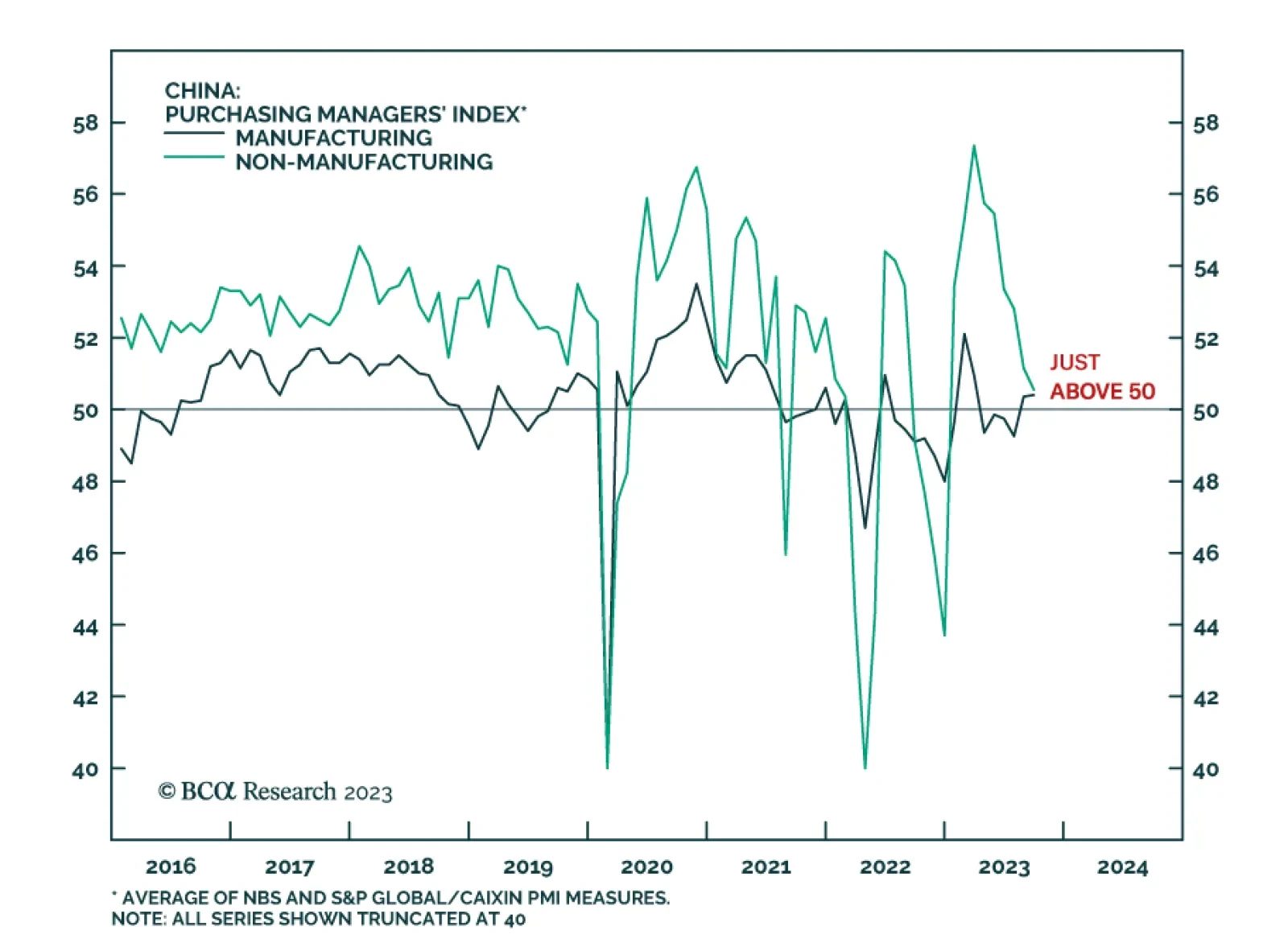

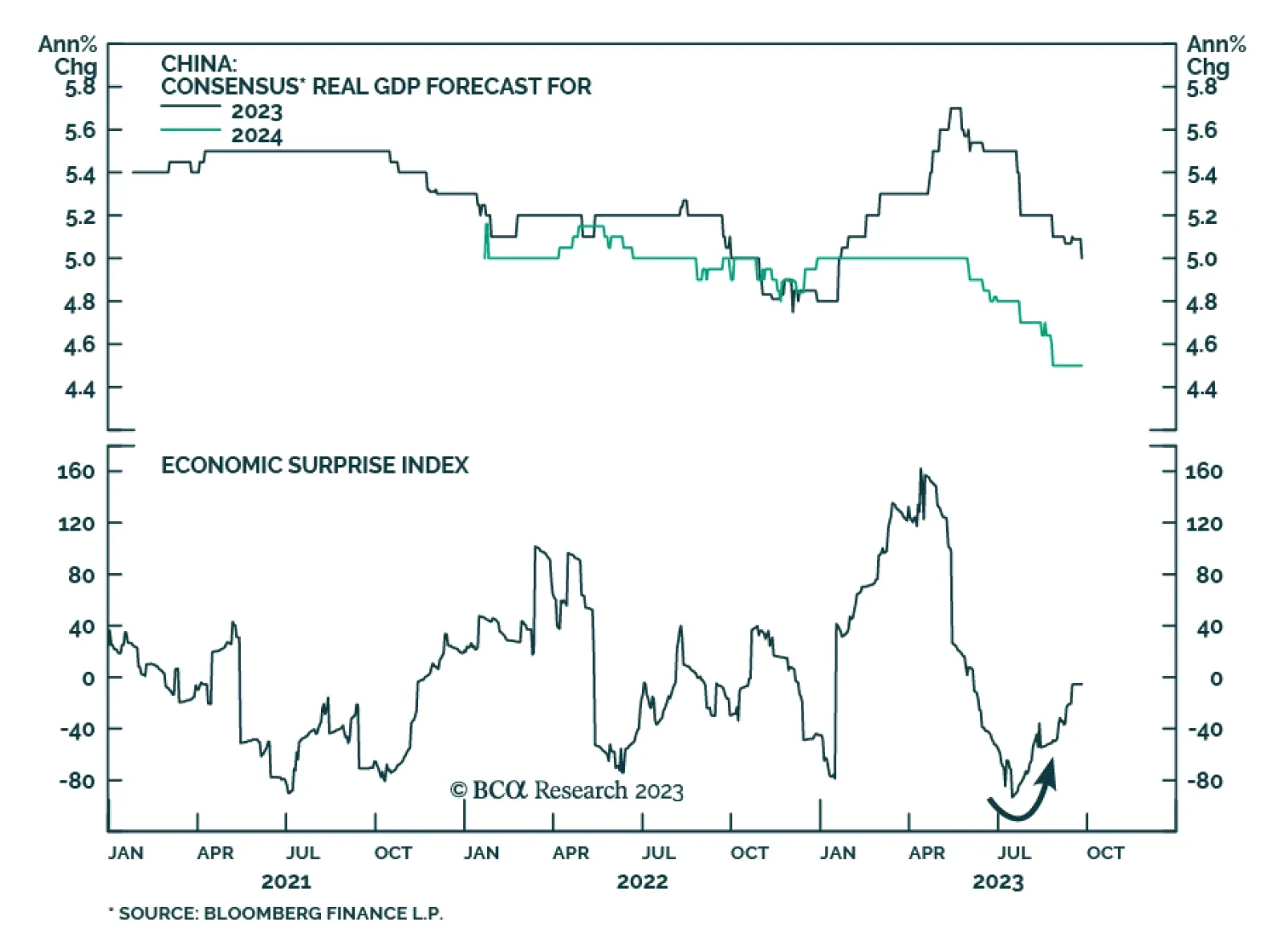

The Caixin and NBS PMIs sent mixed signals about Chinese economic conditions in September. The NBS results surprised to the upside on the back of slightly greater-than-anticipated increases in both the manufacturing (+0.5 to…

