China’s reopening faltered and now it is applying moderate stimulus. OPEC 2.0’s production discipline is getting results, with oil prices climbing. The Fed will not be able to deliver dovish surprises in Q4 2023. Investors should…

The German auto and components sector is under stress. Year-to-date, the sector’s equity prices have declined by 3.5% relative to the broader German market, and multiple indicators suggest that further challenges lie ahead…

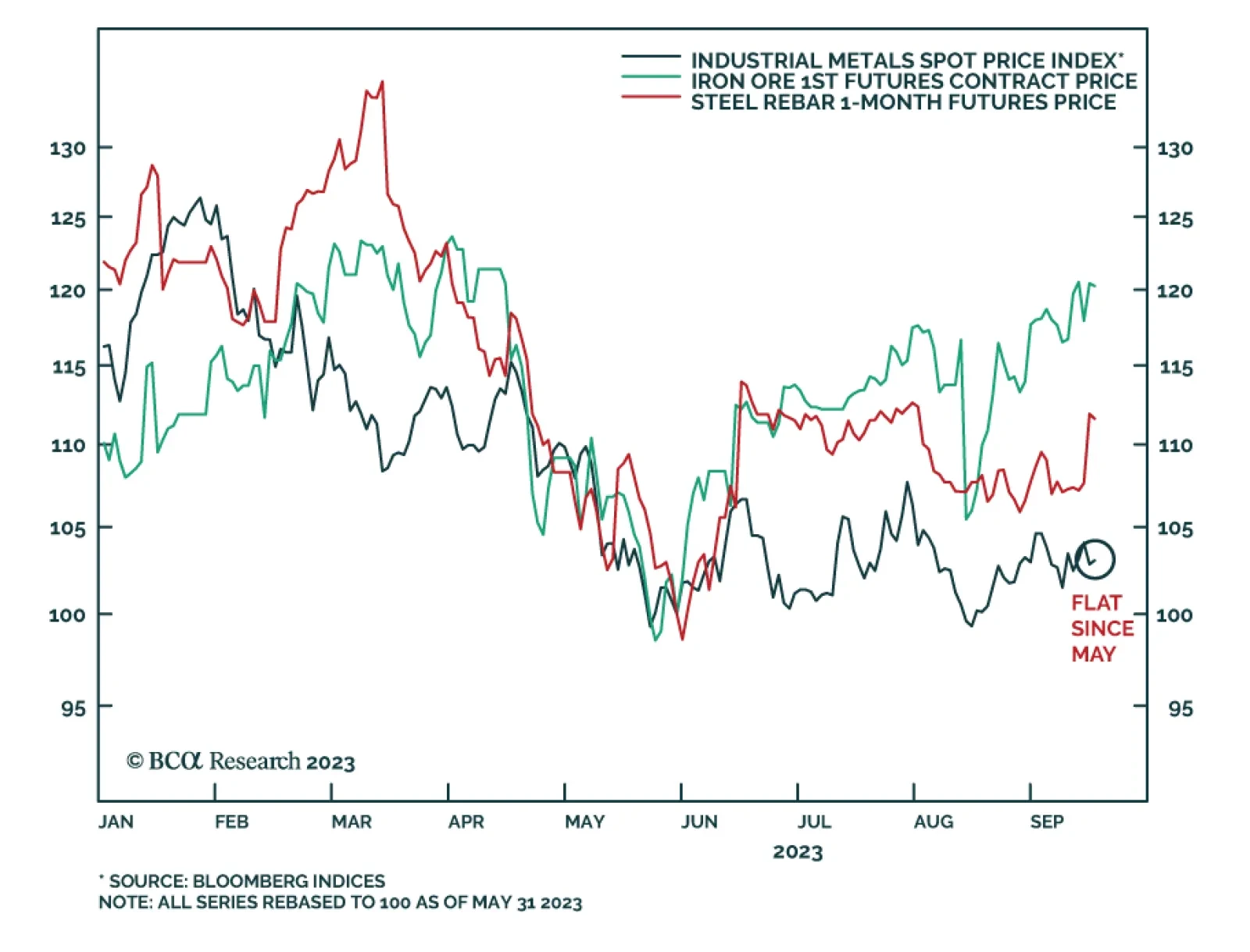

Over the past few months a schism has emerged in the industrial metals complex. On the one hand, the Bloomberg Industrial Metals Index – which is composed of futures contracts on copper, aluminum, zinc, nickel, and lead…

