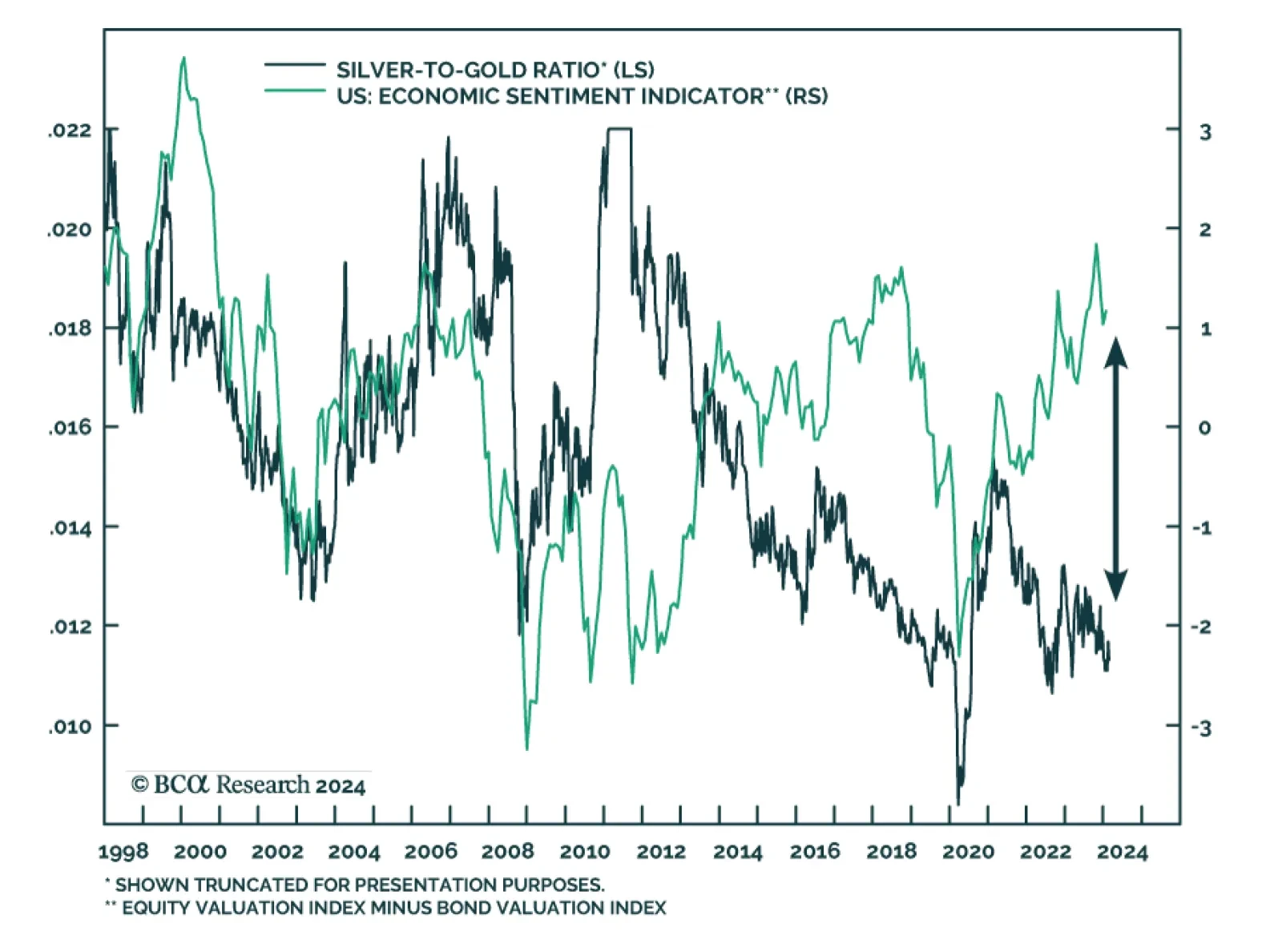

Our US economic sentiment indicator – which is based on the difference between our equity valuation index and our bond valuation index – remains on an uptrend since its pandemic trough. Investors are pushing US stocks…

