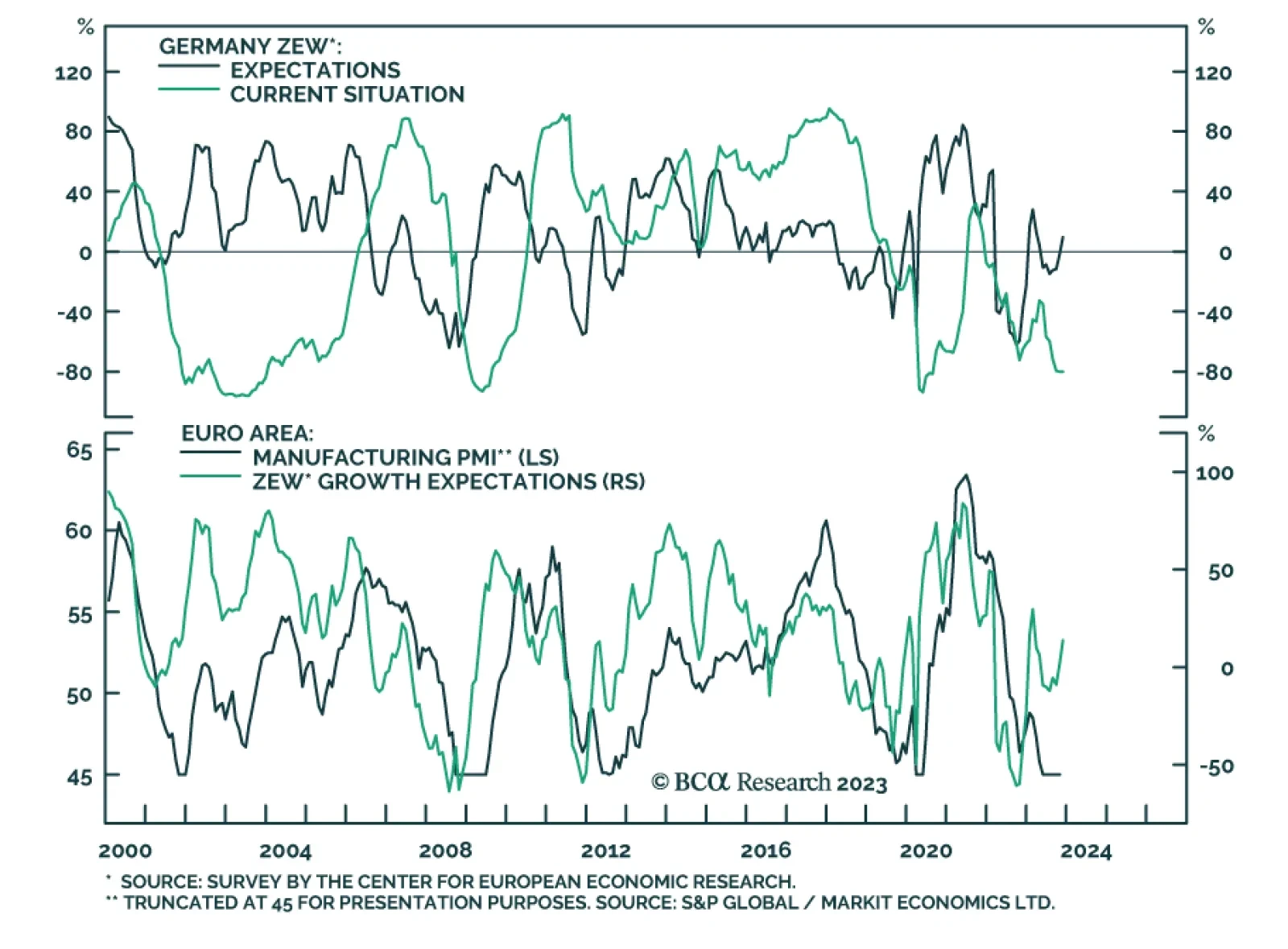

The ZEW survey of investor sentiment continues to send an optimistic signal. German sentiment jumped from -1.1 to +9.8 in November – its highest level since March and beating expectations of a smaller improvement to 5.0.…