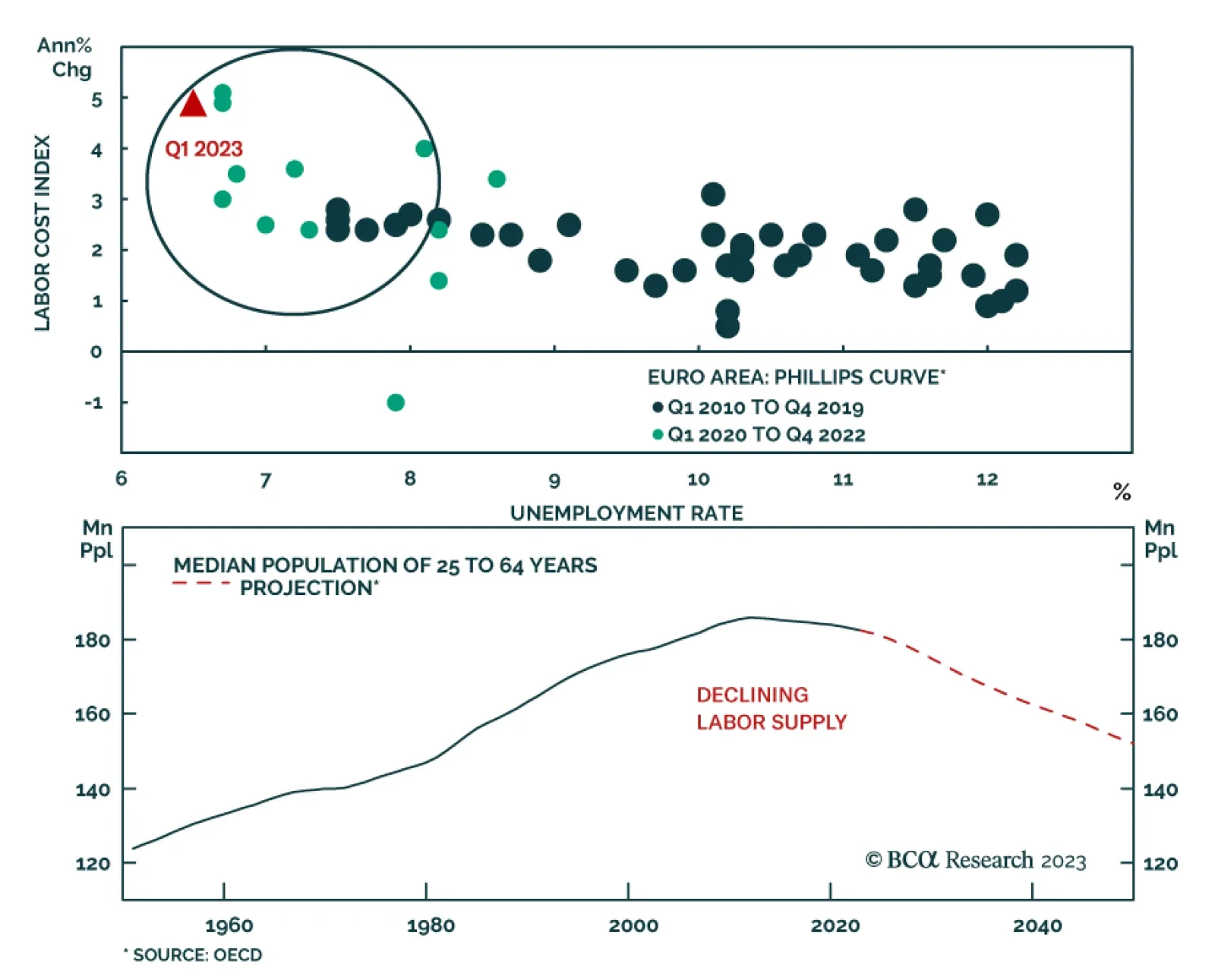

According to BCA Research’s European Investment Strategy service European inflation is likely to remain stubborn through the remainder of the decade, since the working-age population’s decline will keep the labor…

