According to BCA Research’s European Investment Strategy service, European equities near cycle highs are vulnerable to weaker earnings. The team’s earnings model for Eurozone equities continues to point to a double…

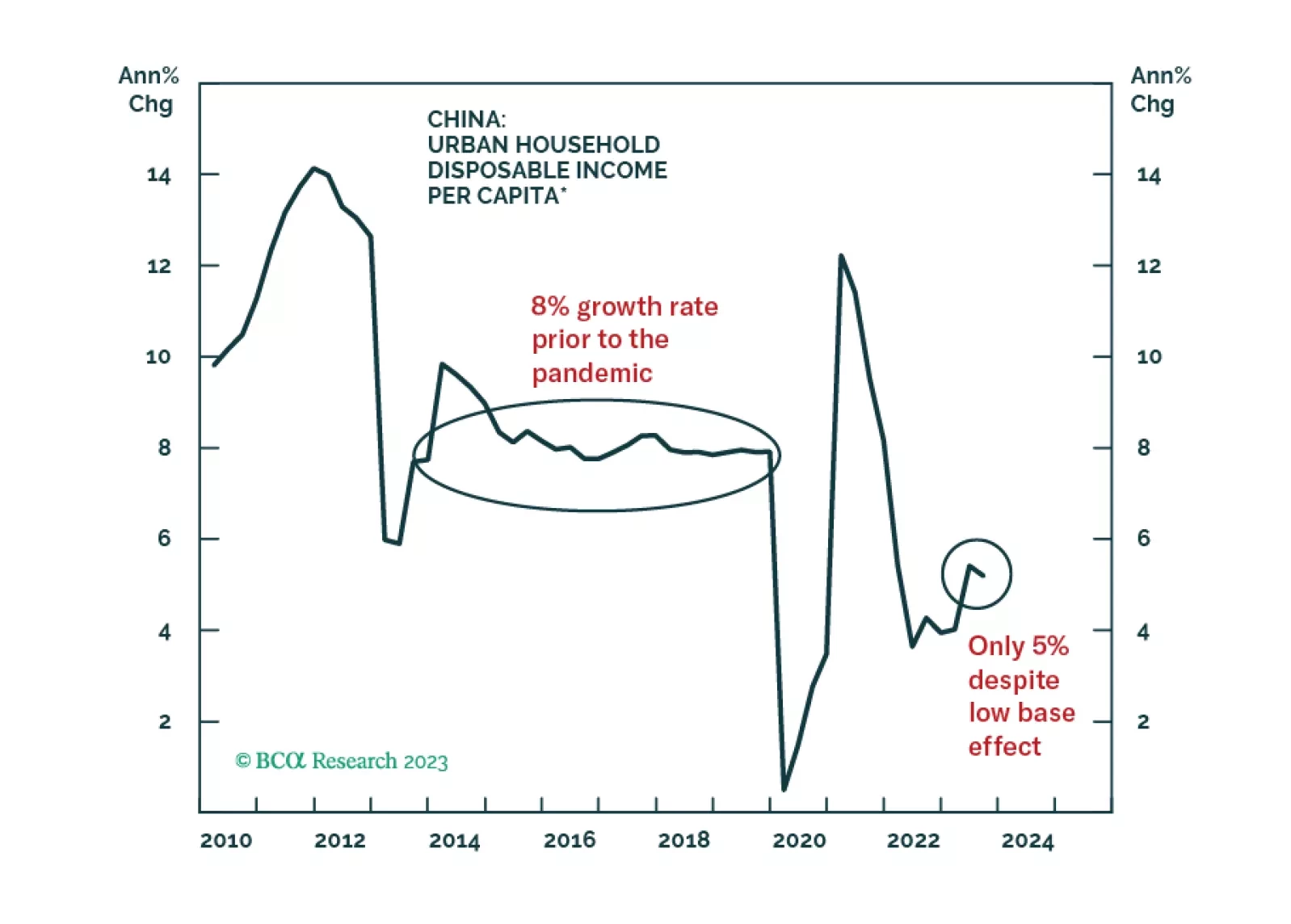

China’s CPI and PPI releases delivered a negative signal about the domestic economy. The rate of contraction in the CPI index accelerated to -0.5% y/y in November, the sharpest rate of decline in 3 years and disappointing…

