The global economy is wobbling precariously between slowing growth and reaccelerating inflation. This is unlikely to end well. Stay cautious, and hedge against both recession and inflation.

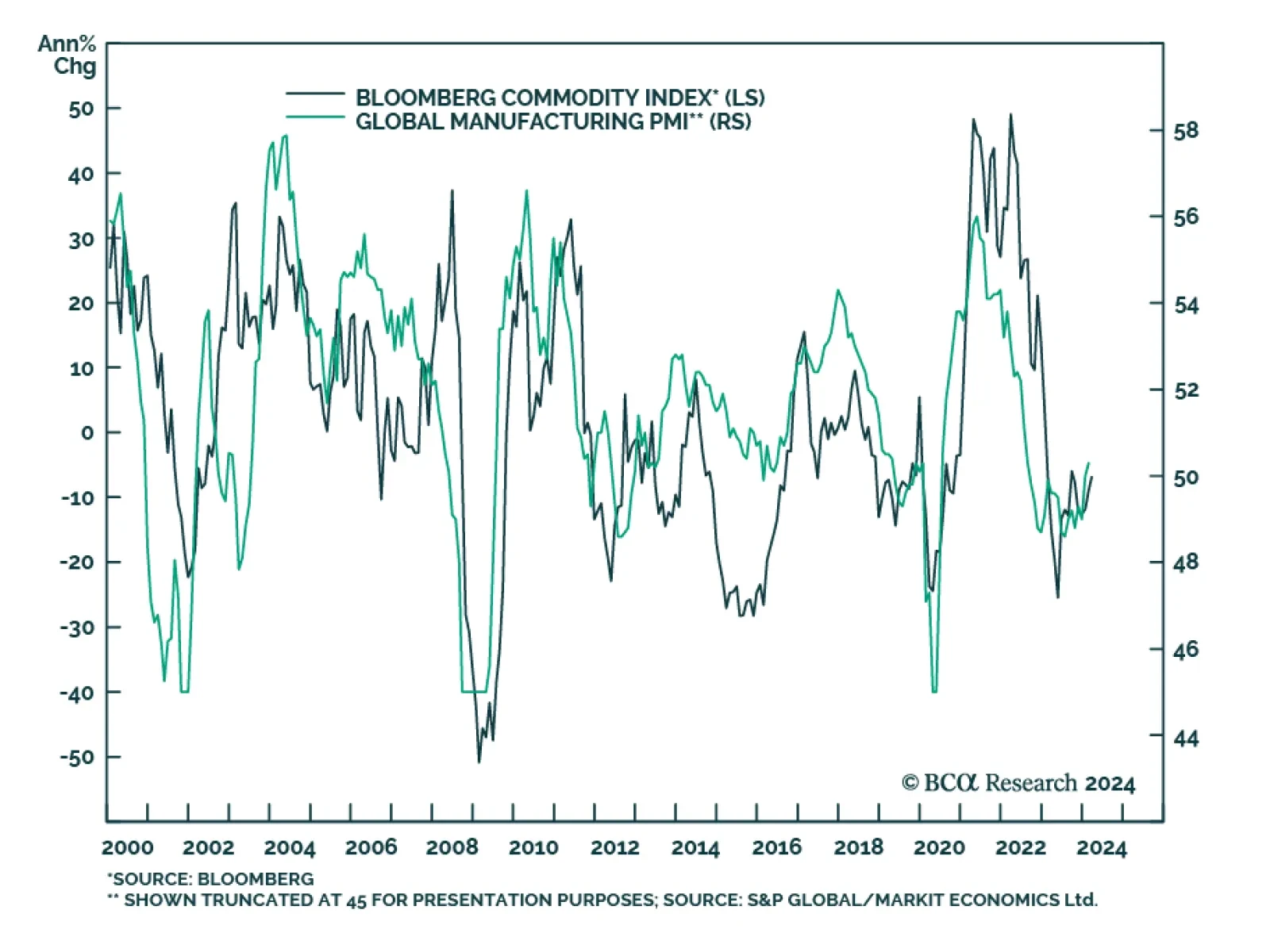

The recent rally in commodity markets is drawing the attention of the investment community and financial media. It’s not just cocoa – which has experienced a staggering 118.4% year to date increase that has further…