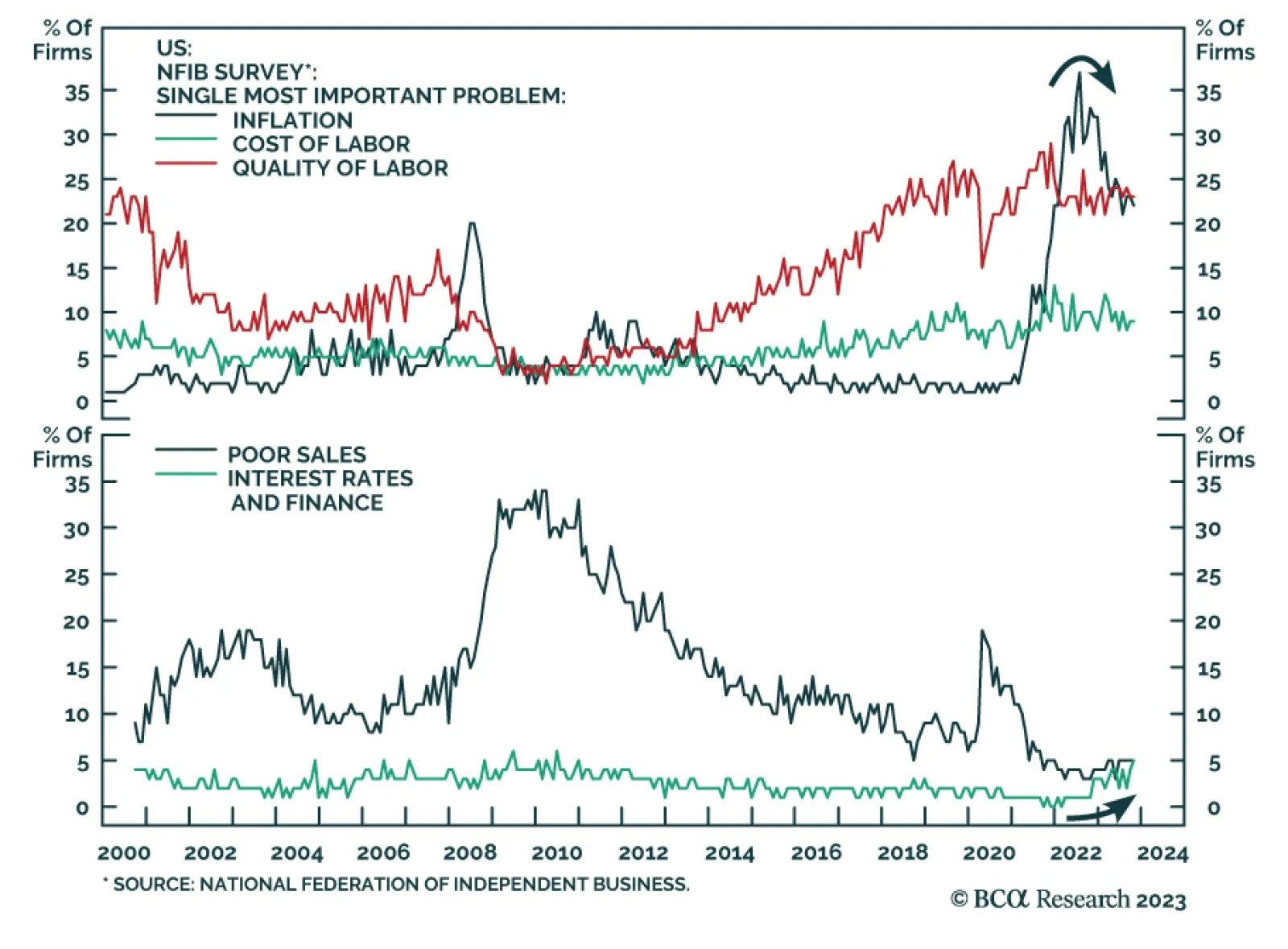

To the extent that US small businesses are typically more exposed to domestic economic conditions than larger firms, results of the NFIB Small Business Economic Trends survey are instructive. One important trend is that the…