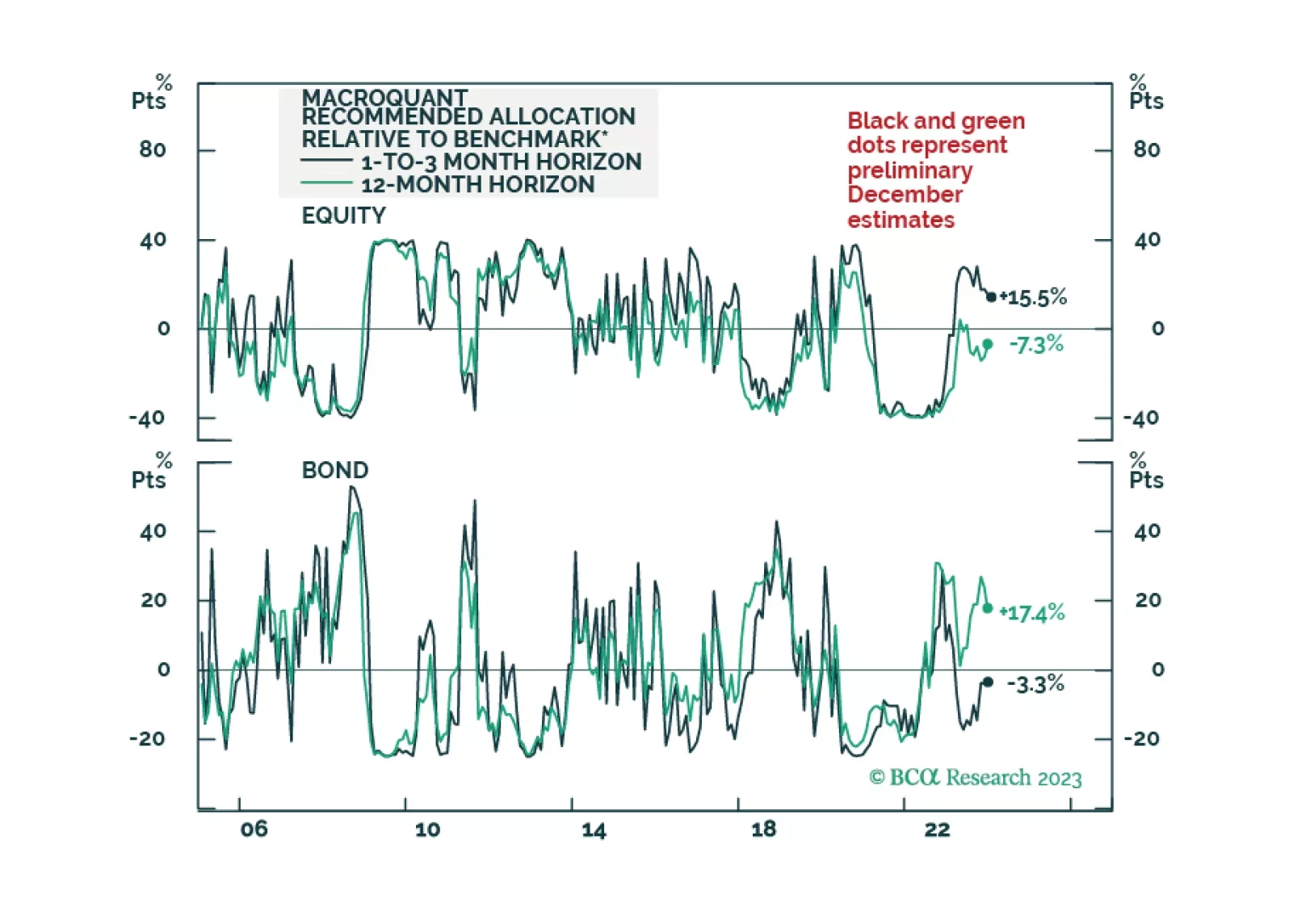

Global Investment Strategy predicted the surge of inflation in 2021/22 and the immaculate disinflation of 2023. Now their unique framework is predicting a recession in the second half of 2024.

