China has generated 41 percent of the world’s economic growth through the past ten years, al-most double the 22 percent contribution from the US. Now that the Chinese growth engine is failing, we explain why it is arithmetically…

Although the RMB has cheapened, macro conditions are not yet favorable for the Chinese currency. We expect the RMB to decline by at least another 5% in the next six months. A weak currency and subdued economic growth lead us to…

The global economy will not enjoy an “immaculate disinflation” but will suffer a very maculate one due to China’s growth slowdown and restrictive monetary policy in the developed world. Investors should stay overweight low-beta…

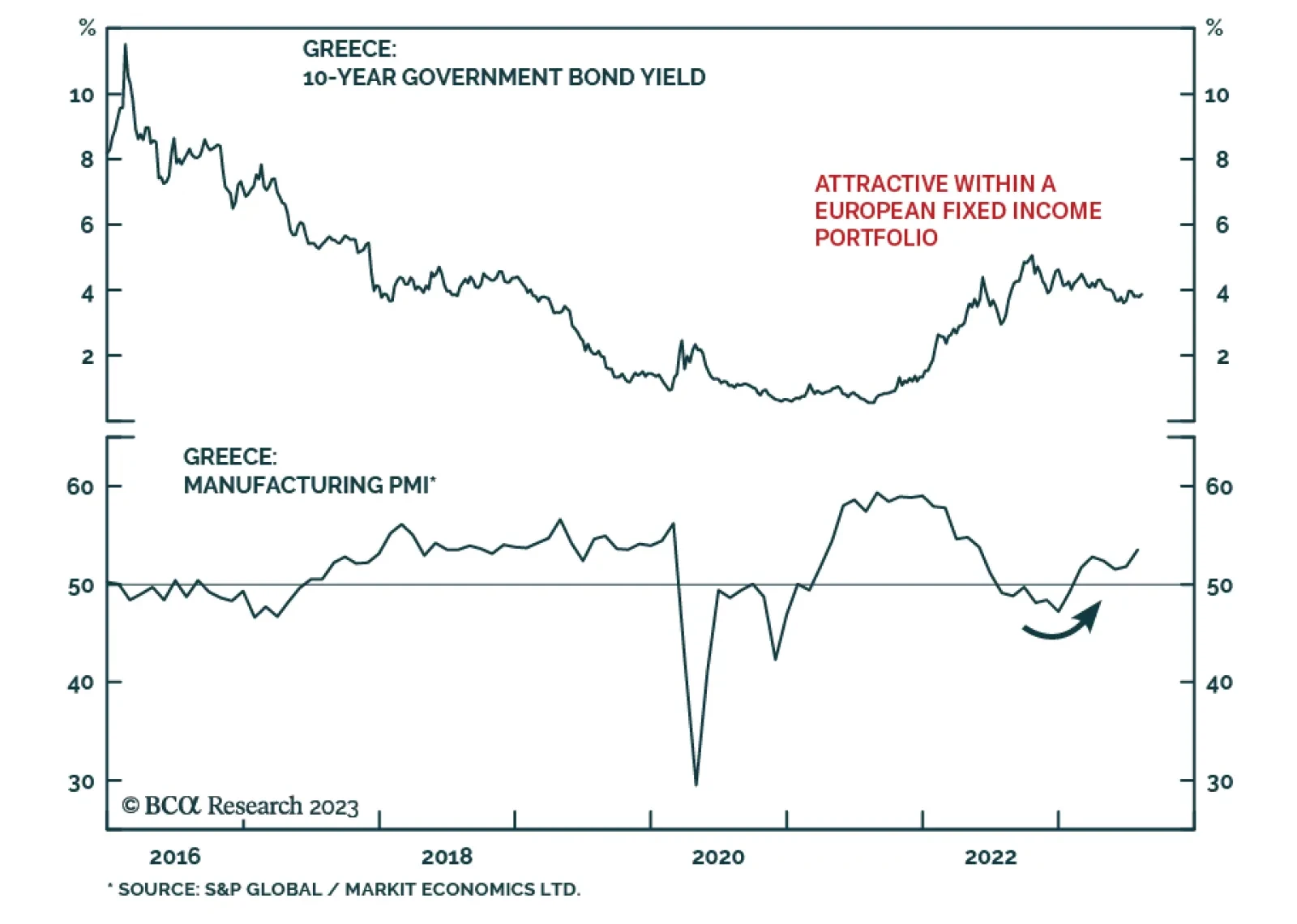

Greece is experiencing a strong economic revival from its lows of the Sovereign Debt Crisis. The Hellenic Republic has shown resilience, with an annual real GDP growth of 4.5%, outpacing the Euro Area’s growth by 2%. Greece…

