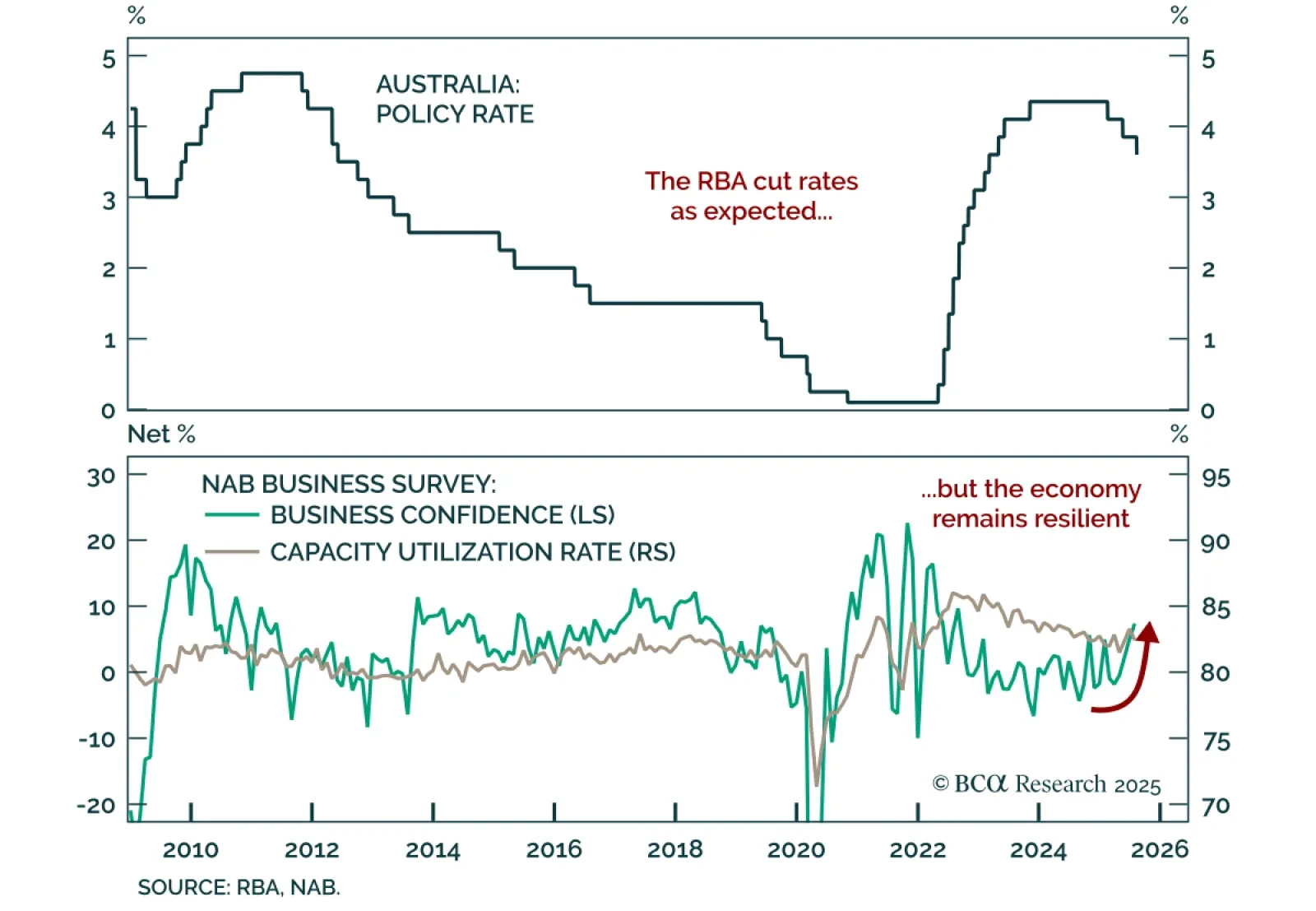

The RBA delivered a widely expected cut to 3.6%, but resilient data warrant an ACGBs underweight. The 25 bps cut was the third this year and Governor Bullock’s guidance was consistent with a cut every other meeting, keeping ACGB…

