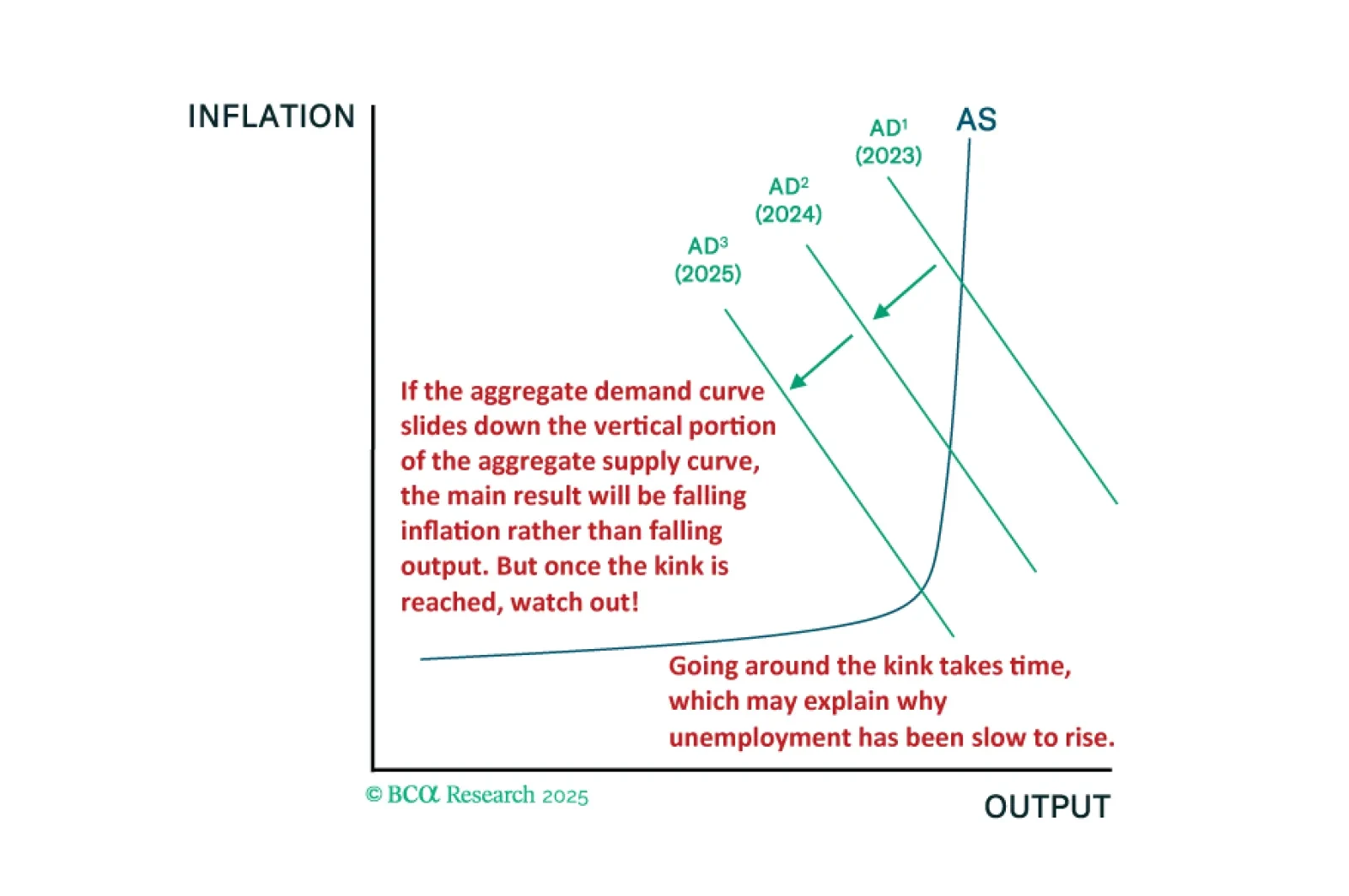

The fact that the US economy has been slower to deteriorate than in past cycles is entirely consistent with our kinked Phillips curve framework. We will be looking to our MacroQuant model for guidance on when to turn fully defensive…