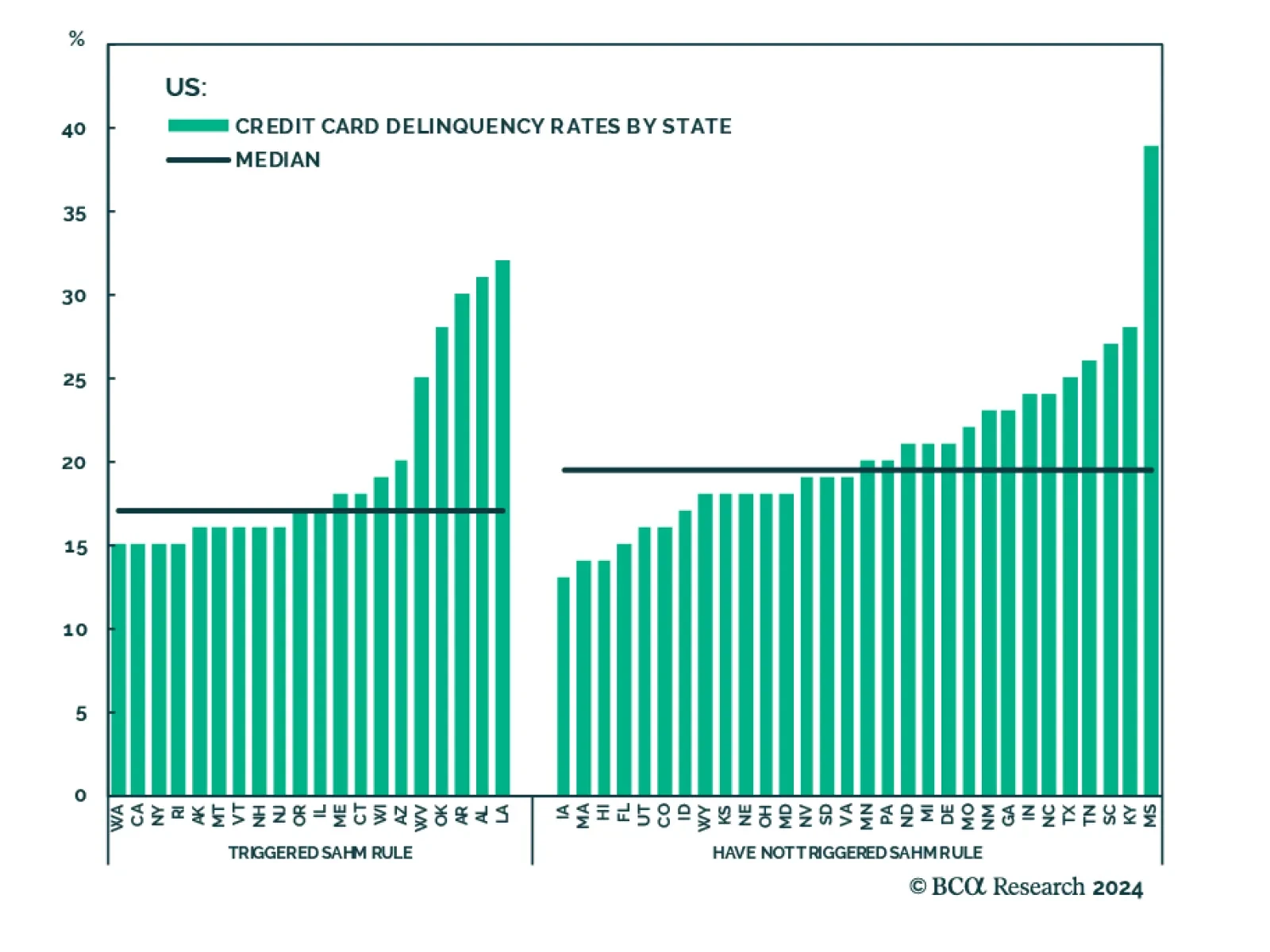

At 3.9% in February, the unemployment rate remains quite low in the US, corroborating the signal from GDP that current economic conditions are fine. Similarly, the Sahm Rule – which currently stands at 0.3 pp – has…