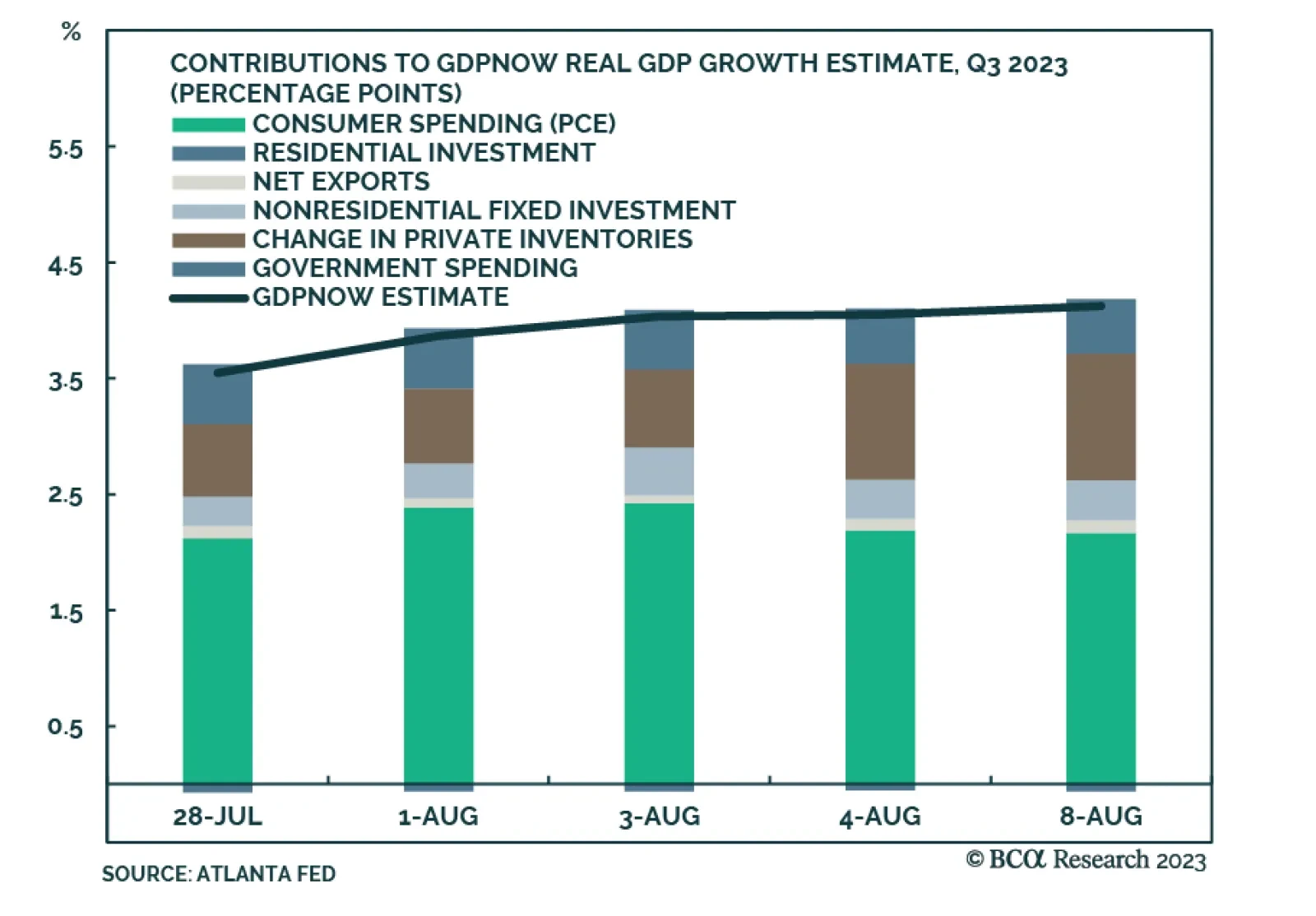

Over the past two months, risk sentiment has improved amid receding fears of an imminent US recession. Economic data have been generating strong upside surprises and the US equity rally has broadened with cyclicals outperforming…