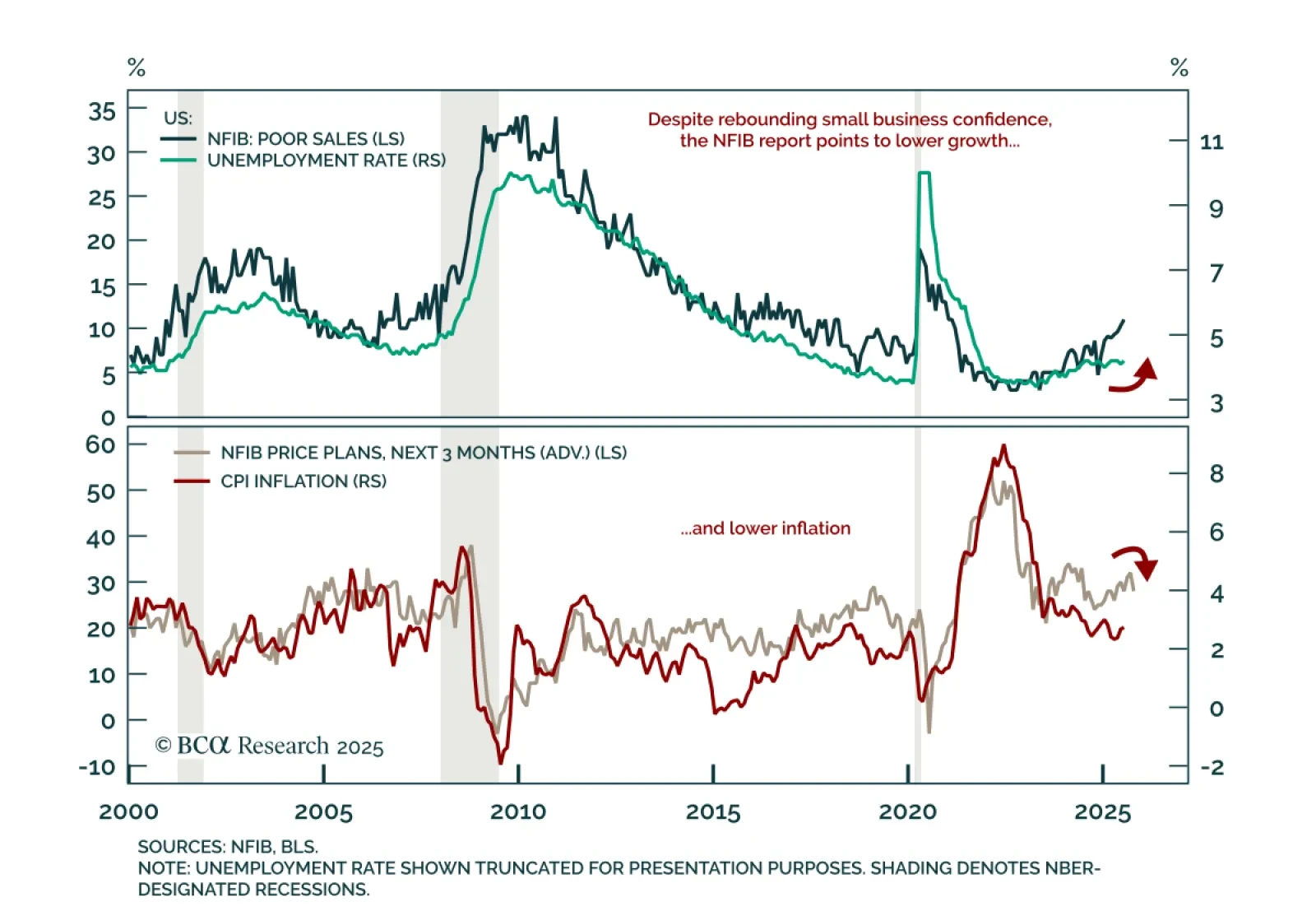

The July NFIB survey showed a rebound in expectations, but underlying weakness reinforces left-tail risks and supports a moderate risk-off allocation. The headline index rose to 100.3, a five-month high, but remains below…

