In this Strategy Outlook, we present the major investment themes and views we see playing out for the rest of 2023 and beyond.

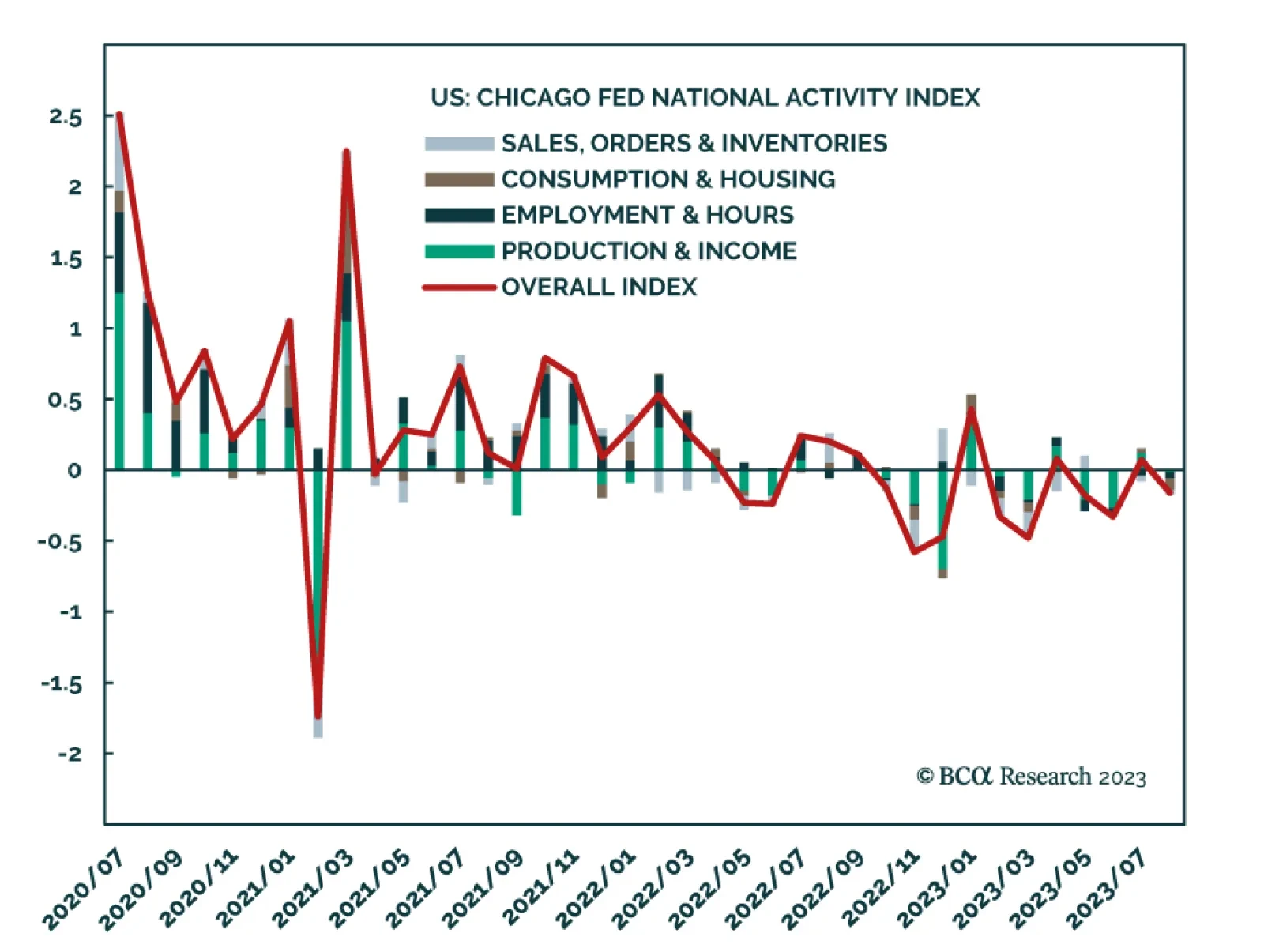

In a recent Insight we highlighted that the GDP tracking indicators produced by regional Fed banks are sending different signals about economic conditions in the US. While the Atlanta Fed’s GDPNow model suggests Q3 growth…

