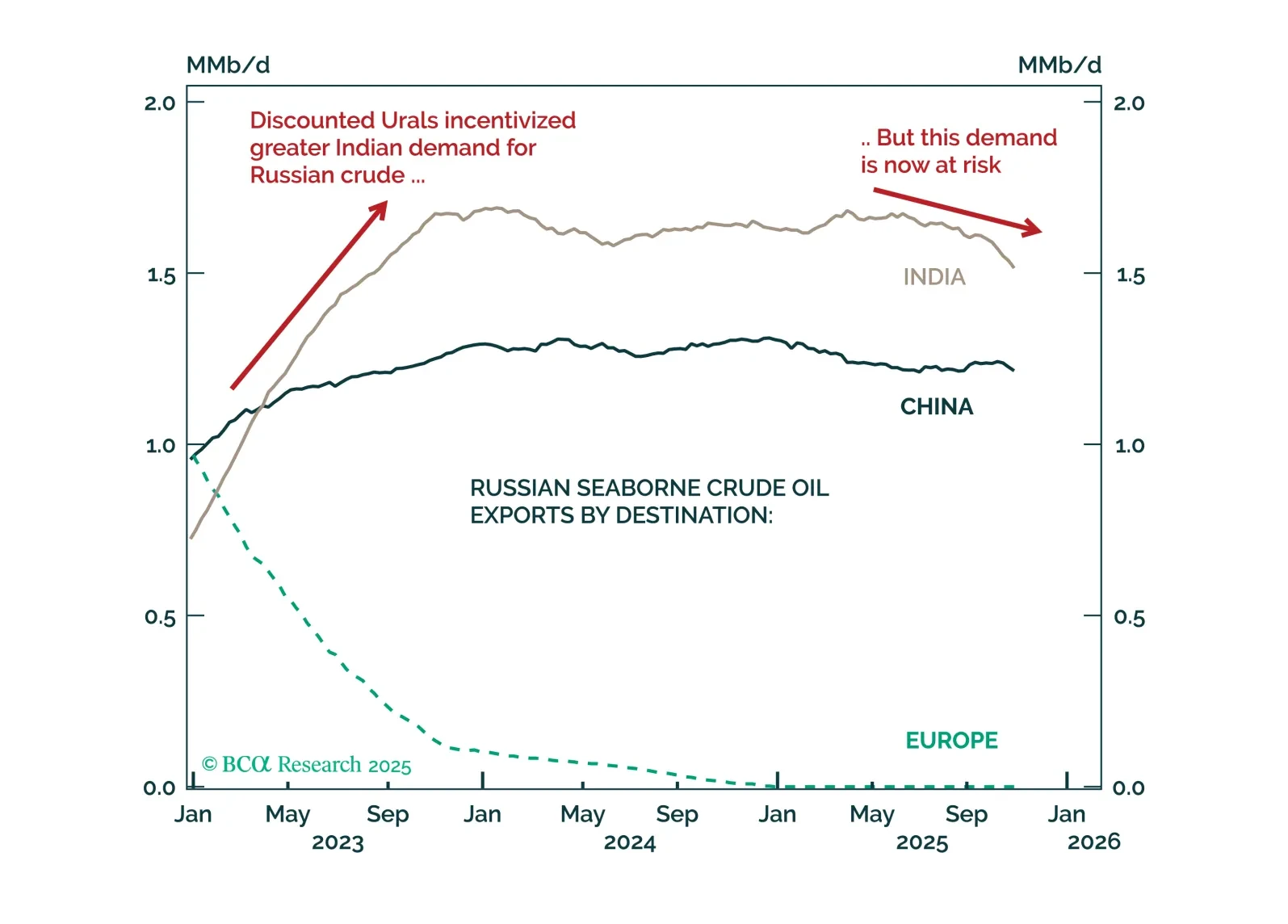

US restrictions on Russian crude exports could disrupt global oil supplies and trade flows over the near term. However, they are unlikely to have a meaningful impact on crude prices over a cyclical timeframe. Stay short Brent.…

Negotiations on trade, Iran, and Ukraine will prove critical this month. Markets will remain volatile because positive data surprises enable the White House to press its hawkish tariff hikes, while negative surprises force the White…

