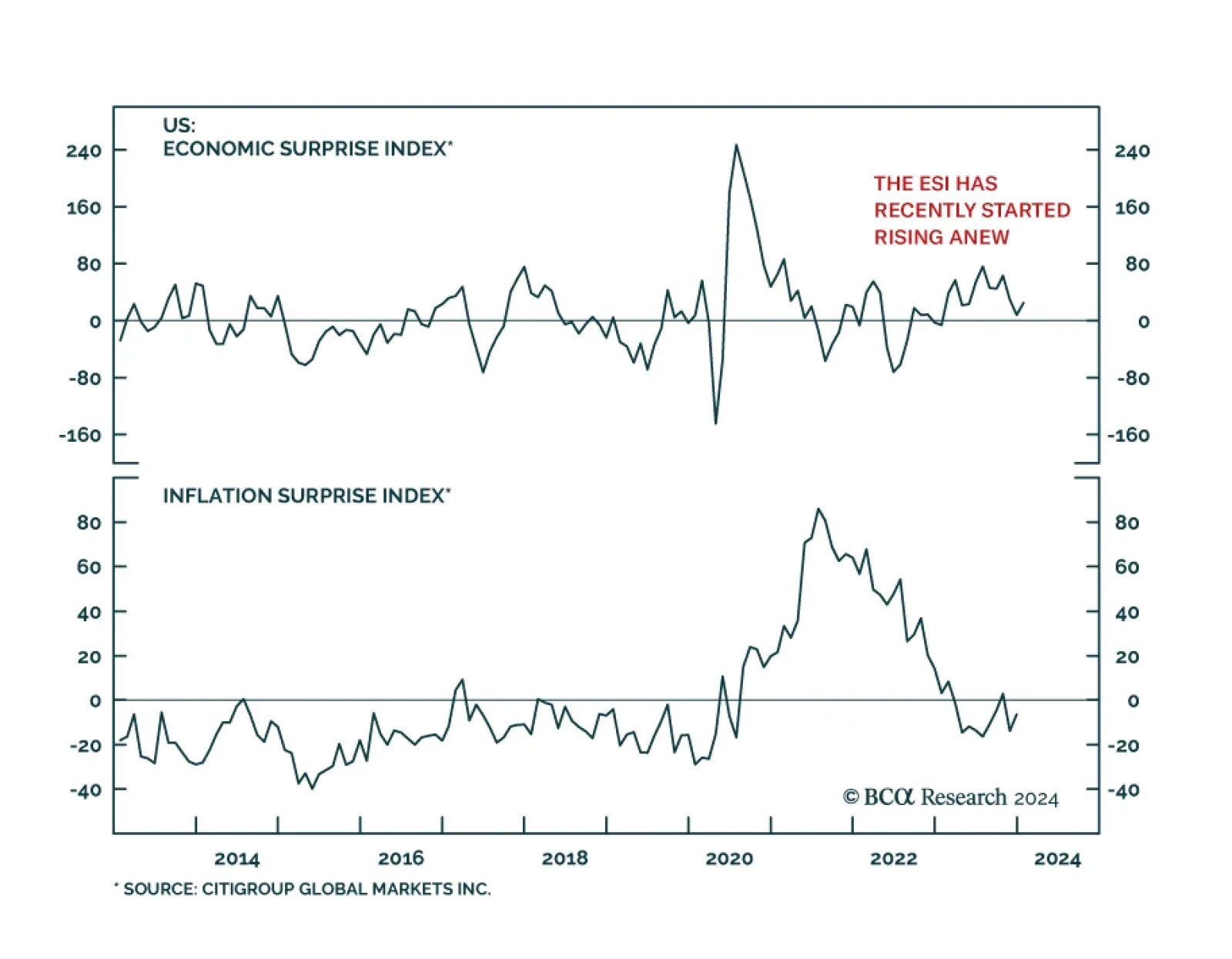

With the latest PCE release confirming that the disinflation process is intact (see The Numbers), a key question facing investors is around the timing of the Fed’s pivot to rate cuts. Indeed, the US inflation surprise index…