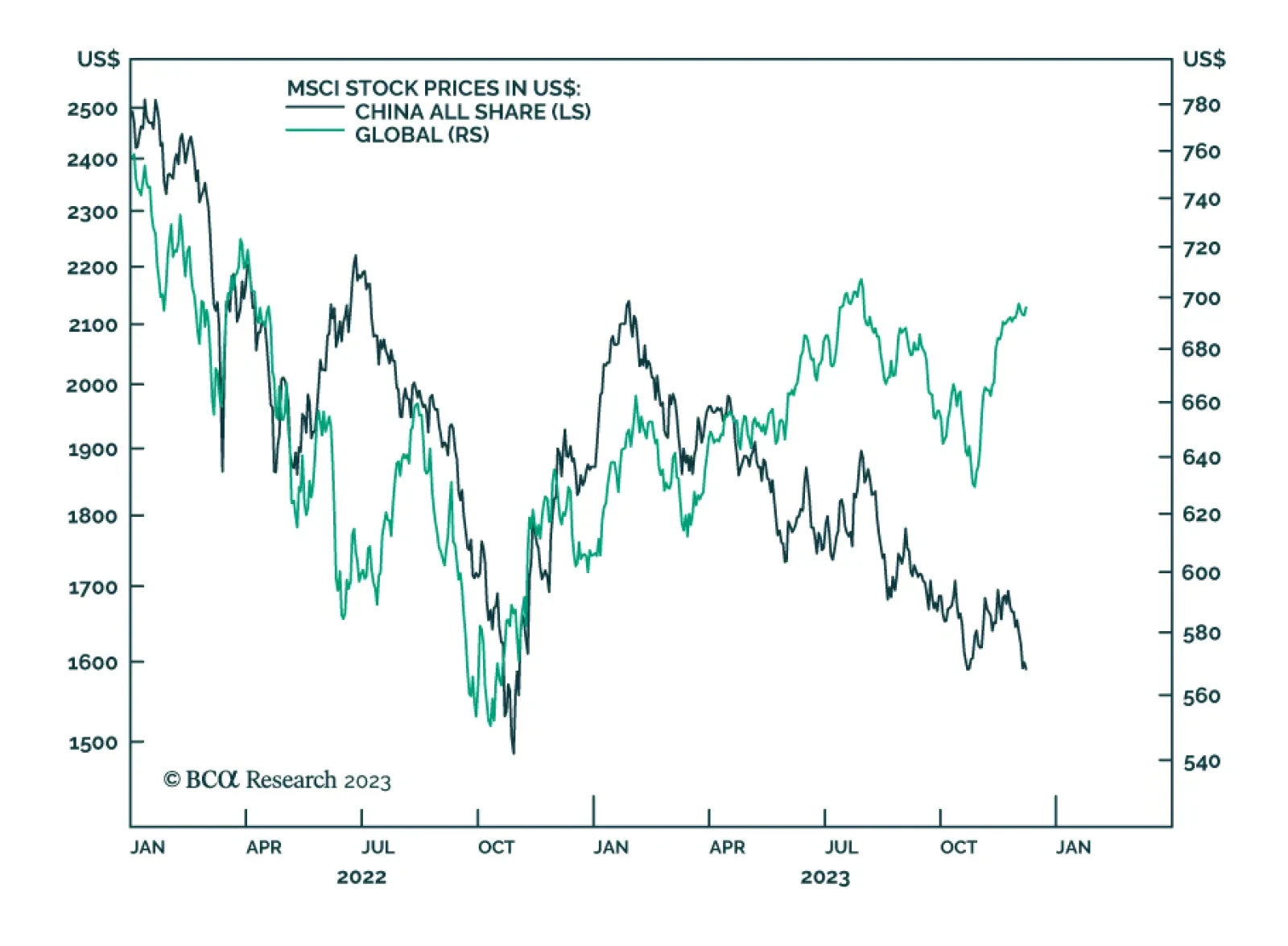

The global investment community has become well aware of many problems facing the Chinese economy including real estate excesses, policymakers’ reluctance to stimulate, as well as elevated debt levels among local…

