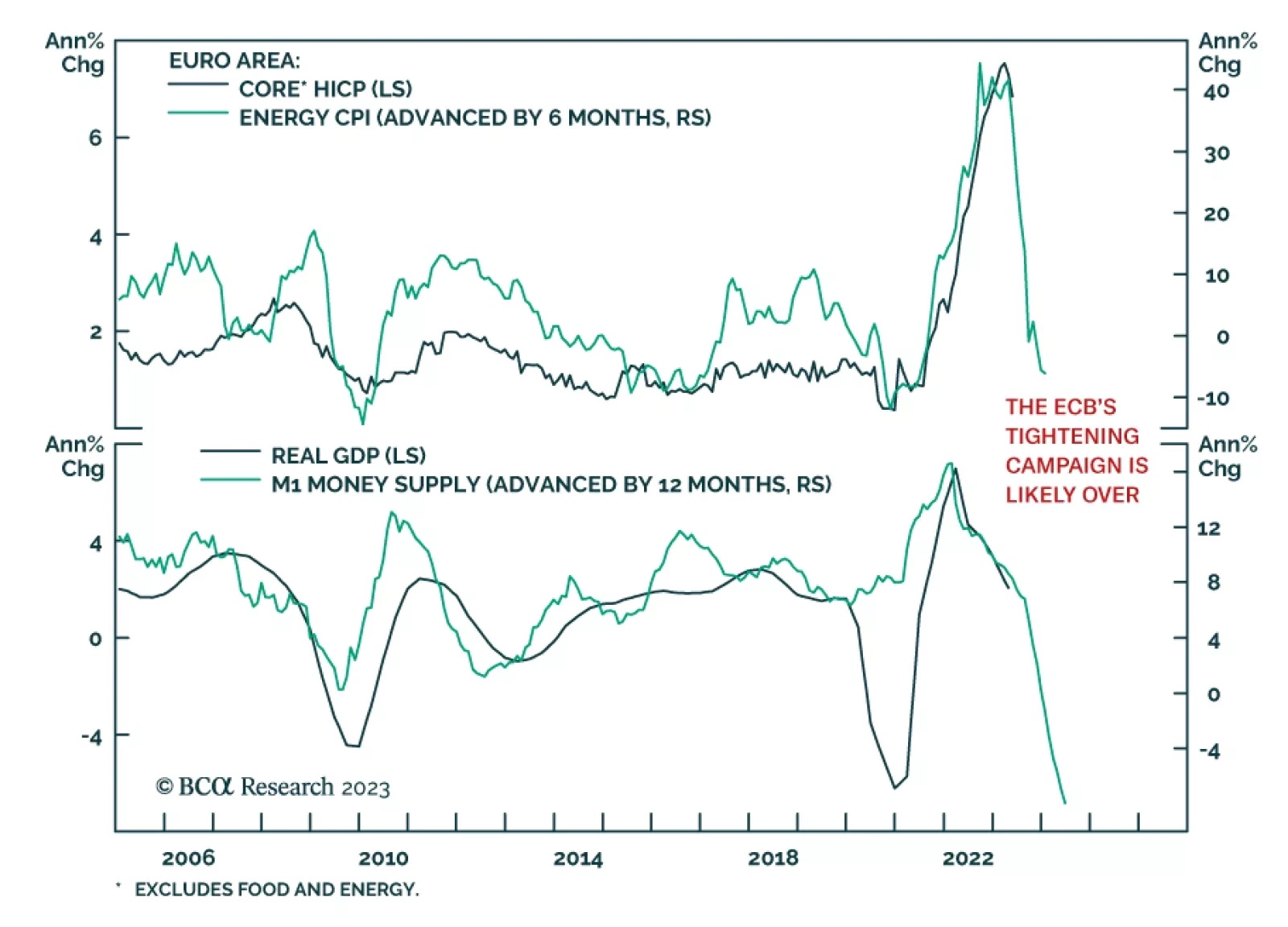

The Eurozone economy returned to expansion in the second quarter with real GDP rising by 0.3% q/q – beating expectations of 0.2% q/q. This follows an upwardly revised 0.0% in Q1 and a 0.1% contraction in Q4 2022. In…