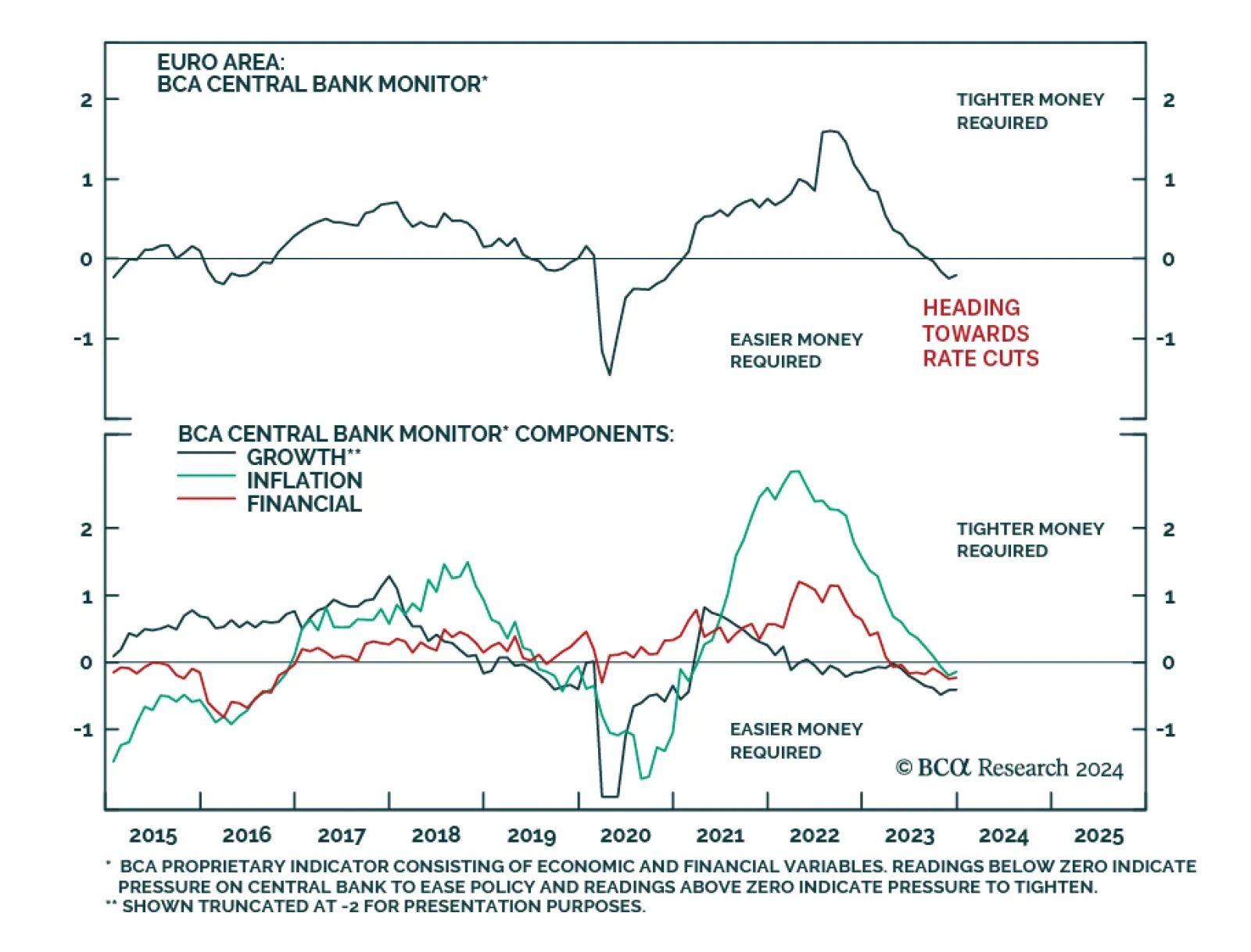

Government bond yields rallied and yield curves steepened across the Eurozone on Thursday following a less hawkish than anticipated tone from the ECB. As expected, the central bank kept policy rates unchanged and reiterated that…