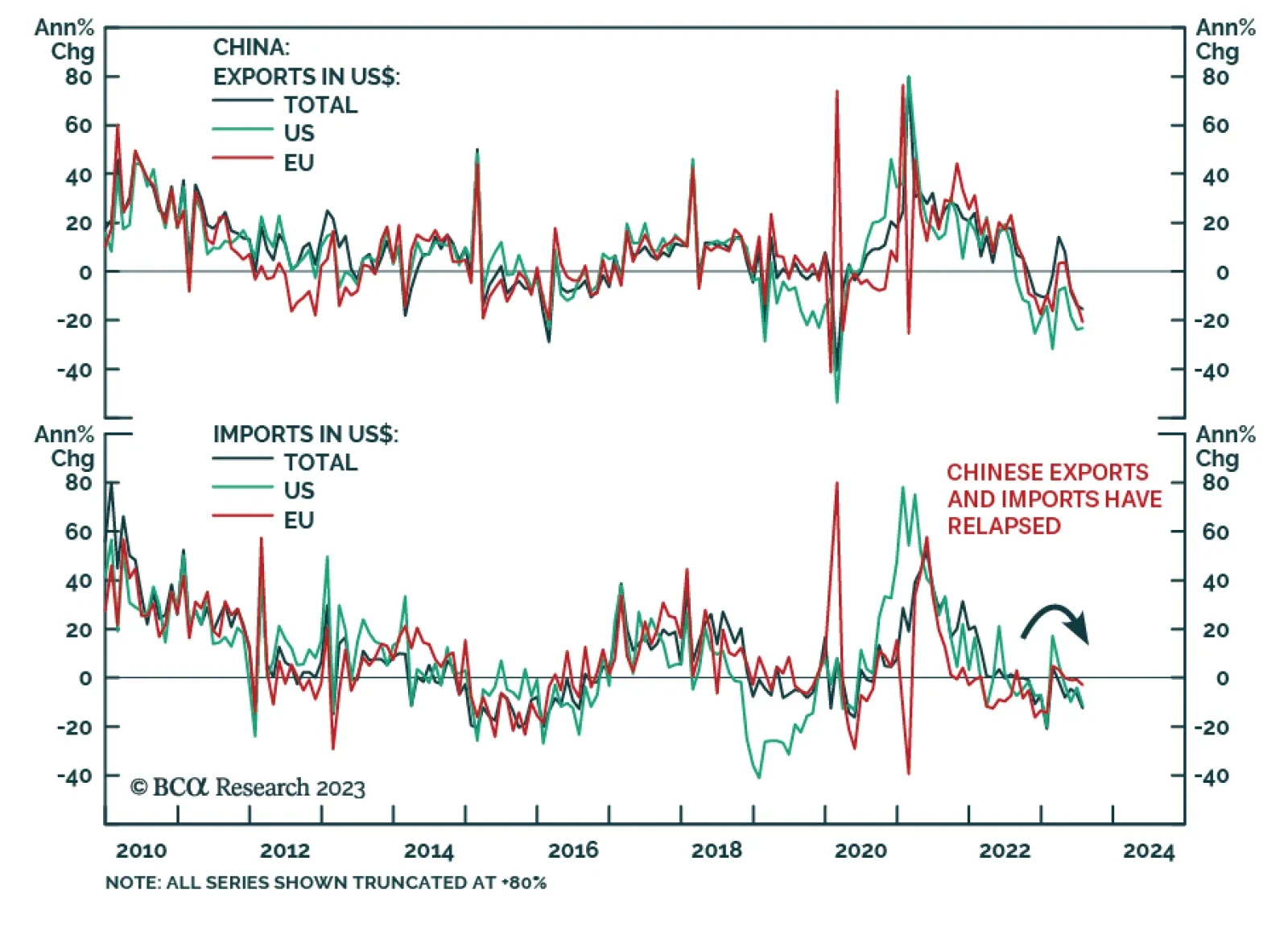

Chinese trade data continued to deliver a pessimistic signal about the global manufacturing cycle. The export contraction deepened to -14.5% y/y in US dollar terms in July – below expectations of a -13.2% y/y decline and…