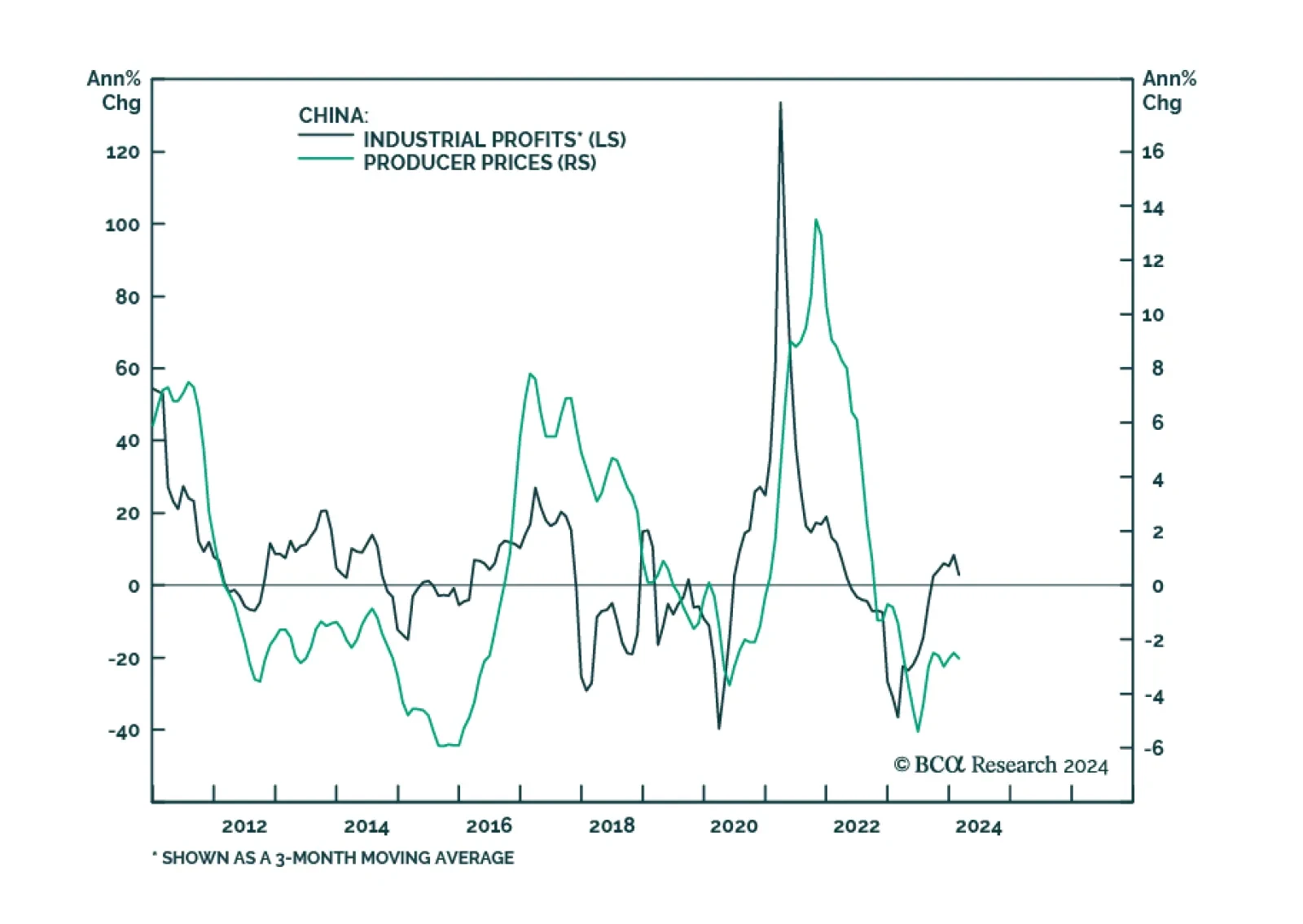

Chinese industrial profit growth surged to 10.2% y/y in the first two months of the year after having contracted by 2.3% in 2023. Does this rebound in profits suggest that investors should become more optimistic about the Chinese…

