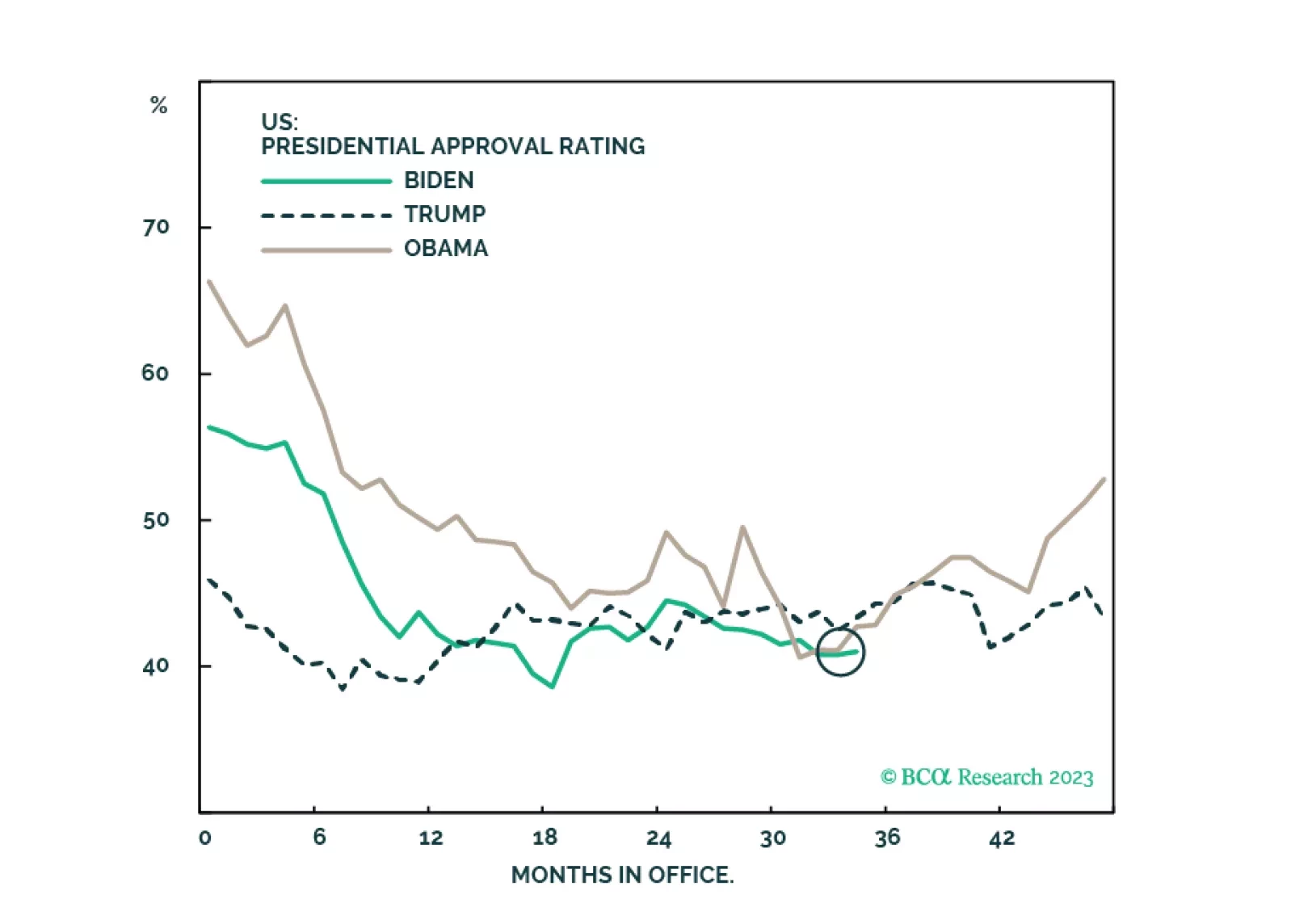

Results from Tuesday’s elections suggest that the Democrats are doing better than what their 2024 polling are showing. While the results are marginally positive for equities, investors should not overrate this off-year election,…

