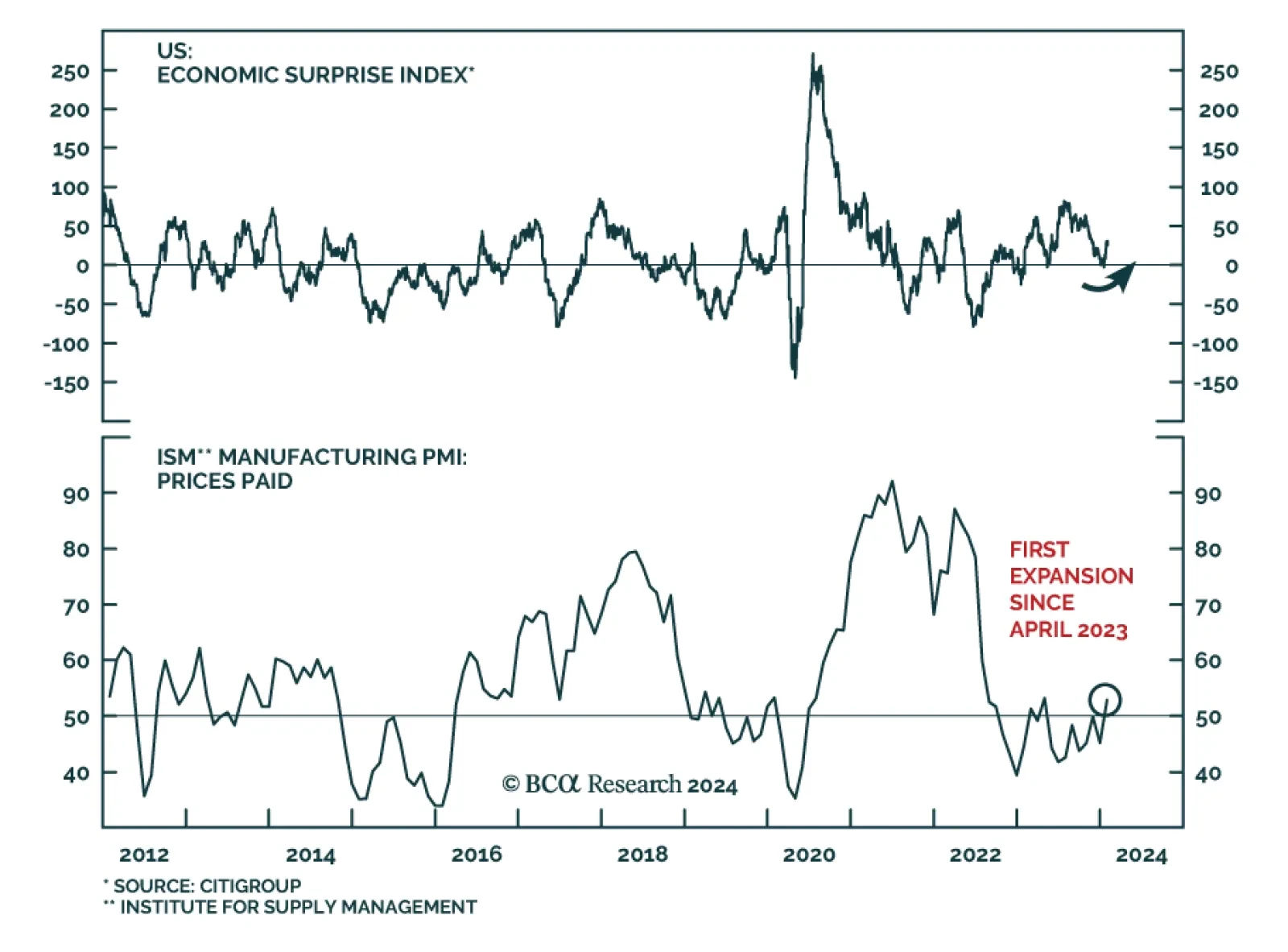

After falling throughout most of the second half of 2023, the US economic surprise index has surged over the past few weeks, indicating that economic conditions are firm at the start of the year. Indeed, Manufacturing PMIs…