Time is running out on the Bank of England’s tightening cycle. UK economic growth is flirting with recession, unemployment is rising, house prices are contracting and inflation is decelerating. Markets are overestimating the eventual…

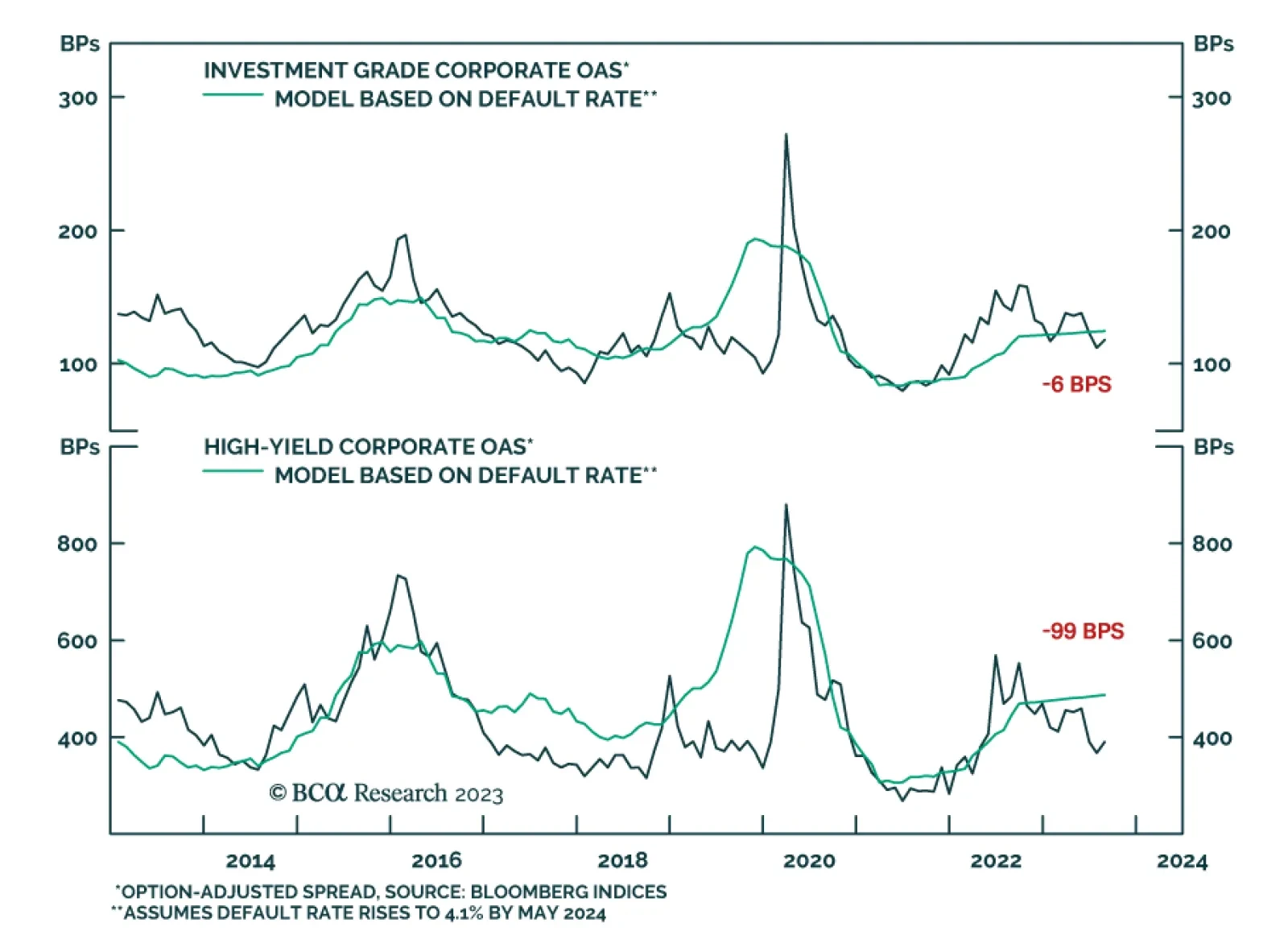

BCA Research’s US Bond Strategy service cautions against turning bullish on corporate bonds. Corporate bonds have delivered strong excess returns versus duration-matched Treasuries during the past two months. Yet the…

