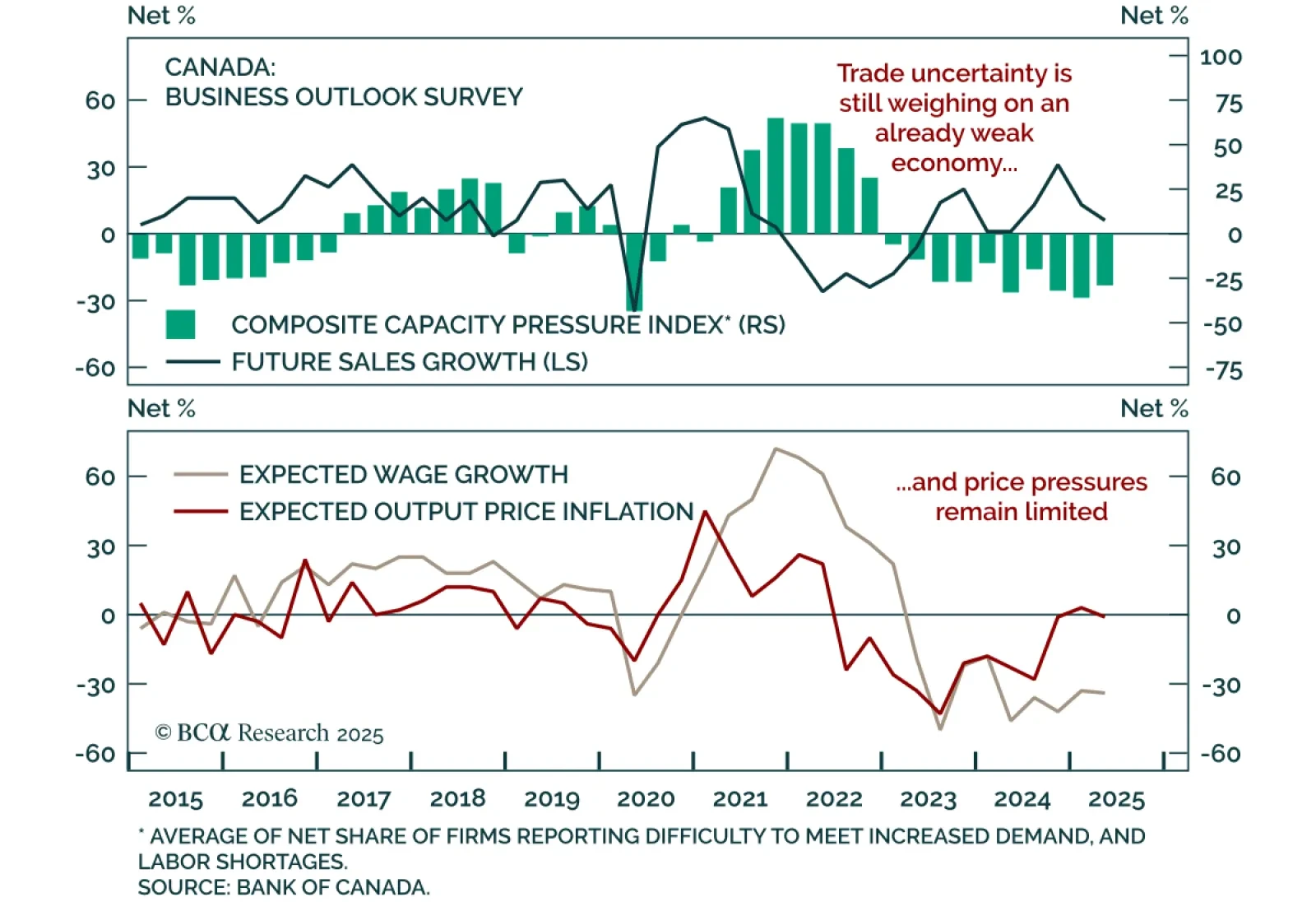

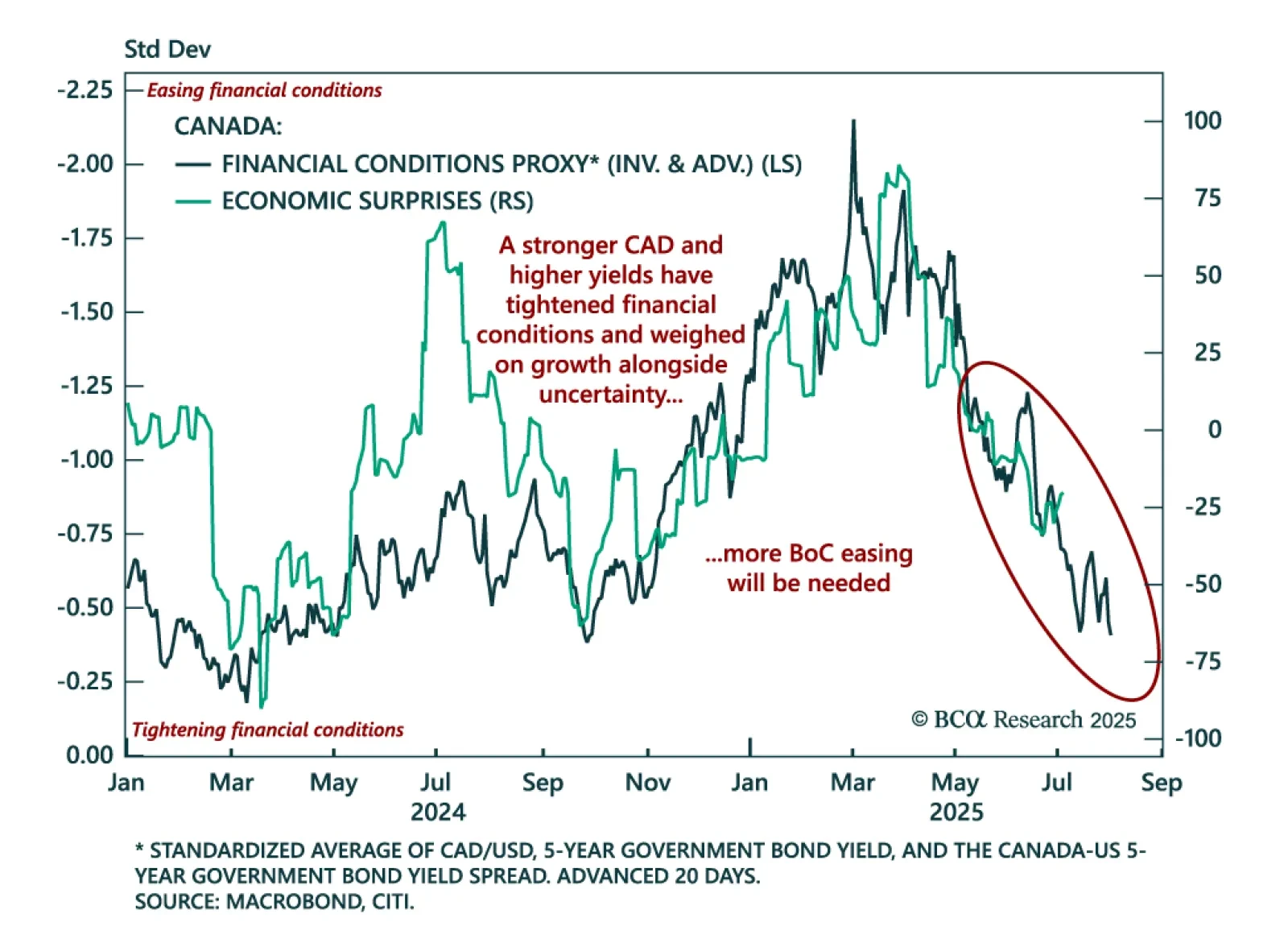

The Q2 Business Outlook Survey showed weaker sentiment and subdued hiring and investment intentions, reinforcing the case for deeper BoC rate cuts and our overweight in Canadian bonds. The BOS indicator ticked down to -2.4 from -2.1…

