Dovish comments by several Fed officials contributed to a Treasury rally and improvement in sentiment towards risk assets on Tuesday. Globally, rumors that Beijing is planning to unleash more stimulus supported Chinese financial…

Households’ excess pandemic savings will eventually run out, but we continue to disagree with the widespread view that they’re already gone or entirely in the hands of the wealthy. Consumers’ demise continues to be greatly…

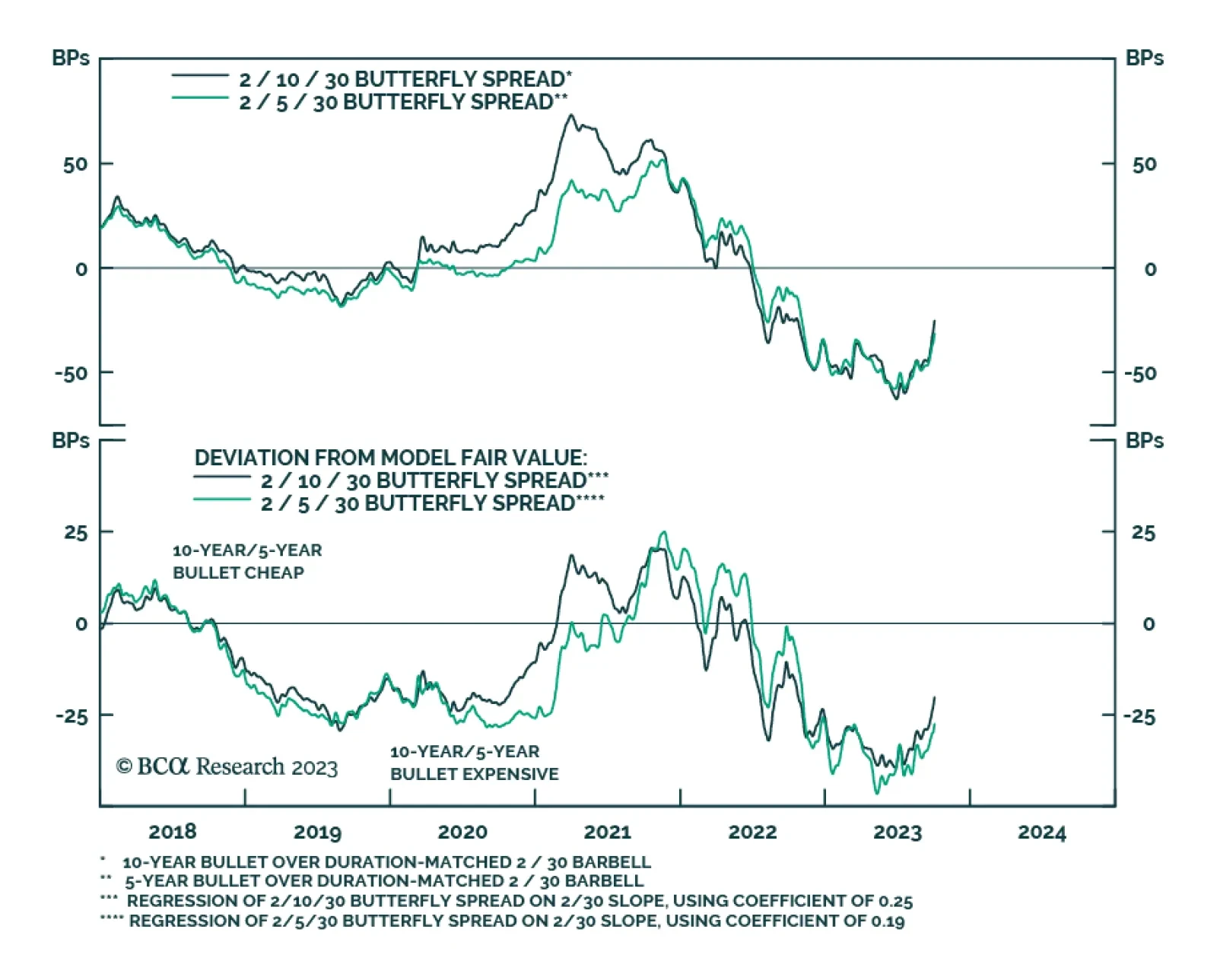

BCA Research’s US Bond Strategy service recommends a barbelled allocation across the Treasury curve. The Treasury curve bear-steepened in September. The 2-year/10-year Treasury slope steepened 32 bps on the month and…