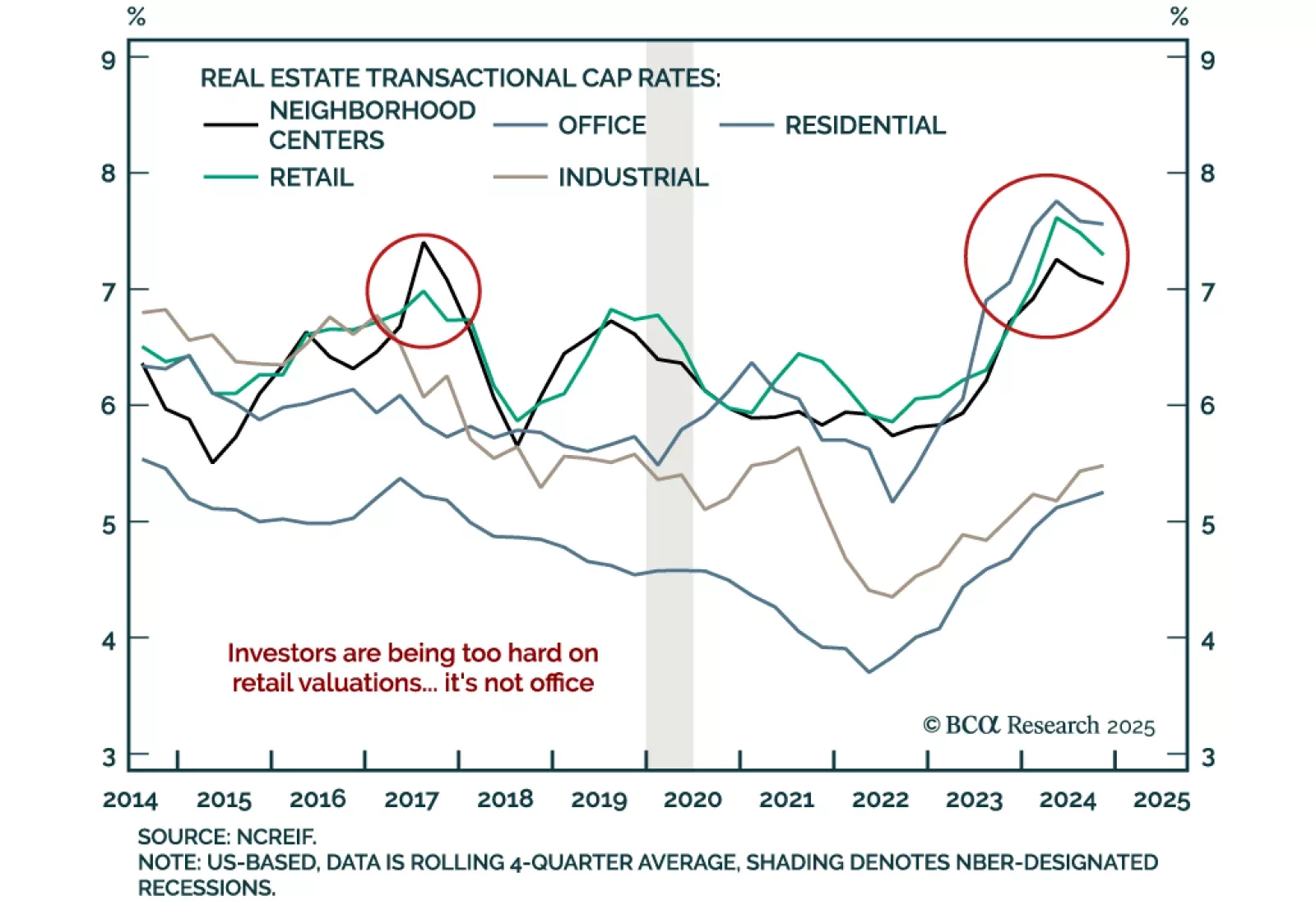

Our Private Markets & Alternatives strategists assessed retail real estate opportunities. Retail Real Estate is a contrarian opportunity, with investor sentiment at rock-bottom levels despite shifting consumption patterns.…