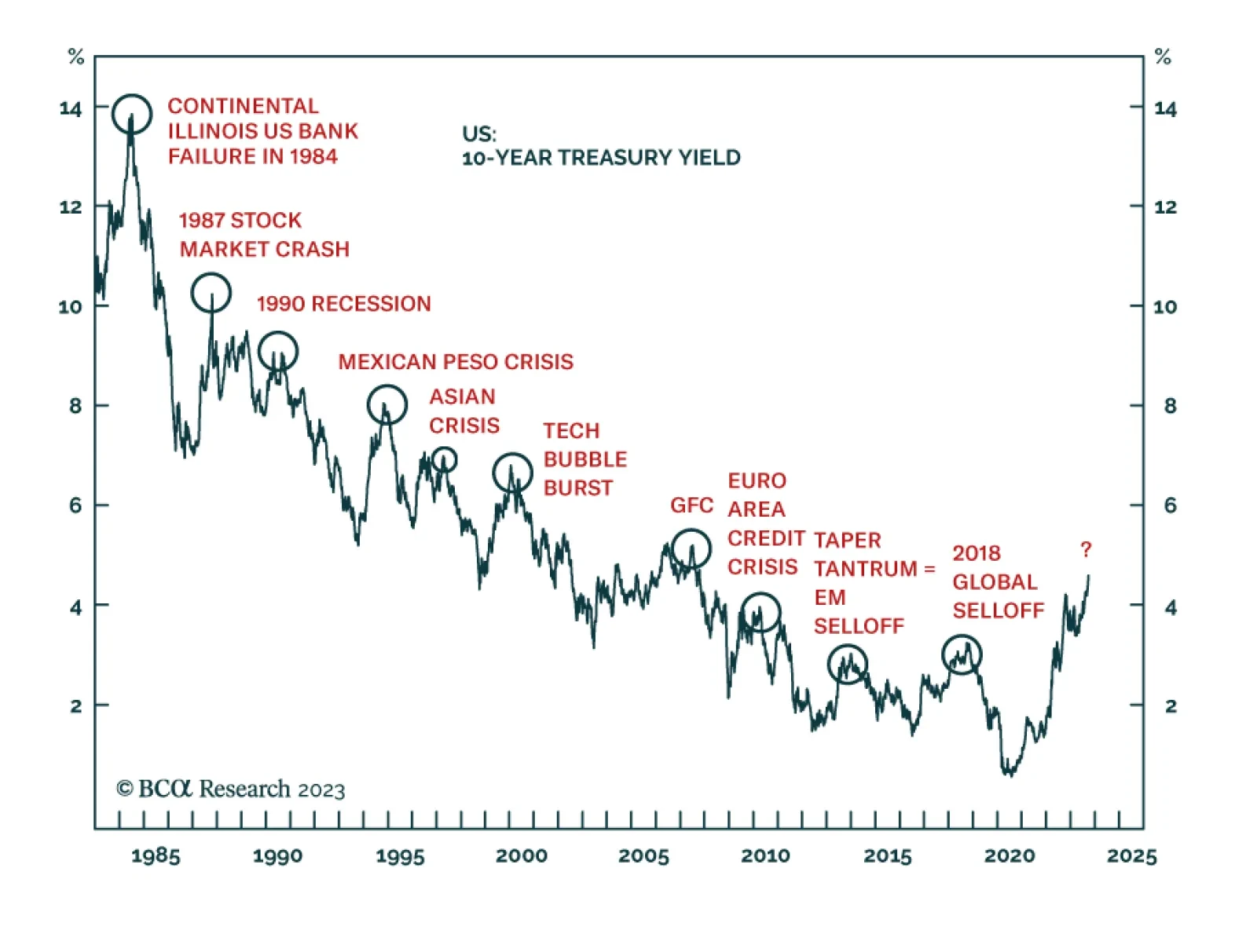

Aggressive monetary tightening has always led to recession, although the timing is uncertain. The effects of high interest rates are starting to be felt. Investors should stay risk off and buy government bonds as a safe haven…

Downside risks to equities are building. Rates, the dollar, and energy prices will remain elevated into yearend. This trifecta makes a soft landing less likely than before and hurts corporate profits and multiples. However, high cash…

According to BCA Research’s Emerging Markets Strategy service, US Treasury yields are set to overshoot before topping out. The selloff in global bonds is becoming advanced, but there will be more damage to bond…

