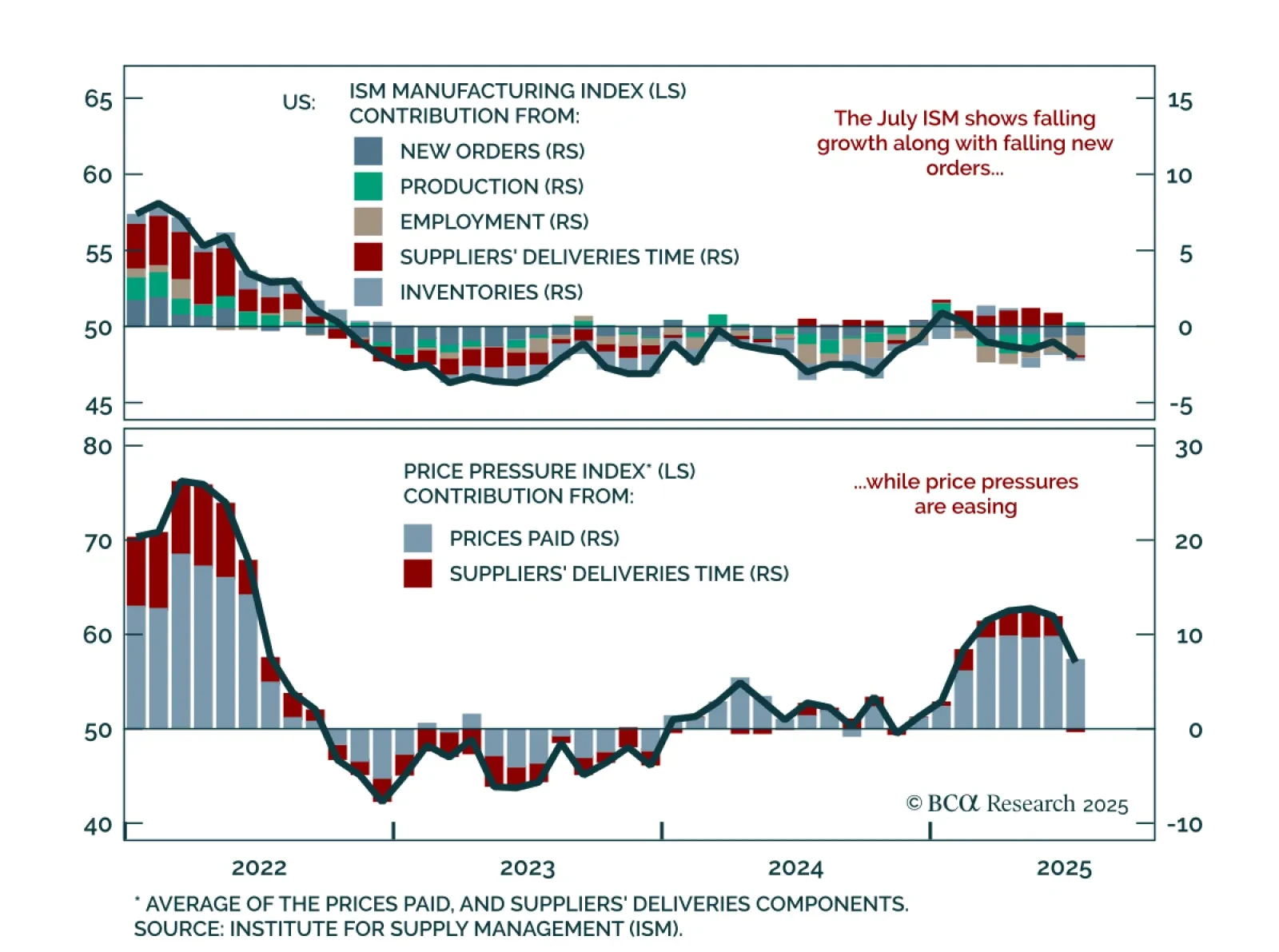

The July ISM Manufacturing miss shows weakening growth and decelerating inflation, reinforcing our long-duration stance. The index fell to 48.0 from 49.0, with only the production component contributing positively. New orders remain…