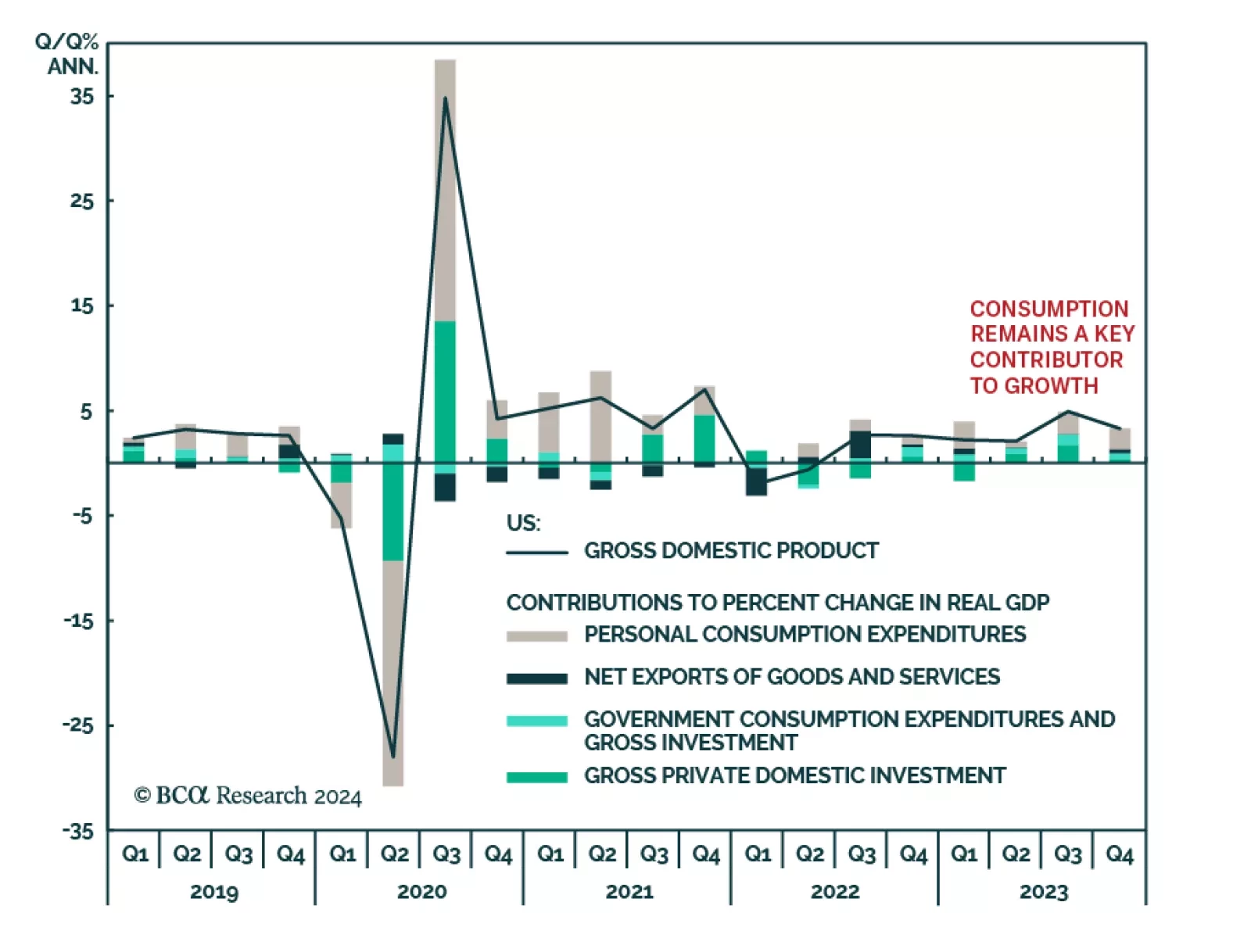

The Q4 2023 US GDP print delivered a positive message on economic conditions. Although real GDP growth decelerated from 4.9% to 3.3%, it came in well above consensus expectations of 2.0% and the Atlanta Fed’s GDPNow…

Middle East conflict, extreme US policy uncertainty, Chinese economic slowdown, US-Russian proxy war, and Asian military conflicts do not create a stable investment backdrop for 2024. Our top five “black swan” risks may be highly…