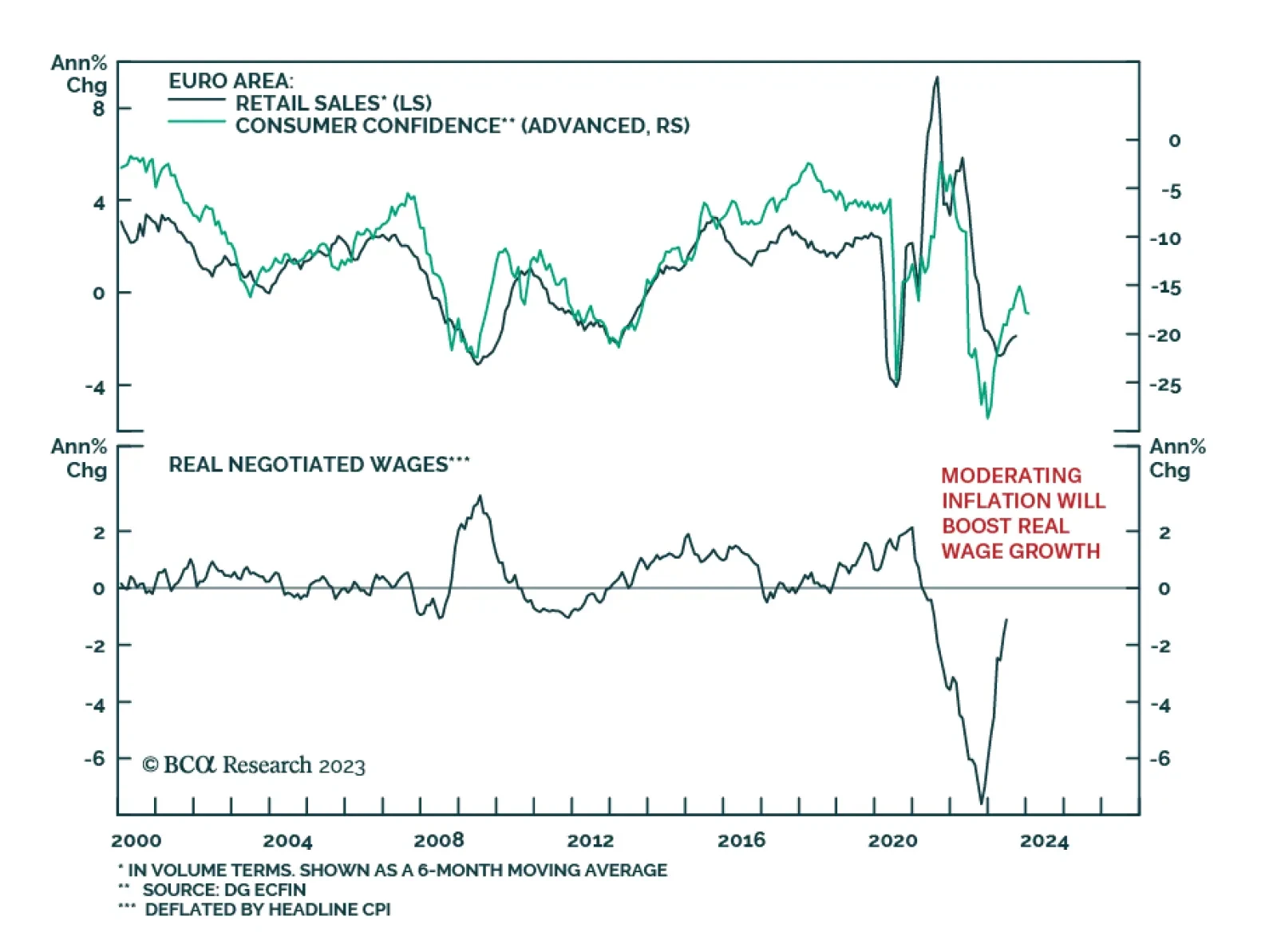

According to BCA Research’s Counterpoint service, the ECB is the central bank that poses the lowest risk of repeating the mistakes of the 1970s and letting inflation expectations unanchor. One reason is the ECB’s…