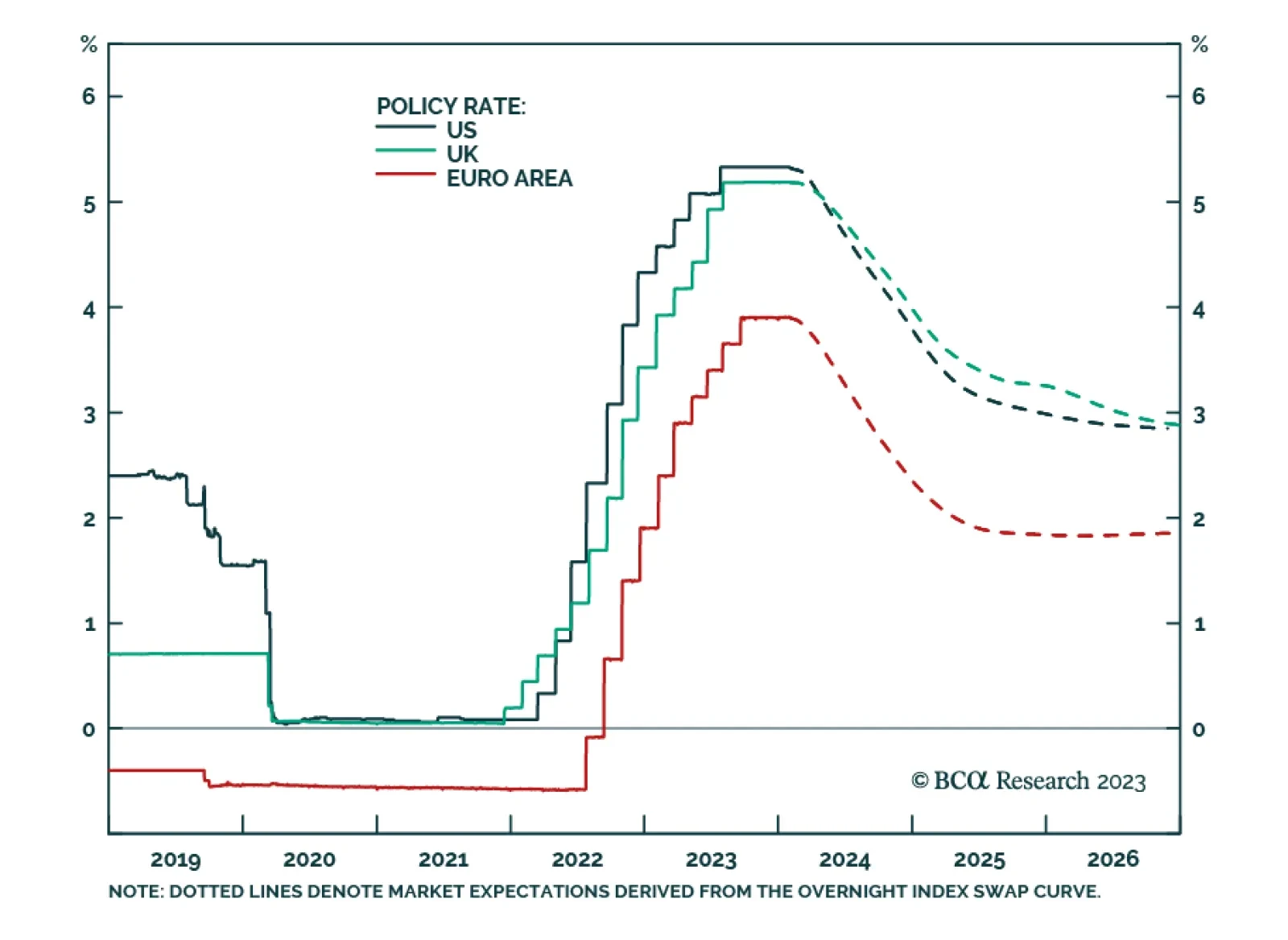

Given the huge disparities in wage inflation between the US, euro area and UK, it is remarkable that the markets are pricing near-identical rate cuts from the Fed, ECB, and BoE of around 150 bps through 2024. Assuming central…