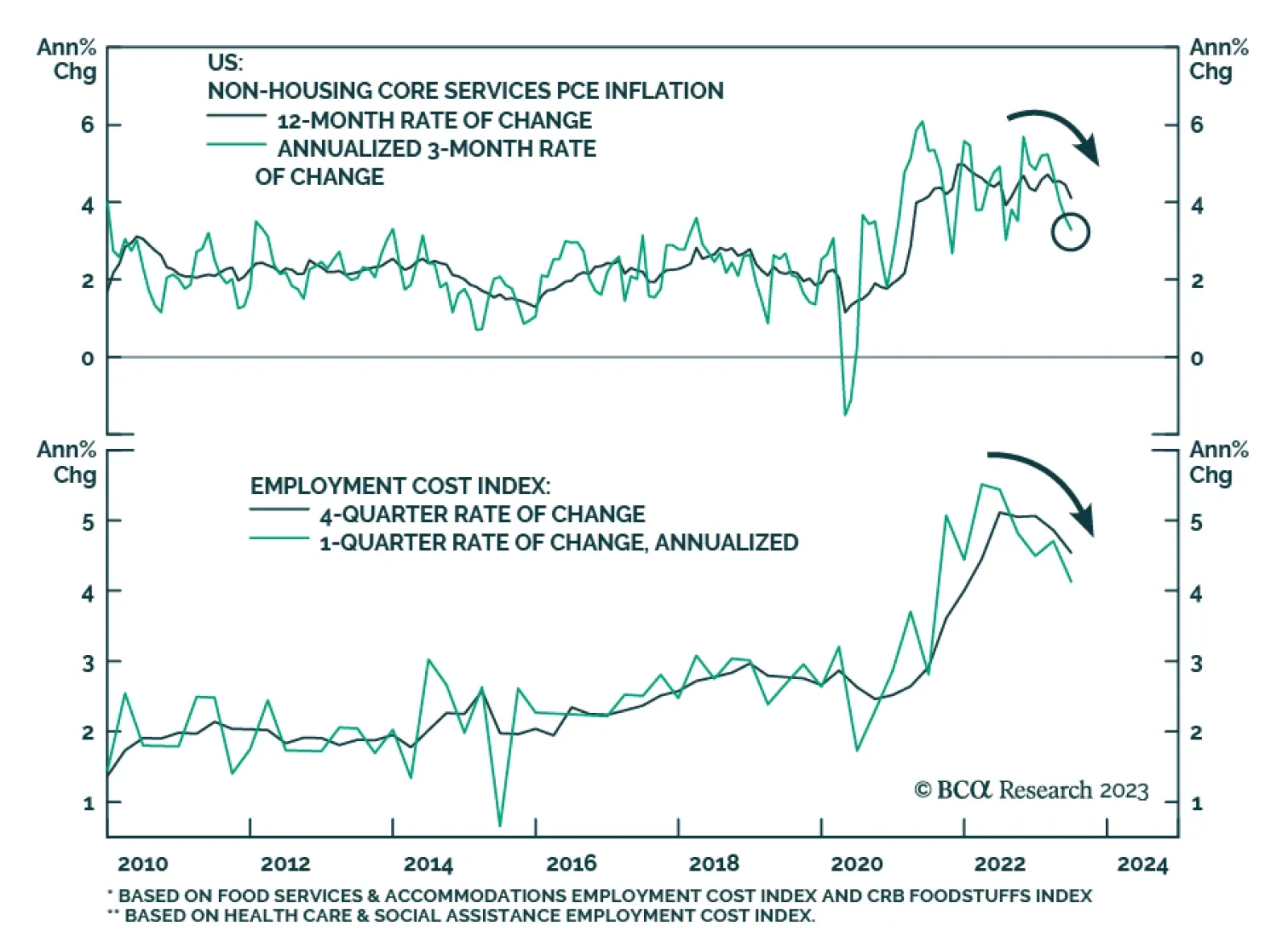

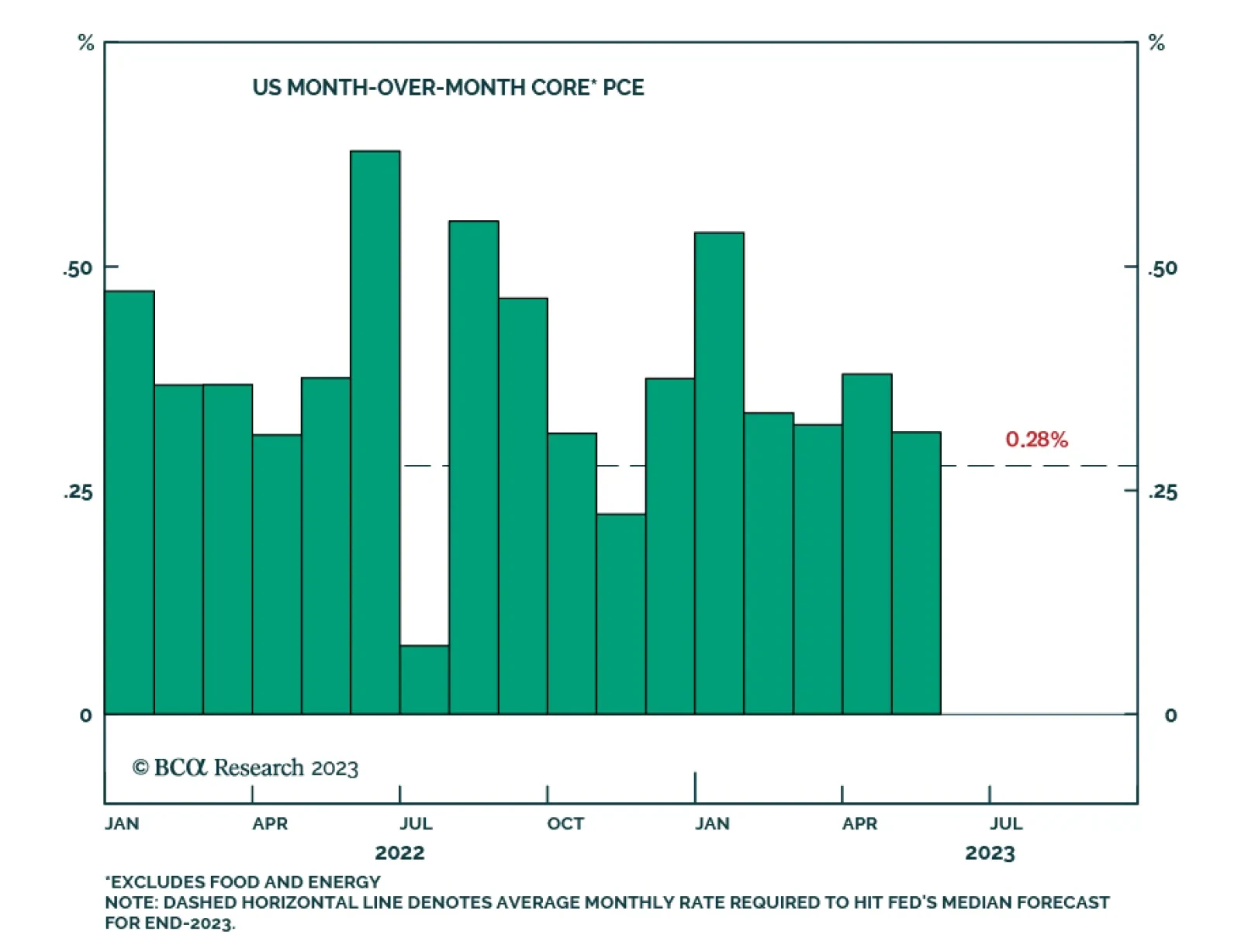

US economic data released on Friday continued the string of good news about the US economy. On the inflation front, core PCE inflation – the Fed’s preferred gauge of underlying price pressures – softened to 0…

The DXY will continue to have near-term upside, as economic growth holds up in the US, while it deteriorates in other parts of the world. Remain constructive on the DXY at current levels, but pivot to a short position on evidence US…

The US is not out of the woods when it comes to inflation, which means that it is too early to conclude that the Fed can stop raising rates. Any further increase in inflation risk would prompt us to turn more cautious on stocks.

A look at recent US data on economic growth and inflation, with an update on the implications for monetary policy and bond yields.