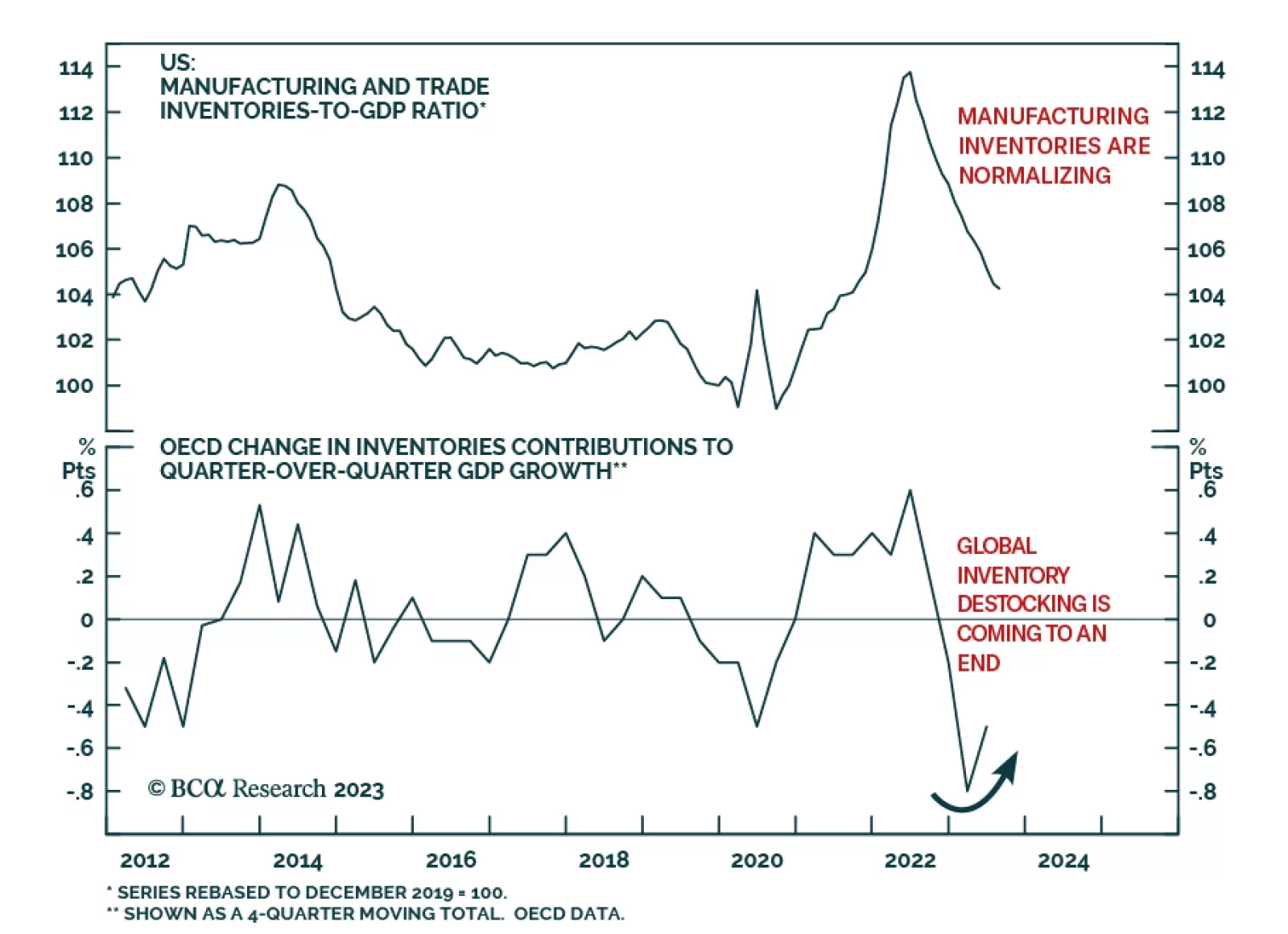

BCA Research's Global Investment Strategy service assigns 25% odds of the recession starting in 2025 or later. Our colleagues continue to think that the US will succumb to a recession in 2024, probably in the second…