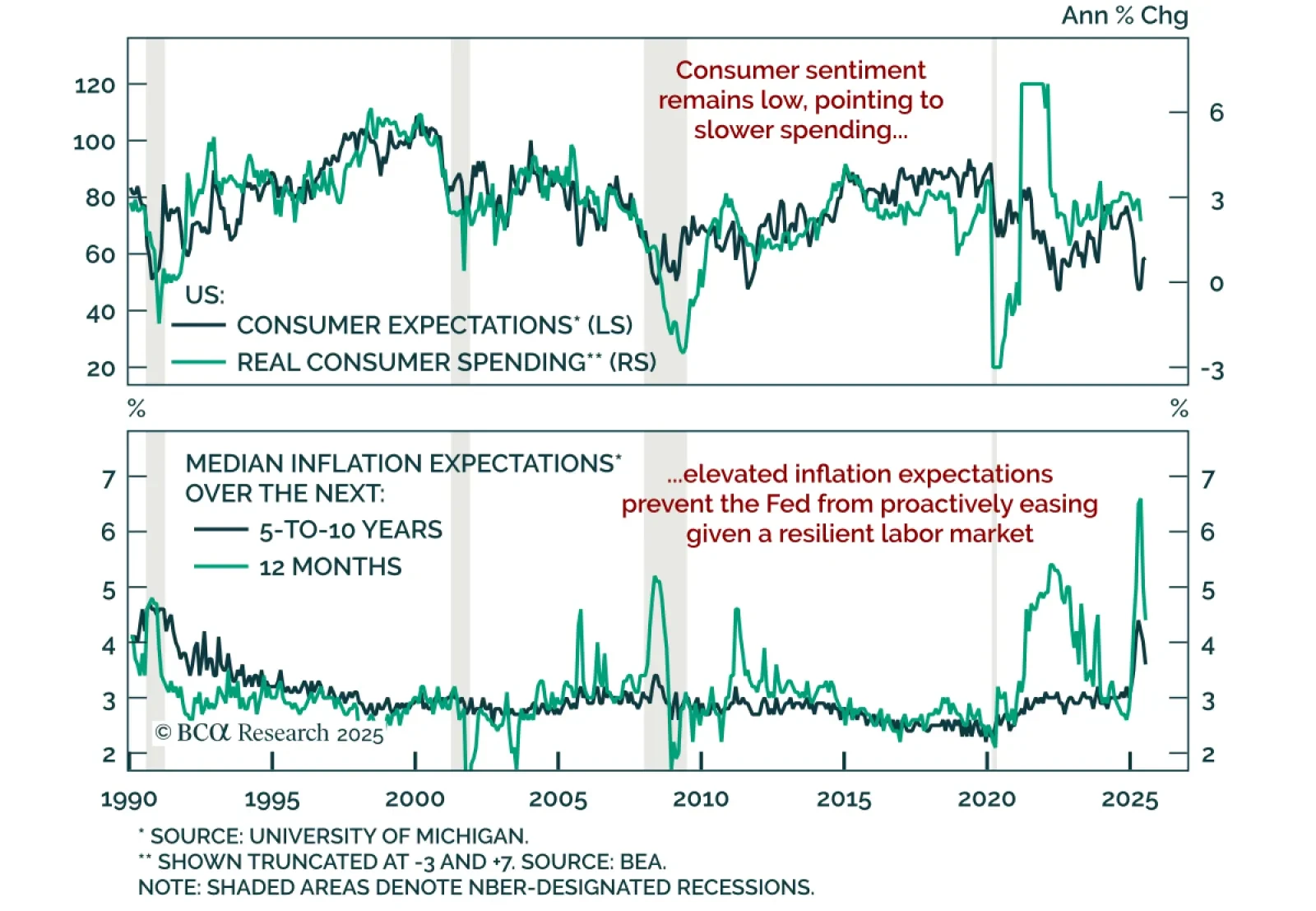

Consumer sentiment improved modestly in July, but remains at levels that still point to subdued spending, reinforcing our defensive stance. The preliminary University of Michigan index rose to 61.8 from 60.7 in June. Expectations…