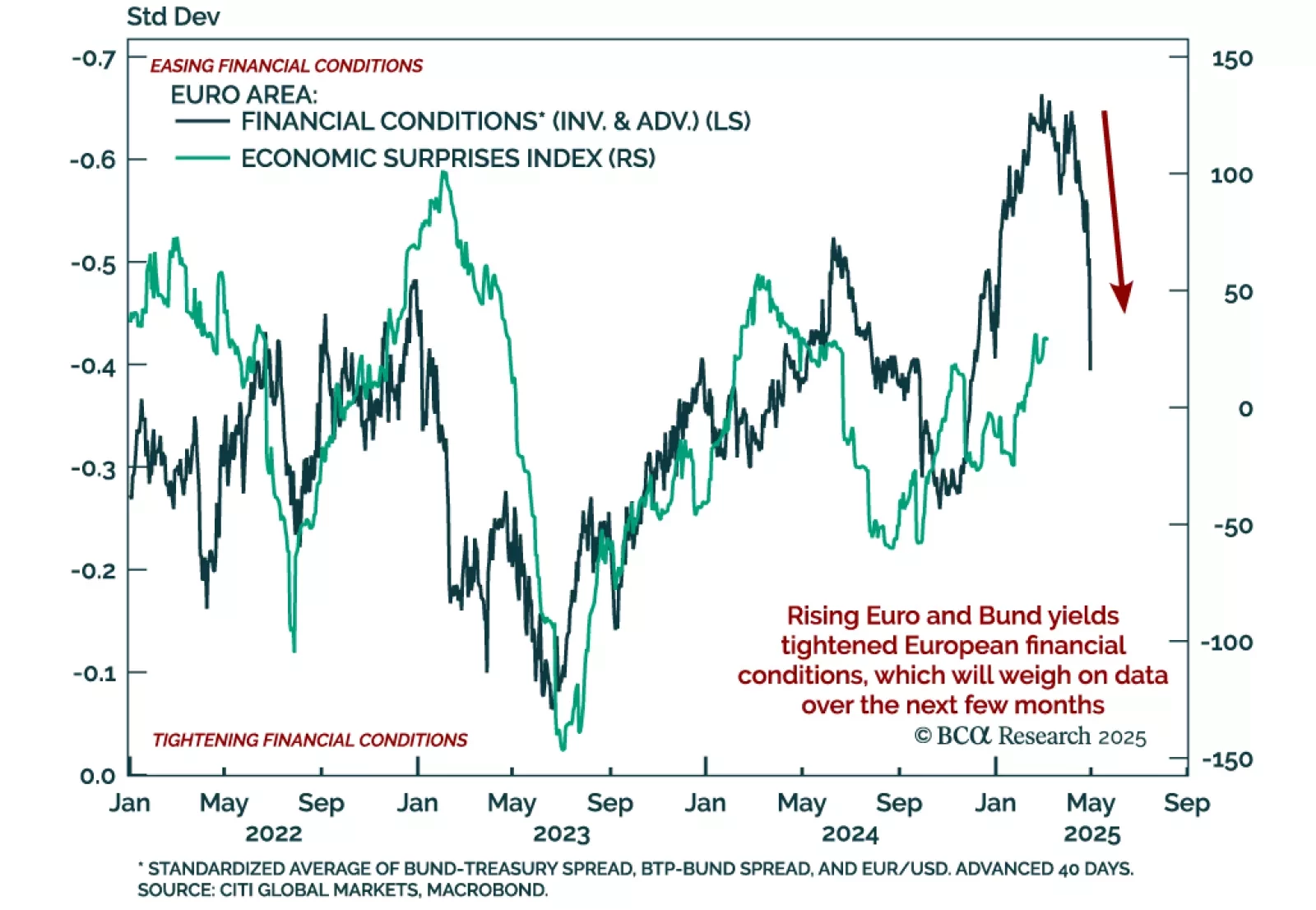

The ECB cut 25 bps as expected, bringing the deposit facility rate to 2.5%. President Lagarde reiterated the disinflationary process is “well on track” and described the policy stance as “meaningfully less restrictive”, signalling…