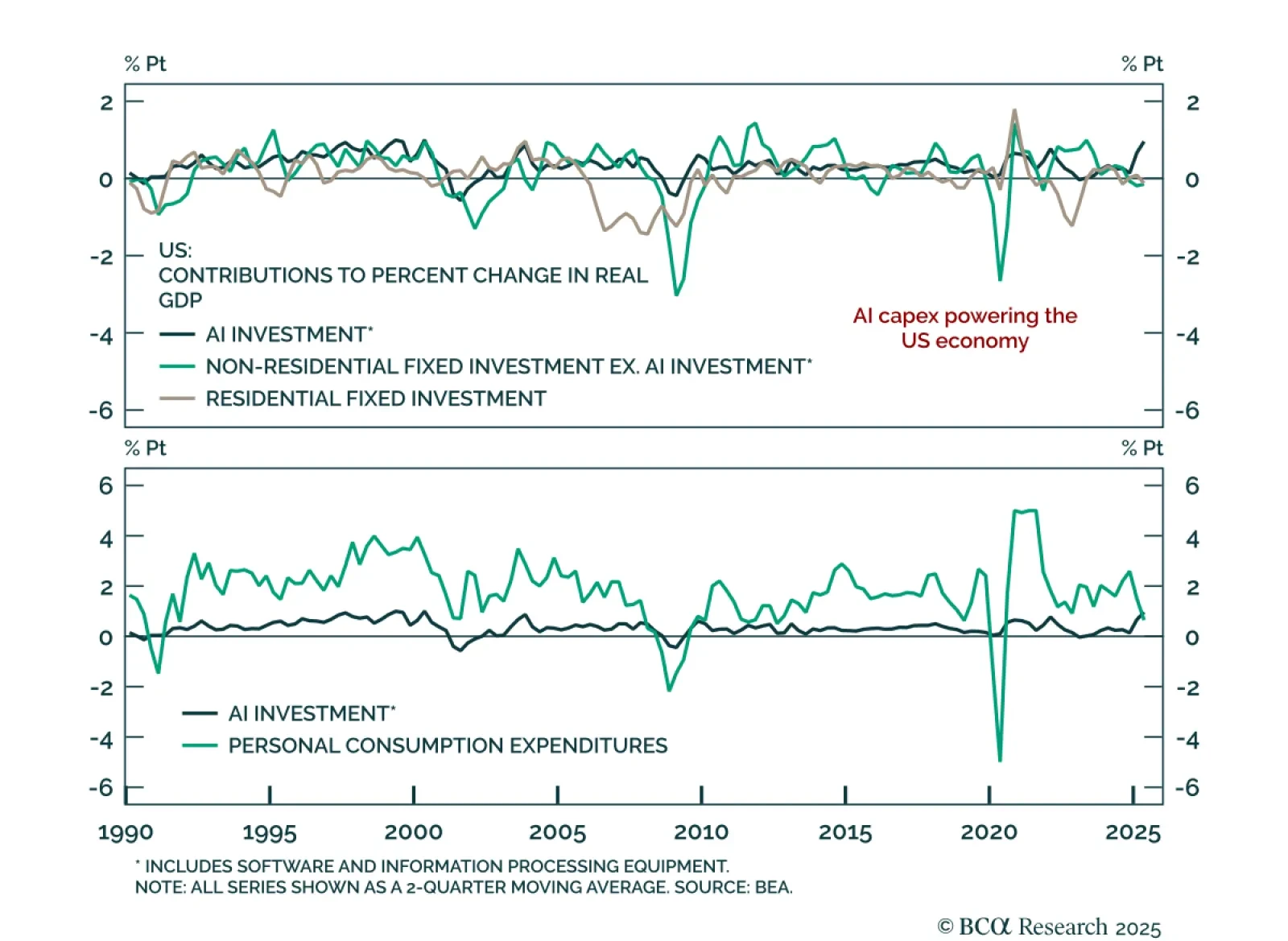

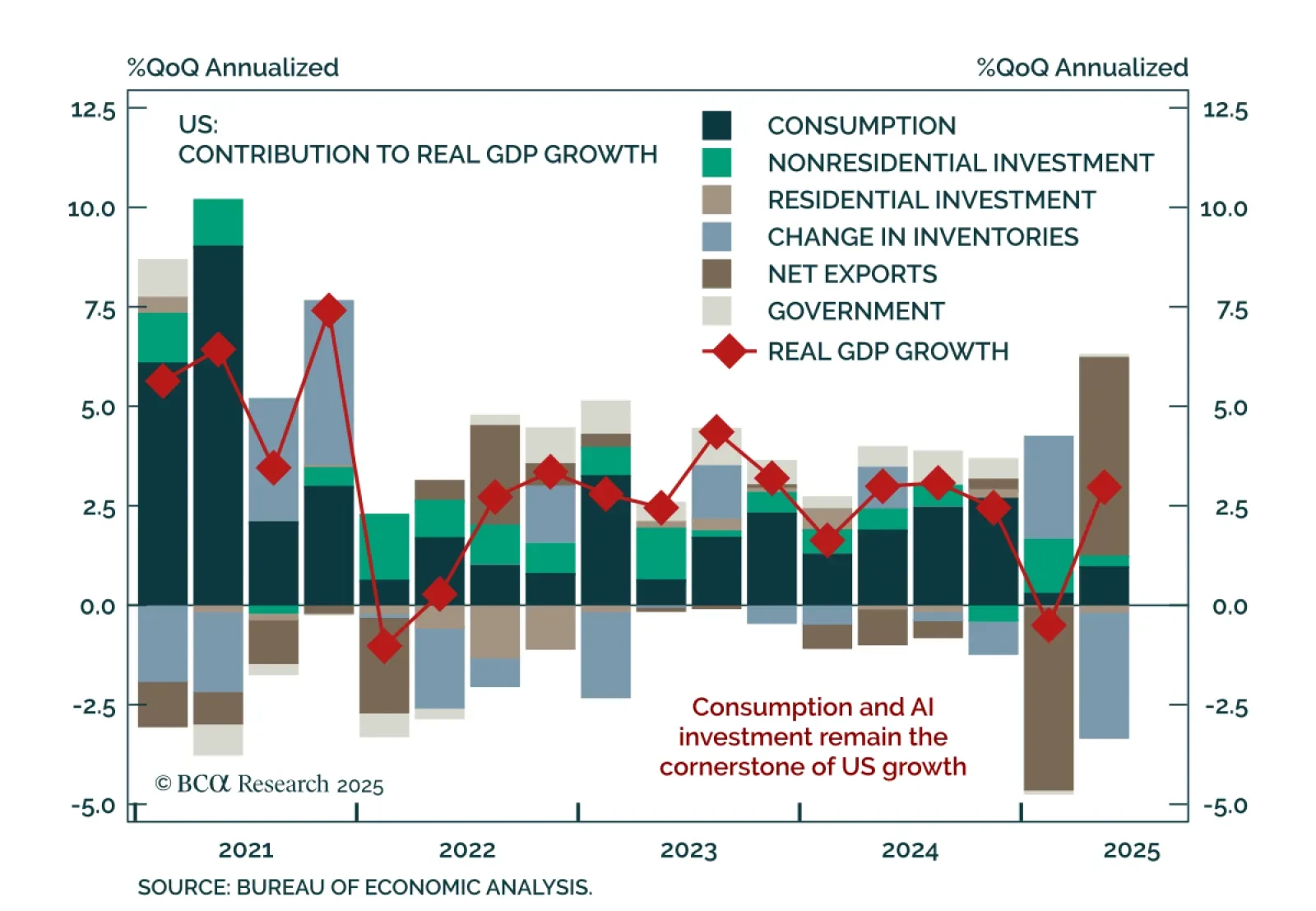

AI capex has emerged as the dominant driver of US growth in 2025, reshaping both macro dynamics and equity strategy. Our Chart Of The Week comes from Juan Correa, Chief Strategist for Global Asset Allocation.Over the first half of…