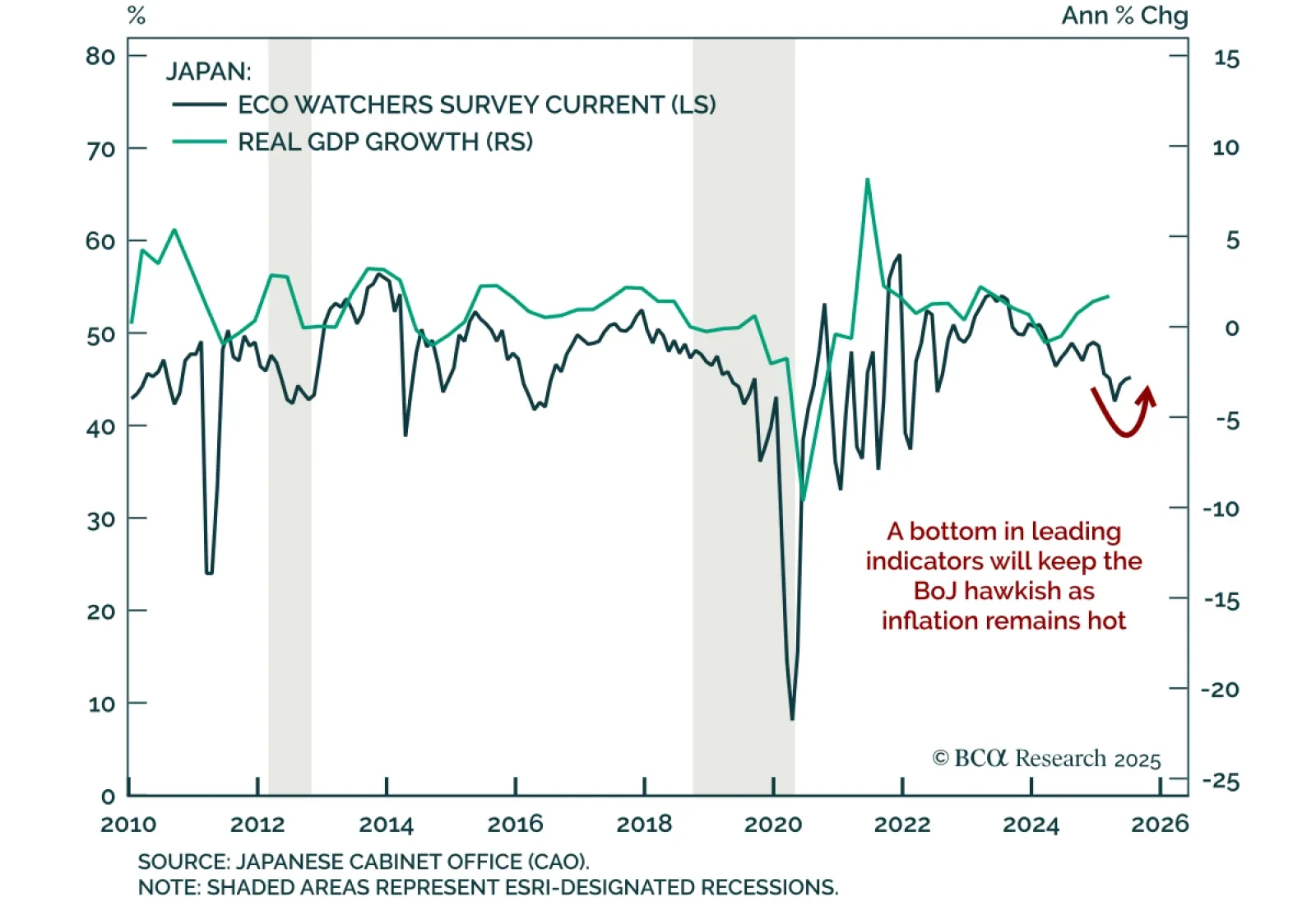

Japan’s Eco Watchers survey suggests growth has troughed, making JGBs vulnerable in both global slowdown and reacceleration scenarios. The July survey showed current conditions ticking up to 45.2 and expectations improving to 47…