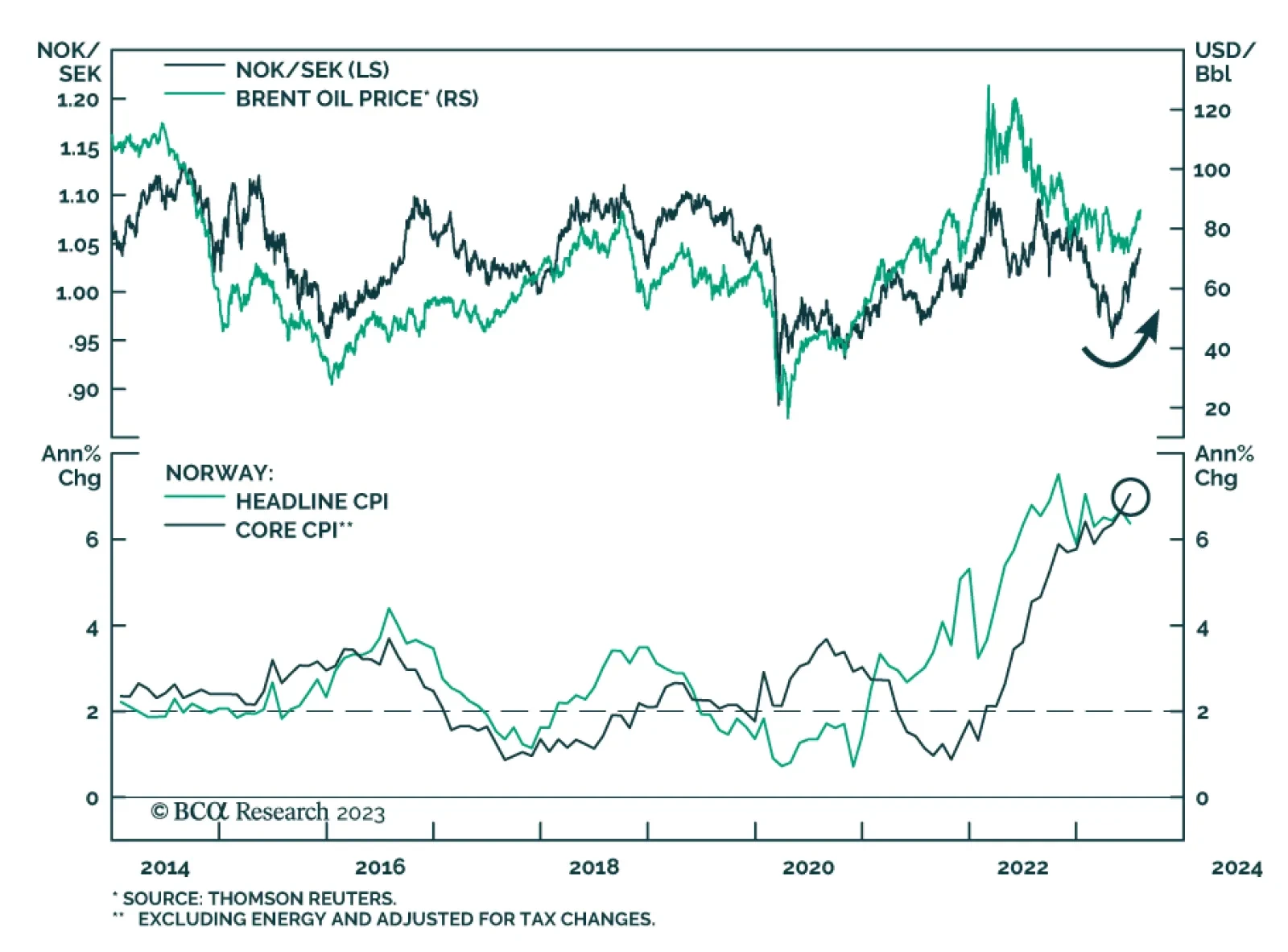

The Norwegian krone’s fortunes have recently reversed. It has been the best performing G10 currency since the end of May. This comes after a period of pronounced weakness during which it was the only G10 currency to…