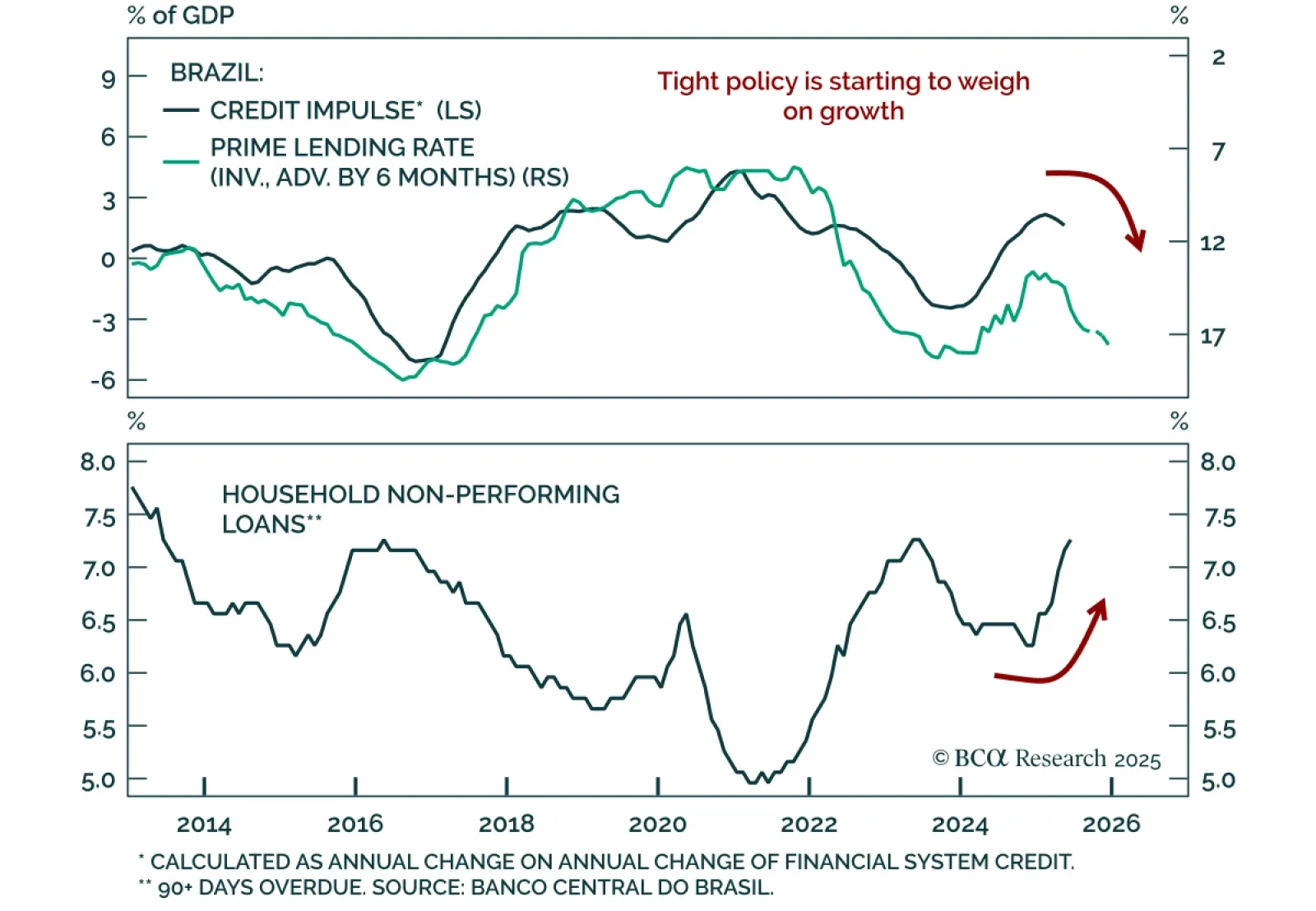

The Central Bank of Brazil (BCB) held rates at 15%, guaranteeing a sharp growth slowdown and reinforcing our underweight stance on Brazilian equities versus EM. All Copom board members voted to maintain an ultra-hawkish policy…