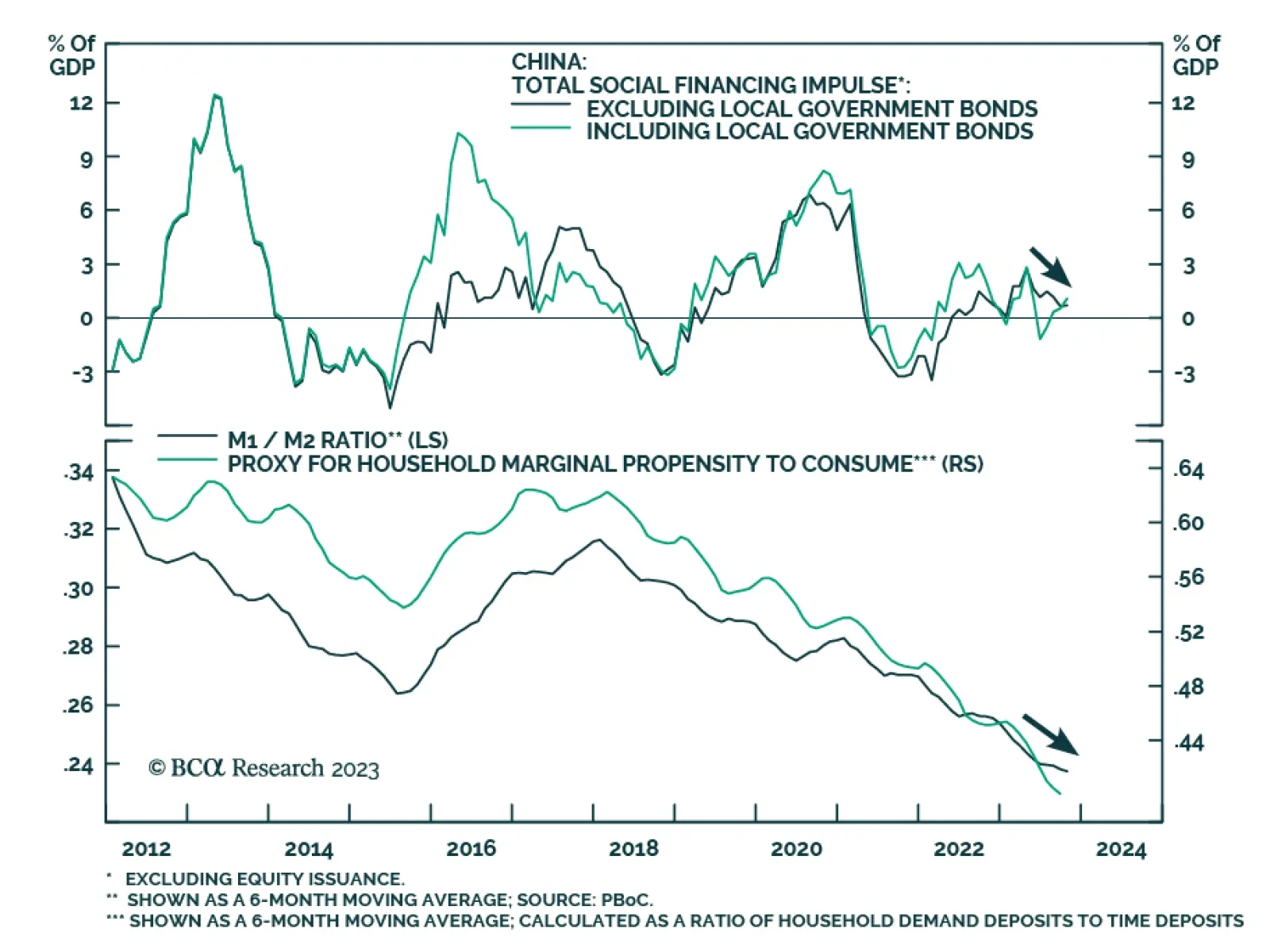

China's money and credit data remained weak in October. New total social financing amounted to RMB 1.85 trillion – less than the RMB 1.95 trillion anticipated and below the prior month's increase of RMB 4.12…