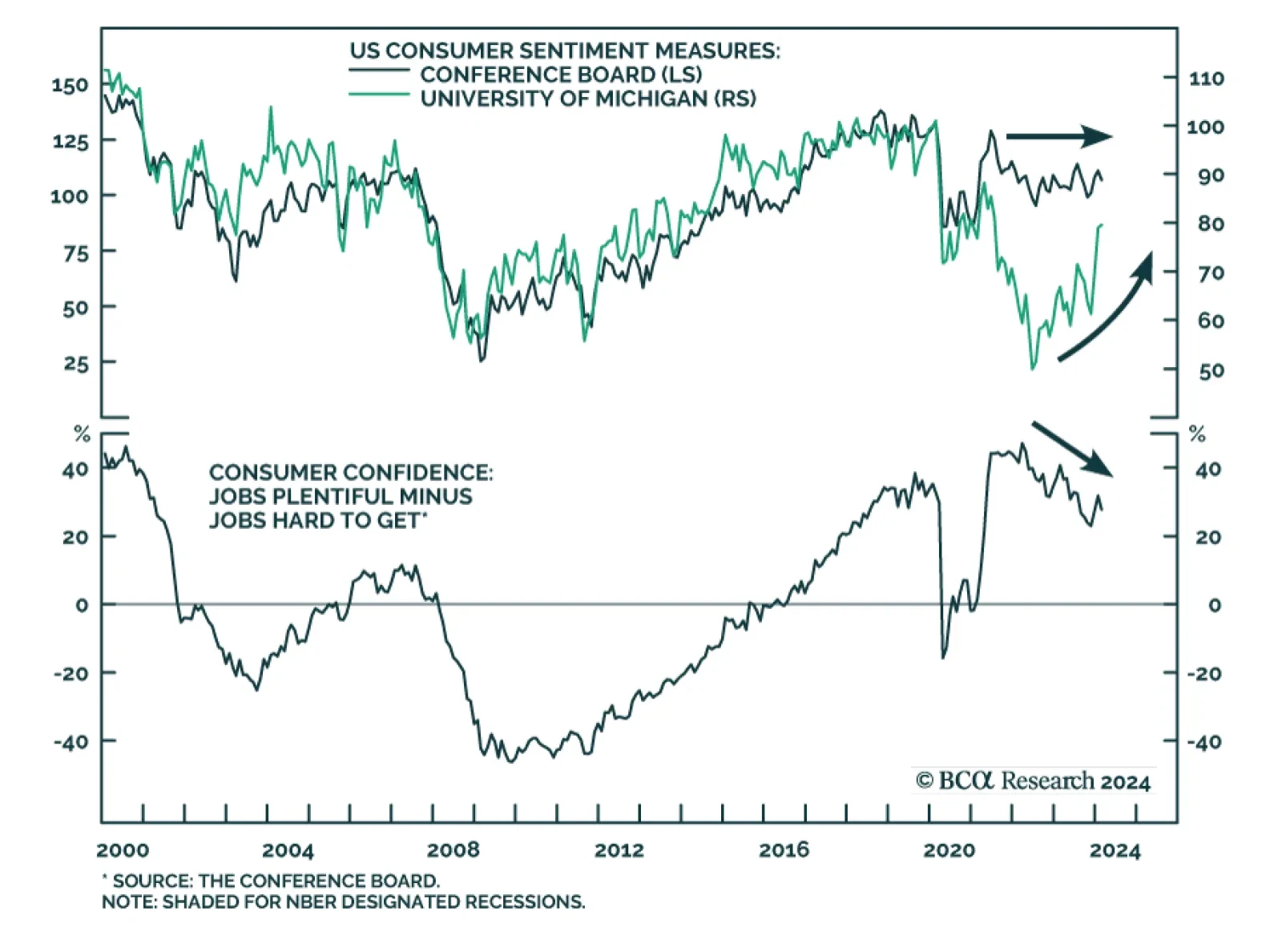

The US Conference Board’s February Consumer Confidence release surprised to the downside. The index decreased to 106.7 from a downwardly revised 110.9, disappointing expectations it would improve to 115.0. Consumers’…