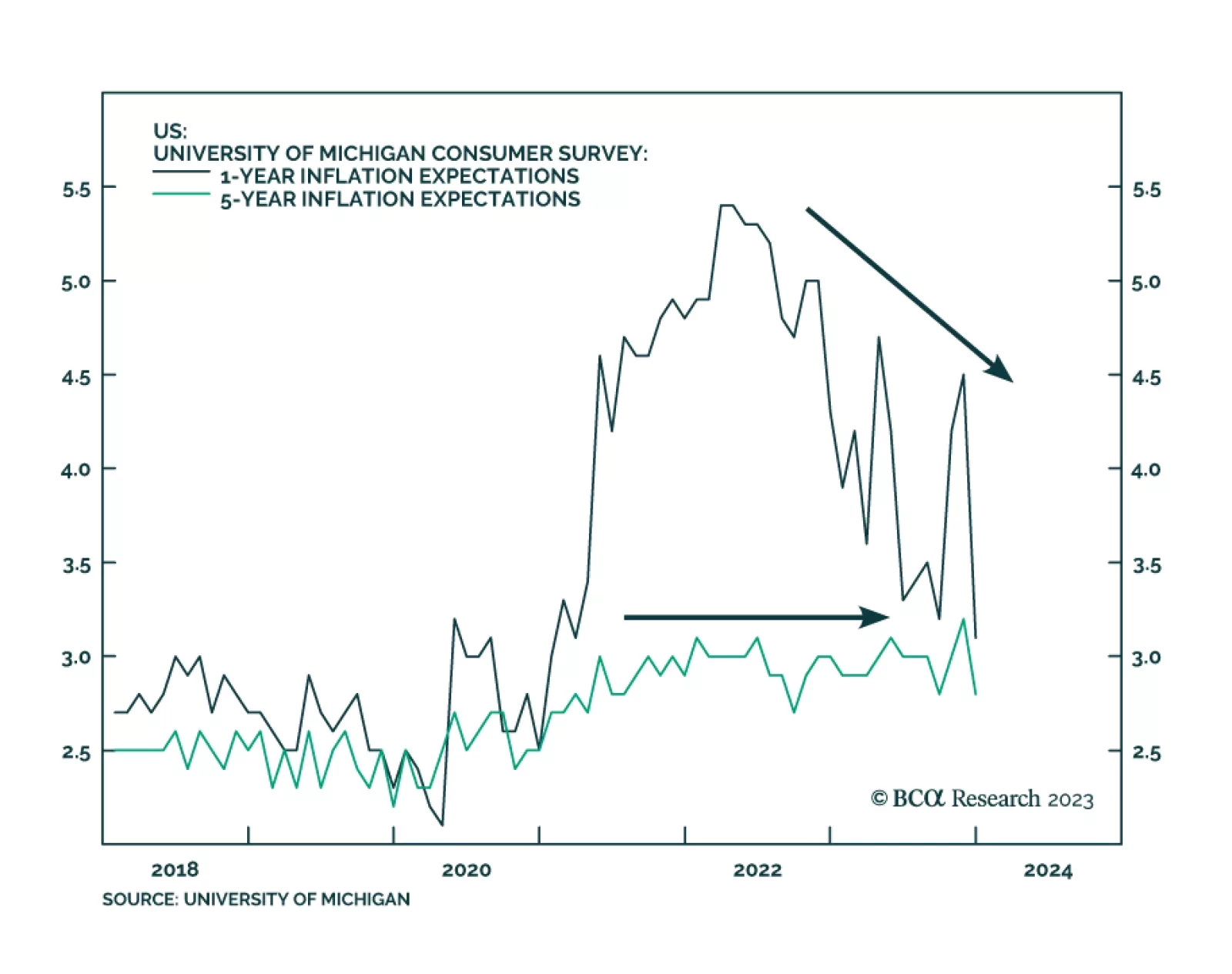

The University of Michigan’s Consumer Survey sent an optimistic signal about the attitude of the US consumer on Friday, handily beating consensus estimates across the board. The preliminary headline index came in at 69.4,…