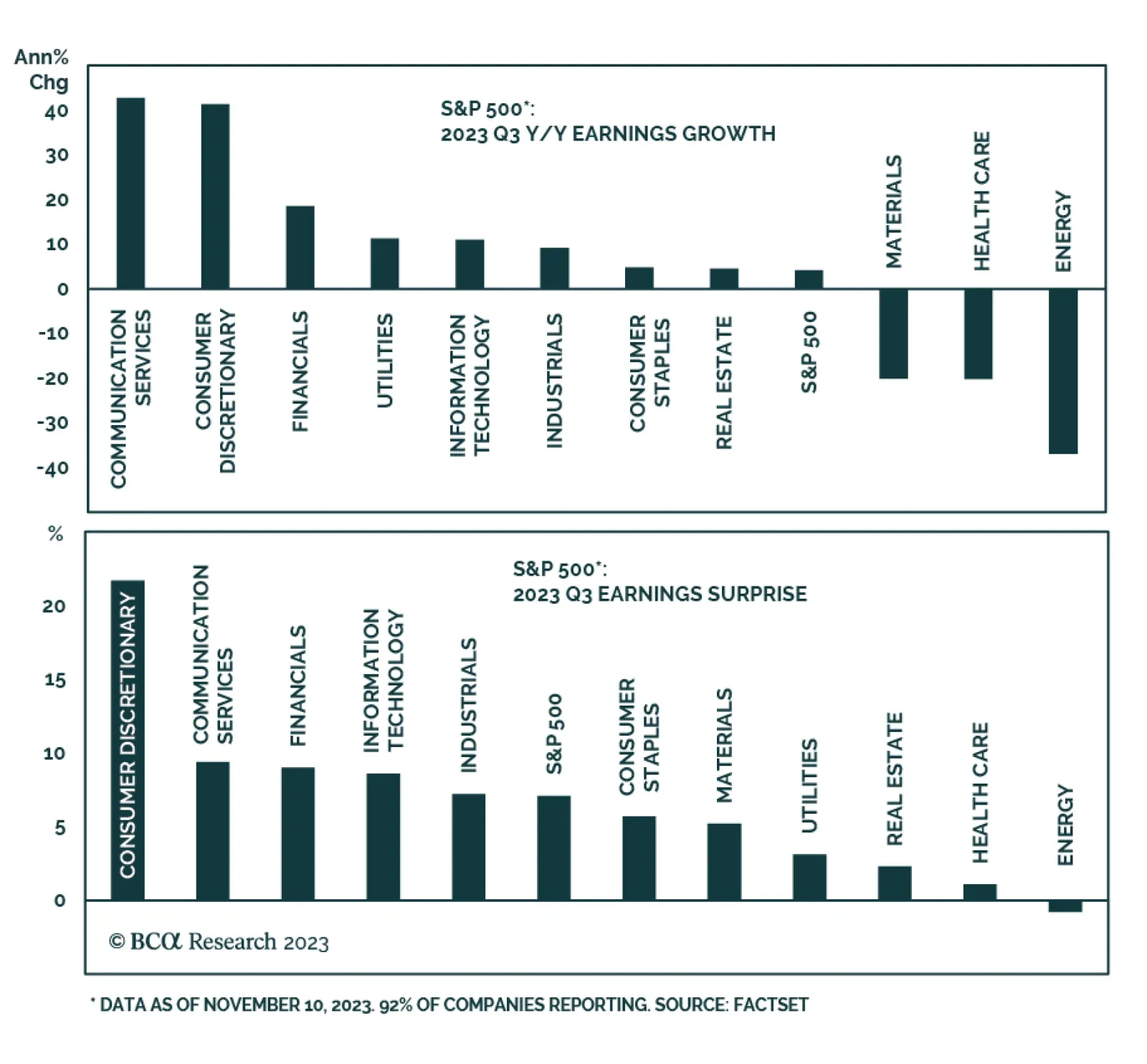

The Q3 earnings season is nearing its end. By Friday, 92% of S&P 500 companies had already reported and thus far the results are positive. According to FactSet, the S&P 500's 4.1% y/y blended earnings growth rate is…