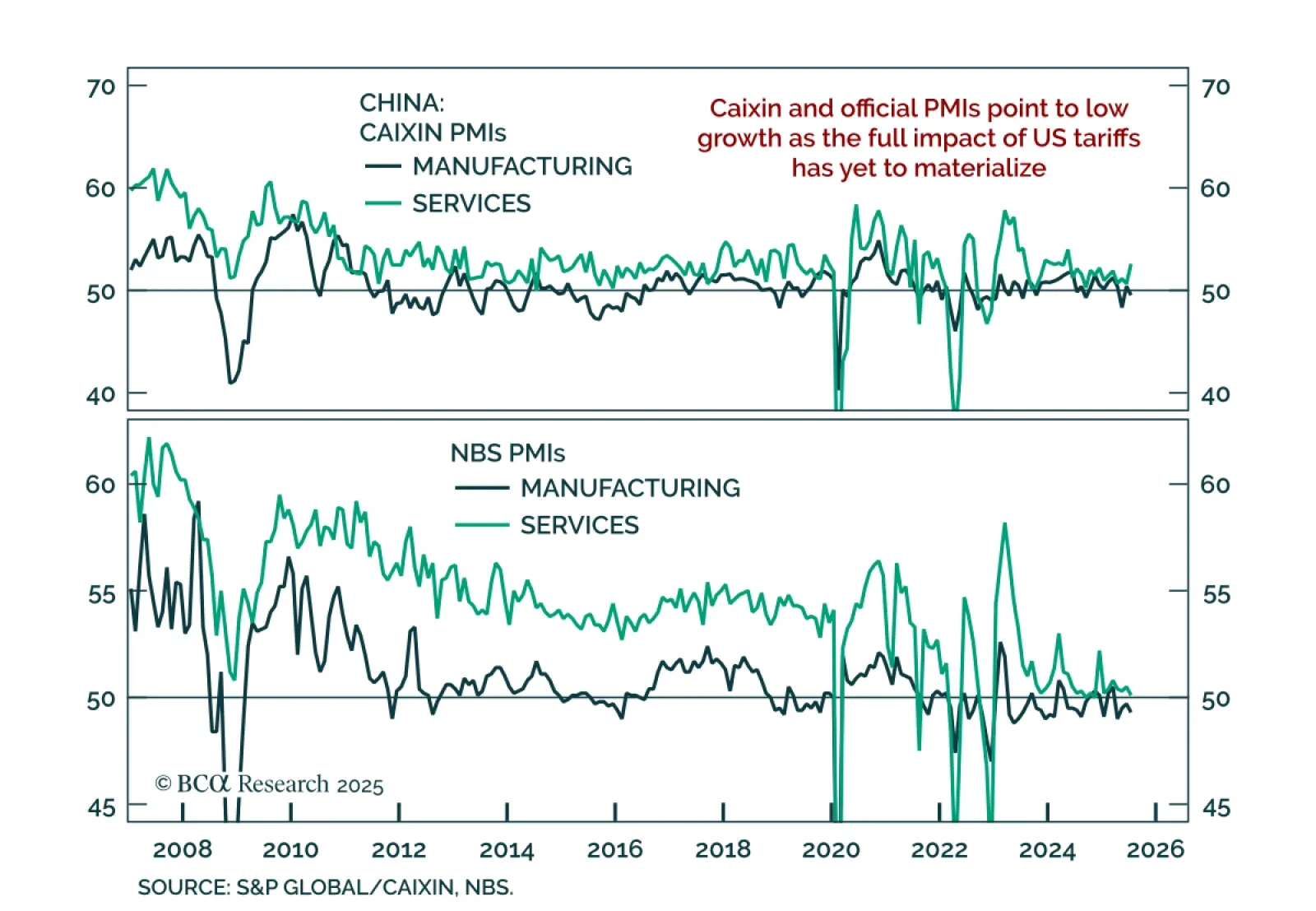

The July PMIs and inflation data confirm that China faces a persistent low-growth, deflationary backdrop, with weak demand and tariff risk warranting defensive equity positioning. The Caixin manufacturing PMI fell to 49.5, while…