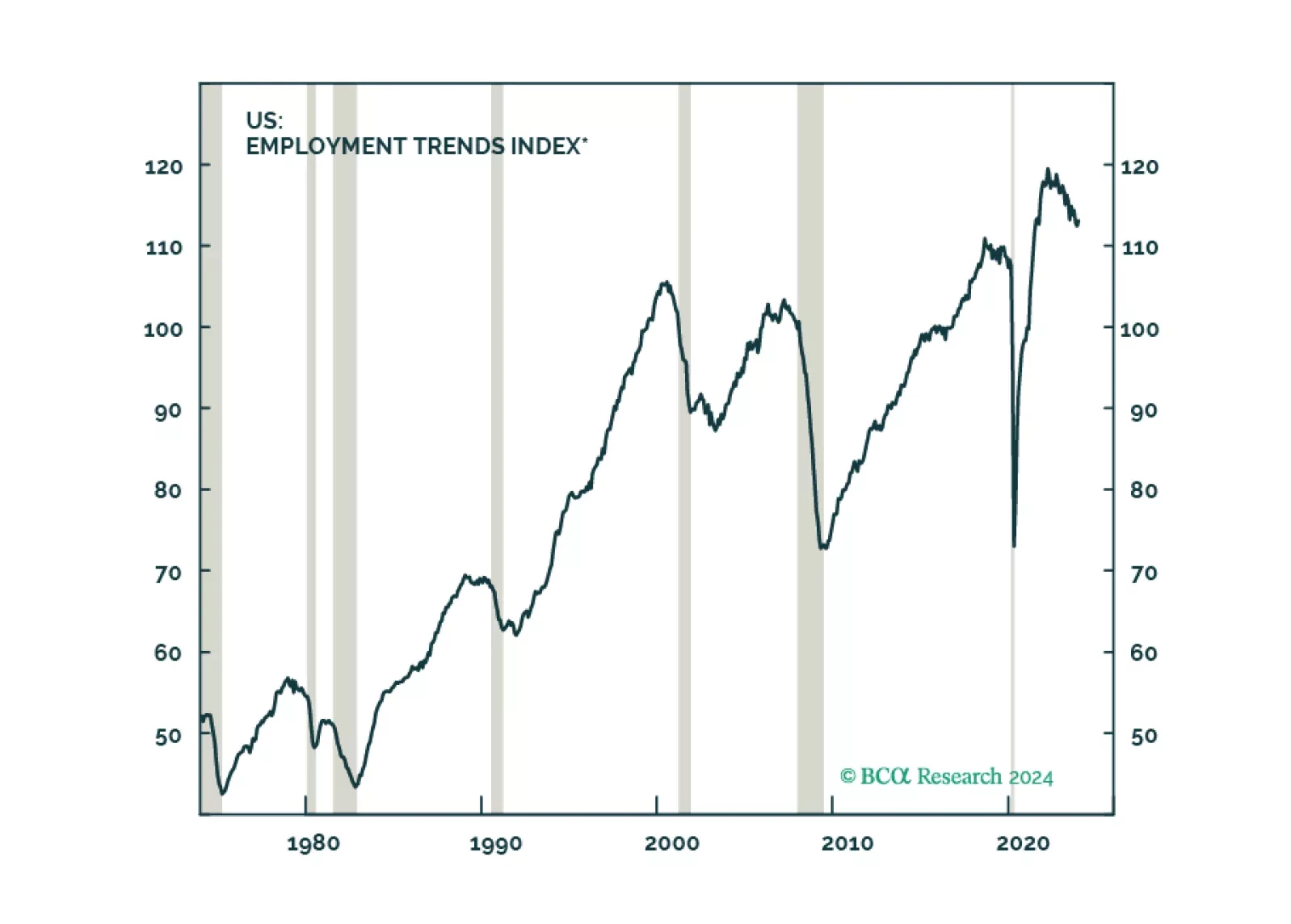

When will the US also buckle under high rates? We expect a US recession to begin around mid-year. Stay defensive.