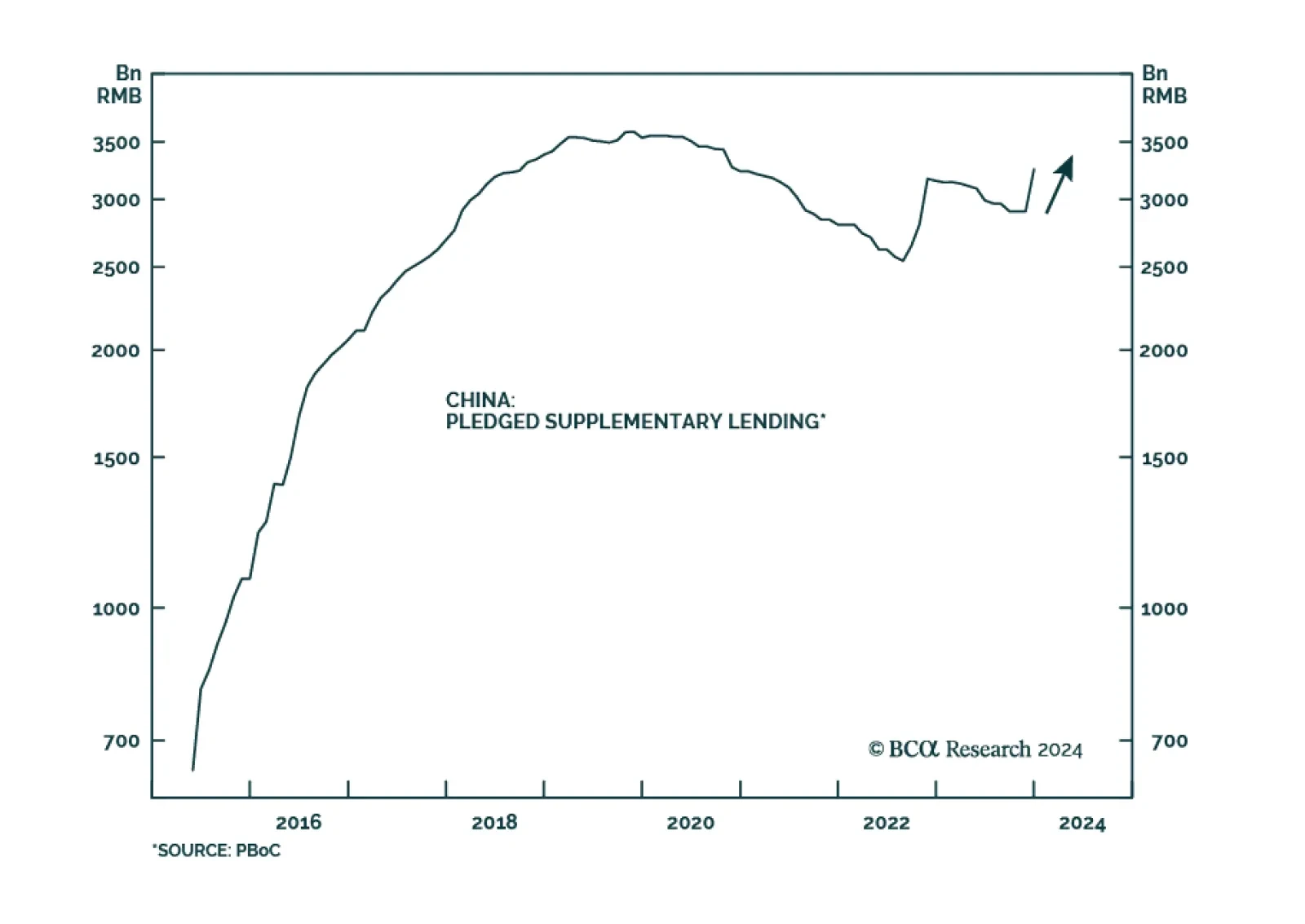

According to BCA Research’s China Investment Strategy service, the current Pledged Supplementary Lending (PSL) program will provide much less support to the housing market and construction activity than the 2015-2018…