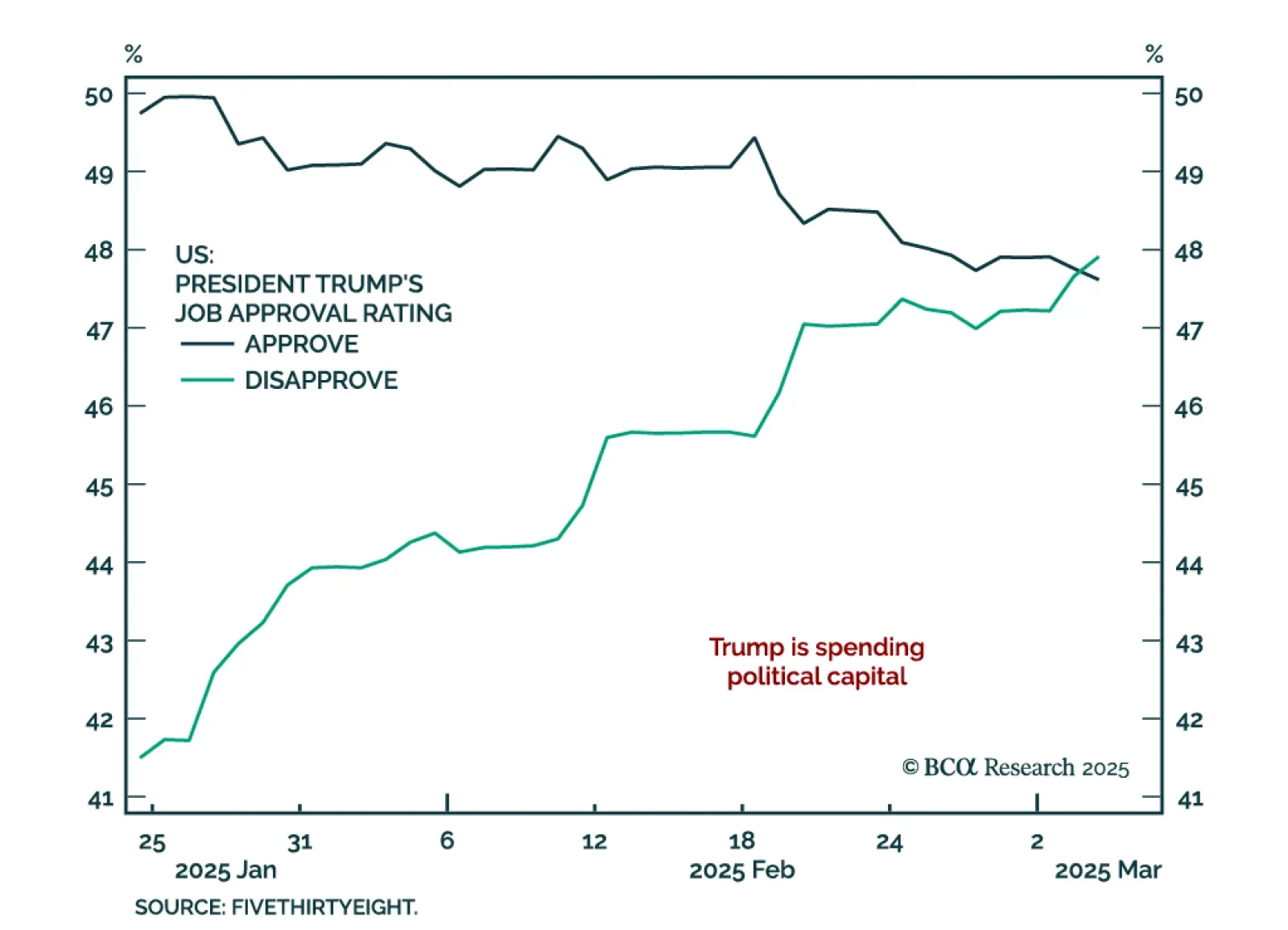

In light of President Trump’s address to Congress and the ebb-and-flow of tariff announcements, our Geopolitical strategists assessed the constraints on the administration’s disruptive agenda. Trump’s ability to implement his…