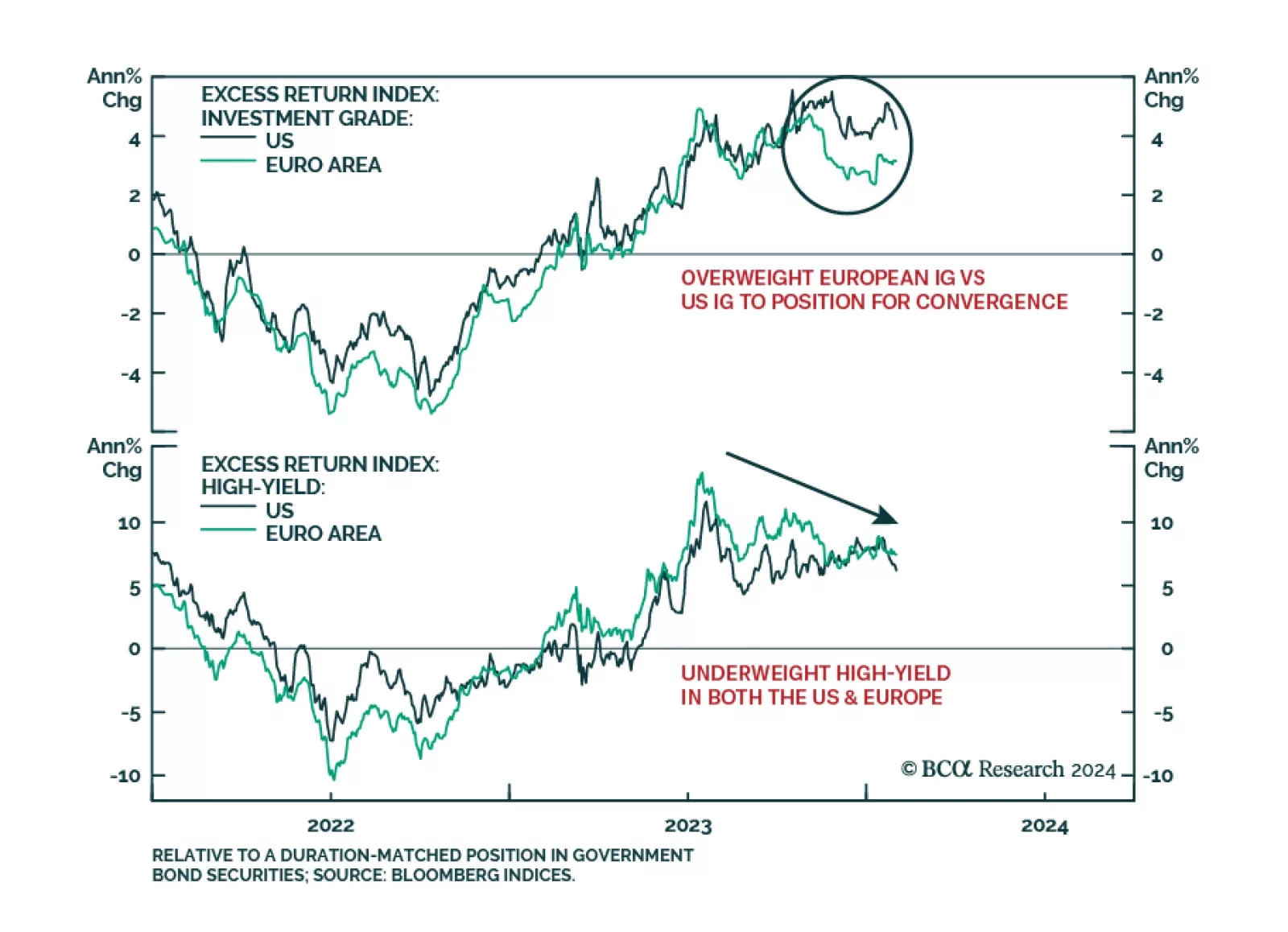

The strong H2/2023 rally in global credit markets can be attributed to lower global inflation and the associated reduction in global interest rate volatility. However, our colleagues at BCA Research’s Global Fixed Income…

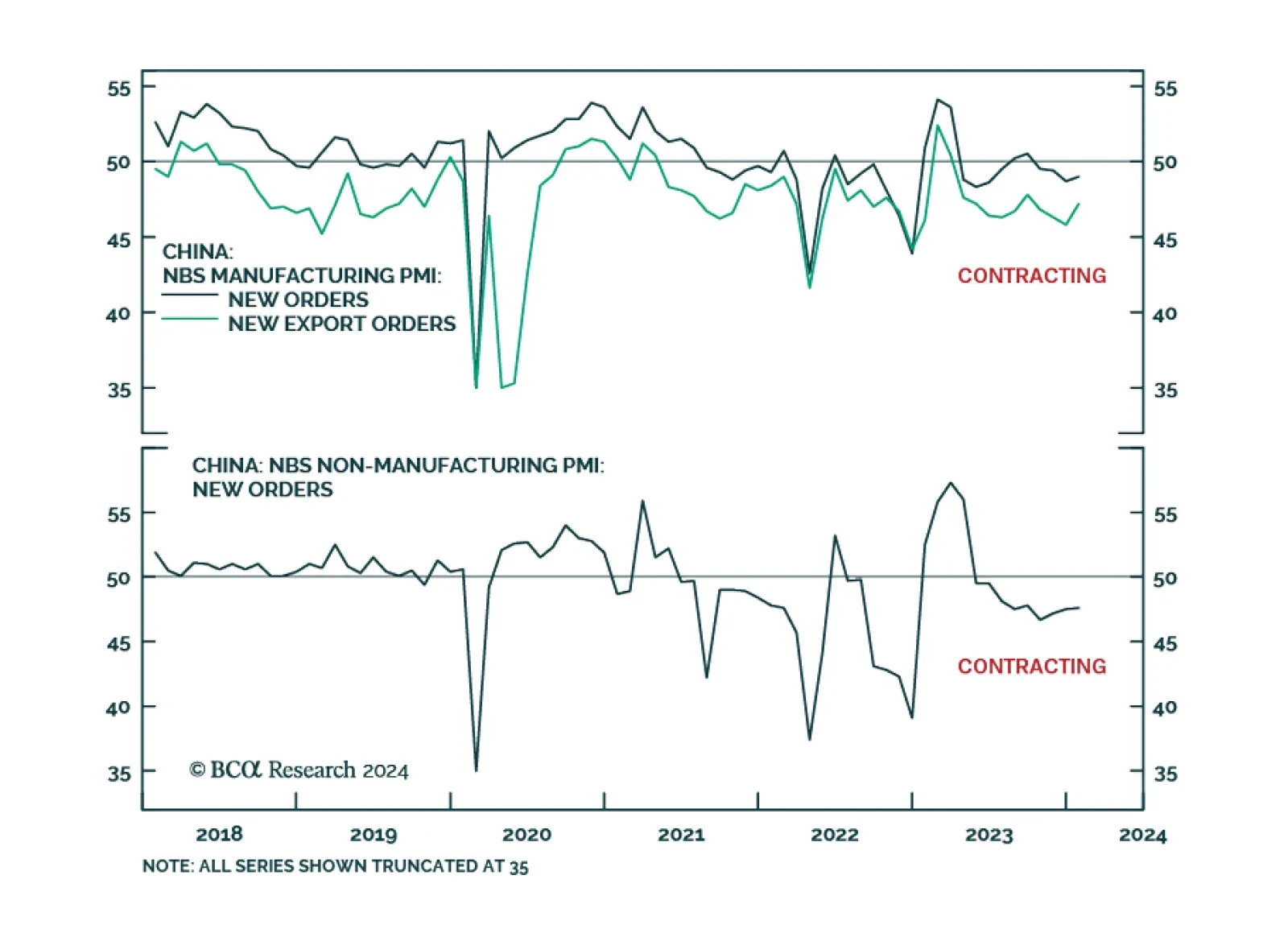

China’s official NBS PMI indicates that growth conditions remain sluggish. Although the composite index ticked up from 50.3 to 50.9, it is still barely in expansionary territory. Notably, the manufacturing PMI – which…