Monetary policy is difficult to calibrate: it is hard to get it just right. The Global Investment Strategy (GIS) service has been iterating that while the Fed could temporarily achieve a soft landing, there is much uncertainty…

While we are sympathetic to the view that the Fed could temporarily achieve a soft landing, we are skeptical that it could stick that landing for very long. Stocks could strengthen into year-end, with small caps potentially leading…

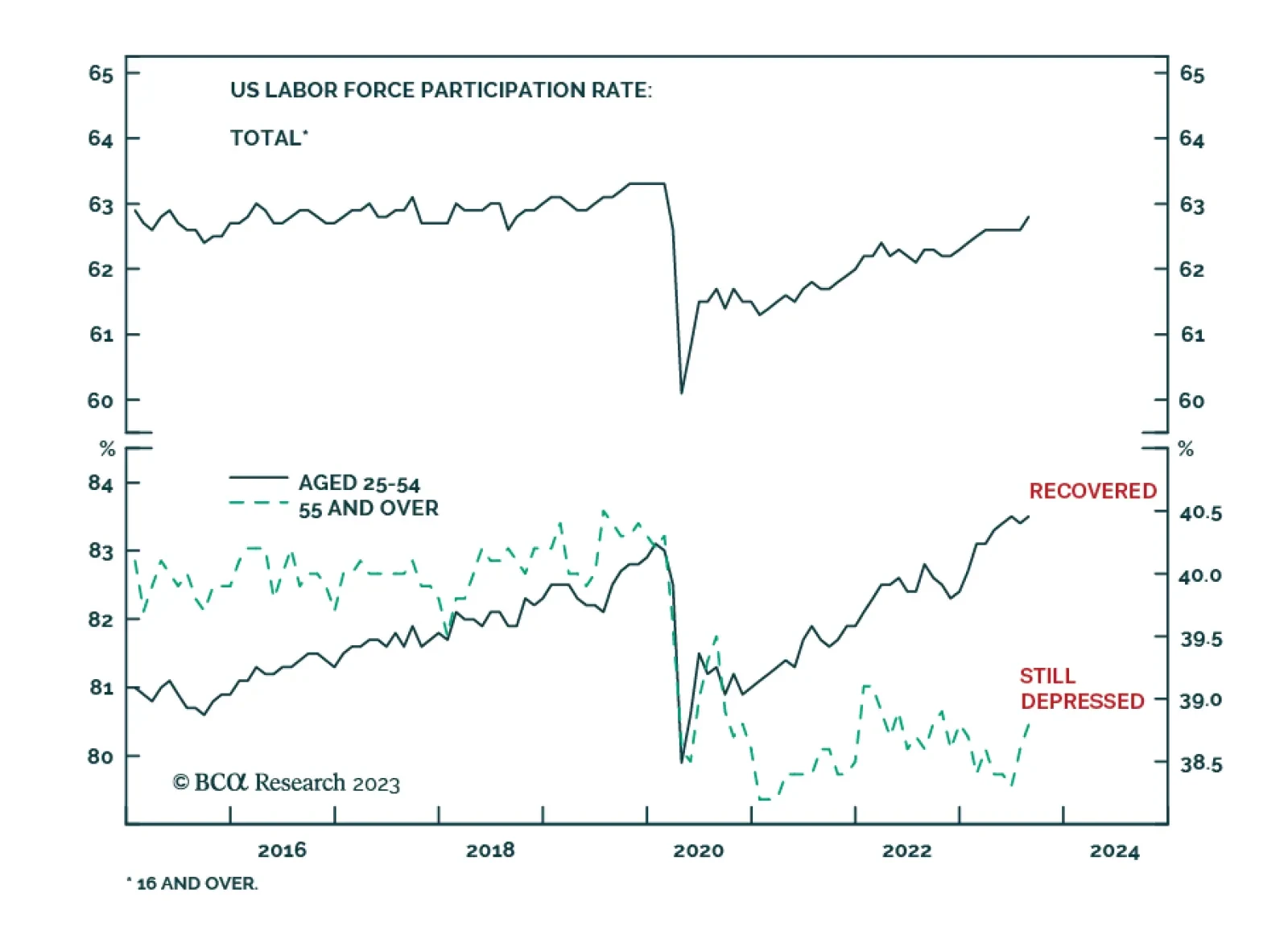

A sharp drop in the US labor force participation rate was among the pandemic disruptions that contributed to tight labor market conditions. The total participation rate collapsed from 63.3% in February 2020 to 60.1% in April 2020…