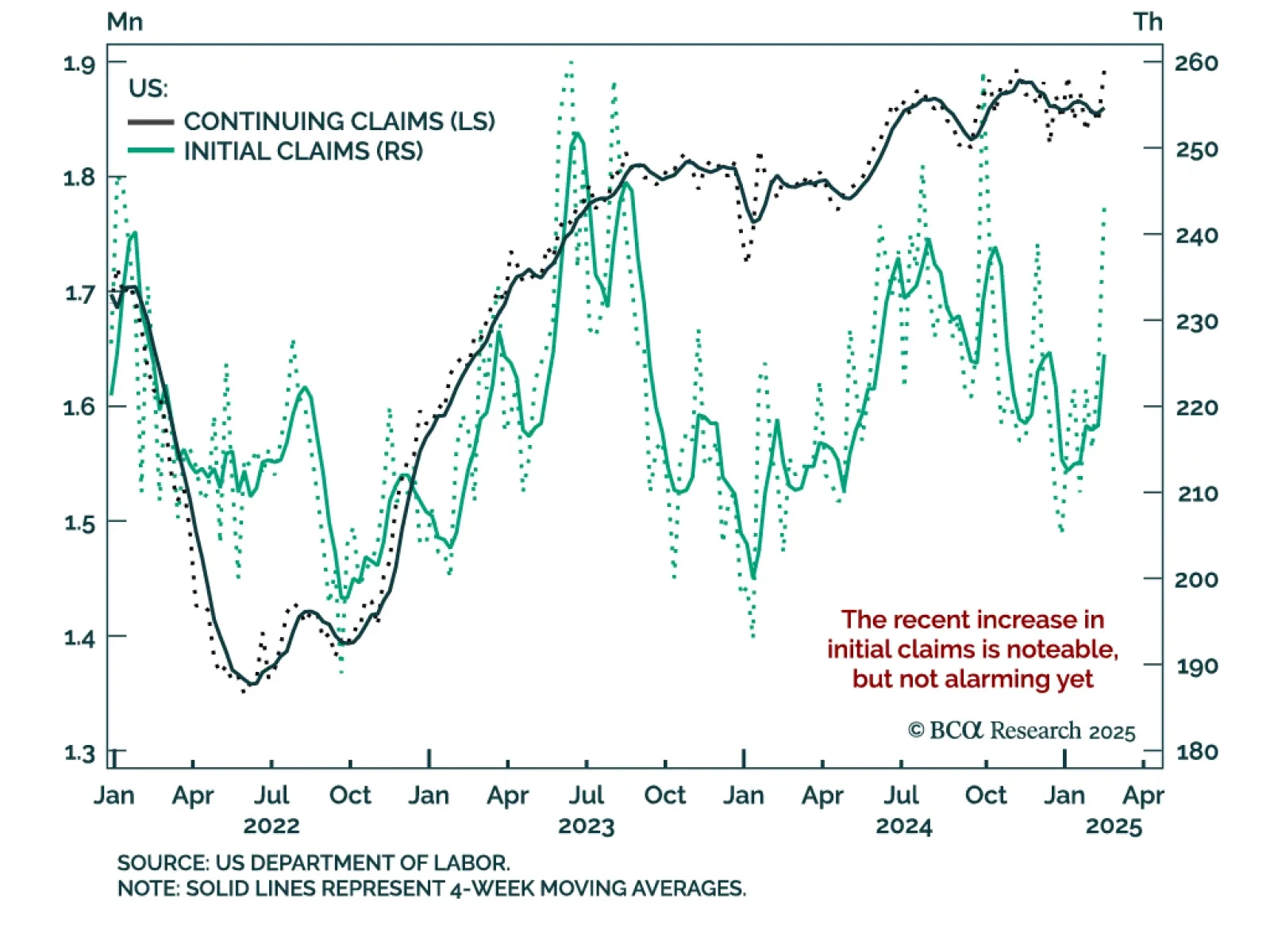

Weekly initial claims ticked up to 242k, near 2024 highs. The data is under the spotlight as the Trump administration implements a reduction of the federal workforce through the DOGE. Initial claims are not alarming yet; they…