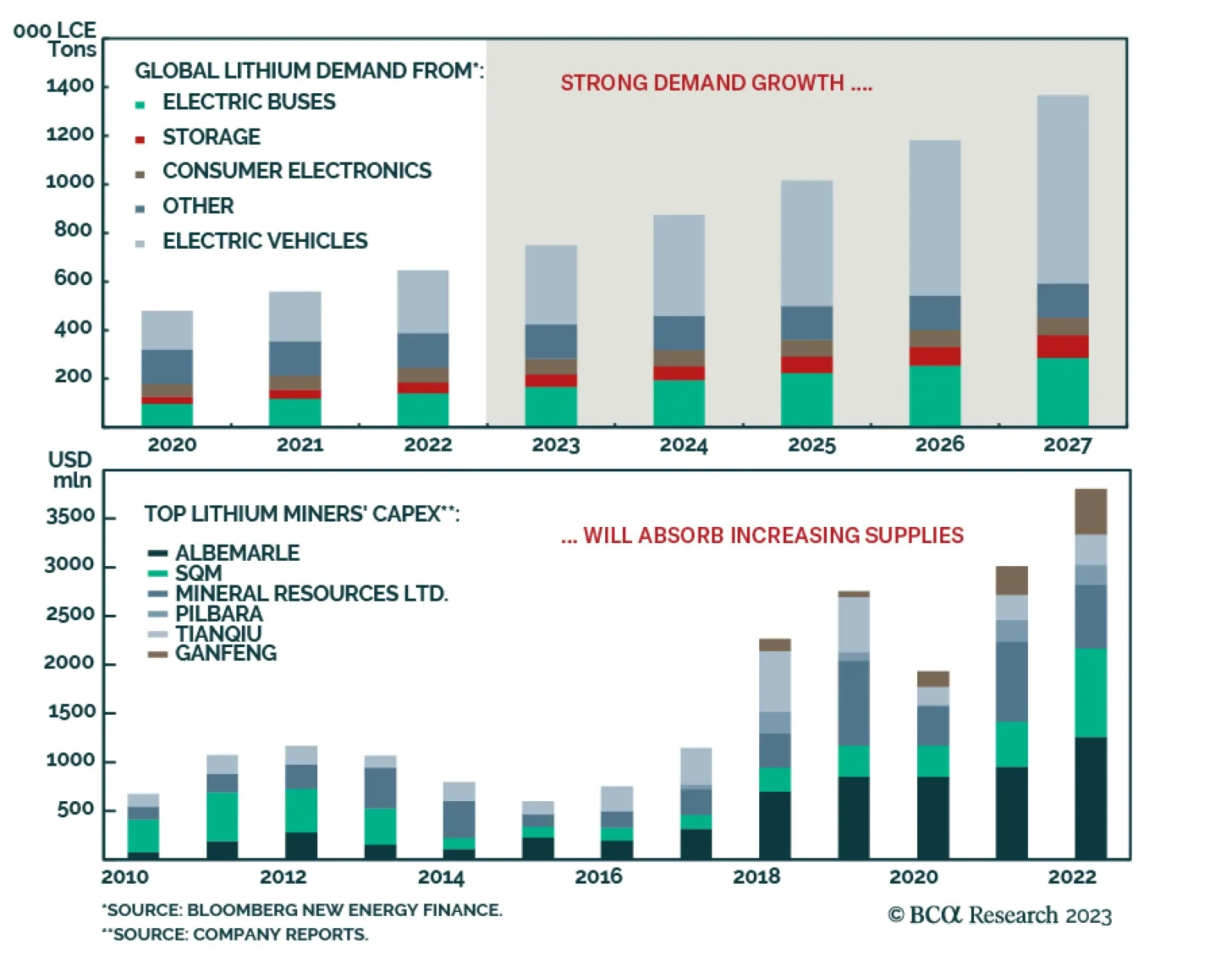

BCA Research’s Commodity & Energy Strategy service expects steady demand for EVs will be able to absorb increasing lithium supplies in the short-to-medium term. The team is getting long the LIT ETF at tonight’s…

Looking at the complete picture of GDP growth, inflation, and unemployment, it is understandable to assume the Fed is doing much better than it expected. GDP growth is tracking to exceed the Fed's forecast, while the outlook…