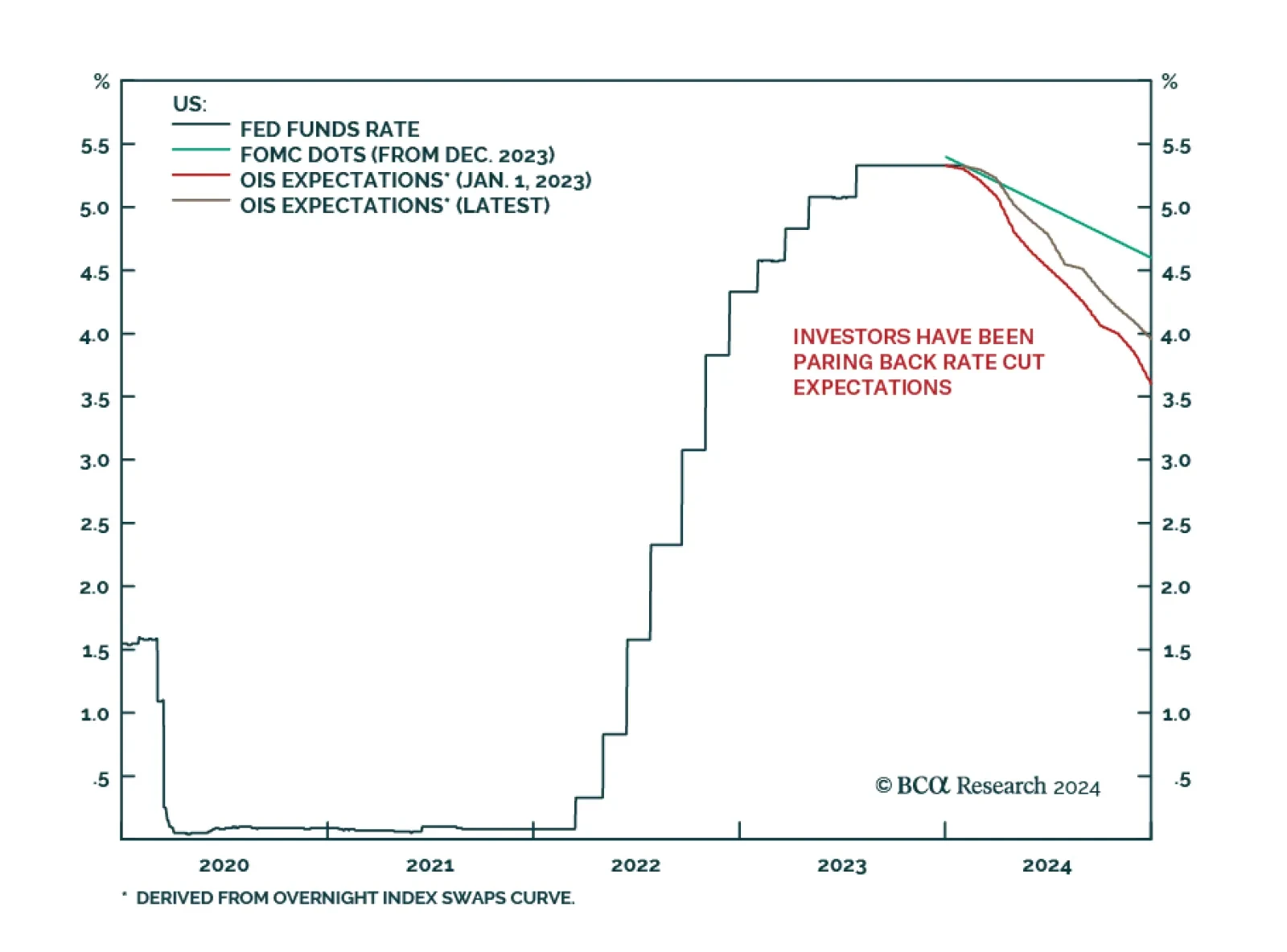

As expected, the Fed decided to keep policy unchanged at the conclusion of the FOMC meeting on Wednesday. The changes to the Fed Statement generally indicate that the central bank is preparing to move towards easing monetary…