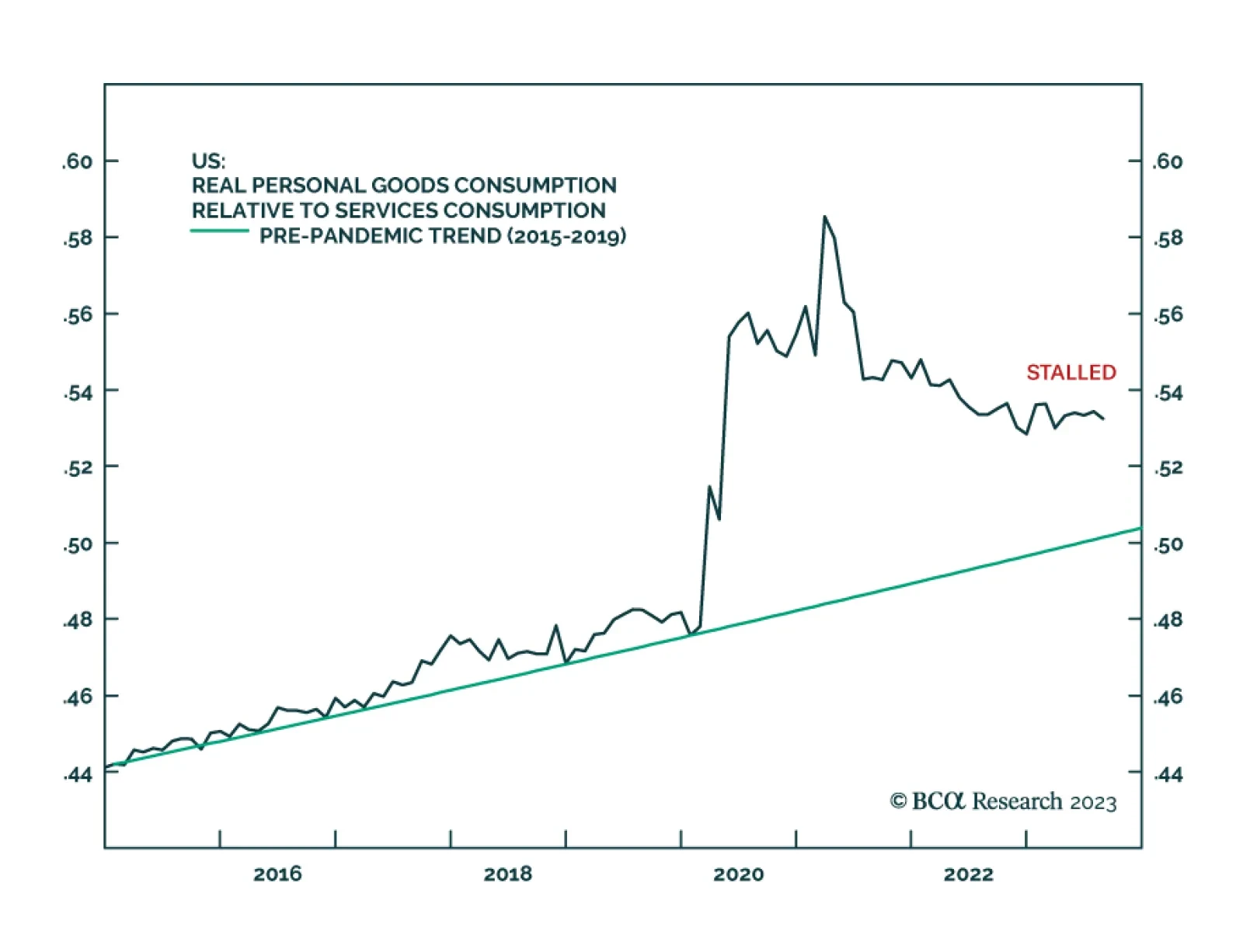

The consumption rotation from goods to services has been one of the drivers of the global manufacturing downturn. Demand for durable goods normalized after the pandemic binge. Meanwhile, consumption of services benefitted from…