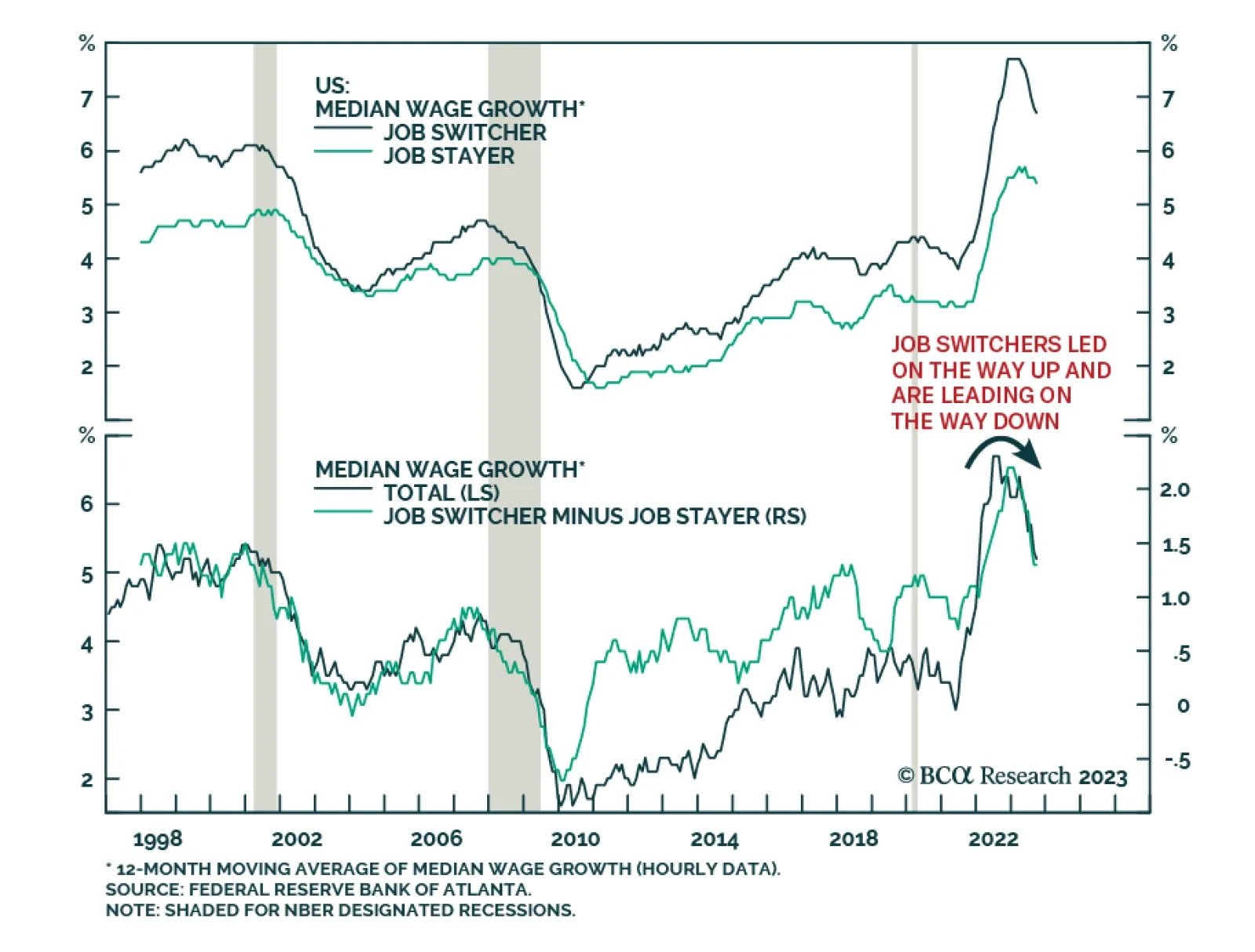

After surging in H2 2021/H1 2022, the Atlanta Fed's Wage Growth Tracker has been on a general downtrend for over a year. The latest reading of 5.2% in October – albeit unchanged from September – is considerably…