In Section I, we audit the market’s “soft landing” narrative in response to a meaningful challenge to our cautious stance from recent financial market developments. We acknowledge that US economic growth was stronger in the first…

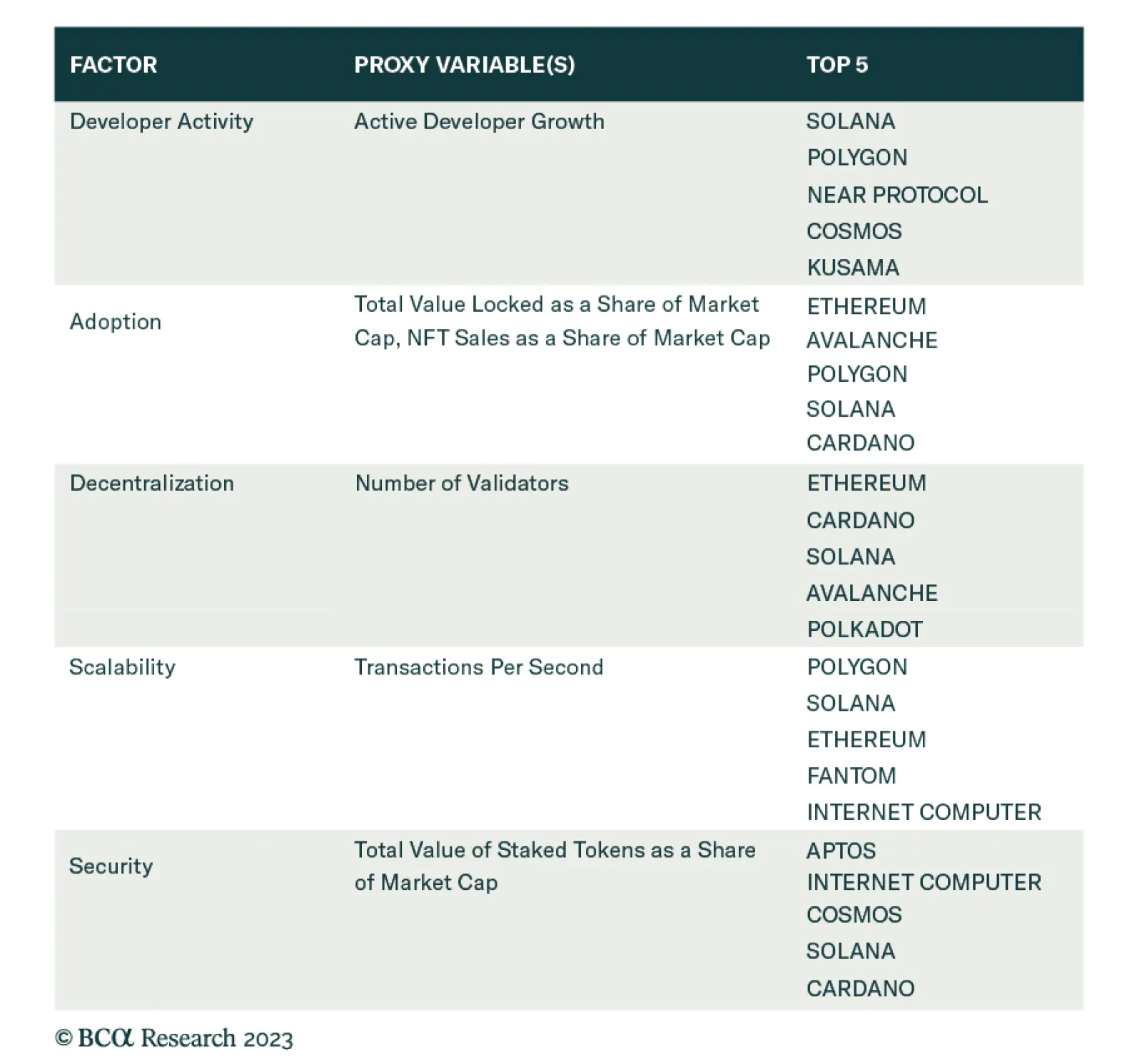

According to BCA Research’s Counterpoint service, the top five blockchains are Solana (SOL), Ethereum (ETH), Polygon (MATIC), Cardano (ADA), and Avalanche (AVAX). Investors should have a small (up to 5 percent)…