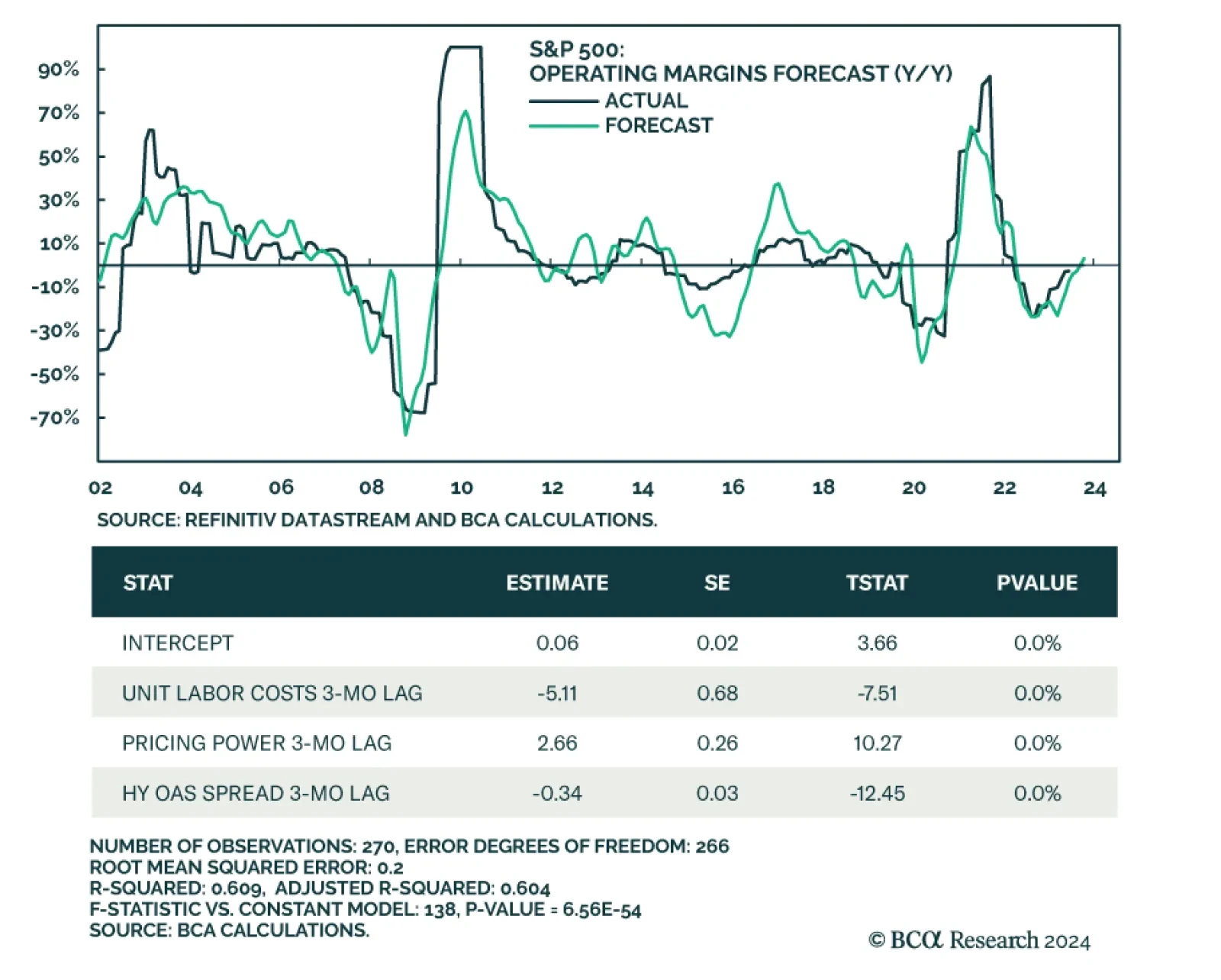

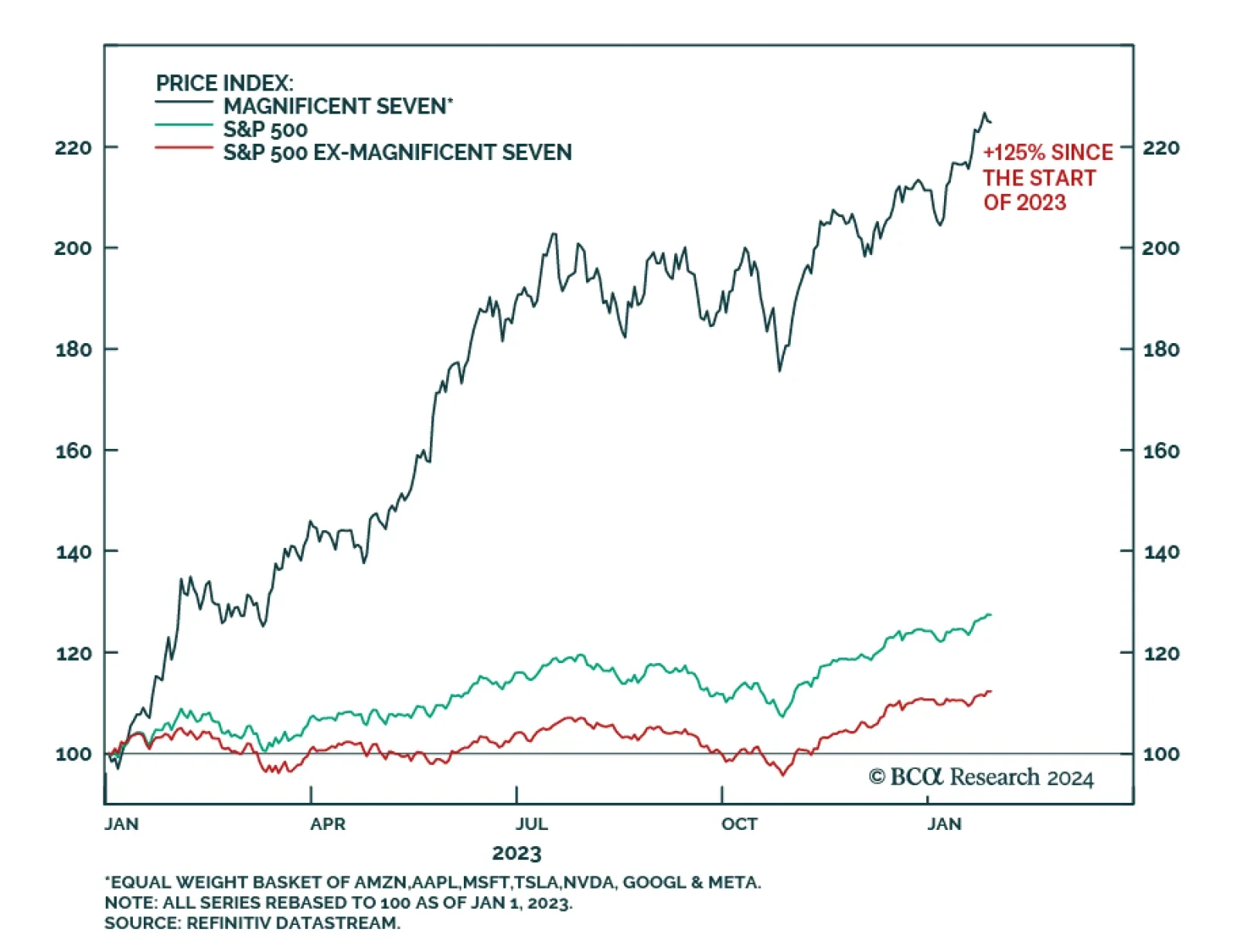

S&P 500 operating margins have been in a downdraft for nearly two years – but the consensus is still penciling in expansion for 2024. How likely is that? Our US Equity Strategy colleagues have addressed this question…