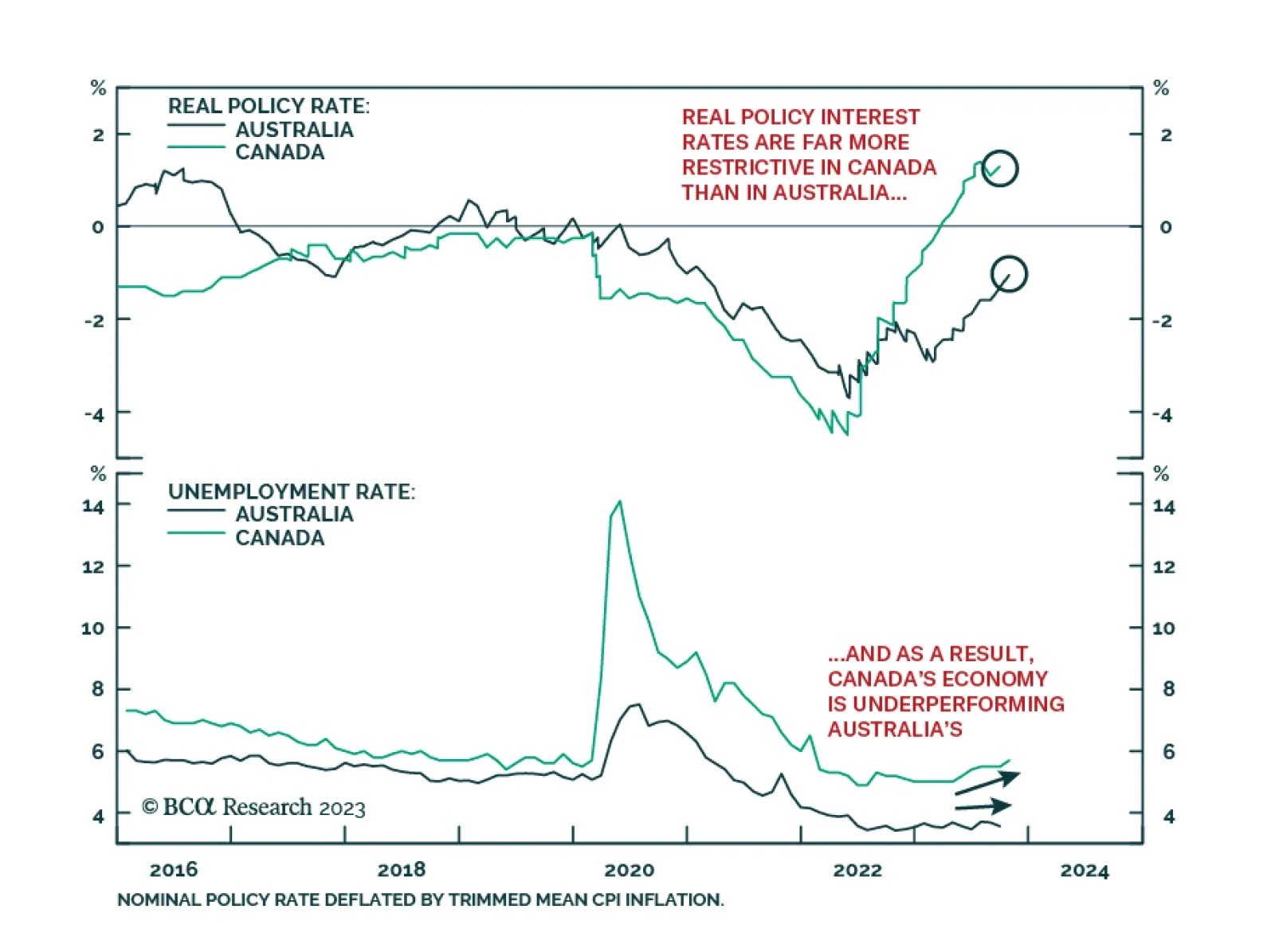

The economies of Canada and Australia share many similarities. Both nations are major commodity exporters, but with overvalued housing markets and highly indebted consumers. Lately, however, a notable gap has appeared…