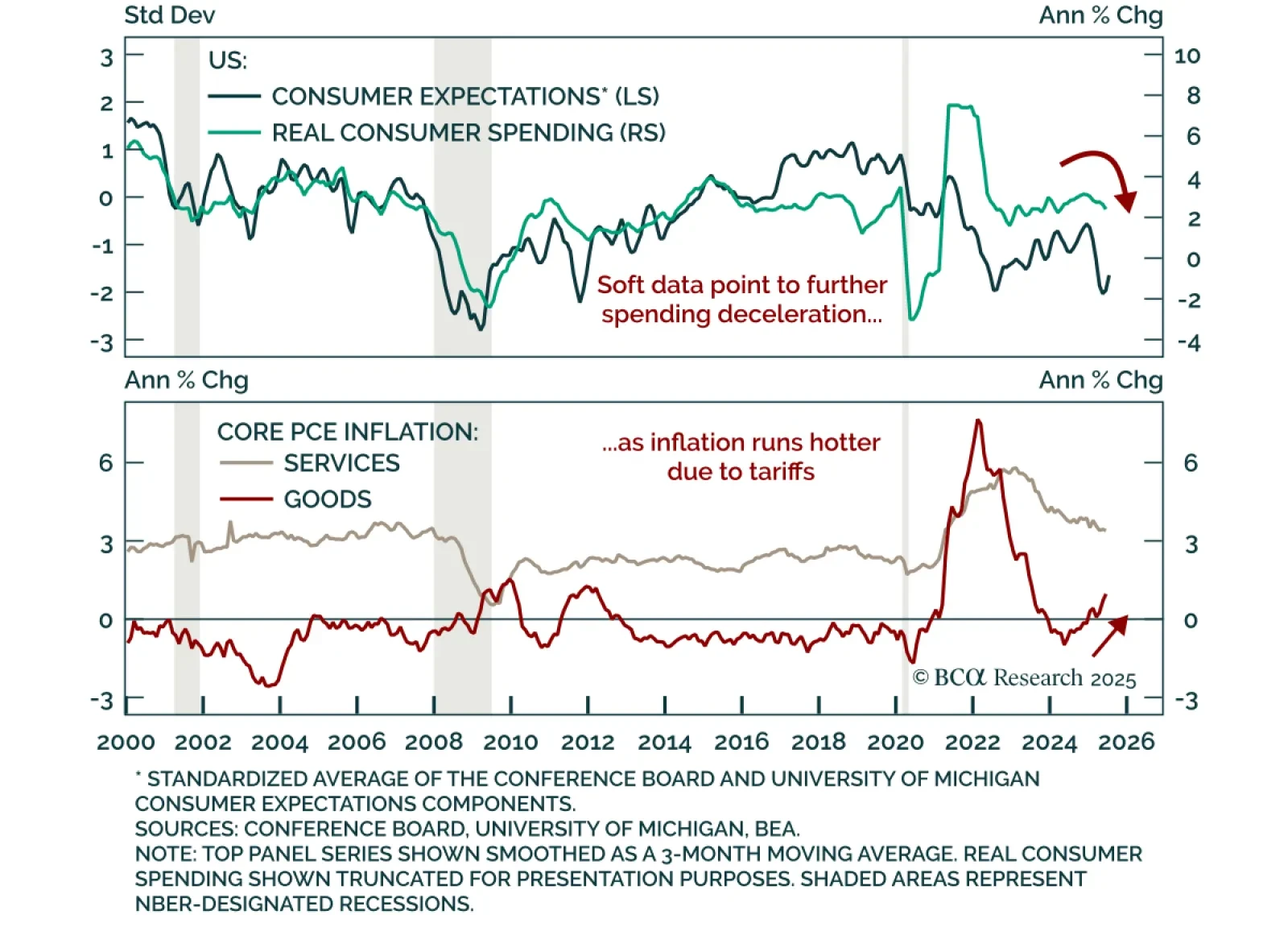

June US income and spending shows softening demand and rising goods inflation pressure, reinforcing our long-duration stance. Real personal spending only rose 0.1% m/m, in line with expectations. Personal income increased 0.3% m…