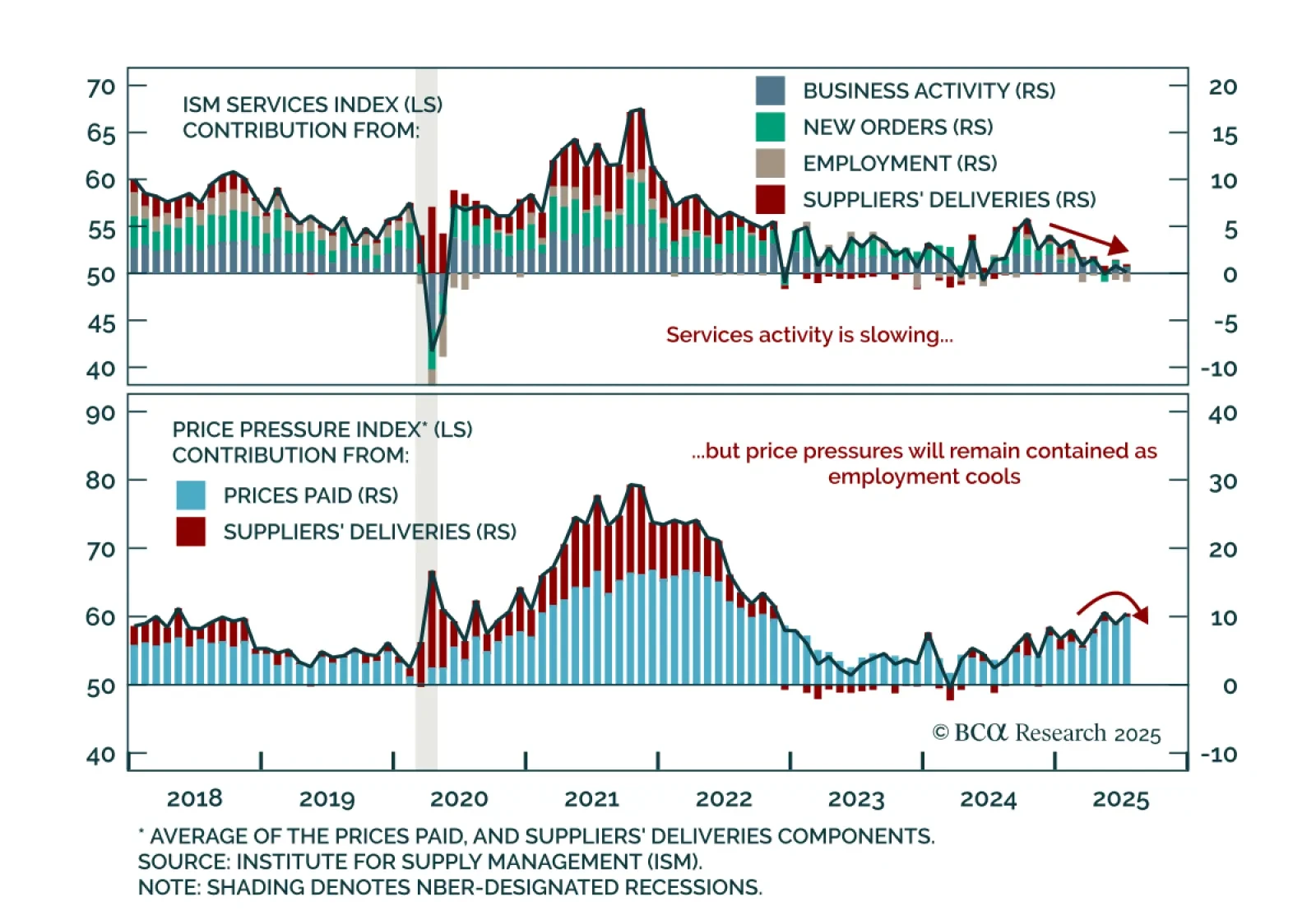

The July ISM Services report showed a stagflationary impulse, but soft labor momentum reinforces the view that price pressures remain contained. The headline index fell to 50.1 from 50.8, missing expectations. New orders softened to…

Our Commodity strategists recommend staying short LME copper outright and long gold/short LME copper on a cyclical basis. The unwind in copper, set off by the US tariff exemption on refined metal, is not yet complete. An inventory…