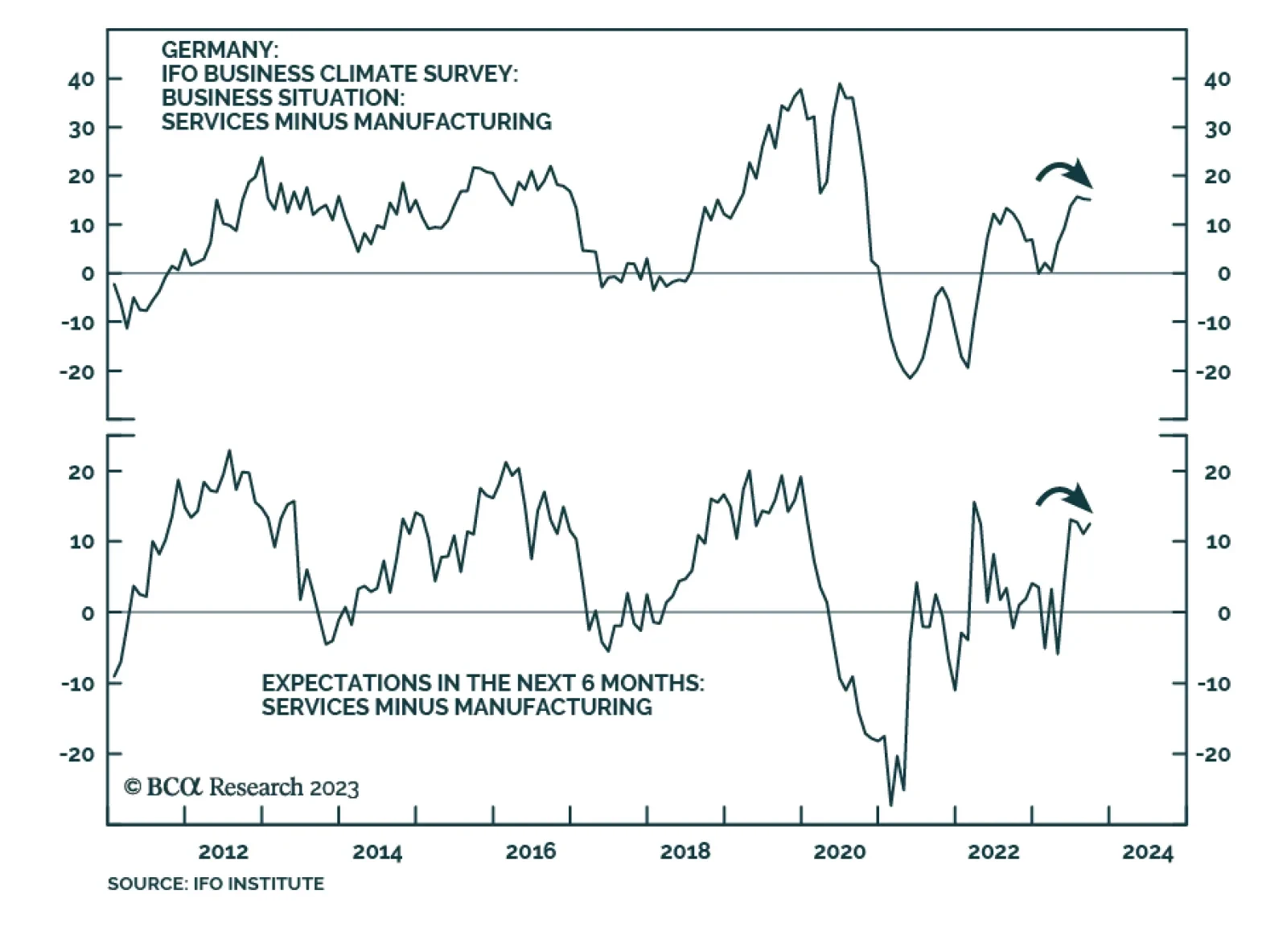

The message from the German Ifo is that although business sentiment continues to weaken, the pace of deterioration slowed in September and appears to be in the process of bottoming. The Business Climate Index’s marginal…