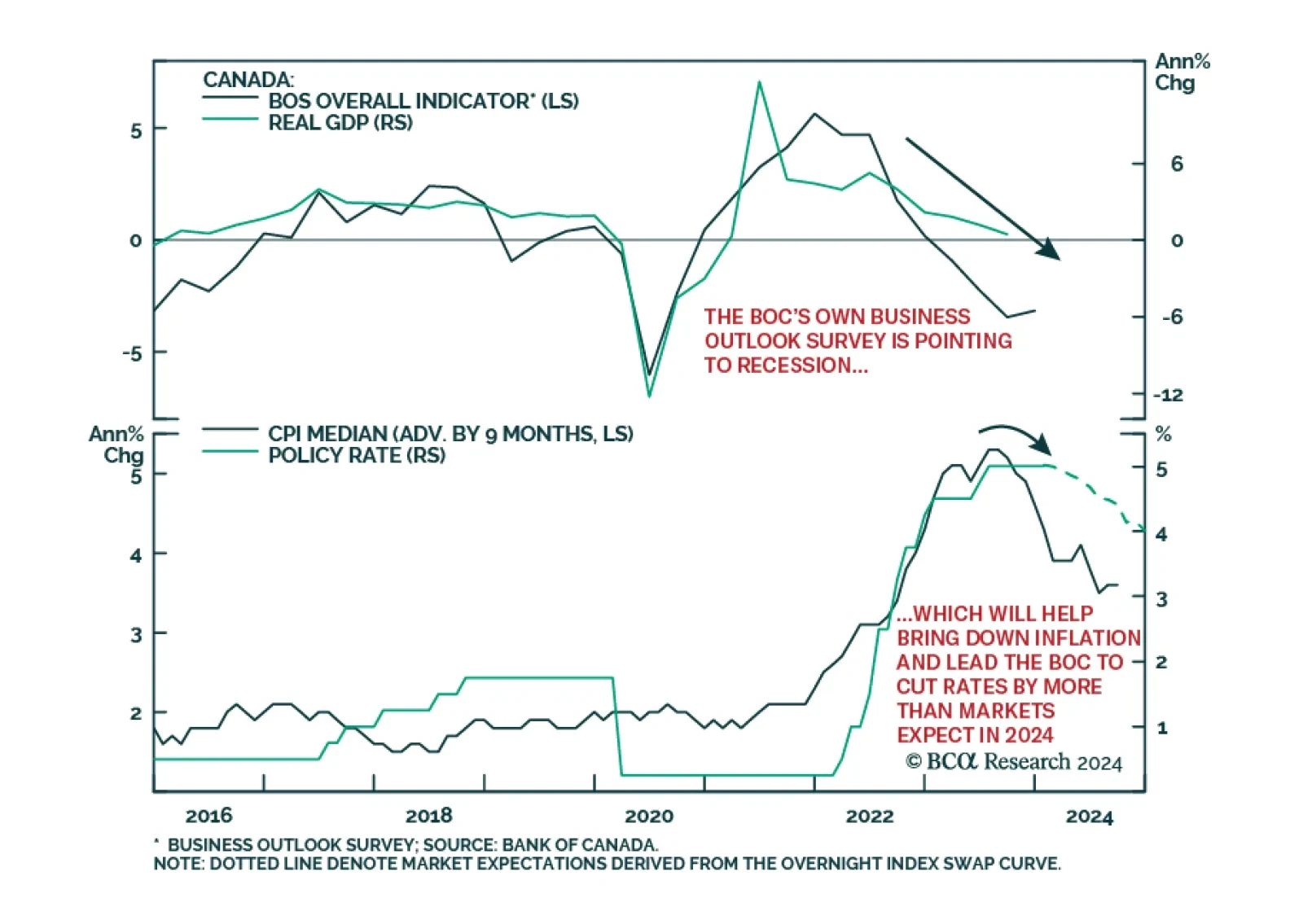

The Bank of Canada (BoC) kept rates steady at yesterday’s monetary policy meeting, leaving its policy rate at 5%. The central bank presented updated economic projections in a new Monetary Policy Report (MPR), which were…