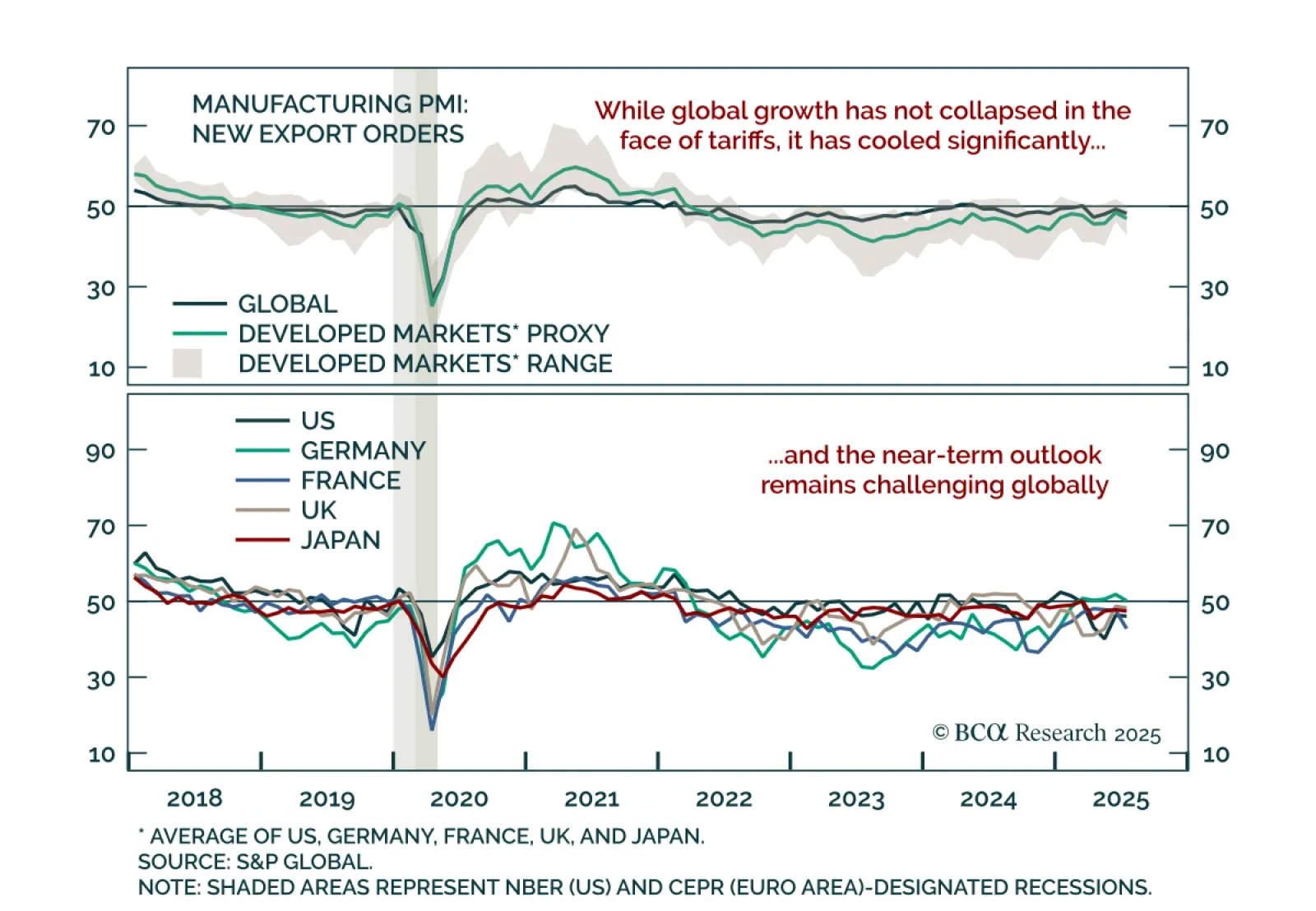

In response to trade uncertainty, global growth is cooling but not collapsing, supporting a cautious near-term view on risk assets. Trade disruption earlier this year raised fears of a global recession, but the data so far point…