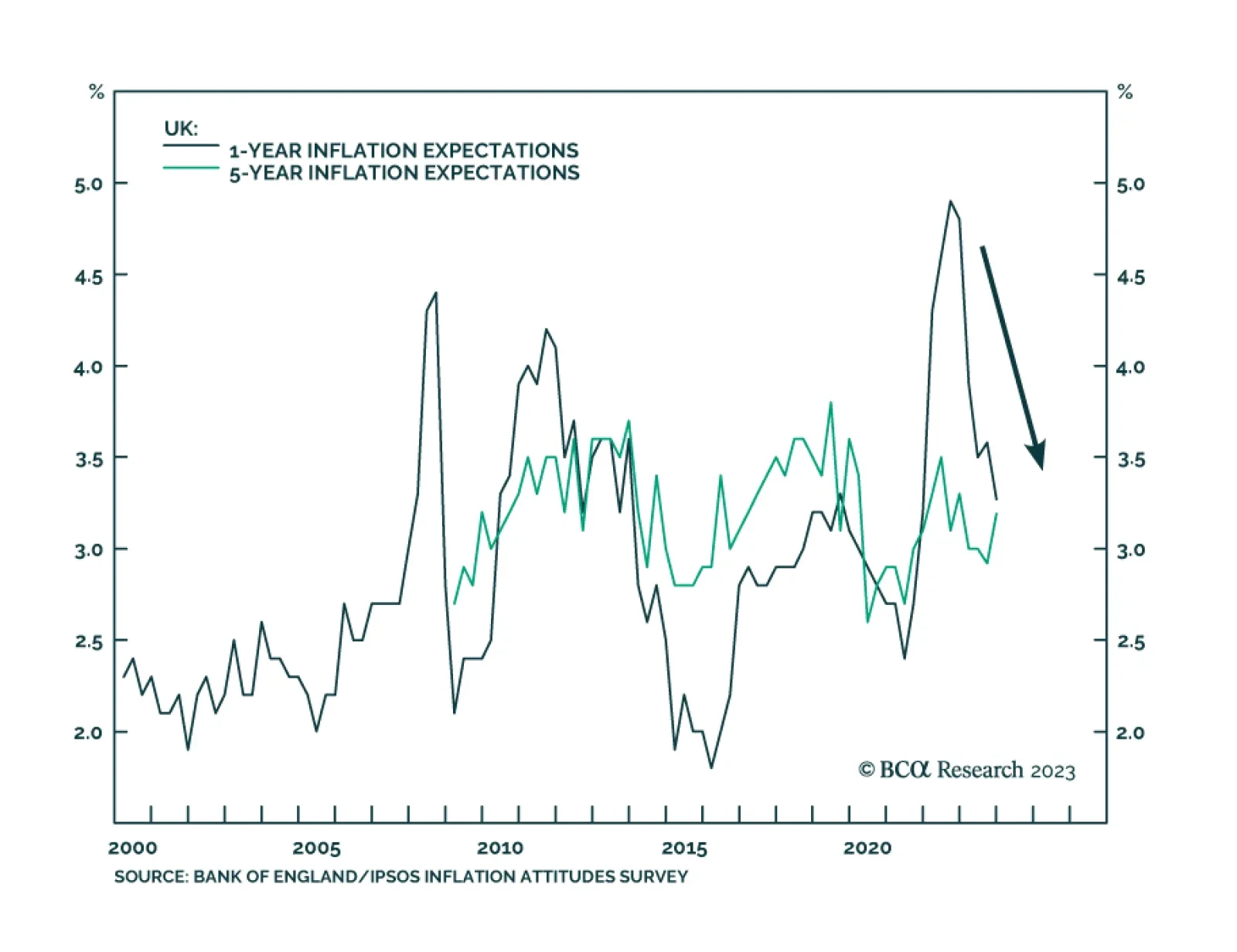

The latest Bank of England/Ipsos quarterly Inflation Attitudes Survey shows the public revised down its near-term inflation outlook. Respondents now believe inflation will fall to 3.3% in the year ahead – down from 3.6% in…