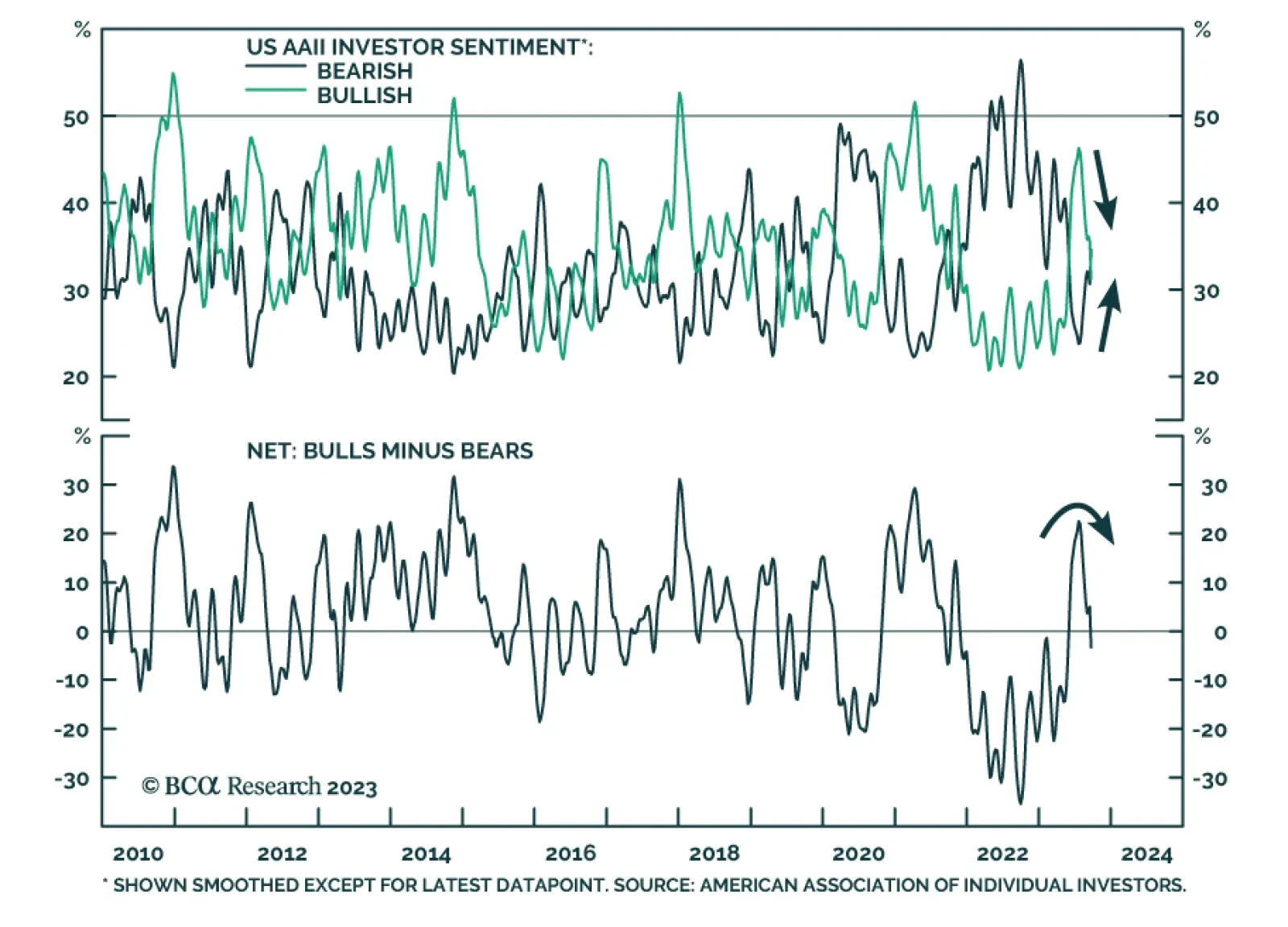

Bulls and bears have capitulated, and the majority of the clients surveyed expect a rangebound market in the near term. Our fair value PE NTM indicates that the S&P 500 is only modestly overvalued. The continued outperformance…