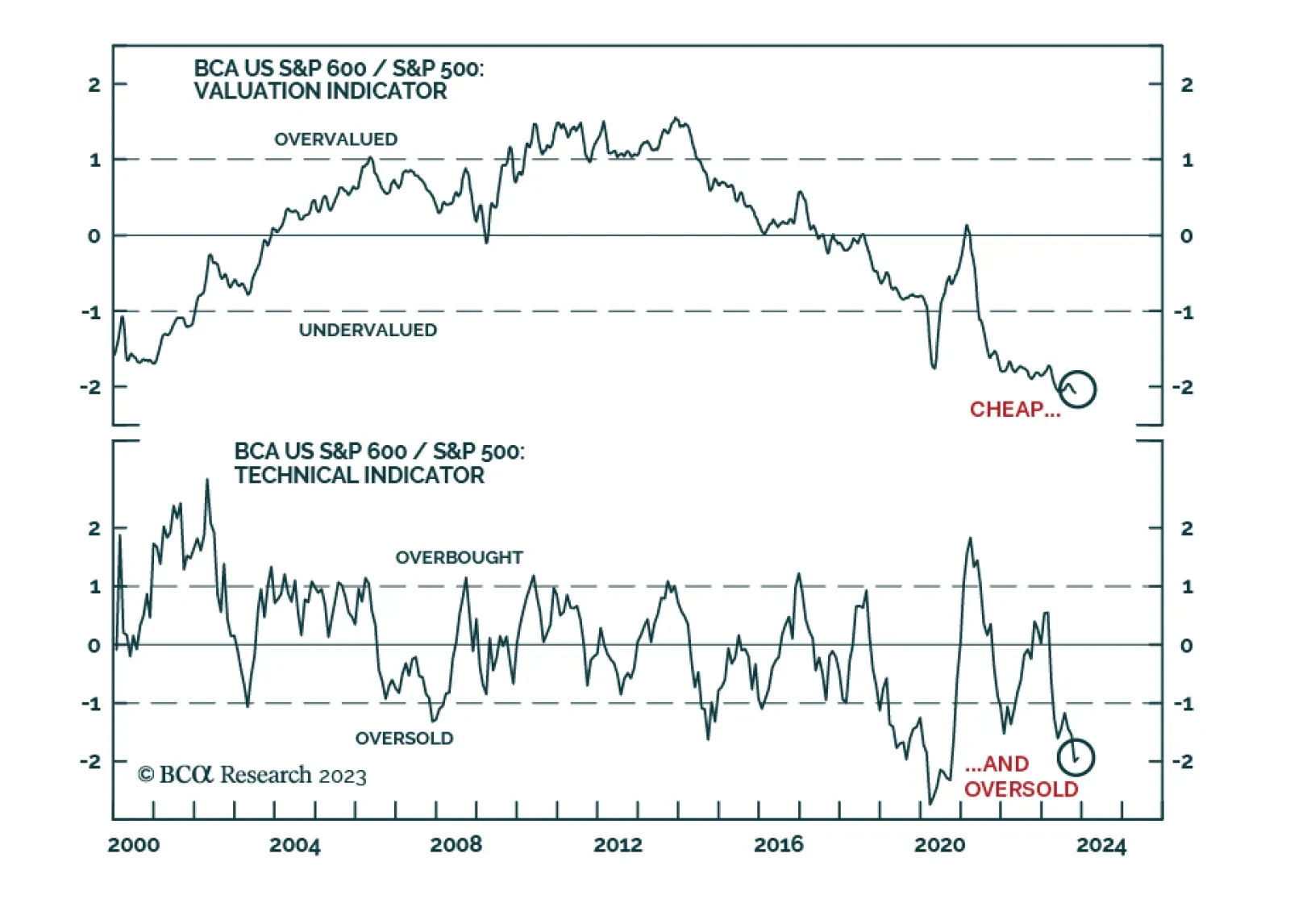

US small-cap stocks have underperformed significantly this year. While the S&P 500 price index is up 14.0% year-to-date, the S&P 600 has lost 2.5%. However, this underperformance has not been a straight line down. Small…

As expected, Euro Area retail sales continued to decline on both a month-over-month and a year-over-year basis in September. The 0.3% m/m drop is slightly below expectations of -0.2% m/m while the 2.9% y/y decline is not as bad…