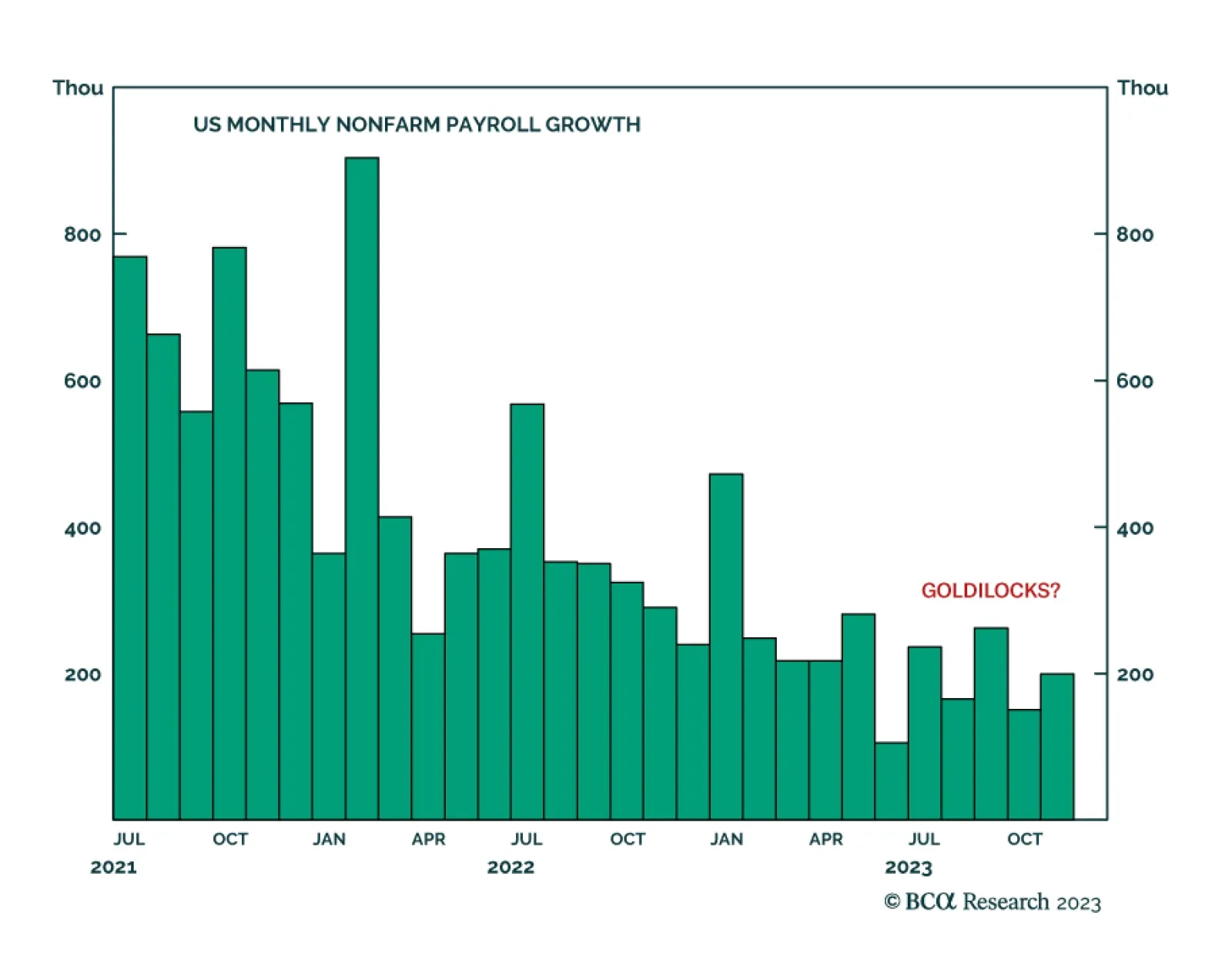

The US employment report delivered a positive surprise on Friday. Nonfarm payroll growth accelerated from 150 thousand to 199 thousand in November, beating expectations of 185 thousand. Importantly, the favorable result was…