Investor sentiment has turned less optimistic. According to the latest AAII survey, the share of respondents with a bullish outlook has collapsed to 31.3% from its peak of 51.4% two months ago. It is now back down below its…

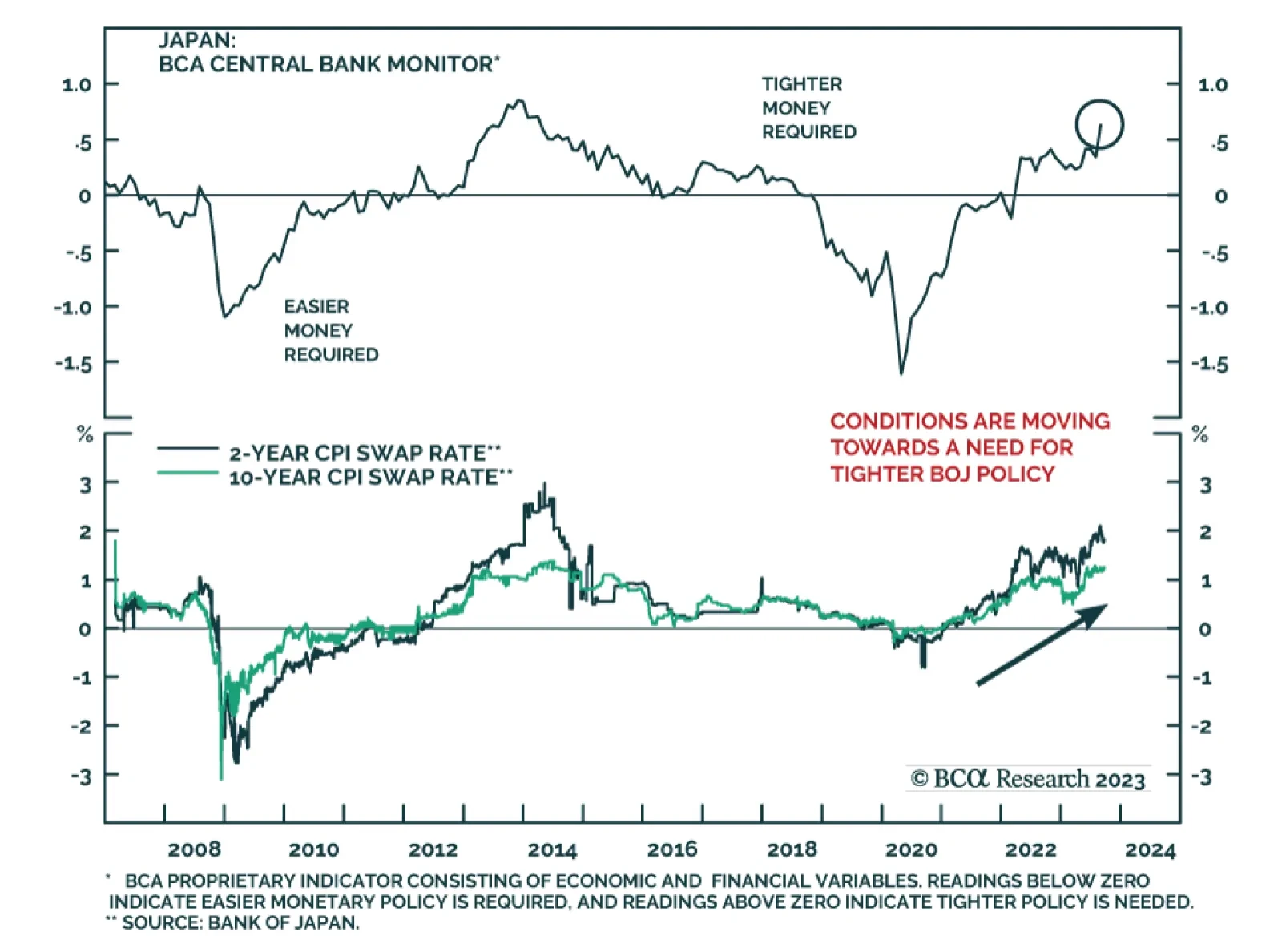

As expected, the Bank of Japan voted unanimously to keep policy unchanged on Friday. The policy rate remains at -0.1% and the central bank maintains Yield Curve Control (YCC) on 10-year JGB yields. To the extent that the BoJ…