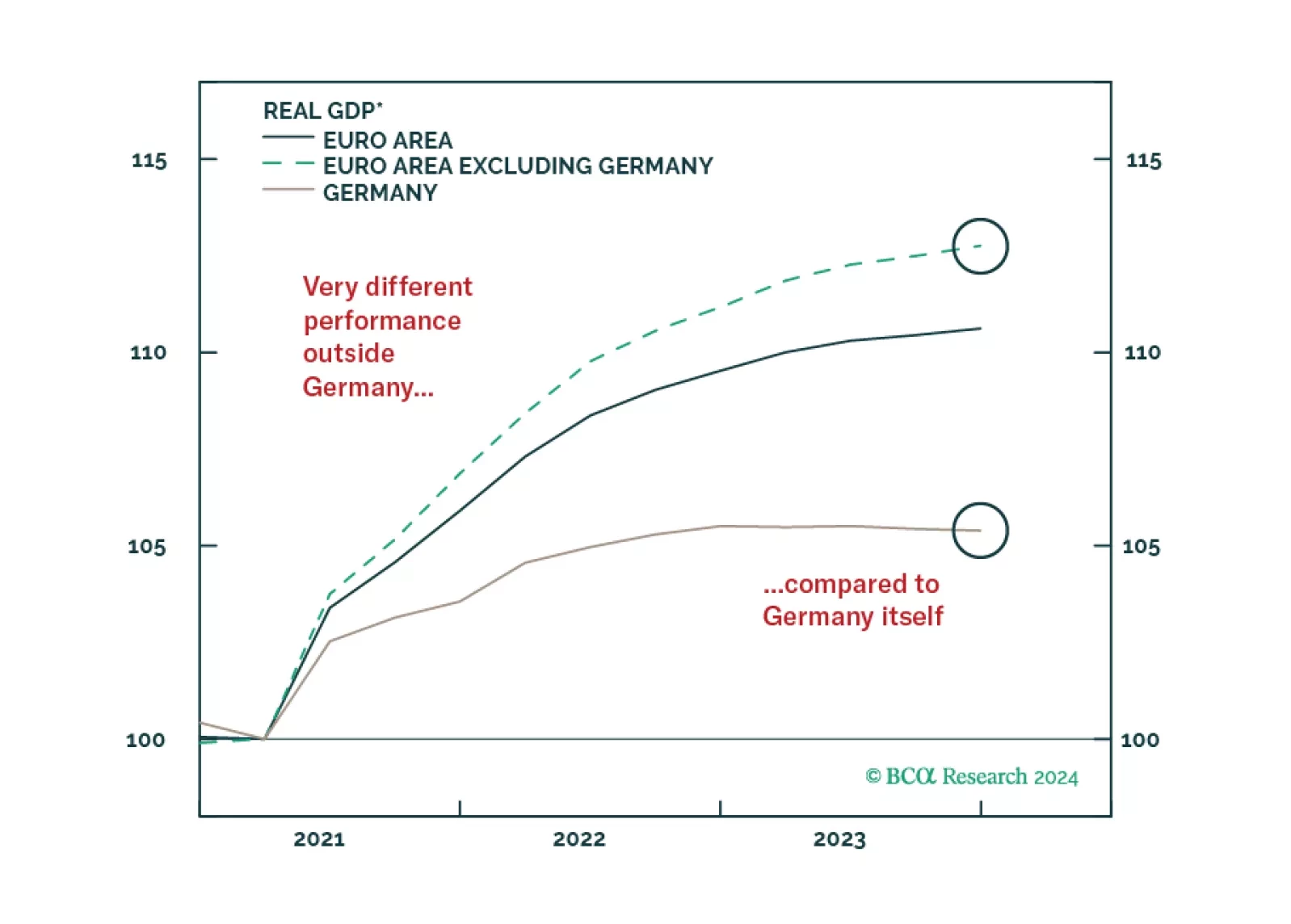

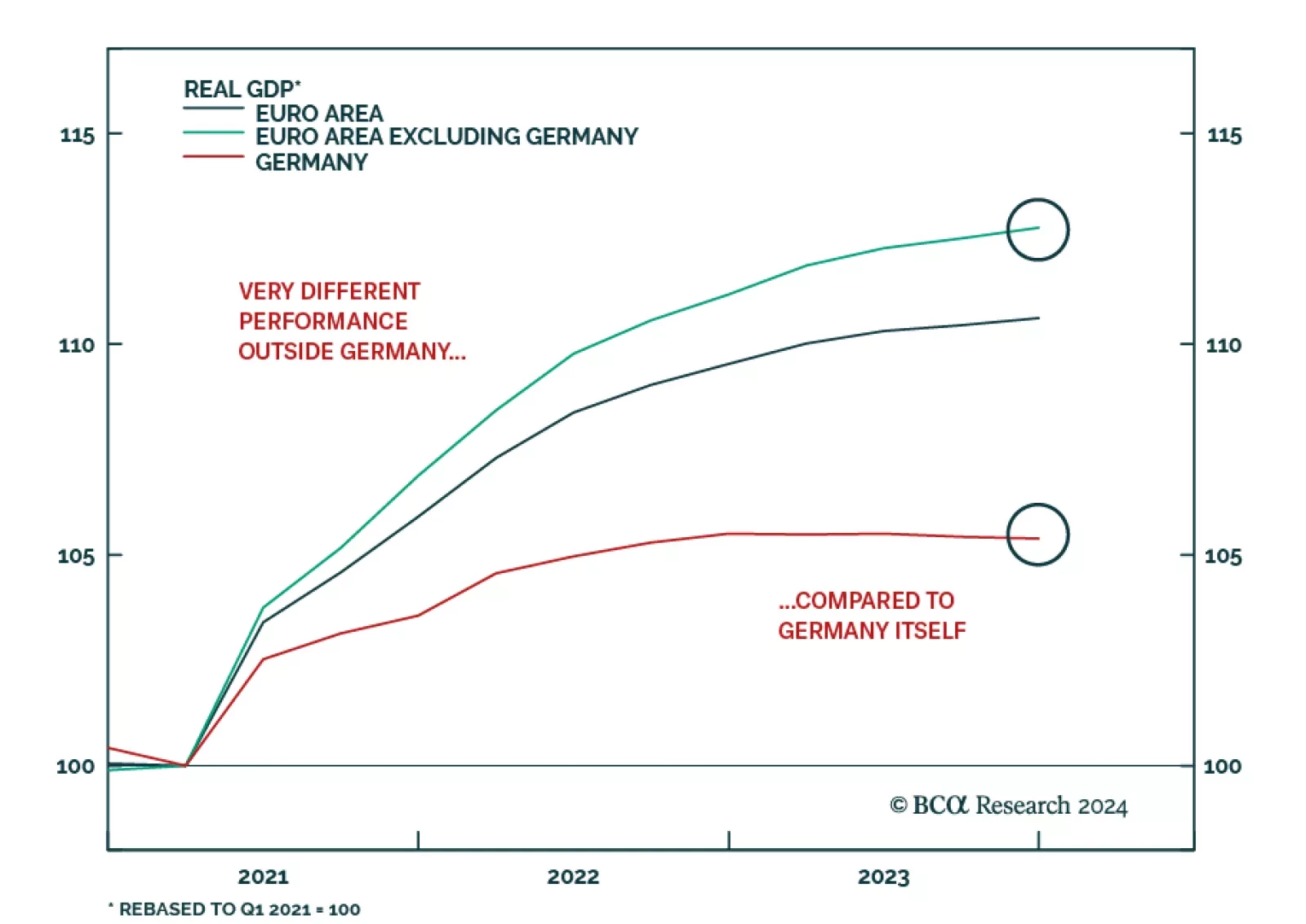

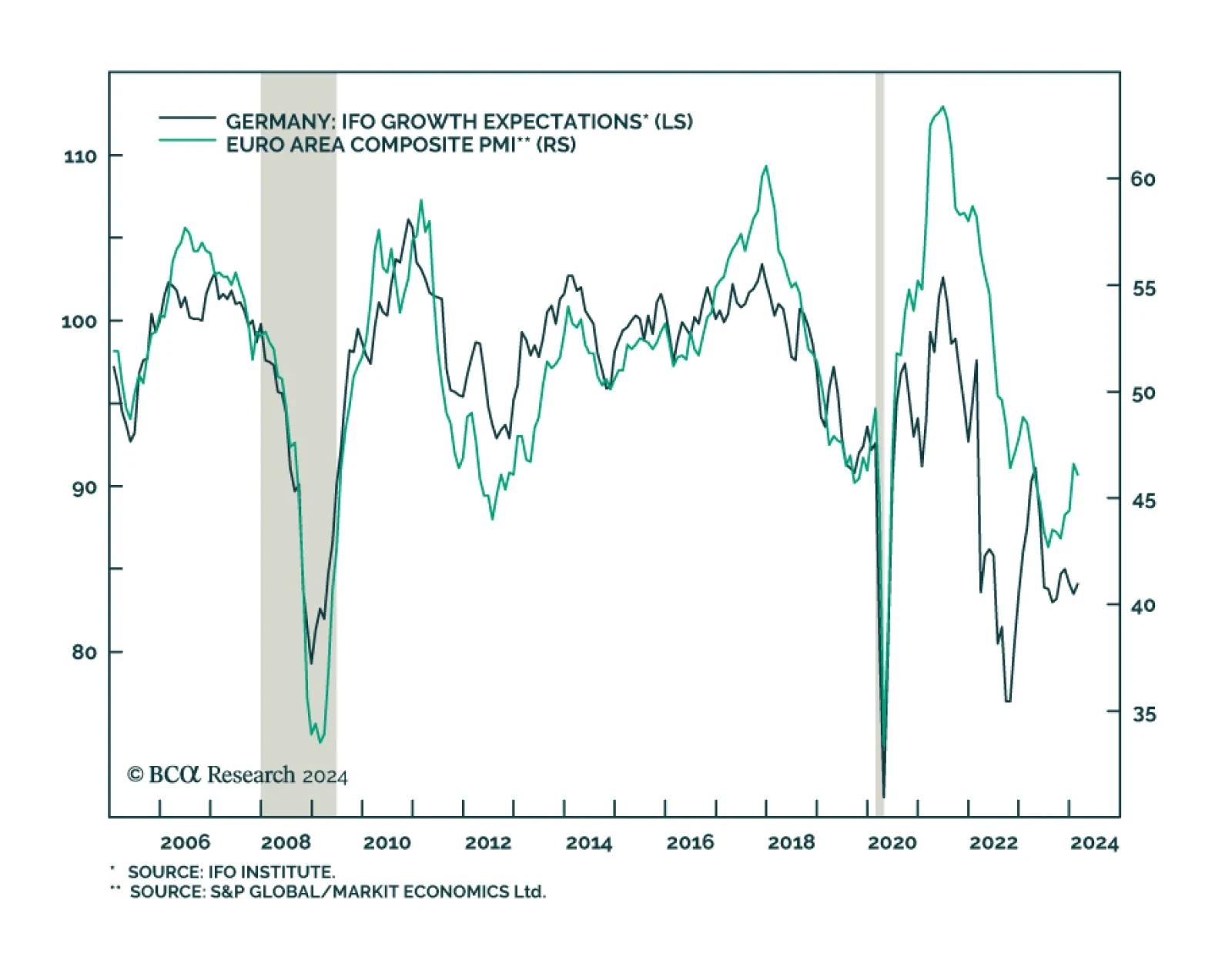

According to BCA Research’s European Investment Strategy service, Germany will likely drag the overall Euro Area into contraction, even if, individually, other countries manage to avoid a recession. This slightly better…