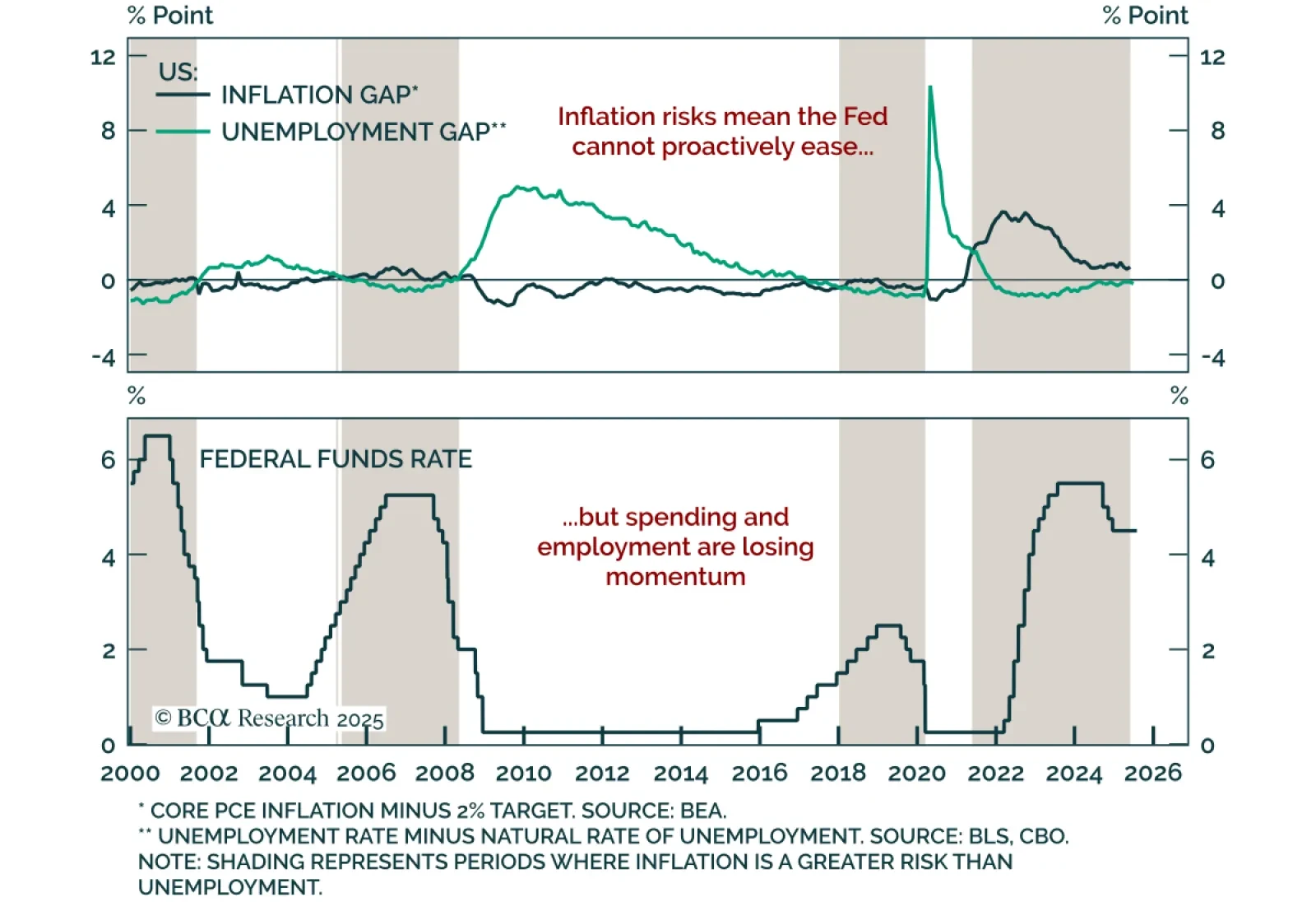

The Fed held rates steady for a fifth straight meeting, with a divided FOMC and resilient growth keeping policy on hold, supporting our long-duration stance. The target range remains at 4.25%–4.50%, with the statement reflecting only…

Q2 US GDP beat expectations at 3.0% annualized, but the underlying data confirm that growth momentum is fading, reinforcing our defensive stance. Consumption rebounded, but disappointed at 1.4%. The quarter was heavily distorted by…