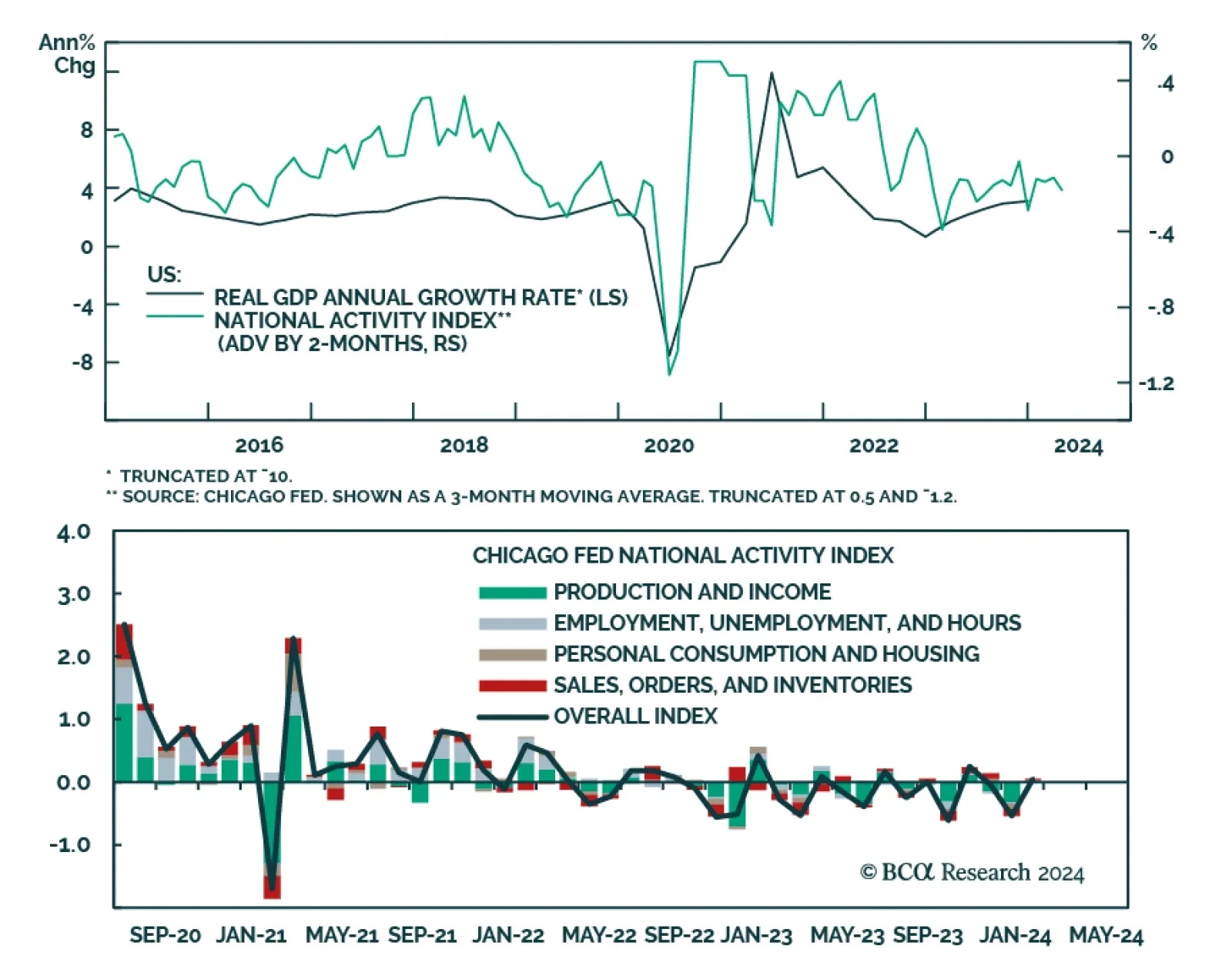

The Chicago Fed National Activity Index (CFNAI) – a summary statistic of US economic data releases – firmed to 0.05 in February from -0.54, and surpassed expectations it would remain in negative (below-average growth…