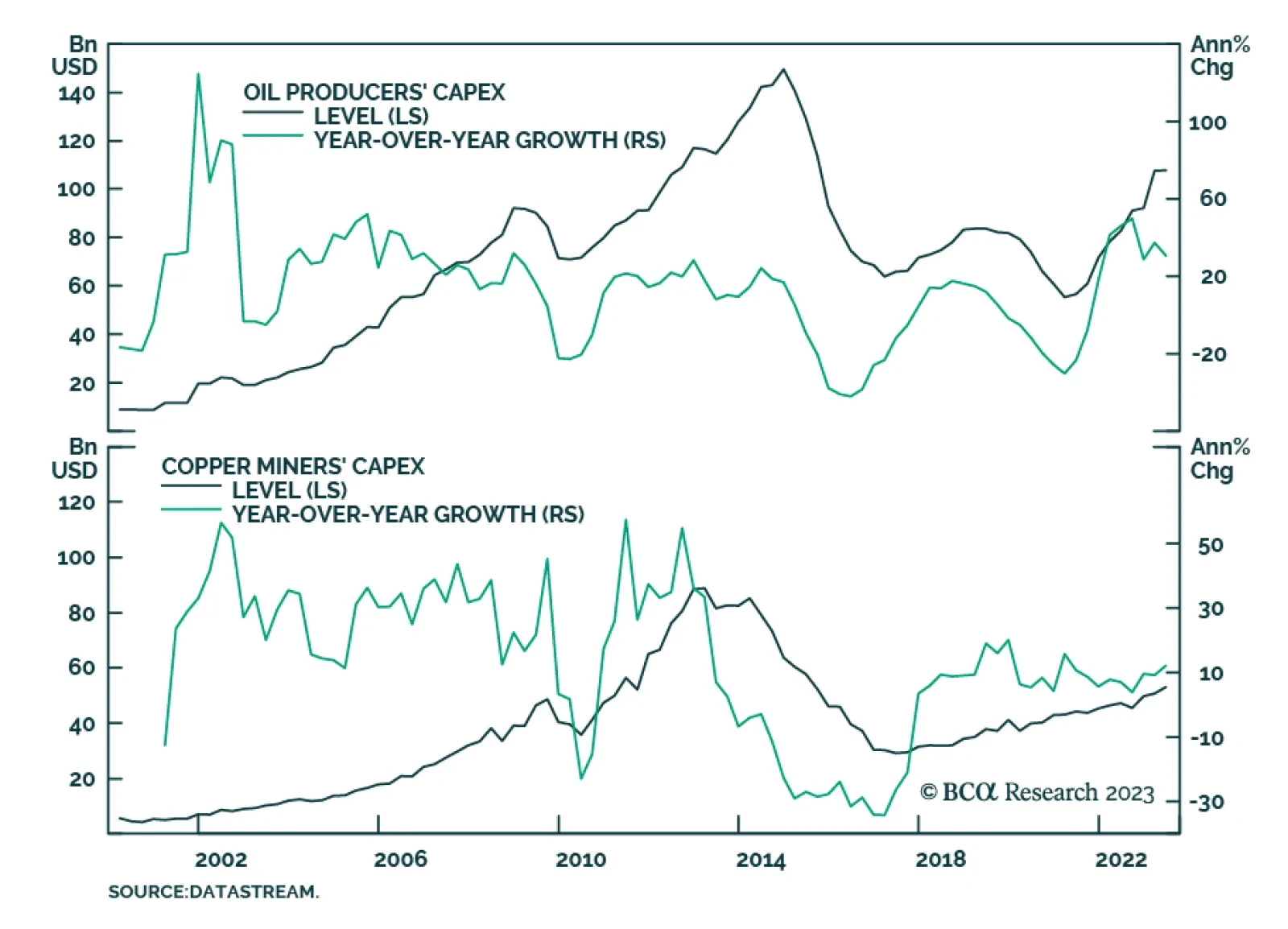

According to BCA Research’s Commodity & Energy Strategy service, the global energy transition will become more disorderly, if oil-and-gas capex growth continues to outpace that of critical minerals. The…