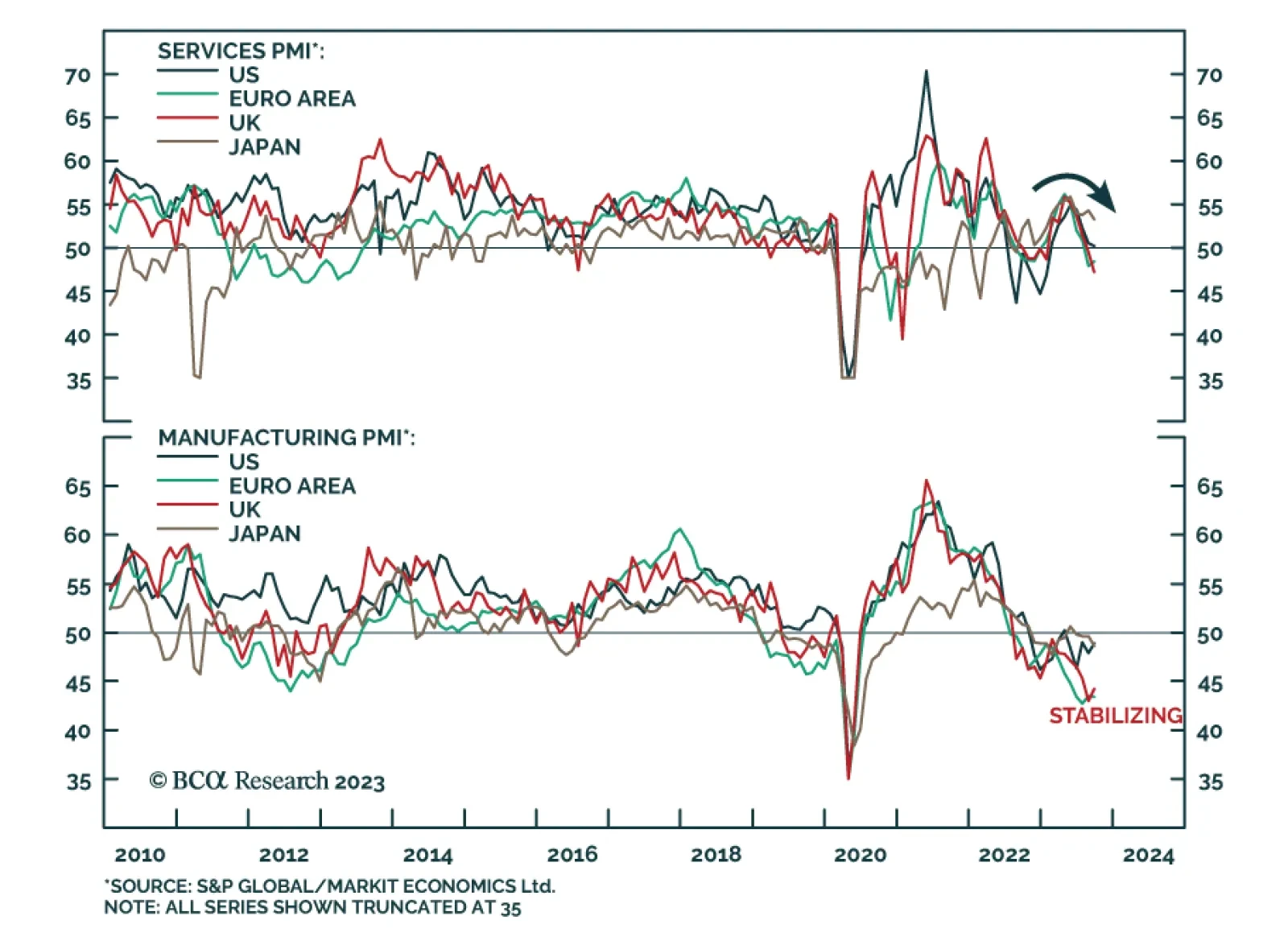

Flash PMIs suggests that the tailwind to services from pent-up demand during the pandemic is easing and that although the global manufacturing downturn is bottoming, it is not meaningfully reaccelerating. In the case of the US…