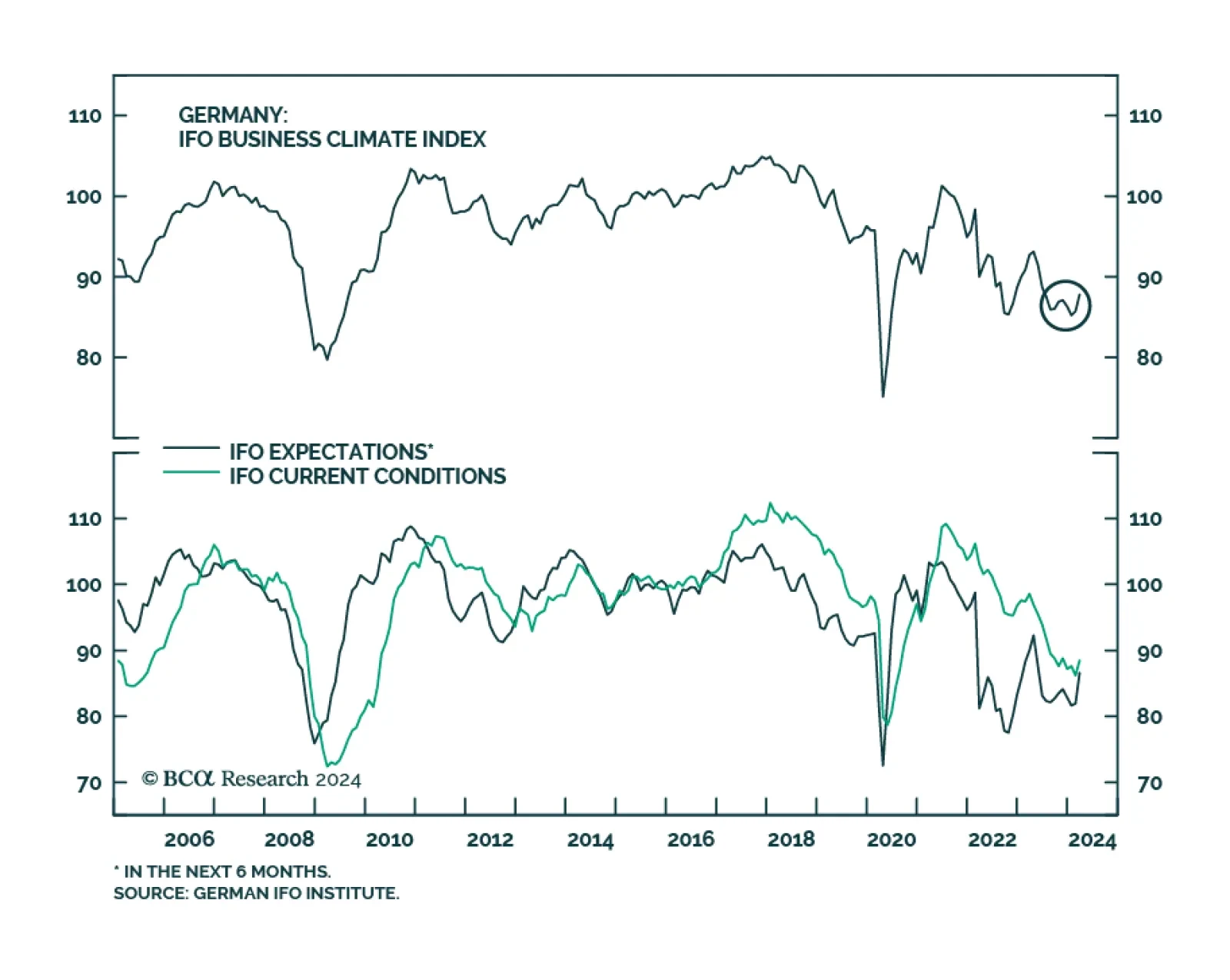

The 2.1-point increase in Germany’s Ifo Business Climate index in March brought it to a 9-month high of 87.8 and beat expectations of a more muted rise to 86.0. Both current economic conditions (+1.2 to 88.1) as well as…