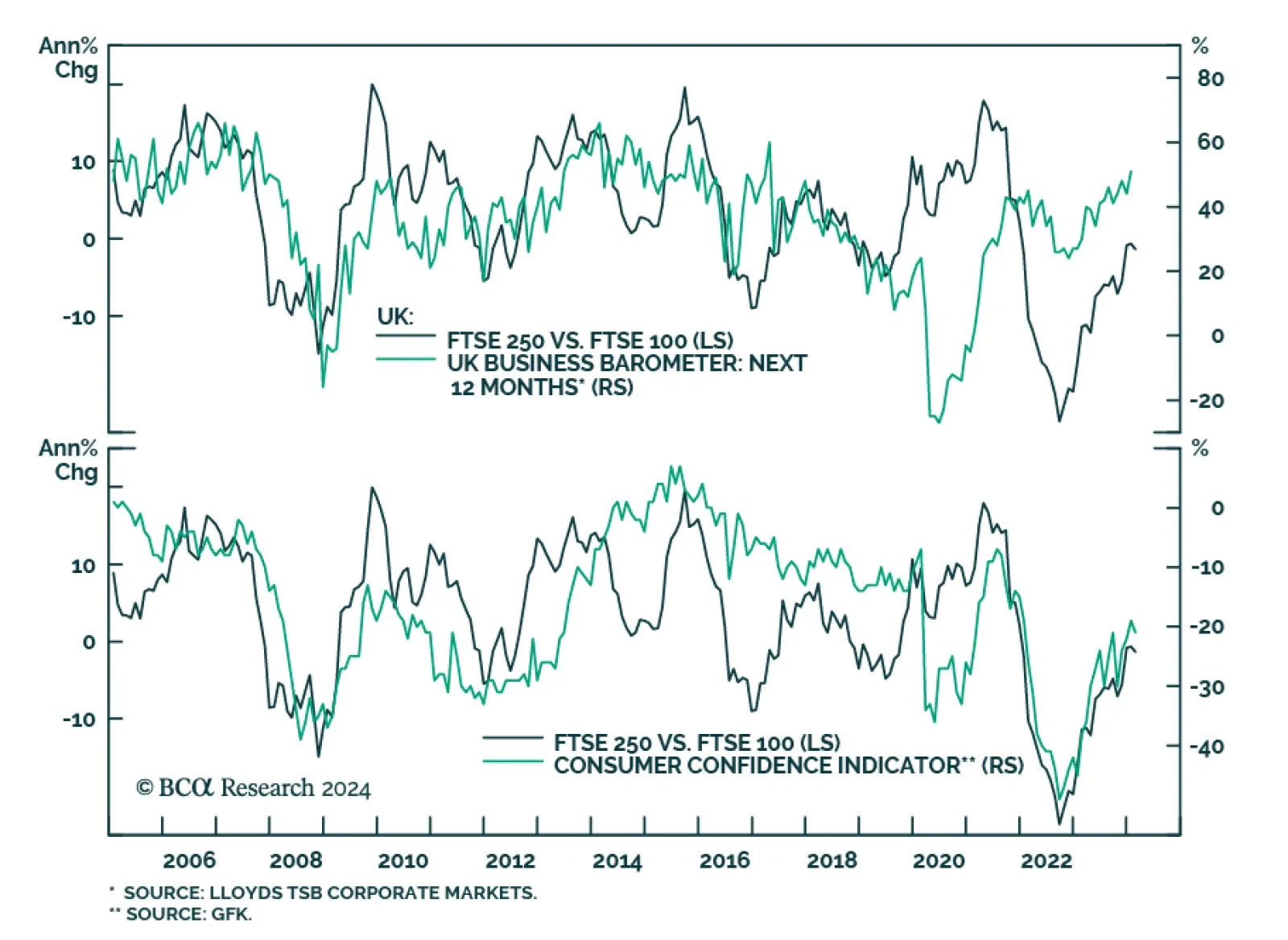

The FTSE 250 has been outperforming the FTSE 100 since late October 2023, with the former gaining 13.7% versus 3.9% in the case of the latter over this period. To the extent that UK small cap stocks are more exposed to…