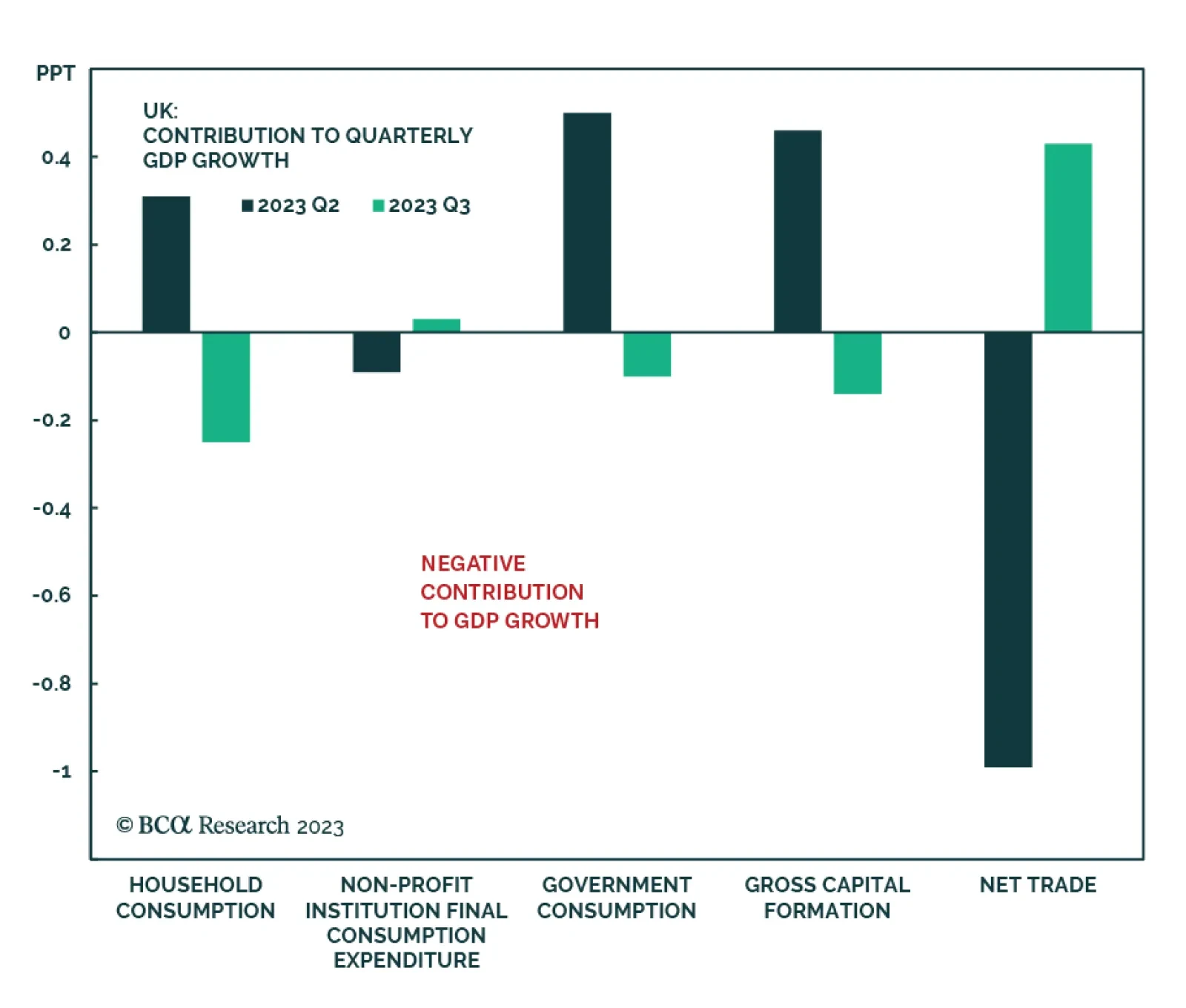

The UK economy stagnated in Q3 – a deterioration from the minor 0.2% q/q expansion in the prior quarter. Although the Q3 figure is slightly better than anticipations of a 0.1% q/q contraction, the details of the report are…