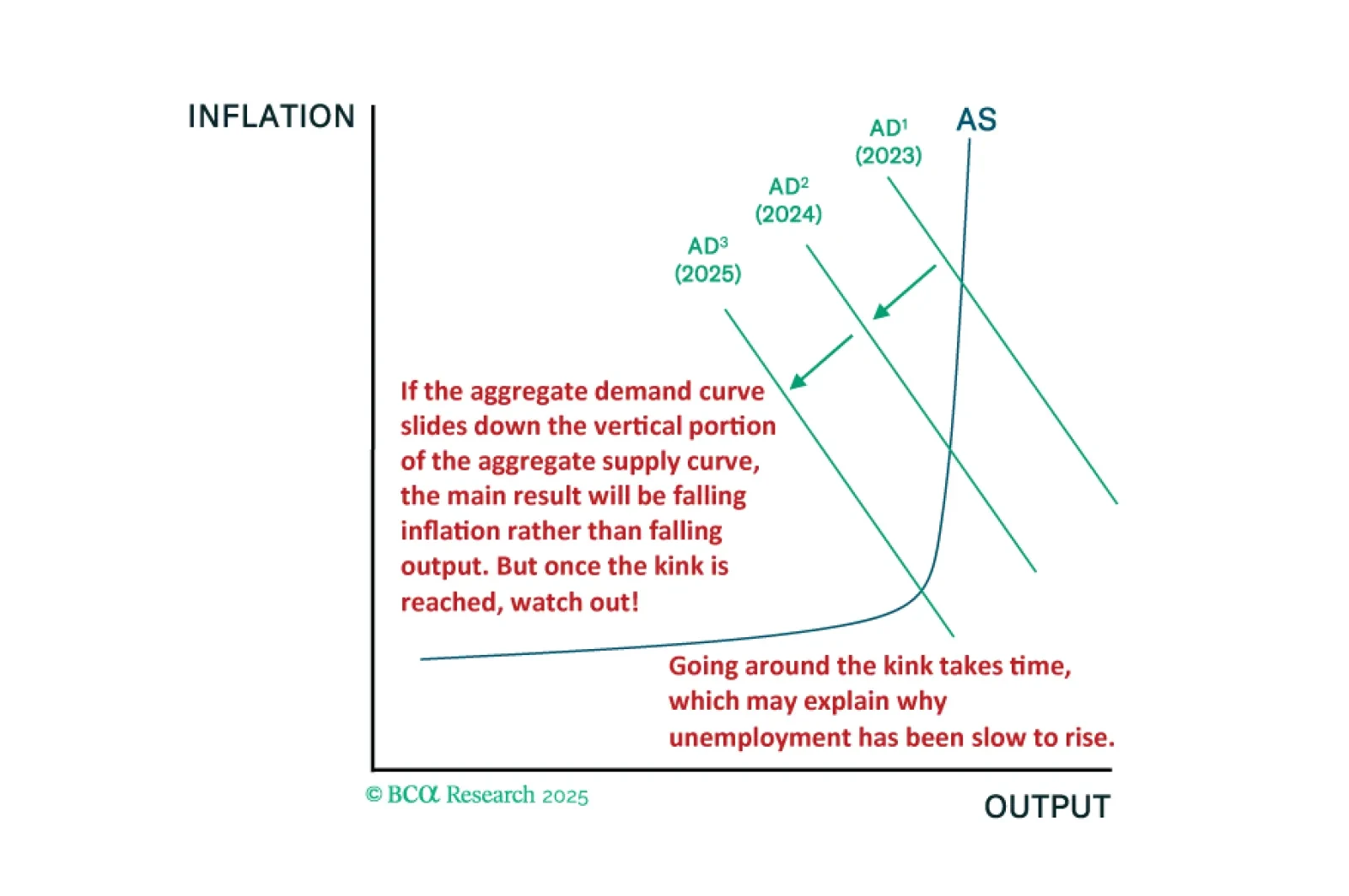

The fact that the US economy has been slower to deteriorate than in past cycles is entirely consistent with our kinked Phillips curve framework. We will be looking to our MacroQuant model for guidance on when to turn fully defensive…