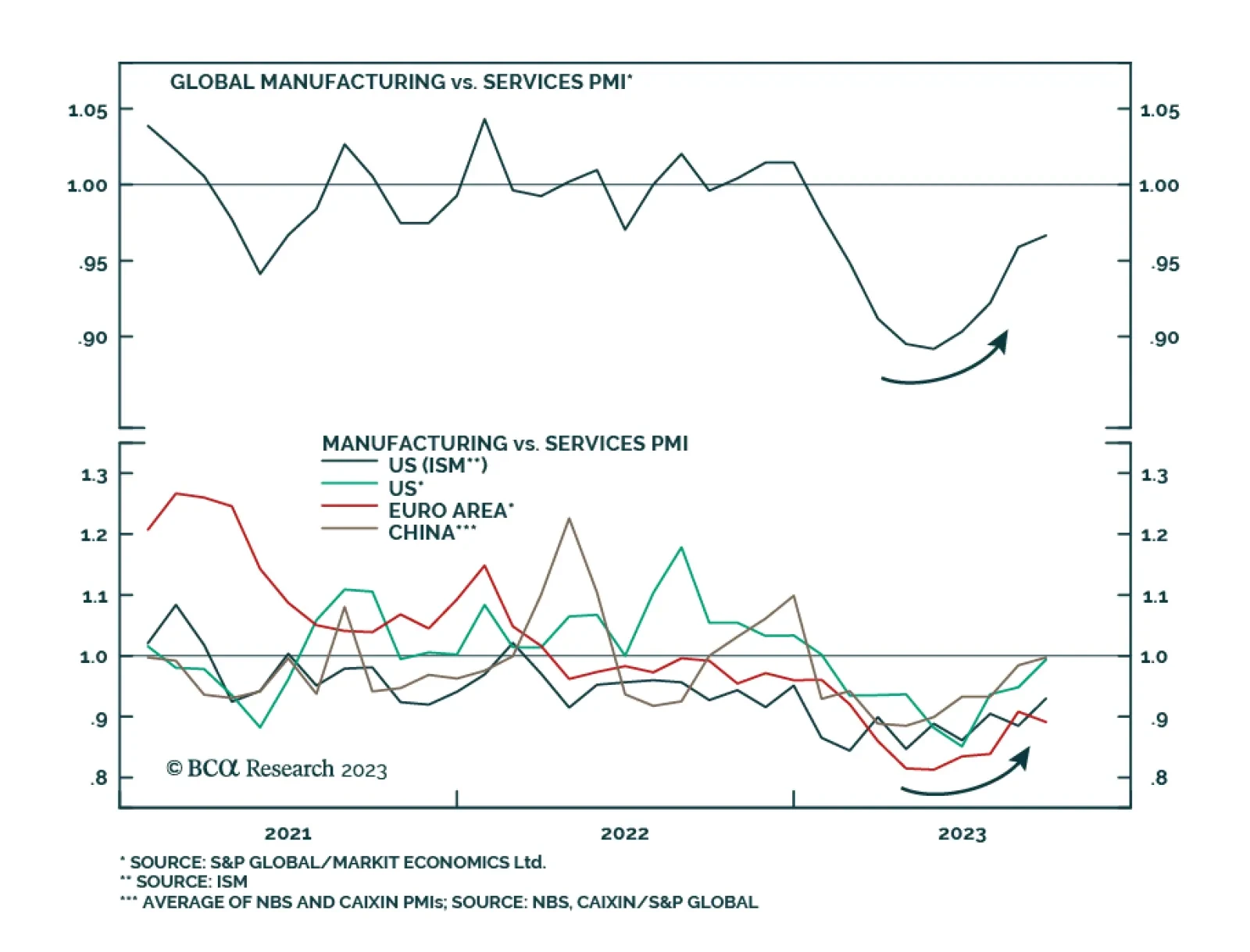

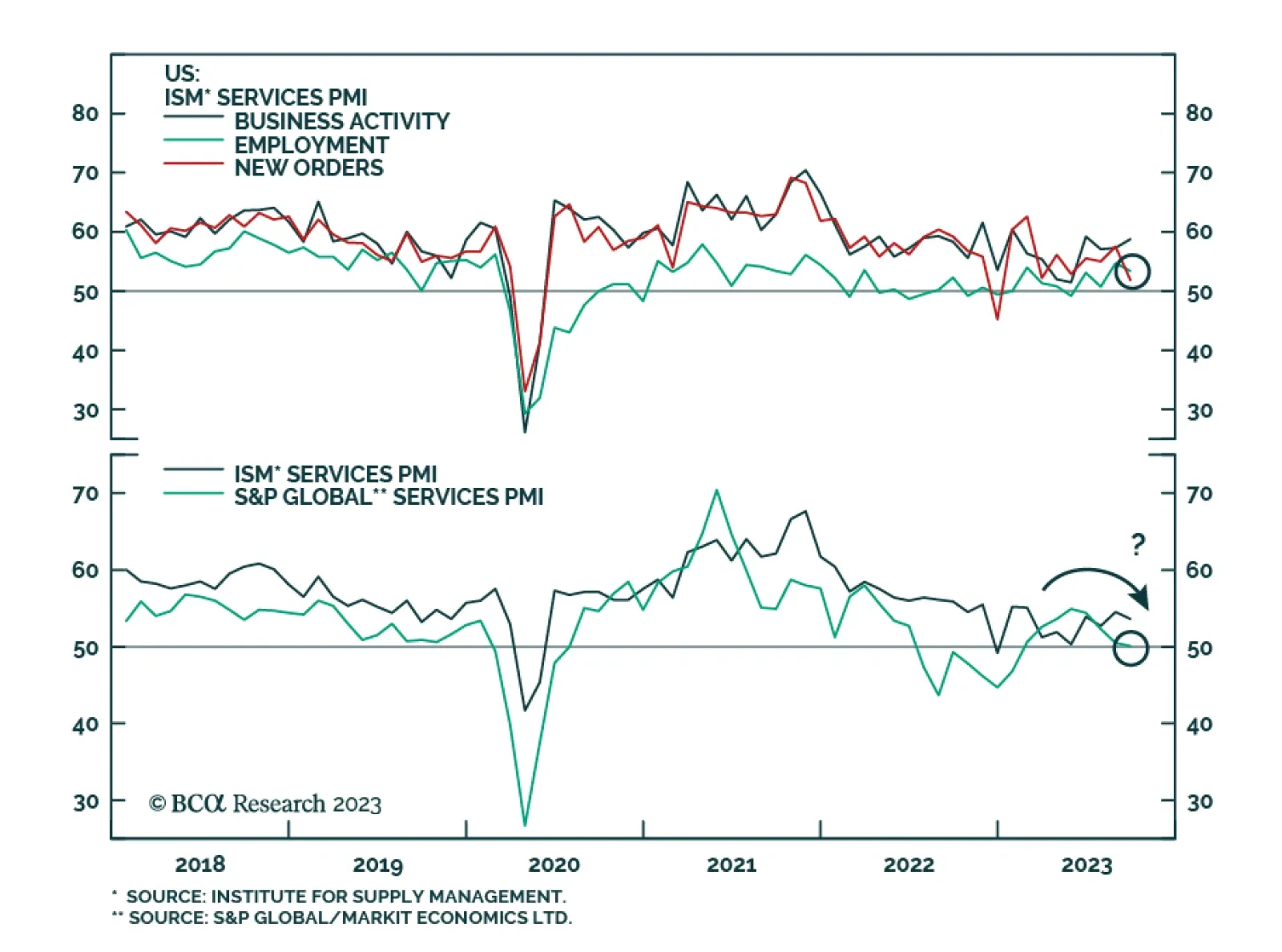

The September update of the J.P.Morgan Global Services PMI inched down from 51.1 to 50.8 in September. This marks the fourth consecutive month of decline and brings the headline index to its lowest level since January. The New…