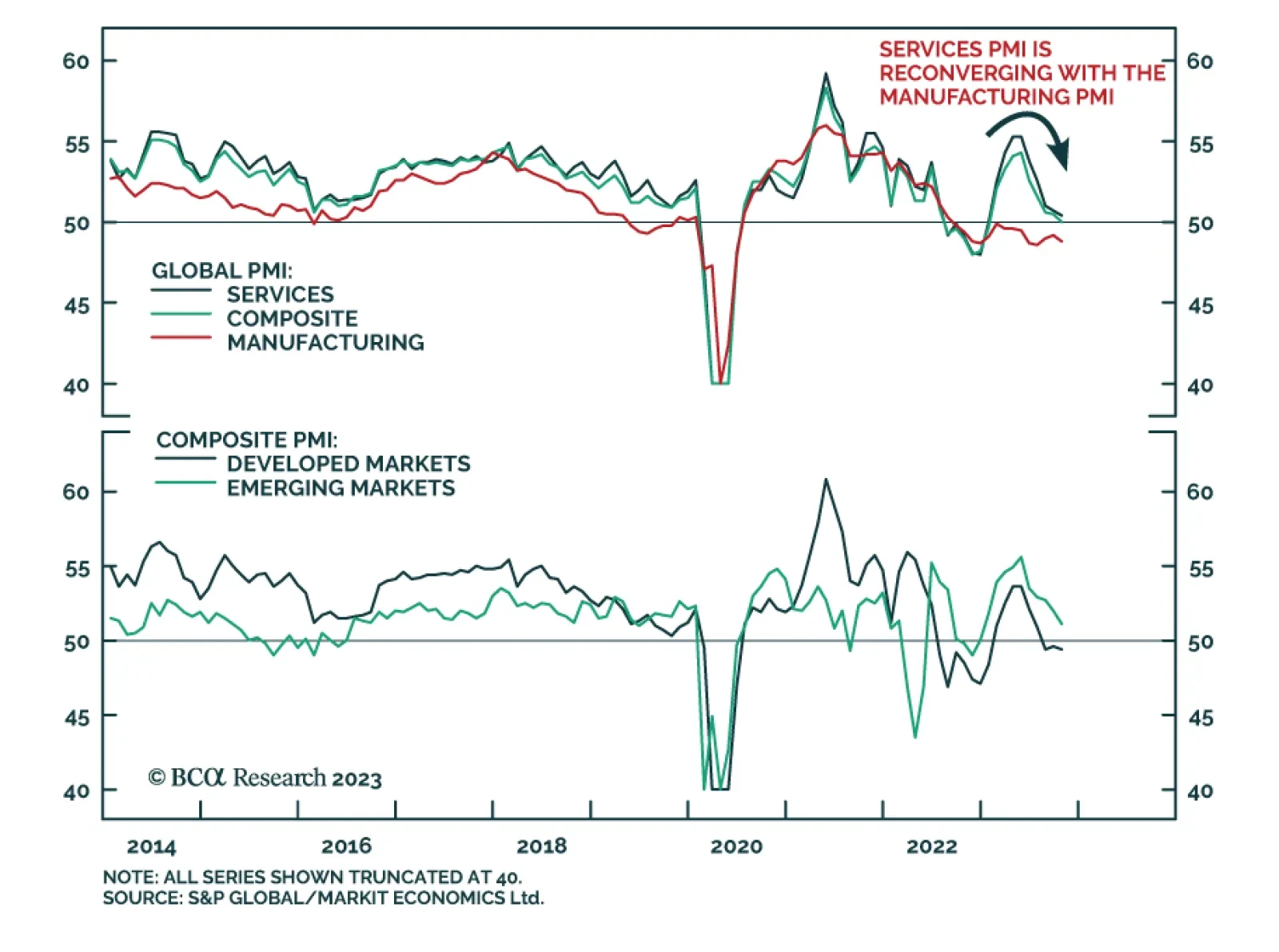

The Global Composite PMI slid to 9-month low in October, sending a pessimistic signal about economic conditions around the world. The 0.5-point decline pushed the index down to 50.0 – right on the boom-bust line indicating…