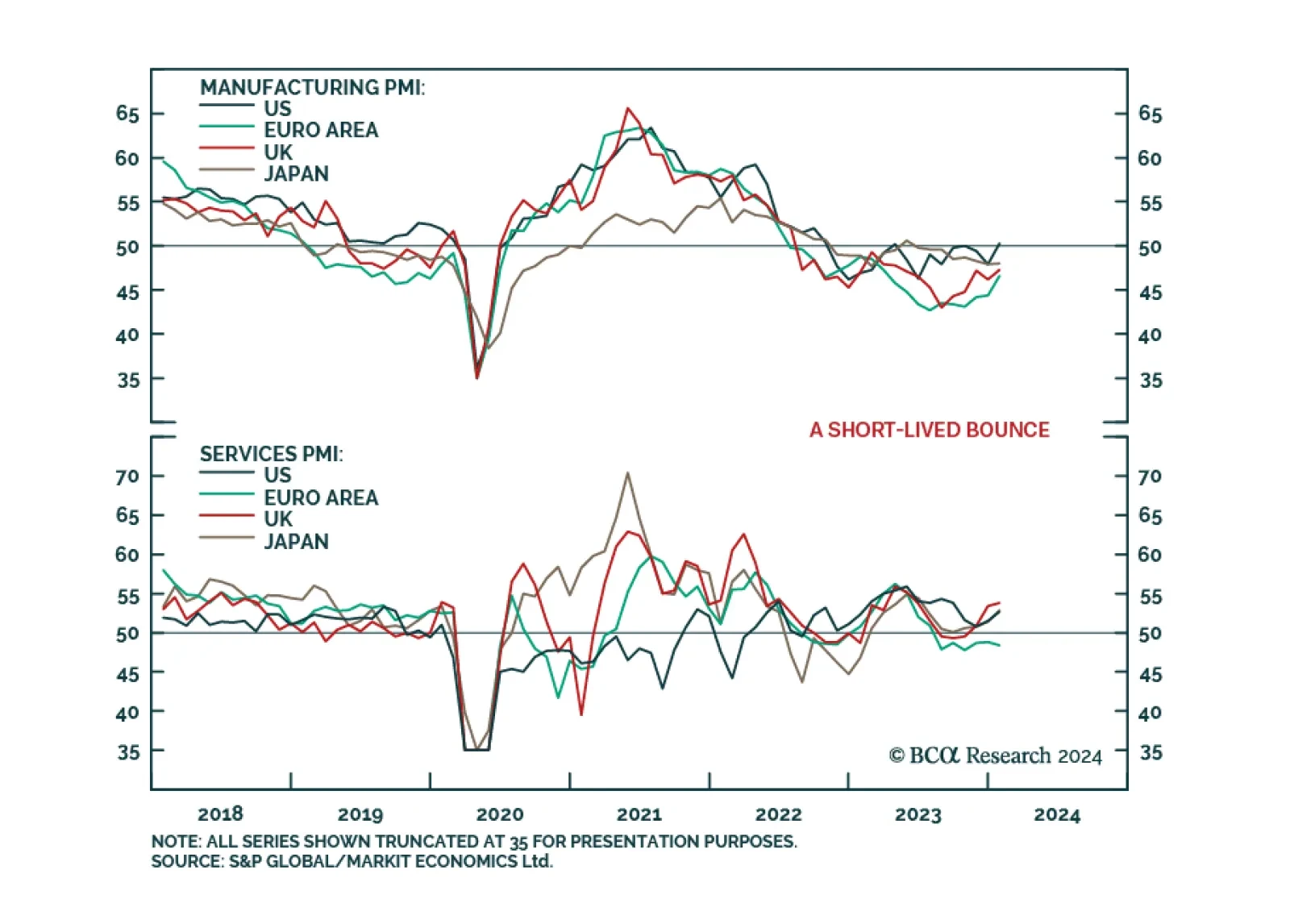

Flash PMIs sent a generally positive update on economic activity across major DM economies in January – particularly in the case of manufacturing. In the US, the composite index rose to a 7-month high of 52.3, beating…