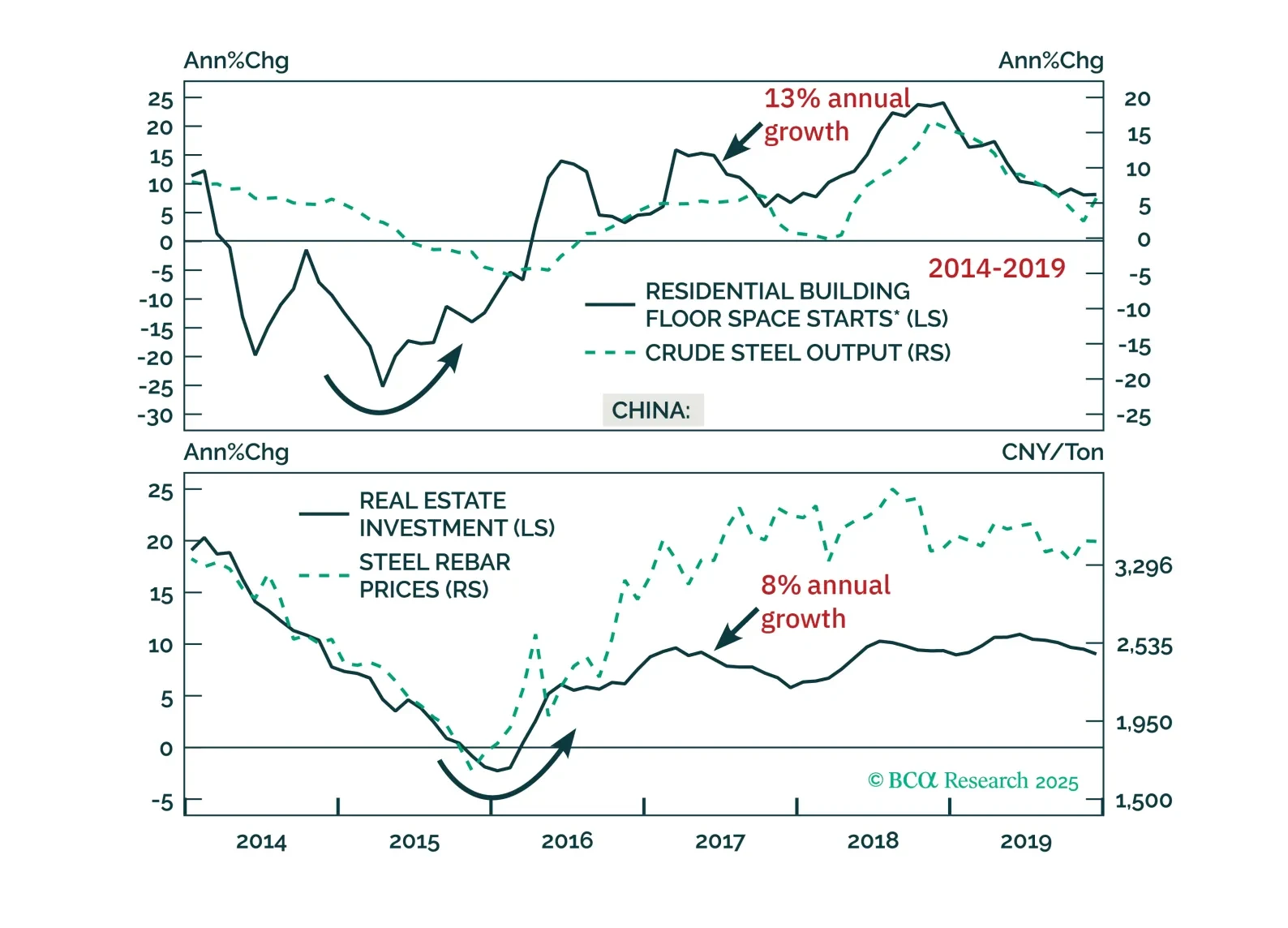

Beijing’s supply-side push faces steeper hurdles than in 2016. With limited demand support and tighter constraints on cutting capacity, today’s reforms are unlikely to pack the same punch.