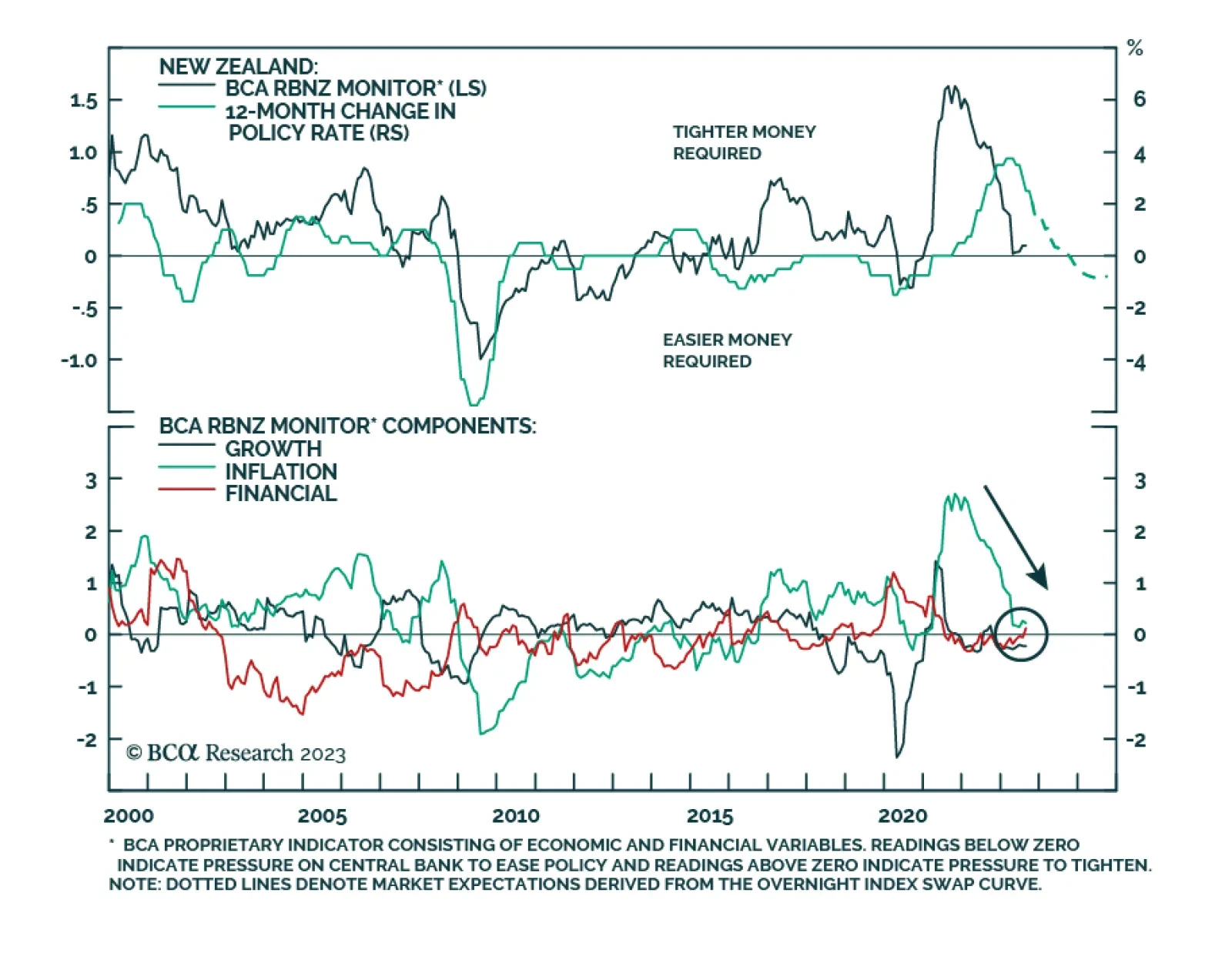

As expected, the Reserve Bank of New Zealand held the official cash rate at 5.5% on Wednesday, keeping policy unchanged for the third consecutive meeting. The press release underscored that while monetary policy is weighing on…

As expected, the US ISM PMI showed service sector activity slowing in September. The Services ISM declined from 54.5 to 53.6, broadly in line with expectations of 53.5. Although the level of the headline index indicates that…