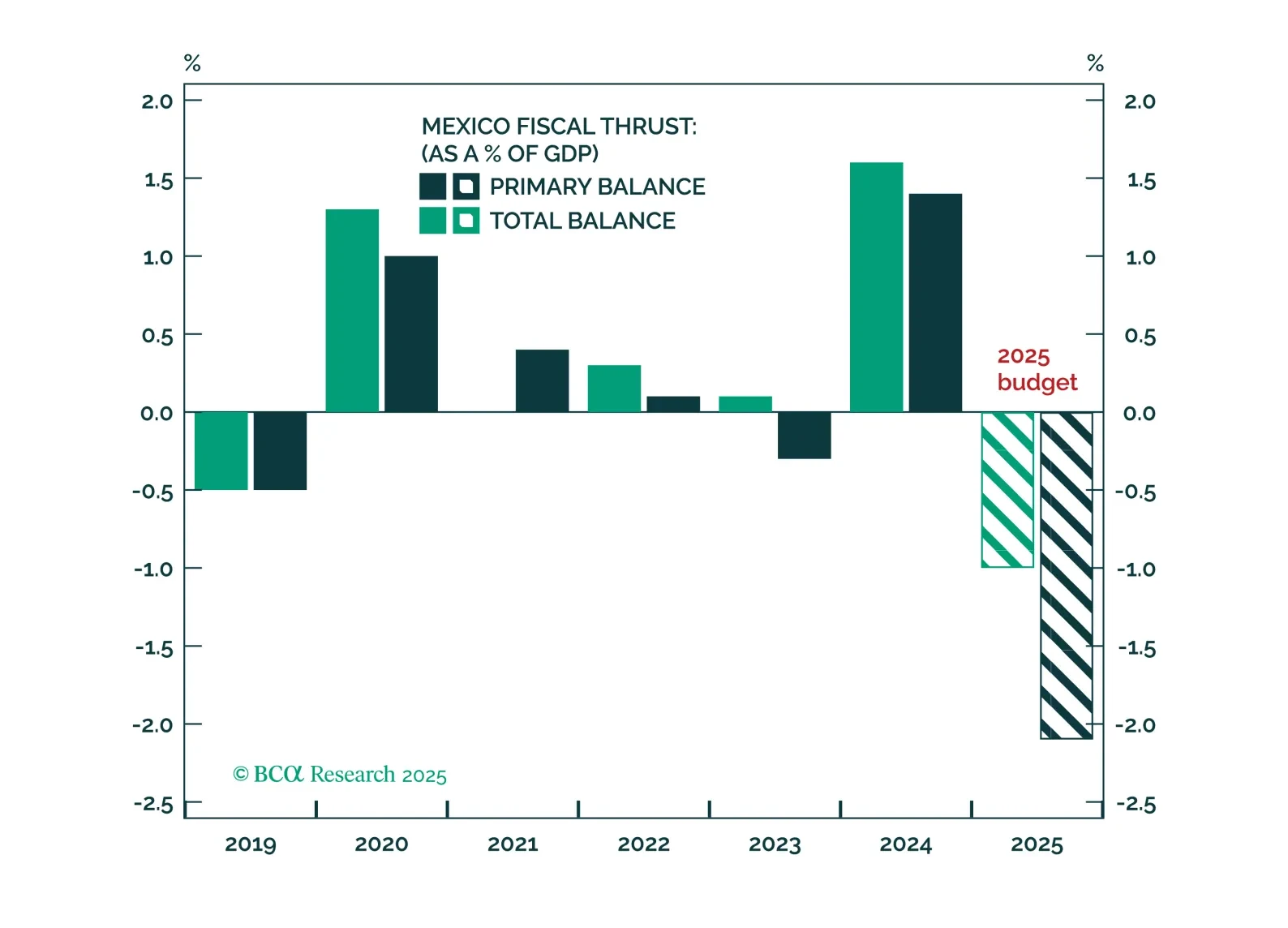

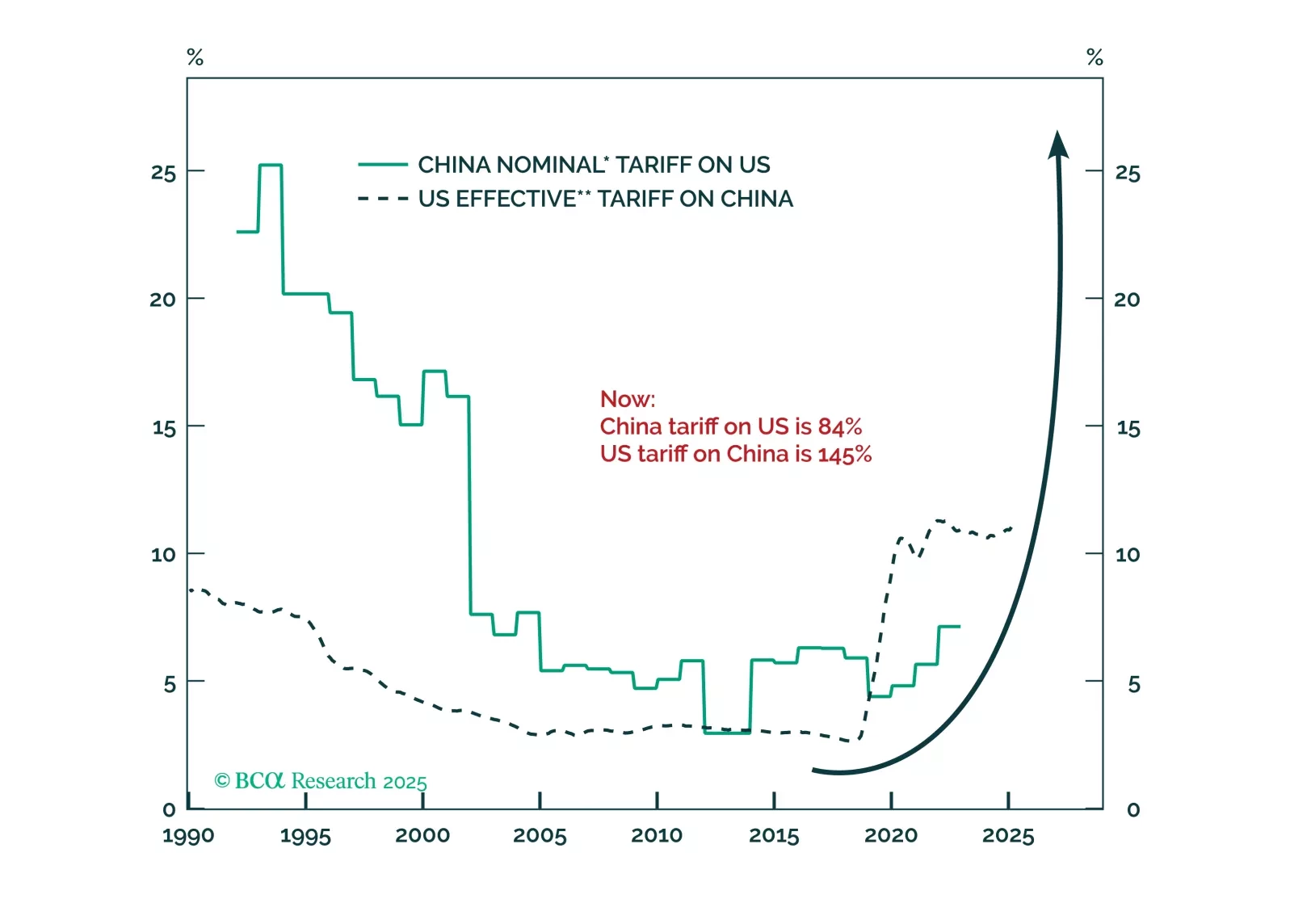

China’s aggressive retaliation against U.S. tariffs will enable President Trump to shift from punishing allies and redirect the trade war toward China. If Beijing does not react to the latest tariffs by doubling its fiscal stimulus,…