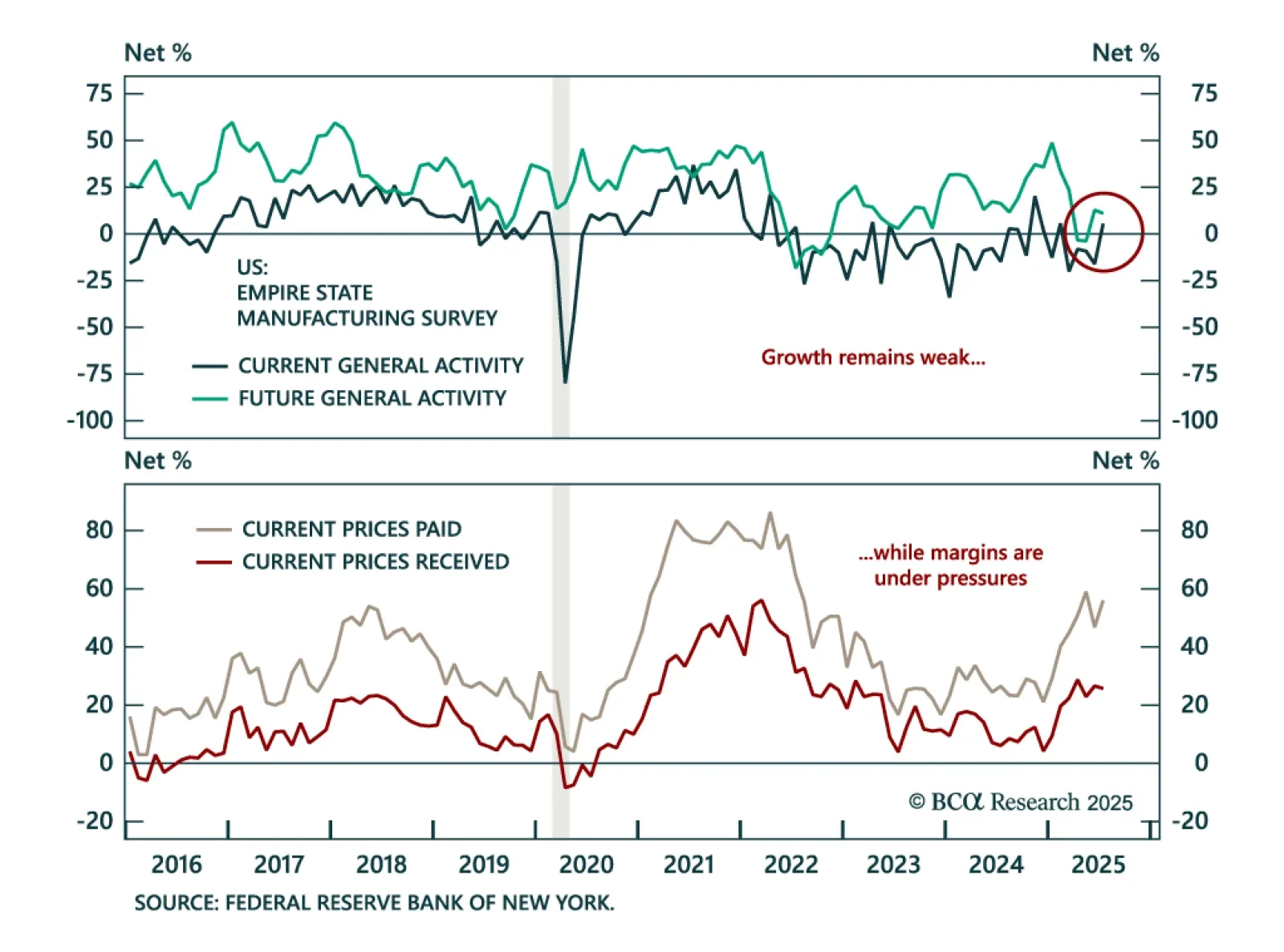

The July Empire Fed beat estimates, but survey volatility, inventory distortions, and shallow strength dampen this signal. The headline index surged to 5.5 from -16.0, supported by gains in shipments, employment, and capex…