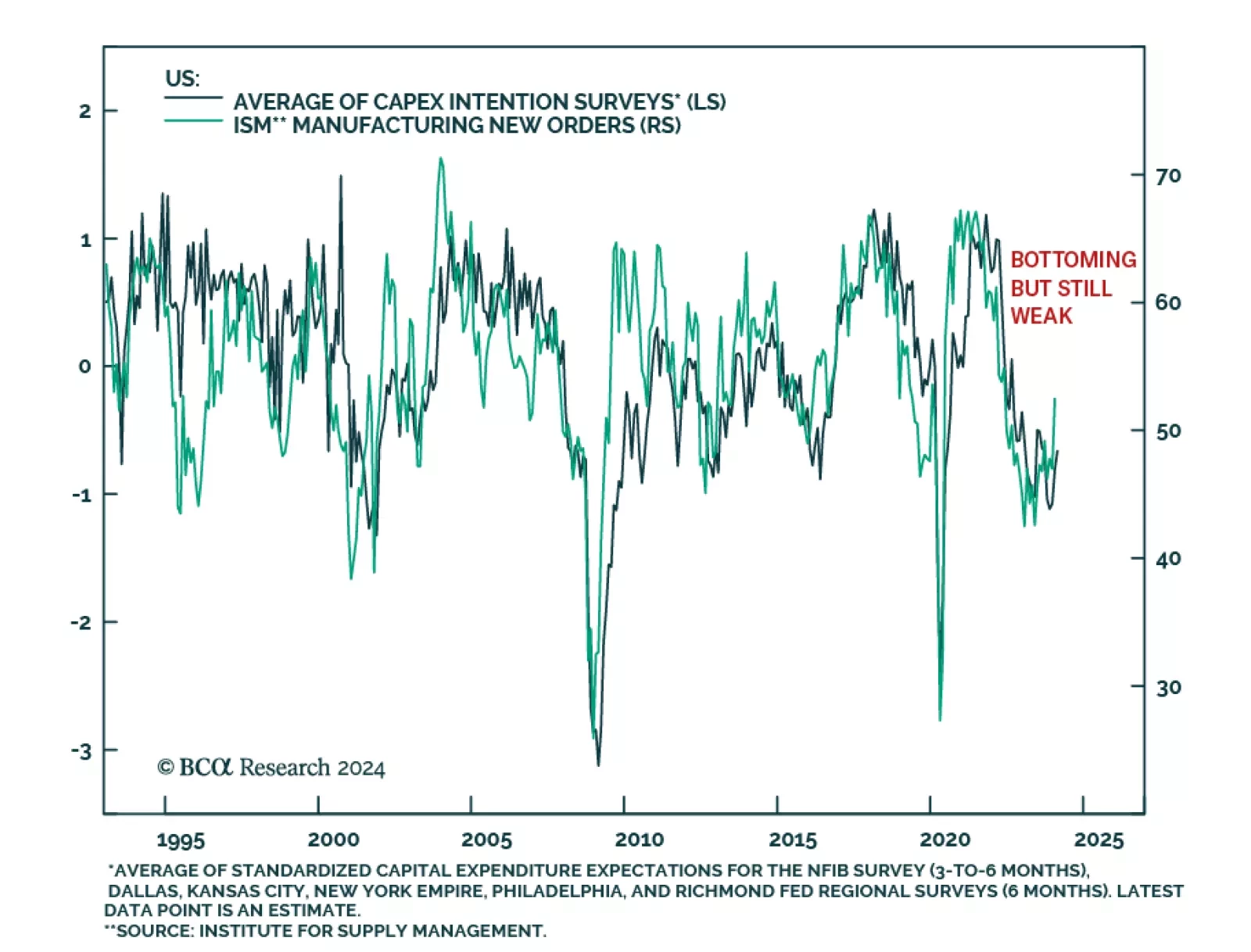

Monday’s release of the Dallas Fed’s manufacturing index corroborates the signal from other regional Fed surveys that manufacturing conditions are picking up in the US. The headline Current General Business Activity…

Outside of Germany, European growth fares better than many believe. Will this hidden resilience help the euro and push German yields higher?