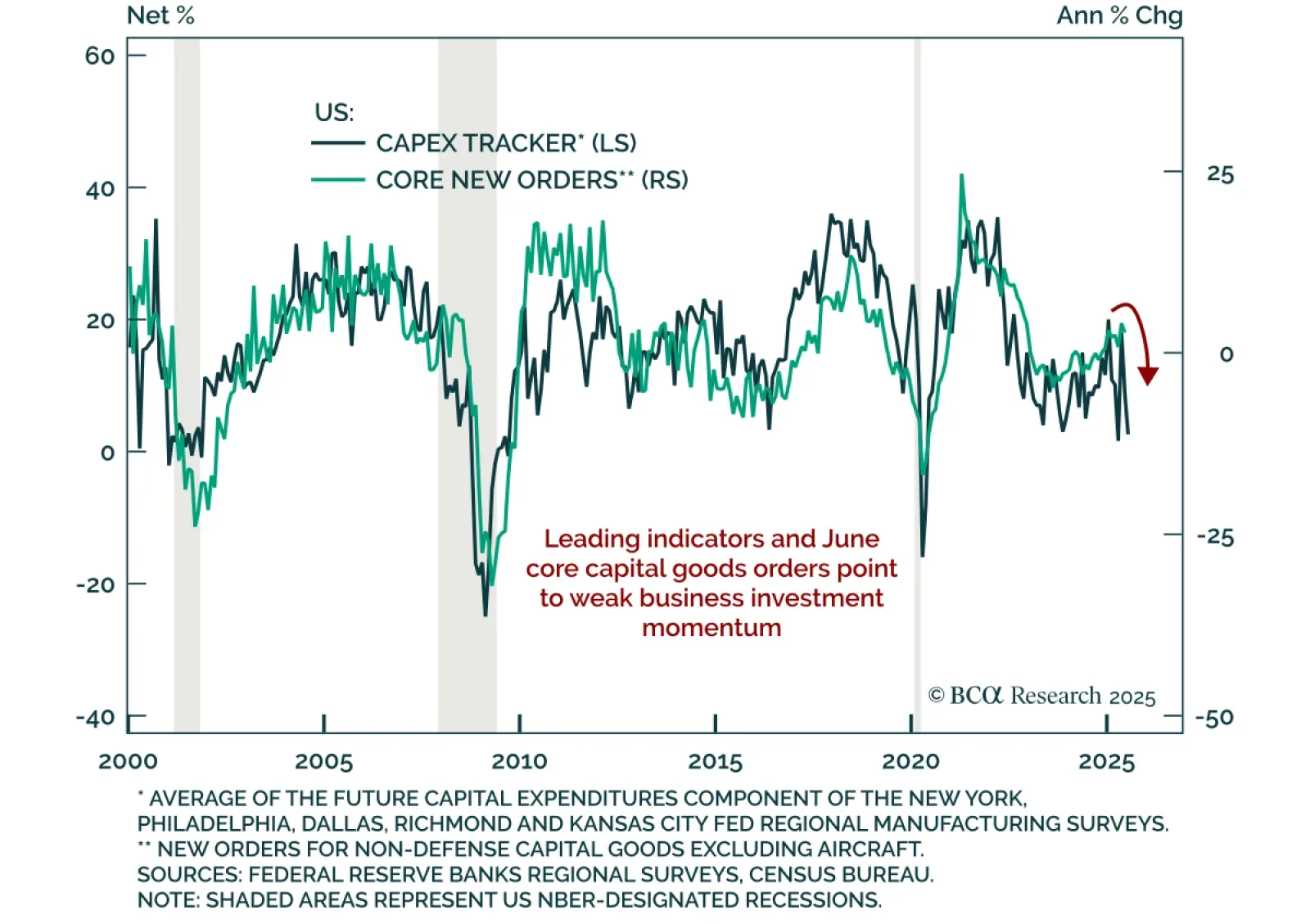

June core capital goods orders missed, confirming subdued capex momentum and reinforcing our defensive stance and long duration bias. Orders fell 0.7% m/m, below expectations, while shipments rose 0.4%. Headline durable goods…