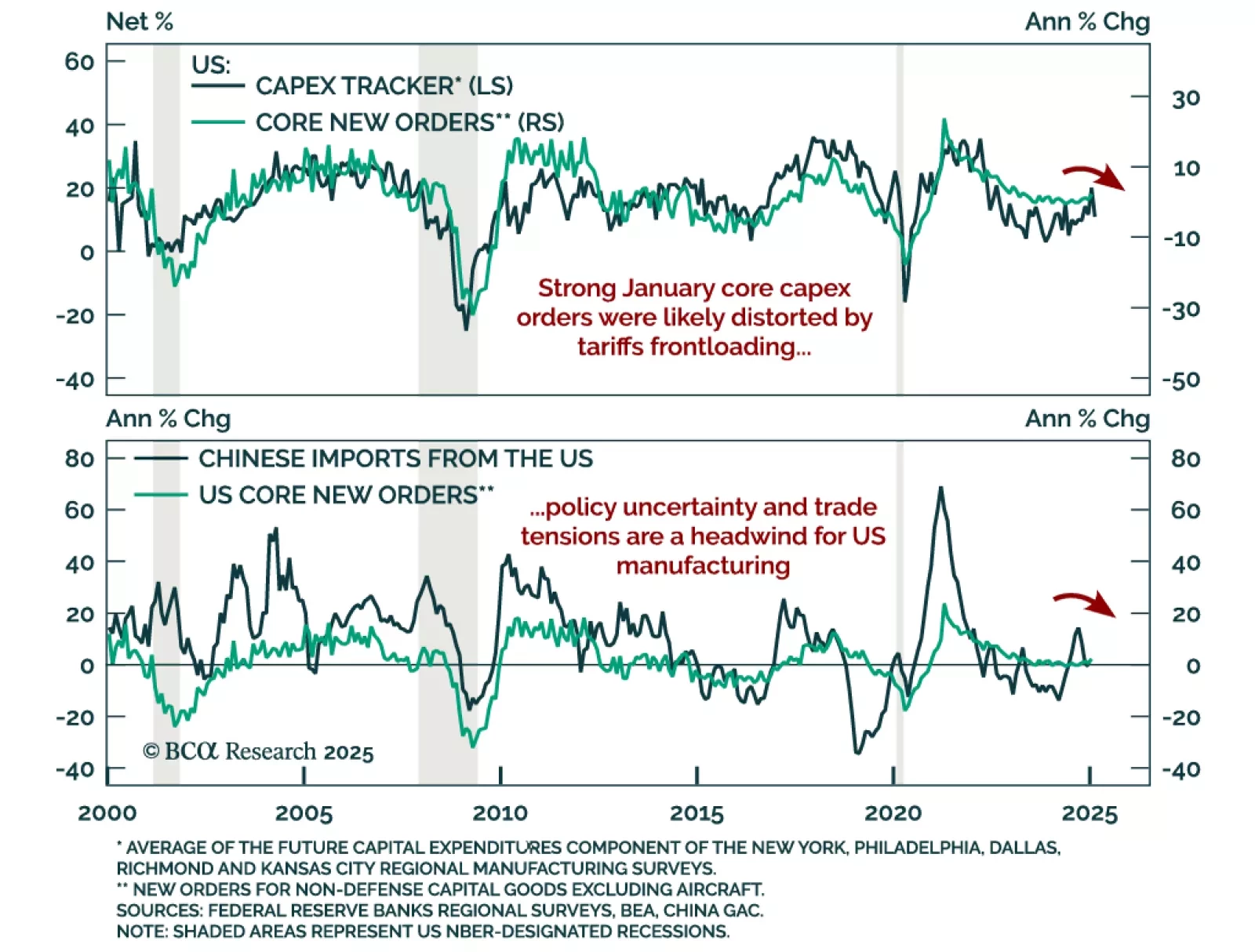

US January core new orders beat expectations, rising 0.8% m/m, an acceleration from 0.2% in December. This measure, which excludes defense and aircraft from capital goods, is used as a proxy for business investment. Core shipments…