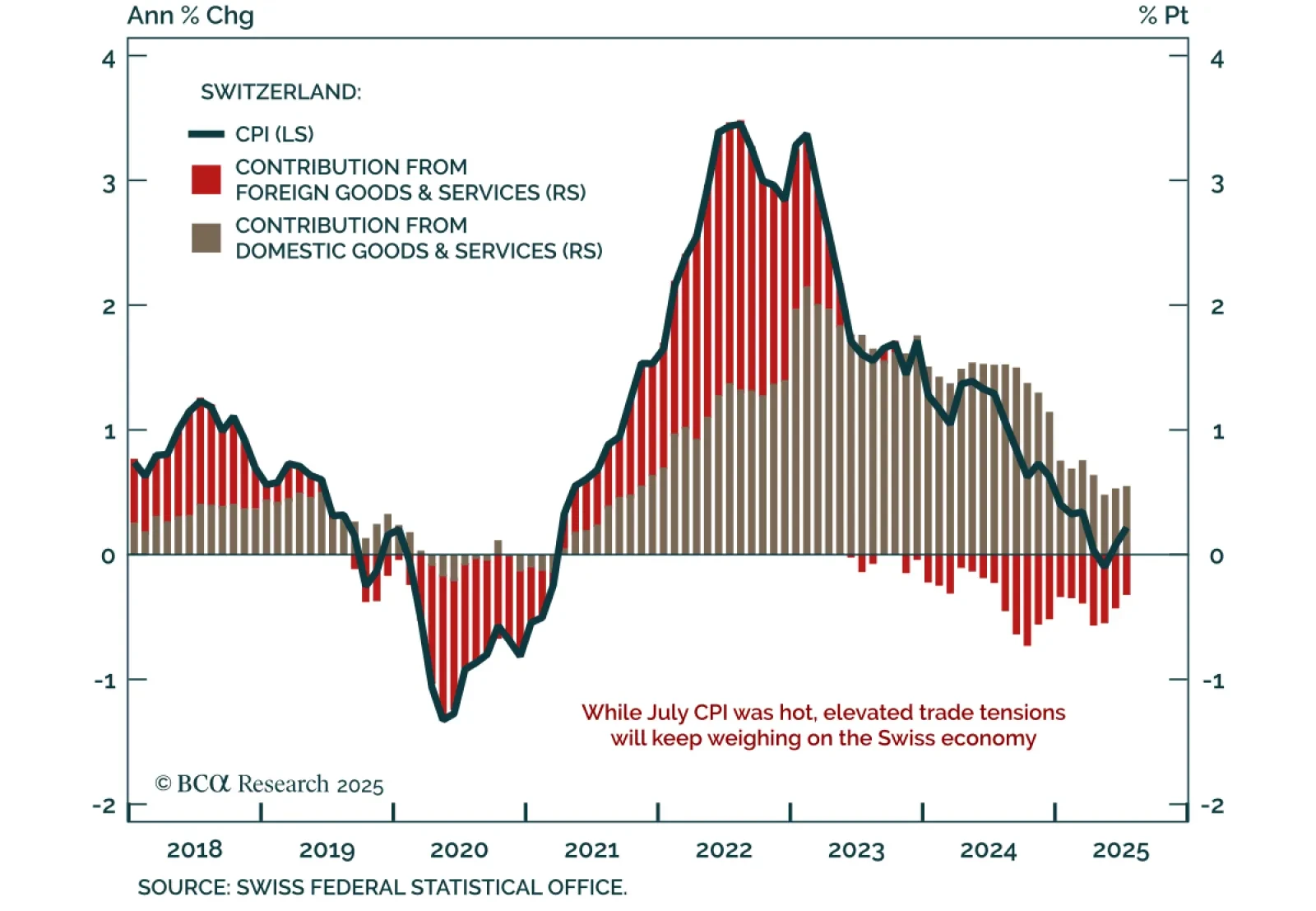

Hot July inflation does little to alter Switzerland’s near-term deflationary outlook, as soft data and trade risks support a defensive stance and preference for bonds over equities. CPI ticked up to 0.2% y/y from 0.1%, with core…