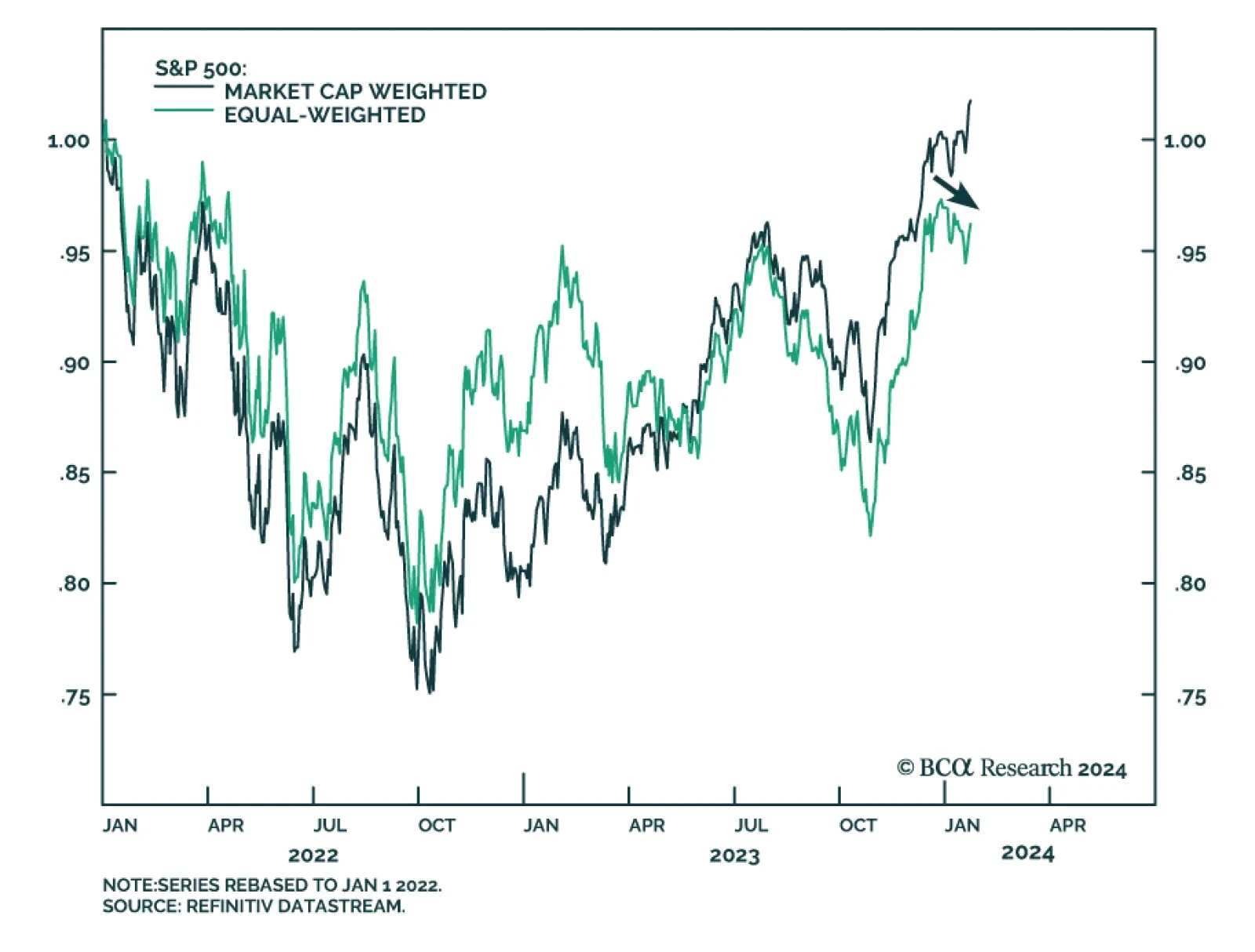

The S&P 500 notched a fresh record high on Tuesday for the third session in a row, bringing its year-to-date gains to 2.0%. Yet as we highlighted in a recent Insight, the lack of a broad-based rally across all S&P 500…

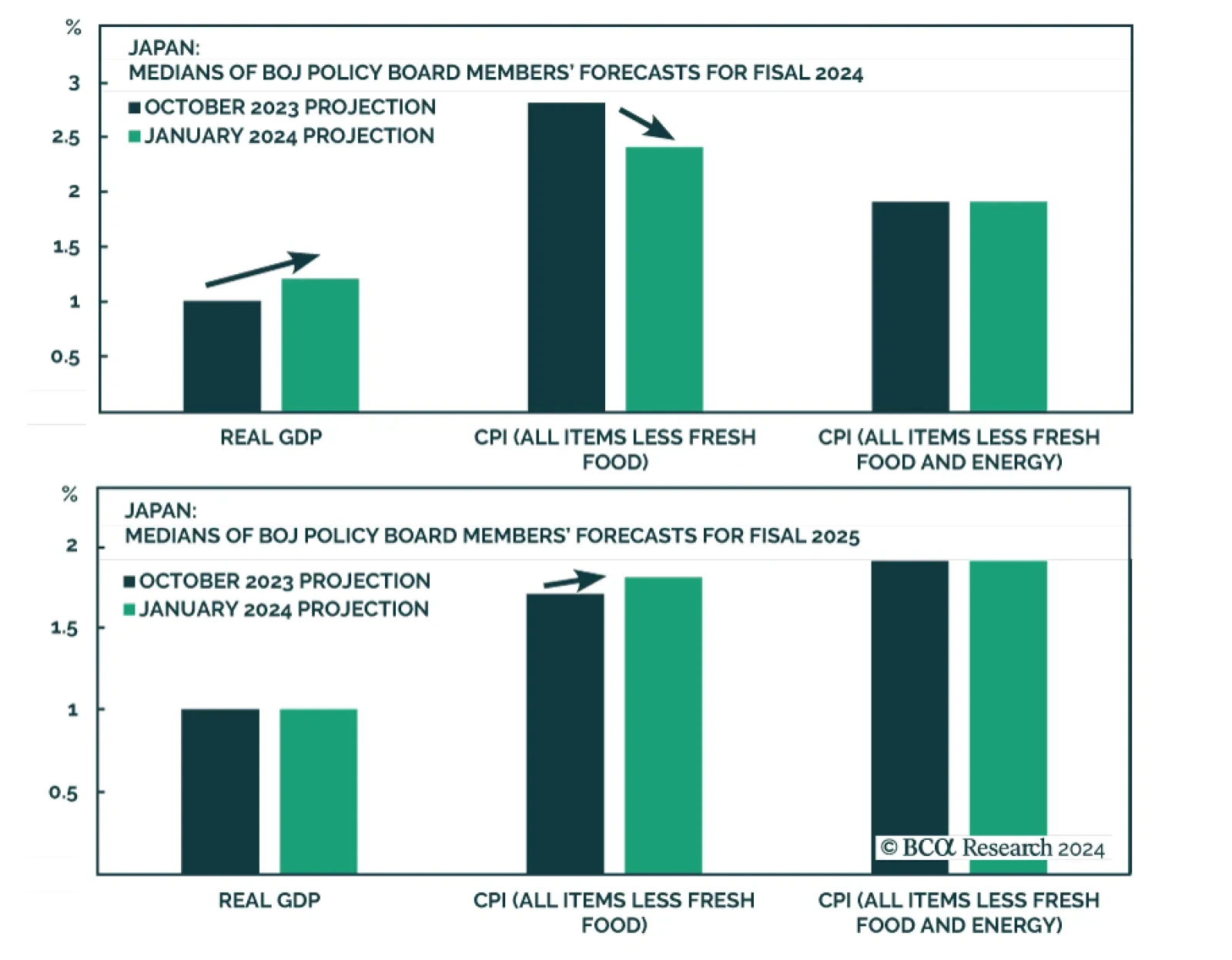

As expected, the Bank of Japan maintained its ultra-easy monetary policy stance at its meeting on Tuesday, making no changes in interest rates or yield curve control. The monetary policy statement highlighted that elevated…