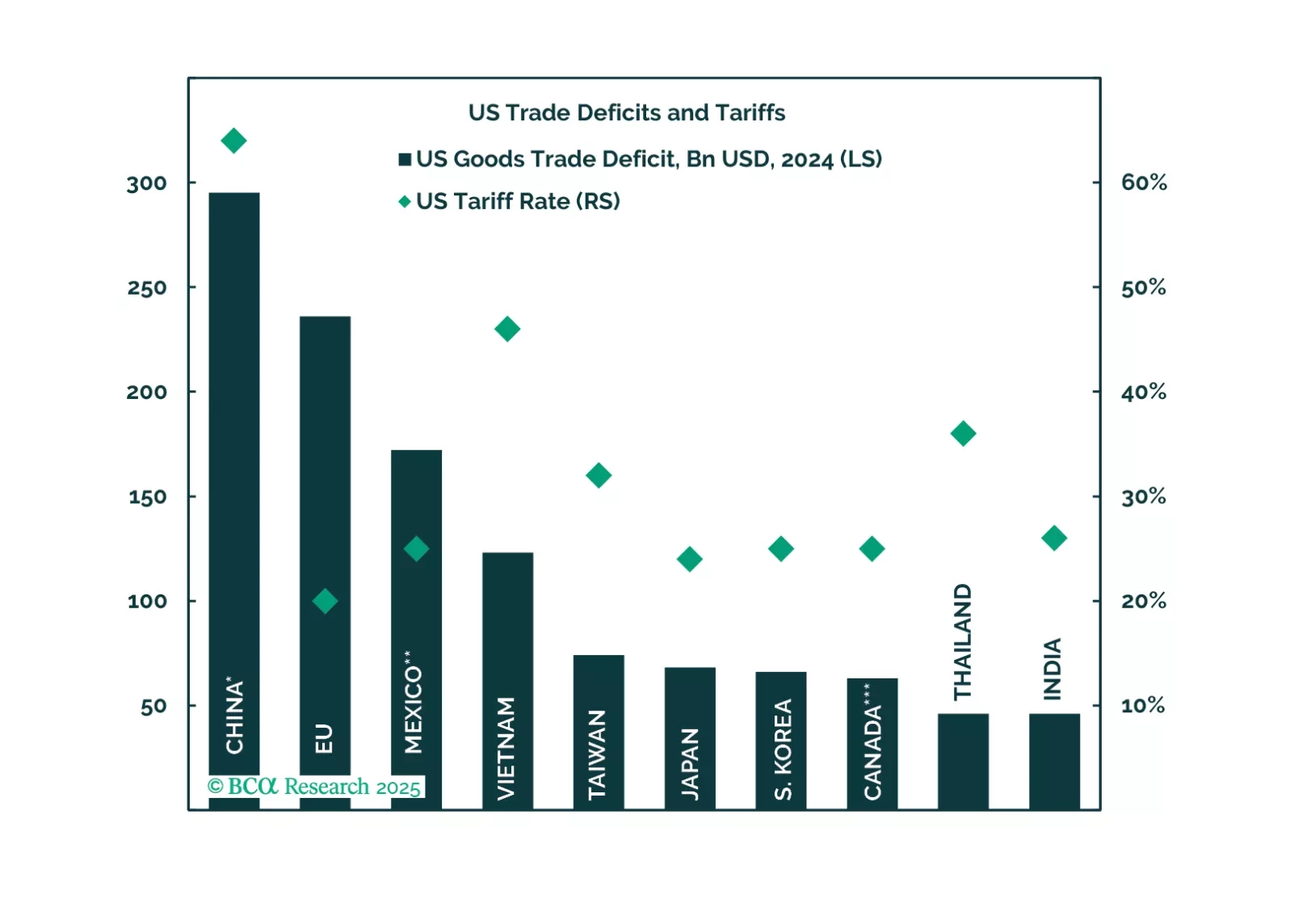

President Trump imposed tariffs on the world in his first 100 days, as we expected. Tariffs may have catalyzed a recession in the US, given the weakness in consumer sentiment and demand. Trump will soon backpedal and grant exemptions…

Trump's Tariff D-Day brings a negative surprise to financial markets already anxious over a declining US cyclical economy. Investors should sell risky assets, increase safe havens, and overweight US assets in the near term.