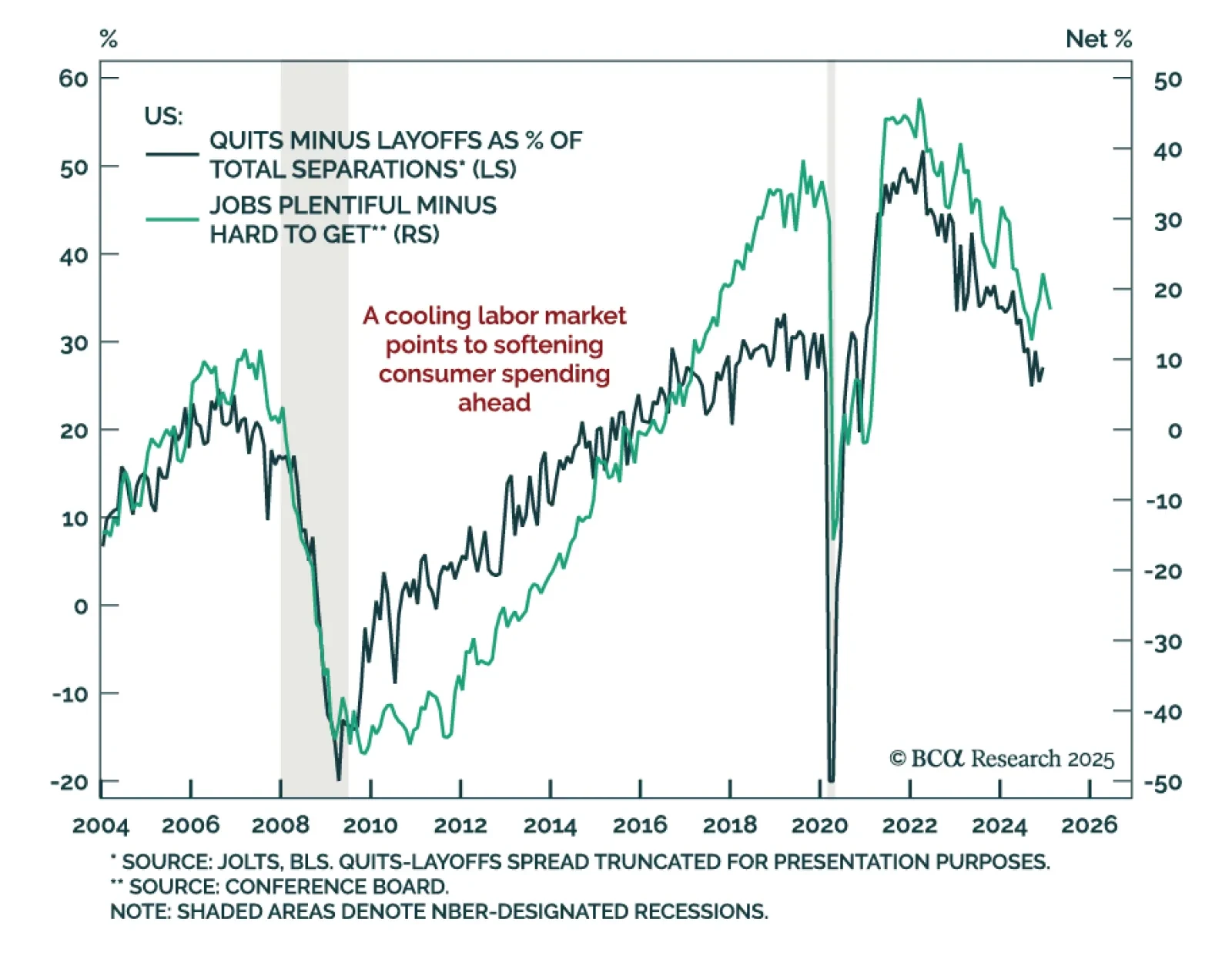

The February Conference Board Consumer Confidence index missed estimates for the third month in a row, falling to 98.3 from 105.3. Consumers’ assessment of both their current situation and their expectations worsened, with the latter…

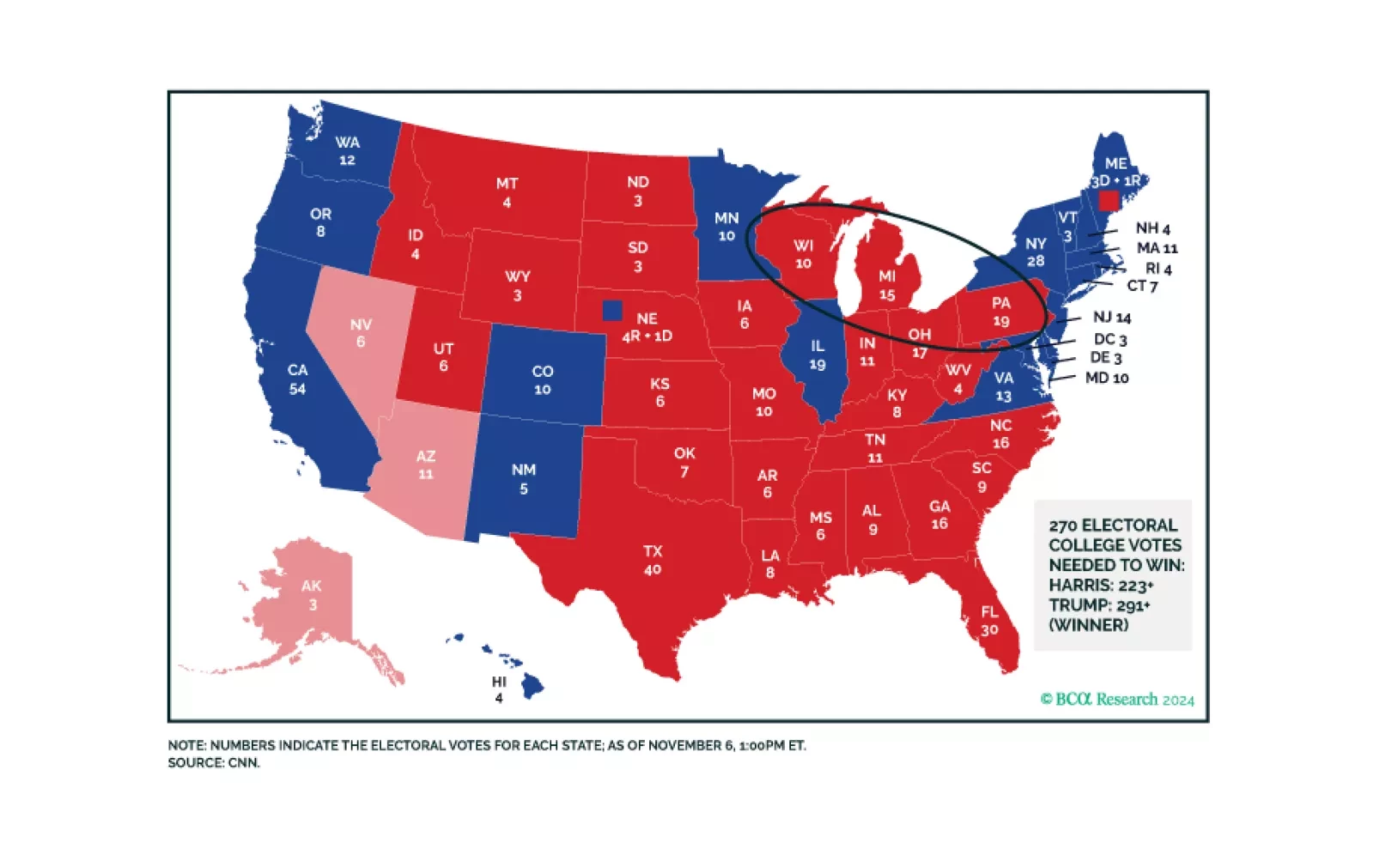

Trump’s resounding victory brings a popular mandate that ensures deregulation and higher trade tariffs. Higher budget deficit and immigration reform are also in the cards as the Republicans look like they may squeak a thin margin in…