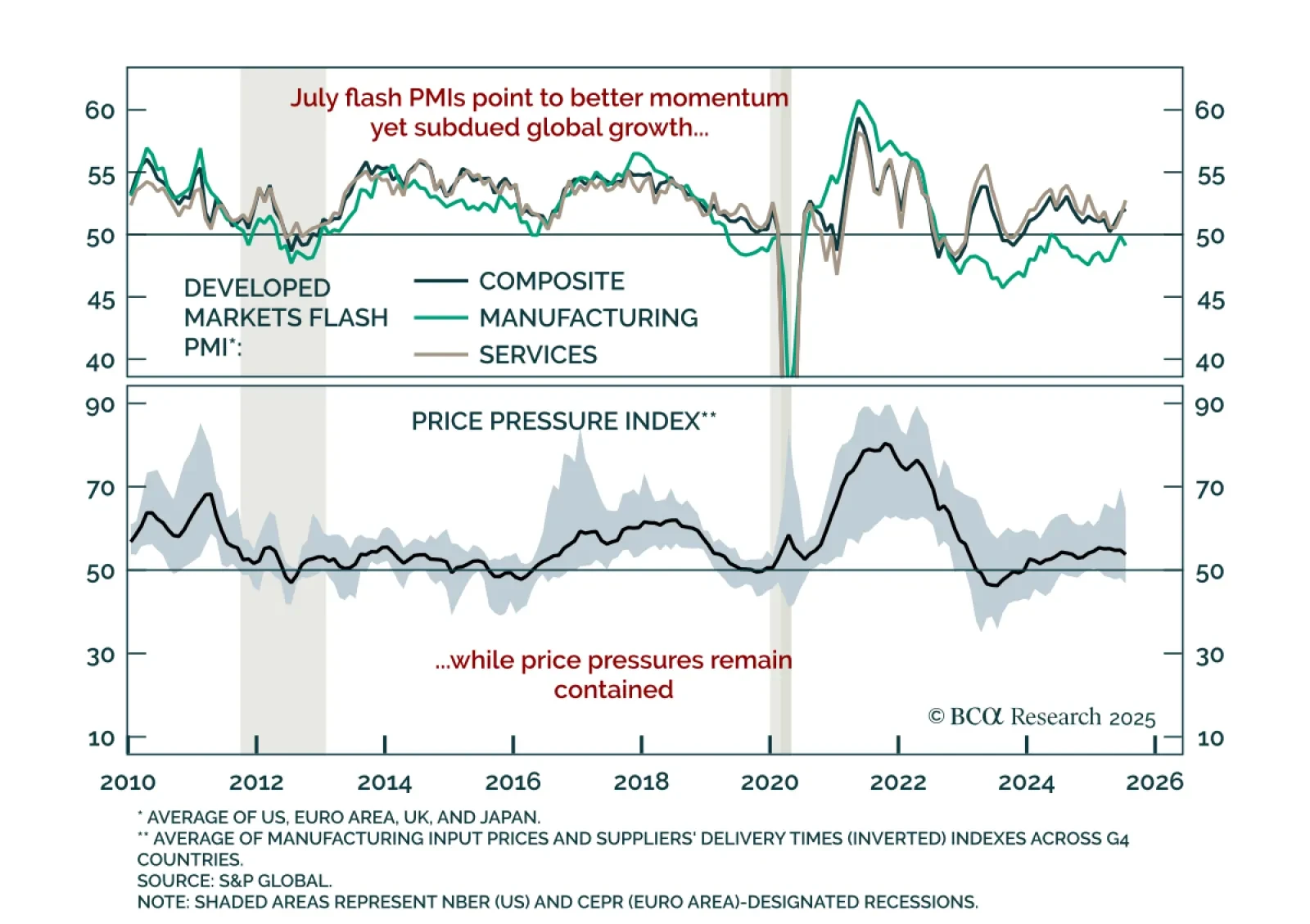

July DM flash PMIs point to improving global growth momentum led by services, but manufacturing remains weak and upside is limited, reinforcing our defensive stance. Services PMIs improved in the US, Europe, and Japan, but…