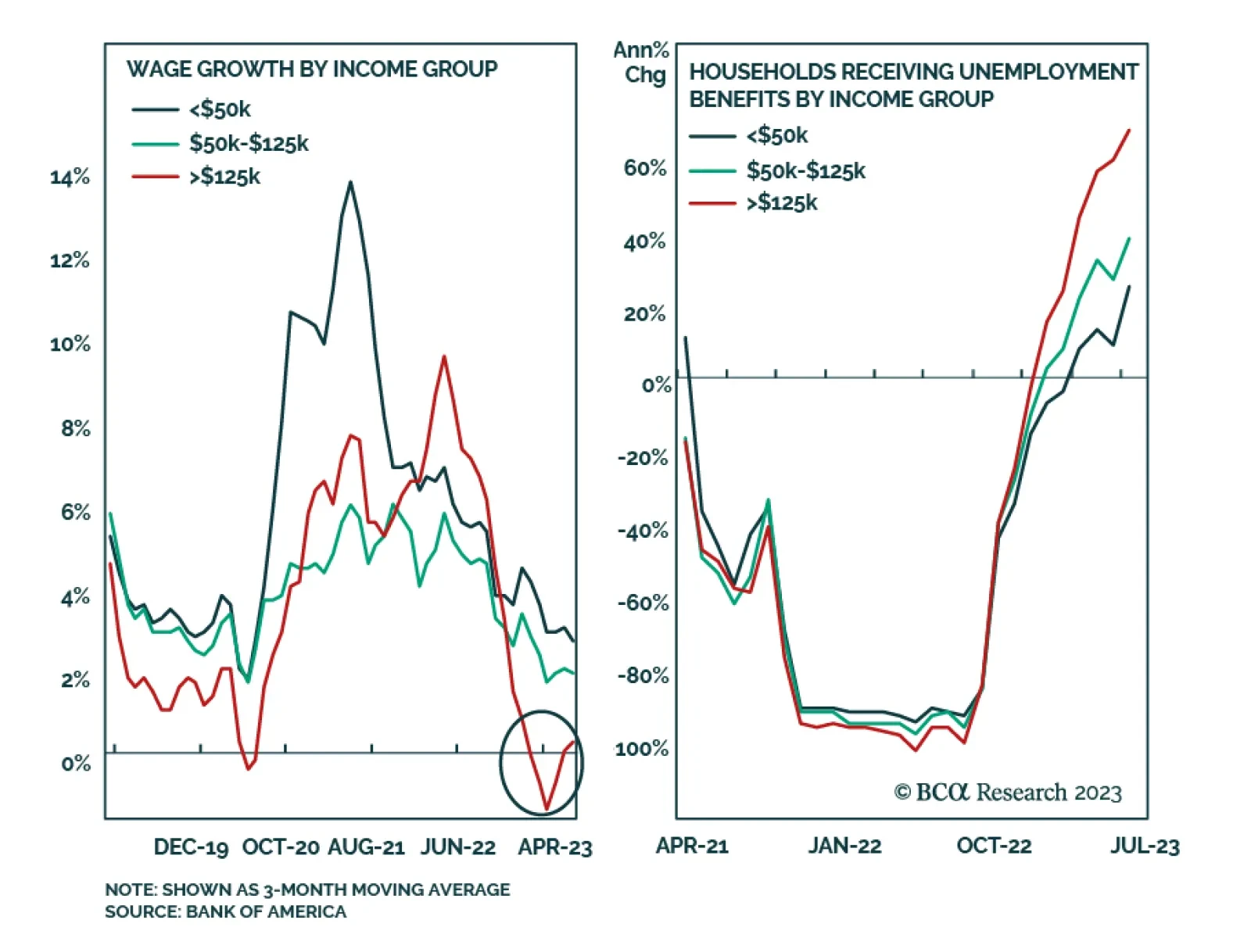

Strong consumer spending so far this year has been powered by robust employment gains coupled with real wage growth turning positive on the back of receding inflationary pressures. However, our US equity strategists…