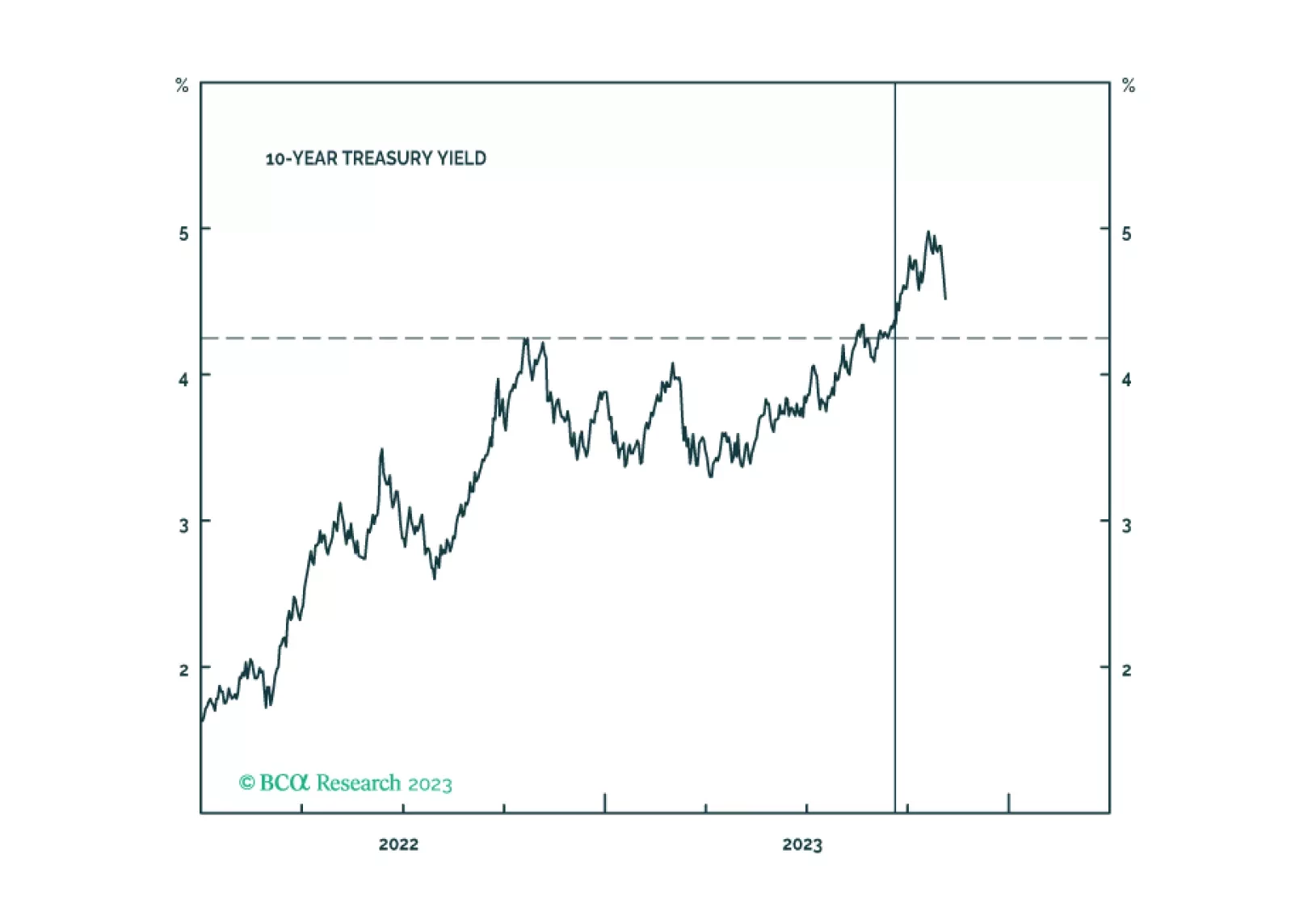

We consider several uncertainties in this week’s report, from the interest rate outlook to the source of the mountain of cash households have amassed since the pandemic began. We have not adjusted our tactical asset-allocation…