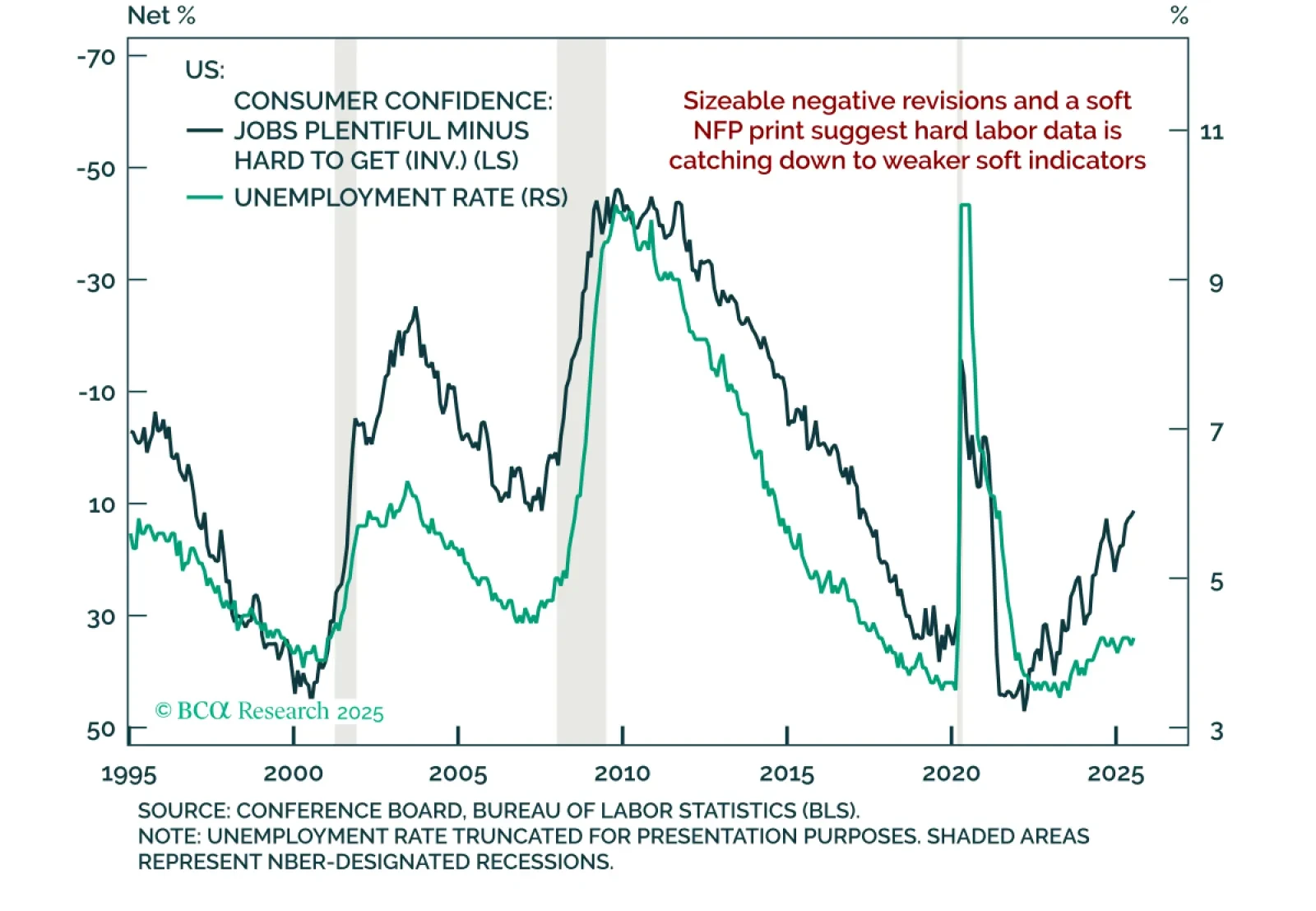

The S&P 500 recently breached new highs, but narrow leadership and a slowing labor market reinforce caution on risk assets. Equities rebounded from their post-Liberation Day lows, but the rally has been led mostly by the tech…

The July employment report revealed large downward revisions and slowing payroll growth, reinforcing our defensive stance. Nonfarm payrolls rose just 73k, and prior months were revised down by 258k, bringing the 3-month average to…