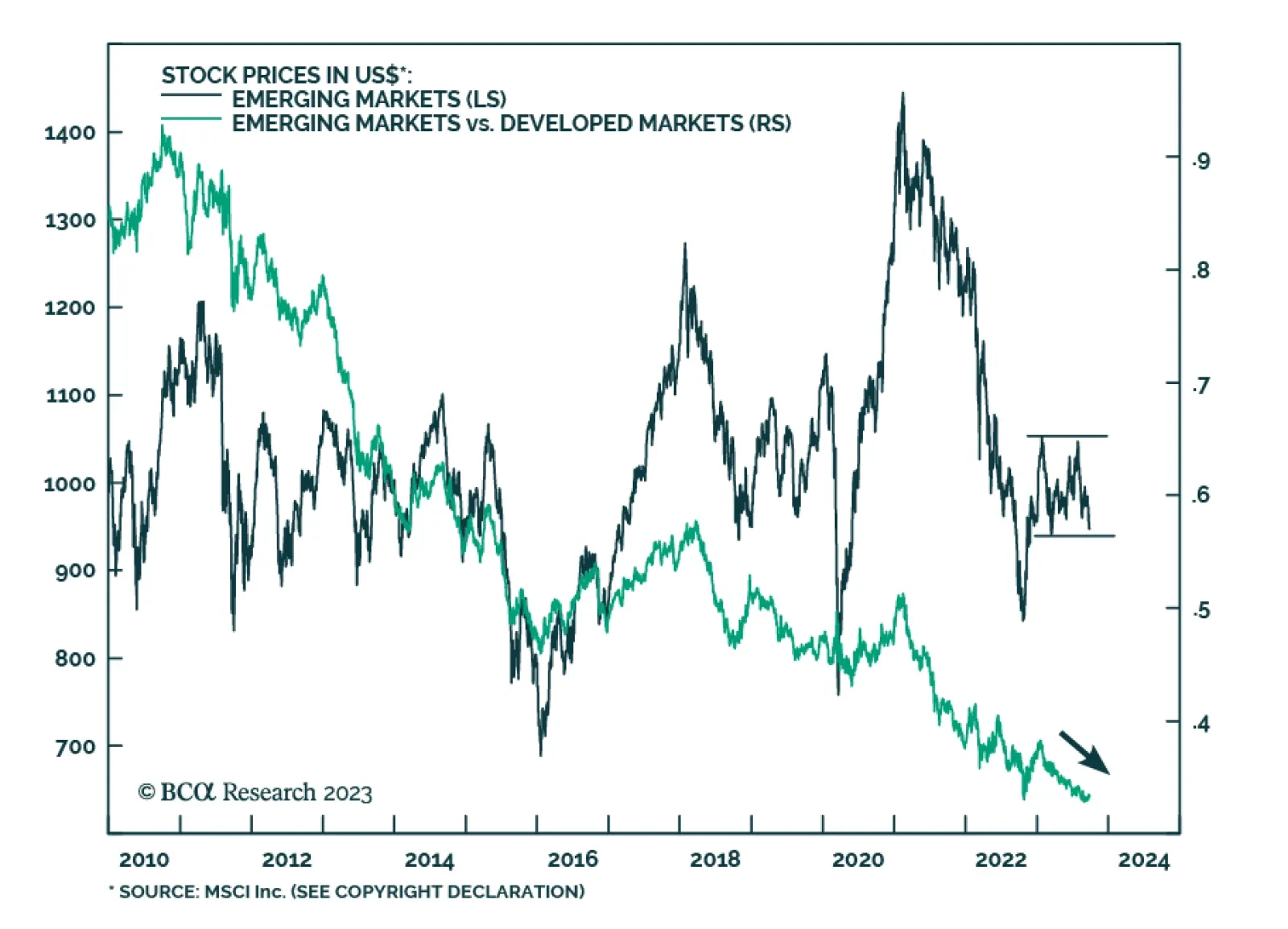

Emerging Market equities have been in a broad trading range all year. The MSCI index peaked on January 26, then bottomed in mid-March before recouping nearly all of its losses over the subsequent months. However, after nearly…