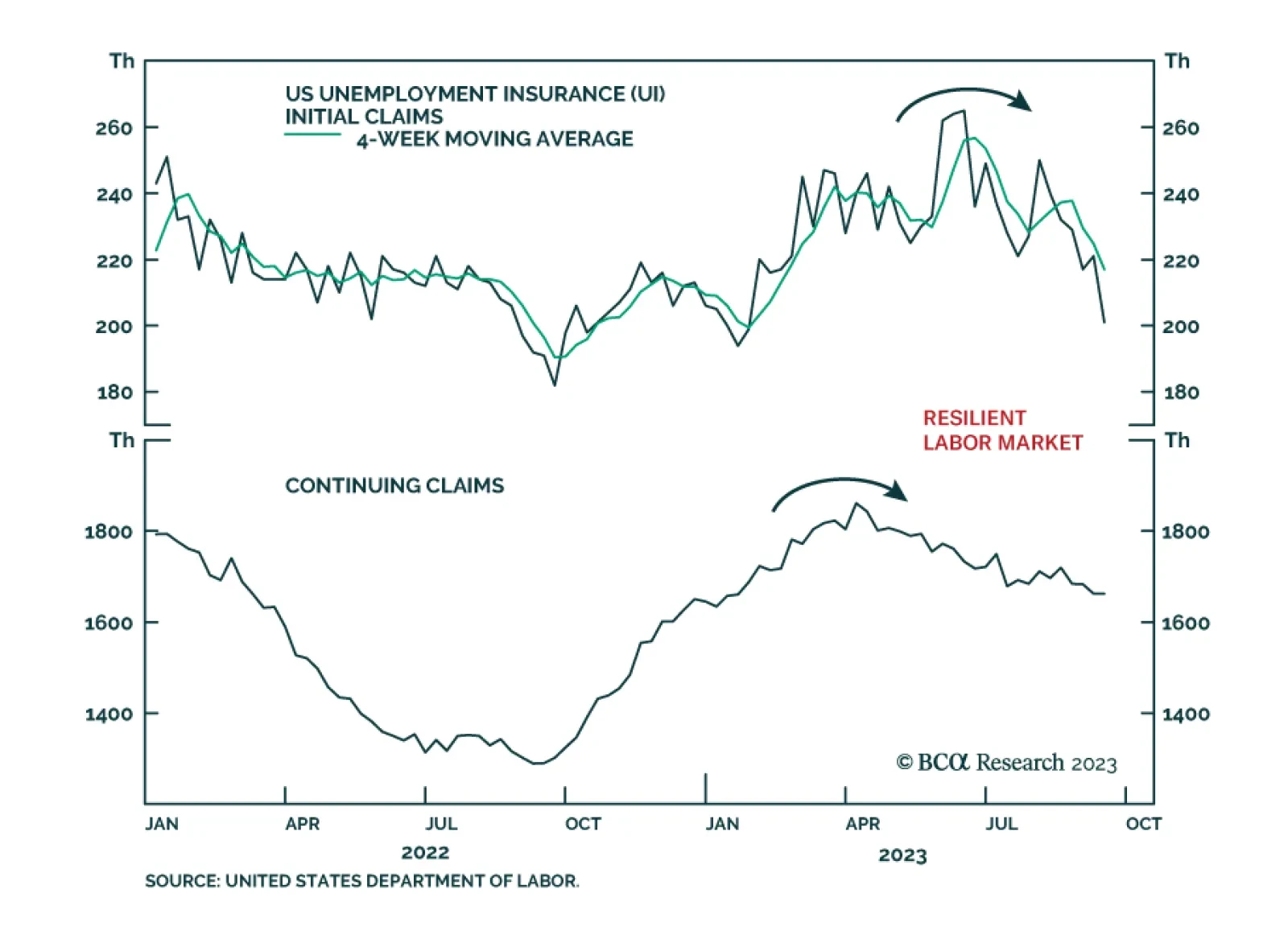

Thursday’s release of US weekly jobless claims and continuing claims delivered a positive surprise about labor market conditions. The decline in initial jobless claims to an eight-month low of 201 thousand came in below…