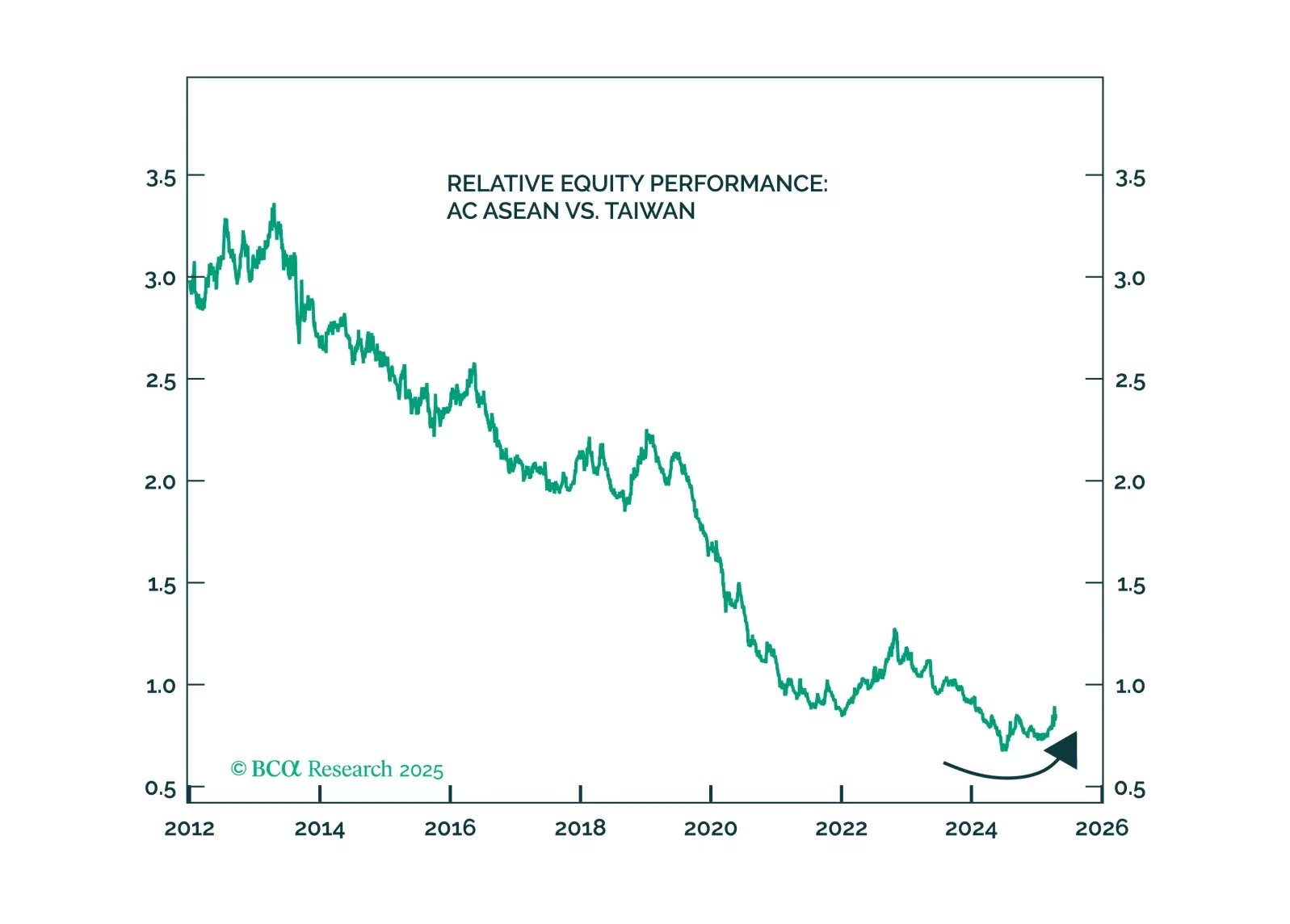

Stocks will continue to struggle in the second quarter as President Trump tries to implement tariffs. Tax cuts will only temporarily dispel growth fears, if at all. Middle Eastern instability will add oil price surprises to an…