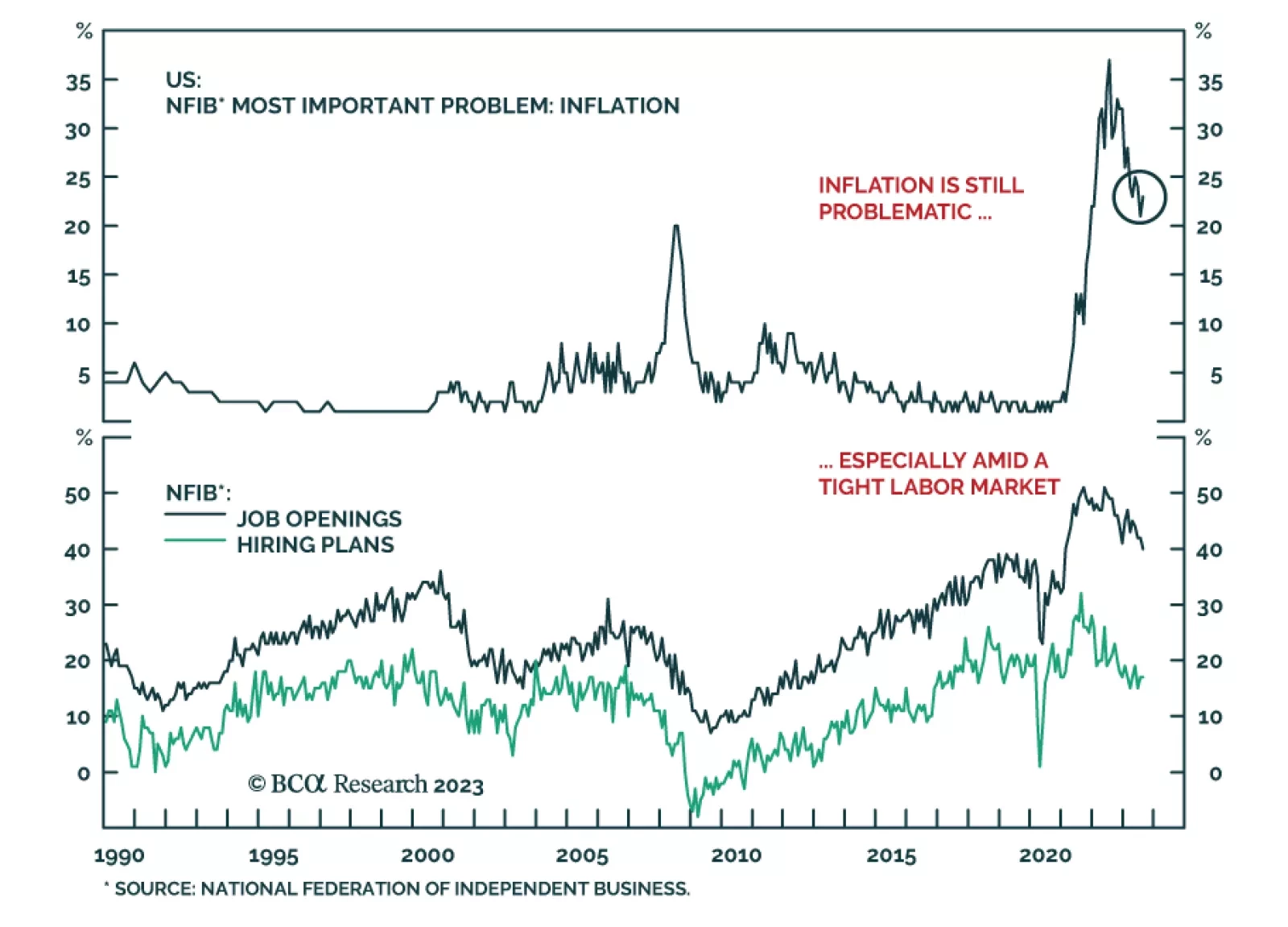

US small business optimism deteriorated for the first time in four months in August. The NFIB index declined by 0.6 point to 91.3, falling slightly below expectations of 91.5. In particular, current conditions deteriorated…