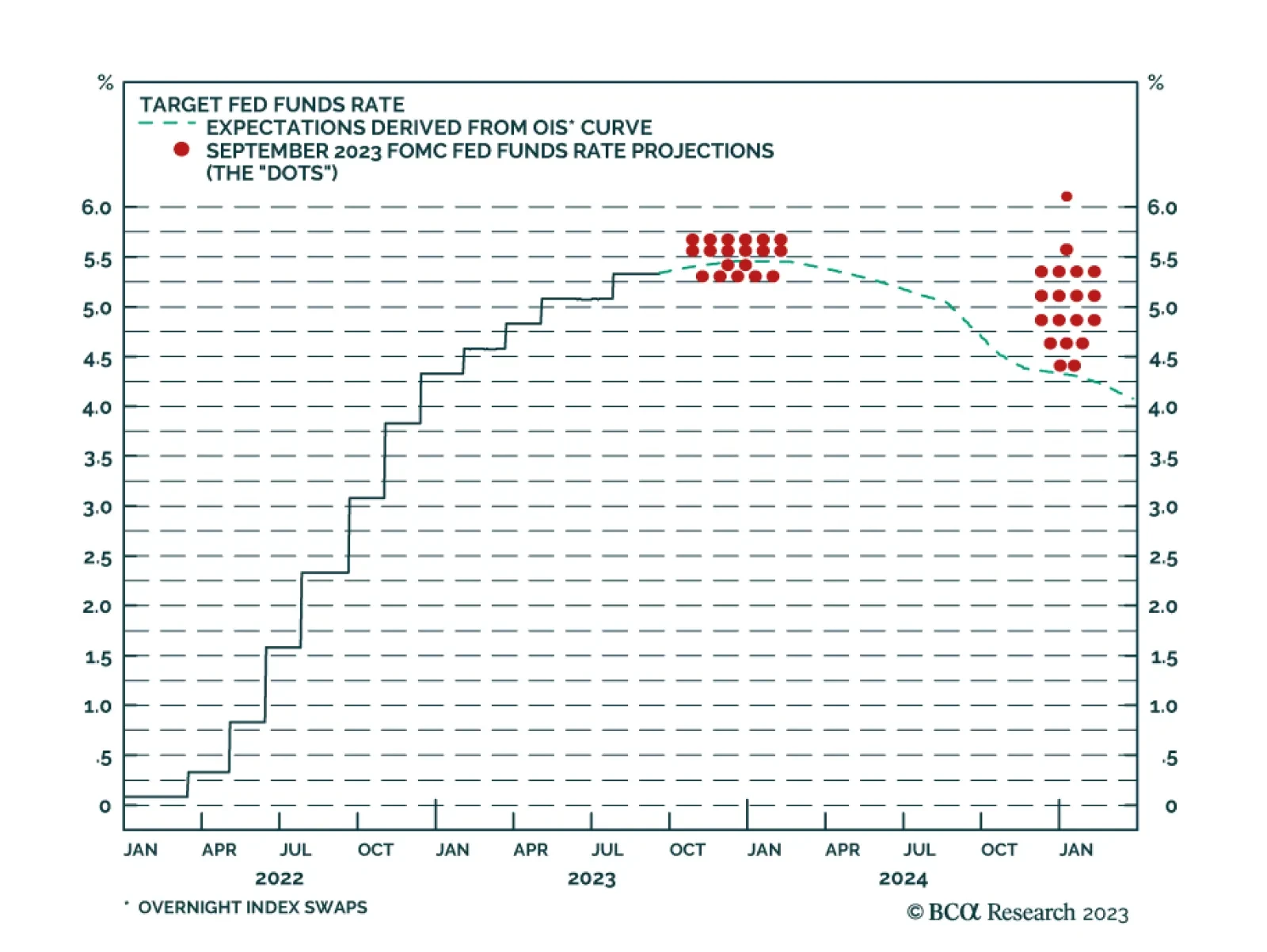

According to BCA Research’s US Bond Strategy service, the 2006/07 roadmap remains a good one for bond investors. The Fed held the funds rate steady this afternoon and made no material changes to its policy statement.…