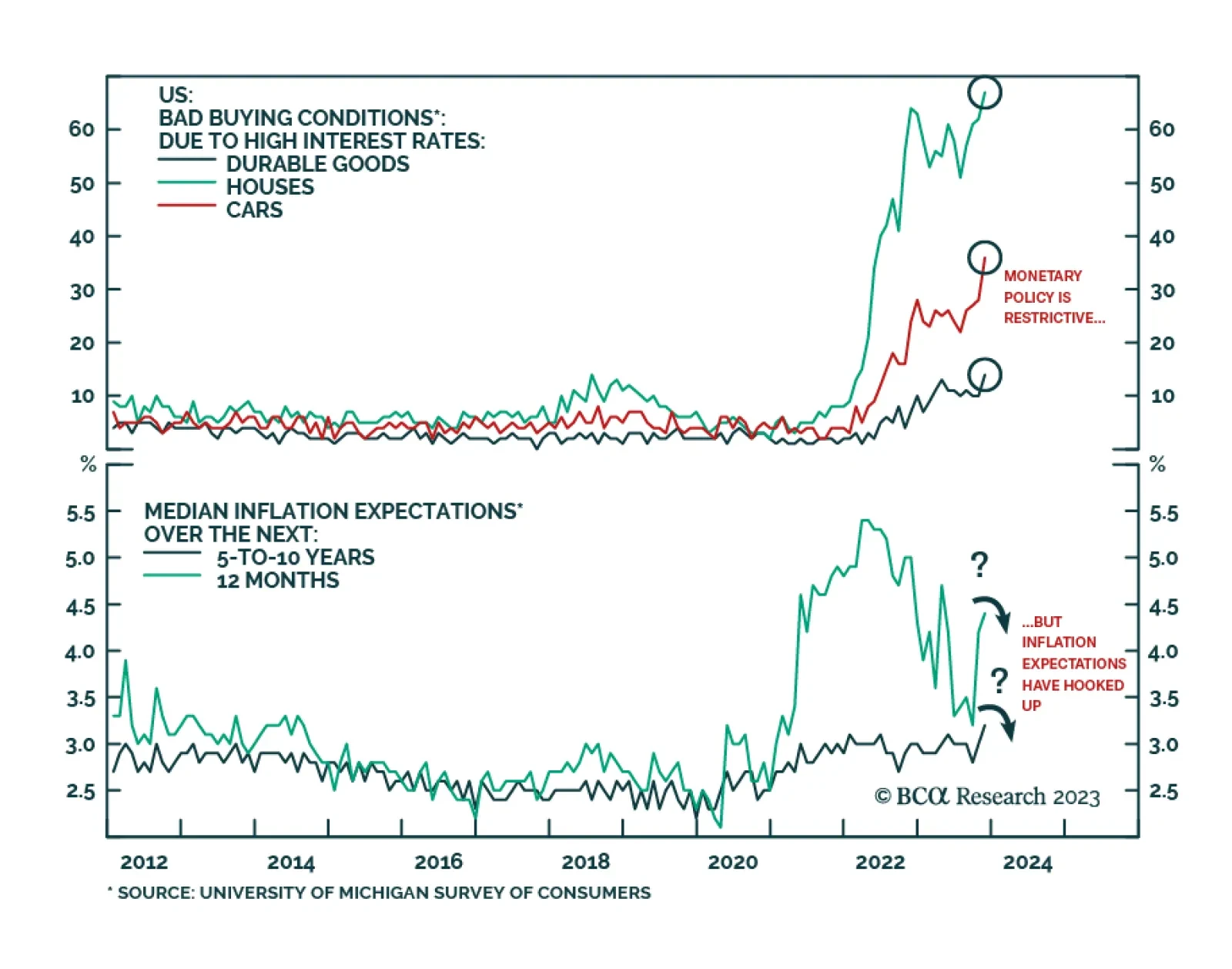

The preliminary release for the University of Michigan’s Consumer Survey sent a pessimistic signal about consumer sentiment on Friday. The headline index fell from 63.8 to 60.4 in November, below expectations of a marginal…

In this report, we go around the globe and survey the near-term outlook for G10 currencies. Our longer-term view on the dollar has been clear, we are sellers. In this report, we review if a tactical sell is also warranted given…