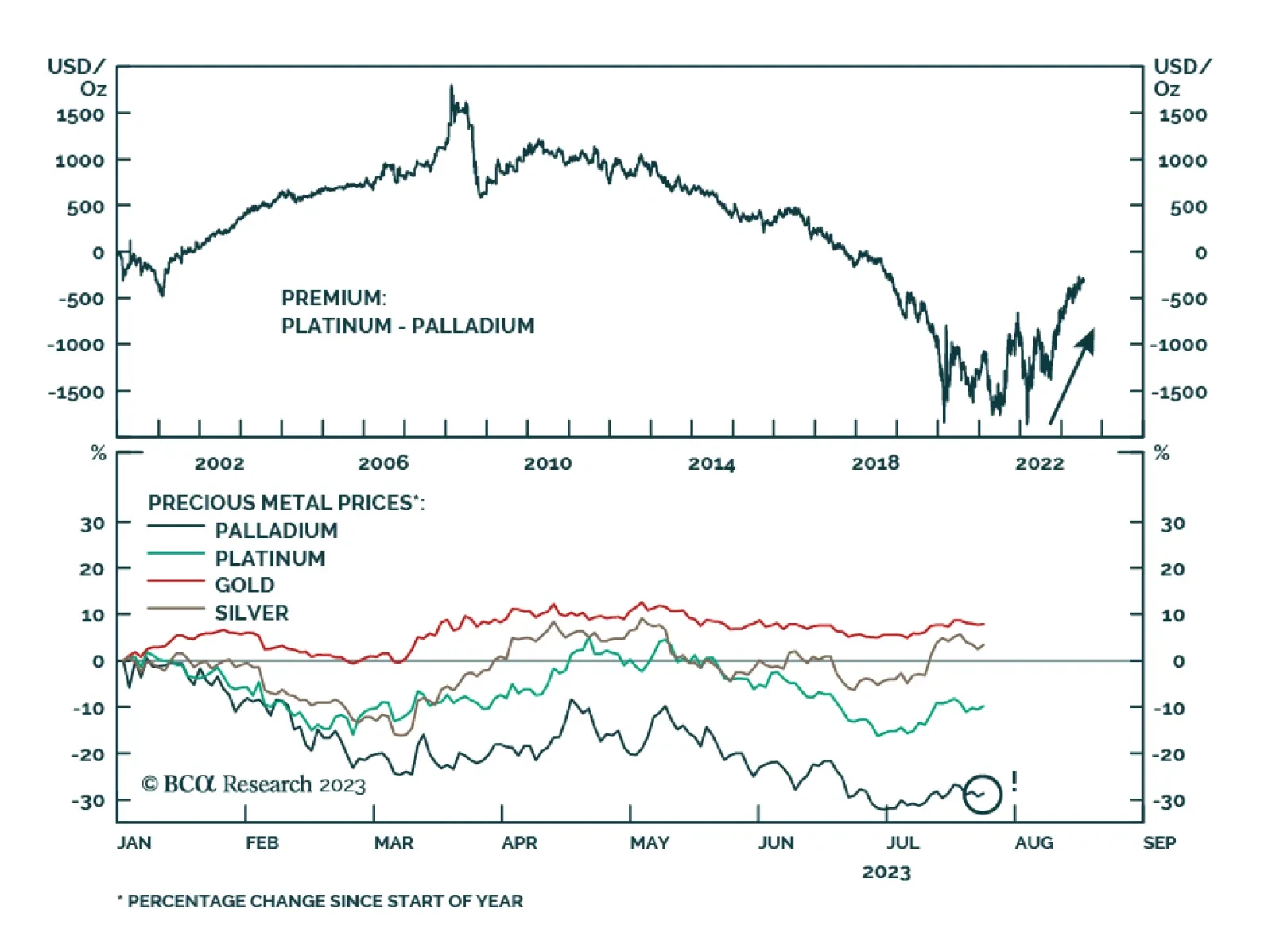

Palladium is by far the worst performing precious metal so far this year. The 30% year-to-date price decline is significantly worse than platinum’s 10% loss and contrasts with higher gold (+8%) and silver (+4%) prices.…