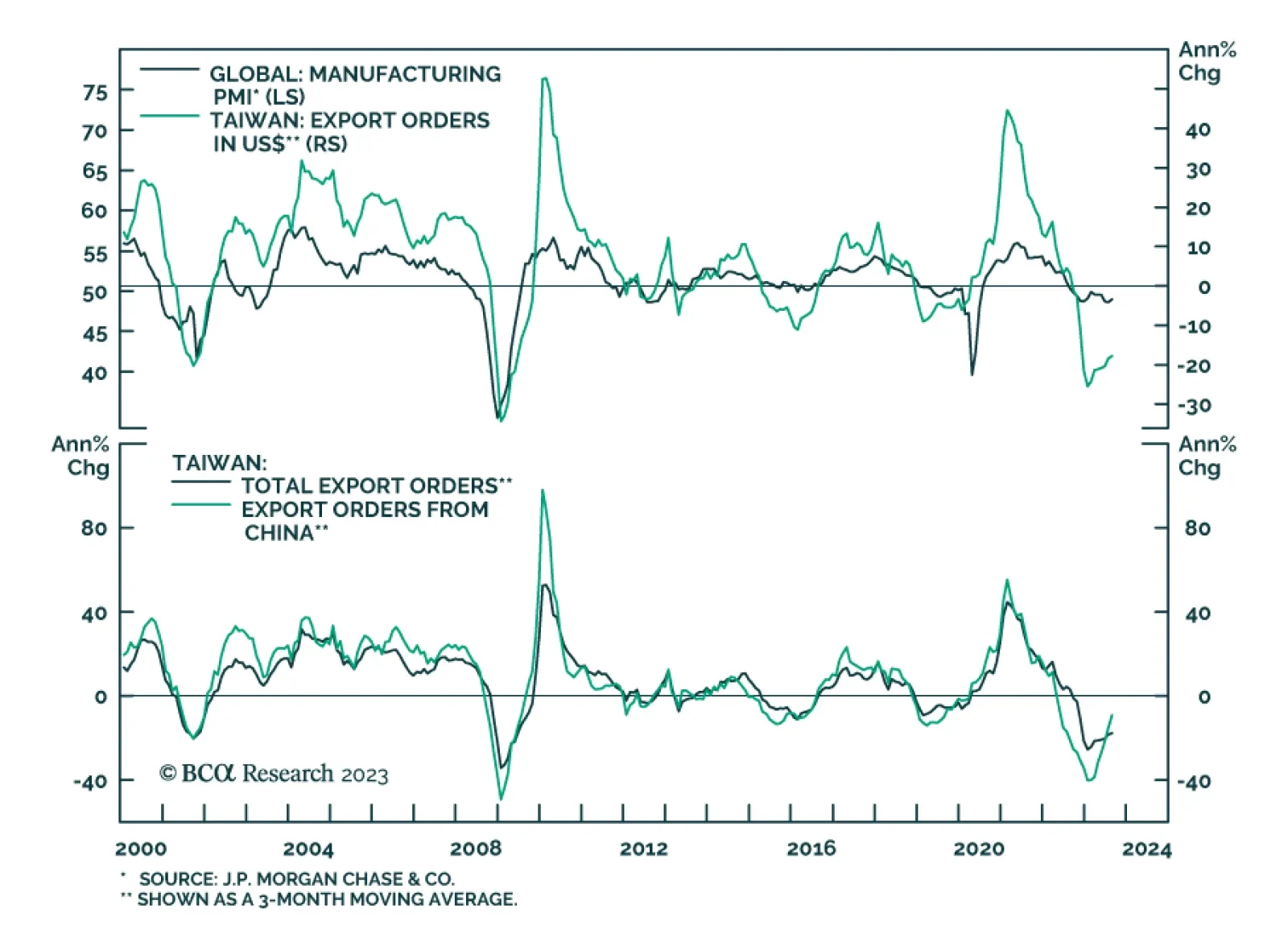

Taiwanese export orders sent a disappointing signal about global manufacturing conditions on Wednesday, corroborating the message from Singapore’s NODX release earlier this week. The pace of decline in export orders…