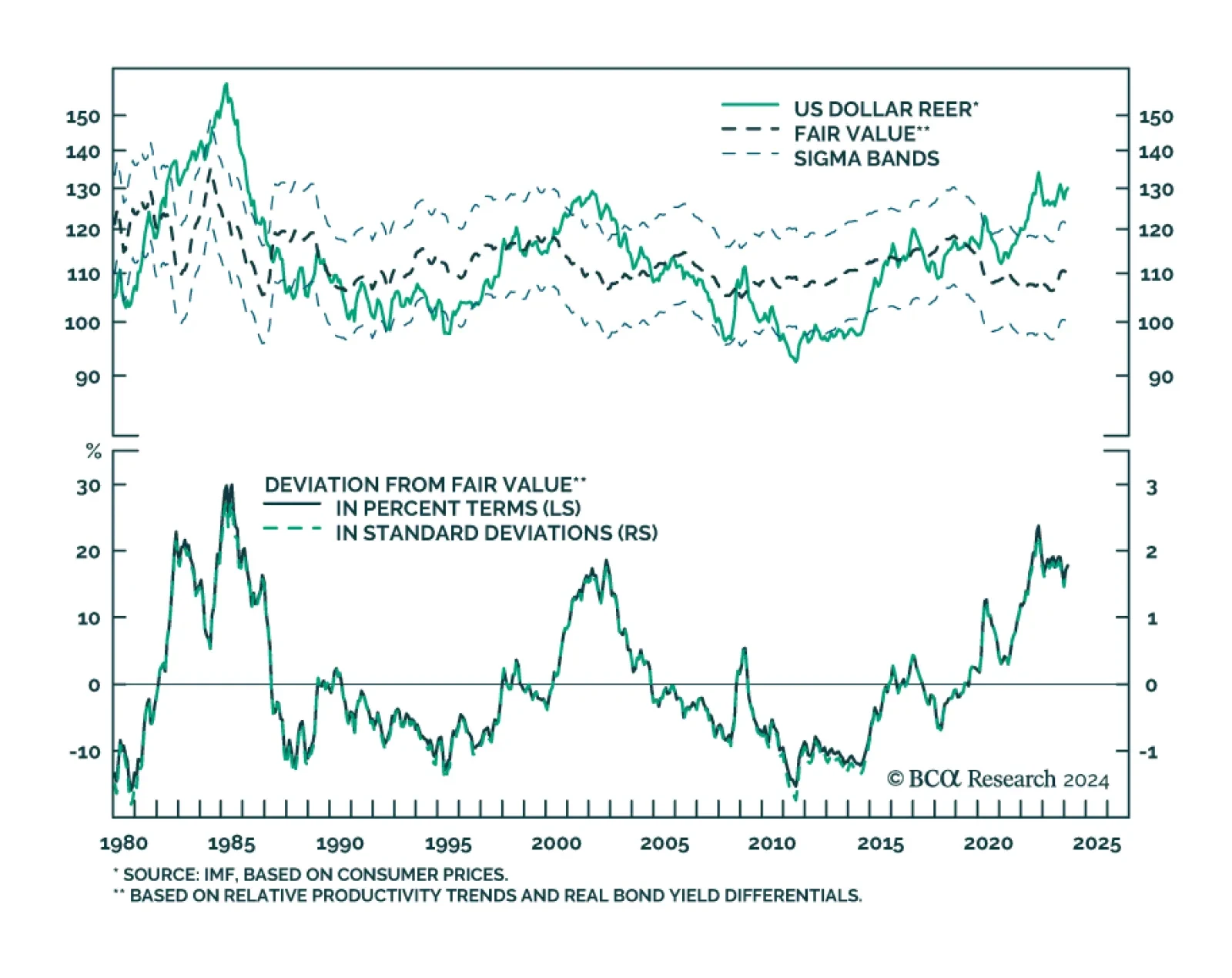

In a recent Special Report, BCA’s Foreign Exchange Strategists update their long-term fair-value models for the real effective exchange rate. The model aims to capture deviations from the long-term drivers of a currency,…