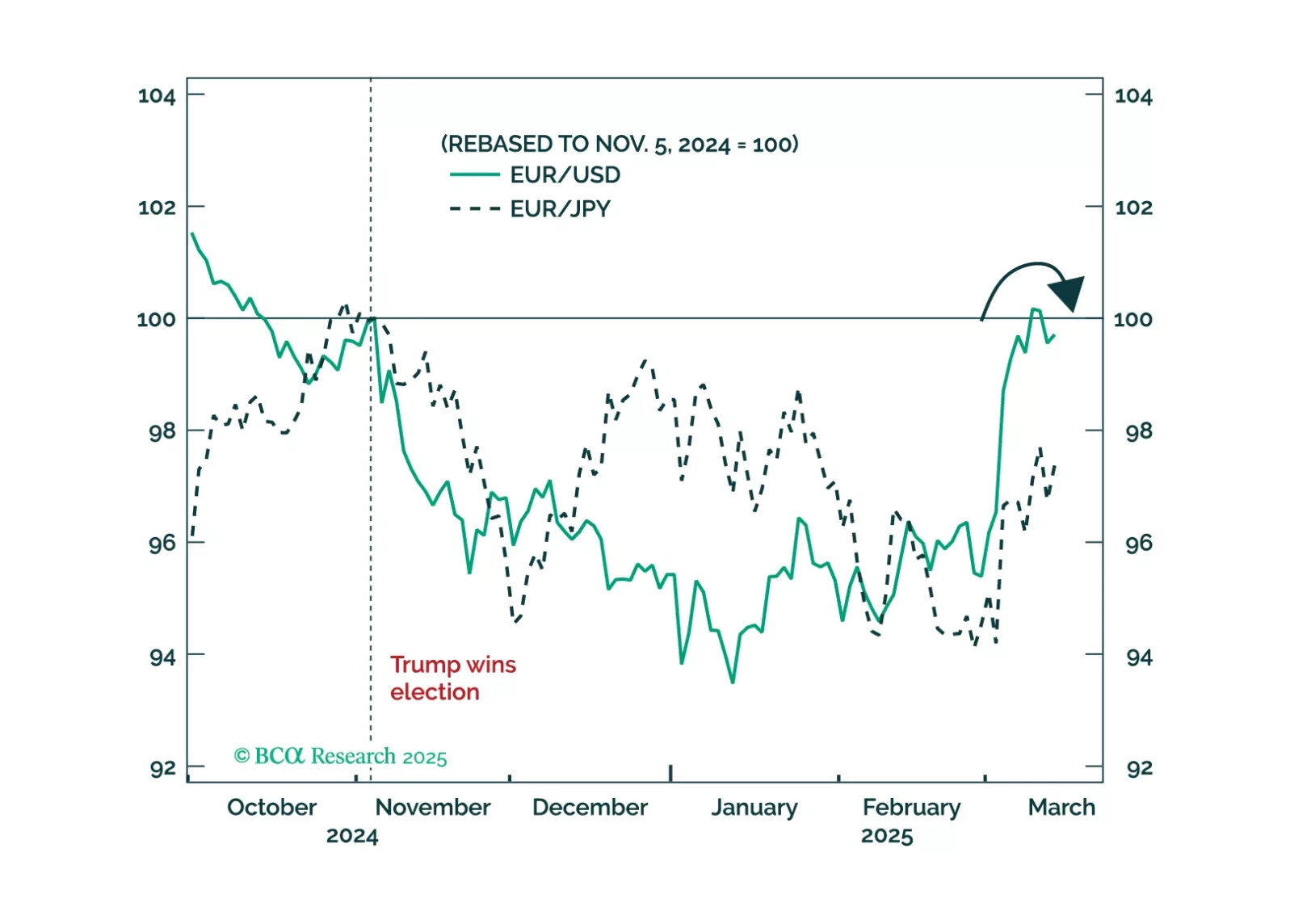

Trump’s foreign policy can be explained by rational US interests, but it requires settling the trade war with allies sooner rather than later. Book gains on EUR-USD for now.