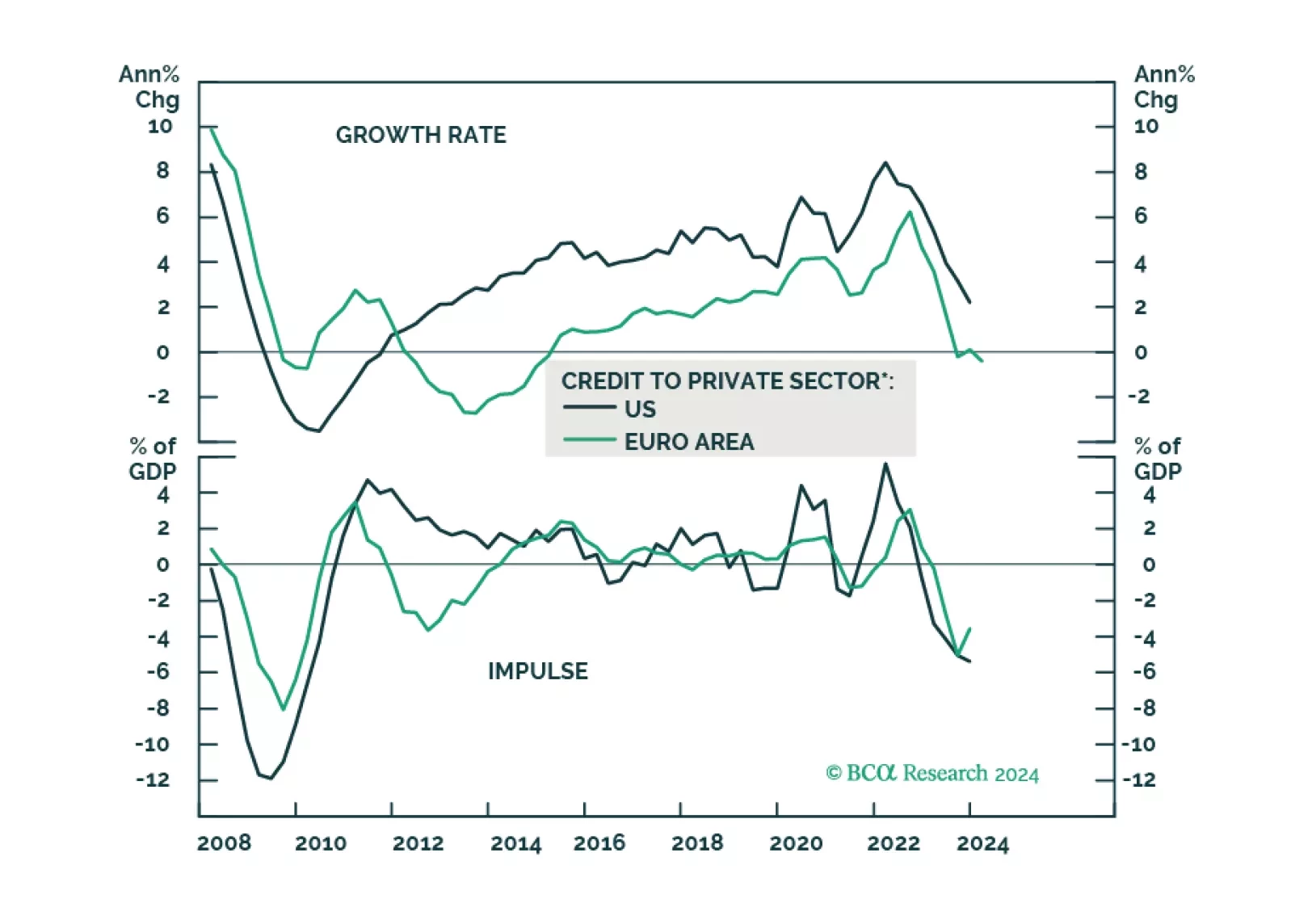

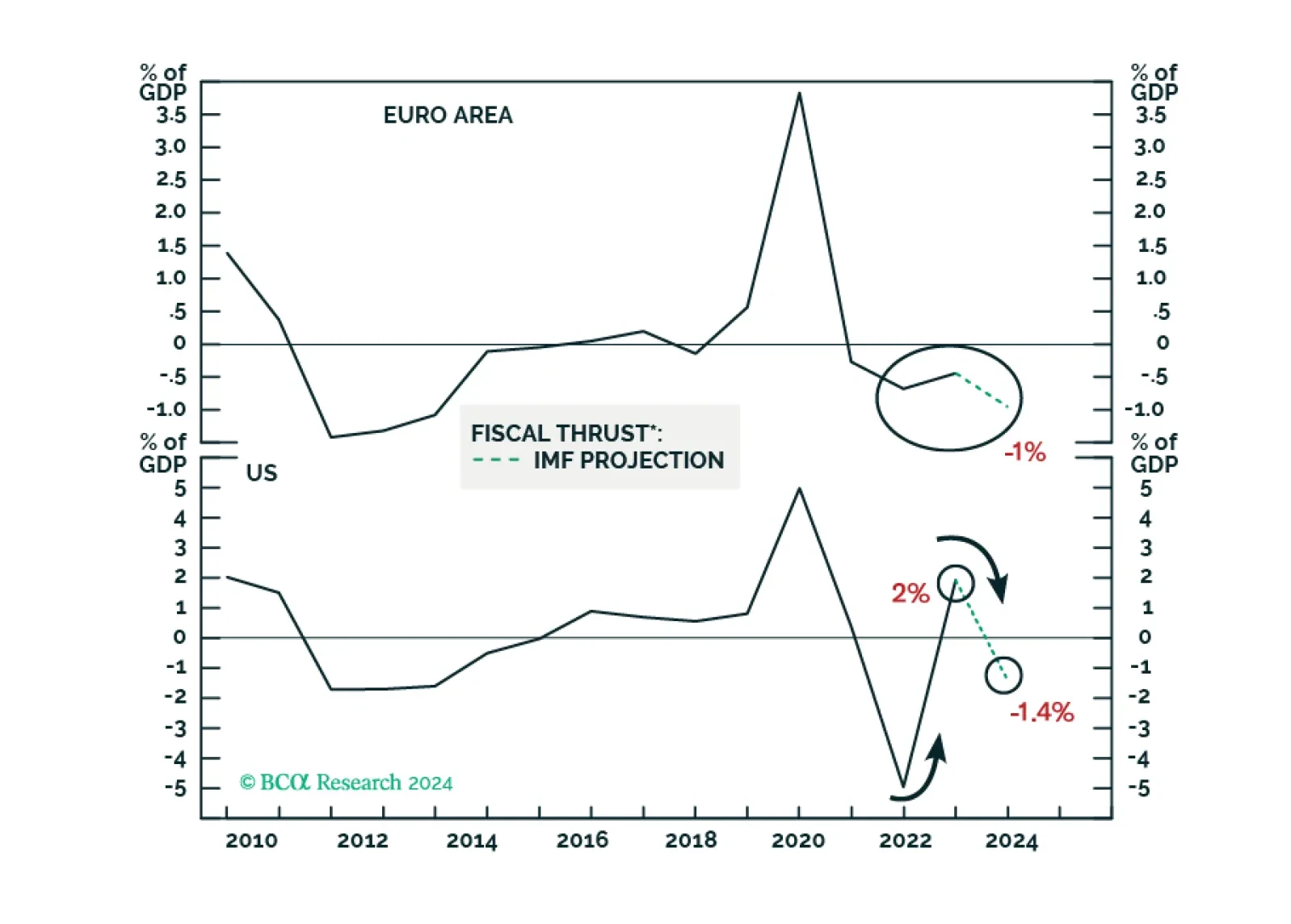

Despite a couple of rate cuts in H2 2024, borrowing costs will remain elevated in real terms amid lower inflation in the US and Europe. This and tightening fiscal policy will hinder domestic demand in advanced economies. Domestic…