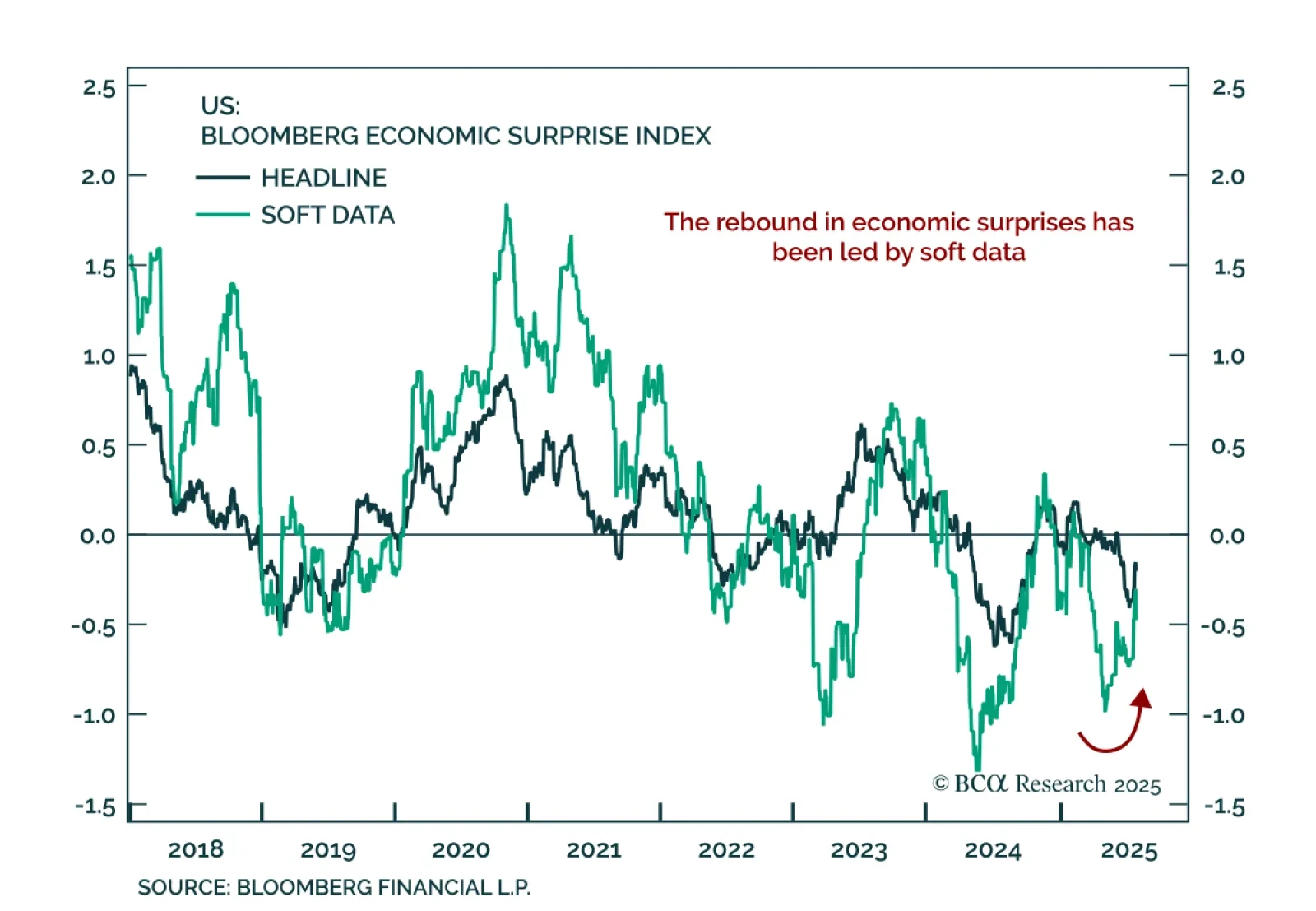

The post-Liberation Day dichotomy between improving soft data and worsening hard data points to an uneven recovery, keeping us positioned for downside risk. Soft data cratered post-Liberation Day as policy uncertainty and market…

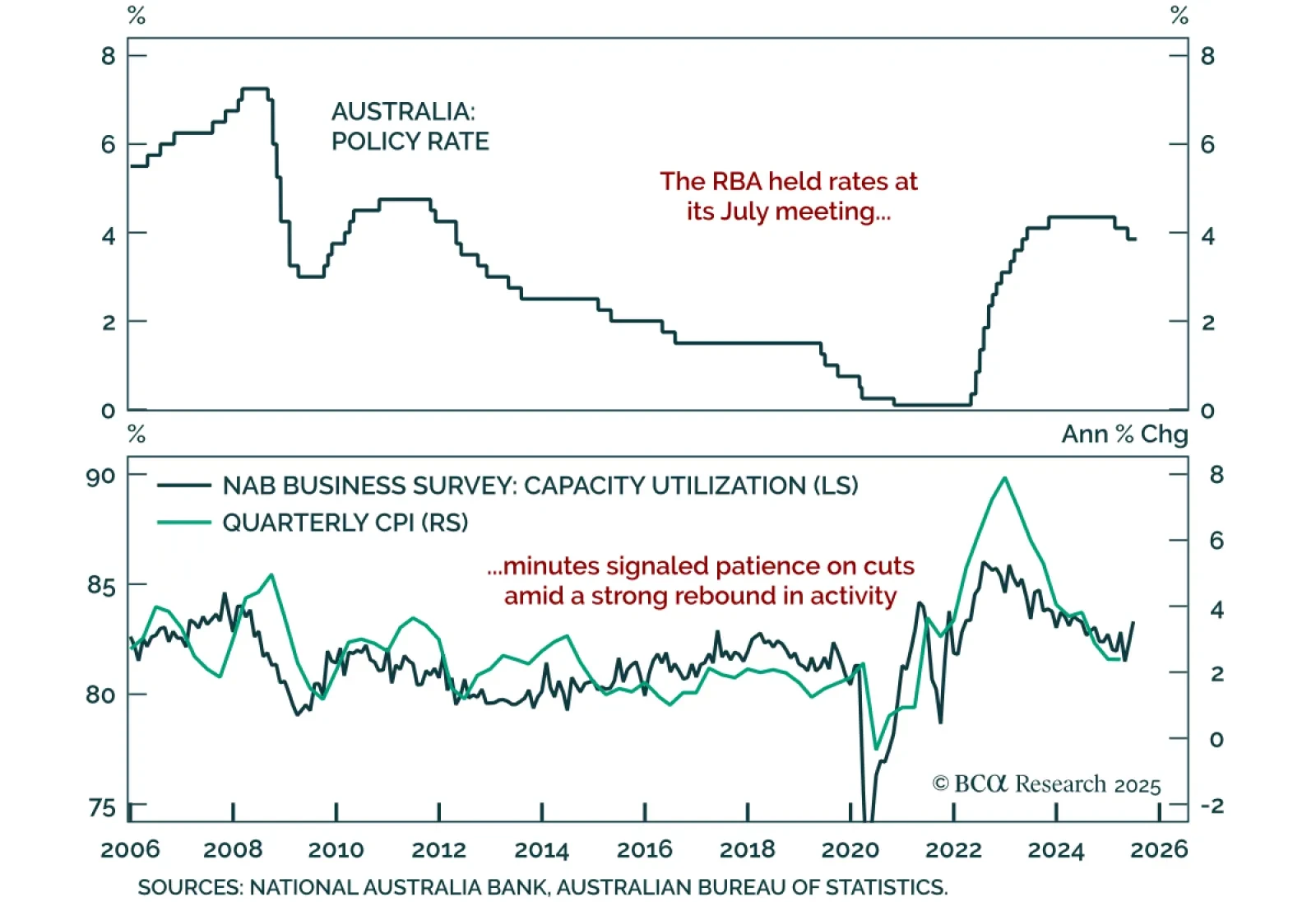

RBA minutes confirmed a cautious approach to easing, reinforcing our underweight in ACGBs and long AUD/NZD stance. The decision to hold at 3.85% surprised markets expecting a 25 bps cut. Governor Bullock had framed the decision…