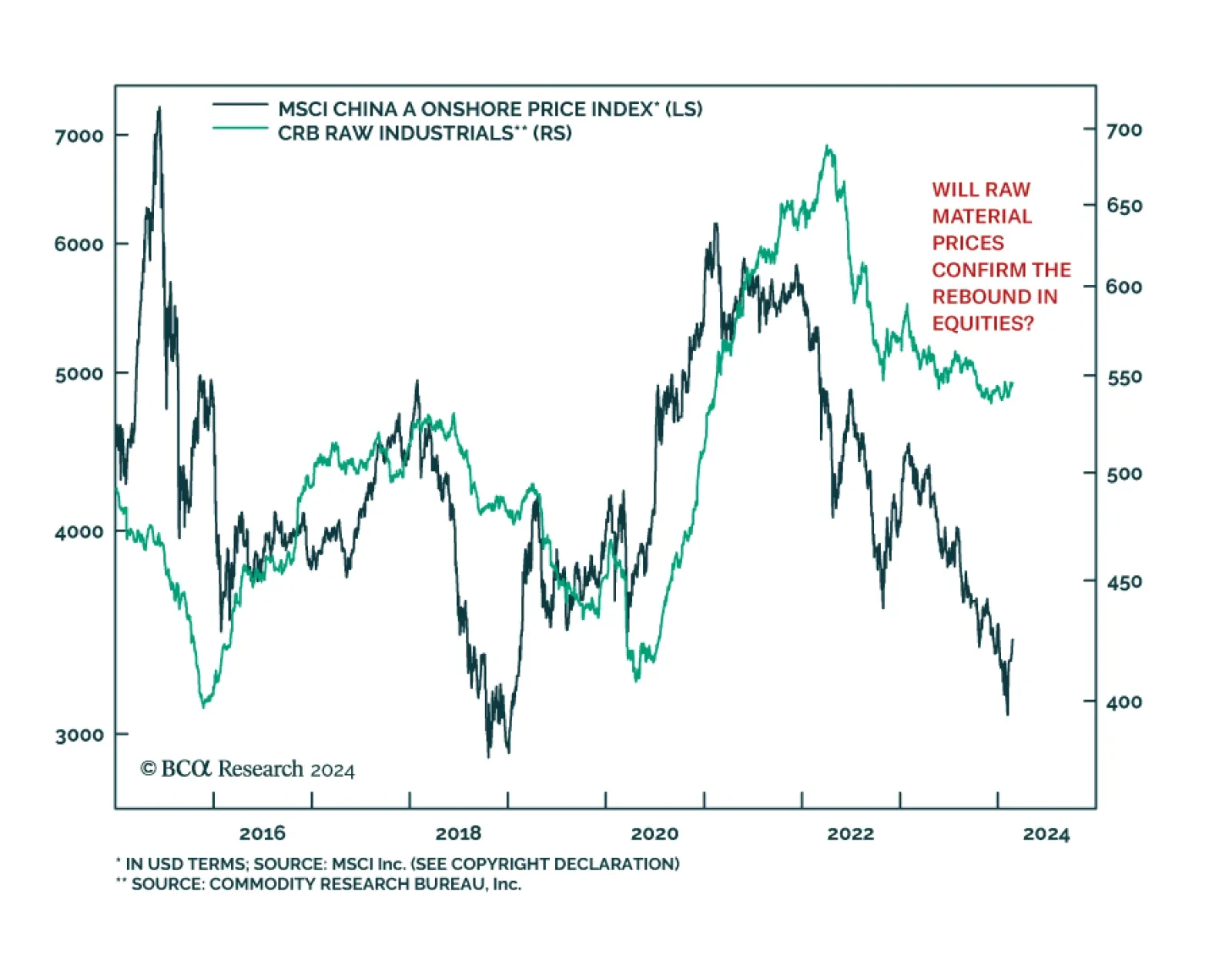

While efforts by policymakers to stabilize the stock market are buoying Chinese equities, domestic economic data remains soggy. Home prices declined further on both a monthly and annual basis in January, reinforcing the…

Germany’s IFO Business Climate index ticked up 0.3 points to 85.5 in February, in line with consensus estimates. Expectations for the next 6 months explain the improvement in sentiment among German companies (up 0.6 points…

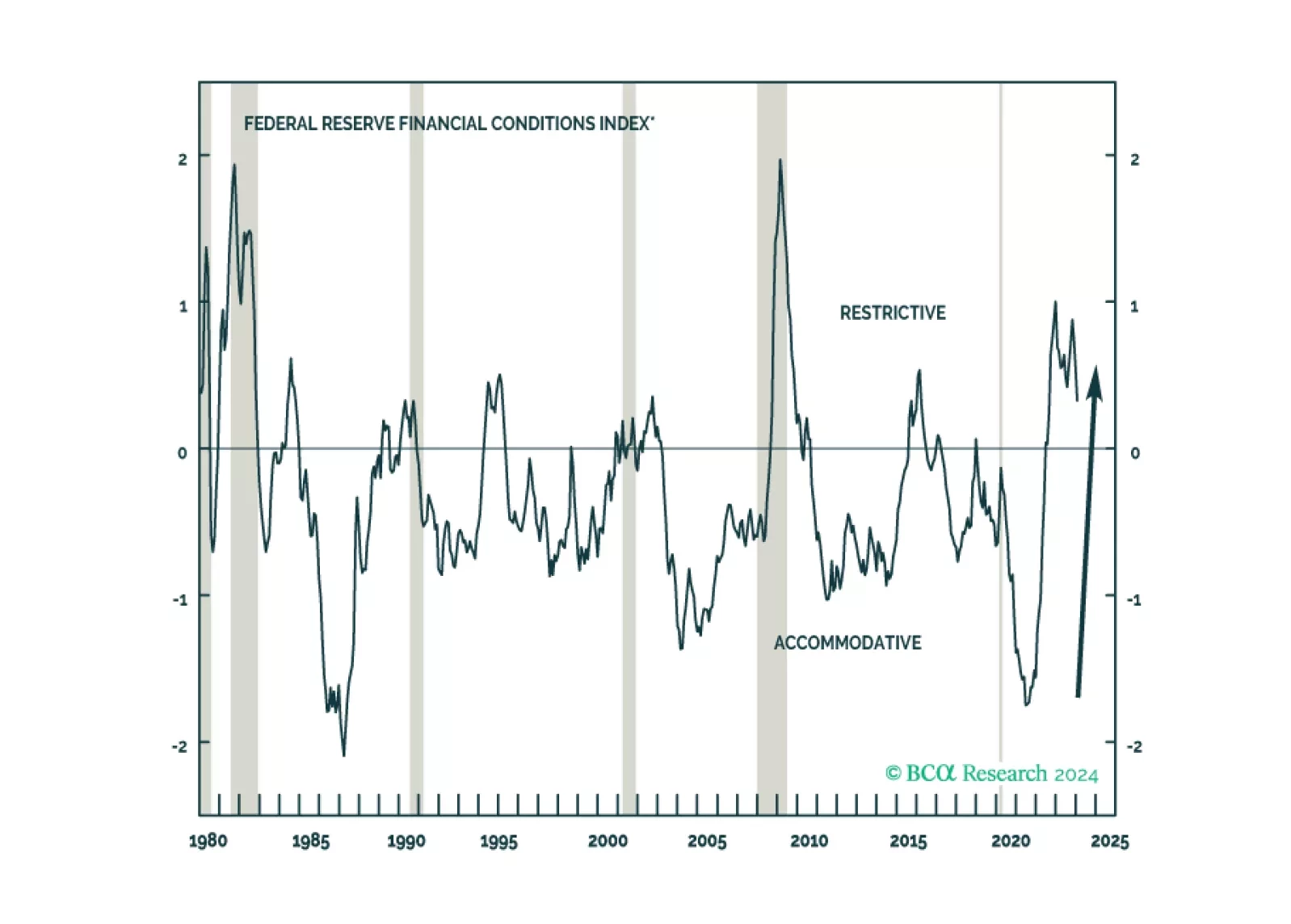

Clients have been pushing back on our recession call on the grounds that it is incompatible with the economy’s second-half acceleration and the more recent easing in financial conditions. We examine both of those points in the course…