There is a connection between the bond market meltdown and Republican Party’s meltdown. Investors should expect more short-term financial market volatility as a result of the triple whammy of high bond yields, high oil prices, and a…

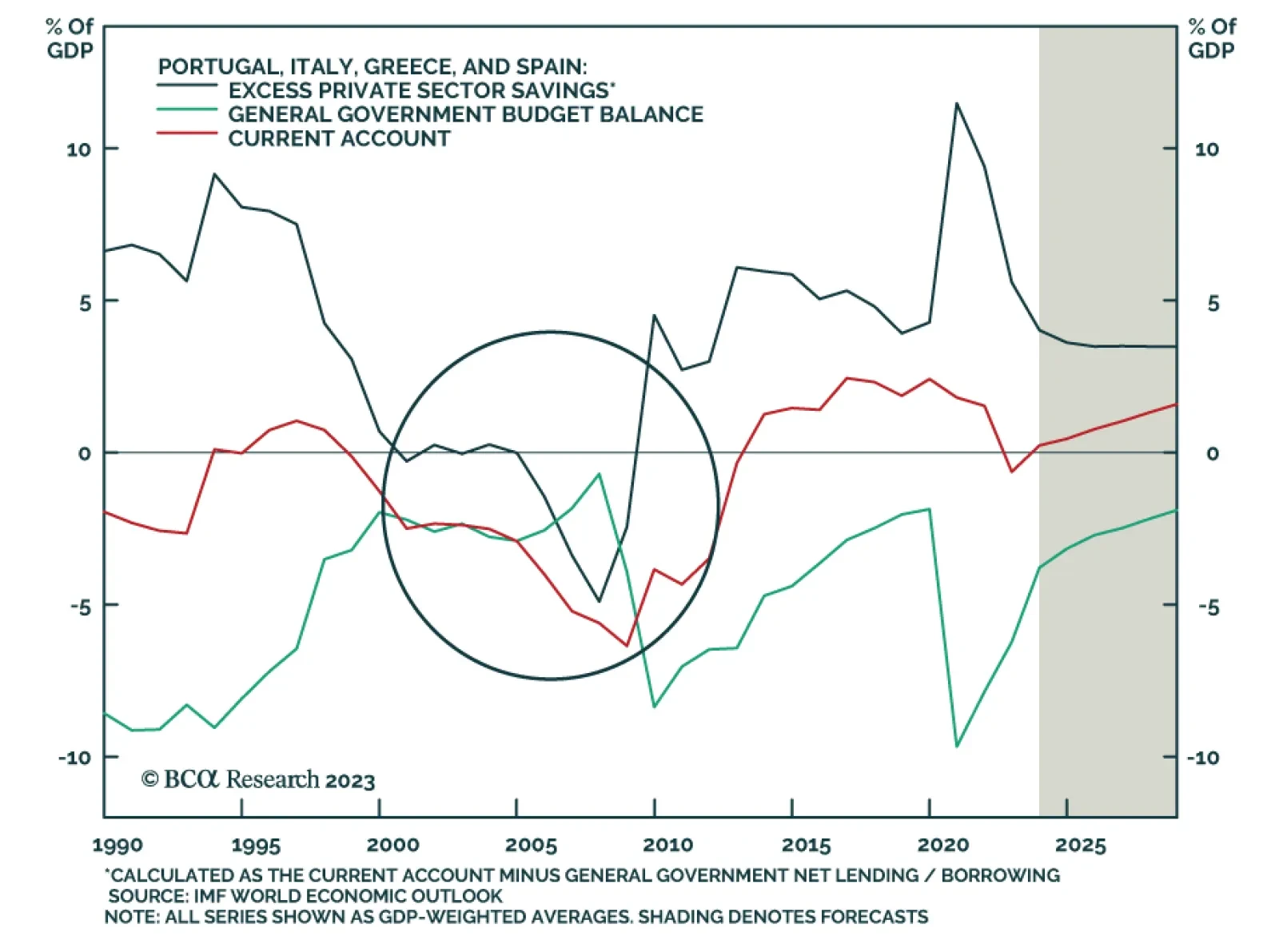

According to BCA Research’s European Investment Strategy service, the Mediterranean bloc’s move from current account deficit to current account surplus nations greatly limits the risk of a new sovereign debt crisis…