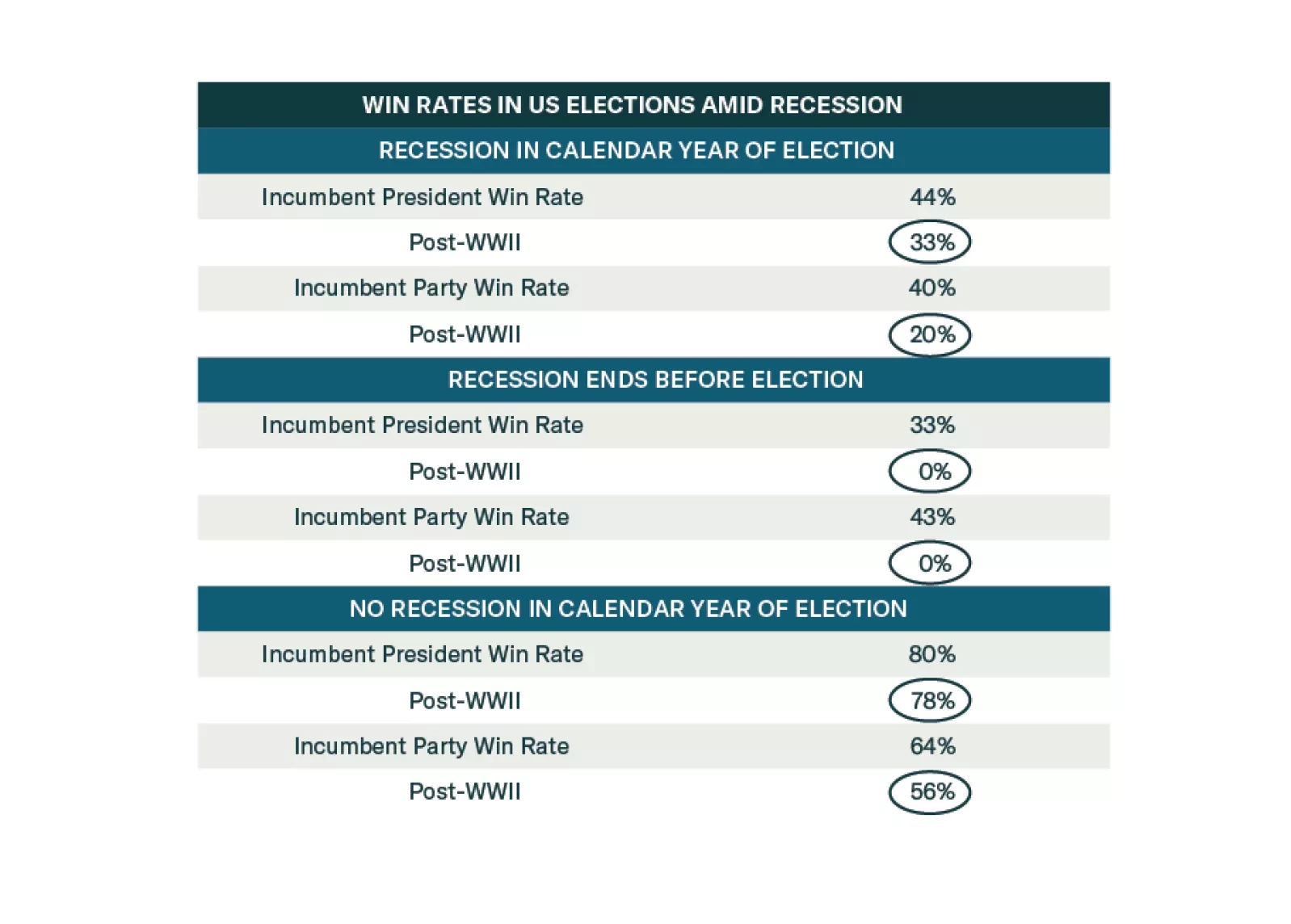

Democrats are favored to win the election until recession materializes. But recession risks are high. Investors should adopt a defensive and conservative strategy in 2024 amid extreme US policy uncertainty.