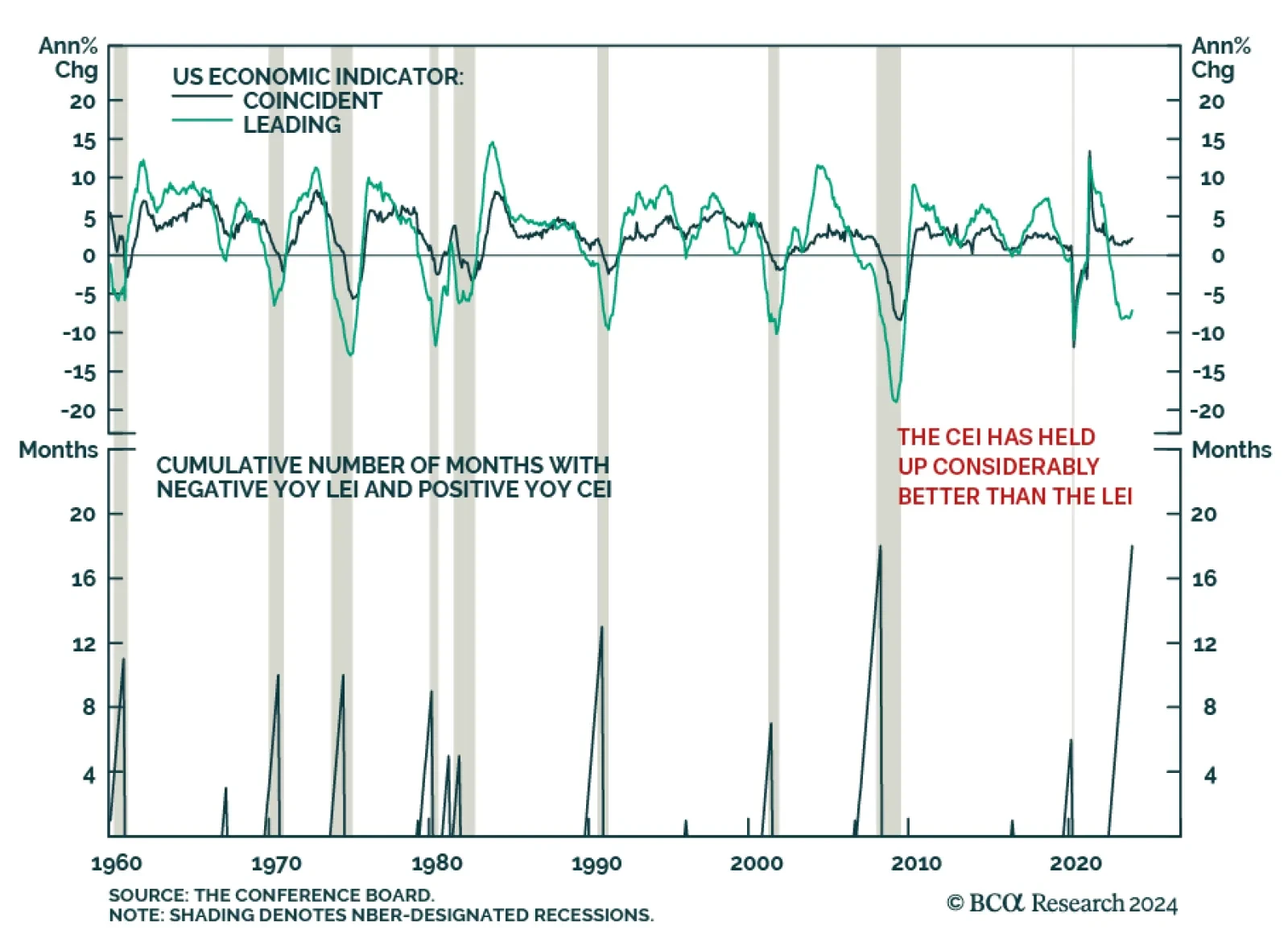

The US Conference Board’s Leading Economic Indicator (LEI) sent a mixed signal on Monday. On the one hand, the LEI posted its 22nd consecutive month-over-month decline in December – a negative sign for the…