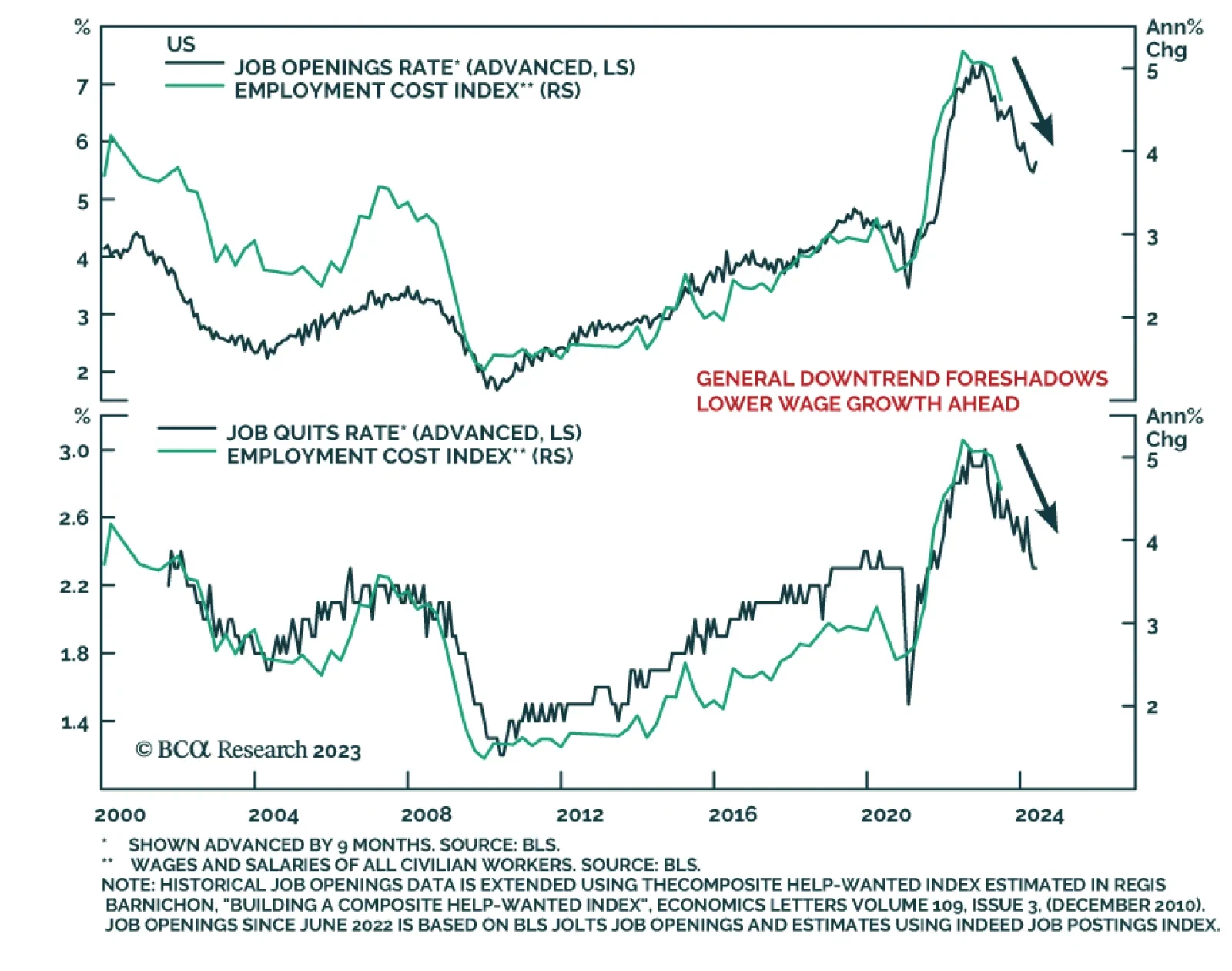

The US JOLTS report sent a chill through financial markets on Tuesday. The bigger-than-expected number of job openings in August fueled investors’ concern that the Fed will be forced to maintain a hawkish stance for longer…