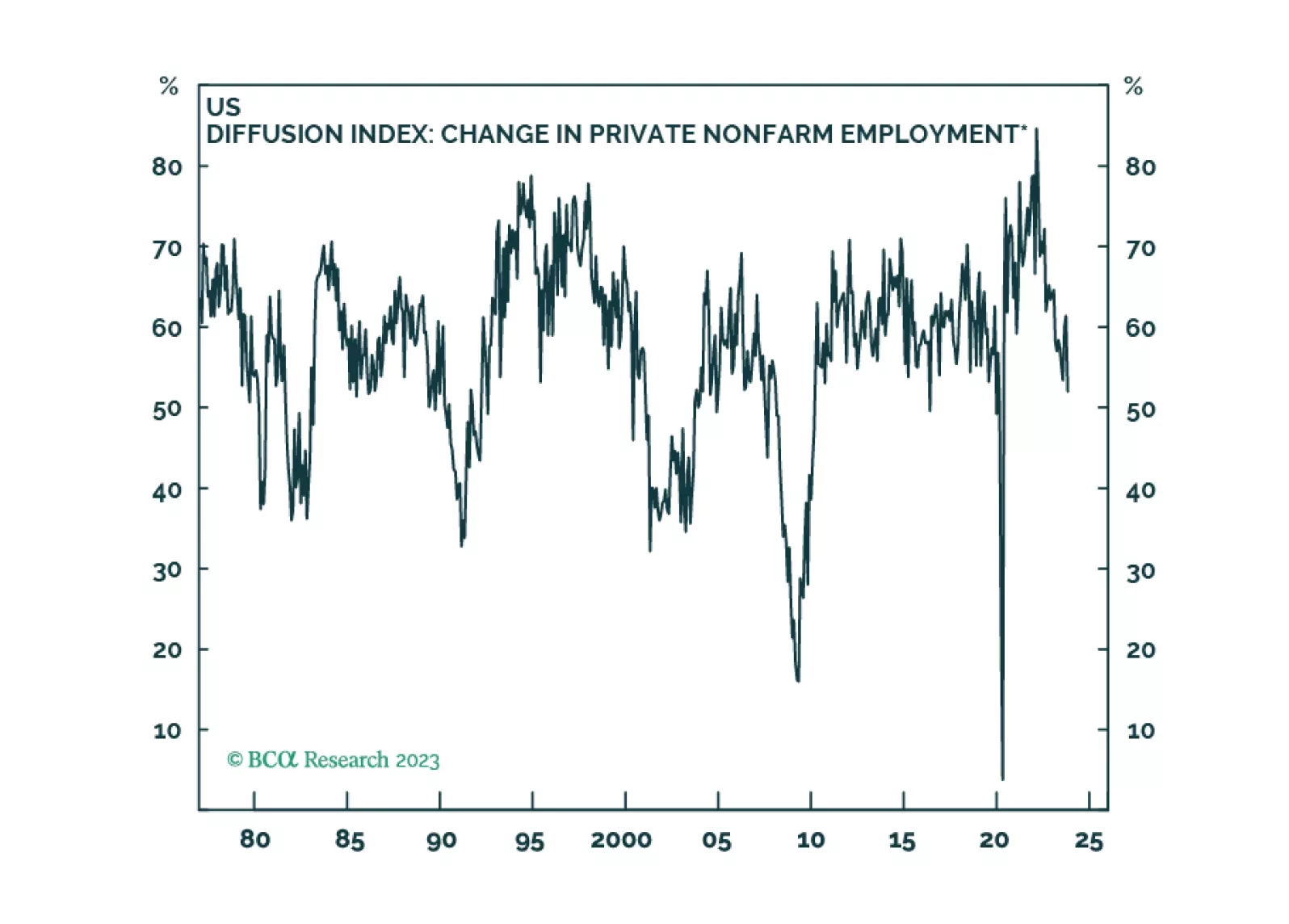

Labor markets are softening in most developed economies, as is usually the case in the lead-up to recessions. Our base case is that the global recession will begin in the second half of 2024, but we will be monitoring our MacroQuant…