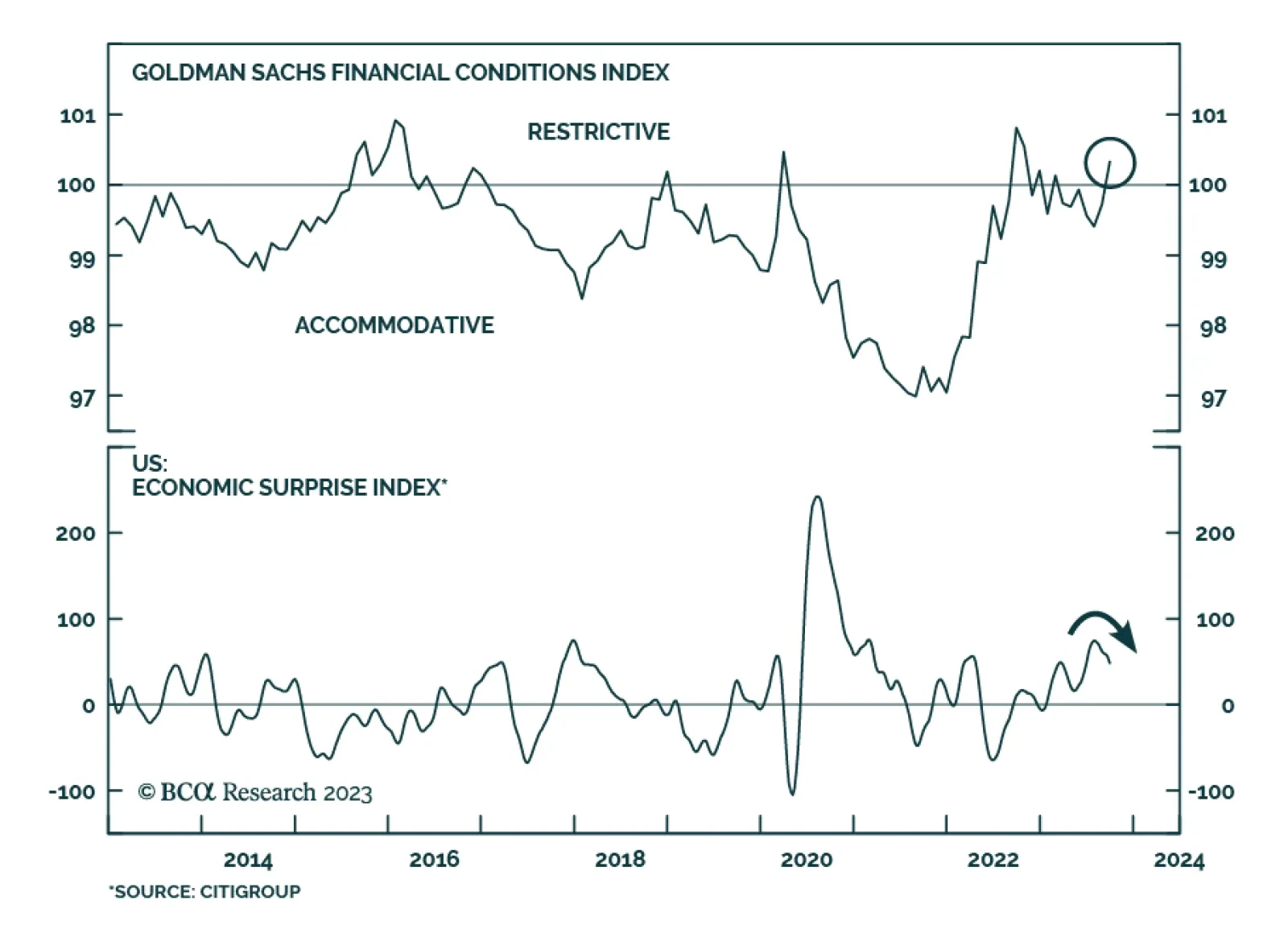

Financial conditions tightened meaningfully in the first three quarters of 2022 as market participants anticipated an aggressive monetary tightening cycle. However, this tightening phase ended in late-2022. Indeed, economic…

The unexpected increase in Chinese industrial profits in August sent a positive signal about the economy. Industrial profits posted its first year-over-year increase since the second half of last year, surging by 17.2% y/y…