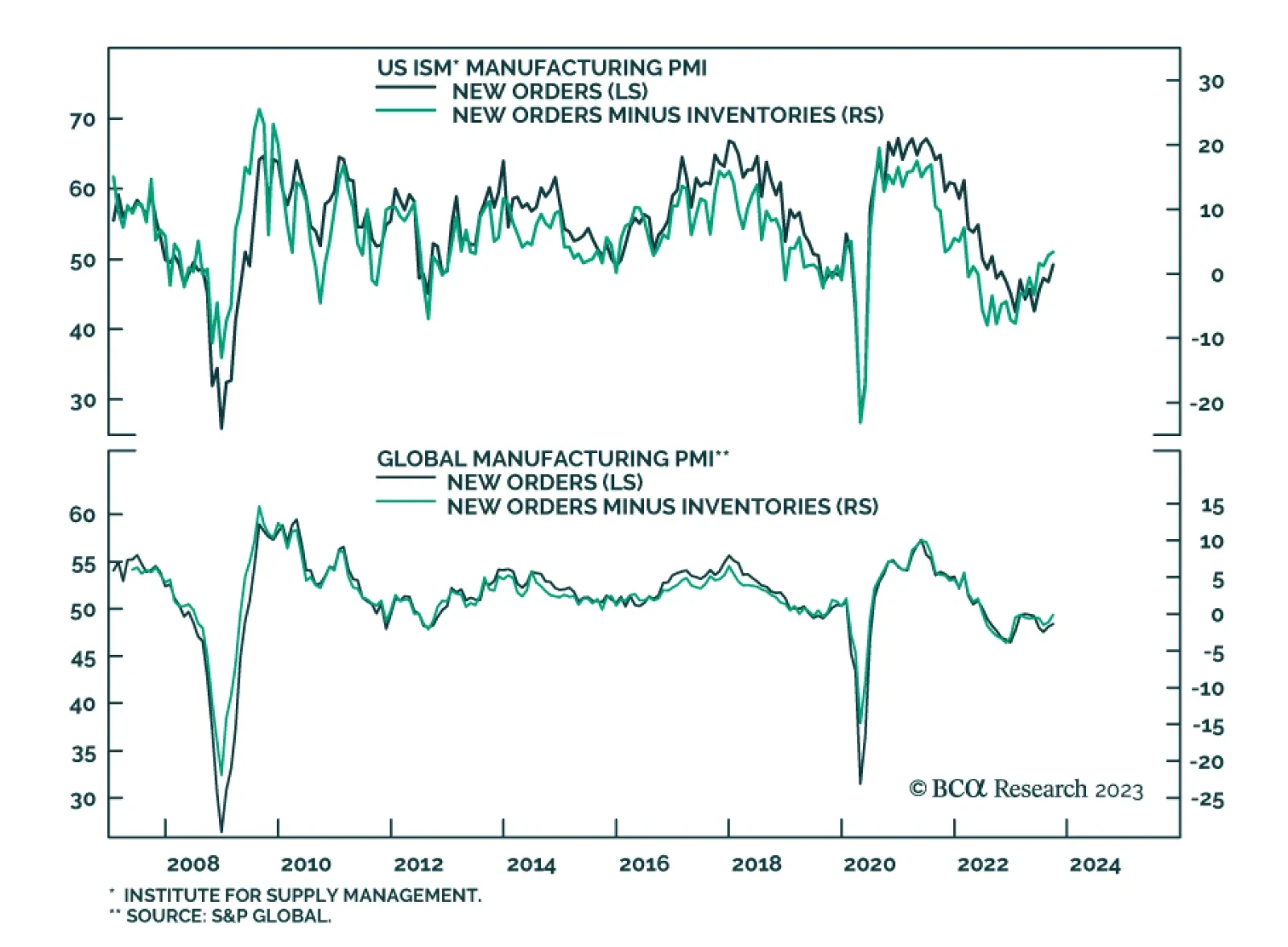

The Global Manufacturing PMI ticked up by a marginal 0.1 point to 49.1 in September, indicating that manufacturing activity deteriorated at a slightly slower pace than in August. However, several of the details of the report were…