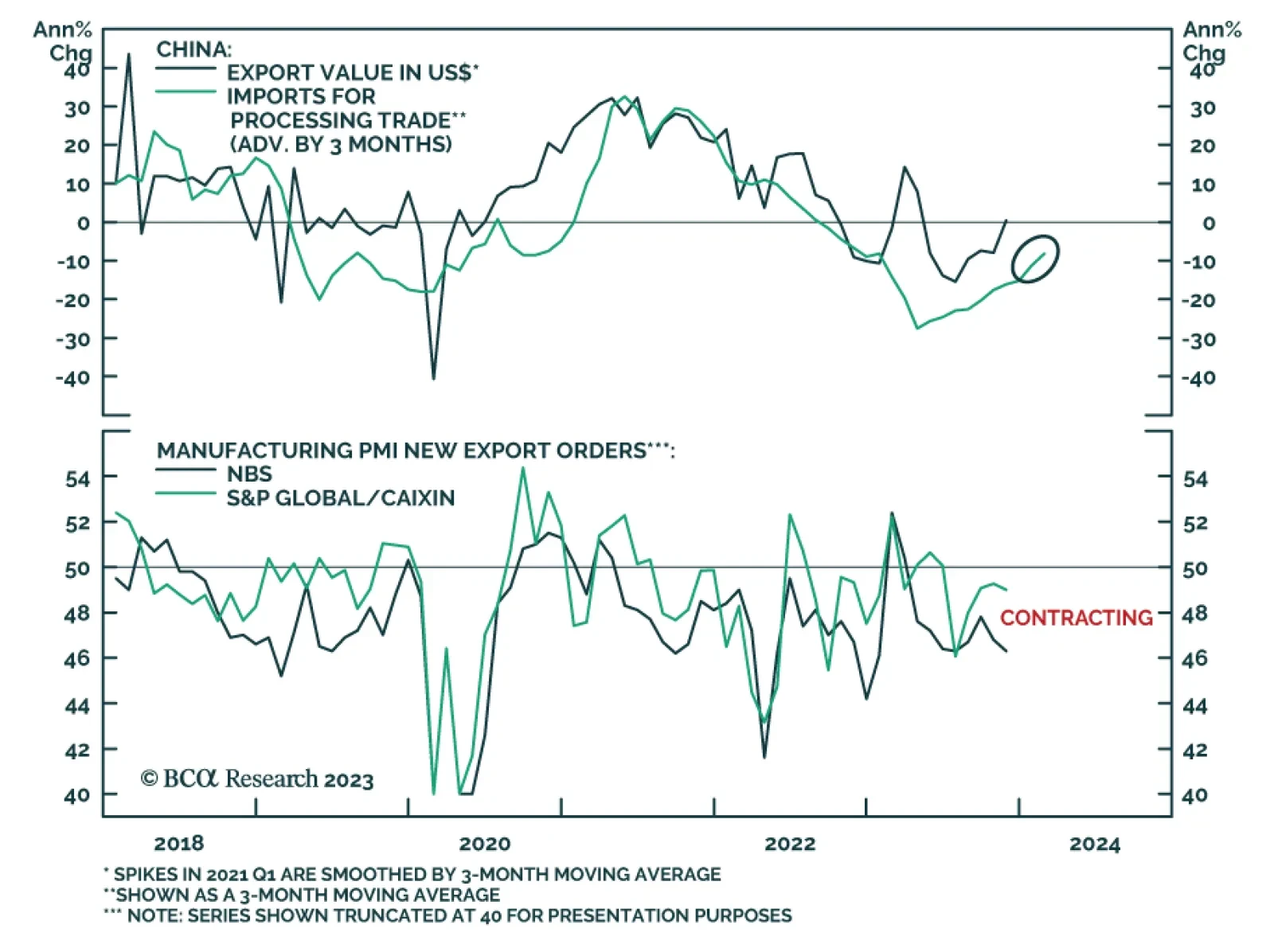

On the surface, Chinese export data delivered a positive surprise on Thursday, painting a favorable picture of the global manufacturing cycle. Exports unexpectedly grew on a year-over-year basis in November for the first time…