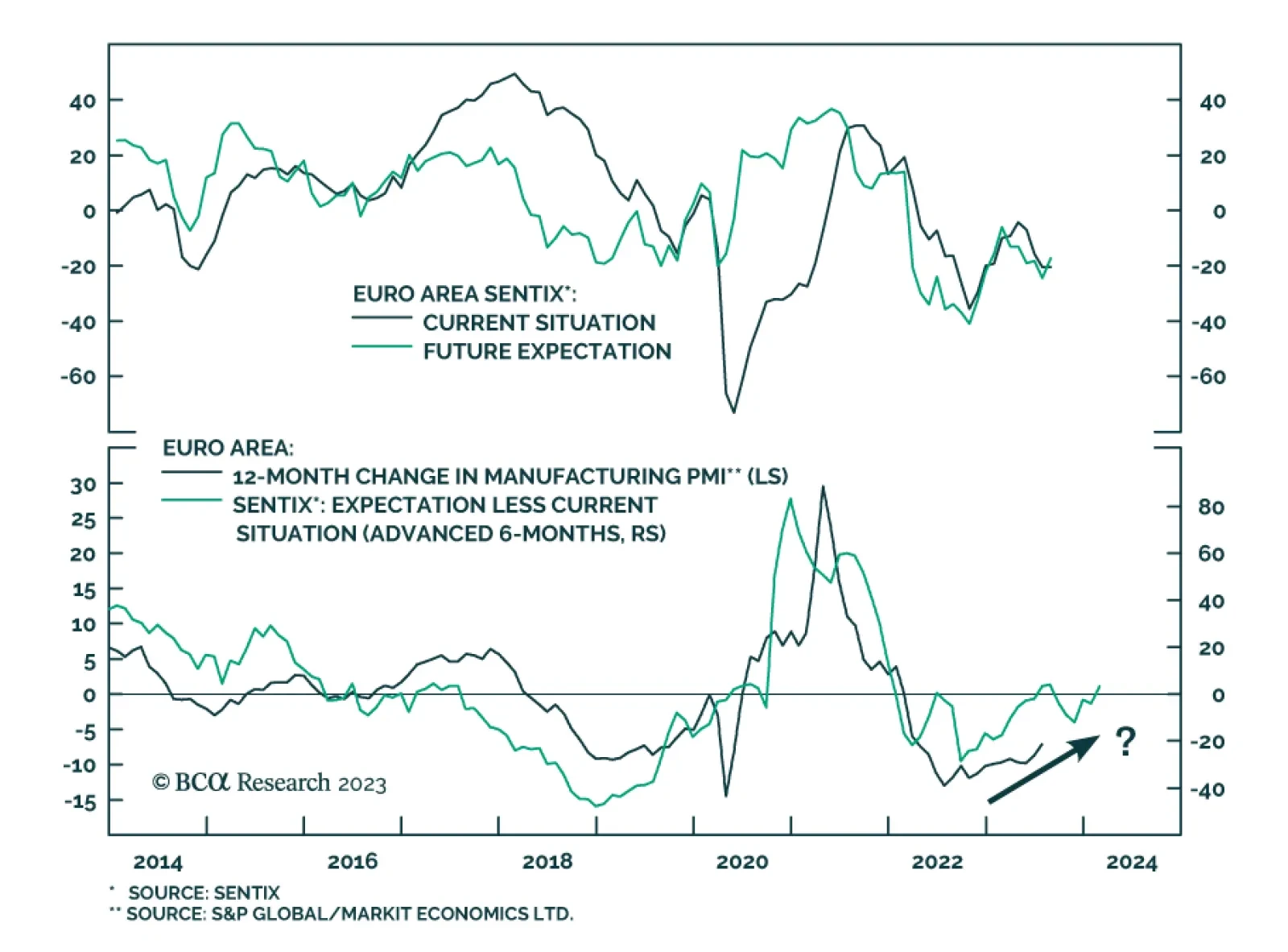

The Sentix Economic Index for the Eurozone sent a positive signal on Monday. It unexpectedly increased from -22.5 to -18.9 in August, surprising expectations of a further deterioration to -24.5. This marks the index’s first…