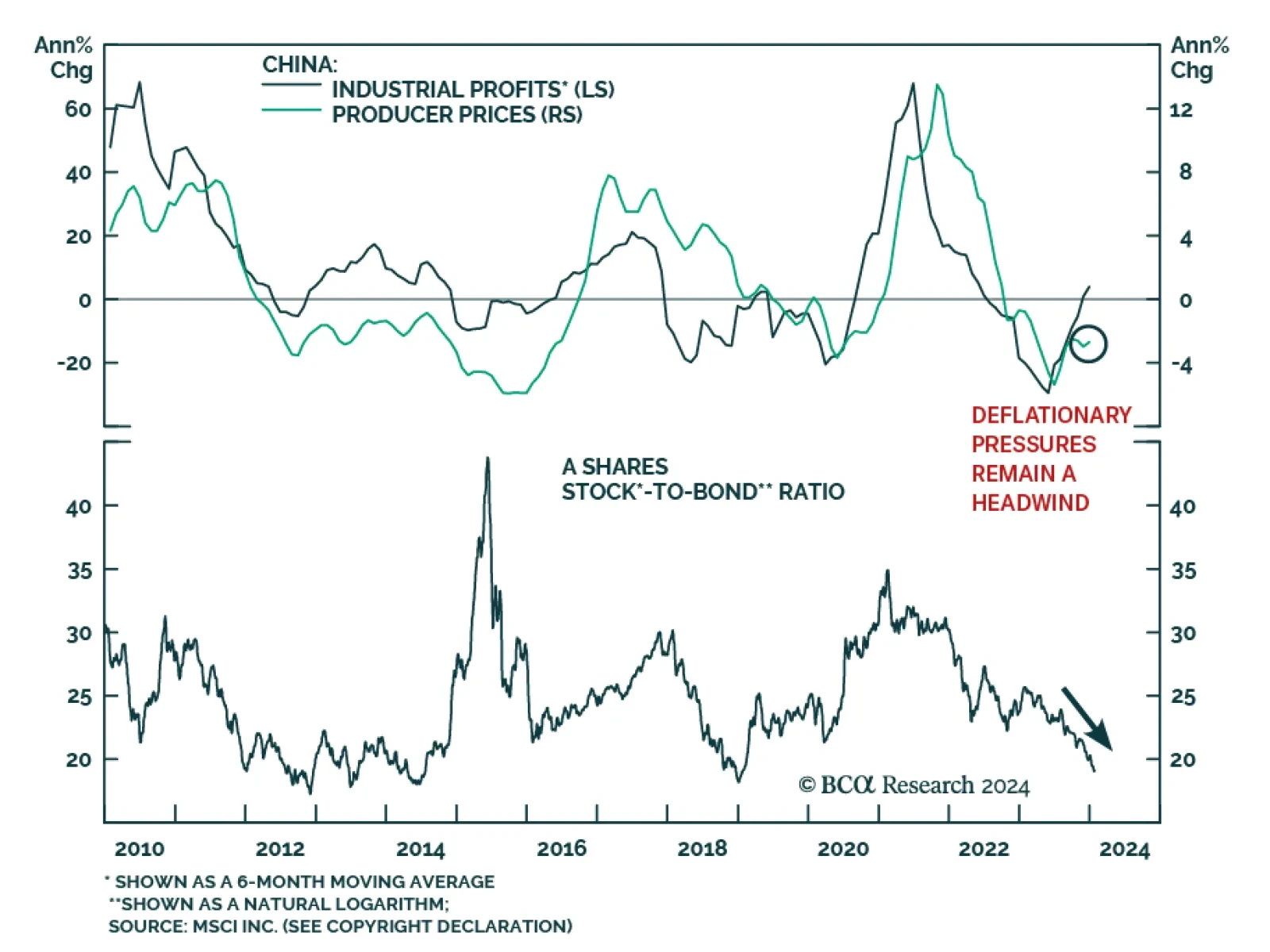

China’s industrial profits registered their second consecutive annual contraction last year, falling by 2.3% in 2023. The full year contraction comes despite a surge in industrial profits near year-end. Profit growth…

This week is set to be a busy one for the US market. On the policy front, there is the Wednesday FOMC meeting