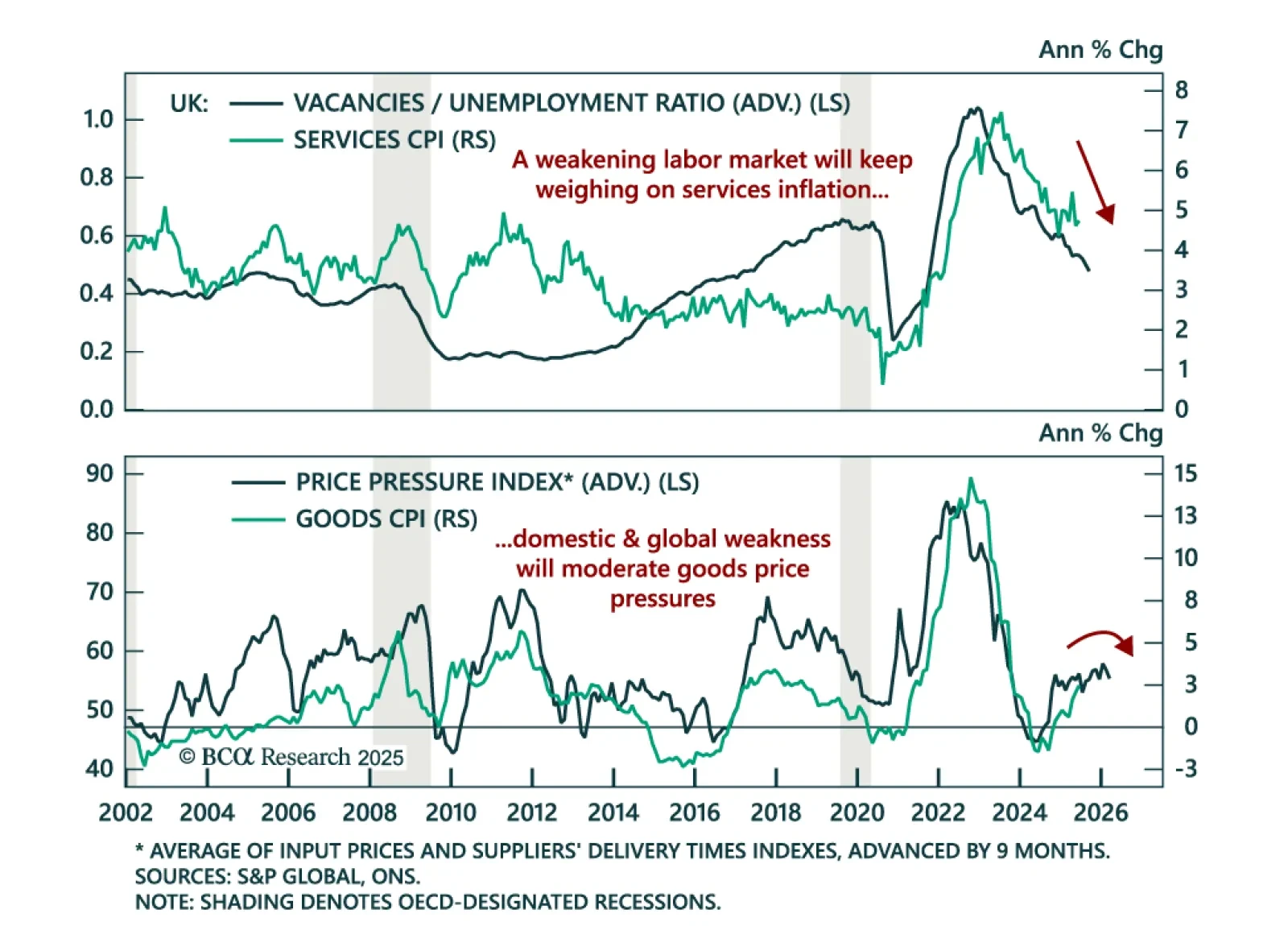

June UK CPI surprised to the upside, but weakening leading indicators point to disinflation ahead. Stay overweight Gilts. Headline inflation accelerated to 3.6% y/y from 3.4%, and core rose to 3.7% from 3.5%. Services inflation held…

We will abandon our recession call if US economic data show clear signs of stabilization over the summer months. For now, that has not happened. Maintain a modest underweight to stocks but look to get more defensive if MacroQuant’s…

Canada’s stronger currency and tightening financial conditions point to further BoC easing and support long Canadian bond positions. The CAD has appreciated this year alongside the global push to diversify away from USD assets, which…

Acute geopolitical risks, like a massive oil shock, may be abating. But structural geopolitical risk remains high and could upset a blithe market. Cyclical economic risks are underrated as the US slows down and China continues to…