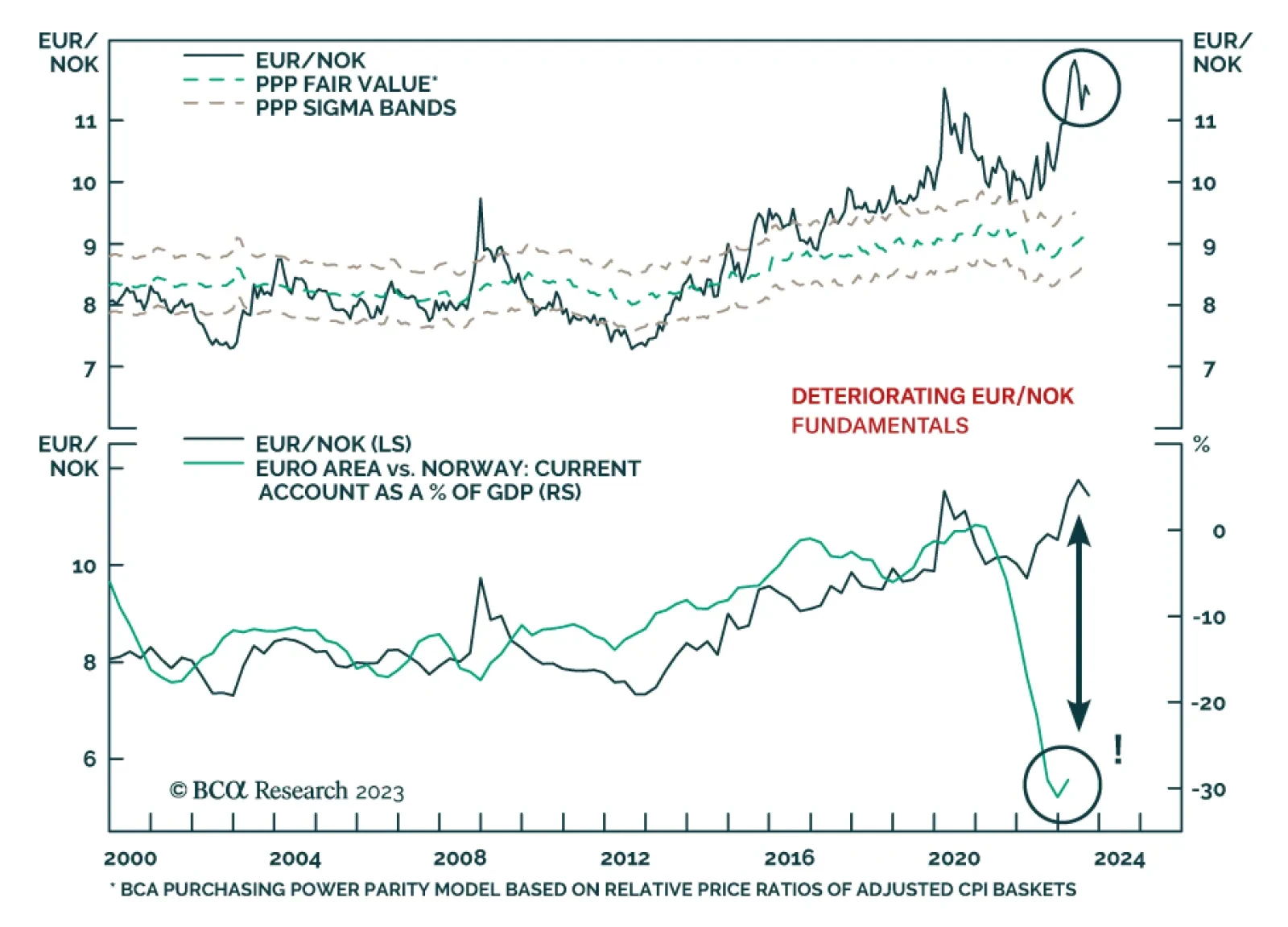

According to BCA Research’s European Investment Strategy service, valuations, interest rate differentials, and higher oil prices favor the NOK over the EUR. Higher oil prices, especially when they reflect tightening…