which will give insight into the Fed’s latest thinking regarding the timing of rate cuts. On the data front,…

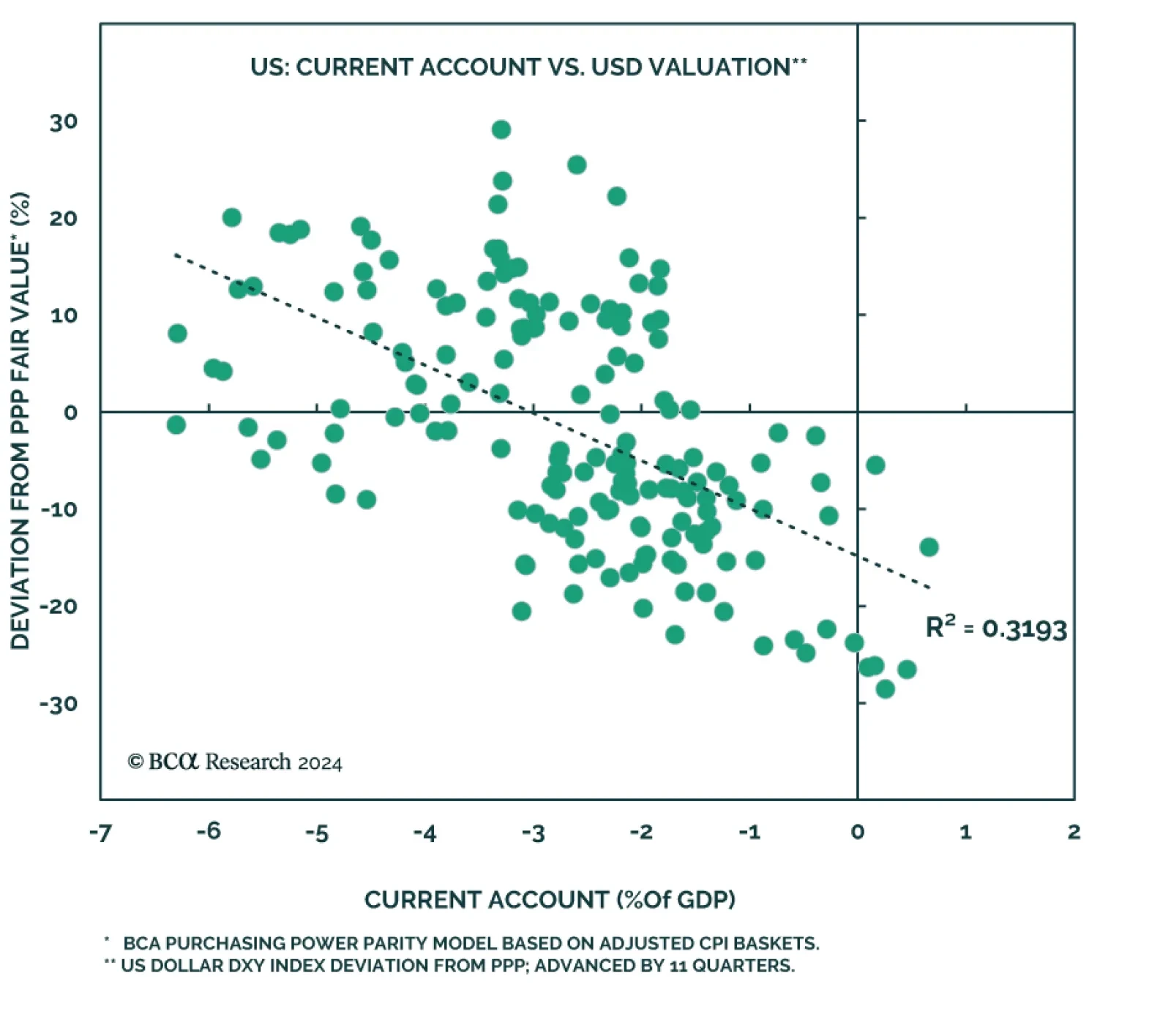

While balance of payments (BoP) do not really matter for day-to-day FX considerations, they do matter over the long term. According to BCA’s Foreign Exchange Strategists, at high levels of US dollar valuation like today,…