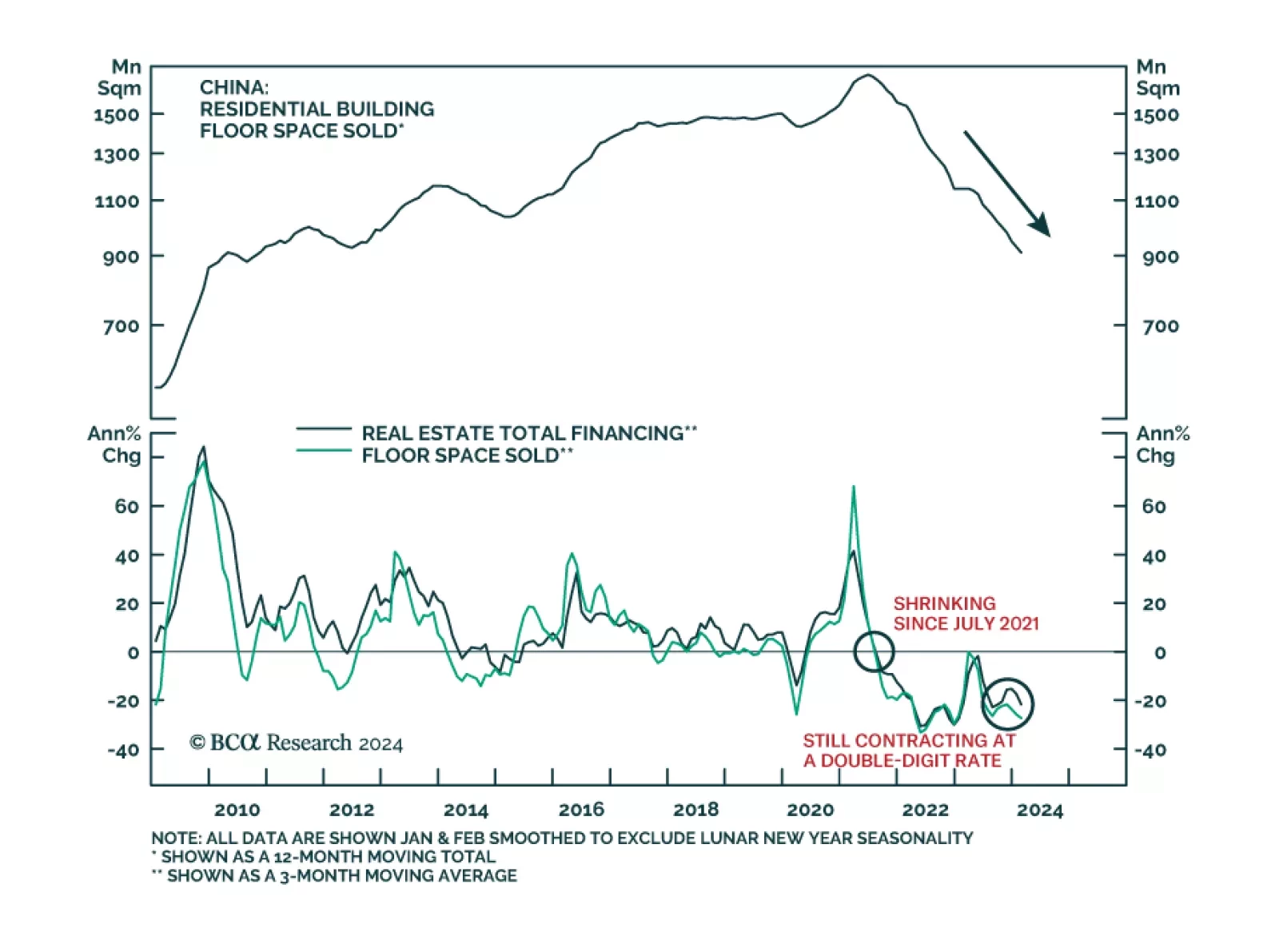

According to BCA Research’s China Investment Strategy service, the adjustment in China’s real estate sector is not over. Odds are that the property market will contract for the fourth year in a row. The property…