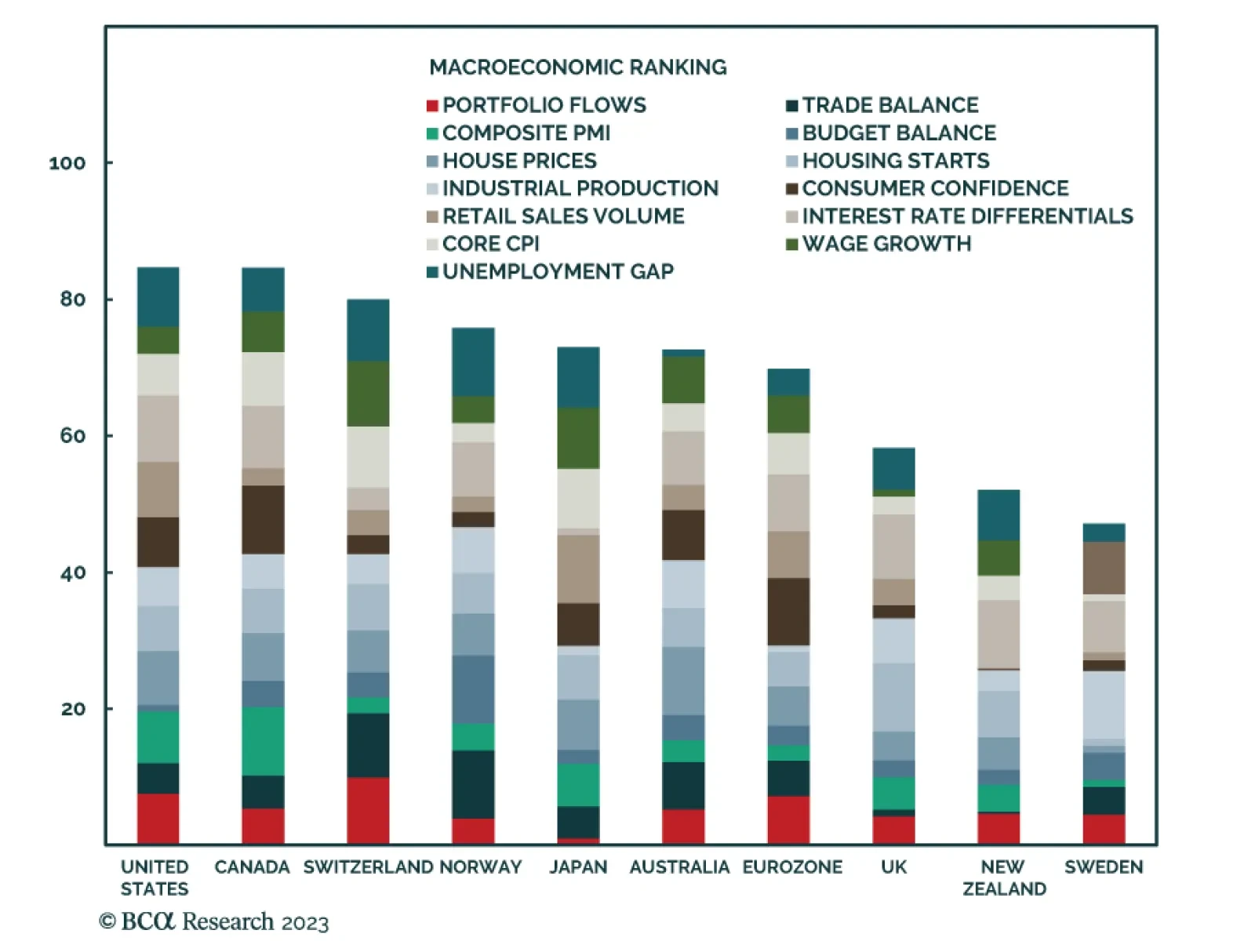

The FX G10 attractiveness model continues to favor the US dollar, but the tide could shift in the coming weeks. Currencies such as the NOK, CHF and even CAD have been rising in rankings in recent months. Using an aggregate of…