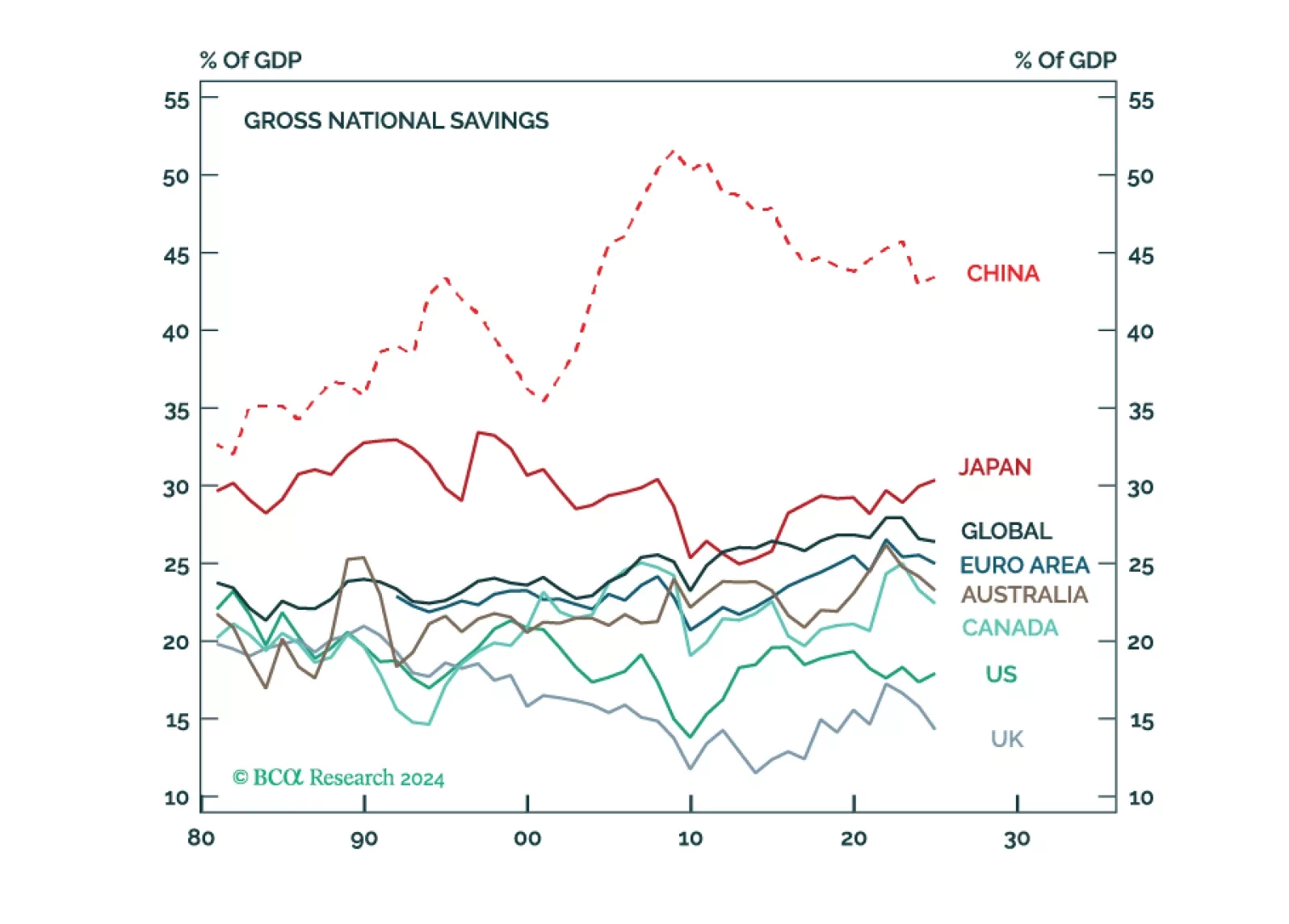

In this report, we discuss why we are lifting our US recession probability from 60% to 65% and explain why China’s latest stimulus announcements are welcome, but probably are “too little, too late.”